What is a separate division

Companies that have decided to expand their commercial interests may need to conduct activities through new divisions - branches or representative offices (according to Article 55 of the Civil Code of the Russian Federation), for example, in another region of our country.

They will pursue the same goals and perform the same tasks as the parent organization. Also, separate divisions are assigned all the functions of the main company or part of them. This is the position of the Civil Code of the Russian Federation. The position of tax legislation differs from civil law. The Tax Code of the Russian Federation distinguishes both branches and representative offices, and simply separate divisions. According to paragraph 1 of Art. 83 of the Tax Code of the Russian Federation, the company is obliged to register each new division at its location. The concept of a separate division can be found in paragraph 2 of Art. 11 of the Tax Code of the Russian Federation. This is a branch of the company, the actual location of which is different from the main legal address. A separate division can be formed in another region, city or district of an urban district, that is, in another municipal entity. One of the main conditions for recognizing a unit as separate is the presence of at least one stationary workplace in it. In this case, the place must be organized for a period of more than 1 month (Article 11 of the Tax Code of the Russian Federation).

As an example, we can cite such structures that have divisions located in different regions of the country and different districts of the same city, such as:

- retail trade networks;

- banking organizations.

Separate divisions can be different and created for various reasons. At the same time, registration under the Civil Code of the Russian Federation and the Tax Code of the Russian Federation is different. According to the Civil Code of the Russian Federation, only branches or representative offices are registered, and according to the Tax Code of the Russian Federation - any separate division (at the location of the property, at the place of installation of the cash register). For the tax inspectorate, a notification that, for example, a cash register or a real estate property is located on its territory is sufficient. This is necessary to control taxation. If your company decides to register a separate division under the Civil Code of the Russian Federation (as a branch or representative office), get ready for full-scale registration in accordance with all the rules. And here you will need detailed step-by-step instructions for registering a separate division in 2022.

To find out whether it is possible for a “simplified” to have a separate division, read the article “Opening a separate division under the simplified tax system .

Answers to questions about separate divisions:

Question: Is it necessary to register a separate division with the Social Insurance Fund if it does not have a separate balance sheet, its own personal account and accrual of payments to individuals?

Answer: According to clause 2 of Art. 2.3 of Law No. 255-FZ of December 29, 2006, if a separate division does not have its own current account and will not make accruals, then registration of a separate division and registration with the Social Insurance Fund is not required.

Question: I have a desire to open an online store. Logistics and warehouses will be outsourced. I am not the owner of the warehouses; couriers and warehouse workers are not my employees. The sale of goods will take place in Moscow, but for certain reasons I want to register the organization in the Moscow region. There will be no real store or other retail outlet from which the goods will be sold. The receipt for the goods will be issued at the warehouse. Under such conditions, is registration of a separate enterprise necessary?

Answer: In this case, you do not have the main criterion for registering an EP – a stationary workplace. If the check is issued by an outsourcing company, this cannot be considered a sign of the existence of an employment relationship. Under such conditions, a separate enterprise is not required.

Question: Hello. I would like to get some advice. At the moment, an LLC is being created with a general tax regime. Registration of the organization will be carried out at the place of registration of the founder. The main activities of the organization will be carried out in another region with the creation of a separate enterprise. In this regard, several questions have arisen that require clarification:

Should a separate division and organization have separate current accounts?

What deductions will need to be made at the place of registration of the LLC if all employees will be registered in the OP in another region?

What reporting and primary documents will need to be submitted at the place of registration of the LLC if all activities will be carried out only by a separate division?

Answer:

- To carry out the activities of an OP, having your own bank account is not a mandatory factor. All transfers can be made from the organization's current account.

- If the OP has a current account and all payments to employees will be made from it, then registration with the Pension Fund, the Social Insurance Fund and the Federal Tax Service at the place of business is required. According to Art. 431 of the Tax Code of the Russian Federation, all necessary insurance premiums are paid at the location of the OP.

- All reporting and primary documents are prepared at the place of registration of the main office.

Package of documents for registration

So, the company decided to create a separate division. Before registering it, she will need to prepare a package of certain documents.

At this stage, the organization's actions are as follows:

- The decision to create a separate division is made by the enterprise management body - the board of directors, the supervisory board, the meeting of shareholders.

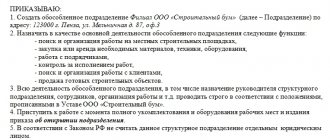

- Based on this decision of the governing body, presented in the form of a protocol, an order is issued to create a unit.

The order must reflect:

- name of the new division;

- the basis for its creation, for example, the minutes of the general meeting of shareholders (number and date);

- location of the unit;

- a manager who is appointed and removed from office by a decision of the management body of the parent enterprise, for example, by a decision of the supervisory board or a general meeting of shareholders;

- within what time the unit must be registered.

An example of an order was prepared by ConsultantPlus experts. If you do not have access to the K+ system, get a trial online access for free.

The document is signed by the head of the parent company.

- Based on the order, an internal local act is developed - the Regulations on a separate division (branch or representative office). It establishes:

- the degree of legal capacity and powers of the new unit;

- activities;

- functions;

- management structure;

- other aspects that relate to the activities and actions of the unit.

- Also, the order is the basis for amending the constituent documents if we are talking about a branch or representative office. They can be formatted as:

- a separate document that is attached to the current charter or constituent agreement, for example, amendment No. 1;

- new edition of the constituent document.

A sample compiled by ConsultantPlus experts will help you prepare the Regulations on a separate division. You can download it by getting free access to the K+ system.

Once the necessary documentation has been collected, we move on to the next stage.

Contents of the order to create a separate unit

Normative acts do not establish a unified form of order. Therefore, the organization develops and approves such a form independently. However, the order to create a separate unit must reflect the following information:

- on the creation of a branch, representative office or other separate division without vesting the rights of a branch (representative office)

- location of the representative office

- goals and objectives

- You can specify the rights and manager. In the latter case, if this is an employee, it is correct to additionally issue an order for employment.

An order to create a separate division is entered into the employer's order register, but may have a special number (for example, as in our example).

Registration of a separate division in 2022: step-by-step instructions

A legal entity is obligated to report the creation of a separate division to the tax office within a month after the decision is made, for example, after the date of the minutes of the general meeting of shareholders. According to paragraph 3 of Art. 83 of the Tax Code of the Russian Federation, a new division of an enterprise must undergo the procedure of tax registration and inclusion in the Unified State Register of Legal Entities.

See also: “The Supreme Court again cancels large fines for failure to register a unit .

Registration of a separate division is carried out by the tax authorities. To do this, the enterprise must contact the tax office that will have jurisdiction over the territorial unit (municipal entity).

To register a branch or representative office, you must submit documents according to the following list to the tax authorities:

- a copy of the decision of the governing body to create a separate division;

- a copy of the approved regulations on the separate division;

- a copy of the constituent documentation and its amendments (as a separate document or as a new edition);

- a copy of the state registration certificate of the main enterprise;

- a copy of the orders on the appointment of the head and chief accountant of the new division;

- a copy of the payment order or bank statement confirming payment of the state registration fee, certified by the seal and signature of the head of the credit institution;

On our website you can use a payment order for payment of state duty “Payment order for payment of state duty - sample” .

- extract from the Unified State Register of Legal Entities for the parent company;

- application for registration of changes in forms P13001 (for changes in the charter) and P13002 (for changes in the Unified State Register of Legal Entities).

All copies must be notarized. If a separate division will conduct its activities in rented premises, then it is necessary to have a copy of the lease agreement for the space. Documents can also be submitted electronically via appropriate communication channels in the form of scans. In this case, they will be certified with an electronic digital signature.

Registration is carried out by the tax authority within 5 days from the date of actual submission of the package of documents or receipt on the server through electronic document management. The corresponding notification serves as a document confirming the registration of the unit.

When registering, a separate unit is not assigned a TIN, but only a reason for registration code (RPC). In its documentation, the division will use the TIN of the parent company. However, it is not an independent legal entity.

ATTENTION! The checkpoint of the division will differ from the code of the parent organization by the 5th and 6th digits: 43 - branch, 44 - representative office, 45 - other OP. How to find out the checkpoint of a separate unit? This information is registered in the Unified State Register of Legal Entities only if the OP is registered as a branch or representative office. There is no information about other OPs in the Unified State Register of Legal Entities. Therefore, you can find out the checkpoint of the unit only in the certificate of registration of the OP.

For other separate divisions, a special package of documents is not required. In this case, it is enough to submit a message to the tax authority in form S-09-3-1, approved. by order of the Federal Tax Service dated 09/04/2020 No. ED [email protected]

Let's look at the procedure for filling out the document in more detail.

Notification of the opening of a separate division in the Federal Tax Service

The creation, any changes in previously provided information, or the closure of divisions must be reported to the regulatory authorities. Where to submit a message about opening a separate division? If this is not a branch or representative office, the company must report the creation of a division to the tax office at the location of the organization (not the OP). There is no additional need to report the creation of new branches or representative offices, since information about them must be indicated in the Unified State Register of Legal Entities. A message to the Federal Tax Service about the opening of a separate division must be sent no later than 1 month.

For such a case, there is an approved message form C-09-3-1. The form of notification of the creation of a separate division was approved by order of the Federal Tax Service of Russia No. ММВ-7-6/362 dated June 9, 2011.

Application for registration of another separate division in form S-09-3-1

The application itself is a one-page form. The company should not have any difficulties filling it out.

The application shall indicate:

- TIN/KPP of the parent company;

- its full name;

- tax office code;

- OGRN of the parent enterprise;

- number of new units;

- Full name of the head of the company, his Taxpayer Identification Number;

- contact information (phone number, email address);

- round seal of the company.

The current application form form S-09-3-1 can be downloaded for free by clicking on the picture below:

ConsultantPlus experts explained how to fill out a message about creating an OP step by step. Sign up for trial access to K+ and go to the Ready Solution. It's free.

If the application is submitted not personally by the manager, but by a representative, then his data is filled out in the document. At the same time, his powers must be documented. Typically, a standard power of attorney form is used for these purposes.

The application is submitted in 2 copies. You can also provide a copy of the application as a second copy. This is necessary to mark on it the date of acceptance by the tax inspector.

Form C-09-3-1 for creating a separate division

A separate division of the organization is opened at the location of the company's permanent workplace. When opening in another city or place other than the place of registration of the LLC, the organization has the right to open an OP.

How to fill out form C-09-3-1 when opening a separate division.

The new form S-09-3-1 is valid starting from December 25, 2022, approved by Order of the Federal Tax Service of Russia dated September 4, 2020 No. ED-7-14/ [email protected]

When filling out form S-09-3-1, on the Title Page we fill in the TIN and KPP of the organization.

Tax authority code We indicate the code of the tax office where your company is currently registered.

Then fill in the full name of the organization, for example Limited Liability Company “Business Assistant”.

We fill in the OGRN of the company and the number of OP at the moment. If you don’t have open OPs right now, put dashes.

Select number 1 when opening a separate division or number 2 when changing information about the OP,

This message is compiled on 2 sheets, with an attachment (we indicate the number of attached documents).

Below we indicate the signatory of the application. If this is a manager, put the number 1, write his full name, tax identification number, contact phone number and date.

For a sample of filling out the title page about opening an OP, see below:

On the second page, in the Information section, fill in the TIN and KPP of the organization.

If we make changes about the OP, we indicate what is changing (address, name, or all together). When making changes, we indicate the code of the separate division, which is indicated in the Notification of registration of the separate division.

If the name and address change, fill in the new name and new address below. We indicate the address in accordance with FIAS.

If you are creating an OP, immediately write the name of a separate subdivision if available, for example, OP Balashikhinskoe.

We fill in the OP address in accordance with FIAS and your lease agreement.

At the very bottom, in the column “Accuracy and completeness of the specified information,” we confirm that we write the date and signature.

PROMOTION: COMPLETING FORM S-09-3-1, INCLUDING WITH A COMPLEX ADDRESS - 500 rubles.

To order, write to WhatsApp or Telegram, or call +7-925-589-44-20 or email

How to fill out form C-09-3-1 when changing address or name?

If the name of a separate division or the address of a separate division is changed, the Company is obliged to make these changes to the Federal Tax Service within three days. When filling out form C-09-3-1, the first sheet is filled out in the same way as when created. An example of filling out the title page is located above.

In the second sheet containing information about the address or name, fill in:

1 - when the address of a separate subdivision changes;

2 - when changing the name of a separate division;

3 - when changing the address and name of a separate division;

in column KPP3 we write the checkpoint of your separate unit, indicated in the notification of the opening of a separate unit.

Date of creation (changes) indicate the date of these changes. Don't forget about the 3-day period so as not to get fined.

If the name changes, fill in the new name of the OP; if the address of a separate division changes, fill in the new address in accordance with FIAS.

Below is a sample of filling out the Information when changing data about a separate division:

What documents are needed when creating a separate division?

1) Form C-09-3-1 dated September 4, 2020;

2) Documents confirming the authority of the signatory;

If signed by the General Director - the Order on the appointment of the General Director, if the person is under a power of attorney - a copy of the power of attorney.

3) A copy of the lease agreement to the address of the separate subdivision;

The above documents are submitted to the tax office at the location of the parent organization.

The Order on the creation of a separate division is drawn up with internal documents. There is no need to submit it to the tax office.

What are the deadlines for notifying about the creation and change of data on a separate division?

1) When creating a separate division, you must notify the tax office within 1 month from the date of the Order on the creation of the OP; 2) If there are changes in the information about the OP - within 3 days;

The separate division is registered within 5 days, after which you are given a Notification of tax registration of the separate division.

How can I submit documents on creating and changing data on a separate division?

1) If there is an electronic signature via electronic communication channels;

How to submit Form S-09-3-1 electronically: The form can be signed and sent electronically using accounting services: SBIS, Kontur, etc.

Or you can sign it using the CryptoArm and send it to the Federal Tax Service through the Other appeals service.

2) On purpose to the Federal Tax Service in 2 copies. A mark indicating acceptance of the documents is placed on your copy;

3) By mail by a valuable letter with an inventory of the contents;

the new form C-09-3-1 from 2022 in Excel (excel) can be found to the right of the article by clicking on the link Download materials for the article.

The new form C-09-3-1 in Excel 2022 can be downloaded for 100 rubles by clicking on the link.

Filling out C-09-3-1 using UK Business Assistant

If you need to open a separate division or make changes to a separate division in 2022, but do not have time to understand all the intricacies, you can entrust this work to the specialists of Law Firm Business Assistant.

PROMOTION: COMPLETING FORM S-09-3-1, INCLUDING WITH A COMPLEX ADDRESS - 500 rubles.

To order, write by email or WhatsApp, or call or email

When working, we enter into an agreement for the provision of legal services; payment can be made in cash or by bank transfer.

Reviews about the company YK Business Assistant can be found in Yandex on our organization’s page. If necessary, you can visit our office, located in the very center of Moscow.

Accounting in branches and representative offices

A separate division carries out activities in accordance with the goals and objectives of the parent company. Functions, types of activities, level of legal capacity and powers are determined by the parent organization and are enshrined in the regulations on the separate division. Including accounting, accounting is possible in two options.

- Option 1: the division does not have its own balance sheet.

In this case, the branch does not have its own accounting department and current account. All settlements with contractors, including payroll personnel, are carried out by the head office accounting department. In this case, the division has the right to issue, for example, shipping documents, but they will be accepted for accounting in the head accounting department.

- Option 2: the division is on an independent balance sheet.

This option involves creating an accounting service and maintaining records within the department. It has a current account with a credit institution and can carry out settlements with counterparties independently. Data from the financial statements of the division are taken into account in the general summary of the enterprise. A separate division carries out accounting according to the rules of the accounting policy of the parent company.

You will learn how to correctly draw up an accounting policy for your company from our material “How to draw up an organization’s accounting policy?” .

Closing a separate division in 2022: step-by-step instructions

The procedure for closing a branch or representative office differs from closing another separate division. According to sub. 3.1 clause 2 art. 23 of the Tax Code of the Russian Federation, an enterprise is obliged to notify the tax authority of the closure of a branch, representative office or other separate division within 3 days from the date of termination of activity.

The procedure for closing a branch and representative office is similar to the procedure for opening it. Such separate divisions are removed from tax registration with a full package of documents: a certified copy of the administrative document on the closure of the division (for example, minutes of a meeting of the board of directors), changes to the charter and the Unified State Register of Legal Entities, an application in form P13002.

To close another separate division, it is enough to submit an application to the tax authority in form C-09-3-2, approved. by order of the Federal Tax Service dated 09/04/2020 No. ED [email protected]

The current application form form S-09-3-2 can be downloaded for free by clicking on the picture below:

The application states as before:

- TIN and KPP of the parent organization;

- full name;

- tax authority code;

- OGRN of the parent organization;

- number of closing units;

- Full name of the head of the enterprise, his personal tax identification number;

- contact information (phone number, email address);

- company seal.

You can see a sample of filling out an application for closing an OP in the K+ system, having received free access to the system.

At the same time, applications for registration and deregistration of a unit are almost identical. The only difference is in the title of the document itself. The application is also drawn up in 2 copies. You can provide the original document and a copy of it, on which a tax inspector will mark acceptance.

If the closed enterprise was responsible for the centralized payment of income tax, then in addition to the above documents, notifications in Forms 1 and 2 should be sent to the Federal Tax Service.

See here for details.

When a manager issues an order to create a separate unit

The Civil Code calls only representative offices and branches separate divisions of a legal entity. And the Tax Code is any division territorially isolated from the organization where the workplace is equipped.

To create a branch or representative office, an organization must make changes to the Charter. And to create another division, it is enough to fill out and submit to the tax office a message on form C-09-3-1. Well, the manager issues an order to create a separate division before contacting the tax authority.

Any separate division has its own characteristics. They are created only by a legal entity - an organization. The unit must be located outside the location of the legal entity. And on the basis of such a unit a workplace is created (for at least 1 month). Are there all the signs? Within a month after the actual creation (and this is the date of hiring the first employee), the organization is obliged to report this fact to the tax office. And an internal order to create a separate division is issued with the correct organization of management activities.

Results

A separate division is not an independent legal entity. The decision to create a new division is made by the enterprise management body. After this, the company must contact the tax authority at the location of the unit and provide the necessary package of documents within a month after the decision is made (for a branch or representative office). To register another separate division under tax legislation, it is enough to notify the tax office in the form of an application.

After registration, the division receives its own checkpoint, and the TIN applies to the parent organization.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.