Options for filling out sick leave: paper and electronic

From 2022 in Russia, you can use two ways to compile sick leave: traditional paper and electronic.

paper sick leave certificate is a special form. The doctor fills out his part of the document and gives it to the employee. After recovery, the employee submits sick leave to the accounting department. The accountant checks the document, fills out the section with company data and calculations, and then transfers the sick leave to the Social Insurance Fund for payment. Also, on the basis of sick leave, in cases established by law, the employer himself transfers benefits to the employee for the first three days of illness.

Temporary disability benefit

The basis for payment of temporary disability benefits is an insured event.

The benefit is paid when:

- the employee is sick;

- the employee was injured due to loss of ability to work;

- the employee was undergoing follow-up treatment in a sanatorium immediately after receiving medical care in a hospital;

- a member of the employee’s family gets sick and needs care;

- the employee is placed in a specialized hospital for prosthetics for medical reasons;

- the employee and any member of his family were in quarantine;

- the employee suffered as a result of an accident at work or received an occupational disease.

But these are all reasons for disability.

When issuing sick leave, the doctor enters a special code to indicate the cause of disability. For example, illness – 01, injury – 02, quarantine – 03, etc.

What is an insured event?

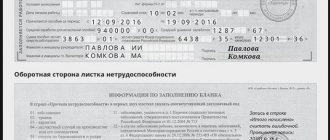

How to check a sick leave certificate before filling it out

Having received a sick leave certificate on paper, the employer must check three parameters.

1. Form number in the FSS database. But here you need to keep in mind that the fund updates the list of stolen and lost sick leave forms on average once a month. Therefore, this check does not provide a complete guarantee against counterfeiting.

2. Authenticity of the form based on external features:

- the color should be blue, darker at the edges and lighter in the center;

- the paper should be thick and resemble the texture of a banknote;

- The watermarks - the FSS logo - should be visible in the light;

- the form number must be convex to the touch;

- The underline under the signatures of the doctor, manager and chief accountant should consist of microtext “certificate of incapacity for work”, which can be distinguished with a magnifying glass.

3. The accuracy of the information filled out by the doctor. In particular, the name of the medical institution must be the same as on the seal, the employee’s full name must correspond to his passport details. But there may be typos in the name of the company, since the doctor enters this information from the words of the employee. In this case, there is no need to replace the sick leave; the employer just needs to enter the company name and registration number in its section without errors (letter of the Moscow regional branch of the Federal Social Insurance Fund of the Russian Federation dated July 14, 2020 No. 14-15/7710-1110-LNK).

If the employer still has doubts after all the checks, he can send a request to his FSS department, attaching the original of the disputed sick leave (letter of the FSS of the Russian Federation dated September 30, 2011 No. 14-03-11/15-11575). When issuing an electronic sick leave certificate, the employer only needs to check its number. If there is this sick leave in the FSS database, then the document is real.

What is an insured event

Now let's figure out what an insured event is.

The definition of an insured event under the legislation on compulsory social insurance in case of temporary disability and in connection with maternity was given by the FSS in a letter dated August 18, 2004 No. 02-18/11-5676.

An insured event, which is the basis for payment of benefits, should be considered a case of temporary disability:

- completed by one completed period of incapacity;

- certified by a certificate of incapacity for work, taking into account all certificates of incapacity for work issued in continuation of the initial one.

Part 1 of Article 6 of Federal Law No. 255-FZ of December 29, 2006 provides that benefits are paid for the entire period of temporary disability from the moment it begins until the day of restoration of working capacity.

Read in the berator “Practical Encyclopedia of an Accountant”

How to determine the period of temporary disability

But it also happens that within the framework of one insured event there is a change in the cause of disability. For example, an employee was first in quarantine, and then fell ill himself.

How to pay benefits in this case?

How to fill out a paper sick leave certificate

The rules for filling out sick leave are given in Section IX of the Procedure, approved by Order of the Ministry of Health of the Russian Federation dated September 1, 2020 No. 925n.

1. Entries must be made in capital block letters using printing devices or using a gel, capillary, or fountain pen with black ink. You cannot use a ballpoint pen.

2. A combined option is allowed, when part of the information on the sick leave is entered using a printing device, and part is written in with a fountain pen (letter of the Federal Social Insurance Fund of the Russian Federation dated October 23, 2014 No. 17-03-09/06-3841P).

3. All entries must start from the first cell and not go beyond the boundaries of the fields.

4. Seals of the medical organization and the employer may go beyond the boundaries of the designated spaces, but should not overlap the fields with information.

5. If the employer makes a mistake when filling out a sick leave certificate, it can be corrected without replacing the form (clause 72 of order No. 925n). To do this you should:

- cross out the erroneous entry;

- make the correct entry on the back of the form;

- certify the correct entry with the employer’s signature and seal.

When correcting, you cannot use a corrector or other similar means.

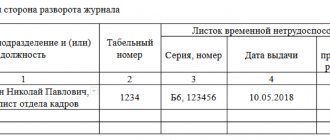

The employer enters the following data in the section of the sick leave sheet “TO BE COMPLETED BY THE INSURER”.

1. Information about the place of work:

- name - here it is better to indicate a short name, since there may not be enough cells for the full one;

- status of the employee’s place of work - main or part-time. This is important, since the part-time worker issues sick leave for each place of work;

- employer registration number in the Social Insurance Fund;

- subordination code - the number of the FSS branch where the employer is registered.

2. Employee identification codes: TIN and SNILS.

3. Special conditions for calculating sick leave:

- codes for various special conditions under which sick leave is calculated according to separate rules. For example, disabled people affected by radiation, etc.;

- the date of drawing up the act in form N-1, if sick leave was issued due to an industrial injury.

If none of the listed special conditions exist, all of these fields must be left blank.

4. Information for calculating benefits:

- insurance experience;

- non-insurance periods that are deducted from the insurance period;

- the period for which the benefit must be calculated - the opening and closing dates of the sick leave;

- average earnings for the previous two years and per day;

- the amount of benefit at the expense of the employer;

- the amount of benefits from the Social Insurance Fund;

- total accrued.

When paying benefits directly through the Social Insurance Fund, you do not need to fill out the last two lines (clause 73 of order No. 925n).

The employer certifies the sick leave with the signature of the manager and chief accountant, as well as a seal, if any.

Who can issue a rolling sick leave?

The legislation allows the issuance of sick leave only to licensed medical institutions:

- These can be public clinics or hospitals and private medical centers that have licenses and certificates. Forms must be filled out in accordance with established rules, dates must be accurately and clearly stated.

- The document can also be obtained from a foreign clinic if the employee falls ill during a business trip. In this case, sick leave is issued according to the laws of this country, and upon return it is provided to the personnel department.

The minimum period for which sick leave is opened is 3 days. Even if the employee feels better, he cannot begin his job duties on the second day.

The maximum period for opening a sick leave is a month. If recovery has not occurred during this time, and it is necessary to continue treatment, the head physician of the medical institution gathers a council of doctors, at which the issue of further treatment or closure of sick leave is decided.

How to fill out an electronic sick leave certificate

In order to work with electronic sick leave, the medical institution and the employer must be connected to the FSS information system. Also, to exchange information with the fund, an enhanced qualified electronic signature (ECES) is required.

The employer enters the same information into the electronic sick leave form as on the paper form. Information must be transferred to the FSS database through the employer’s personal account. After the data is entered, in general they should be certified by the UKEP of the manager and chief accountant, or an individual entrepreneur.

The employer can delegate the authority to certify sick leave certificates to a specialist who is involved in their preparation. To do this, you need to issue an order and issue a power of attorney. Then, to certify electronic sick leave certificates, it will be necessary to use the UKEP of an authorized person (clause 74 of order No. 925n).

If the electronic sick leave data is filled out incorrectly by the employer, the error can be corrected. To do this, you need to fill out the information again and submit it to the Social Insurance Fund, indicating the reasons for the correction. The corrected data should be certified by the UKEP of the manager and chief accountant (clause 72 of order No. 925n).

Requirements for filling in 2017

Fill in with black pen only.

The certificate of incapacity for work is filled out at a medical institution and directly at the company. The points listed below are mandatory on all sides of the document and for all responsible persons.

- The form must be filled out with a gel or fountain pen only. It is forbidden to use a ballpoint;

- The employee’s data is entered in the indicated cells only in block letters;

- It is forbidden to go beyond the cells. Otherwise, the information will not be processed and the form will not be accepted and returned for revision;

- Only printed Cyrillic alphabet must be used. True, it is acceptable to use the company name in Latin;

- Black ink is required;

- Errors and corrections are allowed, but provided that there is a “believe what is written” mark on the reverse side.

Special cases: maternity payments and quarantine

During the epidemic, it is allowed to issue a sick leave as part of a remote appointment using telemedicine technologies. This applies, among other things, to the calculation of maternity benefits (clause 50 of order No. 925n). This reduces the risk of spreading dangerous diseases.

Also, in order to reduce the number of contacts between doctors and patients, during an epidemic, a special rule is provided for filling sick leave during quarantine. In this case, the doctor must issue a sick leave certificate immediately for the entire period of isolation of the patient (clause 48 of order No. 925n).

Otherwise, the procedure for filling out sick leave by an employer during pregnancy or in the event of quarantine does not differ from that described above.

Correct form

The original form has a special shape.

This form is light blue with yellowish-white cells. The A4 sheet on the front side is divided by a horizontal line into two parts - the first for medical staff, the second for filling out by the boss.

On the right you can see a black and white barcode confirming the legality of the document.

To minimize the number of false certificates, the FSS (Social Insurance Fund) also introduced additional security elements:

- binary barcode;

- water marks;

- set of 12 digits;

- grid background.

On the same front side of the form, the reasons for the disability and the reason for calculating benefits are indicated.

Electronic sick leave 2022: how to check, supplement and pay

From January 1, 2022, as a general rule, sick leave will be issued electronically. Not only the form of this document has changed, but also the rules of interaction between the employer and the Social Insurance Fund ( Law No. 126-FZ , RF RF dated December 16, 2022 No. 1567 ). Sick leave is processed in the EIIS Sotsstrakh using the EDMS.

Now, when assigning benefits, the organization plays the role of an intermediary. She transmits to the FSS the information that is needed to pay for sick leave. Payments are made in a “proactive manner”: both according to information “pre-filled” by the Social Insurance Fund, and according to data provided by the employer (clauses 19, 22 and 23 of the Rules, approved by the RF Government of November 23, 2022 No. 2010 ). In almost all cases, benefits for certificates of incapacity for work are paid directly by the Social Insurance Fund (except for clause 1, part 1, article 5 and article 9 of Law No. 255-FZ).

However, it is important for the employer not only to provide information upon request on time, but also to ensure its accuracy and completeness in order not to fall under fines (Article 15.2 of Law No. 255-FZ , Part 4 of Article 15.33 of the Code of Administrative Offenses of the Russian Federation). In addition, the employer is still obliged to pay for the first three days of sick leave for temporary disability (except for clauses 2–5, part 1, article 5 and article 9 of Law No. 255-FZ ). The benefit must be calculated taking into account the indexation of the minimum wage for 2022, as well as the employee’s maximum income base for 2020 and 2022.

How the employer and the Social Insurance Fund interact when assigning benefits for electronic sick leave, as well as what fines the company faces in this case, you can find out in the article on our website.

Content

- How to make sure that the sick leave is genuine

- A vicious circle of checks, or everyone checks everyone

- Features when calculating and paying benefits in 2022

- Who will pay for electronic sick leave and how from 2022

How to make sure that the sick leave is genuine

The employer receives information about the opening of sick leave from the Social Insurance Fund (via the EDMS). Also, an employee can provide his sick leave number on his own initiative, but he no longer has an obligation to do so. You can check the authenticity of the electronic sick leave yourself. To do this, you need to enter the electronic sick leave number, as well as the employee’s SNILS number in the electronic system.

An employee can also check whether he has received an electronic sick leave. Each employee has a personal account on the portal of the Federal Social Insurance Fund of the Russian Federation. Notify employees of the need to register on the State Services portal. They will be able to access their personal FSS account. Electronic sick leave: its information, including processing stages, can be tracked on the website (login with login and password from the State Services portal). Thus, the HR manager will no longer need to answer the question: electronic sick leave - where to view and track this document.

| You will learn how to accurately and easily draw up and coordinate personnel documents when working remotely from our updated training course |

A vicious circle of checks, or everyone checks everyone

Since 2022, the Social Insurance Fund will pay employees benefits directly: in full or starting from the fourth day. In addition, the Fund switched to a “proactive procedure” for their payments. It frees the employer and employees as much as possible from the need to submit documents. For these purposes, departments have developed their own electronic document management system. Thus, the FSS can request from the Pension Fund: SNILS of the employee, information about his employer, the amount of insurance experience, etc. From the Federal Tax Service of Russia - it can clarify information about the employee’s salary for the period of interest (clauses 12 and 44 of the Rules ). In particular, when closing an electronic sick leave, the FSS receives information from the Pension Fund and sends “pre-filled information” to the employer.

If necessary, the employer corrects the “pre-filled information” and supplements it. For example, enters correct data for calculating benefits. This must be done within three working days from the moment the electronic sick leave is closed and the request is received (clauses 22 and 23 of the Rules ).

The FSS again has the right to check this data through interdepartmental cooperation. The Pension Fund and the Federal Tax Service provide the FSS with information no later than three working days from the date of receipt of the request (clauses 44 and 46 of the Rules ).

If the employer sent incomplete (inaccurate) data to the Social Insurance Fund, he will be given the right to correct the error. In this case, the employer will confirm receipt of the notice from the Social Insurance Fund within three working days and send the missing (corrected) information within five working days (clause 10 of the Rules ).

Features when calculating and paying benefits in 2022

The procedure for calculating benefits remained the same, but their actual amount increased. From January 1, 2022, the federal minimum wage in Russia increased to 13,890 rubles. The minimum average daily earnings in 2022 depend on it - 456.66 rubles. (13890*24/730 – part 6.1 of article 14 of Law No. 255-FZ ).

In 2022, the maximum employee income base, which is taken into account when calculating benefits, has been increased. It amounts to 1,878,000 rubles (for 2020 - 912,000 rubles (RF PP dated November 6, 2022 No. 1407 ), for 2022 - 966,000 rubles (RF PP dated November 26, 2020 No. 1935 ). Consequently, the maximum average daily earnings in 2022 – 2572.6 rubles (1,878,000/730 – Part 3.3, Article 14 of Law No. 255-FZ ).

| Advice If your region has established a minimum wage with an increased coefficient, calculate the minimum benefit taking it into account. At the same time, the maximum daily benefit cannot be increased by the regional coefficient (Article 133 of the Labor Code of the Russian Federation, Article 14 of Law No. 255-FZ ) |

The main indicators for calculating temporary disability benefits remained the same: the cause and number of days of incapacity, their maximum duration, the procedure for calculating average daily earnings (with minimum and maximum restrictions), the employee’s insurance length and his income for the billing period (Article 6, Article 14 of Law No. 255-FZ , clauses 22 and 23 of the Rules , Order of the Ministry of Health of Russia dated November 23, 2021 No. 1089n ).

| Scheme 1 Temporary disability benefit = average daily earnings * number of days of incapacity * amount of benefit established as a percentage of average earnings (Article 7, Parts 4 and 5 of Article 14 of Law No. 255-FZ ) Scheme 2 Average daily earnings = the amount of earnings for the two calendar years preceding the year of illness / 730 (parts 1–3 of Article 14 of Law No. 255-FZ ) |

What benefits are paid by the Social Insurance Fund and which by the employer, you can find out in the material on our website

Who will pay for electronic sick leave and how from 2022

The employer, as before, pays for the first three days of illness of the employee. In this case, the benefit is accrued within 10 days from the end of sick leave, and paid on the next payday. The Social Insurance Fund pays its part of the benefit within 10 days from the receipt of all necessary information about the employee. The Fund has the right to refuse payment. The decision to refuse is sent no later than one working day from the date of its adoption (Article 15 of Law No. 255-FZ ).

Benefits are transferred to a bank account, via mail or another organization specified by the employee in the “Information about the insured person.” Sick leave is paid without interest for the transfer (Parts 25, 26 of Article 13 of Law No. 255-FZ, in the form of Appendix No. 2 approved by the Order of the Social Insurance Fund of February 4, 2022. № 26).

| Important! The Social Insurance Fund itself pays for all days of maternity leave (Law No. 126-FZ), as well as sick leave for: quarantine (including for a preschool child under 7 years old), caring for a sick family member, industrial accident or occupational disease, and also – prosthetics for medical reasons in a hospital and after-care in a sanatorium after hospitalization (clause 2 – 5, part 1, article 5, article 14.1 of Law No. 255-FZ, Federal Law of July 21, 2007 No. 183-FZ, Order of the Ministry of Health and Social Development of the Russian Federation of January 27, 2006 No. 44, Federal Law of May 26, 2022 No. 151-FZ, RF PP of December 30, 2022 No. 2375). |

Share this article: