What is included in warehouse documents?

The organization of warehouse accounting at an enterprise is aimed at achieving specific goals.

This is ensuring the safety of material assets and generating reliable and complete information about the availability and movement of material assets. Here's what applies to warehouse documents:

- invoices;

- statements;

- acts;

- inventories;

- magazines;

- other documents that help keep records of materials at all stages of movement and allow you to control the movement of assets in warehouses from the moment of their receipt until their actual disposal, use or write-off.

One of the most common forms is the TORG-12 invoice.

Relocation of goods and materials

We have two types of documents available to us: “Demand-invoice” and “Movement of goods”. What is the difference? “Goods transfer” is used to move inventory (goods, materials, finished products and equipment) from one sending warehouse to another receiving warehouse.

The document is intended to reflect the movement of goods, materials, finished products and equipment between warehouses.

The document can be entered based on the document Receipt (act, invoice).

When entering a document, you must indicate the following details in the header:

- Sending warehouse - the warehouse from which goods, materials or products are transferred.

- Receiving warehouse - a warehouse to which goods, materials or products are received.

To reflect the movement of goods, materials or finished products, you must fill out the Goods .

On the Products , the item, quantity, and item accounting accounts are indicated.

- Sender's Account, Recipient's Account - are filled in automatically when specifying an item based on the Item Account register.

To reflect the movement of consignment goods, you must fill out the Items on consignment .

On the Products on commission , the item, quantity, and item accounting accounts are indicated.

- Sender's Account, Recipient's Account - are filled in automatically when specifying an item based on the Item Account register.

To reflect the movement of containers, you must fill out the Containers .

On the Containers , the item, quantity, and item accounting accounts are indicated.

- Sender's Account, Recipient's Account - are filled in automatically when specifying an item based on the Item Account register.

To reflect the movement of equipment, you must fill out the Products .

On the Products , the item, quantity, and item accounting accounts are indicated.

- Sender's Account, Recipient's Account - are filled in automatically when specifying an item based on the Item Account register.

To reflect the movement of goods from a wholesale warehouse (from a warehouse with the "Wholesale" type) to an automated point of sale (to a warehouse with the "Retail" type), you must fill out the Products .

On the Products , the item, quantity and account of the sender (the account of the goods in the wholesale warehouse) are indicated.

- The Sender Account field is filled in automatically when specifying an item based on the Item Account information register.

- The recipient's account cannot be changed.

The price from the Item Prices information register is taken as the selling price to reflect the product at retail.

To reflect the movement of goods from a wholesale warehouse (from a warehouse with the "Wholesale" type) to a manual outlet (to a warehouse with the "Manual outlet" type), you must fill out the Products .

On the Products , the nomenclature, quantity and account of the sender (the account of the goods in the wholesale warehouse) and the price of the goods at retail are indicated.

- Sender Account - filled in automatically when specifying an item based on the Item Account register.

- The price is filled in automatically when specifying an item based on the Item Price register.

- The recipient's account cannot be changed.

The price from the document is taken as the selling price to reflect the product at retail.

To reflect the return of goods to a wholesale warehouse (to a warehouse with the "Wholesale" type) from an automated point of sale (from a warehouse with the "Retail" type), you must fill out the Products .

On the Products , the item, quantity and accounting account of the recipient (account for accounting of goods in a wholesale warehouse) are indicated.

- The Recipient Account field is filled in automatically when specifying an item based on the Item Account register.

- The sender's account cannot be changed.

The valuation of a product for reflection in a wholesale warehouse is determined as the difference between the selling price and the trade margin for this product.

To reflect the return of goods to a wholesale warehouse (to a warehouse with the "Wholesale" type) from a manual retail outlet (from a warehouse with the "Manual retail outlet" type), you must fill out the Products .

On the Products , you can indicate the product nomenclature, quantity, and the recipient's accounting account (goods accounting account in the wholesale warehouse) and the retail price of the goods.

- The recipient's account is filled in automatically when an item is specified based on the Item Account register.

- The price is filled in automatically when specifying the item. The data is filled in based on the information register Item Prices.

- The recipient's account cannot be changed.

The valuation of goods for reflection in a wholesale warehouse is determined as the difference between the selling price and the trade margin.

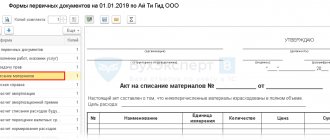

The following printed forms are provided for the document Movement of Goods

- Movement of goods

- TORG-13 (Invoice for internal movement)

How to organize accounting

Step 1. Organize a warehouse. This is especially important if the institution has a large number of inventory items for accounting and storage.

Step 2. Appoint a responsible employee or even several persons authorized to conduct warehouse business.

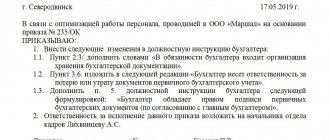

Step 3. Approve the list of warehouse documents that will be used in the company. NPOs and business representatives have the right to develop their own forms and forms. All templates should be fixed in the accounting policy. State employees should be guided by the provisions of Order of the Ministry of Finance No. 52n.

Document flow in the warehouse

Let's present warehouse document flow for dummies in the form of a table with explanations for each form. All unified forms can be downloaded for use. It is not necessary to use the forms; the organization has the right to develop its own templates. Here is a list of the main warehouse documents:

| Stage of inventory accounting in warehouses | Samples of warehouse documents | Recommendations for filling |

| Admission | TORG-12 | Filled out when purchasing material assets from a supplier. They are invoices containing detailed information about incoming goods and materials. Since the documents come from external sources, the supplier (seller, transferring party) is responsible for filling out the forms. |

| M-15 | ||

| M-4 | The receipt order is filled out by the person responsible for maintaining warehouse records. It is possible to refuse to fill out the M-4, replacing the form with a special stamp. A receipt stamp is affixed to invoices. The structure of the stamp must include all the mandatory M-4 details. | |

| TORG-2 | This is an act of discrepancy. It is required to be drawn up if the actual volume, characteristics or quality of the delivery differs from the stated items in the invoice. | |

| Sales receipt or invoice | Used when purchasing goods and materials through accountable persons. As of July 1, 2019, the reporting rules have changed. Now it is impossible to accept materials only using an invoice or sales receipt. A fiscal receipt is required. | |

| Certificates, acts, statements and other forms Sample warehouse certificate | Used for other methods of receipt of goods and materials. For example, in case of a gratuitous transfer, you will have to prepare an acceptance certificate. Or use another document provided for in the accounting policy. For example, a warehouse certificate of balances in free form will be required when reconciling balances with accounting. | |

| Actual accounting | Party card MX-10 | It is used provided that the organization carries out a batch method of accounting for inventory items. That is, each batch of goods is stored separately. A batch card is created for each delivery. A batch is homogeneous goods, valuables, materials that arrived at the institution using one primary document. The party card form is developed by the company independently. |

| Material accounting card M-17 | This accounting method is called varietal accounting. A card is issued for each inventory item. In this case, accounting is carried out by types of materials, grades, names. Moreover, regardless of the date and volume of delivery. | |

| Internal movement | M-11 | A demand invoice is issued when it is necessary to transfer goods and materials from one financially responsible person to another. For example, when transferring materials between warehouses or structural divisions of an institution. M-11 is filled out by the responsible employee of the sending party. 2 copies are made. The first is stored at the place of disposal of the asset, the second - at the place of registration upon receipt. |

| Inventory | Inventory order (INV-22) | A local administrative act is the basis for carrying out control measures. The order should indicate:

All interested parties must be familiar with the completed order. |

| Inventory list (INV-3) | This is the actual availability of assets and inventory items in the enterprise's warehouse. That is, the authorized commission records data in the inventory in accordance with actual indicators and volumes of inventory items. Inventory can be carried out only in the presence of financially responsible persons (Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49). | |

| Collation statement (INV-19) | One of the designated statements is filled out if there are discrepancies between actual and accounting data. If accounting and warehouse accounting do not coincide, then the discrepancy is recorded in the document. Specify which document will be used in your work in your accounting policy. | |

| Statement of results identified by inventory (INV-26) | ||

| Storage | MX-1 | When receiving materials for storage, the responsible person fills out an acceptance certificate for goods and materials according to form MX-1. It records information about assets transferred for safekeeping to the warehouse. |

| MX-2 | Upon expiration of the storage period or at the request of the transferring party, MOL returns the goods. An act of return of goods and materials is drawn up in form MX-2. | |

| Disposal | Limit fence card (M-8) | It is used when writing off materials for production or for transferring assets to third parties. It is started only for one item and for one reporting month. At the end of the reporting period, it is transferred to the accounting department. |

| Invoice for outsourcing of materials (M-15) | Filled in when goods or materials are released externally. Rarely used, in most cases the M-15 form is used. | |

| Request-invoice (M-11) | Issued once. That is, one release of goods and materials - one document. Prepare two copies for each side at once. | |

| Packing list (TORG-12) | Used when selling goods. If goods are shipped to customers through transport companies, then a consignment note should also be issued. |

Control of negative balances

Please note that in our example, according to the “Diesel fuel” nomenclature, there is a negative balance of 2,000 liters. Thus, we shipped goods that were not actually present in any of the company’s warehouses - the receipt of items from the supplier was not reflected in the program.

In order to eliminate erroneous moments, the “Control of negative balances” option is used for automated accounting by scalds. To create it, go to the “Warehouse” – “Reports” section.

Next, set the reporting period and turn to the “Generate” option.

When the control of negative balances is turned off, this allows you to quickly and effectively track the reflections and receipts in the accounting of material reports of responsible persons, as well as eliminate misgrading. Otherwise, the 1C program will not allow you to post the relevant documents

If, in addition to difficulties in setting up and maintaining warehouse accounting, you encounter other issues, contact our specialists.

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Invoices in warehouse accounting

Despite the variety of accounting and primary accounting forms, the warehouse invoice is the main document. The form is used to reflect the receipt of assets at the warehouse and to register the disposal of inventory items during sale or to third parties.

The preparation of invoices is carried out by the party that transfers the goods: the seller or supplier. For example, when purchasing a product, a company receives a ready-made TORG-12 form. Based on this document, the shipment of goods is recorded in the organization's warehouse records.

Already when selling an asset, for example, when selling its own products, the company independently fills out TORG-12, since the company itself acts as a seller. All necessary information about the parties to the transaction is filled in (buyer, seller and transport company, if necessary). Then detailed information about inventory items is recorded.

What's next?

After the lease agreement is signed, it is necessary to begin arranging the premises. But before that, it is important to carefully read the contract and check with the owner who will pay for utilities. We previously wrote that this particular issue becomes a stumbling block in rental issues. You should be more careful here.

However, let’s assume that all the ambiguous aspects of cooperation have been resolved, and now you need to organize the direct work of the warehouse. Depending on how adapted the room is to this, the order of further actions will depend.

There are quite a large number of offers on the market where ready-made warehouses with racks, pallets, forklift services, jacks, etc. are rented. If this is not your case, then you will have to rent equipment and furniture (the Internet will help), and this is an additional expense. In any case, this makes it possible to organize the space exactly as you wish. At this stage you will need to do at least a few things:

- Agree with workers to perform “rough” work (arrange shelving, make partitions, clean the area, etc.);

- Next, you need to negotiate with a transport company that will transport most of the products to the warehouse;

- Find people from among warehouse workers (preferably with good work experience), estimate what the number of personnel should be;

- If you have your own freight transport, you will need a driver and a forwarder;

- Get specialized software. It should be inexpensive.

The diagram shows the well-functioning work of warehouse personnel

Inventory sheets

Control over the safety of valuables and material assets is the key goal of warehouse accounting. To achieve this goal, a special procedure is provided - inventory. In essence, inventory checks are a reconciliation of the actual availability of inventory items with accounting data.

There are several reasons for conducting an inventory:

- Before preparing annual financial statements.

- When changing the financially responsible person.

- If facts of asset theft are detected.

- When transferring assets for rent or safekeeping.

- Upon liquidation of an economic entity.

- In case of natural disasters, fires, floods.

If discrepancies are identified, a warehouse inventory list is drawn up.

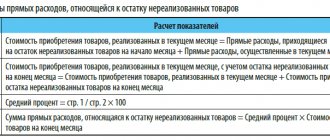

Write-offs of inventory items for production costs

To reflect write-off operations for production costs of materials owned or received for processing, the document “Requirement-invoice” is intended. The document can be entered based on the documents: Receipt (act, invoice), Production report for the shift, Provision of production services, Sales of processing services.

The document supports two data entry modes:

- To reflect standard production operations, the Cost Accounts checkbox is selected on the “Materials” tab in the document header.

- To write off inventories for expenses not related to production (distribution costs, other expenses), the Cost Accounts checkbox on the “Materials” tab in the document header is not selected. In this case, you must fill out the Cost Account .

To reflect the write-off of your own materials as production costs, you need to fill out the Materials tab. When reflecting standard production operations, the Cost Accounts checkbox must be checked on the “Materials” tab in the document header. In this case, the tab indicates:

- Cost account - an account for recording expenses for writing off materials.

- Cost division is a production division of an organization to whose expenses materials are written off.

- Nomenclature group is a type of output for the production costs of which materials are written off.

- Cost item is an item for accounting for expenses related to write-off of materials.

- The fields Cost Account , Cost Division , Nomenclature Group , Cost Items can be filled in automatically based on the documents Shift Production Report, Provision of Production Services, Sales of Processing Services.

, the Expenses (EC) field indicates the procedure for reflecting expenses in tax accounting.

To reflect the write-off of customer materials as production costs, you need to fill out the Customer Materials tab. This tab indicates:

- Accounting account— account for accounting of customer materials in the warehouse. The field can be filled in automatically based on the document Receipt (act, invoice) with the operation For processing . In the Accounting account , you must indicate account 003.01 “Materials in warehouse” or its subaccount.

- Transfer account - an account for accounting for customer materials written off for production. In the Transfer Account , you must indicate account 003.02 “Materials transferred to production” or its subaccount.

For tax accounting (income tax), the operation of writing off customer materials for production is not reflected, because it does not affect the recognition of income and expenses.

The following printed forms are provided for the document Request-invoice

- M - 11

- Request-invoice

Based on the document Shift Production Report, you can enter the following document:

- Sales of processing services

We'll write it off as expenses.

- Date: 01/29/2015

- Item: Printer paper

- Quantity: 1

- Account: 10.01

- Cost account: 26

- Division: Administration

- Cost item: Write-off of materials

Securities in warehouse accounting

You can ensure the safety of inventory items not only in your own warehouse. Often, organizations transfer assets to third-party retail warehouses for safekeeping. When completing a transaction, the receiving party, that is, the trading warehouse, must complete the appropriate documentation. In your question, you should be guided by Article 912 of the Civil Code of the Russian Federation; it will tell you which warehouse documents are securities.

A commercial warehouse, accepting goods and materials for safekeeping, undertakes to issue:

- Warehouse receipt.

- Simple warehouse receipt.

- Double warehouse receipt.

A simple and double warehouse receipt is recognized as securities, since these documents act as collateral documentation. That is, the goods during the storage period are pledged by pledging the relevant certificate. But a unified receipt is not a security.

About work control

"Trust but check"

– the only correct approach to working with warehouse personnel. This does not mean at all that you need to come to the warehouse every day, sit somewhere in the corner and vigilantly watch how others do their work. It is quite enough to periodically log into 1C via the Internet and observe how many products are left in the warehouse, what shipments are taking place, how soon the storekeepers “release” arriving cars, etc. The current development of programs allows you to do this not even from the workplace, but, for example, from a phone, laptop or tablet. The “Rent 1C” service largely favors this.