Holiday bonus: accounting and tax accounting, insurance premiums

Employers can pay their employees one-time bonuses not for a certain period of work and production results, but upon the occurrence of a specific event. For example, these could be bonuses for a professional holiday, an organization’s anniversary, for the employee’s birthday, or for holidays established by Article 112 of the Labor Code of the Russian Federation. The basis for paying such a bonus is the order (order) of the head of the organization to reward the employee. Such bonuses, as a rule, are not included in the remuneration system.

Accounting

Accounting for settlements with employees of the organization for the accrual and payment of bonuses is kept on account 70 “Settlements with personnel for remuneration” (see Chart of accounts for accounting of financial and economic activities of organizations, approved by order of the Ministry of Finance of Russia on October 31, 2004 No. 94n).

The source of payments for holiday bonuses can be undistributed earnings from previous years (account 84 “Retained earnings (uncovered loss)”) or other expenses incurred by the organization to pay such bonuses (account 91.02 “Other expenses”).

The accounting procedure for such payments should be reflected in the accounting policies of the organization.

Personal income tax

A bonus paid to an employee for a holiday is his income and, accordingly, is subject to personal income tax. The date of actual receipt of income in the form of a holiday bonus is the day of its payment, including the transfer of income to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation). The date of tax withholding is the day of actual payment of the premium (clause 4 of Article 226 of the Tax Code of the Russian Federation). It is necessary to transfer the amount of tax withheld from the holiday bonus no later than the day following the day of payment of income (clause 6 of Article 226 of the Tax Code of the Russian Federation).

The income code for the holiday bonus is 2003 “Amounts of remuneration paid from the organization’s profits, special-purpose funds or targeted revenues.” In a letter dated 08/07/2017 No. SA-4-11/ [email protected] , the Federal Tax Service of Russia explained that the income code “2003” reflects remunerations (bonuses) for anniversaries, holidays, bonuses in the form of additional material incentives and other bonuses that are not related to the performance of work duties.

Income tax

Bonuses awarded to employees on holidays do not reduce the tax base for income tax (see letters from the Ministry of Finance of Russia dated July 22, 2016 No. 03-03-06/1/42954, dated July 9, 2014 No. 03-03-06/1/ 33167, dated 03/15/2013 No. 03-03-10/7999, dated 04/24/2013 No. 03-03-06/1/14283). At the same time, permanent differences arise in accounting (clause 4 of PBU 18/02, approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n, hereinafter referred to as PBU 18/02). Permanent differences lead to the formation of a permanent tax liability (clause 7 of PBU 18/02).

As for judicial practice, opinions differ. Some courts conclude that bonuses to employees paid on holidays can be taken into account as expenses for corporate income tax purposes if they are provided for in an employment agreement, collective agreement or other local regulation, while others make the opposite conclusion.

If an organization takes into account the bonus for holidays in expenses when calculating income tax, then, most likely, it will have to defend its point of view in court.

Insurance premiums

In accordance with paragraph 1 of Article 420 of the Tax Code of the Russian Federation, the object of taxation with insurance premiums is payments and other remuneration in favor of individuals made within the framework of labor relations. Article 422 of the Tax Code of the Russian Federation establishes a list of amounts not subject to insurance premiums. Payments in the form of bonuses for holidays are not mentioned in the mentioned list and, therefore, are subject to insurance premiums in the generally established manner. A similar opinion is given in the letter of the Ministry of Finance of Russia dated 02/07/2017 No. 03-15-05/6368.

In accordance with Article 20.1 of the Federal Law of July 24, 1998 No. 125-FZ, the object of taxation of contributions for compulsory social insurance against accidents at work and occupational diseases (AS and Occupational Diseases) are payments and other remunerations accrued by insurers in favor of the insured within the framework of labor relations and civil contracts. Article 20.2 of Law No. 125-FZ names the amounts that are not subject to contributions for compulsory social insurance from NS and PZ. Payments in the form of bonuses for holidays are not included in this list, therefore, they are subject to insurance contributions for compulsory social insurance from the National Social Security and Labor Protection.

1C:ITS

In the “Legislative Consultations” section, see more details: how to set and pay a premium; Is it possible to take into account bonuses for holidays and anniversaries if they are established by collective or labor agreements; How to take into account a bonus in expenses if it is not expressly provided for in the employment contract with the employee.

Calculation of bonuses for the holiday in “1C: Salary and personnel management 8” (rev. 3)

Let's look at the procedure for calculating holiday bonuses in the 1C: Salary and Personnel Management 8 program, edition 3.

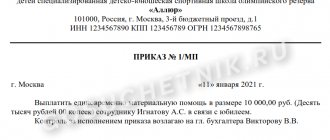

Example

Employee S.V.

By order of the manager, Abramov is paid a one-time bonus for his birthday (anniversary), not provided for by the organization’s remuneration system, in the amount of 25,000 rubles. The program performs the following actions:

- Setting up the accrual type.

- Calculation and accrual of bonuses to employees.

Setting up the accrual type

To accrue a one-time bonus for a holiday, you need to create a new type of accrual in the Settings - Accruals section by clicking the Create button.

In the Name field, fill in the name of the accrual type, in our Example - Holiday Bonus (Fig. 1). In the Code field, indicate the accrual type code (it must be unique).

The Accrual is no longer used flag is set if this type of accrual is no longer used at the enterprise.

On the Main tab (Fig. 1) in the Purpose and calculation procedure section, in the Accrual purpose field, you need to select the value Other accruals and payments. In the Accrual is performed field, set the value Per individual document. Such an accrual cannot be assigned as a planned accrual; until the final payment for the month, it will be accrued as a separate document, which is selected in the Document type field. If the program already has types of accruals with the purpose Bonus and it is customary to accrue them as a separate Bonus document, then in the Document type field, select Bonus. Otherwise, select the One-time accrual document, since the Bonus document for accruing only holiday bonuses will not be available.

Rice. 1

In the Accrual frequency field, you should indicate whether you want to control the accrual frequency and how. In the Calculation and indicators section, set the switch to the position The result is entered as a fixed amount.

On the Time Accounting tab, the default values set by the program are used.

On the Dependencies tab, lists of types of accruals and deductions that depend on this accrual are indicated, and the calculation base for which includes this accrual. For the convenience of viewing and editing accruals and deductions, the calculation base of which includes the current accrual, lists of dependent types of accruals and deductions are provided. When adding a type of accrual or deduction to this list, the current accrual falls into the list of its base ones (on the Calculation of the base of this type of accrual or deduction tab).

Due to the fact that the list of payments from which alimony is withheld is open, alimony must be withheld from one-time bonuses (clause 1 of the List, approved by Decree of the Government of the Russian Federation of July 18, 1996 No. 841). Therefore, the type of deduction Deduction by executive document should be added to the list of dependent deductions. The regional coefficient and the northern bonus to one-time bonuses do not apply if such bonuses are not provided for by the remuneration system, that is, they are not specified in the labor and (or) collective agreement or other local regulatory act of the organization (letter of the Ministry of Health and Social Development of Russia dated February 16, 2009 No. 169 -13).

On the Priority tab, you specify which accruals should be performed instead of the current one, or the accruals in place of which the current accrual is performed. As a rule, these tables are filled in automatically by the program based on the results of an analysis of the main accrual parameters.

On the Average Earnings tab in the Calculation of payment for vacations, business trips, etc. section, you must clear the default flags if the holiday bonus is not provided for by the remuneration system (as in our Example). A one-time bonus is not taken into account when calculating average earnings on vacations, business trips, etc., if it is not stipulated in an employment and (or) collective agreement or other local regulatory act of the organization (clauses 2, 3 of the Regulations, approved by Decree of the Government of the Russian Federation dated December 24 .2007 No. 922, letters of the Ministry of Health and Social Development of Russia dated October 13, 2011 No. 22-2/377012-772, Rostrud dated October 23, 2007 No. 4319-6-1). In the section Calculation of social insurance benefits, a flag is available for viewing or changing, which determines the inclusion of this accrual when calculating sick leave and other benefits of the Federal Social Insurance Fund of the Russian Federation according to the rules in force until 2011 (this procedure is currently not applied).

Then fill out the Taxes, contributions, accounting tab (Fig. 2). In the personal income tax section, set the switch to the taxed position, and in the income code field indicate 2003 “Amounts of remuneration paid from the organization’s profits, special-purpose funds or targeted income” (letter of the Federal Tax Service of Russia dated 08/07/2017 No. SA-4-11/ [ email protected] ). In the Income category field, select the value Other income. In the Insurance premiums section, in the Type of income field, the type of income is indicated from the point of view of taxation of insurance premiums - “Income wholly subject to insurance premiums” (set by default) (clause 1 of Article 420 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated 02/07/2017 No. 03 -15-05/6368, Article 20.1 of Law No. 125-FZ), which corresponds to this accrual. In the Income Tax section, type of expense under Art. 255 of the Tax Code of the Russian Federation, the switch is set to the position not included in labor costs (set by default), since in our Example, the holiday bonus is not related to production results. Otherwise, set the switch to the position taken into account in labor costs and select the required item. The Statistical Reporting section indicates whether this accrual should be taken into account when filling out form P-4 and how to take it into account - as a social payment or as employee wages. In our Example, by default, the switch is set to the position Employee wages, which corresponds to this accrual (clause 8, clause 84.3 of Rosstat order No. 711 dated November 27, 2019).

Rice. 2

In the Accounting section, set the switch to the As specified for accrual position and in the Account, subconto field, select a value from the Methods of reflecting salaries in accounting directory (section Settings - Methods of reflecting salaries in accounting). If the required reflection method is not available in the directory, it must be created. Elements of the directory Methods for reflecting salaries in accounting are synchronized with the elements of the directory of the same name in the 1C: Accounting 8 program. In the program “1C: Salaries and Personnel Management 8” (rev. 3), the elements of this directory are characterized only by name; in the program “1C: Accounting 8”, for each method of reflection in accounting, a debit account and analytics are additionally indicated, on the basis of which in the program “ 1C:Accounting 8" generates accounting and tax accounting entries. If you set the switch to the By employee settings position, then when accruing, the reflection method that is specified for the employee is used (the reflection method is indicated in the form called up by clicking the Payments link, accounting for expenses from the employee’s card (section Personnel - Employees)).

In the Enforcement Proceedings section, in the Type of Income field, the default value is set to 1 - Wages and other income with a limitation on collection, which corresponds to this accrual. This is necessary for correctly filling out the payment document, and based on it - a payment order. From 06/01/2020, all organizations and individual entrepreneurs paying wages and (or) other income to individuals through a bank or other credit institution are required to indicate special codes for the type of income for these amounts in the payment document.

1C:ITS

In the section “Instructions for accounting in 1C programs”, see in more detail: what settings to make in “1C: Salary and Personnel Management 8” (ed. 3) so that the new codes are correctly filled in in payment orders for salary payments from 01.

On the Description tab, in the Short name field, you can specify a short name for the accrual. It will be displayed in various accrual reports. On the same tab you can also fill in a custom accrual description for reference. After filling out all the bookmarks, click the Record and close button.

Summary

Since there are no clear criteria in the legislation, when developing bonus regulations, it is necessary to determine how and for what the bonus is paid and how it may change depending on the financial situation and other circumstances.

If it is impossible to use quantitative indicators in the company’s activities, then the employer has the right to use only estimated indicators. Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up