The need to calculate depreciation of buildings

Buildings, as part of the assets of the enterprise, are used to support the production process and for administrative (management) purposes. Over the years, they gradually wear out, which is natural. Buildings lose their original properties and characteristics. As the technical condition deteriorates, their value decreases. When property is first entered into accounting records, it has an initial value. It is initially determined by the purchase price and the costs of putting it into operation.

Along with normal wear and tear, the value is subject to downward adjustment. That is why depreciation is calculated as a gradual attribution of the cost of fixed assets to the cost of goods manufactured, services provided or work performed.

Depreciation in accounting: basics

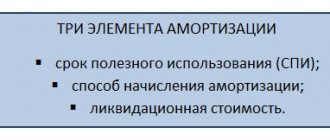

The starting element in the methodology for calculating depreciation is the useful life (LPI) of real estate assets. It is installed following the data of the “Classification of fixed assets included in depreciation groups.” It operates in accordance with government decree in 2002. It is also necessary to take into account the changes made on 07/07/2016. Their action began in January of this year.

The SPI is the period during which the building is able to serve productively as an asset and contribute to the accomplishment of the taxpayer's objectives.

The enterprise determines it itself, based on the date the building was put into operation and information about the OS classification: (click to expand)

| OS groups (buildings incl.) | SPI (years) | |

| over | up to (inclusive) | |

| 4th | 5 | 7 |

| 5th | 7 | 10 |

| 7th | 15 | 20 |

| 8th | 20 | 25 |

| 9th | 25 | 30 |

| 10th | 30 | |

The buildings belong to the 4th and 5th, as well as to 7-10 groups. The enterprise independently determines which of them its real estate should be classified as. The characteristics of each set of buildings provide a clue.

Accounting for temporary buildings and structures

The initial cost of temporary structures is formed according to account 08 “Investments in non-current assets”, subaccount 3 “Construction of fixed assets”. When commissioning, their cost is written off to the debit of account 01 “Fixed Assets”.

The correspondence of invoices will be as follows:

Debit 23 Credit 10

— the actual cost of materials consumed during installation is written off;

Debit 23 Credit 70, 69

— reflects the accrued amount of wages and contributions of workers engaged in the construction of temporary buildings and structures;

Debit 08-3 Credit 23

— reflects the share of expenses of auxiliary production attributable to non-capital work on the construction of temporary buildings and structures;

Debit 01 Credit 08-3

— the fixed asset is included in fixed assets.

The receipt of temporary structures on the balance sheet of an organization is documented by an act in form No. OS-1a “Act of acceptance and transfer of a building (structure)” for title temporary structures and a special unified form No. KS-8 “Act of commissioning of a temporary (non-title) structure” - for non-titlers.

After this, depreciation should be charged on the object. To do this, in accounting, an organization can independently determine the useful life of fixed assets depending on the expected life of the object, expected productivity and power, or physical wear and tear (clause 21 of PBU 6/01 “Accounting for fixed assets”). In practice, the period of use of a temporary structure is most often equal to the construction period, and upon completion it will be completely depreciated.

The correspondence will be like this:

Debit 20 (23, 25, 26, ...) Credit 02

— depreciation has been calculated for temporary buildings and structures.

Building depreciation: wiring

The account used for depreciation is 02. Accounting entries reflecting the transactions:

| Debit | Credit | Operations |

| 20 | 02 | depreciation accrued in production: – mainly |

| 23 | – auxiliary | |

| 29 | – serving | |

| 25 | depreciation of fixed assets for general production purposes | |

| 97 | depreciation of fixed assets in deferred costs |

Calculation of depreciation of buildings in tax accounting

Tax legislation provides two ways to calculate depreciation of buildings:

- Linear – depreciation is calculated evenly and separately for each object. Regardless of the accounting policy of the organization, it must be applied to buildings. The basis for the calculation is their initial cost.

- Nonlinear.

The linear method is described above (example No. 1).

When applying the nonlinear method:

- The amount of depreciation should be calculated for the complex of buildings, and not for each one separately.

- The basis is taken as the residual value of the OS, not the original one. Their total assessment is reduced monthly by the accrued amount of depreciation.

Depreciation charges (A) are determined as follows:

A = Co Na, where:

Co – residual value of the building complex;

Na is the depreciation rate.

The size of the latter is:

| Depreciation group | Norm, % |

| 4 | 3,80 |

| 5 | 2,70 |

| 7 | 1,30 |

| 8 | 1,00 |

| 9 | 0,80 |

| 10 | 0,70 |

Example No. 2. The total residual value of buildings of the seventh group is 15 million rubles on the first day of the year. For the 7th group of fixed assets, the depreciation rate is 1.3%.

Let's calculate the amount of depreciation:

- January 15,000,000 · 1.3/100 = 195 thousand rubles.

- February (15,000,000 – 195,0000) 1.3/100 = 14,805,000 1.3/100 = 192,465

- March (14,805 – 192,465) 1.3/100 = 14,612,535 1.3/100 = 189,963

The residual value of the group of buildings at the beginning of the second quarter will be:

14,612,535 – 189,963 = 14,422,572 rubles.

Further calculations are carried out in exactly the same way.

In a non-linear way, the cost of buildings is written off much faster than in a linear way. The amount will be 35-40% in the first year of asset operation.

Important! The method is convenient to use in organizations that prefer accelerated depreciation.

Methods and formulas used in accounting

In equipment accounting, several types of depreciation are used. Preference is given to the option that best suits the business conditions of the need for faster write-off of the cost or seasonality of equipment use.

The accounting methods used are:

- Linear, with cost written off in equal parts. The simplest method that does not require additional calculations.

- Reducing balance, in which the residual value of the equipment is taken as the basis. When using this method, it is possible to use a multiplying factor.

- Cumulative, with the amount written off depending on the number of years of operation. The largest amount of write-off occurs in the first years of use. Used for high-tech equipment.

- Production, in which write-off is carried out depending on the volume of products produced. Used for seasonal use of equipment.

| Payment method | Formula | Decoding concepts |

| Linear | Sp x N / 100% | Sp – cost upon registration, N – norm |

| Reducing balance | Co x N x K /100% | Co – residual value, N – norm, K – acceleration coefficient |

| Cumulative | Sp x Cho/Chi | Sp – cost at installation, Cho – number of years until the end of use, Chi – number of years of operation |

| Industrial | Of x Sp / Op | Cn – cost at production, Of – actual release, Op – planned release |

The choice of accrual method must be approved in the local regulations of the enterprise. Organizations using a simplified accounting procedure can charge depreciation once, on the last date of the reporting year.

Features of depreciation calculations for reactivated and reconstructed buildings

When buildings are mothballed for a period exceeding three months, depreciation is paused. After the object is put back into production, it begins to be calculated again in the manner prescribed by the enterprise. The peculiarity is that it is necessary to increase the SPI of the building for the period it is in conservation - months or years.

This period also increases during reconstruction. It should only be taken into account that the SPI cannot exceed the service period established for the fixed assets of the corresponding depreciation group. When the period of time spent on reconstruction, major repairs or modernization of a building is more than a year, the depreciation process is suspended.

Depreciation of buildings during liquidation

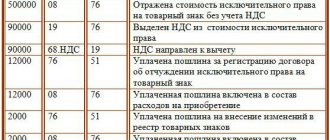

In case of liquidation of fixed assets, they should be written off from the balance sheet. The transaction should be formalized by order of the manager and a Certificate of the appropriate form. In tax accounting, costs associated with liquidation, including underaccrued depreciation, are included in non-operating expenses. The following entries will be used in accounting:

| Debit | Credit | Write-off transactions |

| 01.2 | 01 | initial cost of disposed buildings |

| 02 | 01.2 | depreciation |

| 91.2 | 01.2 | residual value of buildings |

| 91.2 | 60 | Reflection of expenses for liquidation of OS |

How to determine which depreciation group real estate belongs to?

All fixed assets are classified according to depreciation group, which is defined in the OS and OKOF Classifier of the last year of publication.

In order to determine which depreciation group an object belongs to, it is necessary to know its useful life (USI). The organization itself determines the SPI and confirms it with a separate act with the date the premises are put into operation.

According to the OS Classifier (RF Government Decree No. 526 dated April 28, 2018), non-residential buildings and premises belong to:

- Group seven (from 15 to 20 years inclusive):

- wooden;

- container;

- wood-metal;

- panel;

- frame;

- adobe;

- adobe;

- other non-residential buildings.

- Eighth group (from 20 to 25 years inclusive). Buildings with:

- lightweight masonry;

- with cobblestone, chopped or log walls;

- with reinforced concrete, brick and wooden pillars.

- Ninth group (from 25 to 30 years inclusive). Storage for vegetables and fruits:

- with walls made of stone;

- brick and reinforced concrete columns;

- and reinforced concrete coverings.

- Tenth group (from 30 years and above) . Buildings that were not included in previous groups, with durable frames and coatings.

Do you want to know more about non-residential real estate, including industrial and commercial? Read our articles about the peculiarities of transactions with such objects and the nuances of taxation, about their redevelopment, reconstruction and reconstruction, as well as about the ownership of non-residential buildings and premises.

Calculation of depreciation under the simplified tax system, UTII and unified agricultural tax: features

Simplification does not mean that depreciation charges can also be abolished. If operating systems are present and used in the business process, it means that they are worn out and, someday, will require replacement or repair. The amount of depreciation under the simplified tax system “income minus expenses” is included in total costs and reduces the tax base.

In tax accounting, the cost of fixed assets must be repaid evenly, in equal parts over one calendar year. The simplified tax system “income” involves paying tax on the amount of income received. Depreciation is not included in it, so such entrepreneurs may not charge it.

A similar situation exists for enterprises with UTII, where the object of taxation is imputed income. But such organizations keep accounting in full. And depreciation is calculated according to general rules, most often in a straight-line manner. This also applies to the Unified Agricultural Tax.

Tax accounting of temporary buildings and structures

In tax accounting the situation is completely different. The depreciation period of a temporary structure must be determined only in accordance with the depreciation groups of the classification of fixed assets. This was stated in the letter of the Federal Tax Service of Russia dated January 13, 2012 No. 03-03-06/1/12. This means that depreciation periods will, as a rule, be long compared to accounting, and therefore, by the end of construction, temporary buildings and structures will not be depreciated in tax accounting. Their residual value can be written off after liquidation as non-operating expenses.

As a result, during the period of construction work, due to differences in the accounting for depreciation of temporary fixed assets, temporary accounting differences will arise (clause 8 of PBU 18/02 “Accounting for corporate income tax calculations”). Let's explain with an example.

Example

LLC "Montazhnik" is engaged in construction work. In 2012, it built its own warming room for workers. Its cost was 200,000 rubles. The period of use of the premises should be 24 months - during construction. The premises belong to depreciation group 10. In tax accounting, the useful life will be 35 years or 420 months.

We calculate the depreciation rate:

— in tax accounting: 1/420 months. x 100% = 0.24%;

— in accounting: 1 / 24 months. x 100% = 4.17%.

The amount of monthly depreciation charges will be:

— in tax accounting: 200,000 rubles. x 0.24% = 480 rub.;

— in accounting: 200,000 rubles. x 4.17% = 8340 rub.

Therefore, during the construction period, a deductible temporary difference arises monthly:

8340 rub. – 480 rub. = 7860 rub.

This difference, in turn, leads to the formation of a deferred tax asset:

7860 rub. x 20% = 1572 rub.

The formation of a deferred tax asset is reflected monthly by posting:

Debit 09 Credit 68

-1572 rub. – deferred tax asset accrued.

When construction is completed, the entire amount of the tax asset will be collected on debit account 09:

1572 rub. x 24 months = 37,728 rub.

After the liquidation of the temporary structure, this amount must be written off:

Debit 99 Credit 09

— 37,728 rub. – the deferred tax asset is written off.