An entrepreneur, having employees, makes monthly contributions to the Pension Fund for their future pensions. What kind of pension can an entrepreneur himself claim?

To pay pensioners, the employer makes monthly contributions to the Pension Fund. The employer must pay insurance premiums. The employee himself does not make any payments, except in cases where he himself wants to increase the size of his pension.

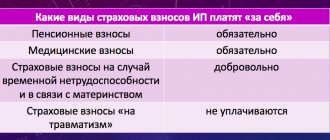

Individual entrepreneurs calculate and pay insurance premiums in a special manner. Thus, an individual entrepreneur is obliged to pay insurance premiums not only for his employees, but also “for himself.”

Individual entrepreneur and pensioner status

Russian legislation enshrines the right of any citizen to be an individual entrepreneur, provided that he is legally capable and has reached the age of majority. Persons under 18 years of age can also register as entrepreneurs with parental consent or through an emancipation procedure.

As for retired businessmen, there are no restrictions for them to obtain individual entrepreneur status either in the registration law No. 129-FZ or in the Civil Code. The only condition, as for other categories of citizens, is legal capacity. According to Article 21 of the Civil Code of the Russian Federation, it begins at the age of 18.

A citizen can only be deprived of legal capacity through a court on the grounds that he suffers from a mental disorder (Article 29 of the Civil Code of the Russian Federation). Thus, the answer to the question - can a pensioner open an individual entrepreneur - is unambiguous. If there is no court decision regarding incapacity against him, then he has every right to become an entrepreneur.

Fictitious IP. What could this mean?

Alas, fraud occurs in the Russian Federation. Thus, some young entrepreneurs try to register their activities in the name of a relative of retirement age, thinking that they will receive additional benefits. And besides, they are also trying to avoid paying taxes.

Therefore, everyone should know that there are no benefits as such for pensioners with individual entrepreneurs. Moreover, ignorance will not be a reason for exemption from liability before the law. All violations, regardless of who they were committed against, impose liability and penalties. When a fact of non-payment of tax or failure to comply with obligations to other participants in commercial relations is revealed, certain sanctions will always be imposed. They can be in the form of a fine, in the form of a complete freeze of activities or current accounts. And even in the form of criminal punishment. Therefore, be extremely careful.

Taxes and fees

So, you can open an individual entrepreneur for a pensioner. Now we’ll find out if he has any benefits. The pensioner must pay taxes on his business in accordance with the chosen regime. He does this along with other entrepreneurs. Russian legislation does not offer any tax breaks for elderly businessmen.

An important question, the answer to which you need to know before opening an individual entrepreneur for a pensioner: should he pay pension contributions for himself? Let’s say right away that you won’t be able to save money on this. All entrepreneurs make these contributions. Only certain periods fall under the exception, namely:

- military service upon conscription;

- caring for children under 1.5 years of age or for a person over 80 years of age;

- living outside Russia with a spouse sent there for diplomatic work.

In accordance with Article 12 of Law 400-FZ of December 28, 2013, these periods are included in the length of service for calculating an insurance pension and without paying contributions.

From this we can draw the following conclusions:

- The status of a pensioner in itself does not give the individual entrepreneur the right not to pay insurance premiums.

- Contributions must also be paid for periods when activities were not carried out, including due to illness. Therefore, if there is a pause in business, it is better to deregister, or, as they say, close the individual entrepreneur. This applies not only to pensioners, but to all entrepreneurs.

Regarding the first conclusion, there is an explanation from the Ministry of Finance in a letter dated August 27, 2019 No. 03-15-05/65730. Officials write that insurance premiums are paid by all individual entrepreneurs, regardless of age or disability. They go towards future pension provision. If a person already receives an old age or disability pension, these contributions affect the recalculation of its amount. In other words, no benefits are provided for retired entrepreneurs.

Free tax consultation

Types of taxes to be paid

- Tax to the Pension Fund. The fixed pension tax for individual entrepreneurs consists of funded and insurance parts. You must pay in two receipts once a year or quarterly, as you choose.

- Payments to the Compulsory Medical Insurance Fund. Individual entrepreneurs pay fixed amounts to the Federal Department of Health Insurance. Payment takes place only through Sberbank cash desks using receipts. If the individual entrepreneur has a bank account, payments can be made from it. No interest is paid in this case.

Regardless of the chosen business activity, a pensioner must pay taxes on the same basis as other entrepreneurs. You shouldn’t wait for problems to arise; it’s better to study all the necessary laws in advance, since fines often hit the budget hard.

Pension amount

Before opening an individual entrepreneur, it is important for a pensioner to understand what will happen to the amount of his pension. The amounts of pension payments are indexed annually, that is, they increase by a certain coefficient, the amount of which depends on inflation. However, this rule applies only to pensioners who are not employed and are not entrepreneurs.

Therefore, if a citizen has received the status of an individual entrepreneur, his pension is not indexed. Although it is correct to say that it is suspended. After the end of the activity, all missed indexing stages will be restored. This means that after the closure of the individual entrepreneur, the size of the pension will be the same as it would have been without the period of entrepreneurship.

Retired businessmen are not entitled to a regional social supplement to their pension. It is provided for those whose payment is below the subsistence level for a pensioner established in a constituent entity of the Russian Federation.

For example, in Moscow the rules are as follows: non-working pensioners must receive at least the city social standard of 19,500 rubles per month. Those who have lived in Moscow for at least 10 years and do not work have the right to count on this amount. If a pensioner lives in the capital for less than 10 years, he is entitled to an additional payment to his pension up to the amount of 12,578 rubles. But again, only on the condition that he is not employed and is not an entrepreneur. Those who run their business as individual entrepreneurs do not receive such additional payments.

How to save for retirement without the Pension Fund?

Since the traditional option of accumulating points for the self-employed is too expensive, you should consider other options to ensure your retirement.

It could be:

- savings in a bank deposit, which allows you to save a comfortable amount every month;

- independent investments (purchase of shares, bonds, etc., which carries both the opportunity to make good money and the risk of losing money);

- open an individual pension plan in a non-state pension fund (NPF).

But it should be noted that none of the alternative options guarantees reliability and an amount sufficient to live on.

How to register

Let's move on to the practical question - how to open an individual entrepreneur for a pensioner? The procedure for registering as an entrepreneur is quite simple and consists of several stages.

Stage 1. Preparation

At this stage, several issues need to be resolved:

- Which tax authority should I contact for registration, since not every inspectorate deals with these issues. The easiest way is to find the required Federal Tax Service on the service’s website through a special service.

- How to submit documents? Options: take them personally to the tax office or the MFC, send them by mail, transfer them with a representative, or send them electronically through the Federal Tax Service website (an electronic signature is required). It’s cheaper, and often easier, to do everything yourself.

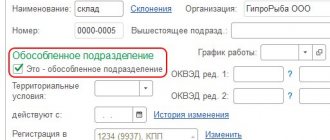

- What types of activities to choose at the time of registration. You need to select suitable codes for them from the OKVED classifier.

- What tax regime to apply. The basic and simplified taxation systems are publicly available. With certain restrictions, you can use UTII, PSN and NAP (in certain regions). The Unified Agricultural Tax regime may be suitable for agriculture.

Stage 2. Application P21001

Registration of individual entrepreneurs is carried out on the basis of an application in form P21001 from the order of the Federal Tax Service dated August 31, 2020 N ED-7-14 / [email protected] ). There shouldn't be any difficulties filling it out. The pensioner indicates personal information - full name, gender, date and place of birth, citizenship, his passport details, registration address and contact telephone number. In addition, the application must include:

- previously selected OKVED codes (one must be the main one);

- email address - it is needed to receive a response. Registration documents are sent electronically with a digital signature from the tax office. They have the power of the original.

An important point - you don’t need to sign the P21001 application! If a pensioner goes to the Federal Tax Service or MFC himself, he will sign there. If you plan to send the package by mail or with another person, you will have to visit a notary.

Stage 3. State duty

The state fee for registering an individual entrepreneur is 800 rubles. Is it possible for a pensioner to somehow obtain individual entrepreneur status without paying it? No, the state does not provide such benefits. Everyone must pay the fee, including pensioners.

The only option to save on fees is to send documents to the Federal Tax Service in electronic form. But this is beneficial if the citizen has an electronic digital signature for the tax service.

If it is not there, then this method makes no sense, since production will cost more. We also recommend checking with your MFC to see if they interact with the Federal Tax Service electronically. If yes, then you will not have to pay a fee or issue an electronic signature.

To generate a receipt for payment, you need to open the Federal Tax Service website and find a special service there. You can pay the fee by card via the Internet or at a bank branch, having previously printed a receipt.

Stage 4. Notary

Above we talked about how to open an individual entrepreneur for a pensioner without a personal visit to the Federal Tax Service or the MFC. Documents can be transferred with an intermediary or by mail. However, you still won’t be able to do without going out at all—you’ll have to visit a notary. The future individual entrepreneur will sign the application form, certify a copy of his passport, and also issue a power of attorney for the person who will take the documents to the Federal Tax Service. You can visit any notary, there is no territorial connection.

Stage 5. Submission of documents

All that remains is to collect all the documents and take or send them to the tax authority. What papers need to be submitted can be seen from the table.

| Feeding method | List of documents |

| Independently at the Federal Tax Service or MFC | Passport of a pensioner; Receipt for payment of state duty; Statement P21001 |

| By mail | + certified copy of passport |

| With a representative | + power of attorney |

If you choose the electronic form, just fill out the application and attach a scan of your passport to it. There is a free program from the tax service for this. In it you can create a package, sign it with an electronic digital signature and send it to the Federal Tax Service.

Free consultation on business registration

Stage 6. Result

The tax authority must review the documents within three working days after they are submitted. If documents are sent by mail, the period is counted from the date of their receipt.

As a result, the applicant must receive one of two documents by email:

- if he is registered as an individual entrepreneur - the USRIP record sheet;

- if for some reason he is refused, the decision is to refuse.

In case of refusal, it is important to understand the reason; it must be indicated in the decision itself. If these are errors in the documents, then you should correct them and resubmit for registration. If you do this within three months, you will not have to pay the fee again.

So, we figured out whether a pensioner can open an individual entrepreneur. His registration is not too different from the actions taken by other applicants. There are no benefits for retired businessmen. On the contrary, having become an individual entrepreneur, they lose the right to some additional payments.

Where can an entrepreneur get information about accumulated pension points?

It is best to obtain this information in the following ways:

- through the official Internet portal of the Pension Fund;

- through the government services website;

- by personally visiting a branch of the Pension Fund of Russia or the MFC.

The best way is to contact the government services portal.

To do this, you need to register on the website, fill out all the necessary information: passport details, SNILS.

If an entrepreneur understands that he does not have enough pension points for a decent pension, then he can buy more. To do this, you need to conclude an agreement with the Pension Fund and transfer money to the specified details.

Unfortunately, an entrepreneur who worked and paid insurance premiums “for himself” will have a pension significantly lower than an employee.

The fact is that the employer transfers 22% of insurance premiums for compulsory pension insurance of an employee, which is significantly higher than the fixed amount of insurance premiums paid by individual entrepreneurs.

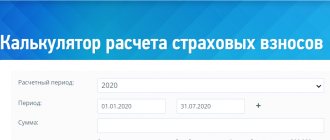

There is a calculator on the website of the Pension Fund of the Russian Federation that will help you find out the size of your future pension (https://www.pfrf.ru/eservices/calc/).

An individual entrepreneur will be able to simulate various situations, for example, changing the retirement date, because the further this date is pushed back, the higher the pension amount will be.

Are there any benefits for individual entrepreneurs?

The mere fact that a citizen applying for a pension is an entrepreneur does not imply any benefits or preferences. They are provided on a general basis to all citizens who, among other things, worked:

- in difficult climatic conditions;

- in hazardous and hazardous industries;

- in the field of education (teachers) and medicine (medical personnel only).

In addition, for long overall work experience, some allowances or recalculation are due.

Why is there no similar allowance for non-working pensioners?

Payments to non-working pensioners are increased annually. Such indexation is legalized and is carried out with a certain frequency. The state increases pensions by a certain percentage every year to compensate for the constant rise in prices. The percentage previously depended on the inflation rate approved in the country; now it exceeds it by 1-3%, depending on government regulations.

The amount added to the payment depends only on the original pension amount, so the supplement may be different for each senior citizen. From January 1, 2022, pensions were increased by 7.05%. If one pensioner received 14 thousand rubles, and another only 10 thousand, then the increase for the first citizen from 2022 will be 987 rubles, and for the second - 705 rubles. This technology for increasing payments only applies to unemployed pensioners. Employers do not pay insurance premiums for them.

Working pensioners have not been subject to such indexation since 2016. The state decided to save budget funds in this way. Elderly citizens who continued to work continue to receive wages, and employers make insurance payments for them. Therefore, they need government support to a lesser extent than those whose pension is their only source of income. But instead, they are recalculated annually, so pension payments are increased, but not by such a large amount as for non-working citizens.

✨ As a summary

Returning to the reader’s question: it will be possible to retire if in 2022 the individual entrepreneur has accumulated at least 12 years of insurance experience, as well as 21 pension points. In addition, the entrepreneur must reach retirement age. But the calculation of the amount that he will be able to receive monthly as maintenance from the state will be of an individual nature, since in the above example we presented basic information on what the minimum pension size may be for an individual entrepreneur who does not have other increasing coefficients.

Minimum wage. Why is it needed, does raising it lead to an increase in salary?

Read

Law on remote work. How workers' rights will be protected from January 2022

More details

Why they can fire you from remote work. Grounds for labor legislation

Look

Indexation for pensioners in 2022

In Russia, they are still discussing the issue of returning indexation of pensions for working older citizens. But for now, working pensioners have to rely only on recalculation of pension points in August. In general, the size of the pension will not change much.

If a pensioner’s salary reaches 30 thousand rubles a month, then a maximum fee of 3 pension coefficients will be added. Each of them costs 93 rubles in 2022. That is, the largest increase is 279 rubles.

Also, for pensioners, regardless of official employment, certain circumstances apply to increase pension payments:

- Having a dependent - a child under 18 years of age or an adult young man enrolled in full-time study at a higher school.

- When developing northern experience. Far North - 15 years of experience, equivalent territories - 20 years.

- The appearance of work experience or salary previously not taken into account by the Pension Fund.

And one more condition for increasing the pension, which was also in effect in previous years, is dismissal from work for indexation.

5 / 5 ( 1 voice )

about the author

Klavdiya Treskova is an expert in the field of financial literacy and investment. Higher education in economics. More than 15 years of experience in banking. He regularly improves his qualifications and takes courses in finance and investments, which is confirmed by certificates from the Bank of Russia, the Association for the Development of Financial Literacy, Netology and other educational platforms. Collaborates with Sravni.ru, Tinkoff Investments, GPB Investments and other financial publications. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email