What is account 60 in accounting?

According to the chart of accounts (approved by order of the Ministry of Finance dated October 31, 2000 No. 94n), account 60 is called “Settlements with suppliers and contractors.” It reflects all transactions related to the acquisition and payment of inventory, work, and services. Here are a few special cases:

- consumption of electricity, gas, water, etc.;

- identification of surplus inventory items upon their acceptance;

- purchasing delivery and communication services;

- uninvoiced deliveries (for which documents were not received from the sellers).

Count 60 is active-passive. The balance on it can be either debit or credit. Increases and decreases in funds can be shown either by debit or by credit (for more details, see: “Chart of Accounts in 2022”).

Analytical accounting is usually organized by suppliers, contractors and invoices issued by counterparties. Sometimes, depending on the specifics of the company, analytics are carried out in the context of contracts, products, etc. The main thing is to have access to information about overdue debts to sellers, as well as about debts that have not yet matured.

Maintain accounting and tax records for free in the web service

How to resolve error 60 02 in Sberbank Online

If restarting the application does not produce results, experts and real users in their reviews recommend trying the following options for eliminating error 60 02:

- Few people know, but if the date and time are set incorrectly , then applications, not only Sberbank, may not work correctly. You can easily solve this problem in your phone settings.

- If you are not connected to the network, you should check your mobile balance. If necessary, top up your account or connect to the nearest Wi-Fi point and log in to Sberbank Online again.

- The device's IP address has been changed . In this situation, you should turn off the VPN or check the settings on your phone.

- If security programs , they can block the operation of installed applications, including Sberbank Online. To enter your personal account, just disable the antivirus for a while.

Note! If you cannot solve the problem, you can remove Sberbank Online from your device and install it again.

Error 60 02 due to internet problems

For many mobile applications to work correctly, a stable Internet connection is required. If problems arise, it is recommended to proceed as follows:

- If there are problems with the Internet, mobile communications or Wi-Fi are lost, then the signal may be blocked indoors (thick walls, the device is far from the router). To catch a stable signal, you need to change your location;

- if the problem is low mobile Internet speed, you can switch to WI-FI. And when this situation occurs frequently, it may be worth changing the tariff or mobile operator;

- if the network is overloaded, then experts recommend trying to log into your account again after some time.

Error 60 02 when there is a problem with the mobile application

If error code 60 02 appears on the screen when logging into Sberbank Online, the cause may be a malfunction of the application. To solve them you can:

- Restart the application, first completely shutting it down and removing it from quick access.

- Update the Sberbank Online program to the latest version via Play Market or App Store.

- Close all other running programs on the phone; perhaps there is not enough RAM to work correctly.

What does the debit of account 60 reflect?

Debit turnover is the amount that the organization paid to its partners - suppliers. These amounts include payment for completed deliveries (they are carried out under subaccount 60.01) and advances to sellers (they are carried out under subaccount 60.02).

REFERENCE . A debit balance on account 60 most often indicates that the company has transferred an advance payment, but the counterparty has not yet made the shipment (did not perform the work, did not provide the service). As a result, the seller has a debt to the organization.

Reasons for error 60 02

The appearance of error 60 02 means that the functions application currently not available to the client.

Reasons for its appearance:

- Internet connection . To use the application, mobile Internet or Wi-Fi must be activated on your smartphone. Low connection speed can also cause problems with access to a bank client’s personal account.

- The network is overloaded . Servers may malfunction if there is a large flow of clients. This situation does not depend on the user and is resolved on the service provider’s side.

- Technical failure of the mobile application . Most often, after updating the application, the old version stops working correctly and may produce various errors. Also, such failures can be due to technical work, which is carried out mainly at night.

- Incorrect operation of the smartphone . If you have an older version of the operating system, some applications may not load.

- Authorization in the application via Wi-Fi with open access . This network is not secure from the point of view of working in banking applications with the entry of personal data of clients. Therefore, the user should be aware that such an Internet connection may be the reason why the application blocks authorization in the personal account.

What does account credit 60 reflect?

Loan turnover is the cost of supplies received from the counterparty. If the shipment goes against a previously made advance, it is carried out according to subaccount 60.02. If payment has not yet been made, delivery is carried out using subaccount 60.01.

When the seller is on the general taxation system and pays VAT, the input value added tax is also reflected on the credit of account 60.

REFERENCE. Credit balance on account 60 means that the counterparty has shipped the product (provided a service, performed the work), but the company has not yet paid it off. As a result, the organization owes a debt to the supplier.

Analysis of account 60: balance sheet, account card

The balance sheet for account 60 is a report in the form of a table, which presents the beginning and ending balances, turnover for the selected period by account or subaccounts, subaccounts, currency amounts, and expanded balance.

An account card is a report with details down to the posting (account).

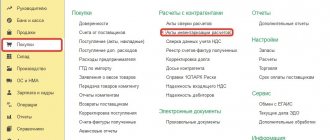

You can analyze mutual settlements and the movement of documents for settlements with suppliers in the 1C Enterprise Accounting program using standard reports Account Card and Turnover Balance Sheet (hereinafter referred to as SALT) for account 60 “Settlements with suppliers and contractors” with a specific counterparty or in general for all.

It is correct to do this according to subaccounts:

- Subaccount 60.01 reflects the settlements with suppliers themselves;

- Subaccount 60.02 reflects advances issued.

In SALT, the balance on subaccount 60.01 is reflected as a credit, and the balance on subaccount 60.02 is reflected as a debit.

For example, when posting a bank, if it is paid to the counterparty on an invoice, then the goods are received and the payment should be reflected in the debit of subaccount 60.01. If there was an advance payment for goods or materials to the counterparty, then - by debit of subaccount 60.02.

If the posting is done incorrectly, then the balance with a minus will “hang” in the SALT for account 60. If there is a minus balance on the loan of the subaccount 60.01, this means that the prepayment was reflected incorrectly, not on the subaccount 60.02.

Example

Snegir LLC transfers an advance to Bor LLC for goods in the amount of 23,600 rubles. A few days later, the goods arrived from the supplier on account of the previously issued advance in the amount of 23,600 rubles.

Postings to account 60 for the advance payment issued to the supplier:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 60.02 | 51 | 23 600 | Transfer of advance payment to Bor LLC | Payment order/Bank statement |

| 10/41 | 60.01 | 20 000 | Receipt of goods from Bor LLC | Waybill, invoice |

| 19 | 60.1 | 3 600 | We allocate VAT | Waybill, invoice |

| 60.01 | 60.02 | 23 600 | We count the advance from the prepayment | Reference |

Accounting entries for account 60

DEBIT 41 (07, 08, 10) CREDIT 60 - goods received and capitalized (equipment, non-current assets, materials)

DEBIT 20 (25, 26) CREDIT 60 - work and services written off to the cost of products (for general production, general business expenses)

DEBIT 19 CREDIT 60 - input VAT reflected

DEBIT 94 CREDIT 60 - the shortage identified during acceptance of inventory items is reflected

DEBIT 60 CREDIT 50 (51) - payment made to the supplier

DEBIT 60 CREDIT 91 - overdue accounts payable written off as other income

DEBIT 60 CREDIT 62 - mutual settlement with the counterparty has been made.

Fill out and print your balance sheet using the current form for free

What does the debit of account 60 show?

The debit of account 60 shows how much our organization's counterparties owe, that is, debit turnover shows the amounts paid to suppliers.

Account 60 can be supplemented with subaccounts if this is due to the accounting needs of the organization. For example, separate accounting is required for overdue debts, payments in foreign currency, and so on. The chart of accounts indicating all subaccounts used by the organization must be approved in the accounting policy. Let's look at the subaccounts that are used more often than others.

The debit of subaccount 60.01 reflects advances against which supplies were made from suppliers, that is, the advance is offset.

The debit of subaccount 60.02 includes advances issued to suppliers for future deliveries.

An entry is made in the debit of subaccount 60.03 when repaying a previously issued bill.

The procedure for organizing accounting of payments

Let's consider the main stages of organizing calculations:

- Preparation of documents. All transactions must be confirmed by settlement documentation and agreements. The main primary document is the agreement with the counterparty. This could be a purchase and sale agreement, supply agreement, or contract agreement. Sometimes property is acquired only on the basis of an invoice or a power of attorney for the acquisition of objects.

- Synthetic accounting. Transactions with counterparties are recorded on synthetic account 60. Reflection is made on the basis of the information specified in the agreement and settlement documents. A score of 60 is considered passive in most cases. The debit records the occurrence of a payable debt, and the credit records its payment. Account 60 will be active only when an advance is paid to the supplier.

- Analytical accounting. Invoice 60 is formed on the basis of settlement papers from the supplier. If one of the parties to the transaction has not fulfilled its financial obligations, a receivable is formed. It can be presented to suppliers for failure to fulfill the terms of the agreement, to contractors for downtime and existing defects, to banking institutions for the amount debited from the company’s account by mistake.

- Inventory of calculations. An inventory is needed to confirm the correctness of the information specified in accounting and reporting. There are situations in which an inventory is a mandatory measure. The list of such situations is specified in Federal Law No. 402. In particular, the inventory is carried out before the formation of annual reporting. Checking the correctness of calculations is carried out by analogy with an inventory of material assets. To carry out the procedure, it is necessary to convene an inventory commission. The result of her work is documented using an act. During the procedure, the amounts in account 60 are checked. To solve this problem, settlement reconciliation acts are generated. During the inventory, the accuracy of the amounts of receivables and payables, the identity of balances, the validity of accrued debt, and the accuracy of settlements with financial institutions are checked. Verification involves the generation of reconciliation reports.

Important! The act drawn up during the inventory must be kept for 5 years. The document must reflect all the required information: company name, accounting accounts, debt amounts, etc.

Basic rules for using account 60

All information is entered into account 60 on the basis of the invoice received when purchasing goods, the certificate of work performed when receiving services. The documents under consideration, on the basis of paragraph 4 of Article 9 of Federal Law No. 402, can be filled out using both unified and proprietary forms.

Count 60 active or passive

Account 60 is included in section VI “Calculations” of the Chart of Accounts. It is a synthetic account. Analytical accounting for it is carried out for each counterparty and for each issued invoice or agreement.

Let's determine whether count 60 is active or passive. To answer the question, you need to understand that the accountant uses it to reflect all payments to suppliers. Therefore, a debt may arise both on the part of our organization (that is, the delivery was made but not paid) and on the part of the supplier (an advance was transferred). In accountant language, this means that the account balance can be either a debit or a credit. Thus, the count of 60 is active-passive.