What is considered arrears in the 4-FSS report?

The availability of data to reflect the debt owed by the policyholder in the specified tables of the 4-FSS report at the end of each reporting period is normal for most premium payers.

Despite the possibility of other situations (when Social Insurance is indebted to the policyholder), the more common process is the formation of a settlement balance for the period with the debt owed to the policyholder. This is explained very simply. The accrual of payable contributions is made monthly at the time of payroll calculation, i.e. on the last day of the month, including the last month in the reporting quarter. The statutory deadline for payment of contributions falls on the month following the month of accrual. Most policyholders pay premiums after they are calculated, i.e. in the month following the month of calculation. Therefore, as a rule, the result of the reporting period in the above tables will be the presence of a debt for the payer of contributions, which has a completely legal basis: the amount of contributions due on the reporting date has been accrued, but the payment period for it has not yet arrived.

However, such a debt will be “normal” only in relation to contributions accrued for the last month of the reporting period, the payment deadline for which will legitimately come later. Therefore, if the amount of debt at the end of the period coincides with the amount of contributions accrued for the last month of the reporting quarter, or turns out to be less than the amount of these accruals, then there can be no talk of arrears, and the line allocated for arrears in 4-FSS will remain blank. If the amount of debt at the end of the period exceeds the amount of contributions accrued for the last month of the quarter, then arrears (i.e., amounts not paid on time) occur. Finding out the amount of arrears is very simple: you need to subtract from the amount of debt at the end of the period the value that corresponds to the amount of assessments for the last month of the reporting quarter.

What is arrears

The decoding of this term is given to us by clause 2 of Art. 11 Tax Code of the Russian Federation:

And although insurance premiums for injuries, which are reflected in the calculation of 4-FSS, are supervised by the Social Insurance Fund, and not by the tax service, the essence of the term does not change.

However, if we look at Table 2 of the 4-FSS calculation, we will see that the arrears are highlighted as a separate line (20) from the total debt owed by the policyholder (p. 19).

Why is this necessary?

Let us turn to Law No. 125-FZ of July 27, 1998. According to paragraph 4 of Art. 22 policyholders are required to pay insurance premiums no later than the 15th day of the month following the month in which these premiums were calculated.

If the month has ended and contributions have been accrued (for example: an accountant has accrued contributions for injuries on August 31, 2022), the policyholder will have a debt to the fund. However, this debt is not yet arrears. After all, the due date has not yet expired.

But if the policyholder does not pay the premiums on time, then after the 15th (in our example: from September 16, 2022) the debt will become arrears .

The policyholder will be punished for arrears (we will talk about sanctions below).

Arrears on insurance premiums (F. Law No. 125-FZ)

Failure to fulfill the obligation to pay contributions or illegality of expenses for CO will entail:

- demand for payment to the policyholder ();

- foreclosure on the insured's accounts ().

Administration of contributions under the specified F. law is carried out by the insurer, i.e. FSS.

How to calculate arrears in form 4-FSS is a question that is not without reason. In both tables of this report, dedicated to the calculation of contributions, there is a line for arrears, but the algorithm for calculating it is not legally prescribed. What will be arrears for 4-FSS?

The calculation of the amount of arrears, for which the final line is allocated in the two tables of Form 4-FSS, is done only when the amount of arrears in contributions at the end of the period exceeds the amount of their accruals for the last month of this period. The amount of arrears is determined by subtracting from the amount of debt the amount of contributions accrued for the last month of the reporting period.

Filling out 4 FSS for pregnancy and childbirth is currently not performed. Organizations that pay insurance premiums submit to 4-FSS only for “injuries” (NS and PZ) will have to submit reports to the FSS authorities in form 4-FSS for 2022. The report form was approved by the Order of the Federal Social Insurance Fund of the Russian Federation dated September 26, 2016. No. 381. This order also approved the Procedure for filling out the form with an example and explanations. Below is an example, a sample of filling out Form 4-FSS for 2022.

The FSS report form has become 2 times smaller. The tables that are filled out for the tax office were removed from it, leaving only the calculation for “injuries.” Now this report focuses only on contributions to compulsory social insurance against industrial accidents and occupational diseases. The procedure for accrual, payment and reporting for this type of contributions is established by Law No. 125-FZ of July 24, 1998.

The changes affected, among other things, the codes of insurance premium payers in the category of insurance premium payers under code 101.

Note: A directory of codes for policyholders of insurance contributions to the Social Insurance Fund is provided for filling out form 4-FSS.

Changes have been made to Form 4-FSS for policyholders who provide personnel to other organizations or individual entrepreneurs

The 4-FSS reporting form has been supplemented with a new table No. 1.1, which will have to be filled out by those insurers who temporarily send their employees under a contract for the provision of personnel to work in other organizations or individual entrepreneurs. Order of the Social Insurance Fund dated July 4, 2016 No. 260 with corresponding changes to the calculation form was registered by the Ministry of Justice on July 20, 2016, and will come into force on August 1, 2016.

to menu

Calculation and collection of arrears

The debt on insurance premiums for the reporting period consists of the following amounts: the balance of the debt at the beginning of the period, plus the amount of accrued premiums for the period, minus the amount of paid premiums.

The arrears are included in the total debt for contributions to the Social Insurance Fund. To calculate arrears, you need to subtract accruals for the last month from the debt at the end of the month (and not at the end of the period). The resulting number is indicated in the “4-FSS” form of the financial statements in the corresponding line “arrears”. It is from this amount that the Social Insurance Fund charges penalties and fines. Tax legislation provides a maximum period for collecting identified arrears. It is calculated as follows. The beginning of the report is the date of its discovery, to it is added the time before issuing a demand for payment, the period for voluntary payment, the time for undisputed collection, the time for going to court. The request for payment of arrears to the Social Insurance Fund is sent by the regulatory authority within three months from the date of its discovery. The obligation to pay the contribution is considered fulfilled from the date of submission to the bank of a payment order for the transfer of funds to the account of the Federal Treasury. Recognizing the arrears as hopeless and writing them off is possible only on the basis of an appropriate judicial act.

The demand for payment of arrears must be fulfilled within ten calendar days from the date of its receipt.

WHERE to submit the report, DEADLINES and METHODS FOR SUBMISSION 4-FSS

Where to submit the payment

If the organization does not have separate divisions, then submit the calculation to the territorial office of the Social Insurance Fund at its location (clause 1 of Article 24 of the Law of July 24, 1998). That is, at the place of registration of the organization.

If the organization has separate divisions, then Form 4-FSS must be submitted in the following order. Submit the calculation to the territorial office of the FSS at the location of the separate unit only if:

- such a unit has a current (personal) account

- and independently pays salaries to employees.

Note: In this case, in the 4-FSS form, indicate the address and checkpoint of the separate unit.

When the above conditions or at least one of them are not met, include all indicators for such a division in the calculation for the head office of the organization and submit it to its location. Do the same if the separate division is located abroad. This follows from the provisions of paragraphs 11, 14 of Article 22.1 of the Law of July 24, 1998 No. 125-FZ.

to menu

Calculations in Form 4-FSS must be submitted at the end of each reporting period.

There are four such periods: the first quarter, half a year, nine months and a year:

- They must be submitted on paper no later than the 20th

- In electronic form - no later than the 25th day of the month following the reporting period.

If the deadline for submitting a calculation falls on a weekend, report on the next business day. This follows from the Civil Code of the Russian Federation. Although the rule on rescheduling is not directly stated in Law No. 125-FZ of July 24, 1998, other areas of legislation can be applied by analogy.

Kontur.Extern: How to easily submit a new 4-FSS form through an EDF operator

to menu

Deadline for collecting arrears on insurance premiums

These requirements are prepared by the body that controls the timeliness and completeness of payment of insurance amounts by payers. Moreover, specific deadlines are fixed for sending demands to debtors - 3 months from the moment the arrears are discovered.

At the same time, at the time of establishing the presence of arrears in contributions for payers, the specified body generates a certificate in the form of 3-PFR in terms of pension and medical contributions and 3-FSS in terms of social contributions. The forms of these certificates are approved by the same legislative documents as the claim forms.

If the presence of arrears is revealed following an inspection of the policyholder, then the demand should be sent to the debtor within 10 days from the date of the decision.

The requirement is submitted either personally to the manager or individual entrepreneur (or their proxies) against signature, or by registered mail, or electronically through appropriate communication channels.

The requirement generated by the regulatory authority must include:

- The amount of debt on the day the claim was made (arrears and penalties);

- Deadline for transferring this amount;

- Grounds for collecting the specified amount;

- Measures that will be applied if the debtor fails to fulfill the requirement;

- Links to clauses of regulatory documents that allow the presentation of these requirements for the collection of arrears.

Upon receipt of the claim, the payer must repay the arrears within 10 calendar days, unless a different time period is indicated in the claim form itself.

In the absence of action on the part of the debtor, the fund carries out a procedure for making a decision on collecting the amount of debt in a forced form; this process is regulated by paragraph 19 of Law No. 212-FZ. This procedure is allotted 2 months, within which a decision must be prepared. No later than 6 days, the decision must be communicated to the debtor himself.

In order to collect the amount of the arrears from the cash savings available in the debtor's accounts, the fund will send an order to the banking institution servicing the accounts of this person indicating the amount of the debt. Upon instructions, the bank, within one day, is obliged to carry out an operation to write off the required amount of money and transfer it to the fund using the relevant details. If the amount is expressed in foreign currency, then one more day is added for the procedure. If there is not enough money in the debtor’s accounts to cover the debt, the bank will write it off to the fund upon receipt.

If the debtor does not have the required amount of money, the arrears can also be seized in the form of other property; the procedure for this procedure is determined by paragraph 20 of Law No. 212-FZ.

If the two-month deadline for making a decision is missed, then the issue of collecting the arrears can be transferred to the judicial authorities. The application may be sent to the court within six months from the date of expiration of the allotted period for repaying the debt. If the six-month period is missed, and the reason is valid, then the period can be restored through the court.

Fines, What are the consequences of late payment submission?

An insured who fails to submit a report on accidents on time will be fined under paragraph 1 of Article 26.30 of the Law of July 24, 1998 No. 125-FZ. The fine is 5 percent of the amount of contributions due to the budget for the last three months of the reporting (settlement) period. This fine will have to be paid for each full or partial month of delay. The maximum fine is 30 percent of the amount of contributions according to the calculation, and the minimum is 1000 rubles.

In addition, administrative liability is provided for late submission of calculations for insurance premiums for injuries. At the request of the FSS of Russia, the court may fine officials of the organization (for example, the manager) in the amount of 300 to 500 rubles. (Part 2).

In addition, the policyholder may be fined for refusing to provide documents that confirm the correctness of the calculation of premiums, and for missing the deadline. The fine amount is 200 rubles. for each document not submitted. The fine for the same violation for officials is 300–500 rubles. (Article 26.31 of the Law of July 24, 1998 No. 125-FZ, paragraph 3 of Article 15.33 of the Code of Administrative Offenses of the Russian Federation).

Note: If for some reason you do not agree with the decision of the territorial office of the fund, you can appeal it.

to menu

Fines for non-compliance with the established method of submitting calculations for insurance premiums

- There is a fine of 200 rubles. (Article 26.31 of the Law of July 24, 1998 No. 125-FZ). The fine for the same violation for officials is 300–500 rubles. (clause 3).

Reporting in Form 4-FSS is submitted in the prescribed form in the following ways:

- on paper ;

- electronically via telecommunications channels.

Form 4-FSS is provided to the FSS on paper, if it does not exceed 25 people. Otherwise, the reporting must be submitted electronically, certified with an electronic digital signature.

If you sent reports in Form 4-FSS via telecommunication channels, the day of its submission is considered the date of its sending.

If the electronic calculation of 4 FSS due to errors did not pass logical control, but at the same time it was transferred to the FSS in a timely manner, then officials do not have the right to hold the policyholder liable for late reporting. This conclusion was reached by the Moscow District Arbitration Court in its resolution dated 03/06/15 No. A40-109343/14.

The courts of three instances declared the fine unlawful, because Article 19 of Law No. 125-FZ provides for liability for failure to submit a report to the Social Insurance Fund within the prescribed period. And if the special communications operator confirmed that the policyholder sent the report to the payment gateway on January 25, that is, on time. And the fact that the report was submitted with erroneous calculation parameters is not evidence of a violation of the reporting deadline, since the indicated erroneous calculation parameters are not related to the reporting deadline. Since the original 4-FSS calculation was sent on time, there are no grounds for a fine.

to menu

4-FSS reporting on paper is submitted:

- personally;

Note: Passport required - through your representative;

- sent in the form of a postal item with a description of the attachment. When sending reports by mail, the day of its submission is considered the date of dispatch.

to menu

How to pay arrears on insurance premiums?

When receiving a request from the fund, the policyholder should look at the period specified in it for payment of the debt. If the period is not specified, then it is considered equal to 10 days from the date of receipt.

If the request was received by mail, then the day of receipt is the 6th day from the date of sending. If it is delivered in person or transmitted electronically, the deadline for execution should be counted from the actual date of receipt.

You must independently generate a payment order for the amount specified in the claim form from the fund and pay the existing debt. If this action is not completed within the allotted time, the fund will decide to forcibly collect the amount of debt from existing bank accounts. If there is no money in the accounts, the fund will refer the case to the judicial authorities, and you will still have to pay the arrears.

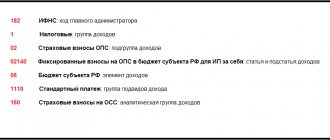

KBC for transferring arrears, penalties and fines for insurance premiums:

1 0900 140

The procedure for filling out Form 4 FSS with an example and explanations

The rules for preparing a declaration of contribution for “injuries” are prescribed in the Procedure approved by Order No. 381 of the Federal Social Insurance Fund of Russia dated September 26, 2016. In many ways, they coincide with the rules for tax reporting. When calculating using Form 4-FSS, be sure to fill out the title page, tables 1, 2 and 5. The remaining tables - only if there is data that needs to be reflected. These are the requirements of paragraph 2 of the Procedure, approved by order of the FSS of Russia dated September 26, 2016 No. 381.

When filling out the Calculation form, only one indicator is entered in each line and the corresponding columns. If there are no indicators provided for in the Calculation form, a dash is placed in the line and the corresponding column.

Average number of employees in 4-FSS

The adjusted calculation is made according to the form that was in effect during the period for which you identified errors. Please indicate the updated calculation number on the title page in the “Adjustment number” field. For example, if you have clarified the calculation for the second quarter of 2022 for the first time, enter the number 001.

If there is arrears, then first transfer the remaining contributions and penalties to the fund. Then you will not be charged a fine (subclause 1, clause 1.4, article 24 of Law No. 125-FZ of July 24, 1998).

Note: Please submit updated calculations in Form 4-FSS for periods before January 1, 2022 to FSS branches (Article 23 of Law No. 250-FZ dated 07/03/2016). It doesn’t matter that they include information not only about contributions for injuries, but also about contributions for compulsory social insurance. For more information, see How to make changes to insurance premium calculations (ERSV).

The organization is obliged to recalculate and pay additional contributions if the fund has increased the tariff due to a change in the main type of activity. At the same time, when the organization receives a notification about the tariff change, then, most likely, the 4-FSS calculation for the first quarter will already be submitted. It is not necessary to clarify its organization - the recalculation of contributions is not due to an error, but to the fact that the fund has established a new tariff. However, territorial branches of the Social Insurance Fund in some regions require clarification of the calculation for the first quarter. Therefore, find out the position of the fund at the place of registration of the organization.

Recalculation of contributions at the new tariff due to a change in the main type of activity is shown in table 2 of the calculation for the half-year:

- on line 5 “Contributions accrued by the policyholder for past billing periods” - the amount of contributions to be paid additionally;

- line 16 “Insurance premiums paid” – details of the payment order and the amount, if you have already paid the recalculated premiums;

- line 19 “Debt owed by the policyholder at the end of the reporting (calculation) period” - the recalculation amount, if additional contributions have not yet been paid.

In line 2 “Accrued for payment of insurance premiums” do not enter the recalculation, otherwise the control ratios will not converge. The indicator “at the beginning of the reporting period” in line 2 of table 2 of the report for the half-year should be equal to the accrued contributions from column 3 of line 2 of table 2 of the report for the first quarter (FSS order No. 83 dated 03/09/2017). Also, the unpaid recount is not a debt, so do not enter it on line 20.

The Social Insurance Fund can reduce the rate of contributions “for injuries” if the organization has . Recalculate contributions at the new rate from the beginning of the calendar year. The overpayment can be returned or offset against future payments (Article 26.12 of the Law of July 24, 1998 No. 125-FZ). In this case, it is safer to submit an update using Form 4-FSS.

There are no special lines in the calculation where you can indicate how you recalculated the contributions. The fund's auditors simply will not understand where the overpayment came from. Don't forget to change the fee rate to the current one. You indicate it in lines 5 and 9 of Table 1 of the calculation. In table 2 clarifications for the first quarter, indicate:

- on line 2 “Accrued for payment of insurance premiums” - accruals recalculated at a reduced rate;

- lines 9 “Debt owed by the territorial body of the Fund at the end of the reporting (calculation) period” and 11 “Due to overpayment of insurance premiums” - the amount of overpayment that the organization incurred;

- line 16 “Insurance premiums paid” – the actual amounts of premiums transferred.

Data for an example of filling out 4-FSS for 9 months of 2022.

Below are the initial data for an example of how to fill out form 4-FSS if the organization uses the labor of disabled people.

The organization employs one group II disabled person. Contributions for insurance against accidents and occupational diseases are calculated:

- at a rate of 0.2 percent (1st class of professional risk according to the Classification of Economic Activities by Class of Professional Risk) - from payments to all personnel, except for disabled people;

- at a rate of 0.12 percent (0.2 × 60%) - from payments to a disabled person.

As of January 1, 2022, the organization had a debt to the Federal Social Insurance Fund of Russia for contributions to insurance against accidents and occupational diseases for December 2016 in the amount of 290 rubles. During the reporting period, contributions for insurance against accidents and occupational diseases are listed in the following amounts:

- in January – 290 rubles. (fees paid on January 12 – for December 2016);

- in February - 76 rubles. (fees paid on February 12 – for January 2017);

- in March – 76 rubles. (fees paid on March 14 – for February 2017);

- in April – 76 rubles. (fees paid on April 13 – for March 2017);

- in May – 86 rubles. (fees paid on May 12 – for April 2017);

- in June – 86 rubles. (contributions paid on June 14 – for May 2017);

- in July – 86 rubles. (fees paid on July 12 – for June 2017);

- in August – 86 rubles. (fees paid on August 14 – for July 2017);

- in September - 86 rubles. (fees paid on September 12 – for August 2017).

Contributions for September 2022 in the amount of 86 rubles. were transferred in October 2022, that is, outside the reporting period.

The accountant reflected the status of settlements with the Federal Social Insurance Fund of Russia for contributions for insurance against accidents and occupational diseases, the calculation base and the amount of accrued insurance premiums in form 4-FSS for 9 months of 2022. There were no industrial accidents in the organization. Activities to prevent injuries and occupational diseases were not funded. Therefore, the accountant did not fill out tables 3 and 4 of form 4-FSS.

During 2016, the policyholder assessed working conditions. The accountant entered its results into Table 5.

to menu

VIDEO: New 4-FSS, What changes to take into account in the report, starting with reporting for the nine months of 2017

Watch video on youtube.com

Program:

- What has changed in the 4-FSS calculation form for nine months. New clarifications from the Social Insurance Fund and other departments on contributions for injuries

- Recent clarifications from the Social Insurance Fund, which are important to take into account when reflecting payments to employees, change of position.

- How not to make a mistake with OKVED in a report: how to determine and where to check. Dependence of tariffs on OKVED, filling out table 1.

- What to consider when filling out the line “Average number of employees”: how not to make a mistake in calculating the indicator.

- Who should sign the report to the Social Insurance Fund now? Requirements for electronic signature. Power of attorney.

- Features of filling out table 1.1.

- What debts to the Social Insurance Fund and overpayments to the fund should be reflected in Table 2. What dates should the data be limited to: upon payment, upon accrual.

- Features of filling out tables 3 and 4.

- How to claim expenses for improving working conditions. What activities does the Social Insurance Fund finance and how to reimburse it.

- What to consider when reflecting data on the special assessment of working conditions.

- Errors in 4-FSS. Control ratios for checking the report

- Contribution rate for injuries

- Average number of employees for 4-FSS

- How to submit and sign a 4-FSS calculation. Errors when sending electronic reports

- How to fill out special 4-FSS tables

- How does the Social Insurance Fund finance activities to reduce injuries?

- Information about special assessments and medical examinations. Calculation table 5

- Responsibility for non-payment of contributions for injuries and delays with 4-FSS

- Rounding in 4-FSS. Tips for accountants

to menu

Answer

We inform you the following: No, you cannot. The procedure for filling out Form 4-FSS, approved by the Ministry of Labor No. 107n dated March 19, 2013, does not provide for the reflection of accrued penalties in Table 7.

The rationale for this position is given below in the materials of the Glavbukh System

Order of the Ministry of Labor of the Russian Federation dated March 19, 2013 No. 107n “On approval of the form of calculation for accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity and for compulsory social insurance against industrial accidents and occupational diseases, as well as expenses for payment of insurance coverage and the Procedure for filling it out (as amended as of February 11, 2014)"

Appendix No. 2

30. The table is filled out based on the policyholder’s accounting records.

31. When filling out the table:

31.1. line 1 reflects the balance of the account credit for settlements with the Fund for compulsory social insurance against industrial accidents and occupational diseases. This indicator does not change during the billing period;

31.2. line 2 reflects the amount of accrued insurance contributions for compulsory social insurance against accidents at work and occupational diseases from the beginning of the billing period in accordance with the amount of the established insurance tariff, taking into account the discount (surcharge). The amount is divided “at the beginning of the reporting period” and “for the last three months of the reporting period”;

31.3. line 3 reflects the amount of contributions accrued by the territorial body of the Fund based on on-site inspection reports;

31.4. line 4 reflects the amounts of expenses not accepted for offset by the territorial body of the Fund for past billing periods based on reports of on-site and desk inspections;

31.5. line 5 reflects the amount of premiums accrued for previous years both by the policyholder himself and based on the results of a desk audit;

31.6. line 6 reflects the amounts received from the territorial body of the Fund to the bank account of the policyholder in order to reimburse expenses exceeding the amount of accrued insurance premiums;

31.7. line 7 reflects the amounts transferred by the territorial body of the Fund to the bank account of the policyholder as a refund of overpaid (collected) amounts of insurance premiums;

31.8. line 8 “Total (sum of lines 1+2+3+4+5+6+7)” – control line, which indicates the sum of the values of lines 1 to 7;

31.9. line 9 reflects the amount of debt owed to the territorial body of the Fund at the end of the reporting period (debit balance of the account on which calculations are made for compulsory social insurance against industrial accidents and occupational diseases);

31.10. line 10 reflects the debit balance of the account for settlements with the Fund for compulsory social insurance against industrial accidents and occupational diseases (based on the policyholder’s accounting data). This indicator does not change during the billing period;

31.11. line 11 reflects the costs of compulsory social insurance against industrial accidents and occupational diseases on an accrual basis from the beginning of the year, broken down “at the beginning of the reporting period” and “for the last three months of the reporting period”;

31.12. line 12 reflects the amounts transferred by the policyholder to the bank account of the territorial body of the Fund, cumulatively from the beginning of the year, broken down “at the beginning of the reporting period” and “for the last three months of the reporting period” indicating the date and number of payment orders;

31.13. line 13 reflects the written off amount of the insured's debt in accordance with the regulatory legal acts of the Russian Federation adopted in relation to specific policyholders or the industry for writing off arrears;

31.14. line 14 “Total (sum of lines 10+11+12+13)” – control line, which shows the sum of the values of lines 10 to 13;

31.15. line 15 shows the balance of debt owed to the policyholder at the end of the reporting period (credit balance on the account on which payments are made for compulsory social insurance against accidents at work and occupational diseases), including line 16 shows the amount of overdue debt calculated by the policyholder himself based on accounting data."

The debt of the policyholder, be it an entrepreneur or a law firm, is the difference in the amounts of accrued and paid premiums according to government officials. But how is this value formed and is it possible to influence and control it? Agree, it’s unpleasant if you decide to participate in the auction, and they give you a certificate that you are a debtor under the Social Insurance Fund, so you can lose an excellent client. To avoid getting into such an unpleasant situation, you need to:

- submit reports to the Social Insurance Fund on time

- carefully fill out all the cells of the report

- pay dues on time

- correctly indicate KBK in payments

- periodically check with the fund

The composition of arrears of contributions includes:

- balance of debt at the beginning of the period

- “+” amount of accruals for the reporting period

- “-” the amount of transfers of insurance premiums with the correct details

This is how we get the total amount of arrears on contributions.

Rules for calculating the period for arrears

The date the debt was identified is the starting point for arrears. To calculate the days, the period from the identification of the debt until the formation of a demand for payment of arrears is taken. It is mandatory to set aside time to repay the debt voluntarily. Next, the days of undisputed collection are counted. If there is no money, then the mechanism of legal procedures is launched.

PLEASE NOTE: within 3 months, the FSS regulatory authority will issue an official demand for the current arrears from the moment of its discovery.

The insured debtor fulfilled the obligation to repay the debt only if the bank was represented and the latter executed a payment order to transfer funds in the required amount according to the fund details with the correct indication of arrears codes.

ATTENTION: if the payment order for arrears is filled out incorrectly, the money will go to another KBK, the debtor organization will have arrears under the Social Insurance Fund in the same amount, and penalties will continue to increase every day.

The arrears can be recognized as hopeless and written off only if there is a court decision that has entered into legal force. Otherwise, the Social Insurance Fund's demand for payment of arrears must be satisfied within 10 calendar days.

Arrears on insurance contributions to the Pension Fund, Social Insurance Fund, Federal Compulsory Medical Insurance Fund

Arrears arise if the payer does not transfer the required amount of insurance pension, medical and social payments by the 15th day inclusive for the month ended. Moreover, for each type of compulsory insurance, an independent payment order should be generated with the transfer of funds in favor of the fund.

A monthly mandatory insurance payment is provided for persons paying remuneration to employees and deducting contributions from these amounts for various types of insurance (for employers, which may be foreign or Russian legal entities, individual entrepreneurs, private practitioners).

For those payers who do not have employees, mandatory medical and pension payments are provided, paid to the accounts of the Federal Compulsory Medical Insurance Fund and the Pension Fund of the Russian Federation until the end of the current year. These payments are made for oneself and are mandatory; they are calculated by payers independently, taking into account the current minimum wage and the level of income insofar as it exceeds 300,000 rubles. in year.

The transfer of social contributions is not among the mandatory payments for such insurers and is exclusively voluntary.

In the absence of transfers on the established dates or in case of incomplete payment of the required amounts, payers have an arrears that require collection in the manner specified in Law No. 212-FZ. The collection procedure for organizations and individual entrepreneurs is prescribed in articles 19 and 20 of this law, for individuals who do not form individual entrepreneurs - in article 21.

Penalties for arrears in the Social Insurance Fund: features of reflection in company accounting

Late payment of contributions is grounds for the accrual of penalties. They are accrued according to the general rule for calculating bank interest from the first day of delay in making contributions to treasury accounts. Penalties for arrears are calculated as a percentage. The interest rate is determined taking into account the key rate of the Central Bank of Russia. It is recommended to transfer penalties to the Social Insurance Fund accounts simultaneously with regular contributions. Otherwise, FSS specialists will forcibly recover them from the policyholder. This tactic is established by the norms of tax law of the Russian Federation.

Late payment Accountant errors Fake sick leave certificates How much does the arrears cost in the Pension Fund and the Social Insurance Fund

Arrears in insurance premiums are actually their underpayment to the budget. Most often, it is discovered during an inspection of the Pension Fund or Social Insurance Fund. And then the company will have to recalculate insurance premiums, pay penalties and fines. Over the course of many years of practice, our experts have identified three main reasons why a company unintentionally experiences arrears in the Pension Fund of Russia and the Social Insurance Fund.

Penalties: calculation, reflection in accounting

Penalties are accrued in case of untimely payment of contributions for each calendar day of delay; they must be paid, in addition to the amounts of arrears due for payment. Penalties for each day of delay are calculated as a percentage of the amount of arrears, the interest rate is equal to one three hundredth of the current refinancing rate of the Central Bank. Penalties are transferred to the Social Insurance Fund simultaneously with the payment of insurance premiums, as well as after payment of insurance premiums in full.

The amount of arrears and penalties may be forcibly collected by the FSS at the expense of the policyholder’s funds and property.

In accordance with the second paragraph of Article 270 of the Tax Code, in order to calculate income tax, expenses in the form of penalties and other sanctions transferred to extra-budgetary funds must be taken into account when determining the tax base. In accounting, the accrual of penalties is reflected in the following entries: Debit of account 99 “Profits and losses”, Credit of account 69 “Calculations for social insurance and security”. Penalties payable in accounting do not affect the financial result; they do not change the tax base. Therefore, in accordance with Accounting Regulations 18/02, there is no difference in accounting and tax accounting for these amounts.

Fake sick leave certificates

Sometimes unscrupulous employees pretend to be sick so as not to come to work. And they even bring a sick leave certificate as confirmation. This way they can take a few extra paid days off.

In addition, it is now possible to obtain sick leave without going through a doctor or clinic. There are a lot of advertisements on the Internet in which, for a small amount, they offer to issue a certificate of incapacity for work, even retroactively. Perhaps, at first glance, such a sick leave will be no different from the real one. But fund inspectors will definitely not miss a fake document. And, of course, they will not reimburse benefits for it.

As a result, the company will have arrears in insurance contributions to the Pension Fund and the Social Insurance Fund. After all, there is no need to pay contributions for sick leave benefits. But it is mandatory for all other payments in favor of the employee. Including the amount that the employee received in the form of sick leave.

If you have doubts about the sick leave certificate, check its authenticity as follows:

- On the FSS website, in the “Employers” section, the list of stolen sick leave forms is updated monthly (). Check the questionable document number against this list.

- Call the clinic that issued the sick leave and ask if they issued a document with that number. If yes, then it should be in the medical institution’s database. It is advisable to obtain written confirmation from a doctor.

- Write a request to the FSS in free form with a request to establish the authenticity of the sick leave. In the letter, provide the details or attach a copy of the certificate of incapacity for work.

Also, explain to employees in advance that buying fake sick leave is a criminal offense. Liability is provided for under Part 3 of Art. 327 of the Criminal Code - use of a deliberately forged document. Not to mention the dismissal for absenteeism and the collection of benefits from his salary.