The types of standard tax deductions to which personal income tax payers are entitled are listed in the Tax Code (TC), Article 218. They can be provided through tax structures or accounting departments at the place of work for both the resident of the Russian Federation and his children.

The procedure for calculating and calculating standard deductions has been worked out quite clearly, and legal violations in this area are not the most common cases in legal practice. But this also happens. Laws are laws, but the human factor has not been canceled. There are violations in the provision of tax benefits by employers and the Federal Tax Service.

And personal income tax payers themselves do not always know exactly their rights. Experienced tax lawyers will help restore justice and return amounts overpaid to the budget.

Do you want to figure it out, but don’t have time to read the article? Lawyers will help

Entrust the task to professionals. Lawyers will complete the order at the cost you specify

51 lawyers on RTIGER.com can help with this issue

Solve the issue >

“Children’s” deductions: to whom and how much

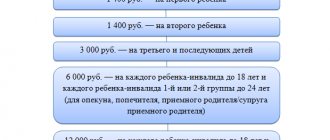

The procedure for applying standard deductions for personal income tax is regulated by Art. 218 Tax Code of the Russian Federation. The amount of the deduction depends on the type of child in the family. For the first and second child, the deduction amount is 1,400 rubles each. monthly. For the third and each subsequent child - 3,000 rubles. monthly.

The following are entitled to such a deduction:

- each of the parents (including divorced ones);

- the parent's spouse (i.e., the child's stepfather or stepmother);

- each of the guardians, trustees, adoptive parents (if there are several of them);

- each of the adoptive parents (if there are two of them);

- spouse of the adoptive parent.

The deduction is valid for each child, without exception, under the age of 18, as well as for each child under the age of 24, if he is a full-time student, graduate student, resident, intern, student or cadet.

There are also separate deductions for children who are disabled. The amount of the deduction depends on age and sometimes disability group. So, if a disabled child is under 18 years old, then the disability group does not matter. If the child is a full-time student, graduate student, resident, intern or student under the age of 24, then a deduction is possible if disability group I or II.

The size of the deduction depends on who receives it. If this is a parent, his spouse or adoptive parent, then the deduction is 12,000 rubles. per month for one child. For an adoptive parent, his or her spouse, caregiver and guardian, the deduction is 6,000 rubles. per month.

The “children’s” deduction is valid until the month in which income taxed at a rate of 13% on an accrual basis from the beginning of the year does not exceed RUB 350,000. From the month in which income exceeds 350,000 rubles, the deduction does not apply. If an employee has been working at his current place of work not since the beginning of the year, then the deduction should be provided taking into account the income received since the beginning of the current year at his previous job.

In the near future, the size of the “children’s” deductions will most likely increase. Bill No. 751335-7 is being considered, according to which they plan to increase the deduction to 2,500 rubles. for the first and second child, up to 3500 for the third and each subsequent child. For disabled children, the deduction amounts are planned to be set at 8,000 and 12,500 rubles. (depending on the status of the employee: parent, guardian, etc.) In addition, the bill proposes to increase the maximum level of employee income, from which the application of the “children’s” deduction ceases: up to 400,000 rubles.

Personal income tax deductions for children in 2022: changes, amounts and provision

Child tax deductions are one of the types of government benefits for parents who support minor children or students under 24 years of age. The use of a deduction allows you to save part of a family’s income due to the fact that the state does not withhold taxes from it (or by refunding taxes already paid to the budget). Benefits for personal income tax (i.e. personal income tax - income tax in Russia in 2022 is 13%) are provided to citizens who support and support a child (native, adopted, adopted or ward).

Supporting documents for “children’s” deductions

“Children’s” deductions are provided on the basis of a written application drawn up in any form and supporting documents. This is what it says in paragraph 3 of Art. 218 Tax Code of the Russian Federation. However, it is not explained which documents must be submitted. In general, this is a copy of the child’s birth certificate (letter of the Ministry of Finance of the Russian Federation dated October 2, 2015 No. 03-04-05/56445).

But in practice, as a rule, more documents are required. The exact list of documents depends on the specific situation. For example, if a child is over 18 years old and is a full-time student, then an additional certificate from the educational institution must be submitted.

If an employee has not been working at his current job since the beginning of the year, he may be required to provide a certificate of income and tax amounts from his previous place of work. This is necessary so that the current employer can check whether the maximum income level at which the application of the “children’s” deduction ceases has been reached (paragraph 2, paragraph 3, article 218 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of the Russian Federation dated July 30, 2009 No. 3-5-04 /1133).

Notarization of copies of documents confirming the right to a standard personal income tax deduction is not required. The Federal Tax Service of the Russian Federation draws attention to this in letter No. ED-4-3/8418 dated May 23, 2012.

Let's consider another question related to documents: how often do you need to write an application for deduction to the accounting department?

It depends on how it was composed. If it indicated the deduction period (for example, “I ask for a standard tax deduction during 2022”), then in order to receive the deduction in 2022, the employee will have to write a new application. But if the period for providing a deduction is not specified in the application and at the same time the employee’s right to a standard deduction is not terminated, then there is no need to re-fill the application. Such clarifications are given by the Ministry of Finance of the Russian Federation in letter dated May 31, 2019 No. 03-04-05/39733.

We receive a deduction through the employer

We collect the necessary package of documents:

- Application addressed to the employer.

- Certificate of birth or adoption of a child (copy).

- A copy of the marriage registration document (passport or marriage registration certificate).

- Certificate of disability (if the child is disabled).

- Certificate from the educational institution (if the child is a full-time student).

ADDITIONALLY, if the employee is the only parent (guardian):

- Death certificate of the second parent (copy).

- Extract from the court decision recognizing the second parent as missing (copy).

- Certificate in form No. 25 confirming the status of a single mother (a woman with a child who officially does not have a father).

- A document confirming that the parent is not married (passport).

ADDITIONALLY, if the employee is a guardian or trustee:

- Resolution of the guardianship and trusteeship authority.

- Agreement on the implementation of guardianship or trusteeship.

- Agreement on foster family.

Next, we present the collected documents to the employer. If you work for several employers at the same time, you can receive a deduction from only one of them.

“Children’s” deductions if children are from different marriages

The right to a standard “children’s” deduction arises provided that the child is supported by a parent. This clearly follows from Art. 218 Tax Code of the Russian Federation. In a standard situation, when a child lives with his parents, no questions arise. But can, for example, the father of a child claim a deduction if the parents divorced and the child lives with his mother after the divorce?

Yes, maybe, if he pays alimony to his ex-wife (letter of the Ministry of Finance of the Russian Federation dated October 11, 2012 No. 03-04-05/8-1179). In this case, such an employee, along with the usual package of documents, must submit to the accounting department documents confirming the payment of alimony (letter of the Ministry of Finance of the Russian Federation dated November 7, 2018 No. 03-04-05/80099).

But not only the father can count on a deduction in this case. His new wife can also receive a deduction for her husband's child from a previous marriage. After all, property acquired by spouses during marriage is their joint property (Article 256 of the Civil Code of the Russian Federation and Article 34 of the Family Code of the Russian Federation). Including money that must be paid in the form of child support. It turns out that the spouses of people who pay alimony also participate in the maintenance of these children. This means they are also entitled to standard deductions. This conclusion is contained in letters of the Ministry of Finance of the Russian Federation dated August 10, 2016 No. 03-04-05/46762, dated March 18, 2015 No. 03-04-05/14392 and the Federal Tax Service of the Russian Federation dated September 17, 2013 No. BS-4-11/16736.

If the employee does not pay alimony, then he still has the right to a deduction if he helps his ex-wife with money and can prove this. For example, documents proving the fact of transferring money to support the child, a written statement from the ex-wife (mother of the child) that the child’s father is involved in providing for him (letter of the Ministry of Finance of the Russian Federation dated 03.03.2016 No. 03-04-05/12376).

“Children’s” deductions if a child starts his own family

Since in some cases the deduction is also given to an adult child (over 24 years old), a situation is likely when he starts his own family. Is the parent still entitled to the standard deduction? Officials from different departments give different answers to this question.

For example, in the letter of the Federal Tax Service of the Russian Federation for Moscow dated June 6, 2014 No. 20-15/055333, it is stated that a deduction for a child is provided regardless of the fact of the child’s marriage.

In letters of the Ministry of Finance of the Russian Federation dated March 29, 2019 No. 03-04-05/21857, dated March 17, 2016 No. 03-04-05/14853, dated March 31, 2014 No. 03-04-06/14217, the exact opposite position is given: after the child joins (including a student) a new family is formed by marriage, so he ceases to be supported by his parents, therefore, the taxpayer is not provided with a standard deduction for a child.

The position of the capital's Federal Tax Service seems to us more correct. In Art. 218 of the Tax Code of the Russian Federation there are no rules that prohibit giving a deduction if a child gets married. If, even after the marriage is registered, the parents continue to support the child, then the parents retain the right to a deduction. In addition, the employer is not obliged to check whether the employee’s child has started his own family. And an employee-parent is not obliged to inform his employer about the wedding of his son or daughter. Therefore, a joyful event should not interfere with receiving a “children’s” deduction.

Who is entitled to the double “children’s” deduction?

Sometimes workers are entitled to double the standard deduction. There are two such situations:

- when the employee is the only parent (adoptive parent, guardian, trustee);

- when the second parent refused the deduction in favor of the other.

Let's look at the first situation first. So, who is considered a “sole parent”? Not just someone who is raising a child alone (for example, due to divorce), but someone who can document the child’s absence of a second parent.

In turn, the absence of the second parent is his death or recognition (in court) as missing or deceased (letter of the Ministry of Finance of the Russian Federation dated February 15, 2016 No. 03-04-05/8123).

The only parent is also considered to be a mother whose child was born out of wedlock and paternity has not been legally established - the father is not indicated on the birth certificate, or information about the child’s father was entered based on the mother’s application (letter of the Ministry of Finance of the Russian Federation dated 02.02.2016 No. 03-04- 05/4973, dated 04/17/2014 No. 03-04-05/17637). But if she gets married, then from the next month after the marriage is registered, she is no longer entitled to a double deduction - regardless of whether the child is adopted by her spouse or not. This follows from paragraph. 13 pp. 4 paragraphs 1 art. 218 Tax Code of the Russian Federation.

Let's consider in what other cases an employee cannot be considered the only parent:

- when one of the parents is deprived of parental rights (letter of the Ministry of Finance of the Russian Federation dated 01.02.2016 No. 03-04-05/4293, Federal Tax Service of the Russian Federation dated 13.01.2014 No. BS-2-11 / [email protected] );

- when one of the parents evades paying child support and does not participate in the maintenance of the child (letter of the Ministry of Finance of the Russian Federation dated June 16, 2016 No. 03-04-05/35111).

Now let's consider the second situation in which the employee is entitled to a double deduction - this is when the second parent refused the deduction in favor of the other. But it's not that simple. A number of nuances should be taken into account.

Firstly, the refusal of the deduction must come from a parent who has the right to a “children’s” deduction, that is, having income taxed at a rate of 13%. If the mother does not have taxable income (for example, in connection with caring for a disabled child or being on parental leave), then she does not have the right to a deduction and she cannot refuse a deduction in favor of her spouse (letters from the Ministry of Finance of the Russian Federation dated 02/06/2018 No. 03-04-05/6880, dated 04/20/2017 No. 03-04-05/23946).

Secondly, if the “refusenik”’s income since the beginning of the year has exceeded 350,000 rubles, then he loses the right to the deduction transferred to his spouse. Accordingly, the other parent stops using the double deduction.

Thirdly, if the “refusenik” at the time of refusal of the deduction has income taxed at a rate of 13%, but then their receipt ceases (for example, due to dismissal and lack of work), then the other parent also ceases to enjoy the double deduction (letter Ministry of Finance of the Russian Federation dated December 14, 2018 No. 03-04-05/91182).

For these purposes, an employee receiving a double deduction must monthly bring to his accounting department a certificate of income from the second parent’s place of work. Such clarifications are provided in letters of the Ministry of Finance of the Russian Federation dated June 22, 2016 No. 03-04-05/36143, dated May 28, 2015 No. 03-04-05/30910. The courts also attach great importance to the fact of submitting a document confirming the receipt of taxable income by the other spouse (Resolution of the Administrative Court of the West Siberian District dated 12/09/16 No. F04-5705/2016).

To receive a double deduction, the employee must write an application for a double deduction, attaching the necessary documents, which include the other parent’s application to waive the deduction (letter of the Federal Tax Service of the Russian Federation dated November 3, 2011 No. ED-3-3/3636) .

Didn't receive the required deduction?

It happens that a taxpayer, for one reason or another, during the year did not receive the tax benefit due to him for his children. Or maybe this deduction was not fully accrued to him: tax agents also make mistakes. This does not mean at all that the possibility of deduction is lost for him.

In the coming year, he has the opportunity to return part of the amount in the amount of a deduction from the tax already paid.

The main thing is to timely submit your tax return and the required documents for a personal income tax refund:

- birth or adoption certificate (copies) for each child;

- Form 3-NDFL (declaration);

- for a son or daughter from 18 to 24 years old - a certificate of in-patient education.

Birth order of children for the purposes of “children’s” deductions

Since the size of the deduction is larger for the third child, many questions arise regarding the size of the “children’s” deduction and the order of birth of children.

For example, an employee has three children, but two of them are not entitled to a deduction due to their age. The question arises: should a deduction be given for the third child in the amount of 1,400 or 3,000 rubles?

In paragraphs 4 paragraphs 1 art. 218 of the Tax Code of the Russian Federation clearly states that 3,000 rubles are given for every third and subsequent child. And there is no condition that in order to receive an “increased” deduction for a third child in relation to older children, the employee must have the right to a deduction. Therefore, in a situation where the employee is no longer entitled to a deduction for older children due to their age, for the youngest the deduction amount will be 3,000 rubles. This conclusion is confirmed by the Ministry of Finance of the Russian Federation in letter dated April 17, 2014 No. 03-04-05/17619.

What if an employee has two children, and the first child died? In this case, although the youngest child is the second in the family, for the purposes of the deduction it will be considered the third, which means that in respect of him the employee will receive a deduction in the amount of 3,000 rubles. This conclusion is contained in the letter of the Ministry of Finance of Russia dated February 10, 2012 No. 03-04-06/8-33.

The birth order of children is determined by their dates of birth. In the cases under consideration, the accounting department must have copies of the birth certificate of all children (including those for whom a deduction is not provided due to their age or death).

Let's consider another situation. An employee in a new marriage has two children, but from a previous marriage he has one child for whom he pays child support. This employee receives deductions for all three children (for the third - in the amount of 3,000 rubles). His current wife also receives the same amounts.

But as soon as a child from a previous marriage turns 18, he ceases to be supported by his father and the payment of alimony stops. That is, the father and his new wife stop receiving a deduction for this child. For two children from a current marriage, the employee still receives 1,400 and 3,000 rubles. But his current wife is changing the amount of deductions for her own children. If earlier she received a deduction for them in the amount of 1,400 and 3,000 rubles, now her deduction will be 1,400 and 1,400 rubles. This conclusion is contained in the letter of the Ministry of Finance of the Russian Federation dated January 21, 2016 No. 03-04-05/1999.

How much to provide deductions for children under personal income tax in 2018

Officials did not provide for changes to the amount of standard deductions for children under personal income tax in 2018. Therefore, as before, the amount depends on the number of children, the relationship between parents and child, as well as on the status of the baby himself.

Deduction depending on the order of the baby. Typically, for the first child, an employee can receive a child deduction of 1,400 rubles per month. The same size is used for the second baby. For the third and subsequent ones the amount is higher – already 3,000 rubles.

Benefits for disabled people. There are also separate amounts for a disabled child:

- 12,000 rub. – for parent and adoptive parent

- 6,000 rub. – for a guardian, trustee, foster parent

These amounts, according to the latest changes, are summed up with the usual benefits depending on the order of the baby (clause 14 of the Review, approved by the Presidium of the Supreme Court of the Russian Federation on October 21, 2015, letter of the Ministry of Finance of Russia dated March 20, 2022 No. 03-04-06/15803) . For example, if there are three children in a family, and the third is disabled, then the deduction for him will be 15,000 rubles. for a parent or 9,000 rubles. for the guardian.

Increased deductions. The law allows employers to provide employees with a double deduction. This is possible in two situations:

- the employee is the only parent (adoptive parent, guardian, trustee)

- the employee receives a deduction for the second parent because he refused to receive it

Is the right to a “children’s” deduction retained in the absence of income?

It happens that in certain months an employee does not have income subject to personal income tax (for example, due to being on long-term leave at his own expense or maternity leave). Is the right to a “children’s” deduction retained during “no-income” periods, and does the tax agent have to accumulate deductions and then provide them to the employee?

Situation 1.

At the beginning of the year, the employee had taxable income, but then the accrual and payment of taxable income stopped until the end of the year.

Under such conditions, deductions for “non-income” periods are not provided by the employer (letter of the Ministry of Finance of the Russian Federation dated October 30, 2018 No. 03-04-05/78020). However, an employee can obtain them independently through the tax office by submitting a 3-NDFL declaration there.

Situation 2.

In certain months of the calendar year, taxable income was absent, but appeared before the end of the year. In this case, deductions are “accumulated”, summed up, and then - when taxable payments arise this year - provided (letters from the Ministry of Finance of the Russian Federation dated December 25, 2018 No. 03-04-05/94556, dated February 15, 2018 No. 03-04-05/ 9654, dated 04.09.2017 No. 03-04-06/56583, Federal Tax Service of the Russian Federation dated 29.05.2015 No. BS-19-11/112, Resolution of the Supreme Arbitration Court of the Russian Federation dated 14.07.2009 No. 4431/09).

Special case of situation 2

: from the beginning of the year, an employee who has an employment relationship with the company had no taxable income, but then appeared (for example, an employee was on maternity leave, but left it within a year).

The same rules apply here as above: the right to deduct for previous months is not lost. However, regarding precisely this situation, the Ministry of Finance of the Russian Federation previously had a position that there is no deduction for “non-income” months (letters dated December 26, 2014 No. 03-04-05/67642, dated June 11, 2014 No. 03-04-05/28141). Officials believed that in this case the tax base for personal income tax should be determined not on an accrual basis from the beginning of the year, but starting from the month when the employee’s first income was accrued. The Supreme Arbitration Court of the Russian Federation clarified that this approach is illegal, since it does not follow from the Tax Code of the Russian Federation (Resolution No. 4431/09 dated July 14, 2009).

Situation 3.

There is no taxable income during the entire tax period, that is, the calendar year (for example, an employee is on maternity leave).

In this case, the employee does not have the right to a standard deduction (letter of the Ministry of Finance of the Russian Federation dated September 4, 2017 No. 03-04-06/56583, dated January 13, 2012 No. 03-04-05/8-10). This is explained by the fact that the tax base for calculating personal income tax in such situations is not determined in principle (for a specific year).