All employers are required to submit a 6-NDFL report quarterly. Despite the fact that a major update to the form of this report is expected in 2022, the assistants for checking the correctness of its completion will remain the same.

So, in the 1C: Salary and Personnel Management program ed. 3.1 the 6-NDFL report is generated in the “Reporting, certificates” section - “1C-Reporting”.

Click the “Create” button and in the “Federal Tax Service” section, find the “6-NDFL” report.

Use the arrow buttons to set the reporting period.

Click the "Fill" button.

The report has two sections:

Section 1 - “Generalized indicators”, including data on the amounts of accrued income, tax deductions, and amounts of calculated tax. The user can view the detailed sums of the report cells. To do this, right-click on the cell and select the “Decrypt” command.

Having received a decoding of the form data in the context of income codes, the user can analyze them.

Section 2 - “Dates and amounts of income actually received and personal income tax withheld.” Here the user can also get detailed information about decoding any cell. This method helps you analyze the data and find errors in the report.

In addition to detailing report cells, 1C also has “helper reports” that make it possible to analyze personal income tax data. They will help the user when filling out and checking the “6-NDFL” form:

- “Summary certificate 2-NDFL”;

- Analysis of personal income tax by date of receipt of income;

- Analysis of personal income tax based on documents;

- Analysis of personal income tax by month;

- Control of personal income tax payment deadlines;

- Accrued income in personal income tax reporting;

- Accrued and received income in personal income tax reporting;

- Detailed analysis of personal income tax for an employee;

- Checking section 2 6-NDFL;

- Tax accounting register for personal income tax;

- Withheld personal income tax.

They can be formed in several ways:

Option 1 - in the section “Taxes and contributions” - “Reports on taxes and contributions”.

By opening the section, you will see a list of personal income tax reports.

Option 2 - in the "Salary" section - "Salary reports".

Go to the very bottom of the list of reports and follow the “All reports” hyperlink.

Open the “Taxes and Contributions” section and a list of additional reports for personal income tax analysis will appear on the right side.

Let's take a brief look at these reports. What information can the user get from them?

“Summary” certificate 2-NDFL

The form itself “Income Certificate (2-NDFL) for an employee” can be generated in the “Reporting, Certificates” section.

The document contains information about the income and personal income tax of the selected employee.

The “Summary” 2-NDFL certificate report contains information from which the 2-NDFL certificate is generated. The advantage of the report is that it generates data for all employees. With its help, you can check all the data on an employee’s income, personal income tax accruals and deductions, and applied deductions.

If necessary, you can set the selection in the “Settings” button.

If an error is detected, the user can make corrections in the program in a timely manner.

For example, a deduction to an employee was not provided, not closed, or was incorrectly indicated.

Go to the employee card - in the “Employees” directory and enter or correct the data on deductions in the “Income Tax” section.

In the section you can enter:

- new claim for standard deduction;

- notification of the tax authority about the right to deduction.

And also view all applications for employee deductions by clicking on the hyperlink of the same name.

Interrelation of 6-NDFL indicators and Appendix No. 1 to the calculation of 6-NDFL

Tax inspectors compare the data from these reports.

First of all, equality must be observed between the figure in line 120 of form 6-NDFL with the number of sections 2 of Appendix No. 1 compiled at the corresponding tax rate. Let us remind you that the application is compiled individually for each employee. Inspectors can easily see how many employees received income in form 6-NDFL.

In addition to equality of individuals, income equality must be observed.

Line 110 of form 6-NDFL (annual) = the total value of the lines “Total amount of income” at the corresponding tax rate of Appendix No. 1.

Inspectors will also check the following ratio of indicators: line 140 6-NDFL for the year at the corresponding tax rate = the total value of the lines “Amount of tax calculated” at the corresponding rate of all compiled Appendixes No. 1. If this is not the case, the amount of calculated tax may be overestimated or underestimated .

Line 111 6-NDFL = the amount of income in the form of dividends (according to income code 1010) of Appendix No. 1 to 6-NDFL, presented for all taxpayers. If they are not equal, check whether the dividends paid are correctly reflected in the reporting.

Line 170 6-NDFL = the sum of the lines “Amount of tax not withheld by the tax agent” of appendices No. 1 to 6-NDFL. If there is no equality, the withheld tax is calculated incorrectly.

The total amount of deductions from line 130 must be equal to the sum of all deductions from the line “Deduction Amount” of Section 3 of Appendix No. 1.

Line 150 for the corresponding tax rate should be equal to the sum of the lines “Amount of fixed advance payments” of Section 2 of Appendix No. 1. If this is not the case, there are errors in the calculation of fixed advance payments.

Analysis of personal income tax by date of receipt of income

The report allows the user to obtain information about accrued and paid income, calculated and withheld personal income tax, etc. Information is displayed in the report by date and combined by month. Using the grouping icons " " and "-" you can collapse and expand data.

Information presented in this form is easier to verify and analyze. It makes it easy to spot errors.

Using the “Settings” button, you can set additional report generation parameters.

Set the setting type to “Advanced” and on the “Selection” tab add additional selection. Click the "Add selection" button and add the "Employee" field.

Set “Employee”, the condition “Equal” and in the “Value” field select an employee from the directory. In our example - Akopyan M.S.

Click "Close and Generate". The data in the report will be displayed in accordance with the selection condition.

If you often use the report, for convenience, you can select by employee in his header. Then, to select an employee, you don’t have to go into settings every time. To do this, in the selection line, click on the symbol “-” and select “In the report header”.

As a result of the setup, a selection field by employee appeared in the report header.

This setting applies to any report in 1C.

As with any other report, the user can analyze the data by looking at its transcript. Double-click on the cell value and select the “Registrar” field value.

As a result, a transcript will be displayed in the context of documents that made an entry in the register. Double-clicking on the name of the base document will open the document itself.

Checking “mathematics” in 2-NDFL

You can check the “mathematics” (compliance of the calculated tax with the tax base, etc.) in 2-NDFL using the Legal Entity Taxpayer program.

You can download the Legal Entity Taxpayer program on the nalog.ru website using the link →

When you start working with the program, you will need to fill out information about the organization, then download the file with 2-NDFL certificates from the 1C program and upload it to Taxpayer Legal Entity.

After launching the check, its results in the Taxpayer Legal Entity can be displayed in the following form:

The most valuable thing about the program is that it tests “mathematics”. For example, it compares:

- the amount of personal income tax calculated in the 2-NDFL with the calculated personal income tax calculated;

- the amount of personal income tax transferred and withheld (personal income tax transferred should not exceed the withheld tax);

- the amount of personal income tax withheld with the estimated personal income tax withheld.

Personal income tax analysis by month

The group of reports “Personal Income Tax Analysis by Month” allows you to compare calculated, withheld and transferred personal income tax, analyze the tax base and applied deductions. The report is presented in a complete and simplified version, as well as with details of the months of the tax period and the months of mutual settlements with employees.

The simplified version contains summary information on the indicators.

To detail records by employee, check the “Detail by employee” checkbox. A section of the same name will be added to the report.

The second version of the “Analysis by Month” report displays the same information, but in a slightly different interface.

The report “Analysis of personal income tax by months of the tax period and months of mutual settlements with employees” has added additional settings and selections. The user can specify:

- period of income;

- settlement period;

- organization and branch;

- Inspectorate of the Federal Tax Service.

Amounts in this report, as in all other reports, can be drilled down by right-clicking and selecting an option to drill down. For example, by the “Registrar” field, i.e. according to the document.

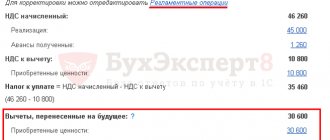

Example 1 of checking data in 6-NDFL for the 1st quarter of 2022.

Let's build a Summary... or Salary Analysis for employees (Salary - Salary Reports) for the 1st quarter of 2022.

In the customized report Analysis of personal income tax by month, we will set the selection by the Period of mutual settlements - 1st quarter of 2022.

The amount of income and calculated personal income tax in Personal Income Tax Analysis by month must agree with the Code...

This will mean that all accruals are included in the tax accounting for personal income tax.

In this case, you should not pay attention Remaining to hold column the data is “cut off” at the end of the Settlement Period (as of March 31, 2021). Therefore, there will always be unwithheld personal income tax.

You can clear the Remaining to hold so that this column is not displayed.

We will establish selections based on Income Generation Period .

Then you can check:

- Income from line 110 Section 2 report 6–NDFL (from 2022)

- Deductions from line 130 Section 2 report 6–NDFL (from 2022)

- Calculated personal income tax line 140 Section 2 report 6–NDFL (from 2022)

In the report Analysis of personal income tax by month, you can check that the calculated personal income tax is equal to the withheld one.

However, line 160 cannot be verified when selecting by Income Receipt Period In order to obtain in the Analysis of Personal Income Tax by month the value for line 160 of Section 2 report (from 2022), we will set the selection by the Period of mutual settlements - 1st quarter of 2022.

For example, in our case, this included amounts not only for the 1st quarter of 2022, but also the December salary paid in January 2021.

As a result, the amount of Withheld Tax from Analysis by month coincided with line 160 of Section 2 of report (from 2021) .

To check Section 1 of report (from 2021) in the report Analysis of personal income tax by month, the data in the Tax withheld to the Deadline for payment . To do this, double-click on the total amount in the Tax withheld and select the field Deadline for payment .

We will receive the same data as in Section 1 report (from 2021) .

To view the personal income tax refund, set the Tax refund checkbox in the Personal Income Tax Analysis by month .

Detailed analysis of personal income tax for an employee

The report allows you to view all information on the selected employee:

- Accrued and paid income;

- Deductions applied;

- Tax base;

- Accrued, withheld, transferred personal income tax and tax debt.

The report is generated indicating the primary documents, broken down by accrual months.

Checking sec. 2 6-NDFL

To help you check section 2 of the “6-NDFL” report, the report form of the same name will serve. It contains information about the amounts of personal income tax withheld and income received, indicating the document, the transfer period and the date of withholding.

Interrelation of 6-NDFL indicators and calculation of insurance premiums (DAM)

Both 6-NDFL and RSV are reports on people. It is quite logical that some equalities should also be satisfied between these forms. Moreover, since 2022, contributions from wages and other income are at the mercy of the Federal Tax Service. The Federal Tax Service offers only one verification formula to companies.

Firstly, the sum of lines 112 and 113 of the 6-NDFL calculation should not be less than line 050 of Appendix 1 to Section 1 of the RSV. Equality is also allowed. But if the amount is less, there is a possibility of underestimating the tax base.

And, of course, if a company submits 6-NDFL, it is also required to submit DAM.

Fill out and submit 6-NDFL reports online without errors. 14 days of Externship free for you!

Try for free

How to fill out section 2 of the 6-NDFL report?

Summarizes data for all months of the reporting period - from January 1 to the last day of the reporting quarter.

Line 110: indicate the income of individuals from the beginning of the year - before personal income tax was deducted from income. For the second quarter - salary from January to June, including salary for June, which you paid already in July. Vacation pay and sick leave benefits paid from January to June - it doesn’t matter for what period. Other income that the physicist received from January to June and from which you must withhold personal income tax.

Lines 111, 112 and 113 are responsible for different types of accruals: dividends, payments under employment contracts and under civil servants' agreements. Enter total amounts since the beginning of the year.

Line 120 - the number of people whose income you reflected in 6-NDFL.

Line 130 - the amount of deductions for income from line 110. For example, children's, property, social deductions.

Line 140 - the amount of personal income tax on income from line 110.

Line 141 - the amount of personal income tax only on dividends, if they were paid.

Line 150 - fill in if there are foreign workers with a patent.

Line 160 is the amount of personal income tax that has been withheld since the beginning of the year. It may not coincide with the amount in line 140. For example, it is not possible to withhold personal income tax until the end of the year, or income was received in one quarter, and tax was withheld in another.

Line 170 is personal income tax, which you will not be able to withhold until the end of the year. For example, personal income tax on a gift worth more than 4,000 rubles to a person who does not receive cash income from you.

Line 180 - fill out if you withheld more personal income tax than you were supposed to.

Line 190 - fill in if tax was returned to employees.

You can submit a report on paper if you have no more than 10 employees. And only electronically - if there are more than 10 employees.

Reconciliation of data in 6-NDFL reports (2022 format) and data in registers. ZUP 3.1

The report was developed based on the report Register of regulated reports 6-NDFL for all organizations and separate divisions. Control of withheld personal income tax. ZUP 3.1

Since 2022, the 6-NDFL form has changed. Old reports are not suitable... it was necessary to develop a new report for the 6-NDFL report form from 2022.

The report is useful for all companies - to check the correctness of filling out 6-NDFL, as well as to understand how the data in the registers has changed after submitting 6-NDFL.

And the report is especially useful for large organizations that have many separate divisions. For each separate division, its own 6-personal income tax is submitted. When there are many separate divisions, it is difficult to check the correctness of the generated reports; you also need not to miss a single separate division... You can also see deviations in cases where an accountant manually changes the data in the 6-NDFL report...

This report contains a register of 6-NDFL reports, with data from Sections 1 and 2 of these reports. And also for each 6-NDFL report, data is collected from the registers on the basis of which 6-NDFL is formed.

The report includes one 6-NDFL report for each separate division or organization (if there are no separate divisions) for the reporting period. (I came across a situation where accountants generate several reports and only one of them is sent to the tax office. For analysis, only the report that was submitted is needed. Ideally, all “extra” generated 6-NDFL reports are marked for deletion. But this does not happen Always). If several 6-NDFLs have been generated for one checkpoint/OKTMO, then the reports for analysis are selected according to the following principle: 1. those not marked for deletion, 2. the last one by type (Primary, Corrective 1, Corrective 2... - the last of these reports will be selected) , 3. latest report by date of signature.

The report has three report parameters:

1. “Organization” - if the organization is not selected/filled in, then the report is generated for all organizations for which salary records are kept in the database.

2. “Report period” - the period for which the 6-NDFL report register is needed. (these may be periods: 1 quarter, 1 half year, 9 months and a year). It should be understood that the period may not be earlier than 2022 - since in 2022 they made a new form of the 6-NDFL report with new filling out rules, and it is for this form that this report was developed.

3. “All reports from the beginning of the year” – checkbox. If the checkbox is not checked, then the report is generated only based on 6-NDFL reports corresponding to the “Report period” parameter. If the checkbox is checked, the report will contain information on all reports from the beginning of the year to the end date of the “Report period” parameter. For example, if the “Report period” parameter is from 01/01/2021 to 06/30/2021 and the “All reports from the beginning of the year” checkbox is selected, then the report will contain 6-NDFL reports for the 1st quarter of 2022 and 6-NDFL reports for the 1st half of 2022.

Register data is collected for the reporting period and grouped by KPP/OKTMO.

Since 6-NDFL reports from 2022 have new rules for filling out OKTMO, for the report the data is grouped according to the first eight characters of OKTMO. (I encountered a situation where in the 6-NDFL report the 11-digit OKTMO was cut off to 8 characters, in connection with this it was necessary to always use eight characters in the report - otherwise the data of 6-NDFL and registers would not be compared). If you have an understanding and ideas on how else you can compare the data from 6-NDFL and registers - write - we’ll think about it - we’ll finalize it!

Now let's take a closer look at the data in the report.

The report contains the following data from 6-NDFL:

Section 2: the report contains all the data from all pages of Section 2. The report displays the data from Section 2 - at rates, as in the 6-NDFL report.

Section 1: The report contains a summary of rows 020 and 030 of all pages in Section 1. This is done because the pages in Section 1 and Section 2 are not correlated with each other. Therefore, I decided to collect the results of all the pages of Section 1. ...Although, now an understanding is already emerging of how this could still be implemented...

The following data from 6-NDFL reports and registers is verified (there are 8 in total):

1. 6-NDFL Section 1 line (020) Personal income tax withheld in the last quarter, total for all BCC = RegTak. Personal income tax withheld during the period - for the last 3 months, total (d.b. = 020)

2. 6-NDFL Section 1 line (030) Personal income tax returned in the last quarter, total for all BCC = RegNak. Personal income tax returned during the period - for the last 3 months, total (d.b. = 030)

3. 6-NDFL Section 2 line (110) Amount of accrued income = RegTak. Amount of income, (d.b. = 110)

4. 6-NDFL Section 2 line (130) Deductions = RegTak. Total deductions, (d.b. = 130)

5. 6-NDFL Section 2 line (140) Personal income tax calculated = RegTak. Personal income tax calculated, total (d.b. = 140)

6. 6-NDFL Section 2 line (150) NDFL Fixed advance payments = RegNak. Personal income tax offset of advance payments, total (d.b. = 150)

7. 6-NDFL Section 2 line (160) Personal income tax withheld (by date of payment of income) = RegTak. Personal income tax withheld, total (d.b. = 160)

8. 6-NDFL Section 2 line (190) NDFL returned = RegTak. Personal income tax returned when withheld, total (d.b. = 190)

Data is verified only for the CAT + OKTMO grouping. If for the KPP + OKTMO grouping there is a deviation in the 6-NDFL data and data in the registers, then this KPP + OKTMO grouping is also highlighted in color (the color will correspond to the color with which the last of the deviations is highlighted).

You should take into account the fact that when generating the 6-NDFL report, the program selects data from registers taking into account the Signature Date. This report does not take into account the date of signature - all available data at the current moment is always selected from the registers. Because of this, there may be deviations in the data in 6-NDFL and data in the registers.

The report contains a lot of different data: income, deductions, taxable base, estimated personal income tax, reconciliation of estimated personal income tax with personal income tax from the 6-personal income tax report, calculated personal income tax, withheld, returned....

The report was tested on versions ZUP 3.1.14.587, ZUP 3.1.18.216. (it was not possible to check the data on fixed advance payments). If you find an error, write to us and we will update the report!

The report is added to the configuration as an external report: Administration - Printed forms, reports, processing - Additional reports and processing - Add from file - select the file with the report and configure “Placement” and “Quick access” for users.

Suggestions and comments are accepted.

Deadlines for submitting 6-NDFL

6-NDFL should be submitted once a quarter:

- for the 1st quarter - until May 4,

- for half a year - until August 1,

- 9 months before October 31,

- for a year - until March 1 of the next year.

If you paid an individual for the first time only in the 2nd quarter, submit 6-NDFL for six months, 9 months and a year.

Anton is an individual entrepreneur and works alone. In June, he turned to a copywriter who wrote 5 articles for the site. Everything was formalized under a copyright contract. Anton paid 10,000 rubles to the copywriter and 1,495 rubles in personal income tax to the state. In July, Anton needs to submit 6-NDFL for six months, 9 months, and then report for the year.