Setting up the inventory accounting method

Correct closure of cost accounts begins with filling out the organization's accounting policies. Let us remind you that the “accounting” in the program is created annually, and along with it you must fill out the directory “List of direct expenses”

.

The first thing we indicate in the accounting policy is the method of assessing inventories. The functionality of the program allows you to choose between two options.

Option 1. Average rating method.

In this case, the cost of an inventory accounting unit is calculated as follows: the total cost of the type of inventory is divided by their quantity, taking into account the balance at the beginning of the period.

Option 2. FIFO method.

This is when the inventory items that were registered first are removed from the register.

Next, you can specify what the organization does:

- “Product Production”

checkbox is for organizations that are engaged in production. - “Performance of work, provision of services to customers”

checkbox is for those who provide services.

If we are talking about a trading company that does not produce anything, we do not tick the box. This means that the program does not use count 20 in this case.

Scheme for writing off general business expenses to the cost of production (main production)

So, general business expenses for the main production have been written off - what entries need to be made in accounting?

Example

Energy Plus LLC produces two types of products:

- Capacitors (devices for storing charge and electric field energy);

- Transistors (electrical signal converters).

Since the beginning of the year, the accounting policy of Energia Plus LLC has established the procedure for writing off general business expenses by calculation items (types of products). The distribution base is the wages of production workers.

For January, the amount of general business expenses amounted to 774,023 rubles. How Energy Plus distributed expenses is shown in the table:

| Index | By product type | Total | |

| capacitors | transistors | ||

| Salaries of main production workers (including insurance premiums) for January, rub. | 2 027 133 | 2 759 426 | 4 786 559 |

| Share of workers' wages | 42,35% (2 027 133 / 4 786 559 × 100%) | 57,65% (2 759 426 / 4 786 559 × 100%) | 100% |

| Calculation of the amount of general business expenses attributable to each type of product, rub. | 327 798,74 (774 023 × 42,35%) | 446 224,26 (774 023 × 57,65%) | 774 023 |

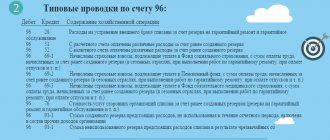

In the accounting of Energy Plus LLC, the following entries were made to write off general business expenses:

According to the working chart of accounts of Energia Plus LLC, according to account 20, analytical accounting has been organized for subaccounts 20.1 “Production of capacitors” and 20.2 “Production of transistors”.

Such postings were used to write off general business expenses for the cost of production in the accounting of Energia Plus LLC in January. General business expenses will be distributed and written off throughout the year in a similar manner.

General business expenses also include entertainment expenses.

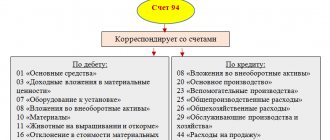

Collecting production costs

Direct

company expenses that can be attributed to a specific type of product are reflected on accounts 20 and 23.

Indirect

costs - those that relate to the production of several types of products at once - on accounts 25 and 26.

The division is not formal! From the program chart of accounts we see that direct expense accounts have a subaccount “Nomenclature group”

. Therefore, these expenses can be written off for a specific product group directly into the cost of production.

Indirect cost accounts do not have the necessary sub-account and, therefore, cannot be closed directly into the cost of a specific product.

Closing account 20 for services

If you checked the box next to “Perform work, provide services to customers”

, you need to choose exactly how expenses are written off from the account on January 20 when closing the month.

To do this, a special field will appear on the tab. See table 1 for possible options. Please note: this setting applies only to services. Table 1. Write-off of costs for services at the end of the month

| Write-off method | What is |

| Excluding revenue | All costs accumulated on account 20.01 are written off by a routine operation when closing the month in Dt 90.02.1 “Cost of sales for activities with the main tax system” , regardless of whether there was revenue or not |

| Taking into account all revenue | This method is the complete opposite of the previous one. Namely: if at the end of the month there is revenue for a specific product group, the account will be closed on January 20. Otherwise, if there was no revenue, it will not close. If, at the end of the month, you need to reflect work in progress for a closed item group, post the document "WIP Inventory" . Indicate in it a specific item group that should not be closed to the cost account 90.02.1 |

| Including revenue from production services only | Only the amount of revenue that was recorded in the “Rendering of Services” . If you posted the document “Sales of goods and services” , the program will ignore the corresponding revenue for calculating write-off of costs |

We determine general business expenses

Check the box “Product release”

?

Then configure the field “Base of distribution of indirect costs”

. Table 2 will tell you which basis to choose for the distribution of indirect costs.

The program also provides the ability to set special distribution rules for certain costs.

And keep in mind: starting from 2022, we will use the only method of accounting for general business expenses - the method of incomplete (reduced) production costs (“direct costing”). The full production cost method (“absorption costing”) is no longer used, since FSBU 5/2019 “Inventories” came into effect from 01/01/2021. That is, previously it was possible to attribute administrative expenses to the actual cost of finished products. Now such schemes are prohibited.

Accordingly, in the 1C: Accounting 8 program, starting from 2022, only one option for accounting for general business expenses is possible - the “direct costing” method (used by default). The switch “General business expenses are included” in the “Accounting policy” form is hidden from 2021.

Account 26 in accounting is closed to account 90.08.1 if at least one of the checkboxes is checked in the “Accounting Policy” form - “Product output”

or

“Performance of work, provision of services to customers

.

In tax accounting, in this case, the costs recorded on account 26 are always classified as indirect. Account 26 in accounting is closed to account 90.02.1, provided that in the “Accounting Policy” form both boxes are cleared: “Product output”

and

“Performance of work, provision of services to customers

.

This option is for organizations whose activities are not related to the production process (commission agents, agents, brokers, dealers, etc., with the exception of traders) and which record all costs in account 26. Table 2. Indirect costs distribution base

| Possible base | How to close account 25 to account 20 |

| Issue volume | If the database contains the document “Production report for the shift” . Moreover, we see not only the cost, but also the quantity of products produced |

| Planned cost | If there is a document “Production report for the shift”. Moreover, with this method, unlike the previous one, we see only the amount of products produced |

| Salary | Proportional to wages by cost items in NU - wages |

| Material costs | Proportional to material costs according to cost items in NU - material costs |

| Revenue | There must be revenue, that is, sales documents or an act of provision of services |

| Direct costs | The base is the turnover of account 20, without selection by cost items |

| Individual cost items | The base is the turnover on account 20, with selection according to the specified list of cost items in the “list of cost items” field |

| Not distributed | Nothing closes automatically. You have to close it manually. The method is used in rare cases when standard closure is not suitable for the organization, none of the above options |

Write-off of inventory items for expenses in 1C

This operation is carried out by generating a document in the section “Domestic consumption of goods/Write-off as expenses”. It is this that reflects the purposes of internal consumption of goods and materials (gifts, promotional items, cartridges, stationery, etc.). With the help of this document, operations related to the formation of additional expenses, which will subsequently be included in the initial cost of fixed assets, are also performed.

In order to create a new document, you need to select “Internal documents (all)” in the “Warehouse and Delivery” subsystem and click “Create”. In the drop-down list of commands, select “Domestic consumption of goods”, and then “Write off as expenses”.

Let us repeat that in other configurations of the 1C program, a similar document is the “Request invoice”.

The expense item in this document, in contrast to writing off shortages, is indicated line by line. In addition, here you can clarify to which account the inventory items will be written off.

In other respects, this document is similar to the product write-off document, but they also have some differences. So, for example, there is a certain limitation on the use of a write-off document for the purposes of forming the value of fixed assets, for production needs, etc.

It is worth remembering that you can write off defective goods with subsequent disposal or lost only by filling out the “Write-off of shortages of goods”.

In other cases, inventory items are written off using a separate document “Domestic consumption of goods/Write-off as expenses.”

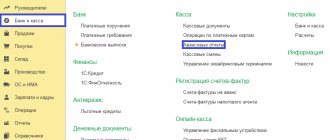

Secrets of the list of direct expenses

To ensure that the program correctly closes accounts 20 and 23, correctly fills out the Income Tax Declaration and correctly calculates income tax, set up a list of direct expenses every year (section “Main”

— Link

“Taxes and reports”

- tab

“Income tax”

- blue link

“List of direct expenses”

).

To add an entry to the list, click on the “Create” button. In the card, select the validity period, organization, type of tax accounting expenses, debit account. For greater detail, indicate the cost item in accounting.

Those expenses that are not included in the list become indirect for the program and, at the end of the month, are written off in tax accounting to account 90.08.

What to do if accounts are not closed

It happens that the month closed well, but when analyzing the balance sheet, we see that the accounts were not closed completely or were not closed at all. Then analyze:

- Postings in the routine operation “Closing accounts: 20, 23, 25, 26”.

Your task is to find to which account accounts 20 and 23 were closed. If on 90.08, then most likely there are not enough entries in the list of direct expenses - check them. - Report “Analysis of subconto.

Look at which item group and cost item did not fully/partially close account 20/23 to account 90.02. Possible reasons: work in progress, lack of entries in the directory of direct expenses, or lack of revenue for the item group.

After analyzing and changing the documents, close the month again.

It happens that the program displays errors indicating where the problem is and how to fix it. Then correct the errors by following the recommendations. Afterwards, re-close the month.

Let's look at how to set up cost items in 1C

In order to open the directory, you need to go to the menu: Directories - then to the Income and Expenses section - then select the cost item link. This will open a directory window. If you have any difficulties working with the program or you need to get a 1C consultation in Moscow, contact our specialists by phone, and also leave applications on our website. We will contact you as soon as possible.

The directory is hierarchical. For convenience, if there are a large number of articles, you can create groups, group articles according to various criteria, by organizations (if records are kept for several organizations in one information base). In addition, directory groups can include other groups, thereby creating a multi-level hierarchical structure.

Fig. 2 Directory “Income and Expenses”

Fig.3 Directory groups

In the new information bases, the directory is filled with default values (predefined elements) for the most common types of costs:

- Depreciation bonus

- Salary

- Salary (UTII)

- Other costs

- Write-off of materials

- VAT write-off

- Write-off of VAT (UTII)

- Commission agent services

They can be distinguished from articles entered by the user by the icon. It is not recommended to correct or delete them.

Depending on the needs and specifics of the enterprise, users can independently add cost items to the directory (create a cost item in 1C), or they can turn to professionals as part of a comprehensive 1C service.

In case of independent work, we recommend that you pay attention that you do not need to enter similar names, as this can lead to incorrect analytics in accounting and “bloat” of the directory. The cost structure of the enterprise should be thought out in advance, if possible combining small similar expenses into larger groups. It is recommended that they be entered into the reference book exactly in the structure in which they are used in reports for economists and managers. Costs are classified based on the purposes for which the cost is calculated.

This work may require the participation of an analyst and a reference specialist. By resorting to comprehensive 1C maintenance services at the stage of program implementation or later - during its configuration, you are guaranteed to receive a completely ready-to-use program with settings that fully take into account the specifics of your enterprise.