Disclosure Rules

By Order of the Ministry of Finance No. 287n dated November 27, 2020, changes were made to the accounting regulations (PBU):

- 9/99 “Income of the organization”;

- 11/2008 “Information about related parties”;

- 2/2008 “Accounting for construction contracts”;

- 12/2010 “Information by segments”.

These changes allow legal entities not to disclose part of the information in the balance sheet and financial results report if they believe that this will lead or may lead to economic losses or damage the business reputation of the organization, its counterparties or related parties. In order not to distort reporting data, this information is disclosed in limited explanations.

"DELICATE" FEATURE

The administrative budget is one of the most “delicate” budgets. The employee responsible for such a budget should be as non-confrontational as possible. If we take, for example, the production budget, then no matter how opposed the production director is to the numbers, there are strict technological standards for materials and labor costs. In addition, there is comprehensive data on production in several structures: accounting, standardization department, financial and economic planning departments. This data is clearly documented and is sufficient for budgeting purposes.

As for administrative and managerial personnel, directors in charge of one or another area strive to obtain maximum funding specifically for their department.

The first reason : having maximum opportunities, there is no need to ask in the future to pay for necessary but not budgeted expenses.

The second reason is ambition: “Why should I, the HR director, have less funding than the logistics director.” Often similar positions are occupied not only by directors of areas, but also by heads of departments, thus wanting to consolidate their authority.

When the budgeting system encounters misunderstanding and resistance on the part of such managers, neither the economist nor the head of the PEO will be able to eliminate this obstacle on their own. This issue will be beyond their competence. The situation entails either a suspension of the process of budgeting administrative expenses, or adaptation to certain “dissenters”. The latter leads to distortion of the methodology for calculating financial results. As a result, managers make erroneous management decisions and the company suffers losses. This means that the budgeting process should be supervised by the general director or the owner of the company . The slightest resistance or violation of regulations must be strictly suppressed.

essence , goals, objectives and methods of budgeting, it is necessary to conduct a separate seminar ( master class ) for administrative and managerial personnel on budgeting . The seminar should be attended not only by heads of departments and directors of areas, but also by those employees who will be involved in budgeting (from 1 to 3 people from each department, depending on its size and the specifics of the data). After all, it happens that the boss is responsible for the budget for the department, but one of the subordinates works with the numbers, makes the necessary calculations, prepares the data, interacts and consults with the PEO economist.

What to include in the report

This form of reporting is regulated by section 5 of PBU 4/99 “Accounting statements of an organization.” Previously, it was called the “Profit and Loss Statement”, but from the annual report for 2012, according to information from the Ministry of Finance of Russia No. PZ-10/2012, the Federal Law No. 402-FZ of 12/06/2011 “On Accounting", it received a new name. The report form itself has not changed much, and accountants continue to use the old name as a colloquial name.

The law regulates what must be included in an example of filling out a financial results report:

- the amount of revenue received during the year;

- cost of sales by organization;

- administrative and commercial expenses of the organization;

- gross profit or loss for the reporting period;

- interest received and paid;

- other income and expenses for the year;

- profit or loss from sales;

- total profit or loss before taxes;

- changes during the year in deferred tax assets and liabilities;

- net profit or loss;

- other reference information.

ADMINISTRATIVE BUDGET

It is recommended to draw up a budget for administrative expenses by department , as this greatly simplifies its analysis (see the example of the budget of Innovation LLC; to simplify the presentation of material by department, only labor costs are presented).

When developing a budget, it is important to ensure that it is informative. The budget should be sufficiently detailed and not bulky. The purpose of the software used is to add up and decompose the budget into nesting levels, provide various variations of sorting and sampling of data, and ensure ease of control and analysis.

If digital codes expense , this will avoid confusion and double-digit interpretations when identifying expenses . Digital ciphers are convenient. For example, if a PEO economist needs to agree on an application for payment for the purchase of a new laptop for the logistics department, he will put the appropriate code, and a specialist from the financial department, accepting the application for payment, will check whether such payment fits into the amount for this item in the budget.

Budget of administrative expenses for 2016 , thousand rubles.

| No. | Budget item | Plan for the year | Monthly plan | ||||||

| January | February | March | total for Q1 | … | total for the 2nd quarter | … | |||

| 1 | Depreciation and rental of premises, equipment, office furniture and equipment | 1705,0 | 150,0 | 140,0 | 136,0 | 426,0 | 315,0 | ||

| 2 | Remuneration of administrative and managerial personnel | 71 038,0 | 5866,0 | 5404,0 | 6520,0 | 17 790,0 | 18 449,0 | ||

| 2.1 | General Director and Secretariat | 2947,0 | 250,0 | 250,0 | 250,0 | 750,0 | 718,0 | ||

| 2.2 | Logistics Directorate | 15 364,0 | 1120,0 | 1120,0 | 1370,0 | 3610,0 | 4053,0 | ||

| 2.2.1 | Director of logistics | 1157,0 | 100,0 | 100,0 | 100,0 | 300,0 | 249,0 | ||

| 2.2.2 | Purchase department | 5578,0 | 300,0 | 300,0 | 550,0 | 1150,0 | 1499,0 | ||

| 2.2.3 | Transport service | 8629,0 | 720,0 | 720,0 | 720,0 | 2160,0 | 2305,0 | ||

| 2.3 | HR Directorate | 8810,0 | 660,0 | 675,0 | 792,0 | 2127,0 | 2100,0 | ||

| 2.3.1 | HR Director | 961,0 | 85,0 | 90,0 | 95,0 | 270,0 | 240,0 | ||

| 2.3.2 | Human Resources Department | 1318,0 | 110,0 | 120,0 | 120,0 | 350,0 | 320,0 | ||

| 2.3.3 | Recruitment department | 1490,0 | 45,0 | 45,0 | 157,0 | 135,0 | 440,0 | ||

| 2.3.4 | Labor Standards Department | 5041,0 | 420,0 | 420,0 | 420,0 | 1260,0 | 1100,0 | ||

| 2.4 | Financial Directorate | 30 720,0 | 2930,0 | 2420,0 | 2873,0 | 8223,0 | 8416,0 | ||

| 2.4.1 | Financial Director | 1380,0 | 130,0 | 120,0 | 110,0 | 360,0 | 374,0 | ||

| 2.4.2 | Financial department | 6393,0 | 700,0 | 250,0 | 763,0 | 1713,0 | 1802,0 | ||

| 2.4.3 | Accounting | 17 320,0 | 1550,0 | 1550,0 | 1550,0 | 4650,0 | 4713,0 | ||

| 2.4.4 | Planning and Economic Department | 5627,0 | 550,0 | 500,0 | 450,0 | 1500,0 | 1527,0 | ||

| 2.5 | Legal department | 3247,0 | 298,0 | 315,0 | 326,0 | 939,0 | 815,0 | ||

| 2.6 | Software department | 5235,0 | 212,0 | 212,0 | 512,0 | 936,0 | 1199,0 | ||

| 2.7 | Housekeeping service | 4715,0 | 396,0 | 412,0 | 397,0 | 1205,0 | 1148,0 | ||

| 3 | Recruitment | 32,0 | 15,0 | 15,0 | 10,0 | ||||

| 4 | Training | 1789,8 | 328,8 | 114,0 | 190,0 | 632,8 | 397,0 | ||

| 5 | Communication services, Internet | 198,0 | 16,8 | 16,2 | 18,2 | 51,2 | 55,0 | ||

| 5.1 | Fixed city communication | 16,8 | 1,2 | 1,2 | 1,2 | 3,6 | 4,2 | ||

| 5.2 | mobile connection | 115,0 | 8,6 | 8,0 | 10,0 | 26,6 | 32,0 | ||

| 5.3 | Internet | 84,0 | 7,0 | 7,0 | 7,0 | 21,0 | 21,0 | ||

| 6 | Material support | 569,0 | 43,0 | 42,5 | 71,0 | 156,5 | 151,0 | ||

| 6.1 | Stationery | 213,0 | 12,0 | 15,0 | 32,0 | 59,0 | 57,0 | ||

| 6.2 | Printer consumables, cartridges | 197,0 | 18,0 | 15,0 | 24,0 | 57,0 | 55,0 | ||

| 6.3 | Small office supplies | 96,0 | 8,0 | 8,0 | 8,0 | 24,0 | 24,0 | ||

| 6.4 | Other material support | 63,0 | 5,0 | 4,5 | 7,0 | 16,5 | 15,0 | ||

| 7 | Public utilities | 2362,0 | 207,0 | 211,0 | 204,0 | 622,0 | 493,0 | ||

| 7.1 | Electricity | 480,0 | 45,0 | 49,0 | 32,0 | 126,0 | 115,0 | ||

| 7.2 | Water supply and wastewater | 60,0 | 5,0 | 5,0 | 5,0 | 15,0 | 15,0 | ||

| 7.3 | Garbage removal | 12,0 | 1,0 | 1,0 | 1,0 | 3,0 | 3,0 | ||

| 7.4 | Heat supply | 350,0 | 36,0 | 36,0 | 36,0 | 108,0 | |||

| 7.5 | Disinfection | 20,0 | 10,0 | 10,0 | |||||

| 8 | Security services | 1440,0 | 120,0 | 120,0 | 120,0 | 360,0 | 360,0 | ||

| 9 | Fare | 626,0 | 35,0 | 33,0 | 150,0 | 218,0 | 140,0 | ||

| 9.1 | Services of third party carriers | 120,0 | 10,0 | 10,0 | 10,0 | 30,0 | 30,0 | ||

| 9.2 | Repair and maintenance of your own vehicles, including spare parts | 240,0 | 120,0 | 120,0 | 50,0 | ||||

| 9.3 | fuels and lubricants | 266,0 | 25,0 | 23,0 | 20,0 | 68,0 | 60,0 | ||

| 10 | Insurance | 332,0 | 40,0 | 0,0 | 60,0 | 100,0 | 150,0 | ||

| 10.1 | Employee insurance | 80,0 | 60,0 | 60,0 | |||||

| 10.2 | Property insurance (except motor vehicles) | 212,0 | 150,0 | ||||||

| 10.3 | Motor insurance | 40,0 | 40,0 | 40,0 | |||||

| 11 | Banking services | 818,0 | 17,0 | 32,0 | 187,0 | 236,0 | 439,0 | ||

| 11.1 | Exchange difference | 360,0 | 160,0 | 160,0 | 180,0 | ||||

| 11.2 | Banking fees | 120,0 | 10,0 | 10,0 | 10,0 | 30,0 | 30,0 | ||

| 11.3 | 24,0 | 2,0 | 2,0 | 2,0 | 6,0 | 6,0 | |||

| 11.4 | Collection | 60,0 | 5,0 | 5,0 | 5,0 | 15,0 | 5,0 | ||

| 11.5 | Interest on loan | 200,0 | 0,0 | 200,0 | |||||

| 11.6 | Loan costs | 10,0 | 10,0 | 10,0 | |||||

| 11.7 | Other bank expenses | 44,0 | 15,0 | 15,0 | 18,0 | ||||

| 12 | Entertainment expenses | 460,0 | 160,0 | 300,0 | |||||

| 13 | Third-party company services | 323,0 | 5,0 | 5,0 | 123,0 | 133,0 | 104,0 | ||

| 13.1 | Auditing services | 50,0 | 50,0 | 50,0 | |||||

| 13.2 | Consulting services | 60,0 | 5,0 | 5,0 | 5,0 | 15,0 | 15,0 | ||

| 13.3 | Legal services | 30,0 | 0,0 | 30,0 | |||||

| 13.4 | Expert services | 68,0 | 68,0 | 68,0 | |||||

| 13.5 | IT services | 115,0 | 0,0 | 59,0 | |||||

| 14 | Post services | 153,0 | 17,5 | 7,5 | 7,5 | 32,5 | 32,5 | ||

| 14.1 | State Post | 54,0 | 4,5 | 4,5 | 4,5 | 13,5 | 13,5 | ||

| 14.2 | Delivery services | 63,0 | 10,0 | 10,0 | 10,0 | ||||

| 14.3 | Courier costs | 36,0 | 3,0 | 3,0 | 3,0 | 9,0 | 9,0 | ||

| 15 | Travel expenses | 365,0 | 15,0 | 45,0 | 39,0 | 99,0 | 118,0 | ||

| 16 | Costs for resolving disputes in courts | 215,0 | 15,0 | 25,0 | 40,0 | 68,0 | |||

| 17 | Services for issuing electronic keys | 13,0 | 5,0 | 8,0 | |||||

| 18 | Subscription to professional literature, purchase of books | 24,0 | 24,0 | 24,0 | |||||

| 19 | Investment costs | 3188,0 | |||||||

| 19.1 | Software | 330,0 | 0,0 | 8,0 | 32,0 | 40,0 | 266,0 | ||

| 19.1.1 | Purchasing ready-made software | 216,0 | 216,0 | ||||||

| 19.1.2 | Software Development Costs | 114,0 | 8,0 | 32,0 | 40,0 | 50,0 | |||

| 19.2 | Office equipment | 578,0 | 480,0 | ||||||

| 19.2.1 | Computer technology | 248,0 | 160,0 | ||||||

| 19.2.2 | Printers, scanners, copiers, other peripheral equipment | 217,0 | 217,0 | ||||||

| 19.2.3 | Keyboard, flash drives and other small equipment | 50,0 | 40,0 | ||||||

| 19.2.4 | Other computer equipment | 63,0 | 63,0 | ||||||

| 19.3 | Office furniture | 2077,0 | 518,0 | 0,0 | 650,0 | 1168,0 | 326,0 | ||

| 19.3.1 | Executive class office furniture for directors and heads of departments | 977,0 | 518,0 | 518,0 | 326,0 | ||||

| 19.3.2 | Office furniture for ordinary employees | 650,0 | 650,0 | 650,0 | |||||

| 19.3.3 | Costs for equipment of premises for clients, halls, corridors, reception, conference room | 450,0 | |||||||

| 19.4 | Blinds | 56,0 | 56,0 | ||||||

| 19.5 | Flowers and landscaping costs | 147,0 | 147,0 | ||||||

| 20 | Fines, penalties, penalties for violation of own obligations | 196,0 | 140,0 | 140,0 | 56,0 | ||||

| 21 | Other administrative expenses | 240,0 | 20,0 | 20,0 | 20,0 | 60,0 | 60,0 | ||

| Total | 86 086,8 | 7235,1 | 6195,2 | 7870,7 | 21 136,0 | 21 705,5 | |||

Financial Director: Medvedev V.G.___________

Head of PEO: Head M.V. ___________

Instructions for filling

When filling out Form 2, it is necessary to take into account the recommendations given by the Ministry of Finance in the attachment to the letter dated January 18, 2022 No. 07-04-09/2185. They relate to issues of conducting an audit of accounting documentation for the reporting period. All amounts displayed in the report must not include VAT and excise taxes. This is especially true for income that affects the amount of income tax. Let's look at an example for dummies of how to draw up a financial performance report based on balance sheet lines and accounting data. Step-by-step instructions will help.

Step 1. Filling out the title page

The report header looks like this:

Step 2. Rules for compiling financial results

Expenses and negative indicators (losses) must be posted without the minus sign. Their negative value is indicated by parentheses. The indicators for the reporting period (2021) must be compared with the indicators for the same reporting period last year (2020). Thus, the presented sample income and expense report contains the following information:

- in column 3 - turnover on accounts from 01/01/2021 to 12/31/2021 inclusive;

- in column 4 - data from column 3 of Form 2 for 2022.

The “Explanations” column is intended to indicate the number of the organization’s explanation to the balance sheet (Form 1) and the financial results report (Form 2).

Step 3. Comparison of indicators

Be sure to compare the data of the current reporting period with the data of the same period for the previous year. This means that all numbers in the document must be formed according to the same rules. Data incompatibility is detected if:

- the accounting policy of the organization has changed;

- During the reporting period, serious errors of previous years were identified.

In this case, it is recommended to adjust last year's data so that it matches existing conditions. There should be no amendments to financial statements of previous years.

In the previous Form 2, not a single line was numbered. The encoding of the lines must be clarified in Order of the Ministry of Finance No. 66n dated 07/02/2010 (Appendix No. 4). So, if you look at what is included in line 2460 of the income statement, then this is an additional payment of income tax due to the discovery of errors in previous tax periods. And line 2410 reflects the current corporate income tax. If you do not use the recommendations of officials, there is a danger that regulatory authorities will raise questions.

Special rules for certain legal entities

Small businesses fill out a special balance sheet form and Form 2. They show aggregated indicators, which include several lines from the standard form. In this case, the code is entered according to the largest of the indicators included in the line. All financial statements contain such codes.

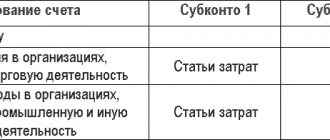

Step 4. Allocation of income and expenses by type of activity

In lines 2110-2200 of Form 2, indicate the income received and expenses for the year for standard types of activities. To fill out these lines, use the indicators of account 90 “Sales”. It is important to remember that the revenue received by the organization on line 2110 is reflected in its pure form, without excise taxes and VAT. Its amount is calculated taking into account all the bonuses and discounts that the organization provided to its clients. This means that if the buyer received a discount under the contract, then the revenue indicator on line 2110 is reflected minus the amount of this discount.

Page 2120 of the report contains data on the organization’s expenses for standard activities - as shown in the example. These are the expenses that form the cost of sales in the income statement (of goods or services). The profit received from standard activities is reflected on page 2100 of the report. This is the difference in indicators between lines 2110 (revenue) and 2120 (cost).

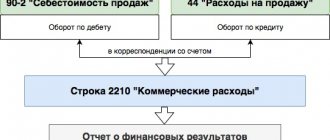

Page 2210 is intended to reflect the amount of expenses associated with the sale of goods, works or services, otherwise they are called commercial. And page 2220 is for administrative expenses.

It is important to follow the guidelines in the chart of accounts instructions to correctly determine the type of expenses. Business expenses include advertising costs. And do not forget to check the accounting procedure provided for by the accounting policy of the legal entity.

How to post other income, expenses and profit

Lines 2310-2350 are intended to reflect other income and expenses in Form 2. They are filled out based on data from account 91 “Other income and expenses.” For example, if an organization received dividends in the reporting year, then they are reflected on line 2310. The amount of profit before tax is calculated based on data from lines 2110-2350, and the amount received is reflected on line 2300.

To do this, sum up the indicators on lines 2200, 2310, 2320 and 2340 and subtract the sum of fields 2330 and 2350 from the resulting number. If this is a profit, then the amount is positive, and if it is a loss, it is negative, and it is indicated in parentheses.

The form contains separate fields for income and expenses from standard activities. Among other income minus expenses, an organization has the right to indicate only those incomes the amount of which does not exceed the level of materiality. Thus, an indicator is considered significant if without it it is impossible to reliably determine the financial position of a legal entity. Organizations have the right to independently determine materiality criteria. They are indicated in the accounting policies for accounting purposes.

For example, cost of sales is shown on line 2120 in parentheses. It affects the gross profit (loss) of the organization, which is indicated on page 2100:

Indicator 2100 = indicator 2110 - indicator 2120.

If the result is positive, this is gross profit in form 2, and if it is negative, it is a loss. In the latter version, the number is indicated in parentheses.

Traditionally, information on income constituting at least 5% of a legal entity’s total income is reflected separately. All costs associated with them should be indicated separately. For a detailed decoding of information from the report, you must use a special application - a separate form for explanations to the balance sheet and Form 2. In the “Explanations” column of Form 2 itself, indicate a link to the serial number of the text explanation or table in this application.

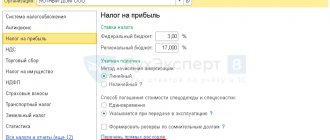

Step 5. Reflection of corporate income tax

Calculations for corporate income tax should be reflected on pages 2410-2400. In particular, page 2410 contains the difference between the total turnover in the debit and credit of account 68 subaccount “Calculations for current income tax” in correspondence with the following accounts:

- 09 “Deferred tax assets”;

- 77 “Deferred tax liabilities”;

- 99 subaccount “Conditional income tax expense (income)”;

- 99 subaccount “Permanent tax liabilities (assets)”.

This indicator is always reflected in parentheses. The difference between the total turnover in the debit and credit of account 99 subaccount “Fixed tax liabilities (assets)” in correspondence with account 68 subaccount “Calculations for current income tax” should be reflected on page 2421 of Form 2.

Line 2460 reflects information about all other indicators not mentioned in the document that affect the amount of net profit. It matters whether the organization, according to its accounting policies, applies PBU 18/02 or not. It is usually calculated using the following formula:

Line 2460 = (debit turnover on balance sheet account 99 “Profits and losses” in the part of taxes that is paid when applying tax special regimes, penalties and fines, additional payments for income tax, written off deferred tax assets) - (credit turnover on balance sheet account 99 “Profits and Losses” in terms of overpayment of income tax or write-off of deferred tax liabilities).

Step 6. Sign Form 2

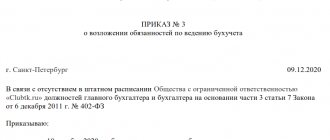

By virtue of Article 13 of the Federal Law “On Accounting”, annual reports are recognized as prepared only after they are signed by the manager. Instead of the manager, any other authorized employee has the right to sign the document. But he must have a power of attorney, even if he is the chief accountant of the organization. Signatures on different copies should not differ.

Organizations are required to submit a report on the results of financial activities to the tax authorities in electronic form - through the taxpayer’s personal account or via telecommunication channels.

WAGE FUND BUDGET

A significant share in the budget of administrative expenses will be occupied by the wage fund for administrative and managerial personnel. Like the administrative budget, the wage budget must be compiled by department. For each division it is advisable to highlight :

- the permanent part is formed on the basis of the staffing table, approved tariff schedules and tariff rates;

- the variable part is bonuses based on incentive schemes. To calculate this part, it is necessary to obtain data on the indicators used in the motivation schemes of the relevant services.

Based on the specifics of the department, not all employees may have a variable part. Some work on a flat rate, such as accounting.

The variable part is not present in every calendar month. Possible reasons : _

- accrual of the variable part is carried out upon completion of the project, and the project, for example, will not yet be completed in January;

- the department has just been created and in the first months it is too early to talk about the variable part;

- quarterly bonuses are provided.

The principle of dividing wages into constant and variable parts greatly simplifies not only the budgeting process, but also analysis and budget adjustments. It will be immediately clear where the imbalance occurred and what is its cause.

Incentive schemes provide for the reduction of bonuses for employees, but it is not recommended to include the amount of possible fines in the budget. This can demotivate employees, even if the company always has strict corporate rules and fines to a certain extent.

One of the mistakes in this budgeting process is planning the maximum salary . For example, the staff is supposed to have ten employees, and the payroll plan is for ten people for the entire plan year, although at the time the budget is formed there are two vacancies. One will be filled in mid-February, the second - at the end of May. At the same time, the maximum possible bonus is planned. This approach is fraught with financial losses.

Firstly, excessive reserves are created for the wage fund, while money should be in circulation.

Secondly, when a similar situation occurs in all structural divisions, then to cover expenses, many companies take out a loan , spend money on the examination of collateral, pay interest and commissions to the bank, and then it turns out that the company can pay salaries from its own funds, no credit.

Let's present an example of a budget for remuneration of administrative and managerial personnel of a large manufacturing enterprise (the main activities are production and wholesale sales).

Budget for remuneration of administrative and managerial personnel

(as part of the administrative expenses budget) for 2016, thousand rubles.

| No. | Budget item | Plan for the year | Monthly plan | ||||||

| January | February | March | total for Q1 | … | total for the 2nd quarter | … | |||

| 2.1 | General Director and Secretariat | 2947,0 | 250,0 | 250,0 | 250,0 | 750,0 | 718,0 | ||

| 2.2 | Logistics Directorate | 15 364,0 | 1120,0 | 1120,0 | 1370,0 | 3610,0 | 4053,0 | ||

| 2.2.1 | Director of logistics | 1157,0 | 100,0 | 100,0 | 100,0 | 300,0 | 249,0 | ||

| 2.2.1.1 | permanent part | 460,0 | 40,0 | 40,0 | 40,0 | 120,0 | 113,0 | ||

| 2.2.1.2 | variable part | 697,0 | 60,0 | 60,0 | 60,0 | 180,0 | 136,0 | ||

| 2.2.2 | Purchase department | 5578,0 | 300,0 | 300,0 | 550,0 | 1150,0 | 1499,0 | ||

| 2.2.2.1 | permanent part | 3309,0 | 300,0 | 300,0 | 300,0 | 900,0 | 910,0 | ||

| 2.2.2.2 | variable part | 2269,0 | 250,0 | 250,0 | 589,0 | ||||

| 2.2.3 | Transport service | 8629,0 | 720,0 | 720,0 | 720,0 | 2160,0 | 2305,0 | ||

| 2.2.3.1 | permanent part | 4385,0 | 360,0 | 360,0 | 360,0 | 1080,0 | 1102,0 | ||

| 2.2.3.2 | variable part | 4244,0 | 360,0 | 360,0 | 360,0 | 1080,0 | 1203,0 | ||

| 2.3 | HR Directorate | 8810,0 | 660,0 | 675,0 | 792,0 | 2127,0 | 2100,0 | ||

| 2.3.1 | HR Director | 961,0 | 85,0 | 90,0 | 95,0 | 270,0 | 240,0 | ||

| 2.3.1.1 | permanent part | 418,0 | 40,0 | 40,0 | 40,0 | 120,0 | 115,0 | ||

| 2.3.1.2 | variable part | 543,0 | 45,0 | 50,0 | 55,0 | 150,0 | 125,0 | ||

| 2.3.2 | Human Resources Department | 1318,0 | 110,0 | 120,0 | 120,0 | 350,0 | 320,0 | ||

| 2.3.3 | Recruitment department | 1490,0 | 45,0 | 45,0 | 157,0 | 247,0 | 440,0 | ||

| 2.3.3.1 | permanent part | 530,0 | 45,0 | 45,0 | 45,0 | 135,0 | 140,0 | ||

| 2.3.3.2 | variable part | 960,0 | 112,0 | 112,0 | 300,0 | ||||

| 2.3.4 | Labor Standards Department | 5041,0 | 420,0 | 420,0 | 420,0 | 1260,0 | 1100,0 | ||

| 2.3.4.1 | permanent part | 3655,0 | 300,0 | 300,0 | 300,0 | 900,0 | 850,0 | ||

| 2.3.4.2 | variable part | 1386,0 | 120,0 | 120,0 | 120,0 | 360,0 | 250,0 | ||

| 2.4 | Financial Directorate | 30 720,0 | 2930,0 | 2420,0 | 2873,0 | 8223,0 | 8416,0 | ||

| 2.4.1 | Financial Director | 1380,0 | 130,0 | 120,0 | 110,0 | 360,0 | 374,0 | ||

| 2.4.1.1 | permanent part | 960,0 | 80,0 | 80,0 | 80,0 | 240,0 | 240,0 | ||

| 2.4.1.2 | variable part | 420,0 | 50,0 | 40,0 | 30,0 | 120,0 | 134,0 | ||

| 2.4.2 | Financial department | 6393,0 | 700,0 | 250,0 | 763,0 | 1713,0 | 1802,0 | ||

| 2.4.2.1 | permanent part | 3105,0 | 250,0 | 250,0 | 250,0 | 750,0 | 700,0 | ||

| 2.4.2.2 | variable part | 3288,0 | 450,0 | 513,0 | 963,0 | 1102,0 | |||

| 2.4.3 | Accounting | 17 320,0 | 1550,0 | 1550,0 | 1550,0 | 4650,0 | 4713,0 | ||

| 2.4.4 | Planning and Economic Department | 5627,0 | 550,0 | 500,0 | 450,0 | 1500,0 | 1527,0 | ||

| 2.4.4.1 | permanent part | 3405,0 | 300,0 | 300,0 | 300,0 | 900,0 | 853,0 | ||

| 2.4.4.2 | variable part | 2222,0 | 250,0 | 200,0 | 150,0 | 600,0 | 674,0 | ||

| 2.5 | Legal department | 3247,0 | 298,0 | 315,0 | 326,0 | 939,0 | 815,0 | ||

| 2.6 | Software department | 5235,0 | 212,0 | 212,0 | 512,0 | 936,0 | 1199,0 | ||

| 2.6.1 | permanent part | 3658,0 | 212,0 | 212,0 | 212,0 | 636,0 | 650,0 | ||

| 2.6.2 | variable part | 1577,0 | 300,0 | 300,0 | 549,0 | ||||

| 2.7 | Housekeeping service | 4715,0 | 396,0 | 412,0 | 397,0 | 1205,0 | 1148,0 | ||

| Total labor costs | 71 038,0 | 5866,0 | 5404,0 | 6520,0 | 17 790,0 | 18 449,0 | |||

HR Director: Ryzhova G. D. ___________

Head of PEO: Golovnaya M.V. _________

About additional points

It should be noted that there are quite a lot of expenses that are not administrative expenses. These are, for example, sales financing (promotion, organization), advertising events and research into introduced products. It is also necessary to note the specifics that accounting for administrative expenses has.

Typically, when accountants process documentation, they do not identify many types of expenses. Conventionally, they divide expenses into ordinary and other. In the first case, they mean expenses that arise due to the nature of the activity and direction of the organization. Others include everything that does not relate to what was discussed earlier.

Purpose and purpose

Administrative expenses are used to pay for needs that have a positive impact on the entire company. Of course, not all expenses can be classified as such. Let's look at a small example. If the costs that exist in a particular department do not provide direct or indirect benefits to other departments, they are not classified as administrative.

At the same time, if you maintain an advertising department that will successfully popularize manufactured products, this will lead to an increase in production and, in general, will have a positive effect on the entire enterprise. Thus, the ultimate goal and purpose of any administrative expense is to provide certain benefits.