About legal entities

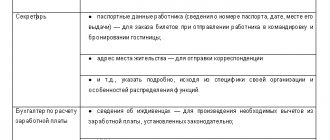

Current laws in the field of labor law and the protection of confidential information require regulation of work with

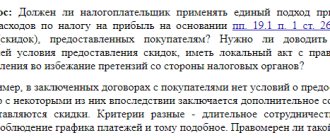

Is it possible to take into account non-operating expenses that are not mentioned in paragraph 1 of Art. 265

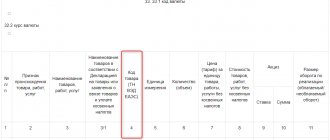

Question 1. How to fill out the “Government Contract ID” field? Most recently, it was added to the invoice

What property is classified as fixed assets when reflected in the balance sheet? Accounting rules for this category

Running a business is a complex process that involves solving many different problems. Including in

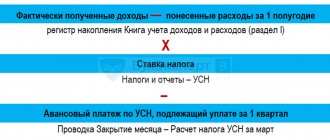

How to calculate the simplified tax system “income” To calculate the simplified tax system tax, the taxpayer who has selected the object “income” should

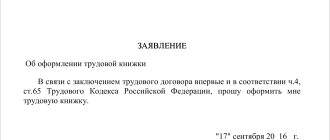

We'll tell you whether you need a paper work book when applying for a job in 2022, and

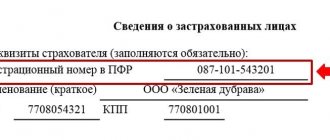

How to correct errors in SZV-STAZH There are three types of correction forms: corrective (KORR); canceling (OTMN);

Updated form From May 30, the resolution of the Pension Fund Board of April 15, 2021 No.

In the current realities, conducting an on-site audit as a form of tax control is a real scourge