Points common to the accounting policies of non-profit organizations

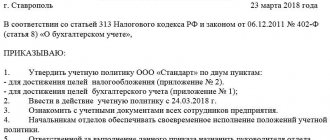

The accounting policy (AP) approved by order of the manager is a standard that regulates for the organization issues that are not specified in federal laws and similar acts or those for which options for accounting and reporting are allowed. Thus, the accounting policy of NPOs for 2022 and subsequent years represents the internal law of NPOs, which should regulate financial procedures, their accounting and disclosure in reporting. Taking into account the specifics of non-profit organizations, the internal standards should contain:

- Disclosure of the specifics of NPO activities, which influences the choice of certain methods and methods of accounting.

- Applicable general legislative requirements (for example, compliance with UP PBU 1/2008, approved by order of the Ministry of Finance of the Russian Federation dated October 6, 2008 No. 106n).

- The specific requirements applied are determined by the legal status and industry characteristics of a particular NPO (for example, the parish of the Russian Orthodox Church, registered as an NPO, applies such a document - the Accounting Methodology of the Russian Orthodox Church, approved by His Holiness the Patriarch of Moscow and All Rus' Alexy II).

NOTE! In religious organizations with long historical traditions, there may even be atypical features of the designation of documents. For example, the above-mentioned ROC Accounting Methodology was actually approved in 2004, but due to the canonical traditions of naming documents, the usual date of approval is almost never indicated in official documents.

- List of persons responsible for organizing and maintaining accounting (and tax) accounting and the procedure for appointing them responsible.

- Methods for accounting and assessing the income and expenses of NPOs for their statutory activities (for example, an NPO HOA is required to draw up an annual budget approved by the general meeting of participants).

- Methods for accounting and assessing assets and liabilities of non-profit organizations, as well as rules for disclosing information on them in reporting (for example, for cases of reporting to founders, investors or a higher organization).

- Working chart of accounts, since it can also have industry specifics. An example of a non-standard plan can be seen in the sample NPO accounting policy for 2022, which is available at the link below.

- Forms of primary accounting documents for which there are no standard (unified) forms (for examples of such forms, see also the sample UP NPO).

- The accounting method used and the registers corresponding to it (for example, with a journal-order form of accounting in an NPO, the UP must contain forms of journals, as well as consolidated registers, for example, a balance sheet and a chess sheet).

- Composition and forms of documents for internal and external reporting (if necessary).

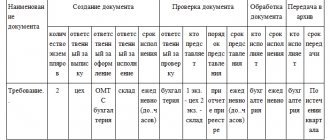

- Approved rules for accounting document flow and its approximate schedule.

ATTENTION!

From 2022, the new federal standard 27/2021 “Documents and document flow in accounting” will become mandatory for use. ConsultantPlus experts explained in detail how to organize document flow for accounting purposes in accordance with FAS 27/2021. Get trial demo access to the system and upgrade to the Ready Solution for free.

A sample document flow schedule for accounting policies can be downloaded here.

- The procedure and terms for storing accounting documents, including non-standard forms and specific registers.

See also “Retention period for accounting documents in an organization.”

- The procedure for carrying out control activities (for example, inventories).

- Other solutions necessary for collecting, recording and monitoring information, as well as for reporting.

Requirements for the content of accounting policies

Accounting policies must meet the following criteria:

- completeness requirement. Absolutely all business transactions in an organization must be reflected in accounting;

- timeliness requirement. All business transactions in the organization’s accounting records must be reflected on time;

- requirement of prudence. This means that in accounting, assets should not be overstated and liabilities should not be understated;

- requirement of priority of content over form. This means that in accounting, business transactions must be reflected based on their economic content and business conditions;

- requirement of consistency. This point means that the data of analytical accounts must correspond to the data of synthetic accounts. This applies to turnover and account balances;

- requirement of rationality. This means that accounting must be carried out rationally.

Also, when drawing up accounting policies, it is necessary to make a number of assumptions:

- assumption of property isolation. This means that the assets and liabilities of the organization and its owners exist separately from each other, as well as from the assets and liabilities of other organizations;

- assumption of going concern. That is, it is planned that the organization will exist and operate for a long time;

- assumption of consistency in the application of accounting policies. This means that accounting policies must be applied consistently year after year;

- assumption of temporary certainty of the facts of economic activity. This means that business transactions relate to the point in time at which they arose and do not depend on the moment of receipt of funds that relate to these business transactions.

Accounting policy of a religious organization using the example of the parish of the Russian Orthodox Church

To clearly show how the mandatory aspects mentioned above are “included” in the UP of NPOs for 2022, let’s consider a sample UP for a religious non-profit organization - a parish of the Russian Orthodox Church.

In accordance with the legislation of the Russian Federation, a religious organization (RO) means a voluntary association of individuals for the purpose of joint worship, as well as the spread of faith (Article 8 of the Law “On Freedom of Conscience and Religion” dated September 26, 1997 No. 125-FZ). The RO must be registered in the proper manner, with division into local and centralized. The legal definition of a local RO includes the formation of a “parish of the Russian Orthodox Church” - this is a church community united around one temple. It is necessary to subdivide the clergy (the staff of clergy appointed in accordance with the Charter of the Russian Orthodox Church) and the lay individuals included in the parish (who are not clergy), as well as other persons with whom the RO may enter into contractual relations to fulfill its goals. Thus, a local RO of the Russian Orthodox Church registered under the legislation of the Russian Federation has the following set of features:

- The activities of the RO are subordinated primarily to the Russian Orthodox Church and the Charter of the Russian Orthodox Church. According to the Charter, the highest governing body is determined - the parish assembly and the highest executive body - the parish council. The chairman of the parish council can be considered, according to the level of authority, the head of the RO as a legal entity. The procedure for appointing the chairman is interesting: if this is the rector of the church, then he becomes chairman with the blessing of the diocesan bishop, and if (which happens quite often) a church warden is appointed chairman, then this is an elective position.

- One more nuance regarding persons included in the clergy of the Russian Orthodox Church: employment contracts are not concluded with them. This is not provided for by the Charter of the Russian Orthodox Church. Acceptance into the service takes place strictly according to the church structure and rules, which differ, among other things, from the norms of labor law of the Russian Federation. Nevertheless, for now this state of affairs is allowed in the Russian Federation and is even sometimes supported by the courts (although appeals to the court are extremely rare). In the format of this material we will not dwell on this nuance in detail, but it should be kept in mind. We note that, according to the recommendations of the Russian Orthodox Church, this aspect should be reflected in the UP of the local RO.

- Current legislation distinguishes the services of a religious organization as an independent type of activity. Thus, what is done under the auspices of the NPO parish is neither trade nor services to the public, for which additional requirements apply (for example, the use of cash registers). Based on the same, any receipts within the framework of religious activities are considered as voluntary donations for the statutory activities of the organization.

- The methods for receiving donations to the RO are also quite specific. Therefore, in the Methodology proposed by the Russian Orthodox Church itself, it is recommended that certain special forms of documents (as well as the procedure for their circulation and storage periods) be fixed in the UE.

- To organize the accounting of RO property, a chart of accounts adapted for church needs is provided. For example, in the Accounting Methodology of the Russian Orthodox Church, account 06 has undergone a transformation - it is recommended to take into account religious items transferred to the temple in the analytics for items used in worship, and items distributed among parishioners and other visitors to the temple.

- In terms of accounting for ordinary property, as well as necessary work and services (for example, repairs and utilities for church property), there is not much specificity. At the same time, the UP of the local RO ROC should provide for the necessary actions, as well as methods of accounting and control.

ATTENTION! From 01/01/2022, PBU 6/01 “Accounting for fixed assets” will no longer be in force, and fixed assets accounting will be regulated by two new FSBUs 6/2020 and 26/2020. Read more about them here.

Find out what changes to make to the accounting policy in accordance with the new Federal Accounting Standards in ConsultantPlus. This material will help you navigate the innovations of FSBU 6/2020; this article will help you navigate FSBU 26/2020. Trial demo access to the system is provided free of charge.

A sample UP of a local religious organization, compiled according to the recommendations of the Russian Orthodox Church and the aspects outlined above, can be found at the link:

ConsultantPlus experts also prepared samples of accounting policies. A sample UE for the purposes of taxation of NPOs on OSNO - see this publication. A sample UE for accounting purposes can be downloaded in this article. If you do not have access to the K+ system, get a trial online access for free.

Fragment of the accounting policy of non-profit organizations regarding separate accounting of expenses

“...Expenditures of an administrative and economic nature are reflected in account 26 “general economic expenses” and are distributed monthly by type of activity of the organization, as well as by type of projects financed from targeted funds.

The share of general business expenses related to the implementation of non-commercial projects is written off from the credit of account 26 to the debit of account 86 “Targeted financing”. The share of general business expenses allocated to commercial activities is written off monthly to the financial result in the debit of account 90 “Sales”.

In this case, general business expenses related to non-commercial projects are distributed by project in proportion to the share of proceeds from the corresponding project in the total amount of targeted financing for the reporting period.

Direct expenses directly related to the implementation of non-commercial activities are reflected in the debit of account 20 “Main production” in the context of non-commercial activities.”

DO YOU NEED TO FORM AN ACCOUNTING POLICY? CONTACT ROSCO!

Results

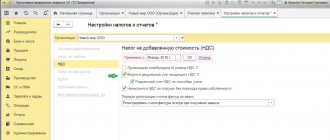

NPOs have the right to conduct accounting in a simplified way (Clause 4, Article 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ). Tax accounting must be maintained in any company, including non-profit organizations. The methodology and algorithm for tax and accounting are prescribed in the accounting policy. The management program of an NPO should reflect the specifics of the activities of a particular organization. A carefully thought-out accounting policy for non-profit organizations will allow you to avoid claims from tax authorities and other supervisory authorities.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Answers to common questions

| Question | Answer |

| Is it possible to date the order approving the accounting policy to the first days of the current year? | No. According to the law, the order must be signed before January 1 of the year in which the accounting policy will be in effect. |

| Is it possible not to indicate the dates of the inventory? | No. The accounting policy must specify the timing of the inventory |

Formulations for accounting policy FSBU 26/2020

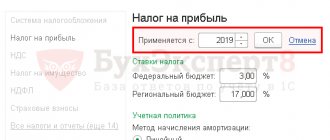

In 2022, it is mandatory to apply FAS 6/2020 “Fixed Assets” and FAS 26/2020 “Capital Investments”. Not everyone has capital investments. And FAS 26/2020 itself does not require very large adjustments to the accounting policies. There are many more changes in connection with the FSBU “Fixed Assets.

On this topic:

What to do before applying FSBU 26/2020

There are two ways to switch to FSBU 26/2020: prospectively or retrospectively.

For accounting policies, you can use the following formulation:

The organization reflects the consequences of changes in accounting policies in connection with the introduction of FAS 26/2020 ( select one of the two options below)

promising. Reason: clause 26 FSBU 26/2020

retrospectively. Reason: clause 25 FSBU 26/2020

If, when making capital investments, an organization is granted a deferment (for at least 12 months, not the entire amount is included in the cost of capital investments. The organization may establish in its accounting policy a shorter minimum deferment period (clause 12 of FAS 26/2020). This must be indicated in the accounting policy.

An example of wording for an accounting policy for deferment and installment payments:

If there is a deferment (installment plan) for a period of more than 6 (six) months, the cost of capital investments includes the amount of money that would have been paid by the organization in the absence of the specified deferment (installment plan).

The organization calculates the fee for deferred (installment) payments based on the provisions of the contracts. Reason: clause 12 FSBU 26/2020

Capital investments in fixed assets must be checked annually for impairment (clause 17 of FSBU 26/2020).

Example wording for an accounting policy to test for impairment:

The organization reviews capital investments for impairment once a year as of December 31. Reason: clause 17 FSBU 26/2020