The Tax Code of the Russian Federation allows VAT payers to use tax deductions later than in the quarter in which goods, works or services were accepted for accounting.

At the same time, all VAT payers must report to the inspectorate quarterly by submitting VAT tax returns for the corresponding tax period (quarter).

Therefore, an organization or individual entrepreneur, when declaring VAT for deduction, thinks about what part of VAT deductions should be shown in the current tax period, and what part should be transferred to the next quarter or quarters.

This question is due to the fact that if a company reflects a significant share of tax deductions in the VAT return, this may lead to the fact that the VAT return will declare tax to be refunded from the budget, or the VAT return will indicate a small amount of VAT due payment when the company's turnover is significant.

In such a situation, the close attention of tax authorities cannot be avoided.

View the safe percentage of VAT deductions for the 4th quarter of 2022. Check your region.

And in this case, the matter will not be limited to a standard desk audit, which usually takes place without the participation of the taxpayer.

Tax officials will send a request to the company to submit invoices and related documents. At the same time, each invoice and related documents will be checked with special care.

In addition, these facts may become the basis for conducting an on-site tax audit.

That is why the question often arises of how to calculate the safe share of VAT deductions and how much such a share is.

We will tell you about the procedure for applying a tax deduction, how its share is calculated, and also how to calculate the safe share of deductions.

How is VAT deduction applied?

Value added tax is paid by organizations and entrepreneurs operating on the special purpose tax system, as well as other categories of taxpayers in accordance with the requirements of Chapter 21 of the Tax Code of the Russian Federation.

Tax payable is calculated on sales transactions and similar ones.

The taxpayer has the right to reduce the amount of the calculated tax by a tax deduction.

It represents the amount of tax presented to the taxpayer by suppliers of goods (works, services) and indicated in the invoice.

To apply the deductible amount, the following conditions must be met:

- The purchased goods (works, services) are registered.

- Purchased goods (works, services) must be used in transactions subject to VAT.

- The supplier submitted a correctly executed invoice.

- No more than three years have passed since the goods (works, services) were registered.

Invoice – invoice – mandatory document in accounting

Invoice - unified form. The modern form of the document was put into effect by Government Decree No. 1137 of 02/01/2022.

This is a document that confirms the amount of VAT when selling or purchasing a product (work, service). The invoice must be issued within 5 days from the date of delivery. This period is established in paragraph 3 of Article 68 of the Tax Code of the Russian Federation.

Every fact of an organization’s life must be reflected in accounting and documented with an appropriate document, including an invoice . Depending on the operation being carried out, the following types of invoices are distinguished:

- The main document that is issued directly upon delivery

- An invoice is an invoice for an advance payment. It is issued when an advance payment is made. The deduction for such a document is provided in the same manner as for the usual one for shipment

- An adjustment invoice is created when the quantitative parameters of a shipment have changed. The deduction is provided from the resulting difference

An invoice is issued according to established rules. Only live signatures of the manager and chief accountant are allowed on the document.

Criterion “Share of VAT deductions” for conducting an on-site tax audit

When selecting organizations for an on-site tax audit, Federal Tax Service specialists evaluate their activities according to certain criteria.

For each criterion there is a threshold value.

If a company's score on this criterion goes beyond the threshold, then its chances of becoming a candidate for an on-site audit increase.

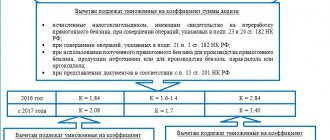

With regard to VAT, the main criterion for tax authorities is the share of VAT deductions in the calculated VAT amount for taxable items

The share of VAT deductions is a percentage characterizing the amount by which a company reduces the amount of tax payable.

In other words, the value of the share of VAT deductions shows what percentage of the accrued VAT the company claims for deduction.

It is this that the tax authorities will compare with the threshold indicator in order to draw a conclusion about the degree of tax risks of the company for VAT.

If the share of VAT deductions according to the taxpayer’s return is greater than the threshold value, then this immediately attracts the attention of tax inspectors.

Where to find data on the share of deductions by region

Don’t forget that in addition to the federal figure, you need to know the share of VAT deductions at the regional level. This indicator is not published, but it can be calculated based on other publicly available data.

The official website of the Federal Tax Service in the “Statistics and Analytics” section contains data on statistical tax reporting forms, including reports on the tax base and the structure of VAT charges.

These are statistical reports in form 1-VAT. In such a report, generated by region, there is data on the total VAT charges and the total share of deductions for the region you need (columns 110.1 and 210.1, respectively). The safe share of deductions for a region can be calculated by finding the percentage ratio of the amount of deductions to the amount of accruals.

note

The Federal Tax Service updates statistical data on its website, so they need to be checked periodically. Thus, statistical data as of November 1, 2022 have now been published.

Share of tax deductions for VAT: how to calculate

Here the question arises: the share of VAT deductions - how to calculate?

For calculations, you must refer to the value added tax return.

For calculations, we need two numbers from section 3 of the report:

- line 118: total tax amount calculated taking into account the restored tax amounts;

- line 190: total tax amount to be deducted.

The share of VAT deductions is calculated using the formula:

Share of VAT deduction = Amount of tax deduction (line 190 of section 3) / Amount of total calculated VAT (line 118 of section 3)

Let us remind you that tax authorities analyze the value of the indicator not for one quarter, but for at least 12 months.

Considering that the share is calculated for 12 months, the taxpayer should determine the coefficient at the end of each quarter, and not be limited only to the calendar year.

For example, based on the results of the 1st quarter of 2022, you need to take into account data on accrued VAT and deductible tax for the 2nd-4th quarters of 2022 and the 1st quarter of 2022.

This means that to calculate the safe share of VAT deductions, the formula can be presented as:

DB = (B1 + B2 + B3 + B4) / (H1 + H2 + H3 + H4)

whereB1, B2, B3, B4 - the amount of VAT deductions for 4 consecutive quarters in the last 12 months;

N1, N2, N3, N4 - the amount of accrued VAT for 4 consecutive quarters in the last 12 months.

Once the share of deductions in the total amount of calculated VAT for four quarters has been determined, it should be compared with the share of deductions established by the Federal Tax Service of the Russian Federation.

To calculate the share of VAT deductions, you need to divide all deductions for the tax period by the entire accrued tax and multiply by 100 percent.

Please note: a low tax burden in itself is not evidence of non-payment of taxes.

The Federal Tax Service can only assess additional taxes and fine you for non-payment if, based on the results of a tax audit, violations of the Tax Code of the Russian Federation are established.

Hello, my dear accountants. Today I want to offer you the following topic for conversation - Safe share of VAT deductions and how the 1C: Accounting 8.3 program will help us control it. First, a few words about what the Safe Deduction Rate is. There is no such concept in the Tax Code of the Russian Federation, but, nevertheless, this is an indicator, the excess of which may attract the attention of the tax authorities to the organization. There are two main quantities that the Federal Tax Service uses:

- the share of deductions for four quarters should be less than 89% of the VAT accrued for the same period - the share of deductions should not exceed the average share of deductions in the region If everything is clear with the federal share of 89%, then where can a simple accountant or business owner find a share of region? You can determine this share yourself; to do this, go to the tax office website, select your region and go to the “Activities” section:

Now go to the “Statistics and Analytics” section:

Now open “Data on statistical tax reporting forms”:

Here we find the “1-VAT” report for the year we are interested in:

We download the report for the period of interest to us, for example, as of November 1, 2019, and find in it the lines with codes 1100 and 2100:

Now let’s calculate the “safe” share of VAT deductions in the Moscow region for the 4th quarter of 2022:

Those. the safe share of deductions under the Moscow Region is slightly less than the federal value. This means that companies in our region should focus on a share of 87.14%

Great, but what about 1C? Our main working tool for generating all kinds of reports and declarations will help us here too. First, let’s set the share of VAT deductions in the “Safe” program. To do this, open the settings for taxes and reports in the “Main” :

On the VAT tab, the federal share of deductions is set by default. Let's change it for our region:

That's all the program setup is. Now 1C: Accounting 8 will help us control this indicator. When generating a VAT return, we always carry out a number of mandatory regulatory operations in the program, and one of them is “Creating purchase ledger entries.” At the bottom of this document there is now information about the share of VAT deductions for 12 months and for the current quarter:

In addition to this document, you can estimate the share of deductions using the “Tax Audit Risk Assessment” , which is located in the “Reports”

After completing the check, we will receive information about the amount of VAT deductions for the last 12 months.

Thus, we can quickly track the safe share of VAT deductions and, if necessary, transfer part of the deductions to the next period.

That's all I wanted to tell you about the new assistant in the 1C: Accounting 8 program. I hope the program will become a reliable assistant for you when submitting reports.

Make it easy for you to submit your declarations. I hope our articles are useful to you. Subscribe to us on social media. networks and stay up to date with all our news.

| Head of care service Budanova Victoria |

Social buttons for Joomla

Example. Calculation of the safe amount of VAT deduction

Let’s assume that during the reporting period, a taxpayer from Moscow paid VAT in the amount of 100,000 rubles.

According to the company’s declaration, for the specified period the amount of calculated VAT, taking into account the restored amounts, is 1,500,000 rubles (section 3, line 118).

The tax deduction for the same period amounted to 1,400,000 rubles (section 3, line 190).

Substituting these figures into the above formula 1,400,000/1,500,000, we find that the share of VAT deductions in the amount of accrued tax in the period under review was 93.33%.

This is more than the threshold value of 88.08% for Moscow (as of August 1, 2019), which means that there is a possibility that the organization will be included in the on-site inspection plan.

What should be the amount of VAT in the considered example for Moscow, so as not to attract increased attention from tax authorities?

It can be calculated using the inverse formula:

VAT accrued * (100 - VAT safe) / 100 = = 1,500,000 * (100 - 88.52) / 100 = 172,200 rub.

Based on the criteria used by the Federal Tax Service, the company in our example needs to pay at least 172,200 rubles in VAT in order not to leave the “safe” zone.

How to calculate safe interest

Russian companies and individual entrepreneurs assess tax risks independently. How to find out the share of VAT deductions for a company: for calculation, you will need a VAT tax return for the last reporting quarter. The calculation uses only two indicators of the third section:

- line 118 is the total amount of value added tax, calculated taking into account the restored amounts;

- line 190 - the total amount of benefits declared by the taxpayer in the billing period.

It is necessary to compare these two indicators. The declaration formula for calculating the safe share of VAT deductions looks like this:

Safe share = line 190 / line 118 × 100%.

Essentially, the taxpayer needs to calculate the percentage of the benefits claimed to the calculated tax amount. The obtained result is compared with standard values. This is the national average (89%) and the regional average. Please note that controllers compare annual values, not quarterly ones.

Can the share of VAT deductions exceed the safe share of VAT deductions legally?

The mere statement of a high percentage reduction in value added tax is not an absolute reason for including an organization in the plan of desk or on-site inspections.

The company's activities are considered comprehensively. A thorough pre-check analysis is carried out in its regard.

Note that sometimes in practice tax authorities ask the taxpayer to explain the reasons for the high share of VAT tax deductions.

At this point, it is important to clearly and reasonably explain why the company has declared a high percentage of reduction in value added tax.

If such reasons are objective in nature, then there is a possibility that the provision of appropriate explanations can reduce the risk of including the taxpayer in the plan of on-site tax audits.

The question often arises: can the share of VAT deductions legally exceed the safe share of VAT deductions?

The answer is, of course it can.

There is no ban on this.

Moreover, if, after a desk audit, the declared amount of tax to be refunded is found to be correct, the Federal Tax Service is obliged to return the excess amount to the taxpayer.

This situation may arise, for example, if:

- the company purchased a large volume of goods, sales of which will occur only in the next quarter;

- the manufacturing enterprise purchased expensive equipment;

- the customer refused to purchase a large batch of products, and the purchase of components for its production had already been made;

- in other reasonable circumstances.

Control over VAT benefits

Tax deductions reduce the amount of taxes payable to the budget. Control over the replenishment of the state treasury is entrusted to the Federal Tax Service. The inspectorate annually draws up a plan for tax audits, in accordance with the order of the Federal Tax Service dated May 30, 2007 No. MM-3-06 / [email protected] Appendix No. 2 to the order lists special criteria for self-assessment of taxpayers’ risks.

Among the special criteria is a formula for calculating the safe share of VAT deductions. If the taxpayer’s benefits exceed the calculated values, the Federal Tax Service will include the company in the on-site inspection plan. In case of a single excess, the inspection will request an explanation. But if large VAT returns turn into a system, then an audit cannot be avoided.

IMPORTANT!

The controllers believe that the basis for including a company in the on-site inspection plan is the systematic excess of the share of benefits over a long period of time. If within 12 calendar months the amount of declared privileges exceeded 89% of the tax, then the organization will be included in the list of “lucky ones”.

Reflection of deductions in the VAT return

The tax calculation on paper is documented by a VAT return. It should be remembered that filing a declaration is only possible in electronic form.

All deductions are reflected in section 3, in lines 120 to 210. In most cases, not all lines are filled out. Typically taxpayers fill out:

| Declaration line | Explanation |

| 120 | Filled in with the amount of VAT that “came” with purchases and accounted for in account 19 |

| 130 | In the line you need to enter the amount of VAT on all prepayments that the taxpayer transferred to suppliers. The figure is taken from the turnover of the credit account 76.VA |

| 170 | Here you need to enter the amount of VAT on advances from previous periods that were closed this quarter. The amount is taken from the turnover on the credit of account 76.AB |

| 190 | The line contains the total amount of tax that is subject to deduction from the accrued amounts |

Consequences of failure to comply with the optimal amount of deductions

Safe percentages of deductions are established for a reason. The state must replenish the budget through taxes in any case, and VAT is the most administered tax, which brings in the majority of revenue. At the same time, one cannot put too much pressure on the business community, as this is fraught with negative consequences. That is why, in the opinion of tax officials, the optimal amount of deductions was chosen, which should suit everyone.

If a company exceeds the safe percentage of deductions, the inspection will first of all require an explanation. In the event that the taxpayer’s explanations seem unconvincing to the tax authority, a decision is usually made to conduct an on-site audit, with all the ensuing consequences.