About legal entities

What is BSO Strict reporting forms (SRB) include a variety of documents on the provision of

The accountant can not only skip the receipt document, but also enter it twice. There are also

Types of tax audits There are two types of tax audits: scheduled and unscheduled. Scheduled tax audit

General characteristics Compensation is reimbursement from the employer for expenses incurred to ensure the purchase of products

Attention! From 2021, the UTII regime is no longer valid. All UTII payers must choose another

Economically justified costs The economically justified costs method can be used in the field of water supply and sanitation,

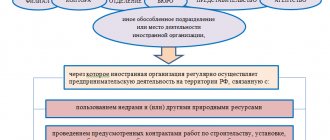

When a branch of a foreign company becomes a payer of Russian taxes. The emergence of tax obligations for a branch of a foreign company.

The dismissal process is always unpleasant and requires clear action. A special point is the issuance of a work book

Help 2 Personal income tax - what is it? This is an official document from the tax office, in

Deadline for payment of UTII The tax period for UTII is a quarter (Article 346.30 of the Tax Code of the Russian Federation). According to the results