How to calculate

Article 127 of the Labor Code of the Russian Federation states: an employee is entitled to payment of compensation for vacation on the last working day. Every working person has 28 calendar days a year for rest (Article 114 of the Labor Code of the Russian Federation). In the cases specified in the law, citizens are entitled to additional paid days or bonus time for rest, as provided by the employer himself in the collective agreement and local regulations. The part over 28 days is allowed to be replaced by a financial payment at the request of the employee. Let us immediately note that the working year is not equal to the calendar year; the countdown begins each time from the date of employment.

If the employee did not rest during the year worked, then vacation pay upon dismissal is calculated 28 days in advance. If some of the allotted days are used, the remaining days are compensated. Money is not paid if the entire allotted period is used.

General rules for payment of compensation for vacation

Compensation must be paid for all unused vacations, regardless of how much the resigning employee has accumulated. Thus, the total amount due to the employee will include (Article 116 of the Labor Code of the Russian Federation):

- compensation for basic holidays;

- compensation for additional vacations.

It should be remembered that the employee is not deprived of the right to vacation compensation, even if he has a disciplinary sanction at the time of dismissal or a disciplinary sanction in the form of dismissal has been applied to him.

Using our compensation calculator for unused vacation, you can calculate the amount of payment taking into account all legal norms.

When should compensation be paid?

According to Article 140 of the Labor Code of the Russian Federation, all payments must be made directly on the day of dismissal. It happens that on the day of dismissal the employee is absent from the workplace.

In this case, he has the right to make a claim for payment of compensation to him (including for vacation), and the employer must pay him this money no later than the next day.

Which days are taken into account?

To figure out how to correctly calculate compensation for unused vacation upon dismissal, you should determine the principle for calculating vacation days that are reimbursed in money. The number of such days depends on how long the person worked before leaving. Days worked per year are rounded up to months. If more than half a month has been worked, the length of service is rounded up; if less than half, vice versa. To receive payments in 28 days, it is enough to work a full 11 months (without rounding). They also compensate all 28 days for citizens who worked from 5.5 to 11 months and were dismissed due to the liquidation of an enterprise, conscription into the army or staff reduction. But if an employee works for less than half a month, he will not receive compensation.

Here is an example of calculating compensation for unused vacation upon dismissal (2021):

Panfilov I.L. has been working at the company since March 10, 2017. Each working year of Panfilov begins on March 10. He resigns on August 13, 2021. Over the last working year, he worked 4 months and 10 days. Rounding down occurs since less than half the month was worked. Provided that Panfilov has already used rest days for previous periods, compensation is accrued for 5 months. During this time of work he is entitled to 11.66 days of rest.

IMPORTANT!

There is no rounding of unused days. The management of the company has the right to decide whether to round days to whole numbers, but they must do this not in an arithmetic way, but in favor of the employee. For example, the number 11.66 is rounded to 12 whole days (letter of the Ministry of Health and Social Development of Russia dated December 7, 2005 No. 4334-17).

How the calculator works

The compensation calculator on our portal will help you understand how compensation is calculated for unused vacation upon dismissal.

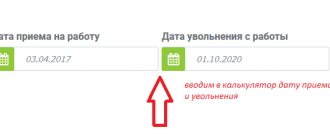

Step 1. Enter the date of hire and date of dismissal into the calculator

We enter into the calculator for calculating unused leave upon dismissal the 2022 dates of employment and dismissal in the format XXXX-XX-XX (year, month, day) or select from the calendar.

Step 2. We indicate the number of vacation days due to the employee per year

The number of such days should be selected from the list. If you click on the arrow in the calculator, the following list will become visible:

- 28;

- 30 - disabled workers;

- 31 - minors with irregular working hours;

- 35 - employed in work with harmful (2, 3 and 4 degrees) and (or) dangerous working conditions;

- 44 - workers in areas equated to regions of the Far North;

- 52 - workers in the Far North;

- other.

If the category of employee does not fall into the proposed list (for example, teachers who are entitled to 42 or 56 days of rest), then select the last item “Other” from the calculator list and indicate the number of days in the window that appears.

Step 3. Add periods to the calculator that are not included in the vacation period

Please note that some periods are not included in the calculation of severance leave. If there were such, we note this in the calculator.

These periods include:

- vacation time at your own expense, if it exceeds 14 calendar days per year;

- child care time up to 3 years;

- time away from work without good reason;

- time of suspension from work due to the fault of the employee.

To mark a period in the calculator, click the “Add Period” button and enter the dates in the same format as you did in the first step.

Step 4. Indicate the number of vacation days for the entire period of work and the average daily earnings

Indicate in the specially designated field of the calculator the total number of days the employee took off for the entire period of his employment and enter the amount of the employee’s average daily earnings (ADE).

IMPORTANT!

Specify fractional numbers in the calculator separated by a period, not a comma.

Step 5. Calculate

Click the "Calculate" button.

The calculator will display the number of unused days on your screen, and monetary compensation for unused vacation will appear - the calculation is complete.

As you can see, the calculation is not that difficult. But where do we get these numbers? Let's figure it out.

Personal income tax, insurance premiums and income tax

In accordance with paragraph 3 of Art.

217 of the Tax Code of the Russian Federation, all types of compensation payments established by the legislation of the Russian Federation and related to the dismissal of an employee, with the exception of compensation for unused vacation, are not subject to taxation. Consequently, this monetary compensation is paid to the employee minus personal income tax. Compensation for unused vacation is fully subject to insurance premiums, since paragraphs. 2 clause 1 art. 422 of the Tax Code of the Russian Federation states that all types of compensation payments provided for by the legislation of the Russian Federation related to dismissal are not subject to insurance premiums, with the exception of compensation for unused vacation.

According to Art. 255 of the Tax Code of the Russian Federation, the organization’s labor costs include all accruals due to employees in cash and in kind, as well as incentives, compensation payments and incentives provided for by the norms of the legislation of the Russian Federation, labor and collective agreements. Based on clause 8 of Art. 255 of the Tax Code of the Russian Federation, which states that labor costs include compensation payments associated with the payment of unused vacation, we can conclude that the amounts of compensation paid to an employee upon dismissal are taken into account as part of labor costs and reduce the taxable income of the institution.

Reflection in “1C: Salaries and personnel of a government institution 8”, ed. 3.1.

Compensation for unused vacation due to an employee is calculated in the “Dismissal” document on the “Vacation Compensation” tab (Fig. 1).

Rice. 1

The number of worker's compensation days is reflected automatically. In order to check whether the days are reflected correctly, you can use the link “How did the employee use vacation?” During the transition, you can see how and on the basis of what documents the established number of days of vacation compensation is formed. If employee data was transferred from the previous edition, on the “Main” tab of the “See” section. also” you need to check “Vacation balances”.

This document indicates the types of annual leave entitled to the employee and the remaining leave by working year. If all data on the employee is entered correctly, then in the “Dismissal” document on the “Accrual and Retention” tab, compensation for unused vacation will be calculated based on the employee’s average earnings and the number of days of compensation, which will subsequently be reflected in the statement of payment to the employee.

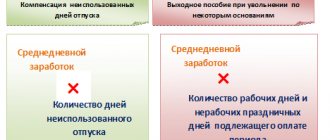

Formula

The generally accepted formula for calculating compensation for unused vacation upon dismissal is as follows:

Where:

- SDZ is the employee’s average daily earnings.

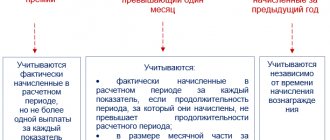

Average earnings are determined according to the rules of Art. 139 Labor Code of the Russian Federation. Formula:

Where:

- SRS - average annual income (employment payments for the last 12 months);

- 12 - number of months for calculating SDZ;

- 29.3 - the average number of calendar days in a month for calculating vacation payments.

As a result, we get the amount that the employee earned per day.

The number of unused rest days is calculated for the entire period of work in the company, and not just for the year of dismissal. This number is calculated for previous periods using the formula:

Where:

- KND - the number of unused vacation days;

- OG - years worked;

- PDO - allotted vacation days per year;

- IDO - used vacation days for the entire period of work.

If less than 11 months were worked in the last year, the number of unused days for compensation is calculated as follows:

Where:

- KND - number of unused days;

- PDO - prescribed days of rest for 12 months;

- 12 is the number of months in a year.

Where:

- KND - number of unused days;

- PDO - prescribed days of rest for 12 months;

- 12 is the number of months in a year.

Special situations for accrual and payment

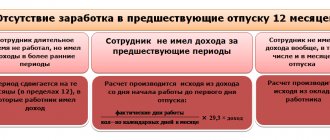

Difficulties in determining the amount of vacation compensation upon dismissal may arise in the following situations:

- In the period for which the right to leave is determined, there are time intervals that are not included in the length of service. In this case, the beginning of the year following the one that includes such intervals is shifted by the corresponding number of calendar days. And vacations at your own expense are shifted to the beginning of the next year only if their total duration for the year exceeds 14 calendar days (Article 121 of the Labor Code of the Russian Federation) and the shift occurs by the difference between the actual number of days of vacation without pay for the year and 14 calendar days days.

- The employee quits before the end of the year for which he has already taken a full vacation. In this situation, upon dismissal, that part of the vacation pay is withheld from him, which corresponds to the overpaid part of the vacation (clause 2 of the Rules on regular and additional vacations, approved by the People's Commissar of the USSR on April 30, 1930 No. 169). However, if the dismissal occurs on grounds that give the right to payment of vacation pay in full, then compensation payments upon dismissal attributable to the overpaid part of the vacation are not considered unnecessary.

For information on how to calculate vacation pay attributable to the overpaid part of the vacation, read the article “Deduction for unworked vacation days upon dismissal .

If an employee goes on vacation with subsequent dismissal, the calculation of compensation and its payment must be made on the last working day. On this working day preceding the vacation with subsequent dismissal, the employee must receive a final payment, work book and other documents necessary for further employment (letter of the Federal Service for Labor and Employment dated December 24, 2007 No. 5277-6-1).

Example of calculation based on formulas, without a calculator

Let's look at how compensation for vacation upon dismissal is calculated using an example. To do this, we will derive the SDZ and the number of days not taken off using formulas (without a calculator).

Example:

Panfilov I.L. has been working at Cinema LLC since March 10, 2017, resigning on August 13, 2021. Every year Panfilov I.L. There are 28 days of rest according to the calendar. While working at Cinema LLC, he used 20 days in October 2017, 14 days in May 2018, 28 days in July 2019, that is, a total of 62. Monthly labor payments to I.L. Panfilov. — 30,000 rubles including bonus. Let's calculate how many days of rest Panfilov has left for 2022 - 2022.

We calculate the number of days of unused vacation upon dismissal using the formula:

Number of unused days for 2022 - 2022 = (3 × 28) - 62 = 22 days.

Over a three-year period from 2022 to 2022. Panfilov I.L. Allotted 84 days of rest (3 × 28), he used 62 days. The number of unused days for previous periods is 22.

How many vacation days did I.L. Panfilov accumulate? for 2022, if he worked for a full 5 months (5 months and 10 days, which are rounded down):

Number of unused days = (28 / 12) × 5 = 11.66 days.

Let’s say that according to the internal rules of the organization, days for compensation upon dismissal are rounded in favor of the employee. Then for 2022 Panfilov I.L. unused 12 days. The total number of days to be reimbursed is 22 + 12 = 34 days.

Let's calculate the average earnings of I.L. Panfilov. in a day. Taking into account the salary of 30,000 rubles, in 12 months he earns 360,000 rubles:

Now it’s easy to understand how vacation time is calculated when you quit 32 days in advance:

1023.89 × 34 = 34,812.26 rubles.

Final amount: before dismissal, Panfilov will receive 34,812 rubles 26 kopecks in compensation.

Is it allowed to replace vacation with monetary compensation without dismissal?

Replacement with monetary compensation without dismissal is permissible only for the part of the vacation period exceeding 28 calendar days (Article 126 of the Labor Code of the Russian Federation). This happens upon a written request from the employee. It is allowed to replace days with money in excess of the main vacation. Only those categories of employees who are entitled to additional days of rest (disabled people, teachers, doctors, Northern workers, etc.) are entitled to receive monetary compensation instead of rest. Or if the employer has provided additional days for rest in the company’s local regulations. But this is not in all cases:

- The legal norm uses the wording “can be replaced,” which leaves the employer the right to refuse the employee financial compensation. Payment of money instead of providing extra days of rest is at the discretion of management.

- Vacation will not be replaced with money for pregnant women, minors and workers in hazardous and hazardous industries.

It is also not possible to accumulate vacation days for the previous year, and then take part of the double vacation over 28 days in cash. Article 126 of the Labor Code of the Russian Federation, when summing up and transferring vacations from one year to another, allows for the replacement of only part of more than 28 days in each year.