Settlements on account 73

The main settlements with personnel are carried out on accounts 70 and 71. The first is wages, bonuses, and so on, the second is the money issued for reporting. Account 73 takes into account other calculations not related to salaries and reporting. This includes:

- financial assistance for various reasons: the birth of a child, difficult financial condition, and so on;

- loans issued to employees;

- payments for the use of personal property of employees for work purposes, for example, rental payments for the use of a personal car;

- own-produced products sold to employees;

- special clothing and footwear transferred into ownership;

- amounts that the employee must compensate in connection with the material damage caused;

- compensation for late wages, vacation pay, and so on.

Payment of wages, bonuses, vacation pay, sick leave, maternity pay, additional payments for overtime work and similar payments are not reflected in account 73.

Material aid

Organizations can pay employees financial assistance upon the occurrence of certain events (birth of a child, anniversary, illness, etc.), that is, its payment is not related to the performance of labor functions by these employees. Financial assistance is paid only at the request of the employer.

As a rule, the provision of financial assistance is not provided for in an employment or collective agreement. The decision on its payment is made by the head of the organization based on the employee’s application, which indicates the reasons for seeking help (with the attachment of relevant documents). Payment of financial assistance is made on the basis of the resolution of the head on the application or on the basis of the relevant order. The order is drawn up in any form, it indicates the amount of financial assistance, the period and source of payment.

Material assistance, in its essence, does not relate to the wage system, and is not of a production or incentive nature (Article 144 of the Labor Code of the Russian Federation). In accordance with paragraph 23 of Article 270 of the Tax Code of the Russian Federation, when determining the base for calculating income tax, amounts of financial assistance are not taken into account.

Also, in accordance with paragraph 28 of Article 217 of the Tax Code of the Russian Federation, financial assistance in an amount not exceeding 4,000 rubles per year per employee is not subject to personal income tax. Assistance provided in excess of this amount is taxed in accordance with the generally established procedure. In addition, the entire amount of financial assistance is exempt from taxation if it is paid (clause 8 of Article 217 of the Tax Code of the Russian Federation):

- to taxpayers in connection with a natural disaster or other emergency circumstances in order to compensate for material damage or harm to health;

- individuals who have suffered from terrorist attacks on the territory of the Russian Federation;

- family members of a deceased employee or an employee in connection with the death of members of his family;

- employees (parents, adoptive parents, guardians) at the birth (adoption) of a child.

The amount of financial assistance paid at the birth (adoption) of a child is exempt from taxation provided that it is no more than 50,000 rubles for each child and is paid within the first year after his birth.

It is important that these payments are one-time and that employees provide the organization with documents confirming their right to receive these payments. For example, a copy of a family member's death certificate or a copy of a birth certificate, etc.

Also, insurance premiums are not charged on amounts of one-time financial assistance provided to:

- to individuals in connection with a natural disaster or other emergency in order to compensate for material damage or harm to health caused to them;

- individuals who have suffered from terrorist attacks on the territory of the Russian Federation;

- employees (parents, adoptive parents, guardians) at the birth (adoption) of a child. On this basis, financial assistance in the amount of no more than 50,000 rubles is exempt from insurance premiums. for each child, provided that it is paid within the first year after the birth (adoption) of the child;

- to an employee in connection with the death of a member (members) of his family.

According to subparagraph 11 of paragraph 1 of Article 9 of the Law of July 24, 2009 No. 212-FZ, amounts of financial assistance provided by employers to their employees that do not exceed 4,000 rubles per employee per billing period (calendar year) are also not subject to insurance contributions. Insurance premiums must be charged on amounts exceeding the established limit.

It is necessary to take into account that in accounting financial assistance is recognized as part of other expenses, but in tax accounting it is not, as a result of which the organization has a permanent difference, which corresponds to a permanent tax liability (PNO) (clauses 4, 7 of the Accounting Regulations PBU 18 /02 “Accounting for calculations of corporate income tax”, approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n).

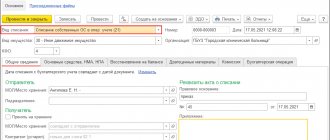

Let's give an example of how a transaction for issuing financial assistance to an employee is reflected in the accounting records.

Example

An employee of an organization was paid financial assistance in the amount of 15,000 rubles in March 2011 due to the theft of a wallet.

These transactions are reflected in accounting as follows. Debit 91-2 Credit 73 - 15,000 rubles - financial assistance was accrued to the employee. Debit 73 Credit 68-1 1430 rubles - personal income tax is withheld from the amount of the employee’s income. ((15,000 rubles - 4,000 rubles)x13%) Debit 99 Credit 68-2 - 3,000 rubles - PNO reflected (15,000 rubles x 20%); Debit 73 Credit 50 - 13,570 rubles - financial assistance was paid to the employee minus the withheld personal income tax. Debit 20 Credit 69 - 3762 rubles - insurance premiums accrued.

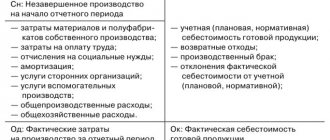

Characteristics of account 73

Account 73 - active-passive. The loan reflects the company's debt to employees. That is, these are amounts due for payment in the form of financial assistance, compensation, fees for using a car, and so on. The loan records deductions from employee salaries, for example, the cost of training, workwear, and so on.

The credit balance of account 73 in the balance sheet is reflected in line 1520 “Accounts payable”.

The debit records the debts of employees to the company. The most striking example is loans issued. This also includes amounts that the employee must reimburse or compensate, for example, as a result of material damage.

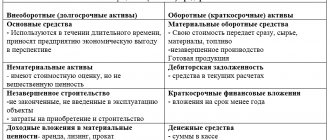

The debit balance of account 73 in the balance sheet is reflected on the following lines:

- 1170 - financial investments in the form of long-term loans to employees;

- 1240 - financial investments in the form of short-term loans to employees;

- 1230 is the employee’s debt to the company.

Account analytics is built by employee.

Account 73 in accounting

In addition to remuneration or accountable amounts, other situations may arise in an organization regarding the accounting of settlements with personnel, for example, accounting for shortages or the use of personal property. For these purposes, account 73 “Settlements with personnel for other operations” is used.

Let's look at other situations:

- Providing loans;

- Compensation for material damage;

- Payment for the use of personal property (for example, a car);

- Reimbursement for telephone calls;

- Other calculations.

For each situation, you can select a separate subaccount:

Characteristics of account 73 Settlements with personnel for other transactions:

- It is an active-passive account. The debit balance characterizes the debt of the employee, and the credit balance - of the organization;

- Analytical accounting is carried out in the context of enterprise employees.

Main entries for account 73

The table contains the main transactions that involve the account for settlements with employees for other transactions.

| Debit | Credit | Content |

| 73 | 50 / 51 / 52 / 57 / 62 | A loan was issued to an employee from the cash register / from a current or foreign currency account / by transferring a bill of exchange. |

| 73 | 94 | The amount of the shortfall is recorded, which is subject to recovery from the employee. |

| 73 | 98 | The excess of the recovered amount of shortage of goods and materials over the book price of goods and materials. |

| 73 | 28 | The employee was accrued the amount of losses from defects due to the fault of the employee. |

| 73 | 20 / 23 / 29 | The guilty employee was awarded the amount of damage caused. |

| 73 | 99 | The guilty employee is charged an amount to be compensated as a result of an emergency: fire, accident, and so on. |

| 73 | 91 | The cost of workwear, training, registration of a work record book, subject to reimbursement by the employee. |

| 73 | 90 | Selling our own products to employees. |

| 50 / 51 / 52 / 57 | 73 | The employee returned the previously received loan. |

| 70 | 73 | Deductions from an employee’s salary (compensation for damage, loan repayment, reimbursement of the cost of workwear, training, etc.). |

| 94 | 73 | Losses due to shortages or defects that were previously attributed to the employee, but for which the court refused to recover, were written off. |

| 91 | 73 | Reflection of financial assistance to an employee. |

| 99 | 73 | An employee's debt due to an emergency was written off. |

We recommend keeping records of settlements with personnel using the cloud service Kontur.Accounting. Calculate salaries, issue money to accounts, make deductions, and so on, right in the program. And also - easily keep records, submit reports via the Internet and use other tools. The system is intuitive and simple. We give all newcomers a trial period of 14 days.

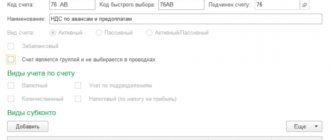

Correspondence of account 73 with other accounts

Table 1. By debit of account 73:

| Dt | CT | Wiring Description |

| 73.02 | 20, 29,23 | Damage caused to the main, servicing or auxiliary production is written off to the perpetrators |

| 73.02 | 28 | The marriage is blamed on the guilty parties |

| 73.01 | 50, 51, 52, 57, 62 | A loan was issued from the cash desk, from a current or foreign currency account, by transferring transfers or by endorsing buyer bills |

| 73.03 | 50, 52 | Payment of rental of personal property or reimbursement of amounts for the use of personal property through a cash register or bank account |

| 73.03 | 68 | Withholding personal income tax from other transactions |

| 73.03 | 69 | Debt on insurance premiums for other operations |

| 73.03 | 76 | Insurance payments for personal insurance are reflected |

| 73 | 79 | Transfer of debt upon transfer from a separate division |

| 73.03 | 81 | Issue of own shares |

| 73.01 | 91.01 | Interest on loans issued |

| 73.02 | 94 | The amounts of shortages and damages within the book value were written off |

| 73.02 | 98.4 | Difference between recoverable and book value, shortfalls for previous years |

| 73.02 | 99 | Amounts of damage from emergency events (fire, accident) are written off to the perpetrators |

Table 2. For the credit of account 73:

| Dt | CT | Wiring Description |

| 20 | 73.03 | Accrual of rental of personal property or reimbursable amounts for the use of personal property through a cash register or checking account |

| 41 | 73 | Receipt of goods through payment of debt |

| 50, 51, 52 | 73 | Receipt of payment from employees (loan payment, compensation for shortages, losses from defects) |

| 70 | 73 | Deduction of employee debt from wages |

| 76 | 73 | Amounts of compensation under the employee's insurance contract |

| 91.02 | 73 | Write-off of unreceivable debt |

| 94 | 73 | The claim for shortages is not justified, write-off of debt for shortages |

| 99 | 73 | Write-off of debt in connection with emergency situations in which an employee died |

Main subaccounts of account 73

K buh. Account 73 can open, for example, the following subaccounts:

- account 73-1 – for settlements on loans provided;

- account 73-2 – for calculations for compensation for material damage, etc.

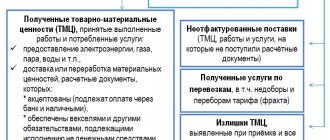

| Subaccount | What do they reflect? | Debit | Credit |

| 73-1 | Settlements with employees for loans provided to them. For example:

| On the debit side, account 73 reflects the amount of the loan provided to the employee in correspondence with account 50 “Cash” or 51 “Cash accounts” | For the amount of payments received from the borrower employee, account 73 is credited in correspondence with accounts 50, 51, 70 (depending on the accepted payment procedure) |

| 73-2 | Calculations for compensation for material damage caused by an employee as a result of:

| In the debit of account 73, amounts to be recovered from guilty persons are included from the credit of accounts:

| On the credit account 73 entries are made in correspondence with the accounts:

|

Analytics on accounting account 73 is carried out for each employee of the organization.

What is reflected in account 73 “Settlements with personnel for other operations”

This account reflects almost all types of settlements with employees, except for payments for wages and with accountable persons. Detailed information about account 73 can be found in the Chart of Accounts, approved. By Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n.

In particular, account 73 reflects:

- help,

- compensation paid to employees for the use of personal property,

- preferential loans,

- other business transactions for settlements with personnel.

Analytics for account 73 is carried out for each employee of the company.

Postings to subaccount 73.1

73 account may have several sub-accounts, the use of which is regulated by the accounting policy of the organization.

Conventionally, we assume that the company uses subaccount 73.1 to account for settlements with employees for loans provided to them. Account assignments using subaccount 73.1

| Dt | CT | Characteristics of a business transaction |

| 73.1 | 50 | The employee was given a loan from the cash register to purchase livestock |

| 73.1 | 51 | A loan for building a house was transferred from the current account to the employee's account |

| 73.1 | 10 | The employee was provided with a loan in the form of construction materials |

| 73.1 | 91 | Interest is accrued on the loan amount for use |

| 50 | 73.1 | The organization's cash desk received the amount to repay the loan debt |

| 51 | 73.1 | Funds to pay for the loan were transferred to the company's bank account |

| 70 | 73.1 | The loan amount and interest are deducted from the employee's salary. |

| 91.2 | 73.1 | The amount of unrepaid debt is written off as expenses of the organization |

As can be seen from the table, the organization has the right to withhold the amount of debt from the employee’s salary. If the retained funds are still not enough to repay the loan amount, the balance is written off to the financial result (account 91.2).