Obtaining a certificate from the employer

Most citizens resort to this method; it is the simplest and most convenient. You don’t really need to run anywhere, and everything will go by quickly.

If you have a question about how to write an application for 2-NDFL, it is better to contact your immediate supervisor. Each company has its own mechanism for submitting an application and issuing a completed certificate.

The standard process looks like this:

- Submitting an application to the accounting department. The forms are usually provided by the organization. You can write an application in free form; a sample is available on the Internet. If the accounting department is located remotely or even in another city, then employee requests are usually accepted by email.

- Processing of the application is fast, a certificate can be issued even on the same day. You will receive it directly from the accounting department, or the document will be transmitted remotely if the place of work is remote from the head office. It all depends on the internal regulations of the company you work for.

If you have a question about the application form for 2NDFL, it is better to contact your immediate supervisor.

In the application, you must indicate for what period you need salary data. Banks usually ask to provide 2-NFDL for the last six months or a year.

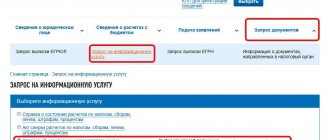

Obtaining a 2-NFDL certificate through State Services

If you have an account on the Government Services website, you can use it. Personal income tax information is tax information, so data on a citizen’s salary can be found through State Services.

It will be even more convenient; you don’t need to deal with accounting issues, write an application and waste time. The request is sent from the Federal Tax Service website, but user authorization goes through State Services.

The system will provide a file for downloading, you can give it to the bank or print it

How to get a document online:

- Log in to the taxpayer’s personal account on the Federal Tax Service website and log in through State Services. An important point - only a verified account is suitable.

- After logging in, you need to go to the My Taxes section, then Additional Information and Income Information.

- Next you need to indicate the period for which you need a 2nd personal income tax certificate. You should also select the desired employer from the proposed list (tax agent).

- Help will be generated immediately, the system will provide a file for downloading. This file can be submitted to the bank for consideration of the loan application.

Deadline for submitting personal income tax certificate 2 at the employee’s request

According to the law, the landlord is obliged to issue a certificate in Form 2 of personal income tax within 3 working days from the date of submission of the application. What are the nuances here?

We recommend additional reading: On personal income tax certificate 2, is an organization’s seal required?

When submitting an application in person or requesting through the tax office, the period for issuing the document will be minimal. In some cases, the form is issued on the same day or the next.

If the request is sent by mail, then the countdown begins from the moment the letter is received by the addressee. And if the method of obtaining a certificate of income is also through mail, for example for military personnel, then the period will be increased. That is, the time for sending the application and the certificate itself is not included in the deadline for submitting the reporting form.

When terminating a contract with an employee, the certificate must be generated on the last working day, even if the application was received on the day of dismissal.

How to write an application for the issuance of personal income tax certificate 2 at the Federal Tax Service itself

If your personal account on the tax service website is not available to you, you can contact the Federal Tax Service office directly. But you need to contact the department where your employer is registered. So, check this information first.

Find out the reception time for citizens of the branch you need and visit it, taking your passport with you. You will be given an application form to fill out on site. After this, the certificate will be issued within 3 days; you will need to visit the Federal Tax Service again with your passport.

Important! Keep in mind that organizations submit information about 2-NDFL to the Federal Tax Service once a year before April 1. Therefore, the certificate obtained in this way may be incomplete.

Check the branch address and opening hours in advance

So, we recommend that you apply for 2-NDFL either directly to your employer, or receive the document through your personal account on the Federal Tax Service website. In these cases, the certificate will be complete.

A sample application for 2-NDFL can be found on the Internet. But in fact, it is rarely needed. If you order a certificate through an employer, application forms are provided to employees as standard.

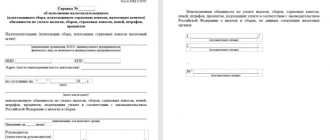

How to make a request for help

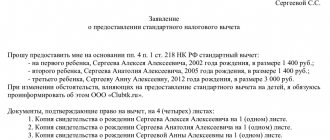

When registering, you can use a unified sample application for the issuance of 2-NDFL, developed in the organization, or draw up a document yourself in any form. A unified application form has not been approved, but it is recommended to adhere to the basic rules of office work and use standard details:

- details of the addressee and applicant. Since this is an internal document, it is allowed to indicate the position of the manager (or chief accountant, since the appeal is submitted to the accounting department), the short name of the company, position, surname, first name, patronymic of the employee. It is not necessary to write addresses and contact numbers;

- the name of the document is written in the center of the appeal;

- in the main part it is enough to indicate “I request you to issue a 2-NDFL certificate for submission to the tax office, bank, credit organization, etc.” without references to regulations;

- Further, it is recommended to express consent to the transfer of personal data, since the employer will use them in the process of working on the form;

- signature and date are mandatory details; without a signature, the document has no legal force; without a date, it is impossible to establish the deadline for fulfilling the obligation to provide information (the employer is given three working days for this, according to Article 62 of the Labor Code of the Russian Federation).

Example of a written application for 2-NDFL from an employee

| Director (or chief accountant) (name of company) from (position) last name, first name, patronymic of the applicant Statement I ask you to provide a 2-NDFL certificate and information on income for ______ year on the basis of Art. 62 Labor Code of the Russian Federation and ch. 23 Tax Code of the Russian Federation. I agree to the transfer of my personal data requested by it to this organization within _______ by any means. Signature, transcript date |

A free sample application for a 2-NDFL certificate from an employee addressed to the manager:

What does the 2-NDFL certificate contain?

This is a document whose type is regulated. That is, no matter where you work, no matter how you order the certificate, it will still have the same appearance.

A 2-NDFL certificate is issued to the employee; it reflects the amount of his salary and how much taxes were withheld from this income. Based on this information, the bank will determine the applicant’s real income level, that is, after tax. Salary, bonuses, vacation pay, sick pay - all this is reflected in certificate 2 of the personal income tax.

The document must include the date of its issue, information about the taxpayer, and his passport details. The following is a table indicating income: each line is a separate calendar month. If the certificate was ordered 6 months in advance, 6 months will be completed accordingly.

Types of income may be different, so the form contains the line Income Code. This will indicate the source of the amount received, for example, it could be a salary, financial assistance to an employee, sick leave payment, etc.

Please check with the bank about the valid validity period of the certificate. Usually this is 14 or 30 days from the date of issue.

What happens if you don’t issue a 2-NDFL certificate?

Tax legislation does not provide for liability for failure to issue a 2-NDFL certificate. But this does not mean that the employer can issue a certificate at its own discretion, or even refuse to provide it to the employee.

Since Article 22 of the Tax Code of the Russian Federation guarantees administrative and judicial protection of the legal rights and interests of all taxpayers, an individual who has been denied a 2-NDFL certificate or has violated the three-day deadline can appeal to the labor inspectorate or court.

This threatens the employer with a warning or the imposition of administrative fines for violating labor laws. For individual entrepreneurs and officials of the organization, this penalty will range from 1 thousand to 5 thousand rubles, and for a legal entity - from 30 thousand to 50 thousand rubles. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Do banks always ask for proof of income?

The only negative aspect of applying for a loan with a 2NDFL certificate is the time required.

But they pay off with the terms of the loan. Not all loans are issued with a certificate of income. If for some reason you cannot document your income, then you can find a simplified loan program.

But keep in mind that programs for which the client does not bring a complete package of documents cannot be profitable, and the amounts issued for them are always small. By issuing money in this way, the lender takes a risk, which is where higher rates arise - this is how the bank covers possible risks of non-repayment.

In fact, by issuing a loan without an income certificate, the bank takes the applicant’s word for it. The client indicates information about his work and salary in the application form, and the bank takes this into account when considering.

If we are talking about a salary client of a bank, he always takes out a loan without 2-personal income tax. Information about his income is already in the financial organization’s database.

Sample application for personal income tax certificate 2

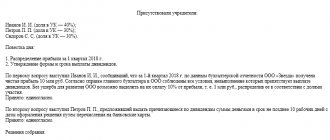

The taxpayer has the right to request a certificate of income for any period he needs, for example for the last 3 months:

But if a document confirming income is needed for a period longer than a calendar year, then the corresponding number of reports is generated for each tax period separately. This nuance must be indicated in the application for the issuance of personal income tax certificate 2 (sample):

You can request a certificate orally from the accounting department at your place of work if you are sure that there will be no problems with issuing the document and the employer will fulfill its obligations within the time limits required by law.

Why is it better to get a loan with 2-personal income tax?

If you have the opportunity to bring this document to apply for a loan, do not ignore it. Only if you have a complete set of documentation can you count on good lending conditions.

The benefits of having a certificate are as follows:

- increased bank loyalty. The level of trust in such clients is definitely higher, so the likelihood of a positive response will also be more serious;

- opportunity to get a decent amount. Without certificates, borrowers receive a maximum of 80,000-100,000 rubles. Without them, you can borrow even 1,000,000 rubles. But here, in any case, everything will depend on the level of solvency of the citizen. They still won’t give out more than he can afford;

- reduced rate. The certificate reduces the bank’s credit risks, so it will set low interest rates under the program.

The only negative aspect of applying for a loan with a 2-NDFL certificate is that the process is more drawn out. You need to order a certificate and wait for it. Review of applications for such loans usually takes 2-3 business days. That is, you won’t get a loan quickly. Without any certificates, you can take it in literally 1 hour.

Many banks allow you to replace 2-NDFL with other forms of income confirmation. This may be a certificate in the form of a bank or obtaining information from the Pension Fund of the Russian Federation, if the client has access to State Services. The second option is generally the most convenient of all methods of confirming the borrower’s income level.

5 / 5 ( 1 voice )

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya