The expansion of the organization indicates business development, the need to cover new territories, clients and market segments. When another retail outlet, hotel premises or bakery opens, it means a separate division is opening.

In the legislation, many aspects of working with EP are not fully disclosed; taxpayers often have to rely on arbitration practice. I would like to focus on the analysis of practical situations.

Pay in order!

There are three types of separate divisions:

- Branch.

- Representation.

- Others.

The characteristics that unite all three types are territorial isolation and the presence of jobs created for more than a month. This is the general definition of an OP given by the Tax Code of the Russian Federation in Article 11. The Tax Code does not define the concepts of “branch” and “representative office”. Their definition will have to be sought in civil legislation.

Article 55 of the Civil Code of the Russian Federation indicates that the representative office represents the interests of the legal entity and also protects them. A branch has broader rights: it carries out all or part of the functions of a legal entity, including those of a representative office. Simply put, if an organization opens an office where a client can seek advice, conclude an agreement, write a complaint, place an order, then this is a representative office; if this office supplies the client with goods under a concluded agreement, then this is already a branch.

Other divisions fall into the “other” category. It is important to correctly determine what type of OP is opening. This matters not only from a legal point of view, but also from the point of view of the Tax Code.

Peculiarities

The Civil Code provides for the right to create organizations to conduct business activities. Legal entities are opened, as a rule, by ordinary citizens. They are also managing their own enterprise.

Any company is opened to obtain some positive result. Legal entities have the same rights as other economic entities.

Literally every organization registered on the territory of the Russian Federation can open a branch or separate division (hereinafter also referred to as SB). This right is enshrined in Article 55 of the Civil Code of the Russian Federation.

When opening a separate division of their enterprise, managers must understand that in this case we are not talking about creating a new legal entity. The OP does not have the same legal status.

But desire alone is not enough to open a separate unit. According to the Tax Code (Article 11), it must have a number of characteristics. Namely:

- the address of the head office (the one written in the registration and statutory documents) and the address of the OP should not be identical;

- It is mandatory to have equipped workplaces for employees to work for a period of 1 month or more.

The Tax Code also contains information about possible types of separate divisions: a branch or representative office, or a stationary workplace (hereinafter also referred to as SPM). Each of them has both its own characteristics and common features.

For example, data on PSA is not entered into the Unified State Register of Legal Entities. And in the case of a branch or representative office, this is mandatory.

When creating a separate division of an organization, you need to fill out a special information form (it is different for each type of OP) and take it to the Federal Tax Service.

For more information about this, see “How to open a separate division of an LLC: instructions.”

Should - don't: don't guess with a daisy

If you are in doubt whether you need to open the OP or not, most likely the answer is yes, it is necessary. Please note that neither the Tax Code nor the Civil Code contain any restrictions on the number of employees of a separate division, as well as the absence of an order for its creation in internal documents.

There are difficult situations when it is really difficult to understand whether an OP occurs or not:

- We hire an employee in another city to provide services or perform work on the territory of clients (customers). Let's say a company provides cleaning services in another city and hires cleaners. In this case, there is no separate division, because there are no stationary jobs. A similar approach is applied to the situation when a worker (electrician, finisher) goes to the customer’s site. Depending on the position and type of occupation, the employee is drawn up with both a regular employment contract and an agreement on home-based or remote work.

- Construction work is underway. Here you need to consider each specific situation individually.

- Road works are being carried out. In this case, the Federal Tax Service believes that there is no need to create an OP. The work is being carried out “in the field”; there is no talk of any permanent location.

- Storage space is rented or purchased. This is one of the frequent subjects of controversy. There are permanent employees at the warehouse: storekeeper, watchman, loaders, which means that you will definitely need to register an OP.

- Premises in the same building. The company rents an office in a business center and decides to open a cafe on another floor. On the one hand, both premises are located in the same building and, naturally, belong to the same tax office, so it is logical to assume that there is no need to open an OP. The judges confirm this point of view, since they consider one of the signs of territorial isolation to be assigned to a tax inspectorate different from the parent enterprise. On the other hand, tax authorities do not always agree with arbitration practice. Their position is that even if in fact the legal address of the organization and the cafe differ slightly, for example, in the number of the premises, then formally such a difference is already a reason for registering the separate entity. The conclusion is drawn from the definition of OP in Article 11 of the Tax Code, the concepts established by Article 55 of the Civil Code of the Russian Federation and the determination of the location of a legal entity (according to paragraph 2 of Article 54 of the Civil Code, this is the place of state registration). You will either have to contact the Federal Tax Service for clarification, or act at your own peril and risk.

- The employee works in coworking mode. A popular way to work outside the home. Freelancers usually resort to it. The point is to engage in some kind of activity in a room where fellow “free artists” gather, perhaps in the process exchanging opinions, achievements and experiences, or simply working in a calm environment. Let’s imagine that a space is rented for an employee under a coworking agreement, is this equivalent to renting an office, is it necessary to organize an OP? In reality, this option involves a short-term rental, usually for a few hours a day, and the employer has no control over such a workplace. This means that it cannot be recognized as stationary and the creation of a separate unit is not required.

Note! Homeworkers and remote workers clearly do not have workplaces controlled by the employer.

Example No. 1: the construction site where the workers are sent is equipped with cabins owned by the organization, the workers are given tools by the employer, and he also controls the progress of the work - there is an OP.

Example No. 2: workers come to the construction site every day from home, safety at the site is monitored not by the employer (subcontractor), but by the general contractor, who also controls the progress of construction. Based on the definition of jobs (Article 209 of the Labor Code), there are none in this case, since construction is not under the control of the employer.

It should be noted that in most cases, tax authorities, regardless of the circumstances, believe that a construction site requires the creation of a separate division.

What if it’s just a room where goods or materials are delivered, unloaded, and picked up, if necessary, by visiting drivers and forwarders? Despite the fact that employees are not constantly in the warehouse, it is considered that there are jobs, and the time spent on them does not matter.

By the way! A similar approach is valid in a situation where an organization has rented or purchased an office, but the employee uses it occasionally.

After the company has decided to create an OP, it is necessary to prepare documents regulating its activities and register it with the Federal Tax Service.

Separate units

As strange as it may sound, it is possible to create a separate unit unintentionally. And the worst thing is that such an “unintentional” creation of a separate unit can lead to negative consequences. In this article we will look at such cases, which will help our readers avoid negative consequences.

A separate division of an organization is any division territorially isolated from it, at the location of which stationary workplaces are equipped, and the workplace is considered created if it is created for a period of more than one month.

Moreover, the division will be recognized as separate, regardless of whether its creation is reflected or not reflected in the constituent or other organizational and administrative documents of the organization, and on the powers vested in the specified division (Clause 2 of Article 11 of the Tax Code of the Russian Federation).

When a separate division is considered created

A separate division is characterized by two characteristics:

1. equipped workplaces created for a period of more than one month; 2. territorial isolation from the head unit.

Let's look at these signs in more detail.

The first sign. The Tax Code does not contain the concept of a workplace, so it is worth turning to the Labor Code.

A workplace is a place where an employee must be or where he needs to arrive in connection with his work, and which is directly or indirectly under the control of the employer (Article 209 of the Labor Code of the Russian Federation). For example, recently so-called “virtual offices” have become increasingly popular, when an organization’s employees work remotely, that is, at home, on home computers, etc. Accordingly, the employee’s apartment and his home computer are not under the control of the employer, either direct or indirect, and therefore the creation of a separate division does not occur.

In addition, the workplace must be created by the employing organization itself (premises are rented or purchased). For example, if a cleaning company sends a cleaner to the client’s office for daily cleaning for a period of two months, then there will also be no separate unit. After all, if the premises or part of it does not belong to the employing organization, then the cleaner will be considered a seconded employee (166 Labor Code of the Russian Federation).

According to the Ministry of Finance, each case of the potential creation of a separate unit must be considered separately. Thus, specialists from the financial department explained that in order to resolve the issue of the presence or absence of signs of a separate division of an organization, the essential terms of contracts (lease, contract, provision of services or others) concluded between the organization and its counterparty, the nature of the relationship between the organization and its employees must be taken into account , as well as other actual circumstances of the organization’s activities outside its location (letter of the Ministry of Finance of Russia dated February 18, 2010 N 03-02-07/1-67).

Among other things, workplaces must be equipped, that is, each workplace must be adapted to perform the function for which it was created. Thus, we can conclude that the workplace must be equipped, created by the employer and be under his direct or indirect control.

Sign two. The Tax Code does not define territorial isolation. However, in our opinion, a division will be considered territorially separate if its location address differs from the address of the parent organization indicated in the constituent documents.

For reference: the location of a separate division of an organization is the place where this organization carries out its activities through its separate division (Clause 2 of Article 11 of the Tax Code of the Russian Federation). Based on the foregoing, we can conclude that a separate division will be considered open from the day the workplaces are installed at an address different from the address of the organization’s location.

Separate division, branch, representative office

Civil legislation distinguishes two types of separate divisions: branch and representative office. A representative office is a separate division of a legal entity located outside its location, which represents the interests of the legal entity and protects them (Clause 1 of Article 55 of the Civil Code of the Russian Federation).

The concept of “branch” is somewhat broader than the concept of “representative office”. A branch is a separate division of a legal entity located outside its location and performing all or part of its functions, including the functions of a representative office (Clause 2 of Article 55 of the Civil Code of the Russian Federation).

The concept of “separate division” is even broader and includes the concepts of “branch” and “representative office”. Each branch or representative office is a separate division, but not every separate division is a branch or representative office.

In addition, the branch and representative office operate on the basis of relevant regulations approved by the parent organization and have managers. Information about representative offices and branches must be indicated in the constituent documents of the legal entity that created them (Clause 3, Article 55 of the Civil Code of the Russian Federation).

A separate division does not necessarily have to have a leader. Also, there is no obligation for the parent organization to approve a special regulation on a separate division. And information about it does not have to be indicated in the constituent documents.

Please note that a representative office and a branch are not legal entities and, accordingly, do not act as subjects of civil or tax legal relations (Clause 3 of Article 55 of the Civil Code of the Russian Federation). Also, a separate division is not a legal entity and does not act as a subject of civil and tax legal relations. Branches, representative offices and other separate divisions of Russian organizations only fulfill the duties of these organizations to pay taxes (Article 19 of the Tax Code of the Russian Federation).

Registration or notification?

A separate division has been created, what next? And then, if an organization operates through this division, then it is obliged to submit an application for registration to the tax authority at the location of this separate division within one month from the date of creation of the separate division (clause 4 of Article 83 of the Tax Code of the Russian Federation).

What if a separate division is created, but activities are not conducted through it? If we interpret this norm literally, then as long as the activity is not carried out through a separate division, there is no need to submit an application for registration. However, if, for example, two months after the creation of a separate division, the organization begins to conduct activities through it, then it will need to register. It will be impossible to do this without violating the established deadline in the case under consideration. Therefore, the right decision would be to submit an application for registration within a month from the date of creation of a separate division, even if activities are not yet conducted through it.

In addition to filing an application for registration, the organization is obliged in all cases, within a month from the date of creation of a separate division, to report this to the tax authority at the location of the organization. The closure of a separate division must also be reported to the tax authority within a month (subclause 3, clause 2, article 23 of the Tax Code of the Russian Federation). The message is submitted to the tax authority in form N S-09-3, approved by order of the Federal Tax Service of Russia dated April 21, 2009 N MM-7-6 / [email protected] (clause 7 of article 23 of the Tax Code of the Russian Federation).

If an organization has created a separate division on the territory of the municipality where the organization itself is located, then there is no need to re-register (clause 1 of Article 83 of the Tax Code of the Russian Federation). In this case, it will only be necessary to submit a message about the opening of a separate division in the manner prescribed by subparagraph 3 of paragraph 2 of Article 23 of the Tax Code of the Russian Federation.

And if several separate divisions of an organization are located in the same municipality in territories under the jurisdiction of different tax authorities, the organization can be registered by the tax authority at the location of one of its separate divisions, determined by the organization independently (clause 4 of Article 83 of the Tax Code of the Russian Federation) .

To do this, the organization must inform in writing which tax authority it has chosen for registration at the location of the separate division. Moreover, you need to inform the tax authority that the organization has chosen for registration. This can be done using the recommended message form developed by the Federal Tax Service of Russia (KND N 1111051) (appendix to the order of the Federal Tax Service of Russia dated March 24, 2010 N MM-7-6 / [email protected] ).

“Legal” and “actual” addresses

Nowadays, such a common concept as the legal address of an organization is quite common. When we say legal address, we mean the address of the location of the organization.

The location of the organization is determined by the place of its state registration. And the state registration of an organization is carried out at the location of its permanent executive body, and in the absence of a permanent executive body - another body or person entitled to act on behalf of the organization without a power of attorney (Clause 2 of Article 54 of the Civil Code of the Russian Federation).

In other words, the address of the organization’s location is the address indicated in the constituent documents. The actual address is the address where the organization is located and actually operates. According to some territorial tax authorities, the difference between a “legal” address and an “actual” one, in essence, is the creation of a separate division. That is, they believe that the actual address is not the organization itself, but its separate division.

In our opinion, this approach is incorrect. A separate division, first of all, must be territorially separated from the parent organization. And in a situation where an organization operates at an address different from that specified in the constituent documents, a separate division is not created, since in this case there is no parent organization (there is no one at the “legal” address, and activities are not conducted there). That is, in order to recognize the creation of a separate division, there must be a parent organization. However, in order to avoid unnecessary and unnecessary disputes with the tax authorities, we recommend making changes to the constituent documents by changing information about the location of the organization.

Under what article is liability?

The Tax Code of the Russian Federation has two articles related to registration. Article 116 of the Tax Code of the Russian Federation provides for a fine of 5,000 rubles for violating the deadline for filing an application for tax registration. If the deadline is violated for more than 90 days, the fine will double and amount to 10,000 rubles. Let us immediately make a reservation that the Tax Code does not establish liability for failure to notify the tax authority about the creation or closure of a separate division. Article 117 of the Tax Code of the Russian Federation provides for liability for conducting activities without registering with the tax authority.

Moreover, the sanctions under this article are significantly greater than the sanctions under Article 116 of the Tax Code of the Russian Federation. Thus, for this offense, Article 117 of the Tax Code of the Russian Federation provides for a fine of 10% of income received from activities that were carried out without registration with the tax authority, but not less than 20,000 rubles. If such activity was carried out for more than 90 days, the fine will double and amount to 20% of income, but not less than 40,000 rubles. In other words, Article 116 of the Tax Code of the Russian Federation should be applied in cases where the organization itself submitted an application for registration, but missed the deadline. Article 117 of the Tax Code of the Russian Federation should be applied in cases where the tax authority has discovered and recorded the conduct of activities by an organization without tax registration.

There is an opinion that the objective side of Article 117 of the Tax Code of the Russian Federation covers only the conduct of activities without registration in general, and not a separate unit. That is, if an organization is registered with the tax authority, then it cannot be held accountable for conducting activities through a separate division without registering with the tax authority at its location (resolution of the Federal Antimonopoly Service of the Moscow District dated June 20, 2007 N KA-A40/5386 -07, dated 10/05/2007 N KA-A40/10377-07, Federal Antimonopoly Service of the North-Western District dated 04/29/2004 N A66-6713-03).

However, not all courts share this opinion, for example, the Federal Antimonopoly Service of the Far Eastern District confirmed the legality of holding a taxpayer liable under Article 117 of the Tax Code of the Russian Federation for conducting activities through a separate division without registration (resolution dated September 3, 2008 N F03-A04/08-2/3593 ).

In conclusion, as you expand your business, do not forget to comply with the obligations imposed by tax laws, this will help you avoid unnecessary disputes and save money.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

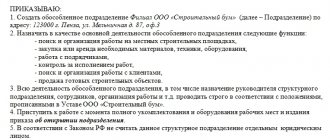

Vesting and registration

I’ll make a reservation that if we are talking about the third type of units (others), then you just need to submit an application in form C-09-3-1. The decision to create a representative office or branch is made by a meeting of participants (Clause 1, Article 5 of Federal Law No. 14-FZ “On Limited Liability Companies”) with at least 2/3 votes, unless otherwise specified in the company’s charter. At the meeting, the position is adopted, a leader is elected, and the director of the organization issues an order.

The provision must include the following points:

- Location and name.

- Functions, rights and responsibilities.

- Functions of the manager, powers (it is worth indicating to whom the manager directly reports - the meeting of participants, the director, the general director, another official).

- Property information.

- The presence or absence of your own account, balance.

- Where payroll is calculated, at the head office or in a division.

You can also specify other points: internal reporting, rules for moving inventory, cash flow, etc.

Note! The registration period is one month from the date of creation (clause 1 of Order of the Ministry of Finance No. 114n dated November 5, 2009). A branch or representative office is reflected in the Unified State Register of Legal Entities after state registration.

For late registration of a company's division, fines may apply: 200 rubles – clause 1 of Art. 126 of the Tax Code of the Russian Federation for failure to submit information on time and 10% of income received (minimum 40,000 rubles) - clause 2 of Article 126 of the Tax Code of the Russian Federation for activities without registration with the tax authority.

In 2022, a bill was considered to increase liability for failure to submit (late submission) to the Federal Tax Service of information on the opening of an OP and increase it to the level specified in paragraph 2 of Art. 126 of the Tax Code, but in November 2022 it was rejected during consideration by the State Duma.

Terminology

The current legislation gives a clear definition to each structural unit. Article 55 of the Civil Code of the Russian Federation states that there are two types of separate divisions (SB): a branch and a representative office.

A branch is a business entity located at a distance from the head office and fully or partially performing its functions.

A representative office is a legal entity that is geographically remote from the head office and represents the interests of a legal entity (LE) or is engaged in their protection.

Property Relocation: Accounting

When moving inventory, fixed assets and money between the head office and other departments, the method of accounting depends on whether the OP has a dedicated balance sheet.

Important! All divisions maintain accounting records in accordance with the accounting policies of the “head”.

There is no separate balance

In this case, when moving, for example, equipment (OS), an internal transfer should be carried out in analytics.

Example No. 3: transfers to division “A-1” a lathe with an initial cost of 150,000 and depreciation accrued at the time of transfer in the amount of 54,000:

- D 01 "A-1" K 01 "A" - 150000, movement carried out.

- D 02 “A” D 02 “A-1” – 54000, depreciation on the transferred machine was transferred.

The same should be done with other inventory items. When a division does not have a separate balance sheet, cash is handled by the central accounting department, and settlements with suppliers and contractors are carried out through it. In this case, normal postings are performed.

Example No. 4: Organization “B” transfers to division “B-2” materials intended for the repair of the premises in which the OP is located, costing 20,000 rubles. To transport them, “B” hires a transport company (TC), its services cost 3,000 rubles:

- D 10.8 materials in the warehouse in “B-2” K 10.8 materials in the warehouse “B” - 20,000, materials were transferred to OP “B-2”.

- D 23 (23, 25, 20, 44) K 76 – 3000, reflects the costs of transporting materials for repairs.

- D 76 K 51 – 3000, paid for TK services.

There is a separate balance

In this case, account 79 “Intra-business settlements” is used to move property and funds.

When transferring fixed assets in the accounting of the head office, it is necessary to make the following entries (we use the data from example No. 3):

- D 79-1 “A-1” K 01 “A” - 150000, the transfer of equipment is reflected.

- D 02 “A” D 79-1 “A-1” – 54000, depreciation on the machine was transferred.

Postings when transferring inventory items and paying the costs of their delivery (we use the data from example No. 4): D 79-1 “B-2” K 10-8 – 20000, materials for repairs were transferred. Further postings depend on whether the department has a current account.

No invoice (services ordered and paid for by central accounting):

- D 23 (...) K 76 – 3000, transportation costs.

- D 76 K 51 – 3000, payment to the transport company.

There is no invoice (the order for services is made by the OP, and payment is made by the parent organization):

- D 79-2 K 76 - the unit transferred the debt to the TC to the “head”. In accounting for the separation itself, the postings will be as follows: D 23 (...) K 76 - 3000, transportation costs, D 76 K 79-2 - the TC debt was transferred to the head office.

- D 76 K 51 – paid for TC services

No invoice (OP independently ordered and paid for the services):

- For division “B-2”: D 23 (...) K 76 - 3000, transportation costs are reflected, D 76 K 51 - payment to TC is transferred.

- The OP can first receive funds for expenses, then in postings “B-2” there will be posting D 51 K 79-2 - funds have been received from the central accounting department for settlements. In this case, wiring D 79-2 K 51 will be reflected in the “head” control unit.

In most cases, the wiring looks like a mirror image, as you've probably noticed. Costs incurred are transferred to the central office by posting D 79-2 K 20, 25, 23, 44. Reverse posting, respectively, is from the head accounting department.

You can read more about taxation in a separate division here.

How do separate divisions affect the taxation system?

One of the most unpleasant restrictions for companies using a simplified taxation system is the inability to open branches (subparagraph 1, paragraph 3, Article 346.12 of the Tax Code does not talk about other types of divisions, including representative offices).

If you create such an OP in the middle of the year, then the simplifier is obliged to start using the general system. However, some organizations, on the contrary, turn this point to their advantage. For example, a company is offered a lucrative contract using the simplified tax system, but the client is ready to work with it only if VAT is available. Then a branch is opened, the company loses the right to use the simplified tax system and switches to OSNO.

Important! The creation of a separate division must be realistic. It must not only exist on paper, but also have a staff, a current manager, an actual address and conduct activities.

It should be noted that if the Federal Tax Service finds signs of formality of the action, then there is a high chance of recognizing the maneuver as deception. For the purpose of obtaining tax benefits, including. You will have to recalculate taxes, pay penalties, resubmit reports, and the client will not be happy.

As for UTII, some questions arise here too. An organization has opened a new store, is it necessary to register if it is located in the same city as other existing retail outlets? The answer is in paragraph 2 of Art. 346.28 of the Tax Code of the Russian Federation: if the activity is carried out in different city districts, municipal areas, in intra-city territories and at the same time they are served by different branches of the Federal Tax Service, then you need to register with one of the inspectorates (the one that has jurisdiction over the first place of activity in the application).

If we are talking about different municipalities, then you need to submit an application in each (only once, and then proceed as described above). You will also have to submit a UTII-2 application if the organization starts a new type of activity on the imputation.

Mandatory notification

If a company has organized workplaces for employees outside its location, the tax office must be notified about this within a month. However, this does not need to be done if the organization has opened a branch or representative office.

Important

A notification about the creation of separate divisions (except for branches and representative offices) of a Russian organization must be submitted in form No. S-09-3-1, approved by Order of the Federal Tax Service of June 9, 2011 No. ММВ-7-6/3 [ email protected] By the same document The procedure for filling out the document has been approved.

Let me remind you that a representative office is a separate division of a legal entity, located outside its location, which represents the interests of the company and protects them. But the branch performs all or part of the organization’s functions, including representative ones. Please note that branches and representative offices are not legal entities. They are endowed with property by the company that created them. Such divisions operate on the basis of regulations approved by the company. She also appoints leaders.

For example, LLCs can create branches and open representative offices by decision of the general meeting of their participants. Moreover, it must be adopted by a majority of at least two-thirds of the total votes, unless the need for a larger number to make a decision is provided for in the charter. In order for a separate division to begin its work, it is necessary to draw up a Regulation on it.

A new organization was opened instead of the OP

Some entrepreneurs resort to a way to organize a business in a new location without opening separate divisions. They simply register a new legal entity. The option is not creative and has a number of serious disadvantages:

- To transfer property or funds, you will have to enter into supply, purchase and sale, loan, etc. agreements. Unlike the option with the OP, when this happens on the basis of internal provisions.

- Each company will pay tax on transactions carried out (after all, most likely, the return transfer of money or goods and materials will be required). Moving between OPs does not affect taxation.

- If it is necessary to transfer some employees to a new company, this will have to be done through dismissal, with the payment of compensation in the old organization, and not all employees may agree to such manipulations. Transfer of personnel within the company occurs according to simpler rules.

- If the Federal Tax Service decides that a business has split up for the sole purpose of optimizing taxation (paying a single tax under the simplified tax system, instead of income tax and VAT, for example), then the organization will face significant fines. Tax Code in paragraph 3 of Art. 122 provides for a penalty of 40% of unpaid taxes. This is not to mention penalties and other costs. When we are talking about multi-million dollar amounts, the organization may face bankruptcy.

- Fragmentation of a business may also be associated with receiving any benefits and support. For example, a separately created company can take part in tenders as a small business entity, while the “old” company could not take part in them, because did not have this status.

- If a dependency is established between the existing and the created organization, then transactions carried out between them will become the object of close attention and assessment by the tax authorities.

The opening of a separate division is a sign of effectiveness and positive dynamics of business development. At the same time, you should not report opening an OP “just in case” if you are not sure of the need for this action. A whole month is given to submit documents. Sufficient time to study the legislation or contact a lawyer and make a final objective decision.

Financial and legal nuances

The creation of a branch or representative office prohibits an enterprise from using the simplified taxation system (STS). This is stated in paragraph 3 of Art. 346.12 Tax Code of the Russian Federation. And this is the main reason why most companies are against opening an OP. The only exception is a simple separate division, the presence of which does not deprive the enterprise of the right to “simplified”.

If a company wants to remain on the simplified tax system, it must open an exclusively simple OP. But here, too, there is the option that you will have to prove that its separate division is not a branch or representative office. It is worth noting that in practice companies often succeed in this. According to judicial precedents in the Russian Federation, if a branch or representative office lacks only one sign of a branch or representative office, then it is a simple division.

In addition, according to recent changes in legislation, an organization cannot obtain a license from the Ministry of Emergency Situations if its legal address is an apartment, i.e. the home address of the owner. To obtain a license, you must open a branch.