Refund of advances from the seller and buyer

According to paragraph 1 of Article 168 of the Tax Code of the Russian Federation, upon receipt of payment amounts, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights realized on the territory of the Russian Federation, the taxpayer is obliged to present to the buyer of these goods (work, services), property rights the amount of VAT calculated in the manner established by paragraph 4 of Article 164 of the Tax Code of the Russian Federation.

For the amount of payment received, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights, the seller issues an invoice to the buyer no later than five calendar days from the date of receipt of the advance payment (clause 3 of Article 168 of the Tax Code of the Russian Federation).

According to the Rules for filling out an invoice, approved. By Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137, the invoice for the prepayment amount received indicates:

- in line 5 - details (number and date of preparation) of the payment and settlement document (clause “h” of clause 1 of the Rules for filling out an invoice, approved by Resolution No. 1137). A partial reduction in the numbers of payment orders is allowed (letter of the Ministry of Finance of Russia dated November 7, 2007 No. 03-07-11/556). In the case of a non-cash form of payment, a dash is placed on this line (clause “z”, clause 1 of Appendix No. 1 of Resolution No. 1137). When an advance payment is received in installments, line 5 indicates the details (numbers and dates) of all payment orders (letter of the Ministry of Finance of Russia dated March 28, 2007 No. 03-02-07/1-140);

- in column 1 - the name of the goods supplied (description of work, services), property rights (clause “a”, clause 2 of the Rules for filling out an invoice). It is allowed to indicate the general name of the goods in case of receiving an advance from the buyer before filling out the application (specification) (letters of the Ministry of Finance of Russia dated 03/06/2009 No. 03-07-15/39 and dated 07/26/2011 No. 03-07-09/22);

- in column 8 - the amount of tax calculated on the basis of the tax rate determined in accordance with clause 4 of Art. 164 of the Tax Code of the Russian Federation (clause “z” clause 2 of the Rules for filling out an invoice, approved by Resolution No. 1137);

- in column 9 - the amount of advance payment received (clauses “and” clause 2 of the Rules for filling out an invoice, approved by Resolution No. 1137);

- in lines 3 and 4 and columns 2–6, 10–11 - dashes (clause 4 of the Rules for filling out an invoice, approved by Resolution No. 1137).

Invoices for advance payments are registered by the taxpayer-seller in the sales book (see paragraph 2 of Appendix No. 5 of Resolution No. 1137) indicating in column 2 “Operation type code” the value “02”, which corresponds to payment, partial payment (received or transferred ) on account of upcoming deliveries of goods (works, services), property rights (Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3 / [email protected] ).

VAT amounts calculated from payment, partial payment for upcoming supplies of goods (performance of work, provision of services) sold on the territory of the Russian Federation are accepted for tax deduction in the event of a change in conditions or termination of the contract and the return of the corresponding amounts of advance payments (clause 5 of Art. 171 of the Tax Code of the Russian Federation). Deductions of tax amounts are made in full after the corresponding adjustment operations in connection with the refusal of goods (work, services) are reflected in the accounting records, but no later than one year from the date of return or refusal (clause 4 of Article 172 of the Tax Code of the Russian Federation).

To exercise the right to a tax deduction, the taxpayer-seller registers the issued invoice for the advance payment in the purchase book indicating in column 2 “Operation type code” the value “22”, which corresponds to the operation for the return of advance payments in the cases listed in paragraph 2 of paragraph 5 Article 171 of the Tax Code of the Russian Federation (Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3 / [email protected] ), and in column 7 “Number and date of the document confirming payment of the tax” - details of the document confirming the return of the advance payment to the buyer (clause “k” clause 6 of the Rules for maintaining a purchase ledger, approved by Resolution No. 1137).

The buyer has the right to deduct the amount of VAT claimed by the seller in relation to the advance payment transferred to him for future supplies of goods (performance of work, provision of services, transfer of property rights) (clause 12 of article 171 of the Tax Code of the Russian Federation).

“Advance” VAT is accepted for deduction by the buyer if available (clause 9 of Article 172 of the Tax Code of the Russian Federation):

- an “advance” invoice, which must be issued by the seller within 5 days from the date of receipt of the advance payment;

- documents confirming the transfer of prepayment;

- agreement providing for the transfer of an advance payment.

The buyer is not deprived of the right to deduct VAT charged on an advance payment even if he makes an advance payment in kind (clause 23 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33).

The buyer can apply the deduction either in full or in part, since this is a taxpayer’s right and not an obligation (letter of the Ministry of Finance of Russia dated November 22, 2011 No. 03-07-11/321).

To exercise the right to a tax deduction, the buyer-taxpayer who has transferred the prepayment amount registers the advance invoice received from the seller in the purchase book, reflecting:

- in column 2 “Operation type code” - the value “02”, which corresponds to payment, partial payment (received or transferred) on account of upcoming deliveries of goods (work, services), property rights (Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. MMV -7-3/ [email protected] );

- in column 15 - the entire amount of payment, partial payment on the invoice, including VAT;

- in column 16 - the amount of tax accepted for deduction at the appropriate calculated rate, determined in accordance with paragraph 4 of Article 164 of the Tax Code of the Russian Federation (paragraphs “t” and “y” of paragraph 6 of the Rules for maintaining a purchase book, approved by Resolution No. 1137).

Received invoices for the transferred amount of prepayment for upcoming deliveries of goods (work, services), transfer of property rights acquired for use simultaneously in taxable and non-VAT-taxable transactions specified in paragraph 2 of Article 170 of the Tax Code of the Russian Federation are registered in the purchase book for the amount specified in the invoice (clause “y”, clause 6 of the Rules for maintaining a purchase ledger, approved by Resolution No. 1137).

The taxpayer-buyer can exercise the right to a tax deduction only in the tax period in which an invoice was received for the transferred amount of advance payment, i.e. paragraph 1.1 of Article 172 of the Tax Code of the Russian Federation does not apply to advance invoices (letter from the Ministry of Finance of Russia dated March 24, 2017 No. 03-07-09/17203).

In case of termination of the contract (change of its terms) and return of the transferred advance payment, the buyer must restore the “advance” VAT previously accepted for deduction. The tax is restored in full in the tax period in which the advance payment was returned by the seller (clause 3, clause 3, article 170 of the Tax Code of the Russian Federation).

To recover VAT, the buyer must register in the sales book the advance invoice received from the seller, which was previously reflected in the purchase book (clause 14 of the Rules for maintaining the sales book, approved by Resolution No. 1137), indicating in column 2 “Transaction type code” value “21”, which corresponds to the operation to restore the tax amounts specified in paragraph 3 of Article 170 of the Tax Code of the Russian Federation (with the exception of paragraphs 1, 4, paragraph 3 of Article 170 of the Tax Code of the Russian Federation) (Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected] ).

| 1C:ITS For more details, see the articles in the “Value Added Tax” reference book in the “Legislative Consultations” section: on issuing an invoice for an advance payment; on the calculation of VAT upon receipt of an advance; on deduction of VAT from advance payment; on the restoration of “advance” VAT by the buyer. |

Transaction type code in the purchase book

The purchase book is maintained quarterly and filled out by the taxpayer for each tax period. When filling it out, it is necessary to take into account Government Decree No. 1137 of 2011.

When returning an advance to a buyer, the seller must record this transaction in the purchase book and make all necessary adjustments in accounting and management reporting related to the return. This fact is reflected in column 7 of the purchase book. Here are the details of the document that confirms the return of this prepayment.

When maintaining a purchase book, you need to use the codes established by the Federal Tax Service for different types of transactions. When returning an advance, the seller indicates in the purchase book the details of the issued invoice for the advance received and puts the transaction code “22” in the second column (according to paragraphs e, clause 6, 22 of the Rules for maintaining the purchase book).

The seller is obliged to register the invoice in the purchase book no later than one year after the buyer refuses to supply. This is indicated in paragraph. 2 clause 22 of Appendix 4 to Government Decree No. 1137.

Additionally, the taxpayer should confirm the right to receive a deduction using documents that indicate termination of the contract (for example, an additional agreement or unilateral refusal to fulfill the contract) and the return of money to the buyer.

VAT accounting for the supplier

Let's consider an example of how the 1C:Accounting 8 program, edition 3.0, reflects operations for accounting for VAT from a supplier when returning advances received to the buyer.

Please note that in accordance with Federal Law No. 303-FZ dated 08/03/2018, VAT tax rates changed from 01/01/2019: from 18% to 20%; from 18/118 to 20/120 and from 15.25% to 16.67%.

Example 1

| Trading House LLC (seller) entered into an agreement for the supply of goods with Clothes and Shoes LLC (buyer) for a total amount of RUB 180,000.00. (including VAT 20% - RUB 30,000.00) on the terms of full advance payment. After receiving the advance payment, the supply contract was terminated and the advance payment amount was returned to the buyer. The sequence of operations is given in Table 1. |

Table 1

Issuing an invoice for payment to the buyer

To perform operation 1.1 “Issuing an invoice to the buyer” (section Sales - subsection Sales), you need to use the Create button to create a new document Invoice to the buyer.

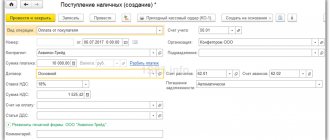

Receiving advance payment from the buyer

To perform operation 2.1 “Receiving advance payment from the buyer”, you need to create a document Receipt to the current account based on the document Invoice to buyer by clicking the Create based button.

The indicators of the document Receipt to the current account are filled in automatically based on the information in the document Invoice to the buyer.

In addition, in the document Receipt to the current account you must indicate:

- in the fields According to document No. and from - the number and date of the buyer’s payment order;

- in the Amount field - the actual amount of the prepayment received.

As a result of posting the document Receipt to the current account, the following accounting entry is generated:

Debit 51 Credit 62.02 - for the amount of money received by the seller from the buyer.

In accordance with paragraphs 1, 3 of Article 168 of the Tax Code of the Russian Federation, the buyer of goods who has transferred the prepayment amount must be issued an invoice no later than 5 calendar days, counting from the date of receipt of the prepayment.

An invoice for the received prepayment amount (operations 2.2 “Creating an invoice for the amount of prepayment”, 2.3 “Calculation of VAT on the received prepayment”) in the program is generated on the basis of the document Receipt to the current account using the Create based button. Automatic generation of invoices for advances received from customers can also be done using the processing Registration of invoices for advance payments (section Banks and cash desk - subsection Registration of invoices).

In the new document Invoice issued

basic information will be filled in automatically according to the base document:

- in the from field - the date of preparation of the invoice, which by default is set to the same date as the date of generation of the document Receipt to the current account;

- in the Counterparty, Payment document No. and from fields - the relevant information from the basis document;

- in the Invoice type field – the value For advance;

- in the tabular part of the document - the amount of the received prepayment in the amount of 180,000.00 rubles, the VAT rate in the amount of 20/120 and the amount of VAT in the amount of 30,000.00 rubles.

In addition, the following will be automatically entered:

- in the Transaction type code field - value 02, which corresponds to payment, partial payment (received or transferred) on account of upcoming deliveries of goods (work, services), property rights (Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected] );

- the Compiled switch is moved to the position On paper, if there is no valid agreement on the exchange of electronic invoices, or In electronic form, if such an agreement has been concluded;

- flag Issued (transferred to the counterparty) indicating the date - if the invoice is transferred to the buyer and is subject to registration. If there is an agreement on the exchange of electronic invoices before receiving confirmation from the EDI operator, the checkbox and date of issue will be absent. If the date of transfer of a paper invoice to the buyer is different from the date of preparation, then it must be adjusted;

- The Manager and Chief Accountant fields are data from the Responsible Persons information register. If the document is signed by other responsible persons, for example, on the basis of a power of attorney, then it is necessary to enter the relevant information from the directory Individuals.

For the correct preparation of an invoice, as well as the correct reflection of the document in the accounting system, it is necessary that in the Nomenclature field of the tabular part of the document the name (or generic name) of the goods supplied is indicated in accordance with the terms of the contract with the buyer.

This information is filled in automatically indicating:

- names of specific product items from the document Invoice to the buyer, if such an invoice was previously issued;

- a generic name, if such a generic name was defined in the agreement with the buyer.

By clicking the Print document Invoice issued button, you can go to view the invoice form and then print it in two copies (Fig. 1).

Rice. 1. Invoice for prepayment issued to the seller

The invoice for the prepayment amount received shall indicate:

- in line 5 - details (number and date of preparation) of the payment and settlement document (clause “h” of clause 1 of the Rules for filling out an invoice, approved by Resolution No. 1137);

- in column 1 - the name of the goods supplied (description of work, services), property rights (clause “a”, clause 2 of the Rules for filling out an invoice, approved by Resolution No. 1137);

- in column 8 - the amount of tax calculated on the basis of the tax rate determined in accordance with paragraph 4 of Article 164 of the Tax Code of the Russian Federation (clause “z” of paragraph 2 of the Rules for filling out an invoice, approved by Resolution No. 1137);

- in column 9 - the amount of advance payment received (clauses “and” clause 2 of the Rules for filling out an invoice, approved by Resolution No. 1137);

- in lines 3 and 4 and columns 2–6, 10–11 - dashes (clause 4 of the Rules for filling out an invoice, approved by Resolution No. 1137).

As a result of posting the document Invoice issued, an accounting entry is generated:

Debit 76.AB Credit 68.02 - for the amount of VAT calculated on the amount of advance payment received from the buyer in the amount of RUB 30,000.00. (RUB 180,000.00 x 20/120).

Based on the issued Invoice document, an entry is made in the information register of the Invoice Log.

Despite the fact that since 01/01/2015, taxpayers who are not intermediaries (forwarders, developers) do not keep a log of received and issued invoices, register entries in the Invoice Log are used to store the necessary information about the issued invoice.

Based on the document Invoice issued, a registration entry is made in the Sales VAT

.

Based on the entries in the VAT Sales register, a sales book is generated for the first quarter of 2022 (section Reports - VAT subsection), Fig. 2.

Rice. 2. Sales book for the first quarter of 2022 from the seller

The amount of VAT accrued from the prepayment received is reflected in line 070 of Section 3 of the VAT tax return for the first quarter of 2019 (approved by order of the Ministry of Finance of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] as amended by the order of the Federal Tax Service of Russia dated December 28, 2014 .2018 No. CA-7-3/ [email protected] ) (section Reports - subsection 1C-Reporting - hyperlink Regulated reports).

Refund of received advance payment

To perform operation 3.1 “Return of advance payment to the buyer”, you must create a document Write-off from the current account.

You can create this document based on the document Receipt to current account by clicking the Create based on button.

The document Write-off from a current account can also be created based on downloading from other external programs (for example, “Client-Bank”). If payment orders are created in the Client-Bank program, then it is not necessary to create them in the 1C: Accounting 8 program. In this case, only the document Write-off from the current account is entered, which generates the necessary transactions.

As a result of posting the document Write-off from the current account, the following accounting entry will be generated:

Debit 62.02 Credit 51 - for the amount of advance payment returned to the buyer in connection with termination of the supply agreement.

Amounts of VAT calculated by the seller and paid to the budget from payment amounts, partial payment for upcoming deliveries of goods (work, provision of services) sold in the Russian Federation are accepted for tax deduction in the event of a change in conditions or termination of the contract and the return of the corresponding amounts of advance payments (Clause 5 of Article 171 of the Tax Code of the Russian Federation).

Deductions of VAT amounts are made in full after the corresponding adjustment operations in connection with the return of goods or refusal of goods (work, services) are reflected in the accounting records, but no later than one year from the date of return or refusal (clause 4 of Article 172 of the Tax Code of the Russian Federation) .

Submitting for tax deduction the amount of VAT calculated on the received advance payment (operation 3.2 “Deduction of VAT calculated on the received advance payment”) is carried out using the document Generating purchase ledger entries (section Operations - subsection Closing the period - hyperlink Regular VAT operations) using the Create command .

Data for the purchase book on tax amounts to be deducted in the current tax period are reflected on the Advances received tab.

To fill out a document using accounting system data, it is advisable to use the Fill command.

As a result of posting the document Formation of purchase ledger entries, an accounting entry is generated:

Debit 68.02 Credit 76.AB - for the amount of VAT claimed for tax deduction in connection with the termination of the supply agreement and the return of advance payment.

To create a purchase book, an entry is made in the Purchase VAT accumulation register.

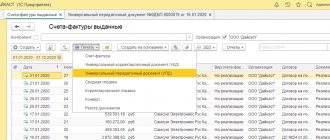

Based on the entries in the VAT Purchases register, a purchase book is generated for the tax period in which the contract was terminated and the amount of advance payment was returned to the buyer, i.e. for the second quarter of 2022 (section Reports - VAT subsection), fig. 3.

Rice. 3. Purchase book for the second quarter of 2022 from the seller

When registering the advance invoice in the purchase book, the following will be indicated:

- in column 2 - transaction type code 22, which corresponds to the operation for the return of advance payments in the cases listed in paragraph 2 of paragraph 5 of Article 171 of the Tax Code of the Russian Federation (Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3 / [email protected] );

- in column 7 - details of the document confirming the return of the advance payment to the buyer (clause “k”, clause 6 of the Rules for maintaining a purchase ledger, approved by Resolution No. 1137);

- in column 15 - the entire amount of the invoice from column 9 on the line “Total payable” (clause “t”, paragraph 6 of the Rules for maintaining a purchase ledger, approved by Resolution No. 1137);

- in column 16 - the amount of VAT that the seller claims for tax deduction (clause “y” of clause 6 of the Rules for maintaining a purchase ledger, approved by Resolution No. 1137).

The amount of the tax deduction will be reflected on line 120 of Section 3 of the VAT return for the second quarter of 2022 (approved by order of the Ministry of Finance of Russia dated October 29, 2014 No. ММВ-7-3 / [email protected] as amended by order of the Federal Tax Service of Russia dated December 28, 2018 No. SA-7-3/ [email protected] ) (section Reports - subsection 1C-Reporting - hyperlink Regulated reports).

VAT on advances issued - what is it?

Sometimes buyers leave an advance payment to their sellers so that in the future they will supply them with products, provide services, etc. This payment is called an advance payment.

The buyer can deduct VAT from the advance payment transferred to the seller. But keep in mind that this is a right, not an obligation. You don't have to claim a deduction. Let's consider both options:

- If you accept VAT as a deduction, you can reduce the tax payable immediately, without waiting for shipment. But after the final shipment, you will have the right to deduct VAT not from the advance payment, but from the full cost of the purchased goods. Then you will need to restore the VAT from the advance and declare the deduction again, but for the full amount.

In addition, VAT must be restored if, after receiving the deduction, you terminated the contract, took the advance payment, or significantly revised the terms of the transaction.

- If VAT is not deducted, then you will still be able to receive a deduction, but after receiving the goods and immediately for their entire cost. In this case, there will be no need to restore VAT.

It makes sense to use the advance deduction when the amount of the advance payment is significant for you, and the deduction actually helps you save on tax. Also, deductions are often received by those whose prepayment and shipment do not fit into one quarter. In other cases, it’s easier to wait for full shipment to avoid unnecessary problems.

Accounting for VAT from the buyer

Now let’s look at an example of how the buyer’s VAT accounting operations are reflected in the 1C: Accounting 8 version 3.0 program when returning the transferred advance payment.

Example 2

| Clothes and Shoes LLC (buyer) entered into an agreement for the supply of goods with Trading House LLC (seller) for a total amount of RUB 180,000.00. (including VAT 20% - RUB 30,000.00) on the terms of full advance payment. After the prepayment was transferred, the delivery contract was terminated and the prepayment amount was returned by the seller. The sequence of operations is given in Table 2. |

table 2

Payment to the supplier

To perform operation 1.1 “Registering an invoice for payment from a supplier,” you must create an Invoice from a supplier document (Purchases section - Purchases subsection) using the Create button.

To perform operation 1.2 “Drawing up a payment order for advance payment to a supplier,” a Payment order document is created (section Bank and cash desk - subsection Bank) using the Create button.

You can create a Payment order document based on the Invoice to buyer document.

Based on the Payment order document, the document Write-off from the current account is entered (operation 1.3 “Registration of prepayment”).

If payment orders are created in the Client-Bank program, then it is not necessary to create them in the 1C: Accounting 8 program. In this case, only the document Write-off from the current account is entered, which generates the necessary transactions. The document Write-off from a current account can be created manually or based on downloading from other external programs (for example, “Client-Bank”).

As a result of posting the document Write-off from the current account, the following accounting entry will be generated:

Debit 60.02 Credit 51 - for the amount of advance payment transferred to the seller, which is 180,000.00 rubles.

In accordance with paragraph 1 of Article 168 of the Tax Code of the Russian Federation, the buyer of goods who has transferred the prepayment amount must be issued an invoice no later than 5 calendar days, counting from the date of receipt of the prepayment by the seller. This invoice is the basis for the buyer, who has transferred the prepayment, to accept for deduction the amounts of tax calculated and presented by the seller, in the presence of documents confirming the actual transfer of the prepayment amounts, and an agreement providing for the transfer of these amounts (clause 2 of article 169, clause 12 Article 171, paragraph 9 Article 172 of the Tax Code of the Russian Federation).

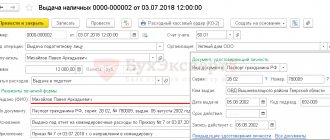

To claim a deduction by the buyer based on an invoice received from the seller (operations 1.4 “Registration of a received invoice for prepayment”, 1.5 “Deduction of VAT from the transferred prepayment”), it is necessary to create the document Invoice received

using the

Create on base

(see Fig. 4).

Rice. 4. Prepayment invoice received by the buyer

In the new Invoice document received, most of the fields are filled in automatically.

This will also automatically install:

- in the Invoice type field – the value For advance;

- in the Transaction type code field - code 02, which corresponds to payment, partial payment (received or transferred) on account of upcoming deliveries of goods (work, services), property rights (Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected] ).

In addition, in the new Invoice document received, you should additionally indicate:

- in the Invoice No. and from fields - the number and date of the invoice received from the seller;

- in the Received field - the date of actual receipt of the invoice, which by default is entered similar to the invoice date specified in the from field.

To automatically reflect the deduction of VAT from the transferred prepayment in accordance with paragraph 12 of Article 171 and paragraph 9 of Article 172 of the Tax Code of the Russian Federation, it is necessary to check the presence of the flag in the line Reflect VAT deduction in the purchase book (Fig. 4).

As a result of posting the Invoice document received, an accounting entry will be made in the accounting register:

Debit 68.02 Credit 76.VA - for the amount of input VAT in the amount of RUB 30,000.00. (RUB 180,000.00 x 20/120), claimed for tax deduction.

From 01/01/2015, taxpayers who are not intermediaries (forwarders, developers) do not keep a log of received and issued invoices. However, after posting the document Invoice received in the Invoice Journal register, an entry is also made to store the necessary information about the received invoice.

To register the received advance invoice in the purchase book, an entry will be made in the Purchase VAT accumulation register with the transaction type code 02, which corresponds to payment, partial payment (received or transferred) on account of upcoming deliveries of goods (work, services), property rights ( Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected] ).

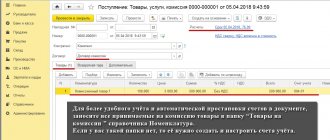

Based on the entries in the VAT Purchases register, a purchase book is formed for the first quarter of 2022 (section Reports - VAT subsection), Fig. 5.

Rice. 5. Purchase book for the first quarter of 2022 from the buyer

The amount of VAT claimed for deduction from the transferred prepayment is reflected on line 130 of Section 3 of the VAT tax return for the first quarter of 2022 (approved by order of the Ministry of Finance of Russia dated October 29, 2014 No. ММВ-7-3 / [email protected] ) (section Reports - subsection 1C-Reporting - hyperlink Regulated reports).

Settlement of mutual counter obligations

The situation is possible in cases where several agreements were concluded between the parties, the terms of which provided for the receipt of an advance payment. By concluding a netting agreement, the parties can secure a VAT deduction, since the amounts of advances can be considered returned (Letters of the Ministry of Finance of Russia dated 04/01/2014 N 03-07-РЗ/14444, dated 06/22/2010 N 03-07-11/262).

Example:

According to the supply agreement, June LLC must ship products to Vesne LLC in the amount of 94,400.00 thousand rubles. (including VAT). The agreement provides for an advance payment of 50%, which Vesna LLC transferred. In addition, Vesna LLC was supposed to provide advertising services to June LLC, for which it received an advance in the amount of 47,200 rubles. (including VAT).

Both contracts were later terminated. Based on the offset, counter obligations to repay advances were terminated. Despite the fact that no actual refund was made, the parties have the right to receive a deduction of VAT that they previously paid to the budget.

However, if the seller counts the advance from the buyer under the terminated contract against new supplies, then in this case there are no grounds for deducting VAT (Letters of the Ministry of Finance of Russia dated 04/01/2014 N 03-07-РЗ/14444, dated 08/29/2012 N 03- 07-11/337). Based on clause 8 of Art. 171, paragraph 6 of Art. 172 of the Tax Code of the Russian Federation, the seller will have the right to deduct only when goods are shipped under the terms of a new agreement (Letter of the Ministry of Finance of Russia dated 04/01/2014 N 03-07-РЗ/14444).

Recovering VAT on advances to the supplier

Restoration of tax on advances from listed suppliers occurs at the moments when the advance is closed for one of the following reasons (subclause 3, clause 3, article 170 of the Tax Code of the Russian Federation):

1. Supplier documents have been received for the delivery made on account of a previously paid advance or part thereof.

2. The advance payment is fully or partially returned by the supplier.

3. The purpose of the payment has been changed, and it is no longer qualified as an advance on account of a future delivery.

4. The amount of the unclosed advance was written off to financial results.

5. The advance payment is taken into account when offsetting mutual claims.

The need to restore VAT is not indisputable for all of the listed cases. Read more about this in the following materials:

- “How to take into account VAT amounts when writing off accounts receivable”;

- “Should VAT be restored when writing off an advance payment that was not worked out by the seller?”;

- “VAT from the advance upon termination of the contract was allowed not to be restored”.

However, in some cases, failure to reinstate the tax will likely result in disputes with the tax authorities.

When recovering the amount of VAT that arithmetically (according to the corresponding tax rate in the calculation formula) corresponds to the amount of the closed advance, an accounting entry is made:

Dt 76/VA Kt 68/02,

where 76/VA is a subaccount for VAT accounting for advances issued.

The total amount of tax recovered for the tax period and subject to inclusion in the VAT return is determined as the turnover in the debit of subaccount 76/VA in correspondence with the credit of subaccount 68/02 for this period.

An example of the restoration of VAT accepted for deduction from an advance from ConsultantPlus: Organization "Alpha" (applies OSN) transfers on June 15 to the seller an advance for goods of 60,000 rubles, including VAT - 10,000 rubles. At the end of the second quarter, she declares the amount of VAT on the advance to be deducted. You can view the entire example in K+ , having received free trial access to the system.