Why do you need an application to the Federal Tax Service for the return of state duty to the tax office?

In accordance with the provisions of Art.

333.40 of the Tax Code of the Russian Federation, an individual or legal entity that has paid state duty to the Federal Tax Service has the right to return it or offset it (against subsequent similar payments). The return procedure is possible if:

- the duty has been paid in a larger amount than required;

- legally significant actions for which the fee was paid have not been carried out;

- the person who paid the fee did not actually contact the state authorities;

- a fee has been paid for a passport or refugee document, but its issuance to the applicant has been refused;

- the applicant withdrew the application for state registration of intellectual property items in the manner regulated by clause 1 of Art. 330.30 Tax Code of the Russian Federation;

- the court terminated the administrative proceedings or left the administrative claim without consideration.

The fee is not refundable if it is paid:

- for unclaimed services of civil registry offices;

- Rosreestr services, but the agency refused to register the property.

Is it possible to refund the state duty from the tax office?

The paid fee can be refunded in full or in part. The Tax Code provides for this opportunity for persons who:

- made a payment in an amount exceeding the limit specified by law;

- filed a complaint or application documentation with the judicial authorities or notaries, but were denied services;

- were notified of the termination of proceedings in their case;

- entered into a settlement agreement until the verdict was accepted and announced by the judicial authority (half of the paid amount is subject to reimbursement).

Payment of state duty to the tax office is carried out upon opening and closing a business (individual entrepreneur or in the form of a legal entity), providing individual information and extracts. If after making a payment a person does not apply for the service, he can initiate a refund. You can count on compensation in case of refusal to issue and issue a passport. You will not be able to receive compensation for the money spent on duties if:

- the defendant in an administrative case voluntarily agreed to satisfy the demands of the second party (plaintiff);

- the payment was made to implement the civil registration procedure (marriage or divorce, change of surname or taking a different name);

- the duty was needed to make adjustments to existing records of acts produced by the civil registry office.

How to return the state fee?

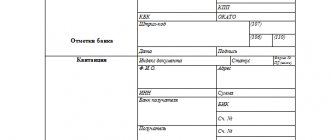

The refund of the duty is processed by sending to the Federal Tax Service an application for the refund of the state duty in the form approved in Appendix 8 to the order of the Federal Tax Service of the Russian Federation dated February 14, 2017 No. ММВ-7-8/ [email protected] From October 23, 2021, this form is used as amended by the Federal Tax Service order dated August 17 .2021 No. ED-7-8/ [email protected] applications are available for free by clicking on the picture below.

The taxpayer must submit an application for refund of the state duty to the Federal Tax Service within 3 years from the date of payment of the duty to the budget.

ConsultantPlus experts explained whether the state duty is refunded if the claim is abandoned. Get trial access to the K+ system and upgrade to the Ready Solution for free.

Let's study the features of filling out this application.

How to return state duty from the tax office

To return the transferred amount of state duty, the payer must submit an application within 3 years from the date of payment. The document must be addressed to the body authorized to provide the services for which the amount was paid. The application form is submitted complete with payment documents:

- if an application to the tax office for a refund of duty is necessary to receive a 100% refund, then the original payment document is attached;

- If you wish to return part of the paid funds, the application is supported by a copy of the payment form.

If the applicant's request is satisfied, the refund will be made within a month, counted from the date of application.

Letter for refund of state duty to the tax office: where are the applications and its sample

To correctly fill out an application for a refund of state duty in a tax form, you can download it for free from ConsultantPlus by signing up for a trial access:

In addition to the application itself, additional documents should be sent to the Federal Tax Service to confirm the expenses incurred. If the courts or magistrates made decisions or determinations on the return of state duty, then payment documents must be attached.

Regarding payment orders or bank receipts, there is one feature that should be taken into account when preparing the package: if the applicant intends to return the full amount of the state duty, then the originals of the payments are sent; if in partial amounts, it is allowed to send copies of the orders, since the originals will be required to claim the rest of the state duty.

From January 1, 2022, there is a rule according to which if the state fee is paid in non-cash form, then to return it to the application you must attach a copy of the payment document. The Ministry of Finance of the Russian Federation clarified whether, for example, an accountant is required to certify a copy of such a payment slip. Get free trial access to the K+ system and find out the opinion of officials.

Consideration of an application for refund of state duty

An application for a refund of state duty is submitted to the same court that heard the civil case. If the application is returned by the court or its acceptance is refused, if the citizen changes his mind about filing a claim in court, the application is still submitted to this court.

Documents can be filed with the court within 3 years. The tax authority and the court will count this period either from the moment the funds are transferred to the budget (when the applicant did not go to court). Or from the moment the court makes a decision to return the state duty. For example, the court will make such a decision automatically based on a ruling to terminate proceedings in a civil case. A missed deadline can be restored (Reinstatement of a procedural deadline).

The applicant must attach a genuine payment document to the application for a refund of the state duty. Or indicate that the court added the document to the case materials. In addition to the actual request for consideration of the merits of the issue of return of payment, the applicant must ask the court to issue a certificate. Without a court certificate, the tax authority will not return the money.

An application for a refund of state duty is considered by the judge alone; a court hearing on this matter is not held. The court does not summon the applicant, so the application must describe all the circumstances in as much detail as possible so that the judge understands everything correctly.

After the ruling is issued (usually within 5 days) and it enters into legal force (15 days), the applicant receives a certified copy of the ruling, a certificate and the original document on payment of the state duty (if the issue of refunding the state duty is partially resolved, then a certified copy of the payment document is issued) court office.

The interested party submits these documents (originals), along with the application, to the tax authority at the location of the court. Refund of the state duty to the tax authority occurs within 1 month from the date of application.

Results

The state duty paid to the budget on the grounds prescribed in Art. 333.40 of the Tax Code of the Russian Federation, the taxpayer has the right to return from the budget. To do this, he needs to send to the Federal Tax Service an application drawn up in the prescribed form for the return of the state duty within 3 years from the date of payment of the duty.

You can find other useful information about state duties in the following materials:

- “Which BCC should I pay the state fee for registering a company or individual entrepreneur?”;

- “Payment order for payment of state duty - sample 2019-2020”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

When and where to contact

The payer has the right to refund the state duty and submit an application for the transfer of overpaid amounts to the intended destination - to the tax office, court, traffic police or the Ministry of Internal Affairs, Rosreestr.

The money will be returned under certain conditions established in the Tax Code of the Russian Federation. For example, you can request a refund of the fee when filing a claim after receiving a special certificate from the court. They apply to the territorial tax office to receive compensation, but only after they have documented grounds.

IMPORTANT!

If the judicial authority rejected the claim or partially satisfied it, the fee cannot be returned. The same rule applies to a settlement agreement: a refund of the state duty when concluding a settlement agreement in an arbitration court is impossible.

Here are the cases in which the tax office will return the money:

- the payer independently decided not to file a claim;

- the court returned the claim to the applicant (Article 135 of the Code of Civil Procedure of the Russian Federation);

- the proceedings in the case were terminated (Article 220 of the Code of Civil Procedure of the Russian Federation);

- the claim was left without consideration (Article 222 of the Code of Civil Procedure of the Russian Federation);

- The plaintiff paid the fee once again.

To return the money, there must be a specific legal basis, which must be referred to in the appeal and supported by documents. You must apply for compensation to the same judicial body to which the original claim was filed and which heard the case.

The payer has the right to apply for overpaid money within 3 years from the date of transfer of the state fee. If this period has expired, update it according to the rules for restoring the procedural period (Article 112 of the Code of Civil Procedure of the Russian Federation).

To correctly fill out the state duty payment form, use free instructions and samples from ConsultantPlus experts.

to read.

When can I return the state duty?

If the state fee for registering an individual entrepreneur has been paid, but for some reason the payer has not used the services of the Federal Tax Service, then he can legally withdraw his payment. And he will have 3 years to do this from the date of payment.

There are four grounds for a refund of paid state duty:

- An amount greater than required was deposited. In this case, you can write an application to the Federal Tax Service for a refund of overpaid funds.

- It was decided not to open an individual entrepreneur (until contacting the Federal Tax Service). Consequently, the person did not have time to use the services of the tax service, which means he can qualify for a full refund of the funds contributed to the budget.

- The payment was sent using incorrect details due to the payer's fault.

In this situation, you need to contact the bank branch from where the payment was sent. The client writes an application, then it is transferred to the accounting department for review and refund. The procedure can take up to several weeks. If an error is detected on the same day, the payment can be returned within 3 business days (the money simply will not have time to leave the bank account). But if the error was discovered after more than three days, then the bank will have to make a request for a refund to the recipient's bank, and this may take longer. Important! If the client indicated an incorrect account, and upon request the bank received a refusal to reimburse them, the bank is not responsible for this. The client can try to claim his own money from the recipient through the court. - Identification of an error in data or details due to the fault of the cashier. In such a situation, the client can also contact the bank and write an application for a refund. As a rule, this procedure will also take from 3 days to several weeks, but the responsibility for correcting the situation lies entirely with the cashier.

The procedure for filing an application for the return of state duty to the court

If a citizen decides to return the paid amount, then he needs to correctly write an application for a refund of the state duty to the court. In addition to this, you need to perform a number of other actions in a certain order established by law:

- apply to the court with a request to confirm that the person has not used the duty receipt (for example, in cases where no one has ever applied to the court with a receipt for the state duty paid);

- wait for the court's decision, if everything is still not decided, the return depends on the judicial act (the final decision in the case or the court's ruling);

- write an appeal to the tax office, see the sample at the end of this material (when a judicial act is adopted and it establishes a refund of duties, when in principle no duty was used, etc.).

If at least one action is performed incorrectly, there is a possibility that the court will refuse to return the state duty. Even the slightest mistake in an application can cost a citizen a refusal, so you should approach this with sufficient care; get advice from our lawyer in civil cases to avoid mistakes.

What happens to the duty that was overpaid? This type of duty can be quickly returned without any problems. In this case, the court is obliged to return the entire amount paid if the case has already been closed or it has been refused consideration. If you are interested in a positive result, you must take into account the information we provide. If you are interested in refunding state fees in an arbitration court or a court of general jurisdiction with our help, contact specialists who have proven themselves to be good. We will solve everything professionally and on time.

USEFUL : watch the VIDEO about reducing the state fee to the court and write your question in the comments to be able to get advice from a lawyer (for more information about reducing the state fee, follow the link on the main part of the site).

How to return the state fee if you change your mind

To get a refund of an overpaid state fee or a full refund due to the uselessness of receiving the service, you will have to submit an application according to the established form

to the Federal Tax Service. This can be done by contacting the tax office in person, with the help of a legal representative, or by mail - by registered letter with an application. It will not be possible to submit an application online in this situation.

This service is provided completely free of charge, but its execution time can reach 30 working days. As a result, the recipient’s account specified in the application will receive the money in full.

So, what is needed for this:

- Prepare receipts, checks and other documents confirming payment of the duty to the appropriate account.

- Fill out the application form in KND form 1150058. It indicates: OKTMO, payer’s INN, tax authority and budget organization code. Then the bank data is entered: name, identification code and account number where the money needs to be returned. Then the applicant’s passport details and the reason for the refund are written down. It is mandatory to enter Article 334.40 of the Tax Code of the Russian Federation in the column number of the article on the basis of which the funds must be returned.

- Submit the application to the Federal Tax Service, according to which the money was paid, using one of the specified methods.

- Get a solution. Review of the application takes up to 10 working days. It will take another 15 to 30 days for the money to be credited.