The line with the attribute has become one of the latest innovations for standard forms with calculations for insurance premiums. At first, this was due to the fact that the Federal Tax Service was now responsible for the document itself, as well as for payments. Many employees still doubt which sign to use in this or that case.

In the article we will discuss which payment attribute to set in Appendix 2 of the calculation of insurance premiums.

What does it mean

First, you should understand what this indicator means and how it can be deciphered. Disability and maternity benefits are paid to insured persons based on certain rules.

There are two mechanisms for these rules, which are recorded in the Procedure for filling out contributions.

- With direct payments and code 1, when benefits are directly paid by the FSS.

- Credit system. The organization is responsible for transferring compensation. Expenses are reimbursed from the Social Insurance Fund. Then use code 2.

The following benefits are paid to employees directly from the social insurance fund:

- When caring for children with disabilities, four days of vacation are paid.

- In the case of caring for children under 1.5 years old.

- Benefit for women who register their pregnancy in the early stages.

- Sick leave, including due to pregnancy and childbirth.

What are direct payments and the credit system?

What is a sign of payments in the calculation of insurance premiums? Appendix 2 calculation of insurance premiums and payment indicator. What to set for payments in the RSV in 2022. What indicator of payments should be indicated in the calculation of insurance premiums? Answer to b-kontur.ru.

Which regions are included in the pilot project for direct payments?

Letter of the Federal Tax Service dated February 14, 2022 N BS-4-11/ comes to the rescue, which states that in accordance with clause 2 of the Decree of the Government of the Russian Federation dated N 294, the pilot project is currently being implemented in:

- Karachay-Cherkess Republic,

- Nizhny Novgorod region,

- Astrakhan region,

- Kurgan region,

- Novgorod region,

- Novosibirsk region,

- Tambov region,

- Khabarovsk region,

- Republic of Crimea and Sevastopol,

- Republic of Tatarstan,

- Belgorod region,

- Rostov region,

- Samara region,

- Republic of Mordovia,

- Bryansk region,

- Kaliningrad region,

- Kaluga region,

- Lipetsk region,

- Ulyanovsk region.

However, this is not a complete list, since from 2022 the credit system will be replaced with direct payments in a number of regions (see table).

Attention! Before filling out the payment attribute in Appendix 2 for calculating insurance premiums, be sure to check whether there is a direct payment system in your region, or whether you are working on an offset system.

This can be done on the website “Federal Portal of Draft Regulatory Legal Acts”, where you will find all the changes to the Russian Government Decree No. 294 of April 21, 2011, which, in fact, regulates the issue of direct and offset payments.

Also, the list of regions and the sequence of their introduction are contained directly in this very Decree of the Government of the Russian Federation of April 21, 2011 No. 294.

Before deciding to fill out this line, you need to understand what the “Payment Sign” is: this indicator refers to the system by which payments are made when an employee becomes incapacitated or goes on maternity leave. Today there are 2 main mechanisms.

The first option is the offset type of payments. In this case, the disability benefit is paid in full by the company, and after the payment is made, the Social Insurance Fund compensates the employer for these costs in full.

The second option is direct payment (regions of the FSS pilot project). In this case, the source of finance for payments for temporary disability or maternity is directly the Social Insurance Fund, and the company’s finances are not involved.

Direct payments are available in the following cases:

- payment is based on sick leave (this also includes all cases of disability associated with pregnancy and childbirth);

- payments in connection with the registration of a woman during early pregnancy;

- child care allowance up to 1.5 years;

- payment of 4-day leave to care for a disabled child to either parent.

Thus, in Appendix 2 of the calculation of insurance premiums, the payment attribute is filled in with the number “1” for direct payments and “2” when using the credit system.

How to find out if a region is included in the FSS pilot project

To determine whether an organization falls under the FSS project, you need to refer to the Government Resolution of the city.

No. 294, which lists the regions included in the project: the Republics of Karachay-Cherkessia, Crimea, Mordovia, Tatarstan, Astrakhan, Bryansk, Belgorod, Kaluga, Kaliningrad, Kurgan, Lipetsk, Novgorod, Novosibirsk, Nizhny Novgorod, Rostov, Tambov, Samara and Ulyanovsk regions, as well as Khabarovsk, Altai and Primorsky Territories, and others. The list of pilot regions should be updated until 2022.

Separate divisions determine their participation in the FSS project in the same way as parent organizations, depending on the region of activity.

What indicator of payments should be used when calculating insurance premiums?

To determine which payment attribute to put - 1 or 2 in Appendix 2 of the calculation of contributions, you must first understand what a “payment attribute” is and what it is connected with.

A benefit feature is a system by which your employees will be able to receive benefits due to disability or maternity. At the moment, there are two payment systems: credit and direct.

* - payments that can be received directly from the Social Insurance Fund:

- sickness benefits (sick leave, including in connection with pregnancy and childbirth);

- payment if a woman registers with an antenatal clinic in the early stages of pregnancy;

- monthly child care allowance until the child reaches 1.5 years of age;

- payment for the required four days of leave for a parent if he is caring for a disabled child.

A direct indication of payments exists only in the regions participating in the “Direct Payment” pilot project. Accordingly, if you have a direct indication of the payment of benefits for VNIM, then when filling out Appendix 2 of Section 1 of the calculation of insurance premiums, you enter code 1. If you have a credit indicator payments, then enter code 2.

Regions in which you need to indicate the payment attribute 1Find yours>>>

What is a payout sign?

Before filling out the column of the report reserved for the payment indicator, let’s figure out what this indicator means. There are rules by which insured persons receive disability or maternity benefits. In the Procedure for filling out the calculation of contributions (hereinafter referred to as the Procedure), two mechanisms for these rules are highlighted:

- direct payments - benefits are paid directly by the Social Insurance Fund - code “1”;

- offset system - benefits are paid by the organization, and the Social Insurance Fund reimburses its expenses - code “2”.

The employee receives directly the following benefits from the social insurance fund:

- sick leave, including disability due to pregnancy and childbirth;

- benefits for a woman who registered for early pregnancy;

- child care up to 1.5 years old;

- payment of four days of leave to a parent to care for a disabled child.

If an organization operates under a direct system, then in column 001 of Appendix 2 it will indicate code “1”.

When using the scoring system - code “2”.

What does the payout attribute code depend on?

The attribute of payments in the calculation of insurance premiums is indicated depending on whether your region is included in the Social Insurance Fund “Direct Payment” project, launched in 2011.

Before this, only the credit system worked; it placed the responsibility on employers for the social protection of employees. But the financial condition of the employer does not always allow paying benefits in full and then returning them from Social Security.

To eliminate problems with the timeliness and completeness of social payments, the project was created.

The idea of direct payments is simple - employees receive benefits directly from the Social Insurance Fund, without affecting company budgets, while:

- employees are guaranteed the transfer of benefits in full, regardless of the financial capabilities of the employer;

- employers retain only the obligation to timely transfer contributions to compulsory social insurance;

- companies do not withdraw funds from economic circulation;

- the number of lawsuits between employers and employees is reduced.

To receive benefits, the employee submits the required list of documents to the territorial social insurance fund and within ten days receives the amount due to him.

What are the benefits of direct payments?

This is beneficial for the following reasons:

- employees who pay insurance premiums are guaranteed to receive benefits in full, regardless of the availability of funds in the organization;

- companies can only transfer insurance premiums from the salaries of their employees, and further actions fall on the shoulders of the fund, which significantly reduces the amount of work and documentation;

- organizations get rid of unnecessary expenses and the need to withdraw money for benefits from their business operations;

- the risk of disputes and proceedings, including litigation, between employees and employers is reduced.

Having closed the sick leave, the employee, bypassing the organization where he works, goes with him directly to the territorial bodies of social security, and within 10 days is guaranteed to receive temporary disability benefits.

Thus, the advantages of the direct payment system over the credit system are obvious. All that remains is to determine whether your region belongs to the pilot program or not.

Direct payments or credit system

Direct payments of VNIM benefits or an offset system depend on whether your region is included in the Direct Payments program. What is this program?

Since ancient times in the Russian Federation, insurance payments were made exclusively according to the credit system. Companies, having paid social insurance the required insurance amounts from the income of their employees, were still liable to them for these payments.

Since if an employee took sick leave, the organization was obliged to pay him disability benefits from its own funds, and then demand a refund from the Social Insurance Fund.

Due to the fact that financial situations in the course of business activities are different, the employer did not always fulfill his duties to the employee in good faith. This caused a lot of controversy, created unnecessary red tape, and forced companies to spend their own money on benefits.

And since 2011, the Russian government has been trying to change the system of payment of benefits for temporary disability, pregnancy and childbirth. From year to year, it systematically includes regions in the “Direct Payments” pilot program so that by 2022, throughout the Russian Federation, the payment of benefits to contribution payers occurs exclusively directly from the Social Insurance Fund, bypassing the company budget.

Sources of information used.

- https://www.rnk.ru/article/215648-priznak-vyplat-raschete-strahovym-vznosam

- https://buhguru.com/strahovie-vznosy/priz-vyplat-v-rasch-po-strakh-vznos.html

- https://www.b-kontur.ru/enquiry/534-priznak-vyplat-v-rsv

Source: https://finpravo55.ru/pryamye-vyplaty-i-zachetnaya-sistema-chto-eto.html

Which one should you set?

The indicator of payments depends on whether the organization participates in the project from the Social Insurance Fund “Direct Payment” of 2011. Before this, only an offset system was in effect, in which all expenses were reimbursed by employers. But the financial situation of companies does not always allow them to be fully responsible for resolving this issue. The project was created to eliminate existing problems.

Employees receive direct payments from the Social Insurance Fund faster, and there are other positive aspects:

- Reducing litigation between parties.

- There is no need to withdraw a lot of money from business circulation.

- Employers must pay only for compulsory social insurance.

- The transfer of full benefits is guaranteed regardless of the current position of management.

Attention! Government Resolution No. 294 of 2011 will be the main document to study in this case. The column is marked with 1 or 2 depending on which side the payments are coming from.

What indicator of payments should be used when calculating insurance premiums?

The required payment attribute code is indicated in column 002 of the second appendix of the reporting form. It is necessary to enter the following conditional code into the calculation:

- 1 – if a direct system is adopted, with direct payment of the required amounts by the state structure;

- 2 – when using the scoring system.

Related article: Features of actuarial calculations in insurance

For regions not included in the pilot project program, there is no choice. In the calculation for this position, indicate code 2 of this characteristic, which can be deciphered as a credit method.

If there are any doubts, this question regarding the rules for filling out this column of Appendix 2 of the calculation and the indicated attribute can be clarified with representatives of the Social Insurance Fund or the tax service to which the enterprise is subordinate and submits the corresponding reports.

Features of filling out Appendix 2

Appendix 2 of the First Section of the calculation of insurance premiums is information that is recorded by almost all employers and payers of contributions. This is usually associated with sick leave and maternity. The most questions arise about filling out this part of the reporting.

First of all, the numbers are entered in lines 070, 080, 090. Secured contributions are taken into account here.

Line 080 is devoted to the amounts of expenses reimbursed by the territorial division of the FSS of Russia as part of insurance for the facts of maternity and the occurrence of various diseases. It is necessary to indicate information regarding the month in which the calculations were actually made.

Line 090 is the difference between the numbers from line 060 of the same Appendix and 070. The totals for line 080 are added to the result. If the region belongs to the participants of the pilot project from the Social Insurance Fund, then the obligation to fill out line 090 is eliminated.

What is the sign of payments in the RSV - 1 or 2?

This indicator appeared in the form relatively recently and is intended to reflect the system of payment of benefits to individuals. The need to add a new parameter to the report is associated with the transfer of the function of administering insurance premiums for VNIM (temporary disability and maternity) under the control of tax authorities. Let us recall that previously such functions were performed by the FSS of the Russian Federation.

The current report form is approved in the Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/ [email protected] The procedure for entering information is also given here. In accordance with the rules on p.

001 Appendix 2 of the RSV provides a sign of payment of social compulsory insurance for employees. That is, the accepted system for receiving benefits is indicated here.

Currently, there are 2 types of it: credit and direct:

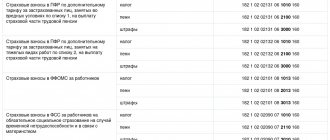

| Type of payment attribute on OSS | The procedure for issuing benefits for VNIM |

| Straight | Funds are paid to the insured individual directly through the social insurance authorities (territorial division of the Social Insurance Fund) without the participation of the employer in the calculations |

| Credit | Funds are paid to the citizen from the employer’s finances with subsequent reimbursement by the fund based on the results of checking the eligibility of accrual and issuance |

Direct payments are not made for all types of social security. But only those that are provided for at the legislative level. These are the following payments:

- Benefits for sick leave, including for pregnancy and childbirth.

- Benefits for pregnant women for early registration at the antenatal clinic.

- Children's leave amounts for caring for children under 1.5 years of age.

- 4 additional days dedicated to the vacation of a parent who is caring for a child with a disability.

In the RSV form, Appendix 2, the payment indicator is not entered at the request of the employer. This parameter depends on whether the region where the policyholder is located is included in the FSS pilot project or not.

Previously, an exclusively offset system operated, that is, first the employer gave the staff amounts for social security, and then (after verification) the fund reimbursed the funds.

But the financial state of affairs in organizations did not always make it possible to pay staff on time. This project was created to eliminate inconsistencies.

Read: How to fill out the RSV with compensation from the Social Insurance Fund - sample

Fill out the RSV – payment sign 1 or 2

In RSV-1, the payment attribute can take one of two possible values. Which ones are specified in the rules for filling out the report. Today there are 2 types of code:

- 1 – denotes a direct system of settlements with insured persons. This value is entered in the case when funds are paid to the employee directly from the Social Insurance Fund. The employer must provide the fund with documents for assigning payments and information for transferring funds.

- 2 – indicates the credit system for issuing compulsory insurance funds. First, the benefit is calculated and issued by the individual's employer (based on the bulletin received from the employee and documents confirming the occurrence of the insured event). Then the FSS reimburses the money to the employer or offsets are made between the amount of the benefit and the accrued contributions.

The employer does not have the right to decide which indicator code to indicate. The payment option depends on the payment system adopted in the region.

To check whether your region is included in the pilot project or not, you need to study Government Resolution No. 294 of 04/21/11. The list of subjects of the Russian Federation included in the project is approved here.

The Crimea, Novosibirsk, Bryansk, Rostov regions, Primorsky, Khabarovsk territories, etc. have already switched to a direct payment system. The list is regularly updated.

Note! If the parameter value is reflected incorrectly, this will not result in penalties. After all, this line does not affect the calculation of the amount of contributions and does not underestimate the amount to be paid. But the employer will still have to submit a clarification with corrections in order to eliminate the inconsistencies.

Read: Maximum base for contributions to the Social Insurance Fund and Pension Fund for 2022

Reimbursement from the Social Insurance Fund: how it is recorded in writing

Example - if the payment was made in May, then the information is recorded on line 080 in the column for month 2 in the second quarter.

As a result of calculations, negative or positive numbers are usually obtained. The calculation does not indicate amounts with a minus sign in front. What is needed is the difference itself, and a negative or positive value is fixed using the numbers 1 or 2. In the first case, contributions are greater than costs, in the second, vice versa.

In this case, simultaneous filling is required for the following lines:

- 110, 120.

- 113, 128.

- 112, 122.

- 111, 121.

If there is a discrepancy with the accounting data

With such discrepancies, fair doubts may arise that the document is generally filled out correctly. For example, the actual costs of the company are reimbursed by the Social Insurance Fund. But according to calculations, it turns out that there is a serious debt of the enterprise to the regulatory authorities, which is not true. Money that has already been reimbursed is added to the assessments accrued for the period.

But in such a situation they do not consider that a mistake has been made. The calculation is filled out in accordance with the general instructions from the Procedure.

The large total amount is recorded in the final line 110 of the first section and in line 090. But only the amount of the contributions themselves is paid to the Fund.

Reference! When all the information is transferred to the card for calculating the budget, the controlling services will immediately see overpayments and arrears. There will be no additional debts; everything will be recalculated automatically.

Checking the correctness of filling

Control ratios make it easier to verify the specified data and its reliability. In most accounting programs, such ratios are checked automatically. The applications simply will not allow you to enter incorrect numbers. Letters from the Federal Tax Service of Russia also contain information on control ratios - this is relevant when entering information independently.

Reconciliation of calculations with the budget can be ordered from the tax service.