Who is entitled to a ticket?

The Law on Sanatorium and Resort Treatment of Employees - Federal Law No. 178-FZ of July 17, 1999 “On Social Assistance” - provides for the following categories of the population who have the right to receive health treatment from the employer:

- the working population, that is, employees of Russian organizations;

- spouses of workers who are officially married. A common-law husband or wife will not be able to receive payment for a trip to a sanatorium-resort treatment at the expense of the employer;

- natural children, as well as adopted children, under the age of 18. Or children under the age of 24 who are in full-time education;

- minor dependents who are in the care of workers;

- former wards of employees who have already reached the age of majority, but are studying full-time in educational institutions. That is, former dependents under 24 years of age;

- elderly parents of working citizens.

In addition to the conditions of close relationship, it is necessary to take into account other requirements and rules regarding how sanatorium-resort treatment at work is paid for.

Limitations on the use of the privilege

There is no mention in the law regarding the target audience to which these legislative norms apply. This means that paid time off is guaranteed in equal amounts to both the CEO and the company’s courier.

However, the federal law provides a clear explanation of the amount of compensation, the types of tourist services to which it may apply, and the citizens who have the right to receive such non-monetary rewards.

Experts note that from 2022, vacation at the expense of the employer is possible only in large companies in which employees receive absolutely “white” wages.

Holiday expenses for Russians should not exceed 6% of the enterprise’s wage fund per person.

This is a fairly large amount of funds spent on maintaining staff, especially when it comes to transparent remuneration. Small firms will not be able to afford to give such gifts to employees.

In general, company management is not obliged to financially support its employees on vacation. This is just a right that each employer will use in its own way. One thing is clear, such a system of rewarding employees will be beneficial for those companies that often make incentive payments to staff, especially of a non-monetary nature.

Terms of payment for health improvement at the expense of the employer

Lawmakers have identified several important requirements that must be met in order to receive tax benefits. These include the following.

- Benefits for paying for sanatorium and resort treatment are provided only for Russian tourism and health improvement. It is permissible to conclude an agreement for sanatorium-resort treatment outside the Russian Federation, but in this case the right to taxation privileges is lost.

- You can receive a tax benefit only if the costs are paid by the employer himself. For example, if an employee purchased a trip on his own and then demands compensation for expenses, then the company will not take these expenses into account for tax purposes. Although compensation for spa treatment by the employer is possible, for example, at the expense of the company’s net profit.

- The benefit has an amount limit. No more than 50,000 rubles are allowed per employee per year. And this is not the only limitation. In total, the costs of employee health, together with expenses for voluntary health insurance, cannot exceed 6% of the wage fund. If the amount exceeds the permissible 6%, then expenses cannot be counted for tax purposes.

- Innovations apply not only to sanatorium and resort treatment for employees, but also to the organization of recreation for subordinates, as well as to tourism services. It is important to correctly draw up an agreement between the employer and the travel agent or tour operator.

Memo for employers

| Action | Result |

| The employer entered into an agreement with the tour operator to pay for the health of his subordinates. | Payment costs can be taken into account when taxed under OSNO and simplified taxation system 15% in the maximum permissible values. |

| The employee purchased the trip on his own, and the employer reimbursed the costs. | Company expenses cannot be taken into account for tax purposes. In addition, such costs are subject to additional tax obligations in the form of insurance premiums paid at the expense of the employer. |

| The company allocated funds to the employee to purchase a voucher. | The type of financial incentives for the employee is important. For example, if this is financial assistance, then only 4,000 rubles of the entire amount are considered non-taxable. The rest of the money will have to withhold personal income tax and pay insurance premiums. Bonuses and other remunerations for paying for sanatorium-resort treatment of subordinates cannot be taken into account as benefits and are subject to full taxation. |

Holidays at the expense of the employer in 2022: explanations for an accountant

From January 1, 2022, an employer can pay for a trip to an employee and his family. How to take these costs into account, who can purchase a ticket and what restrictions an accountant should remember about, we described in this article.

In order to stimulate the development of domestic tourism in Russia, the Government of the Russian Federation, by Federal Law No. 113-FZ dated April 23, 2018, introduced subclause 24.2 into Article 255 of the Tax Code of the Russian Federation, according to which, from January 1, 2019, the employing organization has the right to pay for a tourist voucher for employees and members his family and take into account these expenses for the purpose of calculating income tax in an amount not exceeding 50,000 rubles per year per employee.

Can an employee buy a ticket on his own and then present it to the employer for reimbursement?

No, he can not.

The main condition for accounting for these expenses as part of labor costs is the conclusion of an agreement on the sale of a tourism product by the employer and the tour operator or travel agent. The employee who is the user of the services cannot directly be a party to the contract.

These costs can be taken into account if the relevant services are provided:

- employees;

- their spouses;

- their parents;

- their children (including adopted ones) under the age of 18;

- children (including adopted children) under the age of 24 studying full-time in educational organizations;

- their wards under the age of 18 and former wards (after termination of guardianship or trusteeship) under the age of 24, studying full-time in educational organizations.

In accordance with Federal Law No. 113-FZ dated April 23, 2018, within the framework of subclause 24.2 of Article 255 of the Tax Code of the Russian Federation, the employer can pay for the following services provided under a contract for the sale of a tourism product:

- services for travel across the territory of the Russian Federation to the destination and back or along another route agreed in the agreement on the sale of a tourist product;

- tourist accommodation services in a hotel(s) or other accommodation facility(s), sanatorium-resort treatment and recreation facility located on the territory of the Russian Federation, including tourist food services, if food services are provided in conjunction with hotel accommodation services or another accommodation facility, sanatorium-resort treatment and recreation facility;

- health resort services;

- excursion services.

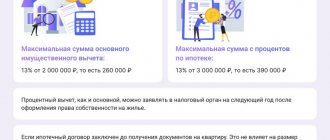

Income tax

The above costs are allowed to be written off as income tax expenses, but not more than 50,000 rubles per tax period, for each employee and his relative separately (clause 24.2 of Article 255 of the Tax Code of the Russian Federation).

The cost of services for organizing tourism, sanatorium-resort treatment and recreation on the territory of the Russian Federation, specified in clause 24.2 of part 2 of Article 255 of the Tax Code of the Russian Federation (clause “b” of clause 1 of Article 1, clause 1 of Article 2 of the Federal Law of April 23. 2018 No. 113-FZ “On Amendments to Articles 255 and 270 of Part Two of the Tax Code of the Russian Federation”), are taken into account for profit tax purposes in an amount not exceeding 6% of labor costs together with contributions under VHI agreements and expenses under agreements for the provision of medical services concluded in favor of employees for a period of at least a year.

VAT

As for VAT, payment by an organization for tourist vouchers issued to employees of the organization does not constitute the sale of goods (work, services) for value added tax purposes (Letter of the Ministry of Finance of Russia dated June 3, 2014 No. 03-07-11/26545). Therefore, the employer does not have an object of VAT taxation.

Personal income tax

Expenses for paying for tourist vouchers, sanatorium and resort treatment of employees and members of their families are taken into account as part of labor costs. Accordingly, wages are subject to personal income tax. As a tax agent, the organization is obliged to calculate, withhold from the employee and pay to the budget the corresponding amount of personal income tax at a rate of 13% (clause 1 of Article 224 of the Tax Code of the Russian Federation, clauses 1, 2 of Article 226 of the Tax Code of the Russian Federation).

As for paying the cost of a tourist voucher to members of the employee’s family for whose benefit other payments are not made, there is no way to withhold personal income tax. In this case, paragraph 5 of Article 226 of the Tax Code of the Russian Federation specifies that if it is impossible to withhold the calculated amount of tax from the taxpayer during the tax period, the tax agent is obliged, no later than March 1 of the year following the expired tax period in which the relevant circumstances arose, to inform the taxpayer in writing and to the tax authority at the place of its registration about the impossibility of withholding tax on amounts of income from which tax was not withheld, and the amount of tax not withheld. Consequently, the employee’s relatives who received the vouchers must pay and submit a declaration to the tax authority.

Insurance premiums

In accordance with subparagraph 1 of paragraph 1 of Article 420 of the Tax Code of the Russian Federation, payments and other remunerations in favor of individuals subject to compulsory social insurance in accordance with federal laws on specific types of compulsory social insurance (with the exception of remunerations paid to individuals specified in subparagraph 2 of paragraph 1 of Article 419 of the Tax Code of the Russian Federation).

The object of taxation with insurance contributions may include any payments that are provided for by the collective agreement, as well as social payments not related to wages, since the provisions of Chapter 34 of the Tax Code of the Russian Federation and Law No. 125-FZ do not specify these payments.

Payment for travel vouchers to employees and members of their families, which is provided for by a collective agreement, may be recognized as a payment made within the framework of labor relations.

At the same time, payment for tourist vouchers to employees is not included in the lists of payments not subject to insurance contributions, which are established by Article 422 of the Tax Code of the Russian Federation and Article 20.2 of Law No. 125-FZ, and should be subject to insurance contributions in the generally established manner.

Members of the employee's family do not have an employment relationship with the organization, therefore payment of the cost of a tourist voucher to members of the employee's family is not considered subject to insurance premiums (clause 1 of Article 420 of the Tax Code of the Russian Federation, Resolution of the AS SZZ dated July 22, 2016 No. F07-4654/2016).

Thus, we believe that if an organization pays for tourist vouchers for an employee’s family, then only the cost of the voucher for the employee himself is subject to insurance premiums.

Simplified taxation system

For the purposes of the simplified tax system, only those payments to employees that are named in Article 255 of the Tax Code of the Russian Federation are recognized as labor costs.

Expenses for payment for services for organizing tourism, sanatorium-resort treatment and recreation on the territory of the Russian Federation are specified in paragraph 24.2 of Article 255 of the Tax Code of the Russian Federation as amended by Federal Law No. 113-FZ of April 23, 2018, which comes into force on January 1, 2019.

Therefore, according to the simplified tax system, expenses for organizing tourism for employees will be taken into account exactly on the same terms as for the purposes of calculating income tax:

- the organization will be able to include in expenses the cost of vouchers, which was paid by the employer himself on the basis of an agreement concluded between tour operators and travel agencies, starting from 01/01/2019;

- this amount should not exceed 50,000 rubles per year for each vacationer (for the employee and for each family member);

- the total amount of costs specified in clause 24.2 of Article 255 of the Tax Code of the Russian Federation, costs for medical services and voluntary personal insurance should not exceed 6% of the amount of the employer’s costs for labor costs.

Accounting

The costs of purchasing tourist vouchers are not related to the production of goods (work, services), the purchase and sale of goods. Therefore, they are recognized as other expenses of the organization. This information follows from the set of norms in paragraph 4, Accounting Regulations “Organization Expenses” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated 05/06/1999 No. 33n. Expenses are recognized when the conditions established by paragraph 16 of PBU 10/99 are met.

Postings when paying for vouchers to employees and their relatives will be as follows:

- D76–K51 – “Voucher paid for employee”;

- D91-2–K76 - “The cost of a trip for an employee is included in other expenses”;

- D91-2–K69 – “Insurance premiums have been accrued for the cost of the issued voucher”;

- D70–K68 – “Personal income tax is withheld when paying wages from the cost of the voucher.”

To ensure control over the safety of travel vouchers that were purchased for employees and their family members, the organization can record these vouchers on an off-balance sheet account.

- D018 – “The cost of the trip is reflected on the balance sheet”;

- K018 – “The cost of the issued voucher has been written off.”

Thus, thanks to this innovation, employees have a wonderful opportunity to take advantage of vacations in the Russian Federation at the expense of the employer, and the employer has new tools for motivating employees. All this helps to strengthen the demand for tourism services on the part of Russian citizens, and therefore, the development of domestic tourism as one of the promising sectors of the economy of the Russian Federation.

What can be included in costs

The composition of costs that are included in the tax benefit is limited. But in addition to treatment, additional services can be included in the package.

Expenses taken into account for tax purposes:

- Treatment and wellness services.

- Accommodation, food, recreation.

- Travel to and from the place of health improvement, recreation or tourism.

- Excursion programs and services.

IMPORTANT!

All types of expenses must be clearly specified in the contract with the tour operator. Otherwise, it will not be possible to offset the costs. For example, if an employee purchased excursions on his own, then no one is obliged to compensate him for these amounts.

Contractor travel expenses: nuances

Indeed, the employer has the right to award vouchers to employees with whom civil agreements have been concluded.

The relationship between employer and employees, in essence, should not be close to labor relations. If the State Labor Inspectorate discovers that the contractor is an actual employee, it will fine the employer a large sum under Art. 5.27 Code of Administrative Offenses of the Russian Federation.

The travel arrangement between the employer and the contractor may be based on the provisions of Art. 421 of the Civil Code of the Russian Federation on freedom of contract. The reason for allocating a voucher may be to perform difficult (emotionally or physically) work for a long time. The customer, interested in constant cooperation with the contractor, can voluntarily compensate for the large amount of labor costs of the latter by paying him a trip (in practice, including its cost in the amount of labor compensation under a civil contract) so that he can recuperate at the resort.

As in the case of calculating income tax on travel expenses for employees, the amount for travel expenses for contractors (if it is included in calculations under a civil contract) can also be taken into account when calculating the tax base as expenses for paying employees who are not on staff (clause 21 of article 255 of the Tax Code of the Russian Federation) or as other production expenses (subclause 49 of clause 1 of article 264 of the Tax Code of the Russian Federation).

It is important that the contractor’s additional income is not a voucher in kind, since in this case the customer will not be able to include its cost in expenses (clause 29 of Article 270 of the Tax Code of the Russian Federation).

At the same time, it must be borne in mind that since the norms of a collective agreement are not applicable to contracts under the Civil Code of the Russian Federation, the employer will have the obligation to accrue insurance contributions (in this case, only pension and medical contributions) on the amount of the voucher payment. The same rules will apply with a simplified tax system of 15%.

You can also give a voucher as a gift, but, as we already know, in this case it cannot be taken into account when calculating income tax.

Taxation of health resort vouchers for employees under OSNO and simplified tax system

It is allowed to count expenses as expenses for income tax and the simplified tax system only if the specified conditions and requirements are met. Any other types of payment for sanatorium-resort treatment, recreation, tourism and health improvement for employees and members of their families are not taken into account for tax purposes.

All company expenses must be documented. The Federal Tax Service has the right to request documents for a desk audit. If the documentation is not provided, the tax authorities will impose a fine of 200 rubles for each document not provided. And most importantly, preferential taxation of expenses for sanatorium-resort treatment is recognized as unfounded, and an additional tax and fine of up to 40% of the unpaid amount will be assessed.

IMPORTANT!

Payment for sanatorium-resort treatment to an employee with a simplified tax system of 6% (income) cannot be taken into account as expenses. The 6% simplified tax system tax regime does not provide for a reduction in the amount of income by the amount of actual costs of an economic entity.

Travel expenses and income tax (or simplified tax system) up to

Until 2022, travel expenses could not be included in expenses when calculating income tax if:

- The employee, based on the provisions of the employment contract or outside its framework (on the employer’s own initiative), was issued a voucher, represented by a package of travel services or a set of options.

The cost of the trip could not be included in the calculation of the tax base due to the direct prohibition under clause 29 of Art. 270 Tax Code of the Russian Federation.

A package voucher or a paid set of options is considered an employee’s income in kind, which should not exceed 20% of the total salary, including the cash component (Article 131 of the Labor Code of the Russian Federation).

- The voucher was given as a gift.

There was also a direct ban in effect here - in accordance with paragraph 16 of Art. 270 Tax Code of the Russian Federation.

In the case of the simplified tax system of 15%, the rules are similar, since the expense in the form of payment for a voucher is not mentioned in paragraph 1 of Art. 346.16 of the Tax Code of the Russian Federation among expenses allowed under the simplified tax system (letter of the Ministry of Finance dated September 24, 2012 No. 03-11-06/2/129).

Expenses in the form of gifts are, in principle, not indicated in Art. 346.16 of the Tax Code of the Russian Federation is among the expenses taken into account under the simplified tax system, therefore they are not included in the tax calculation.

The mentioned rules regarding income tax are relevant for 2018. But as of January 1, 2019, a number of amendments came into force in the Tax Code of the Russian Federation, which significantly changed the tax situation under OSN.

Insurance premiums

If the employer pays for the trip for the employee himself, then insurance premiums for sanatorium treatment will have to be calculated. Tariffs for calculation are general, that is, those that the organization applies to employee salaries. In relation to vouchers purchased for close relatives of subordinates, insurance coverage is not required.

The opinions of the courts on this matter differ from the position of the tax authorities. Judges recognize such company expenses as not subject to insurance premiums (Resolution of the Arbitration Court of the North-Western District dated June 20, 2017 No. F07-5516/2017, Determination of the Supreme Court of the Russian Federation dated November 3, 2017 No. 309-KG17-15716). Representatives of the judicial system justified their position with the provisions of the ineffective law No. 212-FZ. Tax officials, citing the fact that Law No. 212-FZ has lost force, consider the position to be unlawful (Letter No. BS-4-11 dated September 14, 2017 / [email protected] ). Therefore, you will have to pay insurance premiums. Or prove your position in court.

Expenses for travel to a sanatorium and other places of recreation and personal income tax

A voucher (package or as a set of options) as part of a person’s labor income in kind is generally subject to personal income tax (clause 1 of Article 210 of the Tax Code of the Russian Federation). But there are exceptions to this rule.

Income tax is not accrued (and is not paid by the employer as a tax agent) when issuing a voucher under any scheme in the jurisdiction of labor law, if the voucher or set of options involves a visit by the employee or his child under the age of 16 to a sanatorium or resort for treatment. Let us note that personal income tax is not charged for paying for travel to a vacation spot (letter of the Ministry of Finance of Russia dated 02.02.2010 No. 03-04-08/4-19).

In this case, it is necessary that the expenses are not taken into account by the employer when calculating income tax (clause 9 of Article 217 of the Tax Code of the Russian Federation). Under the simplified tax system, in turn, only the sanatorium-resort orientation of expenses is important (since in Article 217 of the Tax Code of the Russian Federation there are no prohibiting references to simplification, similar to those defined for income tax).

When donating a voucher to an employee on the basis of the provisions of the Civil Code of the Russian Federation:

- taxation of a voucher to a sanatorium purchased for an employee, as in the case of an agreement under the Labor Code of the Russian Federation, is not carried out (again, provided that the costs of the voucher are not taken into account when calculating income tax);

- if a trip or a set of options costs no more than 4 thousand rubles. during the year (letter of the Federal Tax Service of Russia dated October 26, 2012 No. ED-3-3 / [email protected] ), then personal income tax is also not charged.

Within the specified limit of 4 thousand rubles. includes any other gifts received by an individual during the year.

In other cases, there is no reason not to charge personal income tax. In this case, personal income tax on the gift is paid by the employer himself as a tax agent, as is the case with wages.

Taxation of vouchers for employees in the form of personal income tax on the cost of the voucher is closely related to the employer’s responsibilities for calculating and paying insurance premiums in amounts that are recognized as the base for such contributions. Let's take a closer look at the legal regulation of these legal relations.