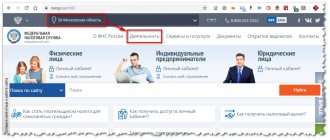

About legal entities

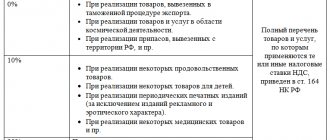

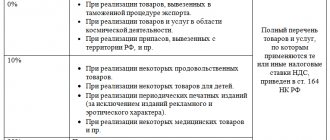

VAT rate for exports There are several points of view that explain the appearance of a 0% VAT rate.

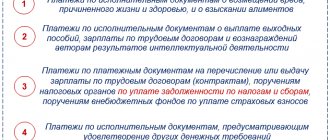

What does priority mean? The priority of payment is a number from 1 to 5, which, in fact,

Balance sheet as a way of reflecting obligations Funds and resources, taking part in ensuring activities, constantly

The Tax Code of the Russian Federation allows VAT payers to use tax deductions later than in the quarter of adoption

Who is entitled to a voucher? Law on sanatorium and resort treatment of employees - Federal Law No. 178-FZ dated July 17, 1999

From the beginning of the year, new rules always come into force. This year, legislators too

Quick liquidity ratio: essence, economic meaning This indicator can also be called the urgent, critical,

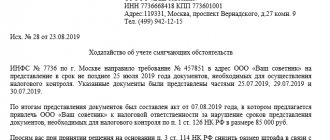

Mitigating circumstances (Article 112 of the Tax Code of the Russian Federation) During the consideration of inspection materials or upon discovery

Start of business An individual has the right to carry out cargo transportation after registering the organizational form of an individual entrepreneur.

Among the variety of taxes and fees intended for mandatory calculation by business entities, VAT ranks