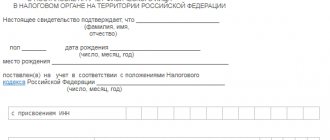

The legislative framework of the Russian Federation states that almost every citizen of the country, with the exception of certain segments of the population, is obliged to pay taxes to the state treasury. In order to systematize the data, the taxpayer is issued a corresponding document, which is a TIN registration certificate.

TIN stands for individual taxpayer number. This code is used for internal state accounting and systematization of data on taxpayers.

The issuance of an individual taxpayer code is carried out at the local tax office, which specializes in processing data of individuals. It is also possible to issue a TIN online, and receive the document itself by registered mail or by email. [contents]

Submitting an application and required documents

As described above, issuing a TIN is a fairly easy procedure, because it does not require collecting a voluminous package of documentation. To submit an application, you only need to have the original and a copy of your identity document (passport).

The individual number itself is stored in the register, and the citizen is issued a document that indicates that the person has been issued a TIN.

You can obtain an individual taxpayer number in the following ways:

- visit the Federal Tax Service office yourself;

- through representatives;

- through the Internet;

- via physical mail.

Let's take a closer look at the procedure for obtaining a TIN online. This procedure is carried out through the official website of the Federal Tax Service.

Obtaining a TIN in Moscow

Registration of a taxpayer number in the capital of Russia, according to its conditions, does not have any differences from the procedure for obtaining it in the rest of the country.

Methods

You can create a TIN:

- At the territorial office of the tax service

. Addresses can be viewed on the official website of the Federal Tax Service here (indicate the region at the top of the address bar and then select the “Contacts” tab). - Via Russian Post

. To do this, you need to send a set of documents plus an application. Sent copies must first be certified by a notary. - In the multifunctional center

(MFC). These institutions provide various government services. - Using the Internet

. You can create and submit an application online on the website of the Federal Tax Service or on the State Services resource.

Note 2.

The latter method is becoming more and more popular, because... takes a minimum of time and does not require a trip or trip to the above authorities before the required moment.

How to do it without capital registration?

You can make a document in Moscow even without having a capital registration.

Important! Each user can benefit from the Order of the Federal Tax Service of the Russian Federation dated June 29, 2012 “On approval of the Procedure and conditions for assigning, applying, and changing the taxpayer identification number.”

This order can be viewed on the tax service website using this link. If necessary, the document can be downloaded on the same page by clicking the “Download” button.

The mentioned document, among other things, states that the TIN is not necessarily made at the place of registration. You can also get it at:

- actual location of the citizen;

- location of real estate or vehicle.

This means that a person located in Moscow and who does not have a capital residence permit nevertheless has the right to apply to any Moscow tax authority to obtain a TIN. It is impossible to refuse to assign a tax number or TIN certificate to a citizen.

Required documents

The list of documents required to obtain a TIN does not depend on which method the citizen intends to use to obtain it.

So, what you will need:

- Application

from an individual. It is drawn up in the prescribed form. - Copy of the passport.

For children - copies of their birth certificate and passports of mother and father. - For a non-resident - a document acting as an identity document

.

If a foreign language passport is provided, a notarized translation

. - Registration or certificate

containing information about the place of registration.

Frankly speaking, there are not many documents, but their submission should be approached responsibly so as not to delay the procedure.

Decoration for a child

The methods for obtaining a TIN that have already been described in our article are also suitable if you receive a document for a child. But it has its own specifics.

Important! For children under 14 years of age, an individual tax number is issued either by one of the parents or by a person who is officially a guardian.

To obtain a certificate, you should visit the regional office of the Federal Tax Service or the MFC. If you choose the option with a multifunctional center, it is better to call there in advance and find out if they provide a TIN registration service.

Note 3.

The application for receiving the document is also written by the parent if the child is under 14 years old.

The following are attached to the application:

- a copy of the birth certificate (from the moment you reach the age of 16, a copy of your passport must be presented);

- a copy of the passport of one of the parents;

- certificate of the place of registration of the child.

The process of assigning an individual number takes 5 working days. This is provided by law.

If the TIN is issued at a location other than your place of registration, it will take 10 working days.

Where can I do it through the regional office of the Federal Tax Service?

In each district of the capital there is a branch of the Federal Tax Service that has the ability to issue TINs. The easiest way is to visit the branch at your place of registration. However, if it is impossible to do this, any department is required to accept the application and other documents

from the citizen and transfer it to the Federal Tax Service at the place of registration.

On the official website of the tax service, you can, by specifying the region, find the addresses of branches

- at the top in the search bar, type “Moscow” - the inscription “77 Moscow city” will appear, confirm this request;

- then click “Contacts” - this is the rightmost tab in the line below the region search.

Region search. Contacts

The “Contacts and inquiries” page will open. Below you will see a list of inspections in Moscow with addresses. For clarity, you can switch from the list to the map

.

Below are the contacts and addresses of the Federal Tax Service Office for the region and the Central Office.

List of inspections and switching to map

We create a TIN on the Federal Tax Service website

For a more convenient understanding, we will consider the process of obtaining a TIN through the Federal Tax Service website in the form of step-by-step instructions.

- We go to the official website of the Federal Tax Service at www.nalog.ru and enter your personal account through the “Individuals” column. In the right panel “Electronic Services”, click on the link “Submission of an individual’s application for registration.”

“Electronic Services” panel on the Federal Tax Service website - Next, we go through a simple procedure for registering a user account. You will need to enter your email address, come up with a password for your personal account, and also indicate your full name. A letter will be sent to the specified mailbox, through which you need to confirm the registration procedure by clicking on the link.

Data entry form for registering a user account - After confirming your registration, an application form for obtaining a TIN will open in front of you. You will need to provide some information about yourself, as well as information about your citizenship.

Entering data on the application

Your further actions will differ significantly from each other depending on the presence of an individual electronic signature. Below we will consider each of the possible options.

I don't have an electronic signature

If you do not have a special electronic signature, then fill out the appropriate form. Carefully approach the procedure for filling out the fields, because errors when filling out are unacceptable. Otherwise, you simply will not be able to complete the TIN registration process, or it will be completed incorrectly, and you will not receive the document.

Passport data filling form

After correctly filling out all application forms, the user is automatically assigned an individual registration number. Next, using the assigned registration number, you will be able to obtain a document confirming the assignment of a TIN at the Federal Tax Service office.

Moreover, you can pause the application at any time and continue from the stage at which you finished. In addition, you can monitor the current status of your application through the user’s personal account.

Registration of application

At the end of the registration process, it is important to click on the link below “Register an application and send it to the Federal Tax Service”.

I have an electronic signature

An electronic digital signature (EDS) is an integral element of any digital document. The functions of the digital signature are almost the same as the standard and familiar handwritten signature. This electronic signature is issued through centers that have been accredited by the Ministry of Communications and Mass Media of the Russian Federation.

If you have this signature, the procedure for obtaining a TIN is greatly simplified. If there is an electronic digital signature, then the document on registration of the individual taxpayer number can be received by mail or by email.

How to get a TIN if you have an electronic signature:

- Go to the official website of the Tax Service of the Russian Federation (nalog.ru) and download the “Legal Taxpayer” software.

Download page for the Legal Entity Taxpayer program on the Federal Tax Service website - According to the instructions, install the program on your computer.

- Using this software, you fill out an application in the form “2-2 – Accounting”. If you would like to receive a TIN registration certificate in electronic form, you also need to attach a request filled out in form “No. 3 – Accounting”.

Application on form No. 2-2-Accounting - Using the same software, you need to prepare a transport container with an application that has a code and is signed with an individual electronic signature. If you would like to receive a TIN registration certificate in electronic form, you must also attach an encrypted and digitally signed request.

- Next, the prepared container is sent for processing, after which you will receive information about the results of processing the submitted application and receive a document confirming the registration of an individual taxpayer number.

Regardless of whether you have an electronic signature or not, you can easily leave an application and receive a TIN on the official website of the Federal Tax Service.

How to obtain a TIN for an individual at the MFC

The opportunity to obtain a TIN (and at the same time SNILS) at the MFC appeared in 2017. Since the service is still quite new, before you go to apply for a taxpayer identification number at the multifunctional center, check first on the website or by phone whether such applications are accepted at this particular branch.

According to the general rules, registration requires a personal application to the MFC by appointment. A representative can also come to the reception, but he will need a power of attorney to submit documents.

It is not necessary to obtain a tax number solely by registration; it is quite possible to do this without reference to the place of registration. But you need to understand that the applicant will still be registered with the tax office at the place of his registration.

Obtaining a certificate

At the moment, there are several options for obtaining a certificate via the Internet.

- You, or your authorized representative, have the opportunity to receive a paper TIN registration document at the inpatient department of the Federal Tax Service. Upon receipt, you only need to provide an identification document. In the case of a proxy, you must present the passport of the proxy, as well as the person for whom the TIN was issued.

By mail. The certificate is sent to the address specified during registration by registered mail.- By email. In this case, you can receive a TIN registration document in PDF format by e-mail or download from the website. The document must have your signature in electronic digital format.

You can receive the document in the form most convenient for you. It all depends on your personal preferences and capabilities.

Sending an application by mail

The method is long, but works.

- Download the application form 2-2-Accounting.

- Print it out and fill it out in block letters.

- Send it by registered mail with an attachment (forms are issued in the postal application) to the Federal Tax Service address at your place of residence. The addresses are listed on the tax office website - go to.

The disadvantages of this method are the long delivery of the letter and the response in the form of a TIN (received in the response letter), refusal to receive a TIN due to a possible error in the application.

Decoration for a child

The application procedure for a child under 14 years of age is identical. It is worth noting that only parents and guardians, that is, legal representatives, can prepare the document. Persons over 14 years of age can issue a TIN registration document in person and without the participation of parents or guardians.

It is important to remember that when filling out the fields of the application, you must indicate the details of the child, not his parent.

Does a child need a TIN?

Drawing up a TIN registration document may be useful for a child in some cases:

- When transferring an inheritance to a child under 14 years of age.

- Purchasing and registering a vehicle or real estate in the child’s name.

- When employing a minor child.

- If a child wants to open his own business.

A TIN is required for a minor if he is engaged in trading activities and makes profit from it.

Minor artists and athletes also need an individual tax number, because their fees are also considered income and must be taxed. Moreover, an individual number can be requested by the kindergarten or educational institution where the child wants to enroll.

It is important to note that no institution can require a child to have a TIN. By and large, the child will need this document when applying for a job. Under 14 years of age, an individual taxpayer number is not required.

Contents of the document

TIN is a taxpayer identification number. This is a kind of list of numbers containing complete information about all taxpayers.

Each number from left to right carries the following material:

- tax authority code;

- immediate sequence number;

- a verification number calculated using an appropriate algorithm confirmed by law;

Previously, it was issued only to legal entities and entrepreneurs. The certificate can only be obtained by registration. If it is not in the passport, then it can be issued under temporary registration.

Receipt

Receiving a TIN again is a simple procedure, because your individual number remains in the registry and simply needs to be restored. Re-obtaining an individual taxpayer number is possible as a result of a change of first or last name, as well as loss of a document.

It is important to note that when changing the first name, last name, patronymic, gender, etc., re-issuance of the registration certificate is not necessary.

Restoration of a document evidencing TIN registration is carried out free of charge or with the payment of a small fee for restoration in case of loss. The restored document is produced within five days. You can obtain it from the Federal Tax Service office.

It is possible to obtain a TIN again via the Internet. Let's briefly look at the steps in the form of instructions:

- Go to the nalog.ru resource and use the search bar to look for the request “Get TIN”.

Search query on the Federal Tax Service website - Next, you will need to switch to the service for obtaining a TIN, having previously logged into an existing user account or created a new one.

- Follow the instructions of the site and indicate detailed information about yourself in the window that opens. You can find out the TIN number that is needed to fill out the form by following the link (service.nalog.ru/inn.do).

Window of a service that allows you to find out the TIN from your passport - After this, you complete the process of filling out the application and submit it for registration. On the same page, do not forget to download the receipt for payment of services for restoration.

- A special form will appear with information about your application for subsequent monitoring.

Application form

Within 24 hours, a message will be sent to your email indicating the address for receiving the restored certificate.

How to restore the TIN if lost?

The TIN is assigned to an individual once in his life and does not change if he changes his place of residence, changes his passport details, or loses his certificate. If the document is lost, then not a duplicate is issued, but a new certificate with the same TIN. To receive it, you need to submit to the tax office at your place of registration:

- application in free form for the issuance of a new TIN certificate;

- a receipt for payment of the state duty for the re-issuance of the certificate in the amount of 300 rubles (Article 333.33 of the Tax Code of the Russian Federation);

- a copy of your passport indicating your place of registration.

If you contact the tax office in person, you need to have your passport with you. If you submit documents by mail or through a proxy, then a copy of your passport must be notarized. The duplicate is issued within five days, after which it must be collected in person or through an authorized representative.

TIN stamp in the passport

Most recently, from October 30, 2022, the Federal Tax Service approved an official order, which states that special marks in the passport are indicated with a citizen identification number.

This stamp will be placed on a special page of the passport. The individual code of the individual, date and signature are written directly on the stamp.

This option is very convenient, because it eliminates the possibility of loss or damage to a separate TIN certificate. As a result, the code is stamped in the citizen’s passport and is always with him. There is no need to carry a separate document with you that indicates that a person has been assigned his code.

In order to put a stamp with an individual taxpayer number in your passport, you need to contact the tax service department that deals with the issue of servicing individuals.

The stamp itself is placed in black or blue and is located in the upper parts of the 18th or 19th page of the passport, if there is free space. If it is missing, then the stamp is placed on the same pages, only at the bottom of the document.

The code numbers are handwritten in the specially designated fields on the stamp. The date of application of the stamp is also indicated and the signature of the tax inspector who dealt with this issue is applied.

In order to put a stamp, you do not need any documents other than the passport itself. The mark is placed on the basis of data obtained from the official register database of the Federal Tax Service on the TIN.

If your information is not in the database, that is, you do not have an individual taxpayer number, the inspector will ask you to go through the procedure of obtaining a TIN certificate. After registration, information about the TIN is entered into the database, and you also receive the desired stamp in your passport with your unique code.

But still, there is one hitch, because the stamp in the passport does not have the same functions as a separate document. When applying for an individual electronic signature, you will still need to present the certificate. At the moment, this is the only difference between the mark in the passport and the original document. But still, in other cases, having a stamp is more convenient and practical.

What is a TIN and why is it needed?

First, let's figure out what a taxpayer identification number (TIN) is and why it is needed. This is a unique digital code. It is assigned by the Federal Tax Service (FTS) to all individuals and legal entities of the Russian Federation for the purpose of registering them as tax payers (Article 83 of the Tax Code of the Russian Federation). The TIN of individuals consists of 12 digits:

- XX - code of the subject of the Russian Federation (region);

- XX - tax inspectorate code (IFNS);

- ХХХХХХ — taxpayer number;

- XX - check number.

Why does an individual need a TIN:

- for registration of benefits and allowances;

- participation in government programs;

- TIN will be needed for identification through Internet portals;

- TIN is required when registering financial transactions, etc.

By the way, employers often require a TIN certificate from applicants when applying for employment. Please note that this requirement is illegal. According to Art. 65 of the Labor Code of the Russian Federation, this document is not mandatory when applying for a job.

Why do it over the Internet?

The Internet is increasingly providing users with various benefits and additional bonuses. What are the advantages of registering a TIN via the Internet?

The most important positive aspect of creating a unique code is the significant time savings.

Often in government agencies you have to wait in long lines to get into the office. If you use the Internet to register a TIN, you need to spend literally 10 minutes, given the fact that you don’t even need to leave your home.- In the electronic application, you can quickly and quietly correct errors that were made during filling out. This cannot be done on a paper form. You will need to fill out the application again.

- If you register your code online, you can monitor the status of your application and follow its progress. The paper version generally lacks this advantage.

Electronic registration of a certificate of TIN assignment is much more convenient than the standard version. It's faster and more practical.

Absolutely anyone can register a TIN, regardless of their age.

Required documents

When you first receive a TIN, you do not have to pay a state fee.

To purchase it you need the following documents:

- Passport or other document approved by the person.

- Special statement of type No. 2-2-Accounting.

- If the passport does not contain information about the place of residence, then a document confirming this information.

- Power of attorney, when submitting an application not personally, but by a representative.

Having chosen a purchase method, you need to know what papers are required: originals or copies. Depending on the method of receipt, either original documents or their copies are requested.

If applications are submitted in person, original passports and birth certificates are required. If the TIN will be received by mail, then copies of the same documents are required, but they must be signed by a notary. When receiving a certificate online, you will not need documents, but when the time comes to pick up the certificate from the tax office, you will have to take them.

Advantages of TIN:

- processing of tax payment information and payer data is accelerated;

- materials about benefits and taxes are processed faster;

- quick access of information to the taxpayer;

- if you have a document in hand, it is not necessary to indicate personal data;

application form in .doc (Word) format

Expert opinion

[expertmnen]

This article pays significant attention to ways to obtain a TIN by citizens of the Russian Federation, including minors. However, it should be noted that stateless persons, like foreign citizens, have the right to obtain a TIN certificate from the tax authority at their place of residence (stay). To do this, you need to fill out an application for registration, attaching the following documents to it:

- residence permit or temporary residence permit with a mark of registration in the Russian Federation,

- passport with a mandatory stamp of registration in the Russian Federation,

- a migration card, which is filled out upon entry into the Russian Federation, or a Notification form (tear-off part) about the arrival of a citizen with a mark from the migration registration authority.

Obtaining a TIN is a mandatory condition for foreigners and stateless persons when they carry out types of activities subject to taxation on the territory of the Russian Federation:

- residence, as well as ownership of movable and immovable property;

- conducting labor activities,

- when obtaining a permit or patent for work, in addition to extending the patent term,

- in case of transactions subject to taxation.

You can obtain information about the availability of a TIN for a foreign citizen or a person without citizenship using the service https://service.nalog.ru/inn.do; to do this, you must fill in all the fields with the o, and also enter the numbers from the picture.

In conclusion, I would like to say that the methods for obtaining a TIN for foreigners and stateless persons are identical to those described by the author in the publication.

Does a foreigner need a TIN and why?

The tax service recommends that a visitor living on Russian territory for a long time obtain a Taxpayer Identification Number (TIN). In some cases, registration is required.

The document is necessary to exercise the rights of a foreigner in Russia. It allows you to freely interact with government agencies at the official level.

It is not necessary to draw up a document for a tourist trip. But during a long stay in the Russian Federation, it will ensure the transparency and legality of the foreigner’s activities.

Any citizen living in Russia is required to pay taxes. This also applies to foreign specialists.

According to paragraph 1 of Article No. 83 of the Tax Code of Russia, everyone can register with the tax service:

- at the territorial office at the place of registration;

- at the nearest branch at your place of stay;

- at the location of personal property or car.

Registration of transactions for the purchase and sale of personal property also requires a certificate.

The migrant’s document allows:

- keep records of tax deductions;

- officially report on real estate purchased in Russia, or transport subject to taxation, of which he is the owner.

A personal tax number is important when finding employment in the Russian Federation.

Obtaining a TIN by a foreigner is justified if he:

- arrived in Russia and is applying for a work permit in Russia;

- registers any professional activity, business. According to the individual number registered with the Federal Tax Service, taxes will be withheld and displayed in the accounting system;

- plans to receive government social benefits provided in the name of the migrant, which are tied to a numerical tax code;

- wishes to apply for a loan;

- is going to get a temporary residence permit.

Consideration of special cases

There are some nuances and key features of obtaining a taxpayer identification number in certain situations that need to be paid attention to, since sometimes the procedure can change significantly.

Obtaining a TIN for a child

Tax registration for children is carried out by legal representatives. In accordance with Russian legislation, a parent, adoptive parent, guardian or trustee can obtain a TIN for a child. To do this, you will need the following documents:

- Passports of the legal representative.

- Birth certificates of a minor.

- Certificates from the passport office (if the passport does not contain a mark indicating registration at the address of residence).

To assign a taxpayer identification number to a child, the legal representative must submit an application to the tax office at the address of residence.

A child over 14 years of age has the right to independently apply both for the initial receipt of a document and for its restoration, replacement or loss at the MFC. A prerequisite in this case is that the minor has a passport.

Restoring the certificate

A unique code is assigned once and remains with the carrier forever. The individual code does not change even if the person moves to a different address. In a situation where the certificate is lost, damaged or stolen, restoration of the TIN is possible by contacting the tax office or the MFC. When applying for a certificate again, a duplicate will be issued.

To restore the TIN if lost through the MFC, you will need to go through a procedure similar to the initial application for a unique code. With one exception, you can obtain a duplicate TIN from the MFC only after providing a receipt for payment of the state duty.

Replacing a document

When a person changes their last name (usually due to marriage or divorce), the unique taxpayer code does not undergo changes. However, in this situation it will be necessary to replace the certificate. To change the TIN at the MFC to a new one with current information, you do not need to pay a state fee. In this case, replacing the TIN in the MFC is carried out in the same way as its initial registration.

Stamp in passport with assigned TIN

A similar service is not provided at the MFC. The mark is affixed only to the tax service. The procedure is carried out in the presence of the client and does not take much time - no longer than 15-20 minutes.

Receipt times

The certificate is issued no later than 5 working days. It all depends on the work of the tax authorities; they can issue it in half an hour.

When filling out the application, the specified reasons for issuance may be as follows:

- Loss of the original document.

- The need to clarify the TIN in the documents required for submission to the tax authorities.

- The need to provide a TIN to the person paying the income.

Only the person who required the issuance of a TIN can fill out the application. Filling out is done very carefully, no corrections are provided.

Materials about the received TIN can be included in your passport; to do this, you should contact the tax authorities, who will be able to put the requested mark. If there is no Internet, you can find out your number by personally contacting the tax department. There is a form that you need to fill out.

Take your passport with you. The completed form will be returned and a response will be received within five working days.