How and in what form a declaration is submitted by a tax agent

The VAT return is submitted by each tax agent before the 25th day of the month following the reporting period.

In this case, the reporting period is a quarter. The declaration must be submitted by the tax agent in electronic form (clause 5 of Article 174 of the Tax Code of the Russian Federation). There is an exception to this. Important! Tip from ConsultantPlus If you are a tax agent, you can submit a VAT return on paper only if the following conditions are simultaneously met... Read more about the conditions under which a tax agent can report on paper in K+, having received a trial demo access to the system. It's free.

You can find out who is a tax agent for VAT from the article “Who is recognized as a tax agent for VAT (responsibilities, nuances)”.

The declaration is submitted by the tax agent to the Federal Tax Service at its registered address. On the title page of the declaration in the line “At location (accounting)”, tax agents, if they apply VAT exemption or work under a special regime, indicate code 231, in other cases they enter code 214 in this line.

For more details, see the article “How to correctly fill out a VAT return for a tax agent?” .

Changes in form 3-NDFL in 2018

The order of the Federal Tax Service made the following adjustments to the current declaration form:

- The barcodes on the pages have changed.

- On the title page of 3-NDFL you no longer need to enter data on the individual’s residential address; it is enough to indicate the taxpayer’s contact phone number.

- When filling out sheet D1 in form 3-NDFL, which is filled out when applying for property tax benefits, you do not need to indicate the location of the property; it is enough to enter the cadastral number of the property.

- When filling out sheet E1 of the 3-NDFL report, you do not need to enter information about the number of months during which the individual’s cumulative income from the beginning of the year was less than 350,000 rubles. In connection with the emergence of a new social deduction, a new column has appeared on this sheet in which the amount of expenses for conducting an independent assessment of the qualifications of a given individual should be indicated.

- Since a new investment deduction has been introduced, sheets Z and I must additionally reflect the definition of income from transactions with securities and derivative funds or income from the definition of income from participation in investment partnerships.

- The 3-NDFL report includes a new appendix in which it is necessary to reflect the definition of income from the sale of real estate. It is intended for filling out information about transactions after January 1, 2016, taking into account that the income from the sale of real estate must be at least 70% of the cadastral value of the property.

Rules for filling out section 2

From the report for the 3rd quarter of 2022, the VAT declaration must be completed in a new form, as amended by the Federal Tax Service order No. ED-7-3 dated March 26, 2021 / [email protected] The changes are related to the introduction of a goods traceability system.

You will find a line-by-line algorithm with examples of filling out all twelve sections of the report in ConsultantPlus. Trial access to the system can be obtained for free.

The order in which information is displayed in section 2 of the declaration is as follows. According to clause 36 of the procedure for filling out a VAT tax return, section 2 is completed by the tax agent for each of the counterparties, which is:

- a foreign person is a non-taxpayer,

- a foreign person registered with the tax authority in accordance with clause 4.6 of Art. 83 of the Tax Code of the Russian Federation and providing services to individuals in electronic form,

- lessor from among municipal and government agencies,

- seller of state property.

Moreover, the information cannot be spread over several pages in the context of various contracts for one counterparty.

It will be useful to read the article “Who is the VAT payer?” .

When selling confiscated property, ownerless property, etc., information is also reflected by the tax agent on one page of the 2nd section. But tax agents-shipowners who did not manage to register the vessel within 45 days fill out this section for each vessel.

How to fill out a VAT return for scrap metal buyers who are also tax agents, see here.

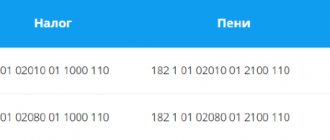

The 2nd section contains information on the amount of VAT payable according to the information of the tax agent in the context of counterparties with the allocation of KBK. At the top of the form of the 2nd section, the tax agent codes (KPP and TIN), as well as the serial number of the page, must be indicated.

Deadlines for submitting the 3-NDFL declaration for property deduction for 2022

As usual, individuals must submit a declaration to the Federal Tax Service by April 30 of the year following the reporting year.

However, if 3-NDFL is submitted to the tax office in order to issue a property tax deduction when purchasing an apartment, for example, then it can be sent to the regulatory authority at any time convenient for the individual - without observing the general deadlines.

It should be borne in mind that a declaration for the year can only be submitted after the tax period has ended. That is, for 2022 you can submit the 3-NDFL report in 2022.

Attention! In this case, you can simultaneously submit a report for 2 years at once or for 3 years at once. Submission of declarations for longer periods according to the Tax Code of the Russian Federation is not allowed. This is due to the existence of a restriction in the form of three years preceding the reporting period.

Line by line instructions for filling

In line 010, the checkpoint of the division of a foreign entity that is registered for tax purposes in Russia is filled in. Lines 020–030 contain the data (name and TIN, if available) of foreign entities - tax evaders, lessors from among state and municipal authorities and sellers of state property. In line 040 the KBK is entered, 050 is the OKTMO code of the tax agent submitting the report. The amount of tax payable is reflected in line 060 and the transaction code in line 070.

According to clause 37.8 of the Procedure for filling out the declaration, the amount of VAT payable is determined taking into account indicators for shipment (080) and receipt of partial or full advance payment (090) by tax agents, which are (clauses 4–5 of Article 161 of the Tax Code of the Russian Federation):

- intermediaries selling goods, works or services (except for services in electronic form) from foreign sellers in the Russian Federation;

- sellers of confiscated property by court decision, as well as sellers of ownerless valuables and treasures.

In this case, the amount of tax payable, displayed in line 060, will be calculated using the formula: line 080 + line 090 – line 100.

Example of filling out section. 2 VAT returns by a tax agent from ConsultantPlus Organization "Alpha" rented premises from the Moscow Property Department. The rental price per month is 129,600 rubles, including VAT. In the third quarter of 2022, the Alpha organization, as a tax agent, calculated VAT on the rental amount in the amount of 64,800 rubles. (RUB 129,600 x 3 months x 20/120). Fragment of section. 2 VAT returns in this situation look like this: You can view the full example in K+. Trial access to the system is provided free of charge.

Right to deduction

To obtain an NV you must:

- The buyer was a tax resident (paid tax at a rate of 13%).

- The ownership of the apartment was registered.

- The cost of the apartment has been fully paid.

- The purchase of the apartment was made at the expense of the buyer’s personal funds.

- The purchase transaction was made between independent persons.

NV is not provided if the apartment was purchased at the expense of the employer, at the expense of maternity capital or other budget funds. No deduction is given if an apartment is purchased from close relatives or other dependent persons. Persons under 18 years of age, unemployed people, and pensioners are not entitled to a property deduction.

Results

The tax agent should not have any particular difficulties in filling out the 2nd section of the VAT return, since in the new declaration form all the lines necessary for filling out are signed quite clearly. The only thing that should be taken into account: for each counterparty (a non-taxpaying foreigner or a foreigner registered with the tax authority in accordance with clause 4.6 of Article 83 of the Tax Code of the Russian Federation and providing services to individuals in electronic form, a state/municipal lessor, a seller of state property) You must fill out a separate page of section 2.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

New declaration form in 2018

At the end of 2017, individuals must submit a 3-NDFL declaration to the Federal Tax Service, for which a new form has been in effect since this period.

Form 3-NDFL was adopted by Federal Tax Service order No. ММВ-7-11/671 dated December 24, 2014, and certain changes were approved by order No. ММВ-7-11/822 dated October 25, 2022. The new type of form came into force on February 18, 2022. Before this date, the Federal Tax Service accepted reports for 2017 using the old form. The new form applies not only to the declaration on paper, but also to its electronic form.

Required documents

can receive a tax deduction

- by exemption from personal income tax at the place of work;

- through the tax service, which will transfer funds to his bank account.

In the second case, after the year of purchasing the apartment, the applicant must submit the following documents to the Federal Tax Service:

- tax return in form 3-NDFL;

- application with bank details for transferring money;

- certificate in form 2-NDFL;

- a copy of the purchase and sale agreement;

- payment cards;

- extract from the Unified State Register of Real Estate;

- act of acceptance and transfer of the apartment.

Declaration 3-NDFL together with certificate 2-NDFL serves as an indicator that the applicant pays taxes.

In addition, the 2-NDFL certificate indicates the amount of tax deductions of the payer for the year. This amount must be returned to the Federal Tax Service.

If this amount is less than the total amount that must be returned to the buyer of the apartment, then the return of the remaining balance is transferred to the next year.

Documents for tax deduction can be submitted personally by the payer, by mail or electronically to the Federal Tax Service website.

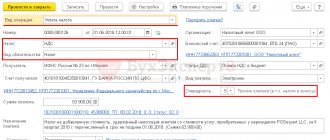

Setting up and withholding personal income tax from an advance paid on the last day of the month in 1C: ZUP

Let's give a conditional example: Karamelka LLC pays an advance to employees on the last day of the month; salary payment, according to the collective agreement, is provided for on the 15th of the next month. In June 2022, employees were paid an advance on the 30th.

In 1C: ZUP ed. 3.1, it is possible to enable the setting of personal income tax accrual from an advance payment, but it is relevant only if the established method for determining the advance payment is “Calculation for the first half of the month.”

The hiring order specifies the procedure for paying the advance to the employee.

Step 1. Go to “Settings” - “Organizations”.

Step 2. Open the company card and on the “Accounting Policy” tab, follow the hyperlink of the same name.

Step 3. On the “Personal Tax” tab, set the settings for calculating and withholding personal income tax from the advance payment.

Step 4. Accrue wages for the first half of the month (advance) - in the “All accruals” journal, enter the document “Accrual for the first half of the month.”

The “Personal Income Tax” tab will display the personal income tax amounts on the calculated advance amounts.

In our example, the total amount of personal income tax from the advance was 14,022 rubles.

When a setting is established in the accounting policy indicating whether to calculate personal income tax from an advance or not, an additional checkbox appears in the document and a personal income tax withholding setting appears.

A checkbox has been added in the header of the document “Delay tax calculation until salary calculation at the end of the month”, and in the lower part of the tax transfer settings:

- when paying wages after final settlement;

- when paying an advance.

Step 5. Record the advance payment. The column “Personal income tax for transfer” will be displayed in the tabular section.

Having configured the ZUP, personal income tax was calculated and withheld from the advance paid to the employees of Karamelka LLC on the last day of the month. In the advance payment document, the amount to be paid is reflected minus personal income tax - 93,835.14 rubles.

Personal income tax to be transferred amounted to 14,022 rubles.

Let's see how these amounts are reflected in the reporting.