Money from the activities of your business comes into your current account, but sometimes these funds are not enough, and the account needs to be replenished urgently. In this case, the individual entrepreneur can deposit his personal money into the account. How to do it? Will the tax authorities be against it?

The law allows individual entrepreneurs to deposit their personal money into their current account. Such situations may arise when a business does not have enough funds to pay urgent obligations. And here there are no restrictions for the entrepreneur.

Corporate card

You can top up business funds through a corporate card. Today, almost all banks issue such a card to your current account. Just deposit money into it at the ATM.

If you top up through an ATM of your bank or a partner bank, then no commission will be deducted from you. Otherwise, you will have to pay for the service. You will see the commission amount on the ATM screen; it varies from bank to bank.

The disadvantage of this method is that here you cannot always indicate that you are not contributing revenue, but personal funds. The consequences of this will be discussed below. Therefore, check with your bank about the nuances of such a replenishment, since usually a corporate card is intended for depositing revenue.

Accounting for depositing own funds in accounting departments

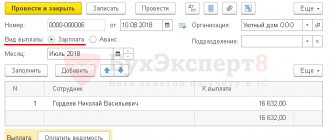

Remember - after the investment of the individual entrepreneur’s money in the company’s turnover is formalized, a receipt order is created. It notes that this financial part is not part of the company’s commercial work, that is, it has no relation to it. Otherwise, the money received by the company may pass for revenue from its activities.

The debit order indicates the account number to which the transferred amount is credited, as well as the address of the bank where the transfer of funds was accepted and executed.

In the process of adding funds to the company's cash desk, indicate where the funds came from.

Note! The “investor” himself can inject funds using his own bank account. If he is not the account owner, the bank has the right to prohibit the transaction.

When the operation is completed, the entrepreneur receives a check, confirmed by a stamp and signature from the cashier. Next, the posting is made (account 84 “Other operating expenses”).

In the cash receipt order, it is required to indicate the purpose of the infusion of financial resources only when these funds are received from the commercial activities of the entrepreneur. Then they are registered as proceeds. Remember that any posting is documented with all the required documentation.

A cash receipt order is also issued when an entrepreneur deposits money to pay off the existing debt of an individual entrepreneur. The amount of funds that were deposited is not taken into account in the book of income and expenses (KUDiR). Read about KUDiR for the simplified tax system here.

In the event that cash is received at the cash desk from your own pocket, you must make entries 72 “Income/expenses of individual entrepreneurs”, 72.1 “Deposit of personal funds”, 72.2 “Account replenishment” and 84 “Other operating expenses”.

In this case, the deposit is supported by order No. Ko-1. It is then that the accounting of finances that are invested takes place in the account of work with creditors (Credit50) and debtors (Debit76) and in the posting account.

In person at the bank

You can top up your account in cash through the cash desk at the bank branch itself.

You will have to come to the banks and contact the manager. He will fill out the required form, and you will deposit the cash through the cash register.

Don't forget to bring your passport when visiting the branch.

The main advantage of this method is that the purpose of the payment will always be indicated correctly, and the tax office will not have any suspicions.

Usually, replenishment through the cash desk of your bank occurs without commission, but there are exceptions. If you top up through the cash desk of someone else's bank, then there is a commission.

Regulatory regulation

The legislation does not separate the property of an entrepreneur and an individual. An entrepreneur can either withdraw or deposit funds at any time. In practice, entrepreneurs often replenish the working capital of their business with personal property.

BOO. Individual entrepreneurs are not required to keep accounting records (clause 1, part 2, article 6 of Federal Law dated December 6, 2011 N 402-FZ, Letters of the Ministry of Finance dated March 20, 2018 N 03-11-11/17116, dated February 7, 2018 N 03- 11-12/7268).

Accounting legislation does not establish the procedure for reflecting the personal funds of an entrepreneur in the accounting accounts.

If an individual entrepreneur decides to keep accounting records, he can establish the procedure for reflecting this atypical transaction in the accounting policy (Letter of the Ministry of Finance of the Russian Federation dated October 6, 2015 N 07-01-06/56934).

WELL. Personal funds contributed by an entrepreneur are not income (Article 41 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated 04/19/2016 N 03-11-11/24221, FAS Resolution dated 01/19/2012 N A40-39341/11-75-163).

There is a risk that the tax authorities will include these amounts in business income if there is reason to believe that the entrepreneur is contributing unaccounted income under the guise of personal funds. There is judicial practice confirming this approach (Resolution of the Supreme Court of the Russian Federation of February 12, 2018 N F02-7062/2017).

To avoid this, an entrepreneur must:

- correctly formulate the purpose of the payment (when depositing funds through a bank);

- if necessary, confirm the origin of funds.

How to withdraw money from an individual entrepreneur's current account?

You should withdraw cash with caution. In theory, a businessman’s money is his property, which means he has the right to do whatever he wants with it. However, the existence of “anti-money laundering” law No. 115 (adopted on August 7, 2001) obliges banks to monitor suspicious transactions. You can learn in detail about transactions considered suspicious from the Methodological Recommendations compiled by the Central Bank.

From the recommendations we can draw the following conclusion: suspicious transactions are considered to be withdrawals of funds that are not related to wage payments or production expenses. The bank has the right to set a block on funds until clarification is clarified.

Of course, this does not mean that withdrawing money from a current account is completely unavailable for individual entrepreneurs. Blocking by the bank threatens only in the case when a businessman makes large one-time transfers, and at the same time he withdraws the entire amount or transfers it to third-party accounts.

Example from life

The entrepreneur registered as an individual entrepreneur and created a bank account.

After that, he completed his first deal with a large customer and received an advance from them in the amount of 300 thousand rubles for work done in the future. Delighted, the businessman immediately wanted to withdraw money from the individual entrepreneur’s current account. He tried to transfer them to the card, but the bank blocked the account for a suspicious transaction. The entrepreneur was not aware that the bank could perceive such an act as an operation to illegally withdraw funds. After the money arrived in the individual entrepreneur’s current account, he should not try to withdraw the entire amount at once. It would be more logical to pay for purchases using a card and withdraw cash in installments.

When paying for goods and services using a bank card, we provide the bank with information to track the movement of funds in accounts. Thus, the bank and the tax office will have no doubts about the integrity of citizens and entrepreneurs. And when paying and withdrawing cash, you can come under suspicion, because tracking becomes problematic.

In case of an emergency need for cash, before withdrawing money from the individual entrepreneur’s current account, notify your bank and explain why you need the money, and also confirm your words with the necessary documents. If your accounts or cards have already been blocked, call the bank and find out why this happened. Employees are required to tell you the reason for blocking. If, after justifying the reason for withdrawing or transferring money from the account and providing documents, the account is not unblocked, then contact the Internet reception of the Central Bank.

Myth 3. I’ll try to withdraw money, but my account will be blocked.

This can only happen if this is the predominant or even the only type of transaction on the account. A withdrawal operation may be considered questionable if no other expense transactions are made from the current account: paying bills, business payments, taxes, etc.

How to withdraw money without any problems? Follow a few simple rules:

1.Try to make your calculations transparent.

For example, pay business expenses more often with a business card. Make all payments that can be made non-cash without using cash. It is especially important that tax payments are made on the account, as well as payments that characterize your actual business activities - rent, communications, Internet, utilities.

2. Pay your taxes regularly.

According to the methodological instructions of the Central Bank dated July 21, 2017 No. 18-MR, the amount of taxes should be no less than 0.9% of the amount of revenue. The limit is recommended, so the bank may well set it higher or lower.

If an individual entrepreneur is on a tax holiday, that is, he can legally not pay taxes , it is better to inform the bank about this. But even in this case, it is advisable not to delay in paying insurance premiums; holidays do not apply to them; pay them in installments throughout the year.

3.Transfer money to employees' cards.

It is better to pay for labor through a salary project, money on account - on employee cards or corporate cards. This approach simplifies expense administration and makes your transactions clear to the bank.

Become a participant in the Ak Bars Bank salary project. The salary project is convenience, savings and speed for businesses of any size.

Is it income to deposit your own funds into an account?

When using individual entrepreneurs' tax systems OSNO or simplified tax system, the relevant questions are: is a contribution to a personal account account considered income and how to deposit funds without paying taxes? When answering questions, it is important to correctly document the ongoing banking transactions for depositing money.

Depositing your own funds is not considered income received:

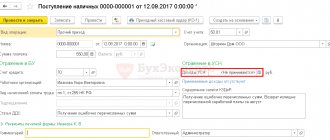

- If the selected method of making a payment allows for the correct indication of its purpose - “Depositing into your own account” or similar wording;

- In KUDiR for entrepreneurs using the simplified tax system 6%;

- In services for accountants (receipt of funds is not reflected in the final tax reporting).

When depositing funds through an ATM from a corporate card, even your own deposited funds are considered income of the individual entrepreneur (usually absent from the ATM menu “Payment Purposes” and the true purpose of the payment cannot be specified).

The main thing is to indicate the purpose of the payment correctly so that there are no claims from the tax service.

Account replenishment technique

Several options are possible: from an individual’s personal bank account; cash via an ATM to a corporate card linked to a current account; through an operator at the bank; using payment systems and electronic wallets.

Option 1: from an individual’s personal bank account

For such a transfer, the details of the individual entrepreneur’s current account are required. In the personal account of the bank in which the account is opened, you need to find how to transfer money using free details. This service may be in the “Transfers” or “Payment for Services” section.

All you have to do next is enter:

- IP name;

- Account number;

- TIN;

- Bank BIC;

- purpose of payment - deposit of own funds.

The method is simple, you don’t need to go anywhere, but a commission may be charged for transfers, especially when your personal and current accounts are in different banks. It is better to find out the conditions in advance.

And you also need to take into account that when transferring between different banks, the period for crediting money to your account can take up to three days. It will not be possible to link a card from a personal account to an individual entrepreneur’s current account.

Option 2: cash via ATM to a corporate card linked to a current account

When opening a current account, the bank offers to issue a corporate card. If the question arises: “How to link a card to a current account?”, then we answer: “There is no need to do this specifically.” A corporate card works the same as a regular debit card: it allows you to pay for purchases in stores or online, and withdraw cash. There is no need to top up your corporate card from your current account.

Online accounting for self-employed entrepreneurs. Suitable for individual entrepreneurs and LLCs using the simplified tax system and a patent.

Try for free

How to top up an individual entrepreneur’s current account if you have a card? It depends on the bank. When choosing this method, you need to pay attention to the following points:

- The bank has a service for replenishing an account via a debit card.

- The size of the commission and what it depends on. For example, the commission may increase in proportion to the amount deposited or depend on which bank’s ATM is used to deposit cash into the account.

- The time that can pass between depositing money into an ATM and it being credited to your account.

- The procedure for depositing your own funds and the ability to specify the purpose of payment. Some banks issue customers logins and passwords for replenishing their accounts through ATMs. The devices have special windows where you can specify details, including the purpose of payment.

If the amount cannot be identified when replenishing your account through a corporate card, it is better to use other methods.

Option 3: through an operator at the bank

You need to come to the bank with your passport and account details, contact a specialist who will fill out the necessary documents and accept money for replenishment.

| Pros of the option | Disadvantages of the option |

| Just | the transfer fee |

| you can specify the purpose of payment | not all banks have branches; the money will not be credited to the account immediately, from the moment the money is deposited until it is received |

| convenient, no need to deal with online banking or ATM | It may take up to three days for your account to be credited |

This method is suitable for those who rarely deposit cash into their current account and do not want to delve into the intricacies of this operation.

Option 4: using payment systems and electronic wallets

You can top up your account this way online:

- first, you need to register in the system or electronic wallet,

- secondly, transfer money using the details of a corporate card or current account.

You can also come to the office of the selected payment system with your passport, give the operator your details and top up your account with cash.

The main difference between this method is the fairly high commission. But it is convenient for those entrepreneurs who store part of their money in electronic wallets or for some reason other options are not suitable for them.

Myth 1. You cannot deposit your money into the account - it is recognized as income

It is not true.

An entrepreneur can replenish his current account with his own money. The main thing is to write the purpose of payment correctly. For example: “Replenish your account with your own funds.”

An individual entrepreneur’s own money will not be considered income. But tax authorities may inquire about the source of this money, especially if the amount is large. Therefore, complete the application on time and do not lose supporting documents. For example: it is better to formalize the transfer of money as a gift from a close relative with a gift agreement in writing.

The payment itself must be received on behalf of the owner of the current account, that is, from the individual entrepreneur himself. The tax authorities will consider a transfer from a third party as income, and will require you to pay tax on this amount.

Is the money contributed the income of the entrepreneur?

How can an individual entrepreneur withdraw money from a current account for personal needs? How much can you withdraw?

The tax office does not recognize own funds as income included in the tax base. However, Federal Tax Service employees may ask for clarification about the sources of these resources. Typically, demands for explanations come to those individual entrepreneurs who often contribute personal money and operate at a loss. Therefore, whenever possible for an individual entrepreneur, depositing personal funds into the individual entrepreneur’s account should be limited to minimum amounts.

Note! Otherwise, the businessman must be prepared for written and oral explanation.

A contribution of an individual entrepreneur's own funds to a current account is considered income only if an incorrect transaction code is specified when replenishing. Typically, bank employees tell beginning entrepreneurs that in order to replenish their account tax-free, they must indicate the type of transaction “own funds.”

If you specify “revenue,” the receipt will be considered income. It will need to be taxed according to accounting requirements. Or the entrepreneur can contact the bank to change the purpose of the posting.

An individual entrepreneur can spend money on purposes related to business activities