DLDETI and CHILDREN - what's the difference

Related publications

DLCHILDREN is a code designation of the status of a “maternity leaver” in the personalized accounting system. It must be affixed for the corresponding category of employees registered with the employer. This type of information is submitted to the Pension Fund of the Russian Federation, despite the fact that the Federal Tax Service is responsible for collecting contributions and reporting on them. From January 2022, employers must submit two types of reports to the Pension Fund of the Russian Federation that serves them - monthly information about all insured persons employed by them and an annual form with information about the insurance experience for all employees - SZV-STAZH, a sample of which you will find here.

Method of presentation of SZV-STAZH

The method of submitting SZV-STAZH depends on the number of insured persons (clause 2, article 8 of Federal Law No. 27-FZ).

Important! The procedure for submitting SZV-STAZH has changed since January 10, 2022 ─ now all employers with more than 10 employees must submit reports to the Pension Fund in electronic form. Until January 10, this limit was 25 people (Federal Law dated December 30, 2021 No. 474-FZ).

If you submit SZV-M on paper with more than 10 people, you will be fined 1,000 rubles. (Article 17 of Federal Law No. 27-FZ). The fine for an official will be from 300 to 500 rubles. (Part 1 of Article 15.33.2 of the Code of Administrative Offenses of the Russian Federation).

Children's Pension Fund - what is it?

The designation of codes by type of length of service of insured persons working at an enterprise or individual entrepreneur is indicated only in the SZV-STAZH. The form template was approved by Resolution No. 3p dated January 11, 2017 (issued by the Board of the Pension Fund of the Russian Federation). A third section is provided for information about different periods of work for all insured employees of the employer.

This set of information is necessary for pension structures to identify the total insurance period for each person. The final value of this indicator will be used when calculating the pension. Only those time intervals that, according to the legislation, can be classified as insurance experience are subject to summation. This category also includes some periods when an enterprise or individual entrepreneur concluded an employment contract with a person, but the employee did not actually fulfill his duties and was not at his workplace. An example is leave taken to care for children until they reach the age of 1.5 years.

CHILDREN - the PFR decoding is given as leave for children aged 1.5-3 years. This is the time when a woman did not actually perform a labor function due to being on maternity leave. This type of leave is provided for by labor law and cannot be interrupted at the initiative of the employer. Its peculiarity is that from the moment the child turns one and a half years old, the time spent by the employee at home ceases to be taken into account in the insurance period. But the right to include these months in the work experience is not lost.

DLDETI and CHILDREN - what is the difference:

In both cases, codes are provided for workers who are not working to care for their children. This only applies to moms. For grandparents and other relatives and guardians, the reporting form offers a separate code designation (DETIPRL). The codes must be entered in column 11. The full list of codes is given in the Parameter Classifier, which is approved by Resolution No. 3p. Despite the fact that only the period of caring for small children up to 1.5 years is important to determine the total insurance period, all types of leave and length of service must be indicated in the information so that the pension authorities have the opportunity to accumulate a full range of information about the work activity of each insured person .

You can always view the full texts of regulatory documents in the current edition in ConsultantPlus.

Source

How to get SNILS for adults?

When applying for a job. When concluding an employment contract or a civil law contract, the employer within two weeks sends the employee’s data and the completed questionnaire (form ADV-1) (Approved by Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 N 2p) to the territorial body of the Pension Fund of Russia. An insurance certificate with SNILS is issued within three weeks and is first transferred to the employer, who issues it to the employee.

Independently at the Pension Fund of Russia at the place of registration (including temporary) or actual residence. You must present your passport and fill out a form (form ADV-1). In this case, issuing an insurance certificate with SNILS takes two weeks. The same procedure goes through those who voluntarily make contributions to their future pension to the Russian Pension Fund for themselves or for another person.

DLDETI and CHILDREN in SZV-STAZH

When submitting SZV-STAZH to the Pension Fund, it is important to correctly reflect the periods of absence from work of the employee using the appropriate codes. Victoria Nikulshina, an online accounting specialist at My Delo, tells us what the codes “ДЛДИти” and “CHILDREN” mean, as well as how to use them in practice.

The SZV-STAGE form reflects information about the work experience of all employees who work under employment or civil law contracts. The report helps to collect information about the total insurance experience of each employee in order to subsequently use it to calculate a pension.

The Federal Tax Service is responsible for collecting tax payments and reporting information from the form, but you need to submit SZV-STAZH to the Pension Fund.

If an employee temporarily does not fulfill his duties, but is still registered at the enterprise, it is important to correctly reflect this using certain codes. They will help the Pension Fund determine which vacation to include in the insurance period and which not.

Most often, questions arise regarding the codes “DLCHILDREN” and “CHILDREN”. Let's figure out what they mean and how not to confuse them.

SZV-STAZH and filling example

You can download:

- FORM Information on the insurance experience of insured persons SZV-STAZH (.xls, 50 Kb)

- EXAMPLE of filling out information on the insurance experience of insured persons SZV-STAZH (.xls, 49 Kb)

- EXAMPLE of filling out information on the insurance experience of insured persons SZV-STAZH (.xls, 47 Kb) when assigning a pension

Do not forget that along with the SZV-STAZH form you must submit the EDV-1 . When submitting reports electronically, forms SZV-STAZH and EDV-1 are generated in one file.

Differences between DLDETI and CHILDREN

The only differences between the codes are the age of the child the employee is caring for and the inclusion of vacation in the insurance record. Caring for children under one and a half years old is taken into account in the general insurance period for calculating a pension, but for children from one and a half to three years old - not.

Otherwise, the codes are used according to the general rules:

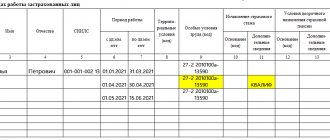

Let us show with an example how to enter codes on the form.

Olga cared for a child up to one and a half years old during the reporting year. In the reporting year, Maria took care of children under three years old until the end of February, and then went to work. This should be reflected like this:

Despite the fact that insurance coverage only includes the period of childcare up to one and a half years, all vacations must be recorded. This is the only way to generate comprehensive information about the work activities of each employee.

Let us remind you that the SZV-STAZH report must be submitted before March 1 of the year following the reporting year. If you violate the deadlines, you can receive a fine of 500 rubles for each insured employee. A similar procedure for fines is imposed for false or insufficient information about one of the employees.

Source

Decoding the DLDETI code in the SZV-STAZH report

DLCHILDREN

— encoding in the SZV-STAZH report, which is used to designate an employee’s leave to care for children aged 1.5–3 years. This type of leave is provided for by the labor law of the Russian Federation and cannot be interrupted by the employer. The main feature is that such maternity leave is not counted towards the length of service, but retains the right to be included in the length of service.

The code is entered in column 11, and the vacation period in columns 6 and 7.

A fragment of the SZV-STAZH sample, when the employee was on maternity leave for six months to care for a child aged 1.5–3 years, and then returned to work.

Sample

Dlotpusk code in SZV-STAZH: what is it and how to indicate it

71 Instructions). That is, corrective information must be provided simultaneously with current reporting in a single set of documents, which includes (clauses 68, 71 of the Instructions): - packs of initial information and packs of corrective information, accompanied by the general inventory form ADV-6-2; - form RSV-1. As it was explained to us in the PFR branch for Moscow and the Moscow region (Prygova Olga Igorevna - Deputy Manager of the Branch of the Pension Fund of the Russian Federation for Moscow and the Moscow region), until 01/01/2012 it was allowed to submit information indicating the code “CHILDREN” for women who are on parental leave both under the age of 1.5 years and in the period from 1.5 to 3 years. And although the Instructions now say that the “CHILDREN” parameter has been in effect since 01/01/2010, the previously submitted information has been adjusted to indicate the code “CHILDREN” for women on maternity leave aged 1.5 to 3 years , not required. But if the initial information is for 2010-2011. were not submitted on time, they can be provided in a separate package of documents. And in this case, there is no need to attach the RSV-1 form for that period to this bundle (after all, in SZV-6-1 there will be no accrued insurance premiums, since nothing was paid to the employees). So we recommend that you submit previously unsubmitted initial information during the reporting campaign for the 1st half of the year simultaneously with the provision of a package of current reporting (form RSV-1, initial information for the next reporting period and corrective information, if any).

The Glavnaya Kniga publishing house has been specializing in publishing publications for accountants and tax specialists for more than 12 years. The "General Ledger" magazine is a practical magazine for the modern accountant. Journal “General Ledger. Conference room" - accounting seminars on your table.

>Types of service periods for reporting to the Pension Fund and their reflection in 1C

What is the difference between children and children?

Child care leave up to 3 years

Part 5 of Article 256 of the Labor Code of the Russian Federation

Additional leave for citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant

Law of the Russian Federation of May 15, 1991 N 1244-1 “On the social protection of citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant”

Vacation without pay, downtime due to the fault of the employee, unpaid periods of suspension from work (preclusion from work), unpaid leave of up to one year provided to teaching staff, one additional day off per month without pay provided to women working in rural areas localities, unpaid time for participating in a strike and other unpaid periods, except for periods with codes DLDETI and Chernobyl NPP

Articles 76, 128, 157, 165, 262, 335, 414 of the Labor Code of the Russian Federation

Parental leave until the age of three, granted to grandparents, other relatives or guardians actually caring for the child

Article 256 of the Labor Code of the Russian Federation

Gazette of the Congress of People's Deputies of the RSFSR and the Supreme Soviet of the RSFSR, 1991, No. 21, art. 699; Gazette of the Congress of People's Deputies of the Russian Federation and the Supreme Council of the Russian Federation, 1992, No. 32, art. 1861; Collection of Legislation of the Russian Federation, 1995, No. 48, Art. 4561; 1999, N 16, art. 1937; 2000, N 33, art. 3348; 2001, N 7, art. 610; 2003, N 43, art. 4108; 2004, N 35, art. 3607; 2005, N 1, art. 25; 2008, N 52, art. 6236; 2009, N 30, art. 3739; 2011, N 23, art. 3270; N 29, Art. 4297; N 47, art. 6608; 2013, N 19, art. 2331; N 27, art. 3477; 2014, N 26, art. 3406.

Source

The procedure for filling out the SZV-STAZH form

The SZV-STAZH form is filled out and submitted by policyholders for all insured persons who are in an employment relationship with the policyholder (including with whom employment contracts have been concluded) or who have entered into civil law contracts with him, the subject of which is the performance of work, the provision of services under author's order contracts , in favor of authors of works under agreements on the alienation of the exclusive right to works of science, literature, art, publishing license agreements, license agreements on granting the right to use works of science, literature, art, including remunerations accrued by organizations for managing rights on a collective basis in the benefit of the authors of works under contracts concluded with users, or with whom employment contracts and (or) civil law contracts have been concluded.

For insured persons recognized as unemployed in accordance with the legislation of the Russian Federation, information in the SZV-STAZH form is provided by the employment service authorities.

Section 1 “Information about the policyholder”

The position “Registration number in the Pension Fund of the Russian Federation” indicates the registration number of the policyholder assigned to him upon registration as an insured under compulsory pension insurance.

In the “TIN” position, the TIN (individual taxpayer number) is indicated in accordance with the certificate of registration with the tax authority of a legal entity formed in accordance with the legislation of the Russian Federation at its location on the territory of the Russian Federation.

For an individual, the TIN is indicated in accordance with the certificate of registration with the tax authority of the individual at the place of residence on the territory of the Russian Federation.

When the payer fills out the TIN, which consists of ten characters, in the area of twelve cells reserved for recording the TIN indicator, a dash should be placed in the last two cells.

In the position “KPP” (code of the reason for registration at the location of the organization), the KPP is indicated in accordance with the certificate of registration with the tax authority of a legal entity formed in accordance with the legislation of the Russian Federation, at the location in the territory of the Russian Federation.

The checkpoint at the location of the separate subdivision is indicated in accordance with the notification of registration with the tax authority of a legal entity formed in accordance with the legislation of the Russian Federation at the location of the separate subdivision on the territory of the Russian Federation.

In the position “Name (short)” the short name of the organization is indicated in accordance with the constituent documents (the name in Latin transcription is allowed) or the name of a branch of a foreign organization operating on the territory of the Russian Federation, a separate division.

In the “Information Type” position, an “X” indicates the type of form being submitted: “Initial”, “Supplementary” or “Pension Assignment”.

Forms with the type of information “Pension Assignment” are submitted to insured persons who, in order to establish a pension, need to take into account the period of work of the calendar year, the deadline for submitting reports for which has not yet arrived.

Forms with the “Additional” type are submitted to insured persons, the data on which, presented in the form with the “Initial” type, is not taken into account on individual personal accounts due to an error contained in them.

Section 2 “Reporting period”

The year for which the SZV-STAZH form is being submitted is indicated in YYYY format.

Section 3 “Information about the period of work of insured persons”

The data in the section is filled in by the policyholder in the nominative case.

In the “Last Name” column, the surnames of the insured persons on which the SZV-STAGE form is submitted (if available) are indicated.

In the “Name” column, the names of the insured persons for whom the SZV-STAGE form is being submitted (if available) are indicated.

In the “Patronymic” column, the patronymic names of the insured persons for whom the SZV-STAZH form is being submitted (if available) are indicated.

The columns “Last name” and (or) “Name” are required to be filled out.

The “SNILS” column indicates the insurance numbers of the individual personal accounts of each of the insured persons on which the SZV-STAZH form is submitted.

The data specified in the above columns must correspond to the data specified in the insurance certificate of compulsory (state) pension insurance (issued by the Pension Fund of the Russian Federation).

The dates indicated in the “Operation period” column of the table must be within the reporting period specified in section 2 of the form and are filled in: “from (dd.mm.yyyy) to (dd.mm.yyyy).”

If it is necessary to reflect several periods of work for a specific insured person, each period is indicated on a separate line. The columns “Last name”, “First name”, “Patronymic name”, “SNILS” are filled in once.

For forms with the “Pension assignment” type, the “Period of work” column is filled in until the date of expected retirement.

The period of work of the insured person under a civil contract is filled in with the codes “AGREEMENT”, “NEOPLDOG” or “NEOPLAVT” reflected in column 11. If payment under the agreement was made during the reporting period, the code “AGREEMENT” is indicated. If there is no payment for work under the contract, the code “NEOPLDOG” or “NEOPLAVT” is indicated.

Column 8 of the section “Territorial conditions (code)” is filled out in accordance with the “Classifier of parameters used when filling out information for maintaining individual (personalized) accounting” given in the appendix to this Procedure (hereinafter referred to as the Classifier).

If an employee performs work full-time during a part-time work week, the period of work is reflected according to the actual working time worked.

If the employee performs work part-time, the volume of work (share of the rate) in this period is reflected.

The work of the insured person under conditions that give the right to early assignment of a pension is reflected in column 9 “Special working conditions (code)” in accordance with the Classifier.

In this case, the code of special working conditions or conditions for the early assignment of a pension is indicated only if, during the period of work in conditions that give the right to the early assignment of a pension, insurance contributions at an additional rate or pension contributions were paid in accordance with pension agreements for early non-state pension provision.

When an employee performs types of work that give the insured person the right to early assignment of an old-age insurance pension in accordance with Art. 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions” (hereinafter referred to as the Federal Law of December 28, 2013 No. 400-FZ) and with Lists 1 and 2 of production, work, professions, positions and indicators that give the right to preferential benefits provision, approved by Resolution of the Cabinet of Ministers of the USSR dated January 26, 1991 No. 10, the code of the employee’s profession is indicated in accordance with the Classifier in the next line, starting with the column “Special working conditions”. Writing code is not limited by the width of the column.

Columns 9, 12 and 13 of the section are not filled in if special working conditions are not documented, or when the employee’s employment in these conditions does not comply with the requirements of current regulatory documents, or payment of insurance contributions at an additional rate or pension contributions in accordance with pension agreements of an early non-state pension There is no security.

The “SEASON” code is filled in only if a full season has been worked in the work provided for in the list of seasonal work, or a full navigation period on water transport.

The “FIELD” code is filled in if code “27-6” is indicated in the “Special working conditions (code)” column and only on the condition that work in expeditions, parties, detachments, on sites and in teams for field work (geological exploration, prospecting) , topographic-geodetic, geophysical, hydrographic, hydrological, forest management and survey) was carried out directly in the field.

Periods of work that give the right to early assignment of an old-age insurance pension, which was performed part-time but full-time, due to a reduction in production volumes (with the exception of work that gives the right to early assignment of an old-age insurance pension in accordance with paragraph 13 and 19–21 Part 1 Article 30 of the Federal Law of December 28, 2013 No. 400-FZ), as well as periods of work determined by the Ministry of Labor and Social Protection of the Russian Federation in agreement with the Pension Fund of the Russian Federation or provided for by lists that, according to the conditions of labor organization cannot be performed continuously, are calculated based on the time actually worked in accordance with clause 6 of the Rules for calculating periods of work, which gives the right to early assignment of an old-age pension in accordance with Art. 27 and 28 of the Federal Law “On Labor Pensions in the Russian Federation”, approved by Decree of the Government of the Russian Federation of July 11, 2002 No. 516.

The number of months accepted for credit towards length of service in the relevant types of work is determined by dividing the total number of full days actually worked by the number of working days in a month, calculated on average for the year, 21.2 - with a five-day working week; 25.4 - with a six-day work week. The number obtained after this action is rounded to two digits if necessary. The integer part of the resulting number is the number of calendar months. For the final calculation, the fractional part of the number is converted into calendar days on the basis that 1 calendar month is equal to 30 days. When translating, the whole part of the number is taken into account; rounding is not allowed.

For the corresponding periods of work, limited by the dates specified in columns 6 and 7, column 11 “Calculation of the insurance period, additional information” reflects the working time in the calendar calculation translated in the specified order (month, day).

When filling out the period of work of convicted persons, column 11 indicates the number of calendar months and days of work of the convicted insured person included in the insurance period.

The time spent under water (hours, minutes) is filled in only for divers and other insured persons working under water.

Data on the flight hours of insured persons - civil aviation flight personnel (hours, minutes) are filled in only if one of the codes is indicated in column 12 “ground (code)”: “PLANE”, “SPECIAL”.

Data on the flight hours of insured persons, participants in test flights (hours, minutes) are filled in if column 12 “base (code)” indicates one of the codes “ITSISP”, “ITSMAV”, “INSPECT”, “LETISP”.

The scope of work (share of the rate) for the position performed by medical workers is filled in simultaneously with the indication in column 12 “base (code)” of one of the codes: “27-SM”, “27-GD”, “27-SMHR”, “ 27-GDHR".

The rate (share of the rate) and the number of teaching hours worked by teachers in schools and other institutions for children are filled in simultaneously with the indication in column 12 “base (code)” of one of the values “27-PD”, “27-PDRK”.

Moreover, if in column 12 “ground (code)” the value “27-PD” is indicated, indicating the number of training hours is not necessary, including for positions and institutions provided for in clause 6 of the Rules for calculating periods of work giving the right to early assignment of a retirement pension for old age in accordance with Art. 27 of the Federal Law “On Labor Pensions in the Russian Federation”, approved by Decree of the Government of the Russian Federation dated October 29, 2002 No. 781 (work as a primary school teacher in general education institutions specified in clause 1.1 of the section “Name of institutions” of the list, teachers located in rural areas general education schools of all types (except for evening (shift) and open (shift) general education schools) is included in the work experience regardless of the volume of the teaching load performed).

If in column 12 “ground (code)” the value “27-PDRK” is indicated, the indication of the rate and number of training hours is mandatory for positions and institutions provided for in paragraphs. “a” clause 8 of the Rules approved by Decree of the Government of the Russian Federation dated October 29, 2002 No. 781 (work as a director (chief, manager) of institutions specified in clauses 1.1, 1.2 and 1.3 (except for orphanages, in including sanatorium, special (correctional) for children with developmental disabilities) and clauses 1.4–1.7, 1.9 and 1.10 of the section “Name of institutions” of the list, for the period from September 1, 2000 is counted towards work experience, subject to teaching work in the same or in another institution for children in the amount of at least 6 hours per week (240 hours per year), and in institutions of secondary vocational education specified in clause 1.10 of the section “Name of institutions” of the list, subject to teaching work in the amount at least 360 hours per year).

If in column 12 “ground (code)” the code “27-PDRK” is indicated, the rate must be indicated; indication of the number of training hours is optional for positions and institutions provided for in paragraphs. “b” clause 8 of the Rules approved by Decree of the Government of the Russian Federation of October 29, 2002 No. 781 (work performed with normal or reduced working hours provided for by labor legislation, work in the positions of director (chief, manager) of orphanages is counted as work experience , including sanatorium, special (correctional) for children with developmental disabilities, as well as deputy director (chief, manager) for educational, educational, educational, production, educational and other work directly related to educational ) process, institutions specified in clauses 1.1–1.7, 1.9 and 1.10 of the “Name of Institutions” section of the list, regardless of the time when this work was performed, as well as teaching work).

For insured persons working in territorial working conditions or in types of work that give the right to early assignment of an old-age insurance pension, the code of territorial working conditions or the code of special working conditions and conditions for early assignment of an old-age insurance pension is not indicated if, when reflecting information in column 11 The form contains the following additional information:

The code “CHILDREN” is filled in column 11 “additional information” if the parent of a child is granted leave to care for a child under 1.5 years of age.

The code “DLCHILDREN” is filled in column 11 “additional information” if the parent of a child is granted leave to care for a child aged 1.5 years to 3 years.

The code “CHILDREN” is filled in column 11 “additional information” in the case of granting parental leave until the child reaches the age of 3 years to the grandparents, other relatives or guardians who are actually caring for the child.

The code “ZGDS” is filled in column 11 “additional information” if a person holds a government position in a constituent entity of the Russian Federation and is filled on a permanent basis.

The code “ZGD” is filled in column 11 “additional information” if a person holds a government position in the Russian Federation.

The “ZGGS” code is filled in column 11 “additional information” if a person holds a position in the state civil service of the Russian Federation.

The “ZMS” code is filled in column 11 “additional information” if a person fills a municipal service position.

The code “ZMD” in column 11 “additional information” is filled in if a person fills a municipal position that is replaced on a permanent basis.

If it is necessary to reflect simultaneously more than one code specified in the section Codes “Calculation of insurance experience: additional information”, used when filling out the forms “Information on the insurance experience of insured persons (SZV-STAZH)”, “Data on the adjustment of information recorded on an individual personal account of the insured person (SZV-KORR)", forms "Information on earnings (remuneration), income, amount of payments and other remunerations, accrued and paid insurance premiums, periods of labor and other activities counted in the insurance period of the insured person (SZV-ISH) » Classifier, codes are indicated in two lines.

In this case, the codes “ZGDS”, “ZGD”, “ZGTS”, “ZMS”, “ZMD” are indicated in the first line.

For insured persons who voluntarily entered into legal relations under compulsory pension insurance, the column “Period of work” of the section indicates the period of their registration with the Pension Fund of Russia, limited to the reporting period, subject to payment of insurance contributions for compulsory pension insurance for this period.

The column “Information about the dismissal of the insured person” is filled in with the symbol “X” only for insured persons whose dismissal date falls on December 31 of the calendar year for which the SZV-STAGE form is being submitted.