Adults hate taxes the same way kids hate brushing their teeth.

Paul Samuelson

Each of the Russians, to one degree or another, is faced with the need to pay taxes on transport, property and income. Payment of tax may be accompanied by conflicts and lack of mutual understanding between the taxpayer and the Federal Tax Service, which administers the collection of tax payments. Often the cause of such conflicts is the taxpayer’s desire to achieve a recalculation of property taxes, because tax inspectors are in no hurry to take the word of a person seeking to reduce his tax liability.

In this article, we tried to provide answers to the most common questions that arise from our clients regarding the methods and procedure for recalculating property taxes for individuals.

Property tax for individuals

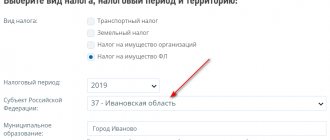

Property tax for individuals is one of the few taxes, the funds paid for which go to the municipal budget. Tax amounts are calculated for each immovable property owned by the taxpayer, if it is named in the Tax Code of the Russian Federation as an object of taxation.

In most regions of Russia, property tax is calculated based on its cadastral value. At the same time, the Tax Code of Russia establishes only the maximum possible tax rate, while its specific values are established by the city or region in which the taxpayer lives (this is due to the status of the personal property tax as a local tax). Sometimes the tax is calculated on the basis of the inventory value of the object - this situation is possible in those regions in which the law on the transition to the cadastral value of the object when calculating the tax has not yet been adopted, but at the moment almost all regions have already switched to calculation based on the cadastral value. In addition, the Tax Code obliges regional authorities to adopt laws on cadastral value by 2022. You can find out the exact tax rate, as well as the methodology for calculating it in your region/city, at the local tax office or on the official website of the Federal Tax Service of Russia.

The tax is paid once a year. The payment itself must be made before December 1, and it is paid for the year preceding the year of payment (for example, property tax for 2022 must be paid before December 1, 2022). One month before the payment deadline, the tax office sends a notice to the taxpayer.

Recalculation of transport tax in connection with the benefit

A certain category of citizens has the right not to pay vehicle tax. These include pensioners, large families, disabled people of groups 1 and 2, as well as heroes of Russia and the USSR. If the tax at the end of the year does not take into account the car owner’s right to a benefit, you need to contact the tax office with an application and documents confirming the legality of applying the benefit.

It is not necessary to use the benefit. That is why the tax office does not begin to apply it automatically.

To receive your legal deduction, the beneficiary must submit an application for a transport tax benefit and, if necessary, an application for recalculation for the last three years.

Owners of large trucks weighing more than 12 tons are required to pay tax according to Plato. It provides for tolls on federal highways. For such motorists, a tax benefit is also provided. If the calculation is incorrect, the owner has the right to recalculate the accrued tax.

How to write an application for transport tax benefits?

In what cases is tax recalculation necessary?

According to the explanations of the Federal Tax Service, there are 2 such cases:

1) The tax notice contains outdated or erroneous information

2) The benefits due to you for personal property tax were not accrued

Please note that the tax office will not recalculate taxes unless the taxpayer declares one of the specified reasons for recalculation. If you receive a tax notice with errors or if it does not contain benefits due to you, you must immediately prepare to file an application with the local tax office, since you may have time to change the amount before the deadline for paying the tax. However, even if you have already paid the tax on an incorrect notification, the law allows the taxpayer to demand recalculation of a number of taxes that are paid in the notification procedure within 3 tax periods, that is, for the last 3 calendar years. It is during this period that an error in a tax notice must be detected.

Recalculation of tax upon receipt of benefits

According to Letter No. BS-4-21/ [email protected] , in accordance with clause 21 of Article 52 of the Tax Code of the Russian Federation, property tax is recalculated for the last 3 periods preceding the calendar year in which it was sent notification of recalculation, unless the law provides for a different procedure.

When a taxpayer applies for a tax benefit, the recalculation of obligations is carried out for the last 3 periods preceding the year in which the relevant application was submitted, but not earlier than the date on which the citizen became entitled to receive this benefit.

In the absence of restrictions regarding the tax period, recalculation can be carried out for any period if there are grounds for doing so.

Where and how to get a compulsory medical insurance policy - 5 stages of the procedure

Read

Who is required to undergo genomic registration in the Russian Federation and who else the law may apply to?

Read

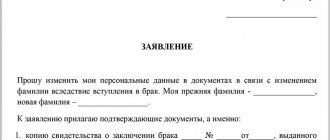

Drawing up an application for recalculation

An application for recalculation must be sent to the local tax office. Typically, the tax notice you receive will contain a form for such an application. The application can also be drawn up in free form, taking into account a number of mandatory elements. These elements of the application will be:

1) Full name

2) TIN

3) Address of the inspectorate to which the application is submitted

4) Number of the notification received

5) The text of the complaint itself

6) Copies of documents that support the applicant’s arguments.

There are several ways to submit an application to the tax office:

1) Come to the inspection in person

2) Transfer the application to the representative for subsequent submission by proxy or on the basis of the powers established by law;

3) Through the taxpayer’s personal account

4) By mail

Legal advice: If you decide to send an application by letter, we recommend sending it by post with a list of the attachments, so that in the future you will have proof that the application was sent properly.

The application was made before tax was paid

A notification with updated data must be sent to you within 30 days from the date of registration of your application with the tax office. The notice must include both the old incorrect tax value and the new one. If you did not manage to pay the tax amount before noticing the error in the notification, then all that remains is to pay the tax office for the correct, updated amount.

The application was made after payment of tax

If the inspectorate agreed with your request to recalculate the tax only after paying an amount exceeding the required amount, it is worth thinking about the further legal fate of the overpaid money.

The return of overpaid funds entails the preparation of a new application to the tax office. Tax authorities will have a calendar month to make a decision on the refund and return these funds. You can submit an application either in the form of a printed or handwritten document, or in the form provided to you in your personal taxpayer account on the official website of the Federal Tax Service of Russia.

The overpaid amount will be credited in the same manner as the refund. Keep in mind that offsets are made only for taxes paid to the same budget as the tax for which the overpayment occurred. Thus, overpayment of property tax can only be offset against land tax and trade tax. We also note that if you have arrears, penalties or fines for non-payment of land tax and/or trade tax (if you are an individual entrepreneur), then the tax office will automatically offset the funds for them. Please note that the offset rule for arrears, penalties, and fines is also subject to a 3-year limit for offset.

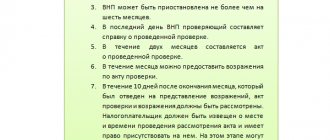

What will the inspection do?

If there are grounds for recalculating property taxes and generating the next tax notice to the Federal Tax Service:

- will reset the previously accrued amount of tax and penalties;

- will generate a new notification indicating a new deadline for tax transfer;

- will place the document in the payer’s personal account;

- will post a response to the appeal in your personal account (including if there is no reason for a recount).

However, not everyone has yet mastered the use of a personal account on the website of the Federal Tax Service of Russia. A similar procedure applies for such citizens. The new notice will have to be collected in person or through a representative, as well as the response to the appeal itself. Otherwise they will be sent by regular mail. Then get ready to wait.

Of course, recalculation of property taxes is also possible during the period of mass formation and sending of consolidated tax notifications. Then the Federal Tax Service will report this fact: that the recalculation is included in the notification (letter of the Federal Tax Service dated July 3, 2017 No. BS-4-21/12760).

Tax dispute

All of the situations described above are a quick and effective way to restore your violated tax rights if the tax inspectorate admits a mistake or considers your arguments convincing. However, often the tax authority does not agree with even the most reasonable arguments of the taxpayer. In this case, you cannot do without the help of a tax lawyer, since you will have to go through a tax dispute procedure. If you are lucky enough to prove your position to a higher authority of the tax service, then you can still count on a speedy solution to the problem that has arisen, but if tax authorities at all levels do not agree with you, then the only way to return the money will be a lawsuit.

Can the Federal Tax Service recalculate the technical tax on its own?

The situation when a motorist did not submit an application to the tax office, but a new receipt with an adjustment arrived, occurs quite often. Usually in such cases there is an increase in the amount payable.

Additional charges have to be made for the same reasons as recalculation: inattention of tax officials who indicated less power than needed, information that was received at the wrong time, and so on.

Despite the indignation of car owners, the Federal Tax Service has the right to do this in accordance with Articles 31 and 32 of the Tax Code of the Russian Federation. The taxpayer, in case of disagreement with the additional assessment, may contact the tax office to clarify the circumstances. If there is no result, you can fight for your innocence in court.

Tax payments of the car owner are his direct responsibility to the state. Money received by the budget as a transport tax is spent on building new roads and repairing old ones. However, there is no such thing as extra money. And paying additional tax amounts is expensive. Therefore, the car owner must independently control the tax accrued on the receipt. If it is necessary to submit applications for recalculation, the motorist needs to collect supporting documents and submit the originals to the Federal Tax Service at the place of registration. After considering the issue, you need to write an application for a refund or offset in favor of future payments. The main thing is not to delay in correcting tax mistakes. After all, the period for which recalculation is possible is only 3 years.

How to achieve recalculation of property tax based on cadastral, rather than inventory, value?

The final transition to calculation based on cadastral value will be completed by 2022 and most regions have already completed this transition. However, if in your region the property tax is still calculated based on the inventory value, then an unpleasant situation for the taxpayer may arise when the tax on the inventory value turns out to be higher than the tax on the cadastral value of the property, although for a long time it was impossible to protest this state of affairs. However, in February, the Constitutional Court ruled that taxpayers have the right to demand a cadastral valuation of their property and the corresponding assessment of tax. If you think that in your situation it is more profitable to pay tax at the cadastral value, you should go to court and defend your right.

Recalculation of tax on a sold car

The transport tax calculation period is calculated in months. Therefore, in order to understand when it should stop accruing, you need to know the date of conclusion of the purchase/sale agreement.

If the sale was completed in the first half of the month before the 15th, then the tax will be charged to the new owner from this month. If the contract is dated in the second half of the month, then the current month will have to be paid to the former owner.

Thus, using the receipt you can check the correctness of the accrual after the sale.

Why might the calculation be wrong? The reason is simple. The tax office did not receive information from the traffic police. Or the employee who calculated the tax was inattentive.

What should the former owner do in this case? First of all, you need to contact the tax office to find out the reasons. Perhaps the mistake was made due to inattention and, in connection with the sale of the car, the inspector will correct it himself. If not, the individual needs to confirm the fact of selling the car by submitting a purchase/sale agreement.

- Take a certificate from the traffic police about your deregistration for a specific car;

- Contact the tax office at your place of registration;

- Fill out the application for recalculation;

- Attach a copy of the purchase/sale agreement to confirm the information provided.

You can fill out the application yourself and send it to the tax office by mail.

The situation will become more complicated if, after receiving ownership of the car, the new owner does not register the car in his name. Then you won’t be able to avoid unnecessary expenses on someone else’s tax.

Our practice

Taxation issues require from a representative not only high professional knowledge, but also significant practical experience in advising companies on choosing the best strategy.

The Krainev and Partners team consists of specialists of various profiles and high qualifications, which allows us not only to offer clients support for the conclusion of agreements and turnkey litigation, but also to advise our clients.

You can sign up for a consultation by sending a brief description of your question by email