Pay taxes in a few clicks!

Pay taxes, fees and submit reports without leaving your home!

The service will remind you of all reports. Try for free

Since 2022, insurance premiums have come under the control of the tax service, so all calculations for insurance premiums are now sent to the Federal Tax Service. But the Pension Fund must also receive information about the insured persons, so it has developed a whole list of other reports and personalized forms. Among them is the annual SZV-experience report, which we will discuss in this article.

Who needs to take the SZV-experience?

The report is filled out for each insured person, and in essence this form is personalized.

All organizations and their separate divisions, individual entrepreneurs with employees, as well as lawyers and notaries take the SZV experience. The report is submitted to each insured person with whom you have concluded an employment contract, a civil contract for the performance of work or provision of services, an author's order agreement, or a license agreement. The duration of the contract and the availability of payments under it do not matter. The SZV-experience must be passed, even if the contract was valid for only one day, and the insured did not receive payments subject to contributions under it.

Insured persons include:

- citizens of the Russian Federation, regardless of the place of activity;

- citizens of EAEU states, except for temporarily staying highly qualified specialists;

- highly qualified specialists with a temporary residence permit or residence permit;

- foreigners permanently or temporarily residing in the Russian Federation, temporarily staying in the Russian Federation;

- the director is the sole founder.

There is no need to submit a report for the self-employed and individual entrepreneurs who are executors under GPC agreements. There is no zero report on the SZV-experience form. If the organization has at least a manager who is the only participant and owner of the property, data about him must be included in the report. Data on an individual entrepreneur without employees is not included in the SZV-experience; he simply will not have to report on the form.

Deadlines for submitting the SZV-experience form

The report is submitted once a year - from January 1 to March 1. The report for 2020 must be submitted by March 1, 2022, the report for 2022 must be submitted by March 1, 2022. Remember that the deadline for submission may be postponed if the last day falls on a weekend or holiday.

Sometimes a report must be submitted during the inter-reporting period:

- the employee retires and quits - submit a report with the type “Pension assignment” within three days from the date of receipt of the application from the employee (according to bill No. 1075528-7, it is proposed to oblige employers to transfer information about the length of service to the Pension Fund at the request of the Pension Fund without the participation of the employee).

- liquidation of an organization - submit a report with the “Initial” type within a month from the date of approval of the interim liquidation balance sheet;

- bankruptcy of a company - pass the SZV-experience with the “Initial” type before submitting a report on the results of bankruptcy proceedings to the arbitration court.

Remember that along with information on the length of service, the Pension Fund is waiting for additional information on the EDV-1 form. It must be submitted along with the SZV-experience report. The EDV-1 form was also approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507P.

How to correct mistakes after passing SZV-STAZH

If, after successfully submitting the SZV-STAZH report, you find errors in it, you need to submit an updated report. In what form you submit it depends on what exactly you made a mistake:

- you forgot to include the employee in the report - in the SZV-STAZH form with the information type “Additional”, fill out information only for this person;

- incorrectly indicated the period of work - fill out a special form SZV-KORR with the “KORR” type only for the people for whom corrections need to be made;

- included an extra person in the report - fill out the SZV-KORR with the type “OTMN” for it.

Together with the clarification, submit the EDV-1 inventory with the “Initial” type.

Errors can also be detected by the Pension Fund itself. Then the report will not be accepted - in whole or in part. Also, SZV-STAZH can first accept and then send an error report and a notification about the correction of inaccuracies. If errors are identified by the Pension Fund, you must submit an update within 5 working days from the date of receipt of the notification, otherwise there will be penalties.

Rules for filling out the SZV-experience report in the general manner

The employer fills out each form for one employee and certifies the report. You can fill out the form by hand in block letters or using a computer. The ink color when filling out the report can be any color except red and green. Marks and corrections are unacceptable. The SZV-experience report can be submitted on paper and electronically.

To fill out the report, the employer must have information about his employee:

- data on salaries and all other payments and remunerations;

- data on contributions - accrued, additionally accrued and withheld;

- information about the employee's work experience.

Basic filling rules

- At the top of the page the registration number in the Pension Fund is indicated.

- Only one indicator is entered in each line.

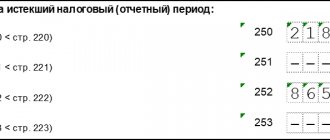

- If there are no indicators, dashes are placed in the columns of sections 1-5, and the columns of section 6 are not filled in.

- In SZV-STAZH it is not allowed to correct errors using a correction tool.

- The document can be completed by hand or using a computer.

- When filling out by hand, you can use a gel, fountain or ballpoint pen of any color except red and green.

- Information in the report is entered in capital block letters.

Features when filling out a report

Let's go through the sections of the form.

Section 1 “Information about the policyholder” - indicate your registration number in the Pension Fund, TIN, KPP, abbreviated name of the organization. Pay attention to the field “Registration number in the Pension Fund of Russia”. In it, indicate the policyholder's registration number of 12 characters. In the “TIN” field, indicate the individual number of the organization or individual entrepreneur of 10 or 12 characters, and if there are empty cells left, put dashes.

In the “Information Type” field, mark the desired type of report with an “X”: initial, supplementary, or pension assignment. When submitting a report according to the latter type, the form is submitted without connection with reporting deadlines, and only for those employees who need to take into account their work experience for the current calendar year to establish a pension. We send a supplementary report to the Pension Fund for employees who for some reason were not included in the main report.

Section 2 “Reporting period” - indicate the year for which you are submitting the report. If you report when an employee retires, the current year.

Section 3 “Information about the period of work of insured persons” is presented in the form of a table with columns. Assign a serial number to each covered employee, even if the job information spans multiple lines.

- Column 1 indicates the serial number of the insured person. If data about the period of its operation is repeated on several lines, then subsequent lines are not numbered;

- in columns 2-5, indicate the full name and SNILS of the employee;

- in columns 6-7 the start and end dates of work. Indicate the dates within the reporting period that you indicated in the second section of the report. If there was a break in your work experience, start a new line, but do not duplicate the employee’s data and SNILS number.

- in column 8, indicate the code of territorial conditions in accordance with the section of the Classifier. For example, for the regions of the Far North the code is “RKS”.

- in column 9, indicate the code of special working conditions that give the right to early assignment of a pension. Codes of special conditions are indicated in accordance with the corresponding section of the classifier. The code must be indicated for the period of work giving the right to early retirement if the working conditions were classified as harmful or dangerous and contributions were paid for them at additional rates. This also includes periods during which the employer paid contributions for the employee under early non-state pension agreements;

- in column 10, provide the code of the basis for calculating the insurance period according to the Classifier. For example, for health workers who, from January 1 to September 30, 2022, provided assistance to patients with coronavirus or suspected cases of it, the code “VIRUS” must be indicated. For employees engaged in seasonal activities, the code “SEASON” is indicated.

- In column 11, indicate additional information for each period from columns 6-7: whether there were maternity leaves, leaves without pay, advanced training, etc. They are reflected in the form of the corresponding codes - “VRNETRUD” for the paid sick leave period, “Children” for parental leave up to 1.5 years.

- in columns 12 and 13 - indicate information about the conditions for early assignment of a pension

- Complete column 14 only if the employee resigns. Here you need to select an indicator: “12/31/yyyy” - for the insured who quit on December 31, “BEZR” - for the insured who received unemployment benefits, performed paid public works or moved to another area in the direction of the employment service for employment.

Sections 4 and 5 should only be completed when assigning a pension.

How to fill out the SZV-experience for employees - future retirees?

Many employers will have to fill out this form for employees retiring. Therefore, we provide a detailed procedure for filling out the report. SZV-experience is filled out if, in order to assign a pension, it is necessary to take into account the period of work in a calendar year, the deadline for submitting reports for which has not yet arrived.

First of all, when an employee is preparing to retire due to old age or disability, he turns to the policyholder with a request to submit a SZV-experience report for him with the type “Pension Assignment”. The employer is obliged to satisfy this request so that the months worked in the current year are included in the employee’s length of service.

In this case, ask the employee for an application to submit a SZV-experience report to the Pension Fund (a sample application is given below). After this, prepare a report on the employee and send it to the Pension Fund no later than three calendar days from the date of submission of the application. This procedure is provided for in paragraph 2 of Art. 11 of Federal Law No. 27-FZ of April 1, 1996.

Sample application:

To the director of Romashka LLC, I.I. Ivanov, from florist P.P. Petrova.

STATEMENT.

In accordance with paragraph 2 of Art. 11 of Federal Law No. 27-FZ of April 1, 1996 and Part 6 of Art. 21 of Federal Law No. 400-FZ of December 28, 2013, I inform you that on June 17, 2022 I will turn 56.5 years old. In connection with reaching retirement age and having the necessary work experience, from June 17, 2022, I have the right to receive an old-age pension.

Please provide the necessary personalized accounting information in the SZV-STAZH form, necessary for assigning a pension, to the territorial office of the Pension Fund of the Russian Federation within 3 calendar days from the date of submission of this application.

05/10/2021 Petrova P.P. ___________

When filling out the SZV-experience form in the name of an employee - a future pensioner, make the following notes:

- Section 1 “Information about the policyholder.” In the “Type of information” field, mark the “Pension assignment” field with a cross.

- Section 3 “Information about periods of work of insured persons” . Indicate the periods when the person worked, was on vacation, was on sick leave, or was absent from the workplace for other reasons. In the “Period of work” column, reflect the date preceding the date of expected retirement: if the employee’s application was written before reaching retirement age, then this is his closest date of birth; if the application is written after reaching retirement age, this is the date when the employee intends to provide documents to the Pension Fund (in this case, ask the employee to indicate the date in his application). In column 11 you need to indicate the period of work in special conditions, hazardous work. This applies to those who have the right to retire early. For the same reasons, columns 8-10, 12, 13 are filled out.

- Section 4 “Information on accrued (paid) insurance premiums for compulsory health insurance” . Please indicate whether pension insurance contributions have been accrued for the period specified in section 3. Place an “X” in the “Yes” or “No” fields, respectively.

- Section 5 “Information on paid pension contributions in accordance with pension agreements for early non-state pension provision” . Fill out only if the future pensioner worked in harmful or dangerous industries for which there is an agreement with the NPF on early pension provision. Indicate the periods for which contributions were paid.

- Attach the EDV-1 inventory to the SZV-experience form: in the “Reporting period” field put “0”, in the “Year” field - the year of submission of information, in the field with the type of information “Initial” put a cross and indicate the number of employees for whom you are submitting information .

The concept of insurance experience

Since 2002, in connection with changes in the legislation on pensions (Law of the Russian Federation “On Labor Pensions in the Russian Federation” dated December 17, 2001 No. 173-FZ), the concept of “total length of service”, on which, along with the average monthly earnings, depended on the size of the labor pension, came concept of "insurance period".

What is insurance length of service for pensions? Unlike length of service, which is determined by periods of work and some non-working periods, insurance length of service corresponds to those periods of working time in which insurance contributions to the Pension Fund were paid from the citizen’s income. In this case, just as when calculating length of service, some non-working periods are included in the insurance coverage. But the length of the insurance period in the assignment of a pension began to play a lesser role than the length of the total work experience. The amount of contributions paid for insurance periods has come to the fore in the new pension legislation.

Since 2015, pension legislation has again undergone a number of changes (Law of the Russian Federation “On Insurance Pensions” dated December 28, 2013 No. 400-FZ), the main of which are:

- the disappearance of the definition of “labor” in relation to pensions and the appearance of a new name for it “insurance”;

- introduction of individual coefficients (pension points) for the annual assessment of pension rights, taking into account the amount of contributions accrued/paid to the Pension Fund, the length of the insurance period and the presence of a decision on a later start of receiving a pension;

- an increase in the importance of the duration of the insurance period for the assignment of a pension.

In what form is the SZV internship submitted?

When the form is filled out, we indicate the position of the manager and certify the report with his signature; if available, we affix a stamp. Before sending the SZV-experience forms to the Pension Fund, we collect them in a bundle and make an inventory of them according to the OVD-1 form, without which the reports will not be accepted. In EFA-1, put 0 in the “Reporting period (code)” field, in section 3 indicate the number of employees in the SZV-experience, do not fill out section 4.

You can submit your work experience in paper or electronic form - it depends on the number of people whose work experience information is submitted by the employer. If there are less than 25, information can be submitted on paper; if there are 25 or more, only electronic submission is acceptable.

You can submit your SZV-experience report in 2022 from the online service Kontur.Accounting. You can also keep records, calculate salaries, send reports, use the support of our experts and other service capabilities. The first 14 days of operation are free for all new users.

Try for free

Penalties for lateness, failure to submit and errors in SZV-STAZH

If you are late in submitting your SZV-STAZH, the fine will be 500 rubles for each employee for whom you did not report. If the report contains incomplete or unreliable information, the fine is the same, but it will be multiplied by the number of employees for whom you submitted incorrect information (Article 17 of Law No. 27-FZ of 04/01/1996).

Officials of the organization - the director or chief accountant - may also be fined through the court in the amount of 300 to 500 rubles . (Part 1 of Article 15.33.2 of the Code of Administrative Offenses of the Russian Federation). Individual entrepreneurs are not subject to administrative liability on this basis.

If errors in SZV-STAZH led to the Pension Fund overpaying someone’s pension, the employer may be required to recover damages for overspending of budget funds in court.

If you are required to take the SZV-STAZH electronically, but passed it on paper, for violating the method of submitting information there will be a fine of 1000 rubles.