In modern fiscal realities, desk audits have been turned into the main form of tax control, both in terms of their mass and in terms of the volume of additional charges. Including voluntary and forced ones. The scope of tax authorities' powers is increasing. And amateur activity knows no bounds. The chamber can be deepened, the term can be delayed, the result can be rolled out in a few years - and the courts will recognize these violations as insignificant.

Shall we discuss? What is the practice of desk audits, methods of survival and what is the news. How to survive it with minimal financial losses, save your nerves, avoid confrontations with tax authorities and prevent it from developing into an exhausting exit trip.

It’s not news to anyone that absolutely all tax returns and calculations are “cameraized.” And companies, and individual entrepreneurs, and individuals. For all taxes and fees. Full coverage. Initially - with the help of automated systems, and then - if necessary - with the participation of auditors. The purpose of a desk audit, like any other tax control procedure, is clear - to find a violation and encourage you to pay additional taxes. Or punish.

If everything is in order, you will not be disturbed. But if the system diagnoses errors or inconsistencies, wait for news.

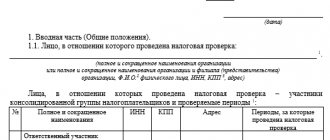

Stages of desk verification.

There are several of them:

- checking the declaration based on final data and benchmarks,

- comparison of information from the declaration with calculations for previous periods and with reporting on other taxes,

- analysis of the completeness of the declaration and information received by tax authorities from external sources - government agencies, registration and control structures, etc.

- and additionally for VAT declarations: cross-checking the compliance of the declaration with the reporting of counterparties. The data in the Purchase Book of the company claiming tax deductions must match the records in the Sales Book of its supplier, which reflects VAT accrual.

A desk audit of VAT takes place according to its own rules. Initially, all declarations undergo automated format and logical control in the ASK VAT-2, and then an in-depth check follows. If VAT is claimed for refund or contradictions are identified in the VAT return or discrepancies with suppliers’ data (gaps).

Status of desk audit of 3-NDFL. How to check?

If the taxpayer wishes to personally control the desk audit procedure and monitor its current status, then the following actions can be taken:

- Check the telephone number of the department involved in desk audits of income declarations of individuals, and then monitor the status of the audit using periodic calls;

- Register your personal account on the tax service website.

These actions allow the taxpayer to monitor the actions of cameramen, clarify the necessary questions, deadlines for completing the audit, and its progress, which is especially important when receiving personal income tax deductions.

Not all requests require clarification

The main errors and discrepancies are identified at the stages of automated verification. Such as:

— erroneous indication of results or their absence,

- discrepancy or incorrect indication of amounts,

— incorrect indication of transaction type codes,

— discrepancies between invoices and supplier data,

- contradictions in “symmetrical” operations on purchase books and sales books and others.

For each error, an automatic request is generated in which you will be asked to provide explanations or make appropriate corrections to the tax return and pay additional tax.

The vaunted digitalization often fails: foreign or unreliable information is uploaded, and ridiculous and strange requests are generated. Often, the tax authorities themselves cannot explain the indicators included in the auto claim and refer to the crooked program and terrible employment.

Therefore, before fulfilling the requirement, I advise you to check them. Including the adequacy of the request.

When receiving a request for clarification on the TKS, do not forget - no later than the next day - to send a receipt for the receipt of the request to the tax office under the TKS. If you are forgetful, tax authorities have the right to suspend transactions on your current account.

During an audit, the tax office can literally overwhelm you with demands, since there are no restrictions on the frequency of requesting documents and the number of requests. Every must be answered . Even more advice in the article “In a stream of disturbing news. We are preparing a response to the tax authorities’ demand.”

The deadline for submitting explanations to the tax office is 5 working days from the date of submission of the request for explanations. Failure to submit will result in a fine of 5,000 rubles. (Clause 1 of Article 129 of the Tax Code). For repeated failure to provide explanations during a calendar year, the fine increases to 20,000 rubles (clause 2 of Article 129.1 of the Tax Code).

Based on the nature of the errors and the analysis of tax risks, you need to make a decision: submit an updated declaration or do not rush - an explanation will suit you.

New control ratios to the updated 3-NDFL

The Federal Tax Service of Russia, by letter dated March 15, 2021 No. BS-4-11/3277, sent control ratios to the new 3-NDFL declaration form to the territorial tax inspectorates. The updated declaration was approved by order No. ED-7-11/ [email protected] ; it is being used for the first time for reporting for 2020. All individual entrepreneurs on the general taxation system and citizens who received income from which tax was not withheld during the year are required to submit it. Due date: 04/30/2021.

How to write an explanation

Check all discrepancies identified by tax authorities using error codes from the application to the request. Check the entries in the declaration with your documents. By details, numerical indicators and amounts.

When the requirement does not indicate specific errors and the accountant is unclear which indicators to explain, the company is not obliged to fulfill such a requirement. Send a reasoned refusal to the Federal Tax Service with a request to clarify the request.

If the errors are technical, it is convenient to use a formalized explanation of the TKS with corrected entries to answer. Reduce preparation time. But you can write a response to the tax office in free form.

1. If there are no errors, the explanations must indicate that there are no errors, inconsistencies or contradictions in the declaration. There are no grounds for adjusting tax liabilities and making corrections to the declaration.

The most common reasons for requesting clarification are the following:

- VAT has not been restored in the VAT return, payment and shipment are reflected in different tax periods, - the amount of income from sales in the income tax return and the indicator of proceeds from sales in the VAT return, - when receiving property, goods or services free of charge, - when transferring them free of charge for one’s own needs, which are not taken into account when calculating income tax - between the indicators of accounting and tax reporting, and others.

The wild imagination of tax officials is not limited. They may be interested, for example, in the validity of VAT deductions for unpaid transactions. Or reflected in the accounting of interest on obligations. Be prepared to explain the reason for the delay, offsets, or other unusual or strange transactions or contract terms.

2. If there are errors, but they did not affect the value of the tax base and the amount of tax, indicate in the explanation the reasons for the distortions and the correct data.

These could be the following errors: incorrectly specified TIN of the counterparty, transaction type code. Or the supplier reflected the sales in an earlier period than you reflected tax deductions, etc.

You can submit a clarification. The Federal Tax Service in its letter dated December 3, 2022 No. ED-4-15 / [email protected] recommends submitting both clarification and explanations. But I don’t advise you to rush with the clarification - as soon as it is submitted, the deadline for the desk audit will begin to run again. At this point, enough explanation.

You can also attach supporting documents to the explanation, at your discretion. But it's not worth it yet. If the tax authorities require them, they will be requested separately.

3. If errors in the declaration lead to an understatement of tax , all corrections can be made only through an updated declaration.

Before submitting the amendment, pay the arrears and penalties. To avoid fines.

A special topic is tax gaps. If you are confident in the legality of VAT deductions when tax gaps are discovered and are not in a hurry to submit an updated declaration, be prepared for an in-depth audit with bias. Check the information and documents you have, contact your counterparties. Analyze your prospects for defending the deduction and your readiness for litigation.

It is worth knowing that in the case of a weak link / black sheep in the chain, demands for tax breaks come to all participants in the chain. But not everyone refuses deductions and gallops to submit the amendment. It is important to assess the degree of your risk and the possible scale of losses - pay taxes for a 5-7-9 level supplier or still resist.

Normative base

Order of the Federal Tax Service of Russia No. ED-7-11/ dated August 28, 2020 “On approval of the tax return form for personal income tax (form 3-NDFL), the procedure for filling it out, as well as the format for submitting a tax return for personal income tax in electronic form"

Federal Law of April 20, 2021 No. 100-FZ "On Amendments to Parts One and Two of the Tax Code of the Russian Federation"

Letter of the Federal Tax Service of Russia dated 05.05.2021 No. PA-4-11/ “On the provision of tax deductions for personal income tax in a simplified manner”

When additional documents are required

During a desk audit, tax officials may request additional documents only in cases strictly defined by Article 88 of the Tax Code . Any requests beyond this list are unlawful. Therefore, before preparing documents on demand, check whether you are obliged to comply with it.

Documents may be requested if:

- the declaration states the amount of VAT to be refunded,

- losses have been declared or a clarification has been submitted to reduce the amount of tax,

- tax benefits applied,

- contradictions and inconsistencies have been identified that indicate an understatement of the amount of VAT to be paid or an overestimation of the amount of VAT to be reimbursed,

- errors, inconsistencies and contradictions were found in the declaration from documents available to the tax authorities,

- the income tax or personal income tax return is submitted by the participant in the investment partnership agreement,

- in the updated declaration, after 2 years from the date of reporting, a tax reduction or increase in loss is declared,

- in the calculation of insurance premiums, a reduced tariff is applied or payments not subject to insurance premiums are reflected,

- an investment tax deduction is declared in the income tax return,

- on declarations on taxes related to the use of natural resources: mineral extraction tax, water and land taxes.

- reporting that is not accompanied by documents required to be submitted simultaneously with the declaration.

The deadline for responding to a request is 10 working days from the date of its receipt. (Article 93 of the Tax Code).

How it goes

Tax officials explain what it means that information has been received about the progress of a desk tax audit of a declaration: this means that control measures are being carried out in relation to the submitted report. At the first stage, control is carried out in the form of reconciliation. The reporting is checked for errors, typos, etc. The provided data is compared with data for the previous period, with information on movement on current accounts, with indicators for other fees for the same period.

Where to see what information has been received about the progress of the desk tax audit of the declaration - all information is available in the personal accounts of taxpayers (individuals, individual entrepreneurs, legal entities) on the official website of the Federal Tax Service.

As a result of the reconciliation, the following is revealed:

- errors;

- contradictions;

- inconsistencies.

The regulations indicate whether it is necessary to provide documents for a desk audit of an income tax return - yes, if the inspector requests them. But first, the Federal Tax Service checks the payer based on submitted reports and information available in the database. During a desk audit, tax officials examine the following documents provided by the taxpayer.

| Type of declaration and rules for filling out | Article of the Tax Code |

| Declaration and/or calculation of advance payments for income tax | Art. 246, 286 |

| VAT | Art. 173, 174 |

| For property tax | Art. 386 |

| According to the simplified tax system | Art. 346.13 |

| Calculation of insurance premiums | Ch. 34 |

If clarifications have been sent to the tax office, they also become the object of control.

If there is a suspicion of a violation or errors are identified, the Federal Tax Service has the right to request additional documents, explanations or clarifications to the reporting (primary documents are allowed to be requested only if violations are identified). They must be provided within 10 days (Article 93 of the Tax Code of the Russian Federation). A form that has already been verified is not checked again if a clarification has not been submitted.

When declaring benefits on a reporting form or presenting VAT for reimbursement from the budget, inspectors have the right to request supporting documents.

| When does the tax office show interest in documentation? | Rule of law | What documents are allowed to be requested? |

| Contradictions and inconsistencies with other documents were identified | Clause 3, clause 8.1 art. 88 Tax Code of the Russian Federation Letters of the Federal Tax Service No. ED-4-15/19395 dated November 6, 2015, No. SD-4-15/16337 dated September 16, 2015 | Copies of invoices, purchase and sales books Explanations or corrected (clarified) report |

| VAT return with the declared amount of compensation (line 050 of section 1) | Clause 8 art. 88 of the Tax Code of the Russian Federation, clause 25 of the resolution of the plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57 | Documents confirming the right to deductions |

| Declarations with claimed benefits | Clause 6 art. 88 Tax Code of the Russian Federation | Documents confirming rights to benefits |

| Declarations on mineral extraction tax, water or land taxes | Clause 9 art. 88 Tax Code of the Russian Federation | Documents providing the basis for the calculation and payment of these taxes |

Inevitable depth

If your response to the request - the volume of documents or refusal to clarify the payment of tax - does not suit the tax office, an in-depth desk audit will begin with every possible set of control procedures: research of your business environment, searches for the beneficiary, counter audits, summonses for interrogation, to a commission, etc. .d.

With the study of the reality of transactions, the control and interdependence of their participants, the reputation of counterparties, prudence in their choice, economic goals, money flow chains, etc.

When conducting an in-depth desk audit, tax officials may apply any tax control procedures at their discretion:

— requesting documents, incl. from counterparties and other persons who have information,

- interrogation of witnesses,

— appointment of an examination, involvement of specialists, a translator,

— inspection of premises, territories, documents and objects.

Controversial issue with the seizure of documents during a desk audit. But recent court decisions support tax officials, fully allowing for seizures during a desk audit: the Tax Code does not contain direct prohibitions, but this was necessary for tax control. Like this.

In fact, there is nothing wrong with in-depth checks: they are carried out quite en masse. And not every one of them leads to additional charges. If you don’t mess around with taxes, fly-by-night tricks and other tricks, you shouldn’t be afraid of it. Yes, they will call you to the tax office and convince you to pay extra taxes, and perhaps they will find gaps somewhere. Or any suspicions will arise (precisely suspicions!). But if you have your documents and contractors in order, it makes sense not to give up.

Is it possible to track the status of a review?

The ability to track the status is available to those taxpayers who are registered on the official website of the Federal Tax Service or on the State Services portal, in the personal account of an individual in the “Life Situations” tab. Services allow you to find out whether the report has been accepted by the inspector and track statuses, results and other information, namely:

- detailed information on the progress of the desk tax audit of the 3-NDFL declaration (completed or in progress);

- result;

- information on return decisions;

- the amount of tax to be refunded.

To connect to the “Personal Account”, the taxpayer has the opportunity to contact any Federal Tax Service, regardless of place of residence and registration. You must have with you an identification document, and, if the taxpayer applies to an inspectorate other than his place of registration, a certificate of registration of the individual with the tax authority (TIN). Without visiting the inspectorate, the application is filled out on the Federal Tax Service website on the “Taxpayer’s Personal Account for Individuals” page. But how long it takes to review a 3-NDFL declaration filed in your personal account is no different from checking a paper form - the same 3 months.

In addition, you can find out the stage at which the desk tax audit of an individual’s 3-NDFL declaration is by calling the Federal Tax Service Inspectorate or by visiting your inspector in person.

About VAT refund

Declarations with a claim for VAT refund are regarded by tax authorities as #lostshore. There are some exceptions - export and some other operations with their own rules.

All declarations with declared VAT for refund are always studied with passion. The control flywheel goes into full swing: interrogations, oncoming meetings, inspections, etc. The goal is to find artificial conditions for VAT refunds and evidence of receiving an unjustified tax benefit.

Be ready. If you are not one of the exporters that has been repeatedly verified, in 98% of cases you will be denied a VAT refund. Any reason is suitable for an inspection: inconsistencies, errors, doubts about the reality of the transaction, the potential capabilities of the counterparty, suspicions about its control or interdependence. If everything goes well with this, the target of the transaction will be targeted - what? besides saving on taxes? What about the economy? You will also be reminded about your share of the tax burden: you must pay, not reimburse!

The smaller the inspection, the higher the likelihood that they will be kicked out - there is a plan for collecting taxes. The inspection will not mind if you complain to the Federal Tax Service. Let big brother decide whether the budget will allow such spending or not.

The Tax Code allows for a declarative procedure for VAT refund. Until the end of the camera room. The code has its own rules for it.

You have the right not to fulfill illegal requests.

During desk audits, tax officials often forcefully and forcefully demand primary documents, accounting registers, financial statements, accounting cards, balance sheets and other documents that, in general, are not related to the calculation of taxes.

Yes, you can resist and prove the unlawfulness of the demand. According to paragraph 7 of Article 88 of the Tax Code, when conducting a desk tax audit, the tax authority does not have the right to request additional information and documents from the taxpayer, unless otherwise established by this article or if the submission of such documents along with the tax return is not provided for by the Tax Code of the Russian Federation.

Therefore, yes, when a sense of proportion is lost, we write a letter about the illegality of requesting documents with justification and links to the regulatory framework. And calmly, selectively, without any special decoding according to subconto, in a very condensed version, we prepare the documents. With an inventory, of course, as expected.

Take a sideways look at your folded accounting registers – do you get much information out of them?

Even more advice can be found in the Article “In a stream of disturbing news. We are preparing a response to the tax authorities’ demand.”

Try to avoid going to court. Appeals to the head of the inspectorate, complaints to the Federal Tax Service may bring some reason to the overly restless inspector.

But the judicial rigmarole and battles on this issue are a waste of time. Firstly, tax legislation does not contain a list of documents that a taxpayer is required to maintain for tax accounting purposes - the requests of tax authorities are not limited. Secondly, the modern practice of tax disputes mainly supports auditors who claim that they need documents to carry out control activities.

What information can be obtained through the taxpayer’s personal account?

— a convenient tool for interaction between an individual and the tax office. You can register in it by contacting any tax office with an identity document and receiving a login and password.

This is what the main page of your personal account looks like:

We also list the functions of your personal account:

Coming to the main topic of the article, we note that you can also receive information about the progress of the desk tax audit of the 3-NDFL declaration. The progress of a desk audit in your personal account is indicated by the term “status”. The status of the desk tax audit of the declaration may vary. We will consider below what values it can take.

First, let’s answer the question, what does a desk audit mean? During the desk audit, compliance with the legislation on taxes and fees is examined on the basis of the declaration submitted by the taxpayer and other documents, as well as documents available to the tax authority. Thus, any declaration undergoes a desk audit.

The stages that must be completed to return overpaid personal income tax by submitting 3-personal income tax to the tax authority:

- submission of the 3-NDFL declaration and other necessary documents to the tax authority. As of reporting for 2022, a new form, Form 3-NDFL, has been introduced, which already includes an application for a refund of overpaid tax. Previously, such an application had to be submitted separately. In the taxpayer’s personal account, you will not fill out the declaration form itself, but will only enter your data in the cells, so there should be no difficulties with the current form when submitting it. Required additional documents include, for example, a contract, receipts and a license from a medical institution if a social deduction is claimed.

- desk audit of the 3-NDFL declaration within 3 months

- confirmation of return request or request for clarification in case of identified discrepancies

- if the decision is positive - personal income tax refund

For those who do not have the opportunity to use their personal account, we will provide a link to the current 3-NDFL declaration form

How to fill out 3-NDFL, read the article

We wrote more about the procedure for conducting a desk audit of 3-NDFL here

The period of the desk inspection has been reduced, but bleakly

As a general rule, the period for a desk audit cannot be more than 3 months from the date of submission of the tax return and tax calculations.

From September 3, 2022, the period for desk audits for VAT returns has been reduced to two months. But it can be extended by the head of the inspection for up to 3 months. Moreover, it is very easy - if there are suspicions of violations. In this case, no one will notify the person being checked - you. No obligation. You will understand for yourself by the activity of the inspector or your contracting partners will inform you.

For VAT returns submitted by foreigners providing services electronically via the Internet, the period for desk audit is 6 months.

There are cases when, after three months or more, a desk inspection report arrives. And it is followed by a decision to collect taxes and bring them to justice. Yes, unfortunately, recently a negative practice has emerged, supported by the courts, allowing tax officials to delay procedural deadlines for desk audits. And it will not be possible in court to cancel the decision based on the results of the audit only on the grounds that the tax authorities checked you longer than the required period. If, as a result of the audit, the tax authorities reveal a tax violation.

But if you have not violated the law and are ready to defend the legality of your position on the merits, apply for the cancellation of the tax authorities’ decision due to violation of the deadlines for control procedures. The deadline has been set and no one has canceled it!

You have the right to appeal the actions and inactions of the tax authorities to a higher tax authority and in court. The court will accept your application only after filing a complaint with a higher tax authority. According to paragraph 2 of Article 138 of the Tax Code.

A complaint to the prosecutor's office may encourage tax officials to comply with the deadlines established by law. If the complaint is sent in a timely manner, the prosecutor has the right to demand that the inspection be stopped. Right, but not obligated. The period for consideration of the complaint is 30 days from the date of registration. Don't delude yourself. But the main thing is that you can try.

Situation. If, a few days before the inspection deadline, the inspector asks you to submit an update with minimal, meaningless corrections, don’t be fooled. You are being used. The inspector did not meet the deadline set for the inspection, and does not want to explain to the strict boss about extending the deadline. Submitting a new clarification will restart the verification counter. And it will add an avalanche of demands, headaches and sleepless nights.

Possible results of consideration of the declaration

The maximum period for conducting a desk audit of 3-NDFL in 2021 is three months. Based on the results of control activities, the taxpayer receives a notification with a decision on payment (offset) of overpaid income tax or refusal of compensation.

IMPORTANT!

If the inspection refuses to transfer money from the budget, the payer has the right to appeal the refusal. Before sending out the notification, the inspector will send a letter demanding that you make changes or provide a package of supporting documentation to the Federal Tax Service. The taxpayer is given 5 days to prepare written explanations (clause 3 of Article 88 of the Tax Code of the Russian Federation).

For those who submit an annual report to confirm the income received (IP on OSNO), the period for how many days they check the 3-NDFL declaration is the same, that is, 3 months from the date of registration of the reporting form. If, based on the results of the inspection, the Federal Tax Service did not send any documents to the taxpayer, then the inspection was successful. If the report reveals violations, the inspectorate will send a desk inspection report within 10 days after the end of control activities (Clause 1 of Article 100 of the Tax Code of the Russian Federation). The payer must correct the errors and submit a correct return to the tax office.

The deadline for the desk audit may change

The reduction of the desk audit of the VAT return to 2 months was announced as a broad gesture by legislators concerned about the difficult fate of Russian business.

But there is a big risk that this attraction of unprecedented generosity will be devalued by other possible innovations in the Tax Code.

The auditor of the Accounts Chamber, having analyzed the work of the Federal Tax Service, became agitated: tax authorities do not have enough time to check VAT returns using the mechanism of symmetrical reconciliation with counterparties of ASK VAT-2. Tax returns submitted, for example, from the 7th to the 12th cannot be cross-checked until the 25th. Since the main part of the declarations is submitted and loaded into the system on the last days of the deadline, on the 25th. An amendment is needed to Article 88 of the Tax Code: the deadline for a desk audit for VAT is counted from the 25th day of the month following the reporting quarter. One for everyone. And the actual date of submission of the declaration will not be important for the cameral period.

Another concern of the same official: the tax office does not fine enough for violation of deadlines for submitting reports. And the amount of fines must be increased. Otherwise, it’s a mess: the budget costs for drawing up and processing one protocol on an administrative offense are 2,540 rubles, and the maximum fine for an official under Article 15.5 of the Code of Administrative Offenses is only 500 rubles. The budget is suffering.

And another proposal to the government from the Accounts Chamber is to oblige businesses to send documents for audits to the tax office exclusively in electronic form via TKS, enshrining the norm in paragraph 2 of Article 93 of the Tax Code. How do you like the offer? Considering the flow of requests from the tax office? Has everyone switched to electronic document management? Or are you ready to hire scanners and female scanners?

Here's the news. The fiscal system is like the Lernaean hydra. In place of one positive norm, three harmful ones grow.

Will these changes be introduced into legislation? Or not? We'll watch.

Deadlines for conducting a desk audit of 3-NDFL

Paragraph 2 of this article determines that a desk audit must be carried out no later than three months from the date of transfer of 3-NDFL to the tax office .

The starting point for the specified three months is the moment of submission of 3-NDFL. This declaration can be submitted by an individual in several ways:

- personal delivery to a tax specialist;

- electronic transmission;

- mailing.

Date of submission of 3-NDFL depending on the method of submission:

| Feeding method | The date of submission from which the period for the desk audit will begin |

| Personally | The actual day the documents are handed over to the tax specialist. |

| Electronically | The moment of sending the electronic form 3-NDFL to tax specialists. |

| By mail | The actual date of dispatch of the mail with attached documentation. |

Thus, the moment the desk audit begins is the date of transfer of 3-NDFL to the tax office; within 3 months from this date, the desk clerks must check the declaration.

If the taxpayer is required to provide an updated or adjusted 3-NDFL, then the three-month period will be recalculated from the date of submission of the last document or explanation.

About additional events

If the inspection is completed, the report has been handed over and the inspection materials have been reviewed, the head of the inspection has the right to decide to conduct additional inspections. events. And indicate the reason. Additional measures are appointed to obtain additional evidence exclusively for violations already identified by the desk audit.

The duration of additional measures is no more than 1 month (2 months for consolidated groups and foreign companies). But in the opinion of the Federal Tax Service and the Ministry of Finance, if a tax violation is detected, the protracted period of additional measures is not an absolute reason for canceling the decision based on the results of the audit.

The list of additional measures is closed and includes a limited list of tax procedures. These are: 1) requesting documents, 2) counter-inspections, 3) interrogating witnesses, 4) conducting an examination. But it is worth knowing that both the inspection of the premises and the seizure - not provided for additional measures - are recognized by the courts as legal and legitimate. Yes, this is the modern practice of litigation. It allows unpunished violations of procedural norms, ignores the Tax Code and creates its own parallel norms in the Russian legal system. Unfortunately.

How adjusted declarations are checked

Tax authorities are required to accept and verify each updated return submitted. Checking the clarification consists of finding out the reasons and circumstances of the changes. And how they affected the tax base. If the amount of tax payable has decreased or the amount of loss has increased, they will be biased to study why.

The consequences of the clarification depend on the procedural actions of the tax authorities and the moment of submission of the clarified declaration:

- If the clarification is submitted during a desk audit of the declaration or after its completion, and the audit report is not drawn up and handed over : the check of previously submitted reports is terminated, the tax authorities will not draw up a report on it, but will begin a new desk audit.

- The clarification is presented after the report of the desk or field audit is delivered, but before a decision is made on it : the tax authorities will make a decision on the report of the audit of the primary declaration. And then they will choose a way to check the amounts declared in the updated one.

- The clarification is presented after the on-site inspection report is drawn up : the auditors will decide how to check it. They have the right to appoint additional measures, a desk or repeat on-site inspection.

- The clarification is presented after a decision has been made on a desk or field audit : tax officials request clarifications on the updated tax return, including the fact that the results of the completed tax audit are reflected.

If the updated declaration does not change the tax amount or changes it to a decrease, tax liability in the form of a fine for incomplete payment of tax is not provided. If clarifications lead to additional payment of tax, it is important to pay the missing amount of tax to the budget, calculate and pay penalties, before submitting the revised declaration. In this case there will be no fine. Provided that the error was discovered and corrected by you yourself - and not from a report from the tax authorities about the error or about the appointment of an on-site tax audit.

Everyone knows, but let me remind you: from the date of filing the updated declaration, the period for the desk audit begins to run again.

Tax return verification deadlines

Tax officials check all tax reports: the information reflected in them and the attached documents.

The period for which a desk audit of a declaration takes place at the inspectorate is strictly regulated by tax legislation. Clause 2 Art. 88 of the Tax Code of the Russian Federation instructs tax authorities to carry out control procedures for no more than three months. According to the law, the period for consideration of the 3-NDFL declaration in electronic form or on paper is considered without taking into account non-working days provided for by presidential decrees (Letter of the Federal Tax Service No. EA-4-15/6101 dated 04/10/2020). This is especially true when submitting a report in April, before the May holidays. IMPORTANT!

The new form 3-NDFL has been approved! Don't forget to update the form when submitting your reports.

The countdown begins from the day you submit your reports in person or on the website nalog.ru. When sending documents by post, the period is counted not from the moment of sending, but from the day the documents are received by the inspector.

The time it takes to check 3-NDFL at the tax office also depends on the correctness of its initial completion. If errors are discovered, tax authorities have the right to request clarification from the taxpayer, who is obliged to provide them within 5 days. If the declarant decides, without waiting for an official request, to send updated reports with explanations and attached documents confirming the correctness of the calculations, then the three-month period for consideration of the 3-NDFL declaration is reset and starts anew (Letter of the Ministry of Finance No. 03-02-07/1/40441 dated 14.07 .2015). The number of such adjustments is not limited by law.

There are no other grounds for extending this period in the Tax Code of the Russian Federation. The Federal Tax Service of Russia strictly monitors compliance by the Federal Tax Service departments in the constituent entities of the Russian Federation with the time frame (Letter of the Federal Tax Service No. BS-4-11 / [email protected] dated 04/09/2020).

How to fill out 3-NDFL: instructions for individual entrepreneurs

3-NDFL is one of the mandatory reporting forms for individual entrepreneurs. ConsultantPlus experts told us how to fill it out and submit it correctly.

A successful desk audit does not provide guarantees

Tax officials have the right to assess additional taxes during an on-site audit, even if they did not find any violations during a desk audit during the same period. Penalties and fines may also be assessed. There will be no exemptions or mitigations. And a reduction in the fine too.

There are a lot of explanatory letters from the Federal Tax Service about this (one of the latest dated June 7, 2022 N SA-4-7 / [email protected] ) and court decisions.

According to the Constitutional Court No. 571-O dated March 10, 2016, there is nothing wrong if during an on-site audit, tax officials identified violations that they did not notice during a desk audit. After all, an on-site inspection is more thorough and in-depth. Desk and on-site audits are not duplicative tax control procedures. And, according to the court, there is no violation of taxpayers’ rights in this case.

No declaration - no desk audit?

Yes, this was confirmed by the Supreme Court: it is impossible to conduct a desk audit if the taxpayer fails to submit a tax return.

Yes, this particular control event is not launched. But the tax office has other sobering measures:

1) blocking of bank accounts and electronic money transfers. If the declaration is not submitted within 10 working days after the due date for filing,

2) bringing to tax liability:

- under clause 1 of Article 119 of the Tax Code in the amount of 5% of the amount of tax not paid on time for each month of delay, but not more than 30% and not less than 1,000 rubles;

- under clause 1 of Article 126 of the Tax Code in the amount of a fine of 200 rubles.

3) bringing officials to administrative liability in the form of a fine of up to 500 rubles (Articles 15.5, 15.6 of the Administrative Code).

The amounts of fines are not very scary, but blocking an account will immediately cheer you up.

Situation. There are cases when deadlines for submitting reports are running out, and it is necessary to clean up (or restore) accounting, or clarification is required - in general, circumstances have arisen when an accountant understands that submitting reliable reports on time is not possible. And as a rule, we rent out what we have. Approximate. So that the tax office does not block the account. We'll clarify later. It should be remembered that immediately after receiving the declaration, a control procedure is launched in an automated mode: with the identification of “jambs”, with demands to justify them, with subsequent clarifications piled up and the harsh consequences of a desk audit. As a possible option: there are 10 working days before the account is blocked - you can use it as a temporary bonus in order to clean out the declaration and survive the cameral without any special worries. Yes, pay a penalty for these days of delay.

Deduction for 3-NDFL declaration - procedure and timing of desk audit

The new rules do not apply to all taxpayers, and therefore do not cancel the previous procedure for receiving deductions. Those who need a social deduction or who do not have a personal account must proceed the old fashioned way - submit declarations in form 3-NDFL and a package of supporting documents.

For 2022, you need to submit a declaration using the new form 3-NDFL, approved. by order of the Federal Tax Service dated October 15, 2021 No. ED-7-11/ [email protected]

Having received the documents, the tax authorities begin a desk audit - they check the information with the documents, check the amounts to be deducted, etc. According to clause 2 of Art. 88 of the Tax Code of the Russian Federation, they are given 3 months for verification, starting from the day the taxpayer submits a tax return. If you send it by mail, the period will begin from the day the tax office receives the letter (Explanations of the Ministry of Finance dated June 19, 2012 No. 03-02-08/52).

During the audit, the inspector may identify an error, unreliability or forgery of a document. He will inform the applicant and demand explanations, documents or corrections.

Please note that it is not possible to correct a declaration that has already been submitted. You will have to submit a new, updated one. Having received the “clarification”, the inspector will stop verification activities on the old declaration and begin to work on new documents. However, the deadline for checking the first one is canceled and starts anew from the date of receipt of the updated declaration (clause 9.1 of Article 88 of the Tax Code of the Russian Federation). Likewise, if the applicant himself discovered an error and immediately submitted an updated declaration.

Sometimes the tax office still denies the deduction. Then, within 10 days from the date of completion of the inspection, the inspector draws up a corresponding act and delivers it to the applicant within the next 5 working days (clause 1, clause 5 of Article 100 of the Tax Code of the Russian Federation). In this case, the disagreeing applicant has the right to submit written objections within 1 month to the regional Federal Tax Service, the Main Directorate of the Federal Tax Service or to the court if there are no results on the complaint.

However, if the audit was successful, then within a month the tax office will return the overpaid personal income tax to the applicant’s specified bank account (Article 78 of the Tax Code of the Russian Federation). Consequently, the total period for returning personal income tax will be 4 months (Letter of the Ministry of Finance dated December 27, 2005 No. 03-05-01-05/233).

You can find out whether the check has ended or not in the individual’s personal account on the Federal Tax Service website (nalog.ru) in the “Life Situations” tab. You can log into your personal account through “State Services” or using a login and password previously obtained from the inspectorate.

Let's summarize. And some tips

- Do not underestimate the importance of a desk audit and its possible negative consequences. Carelessness, haste and carelessness in actions may lead to other control measures and financial losses.

- You need to prepare for an in-depth desk audit just as responsibly as for an on-site audit. According to all the rules - instructing staff, preparing for inspections, assessing the feasibility of interrogation visits, working with contractors, etc. And keep the process under control.

- Always respond to demands. For each. Even if you have no errors or the request was sent to you incorrectly. Silence or ignoring demands will be interpreted negatively. With a sad outcome.

- Submit your documents very carefully. Don't try to distinguish yourself - be exemplary and efficient. Sometimes the “toffee” even helps a lot. Don't post everything at once. Upon request. Check the specifics. Always with cover letters and a list of documents. With references to legal norms demonstrating your absolute legal confidence.

- Notice and record auditors' mistakes. Prepare complaints, stop illegal actions.

- If you do not agree with the inspectors’ conclusions, submit reasonable and reasoned objections.

- Wearly assess the possible risk and the prospect of defending your position. And readiness for trial.

I hope this was helpful.

Good luck, colleagues! Easy and discreet office checks!