About legal entities

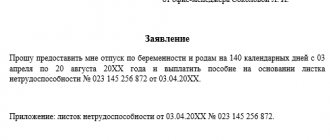

General rules in 2022 The key responsibility of all policyholders is timely accrual and payment

Hello! In this article we will talk about customs checks. Today you will learn: When is customs clearance carried out?

Features of the procedure In order not to waste time and effort, it is better to study the rules for obtaining in advance

Article 93 of the Tax Code of the Russian Federation: who is it for? All tax payers (and from 2022

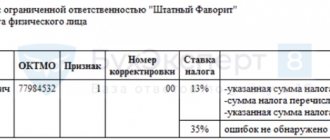

New in 6-NDFL from 2022 The last time we will fill out the current 6-NDFL form

Composition of the annual financial statements The composition of the annual financial statements is fully regulated by Art. 14 of the Law “On

All employers are required to submit a 6-NDFL report quarterly. Despite the fact that in 2022

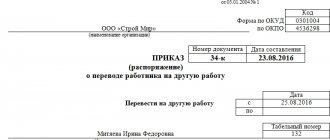

During the period of work at the enterprise, its employees can be transferred from one position to another.

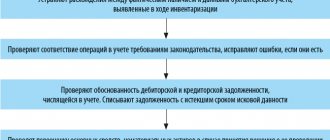

In modern fiscal realities, desk audit has been turned into the main form of tax control - and

What are they punished for? A fine is one of the types of sanctions applied by tax authorities to violators