Employees of the Ministry of Labor in Letter dated August 15, 2016 No. 16-5/B-421[1] recommended the form of a certificate of average earnings for the last three months of work, which is issued at the last place of work. This certificate is issued to a dismissed or former employee to receive unemployment benefits from the employment service at his place of residence. In the article we will remind you how the average earnings are calculated to fill out such a certificate.

According to paragraph 2 of Art. 3 of the Law of the Russian Federation No. 1032-1[2], a certificate of average earnings for the last three months at the last place of work is necessary for a dismissed employee to receive unemployment benefits from the employment service.

For your information:

The employer is obliged to issue this certificate upon a written application from the employee no later than three working days from the date of filing such an application (Article 62 of the Labor Code of the Russian Federation).

Despite the fact that the Ministry of Labor recommended the certificate form in its letter, its use is not mandatory. This means that if the specified certificate is drawn up by the employer in any form, but contains information necessary to determine the amount and timing of payment of unemployment benefits, then there are no grounds for refusing to accept it. Such clarifications are presented in letters of the Ministry of Labor of the Russian Federation dated August 15, 2016 No. 16-5/B-421, Rostrud dated November 8, 2010 No. 3281-6-2.

Note:

A citizen can obtain a certificate of average earnings for the last three months at his last place of work from an archival organization. Such a certificate will also be accepted by social security officials to calculate unemployment benefits. These clarifications are presented in paragraph 20 of the Information of the Ministry of Labor of the Russian Federation dated 03/05/2013[3].

What details should a certificate drawn up in any form contain?

So, the certificate drawn up in any form must contain the following information:

- name, TIN and legal address of the institution where the citizen worked;

- Full name of the employee;

- the period of his work and position (the same as they are indicated in the work book);

- information about working conditions (full or part-time);

- average earnings for the last three months of work;

- information about the presence, during the 12 months preceding dismissal, of periods not included during paid work - when the employee did not work, but his average earnings were retained (for example, maternity leave, parental leave, temporary disability, business trips, etc.);

- basis for issuing a certificate (personal accounts, payment documents);

- signatures of the head and chief accountant of the organization, seal impression.

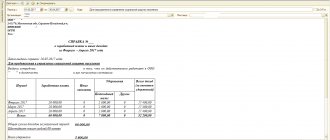

On the form of the Ministry of Labor

To begin with, let's give an example of a certificate of average earnings, the form of which was developed and recommended by the Ministry of Labor of the Russian Federation in letter dated August 15, 2016 No. 16-5/B-421. You can download it from our website using the following direct link .

EXAMPLE

Shirokova Elena Alekseevna worked at Guru LLC from October 1, 2009 to November 25, 2016. The main activity of the company is non-specialized wholesale trade. According to OKVED it has code 46.90.

Address of Guru LLC: 111456, Moscow, st. Tkatskaya, 17, building 6. Contact phone number. TIN 7719123456.

Throughout the entire period of her work at Guru LLC, Shirokova had a standard working week – an eight-hour, five-day week.

During the 12 months before the day of dismissal, Shirokova was on sick leave from 09/06/2016 to 09/14/2016 (period excluded from the calculation).

Shirokova’s average earnings over the last 3 months before leaving the company were 45,000 rubles 10 kopecks.

Based on these data, the accountant of Guru LLC needs to prepare and issue to her a completed certificate of average earnings for the employment center within 3 working days from the date of receipt of Shirokova’s application (Article 62 of the Labor Code of the Russian Federation).

Below is a sample certificate of average earnings in 2022 on the form of the Ministry of Labor.

Since the rules for filling out this certificate are not approved by law, it is not entirely clear, it is necessary to provide specific details of the employee’s personal account and payment documents on the basis of which he received earnings and the company made the corresponding calculations.

Also see “Form for a certificate of average earnings for the employment center.”

Calculation of average earnings

Currently, the calculation of average earnings must be made in accordance with the Procedure for calculating average earnings to determine the amount of unemployment benefits and scholarships paid to citizens during the period of professional training, retraining and advanced training in the direction of the employment service authorities, approved by Resolution of the Ministry of Labor of the Russian Federation dated August 12, 2003 No. 62 (hereinafter referred to as Procedure No. 62).

Average earnings are necessary to determine the amount of unemployment benefits paid to laid-off citizens. It is accrued to citizens from the first day of their recognition as unemployed (clause 3 of Article 31 of Law of the Russian Federation No. 1032-1). According to paragraph 1 of Art. 34 of the Law of the Russian Federation No. 1032-1 unemployment benefits for citizens dismissed for any reason during the 12 months preceding the start of unemployment, who during this period had paid work for at least 26 weeks on a full-time (full-time) or part-time basis days (part-time working week) recalculated to 26 weeks with a full working day (full working week) and recognized as unemployed in the prescribed manner, is accrued:

a) in the first (12-month) payment period:

– for the first three months – in the amount of 75% of their average monthly earnings (salary), calculated for the last three months at the last place of work (service);

– for the next four months – in the amount of 60%;

– in the future – in the amount of 45%, but in all cases not higher than the maximum amount of unemployment benefits and not lower than its minimum amount, increased by the regional coefficient;

b) in the second (12-month) payment period - in the amount of the minimum amount of unemployment benefits, increased by the regional coefficient. This period concerns unemployed citizens who are not employed after the first period of unemployment benefits. They have the right to receive unemployment benefits again, unless otherwise provided by law. The total period for payment of benefits to a citizen cannot exceed 24 months in total for 36 months (Clause 5 of Article 31 of Law of the Russian Federation No. 1032-1).

For your information: For 2016, Decree of the Government of the Russian Federation dated November 12, 2015 No. 1223 established the following amounts of unemployment benefits:

– minimum – 850 rubles;

– maximum – 4,900 rub.

On a regional form

It should be noted that your sample certificate of average earnings for an employment center can be approved at the level of a constituent entity of the Russian Federation by the body responsible for labor relations in the region.

For example, in Moscow - this is Appendix 1 to the order of the DTSZN of the city of Moscow dated December 24, 2022 No. 1721. Appendix No. 1 approves the form of the Moscow certificate. It can be downloaded from the official website using the link. Here is her form.

The following is an example of filling out a certificate of average earnings, which can be used by employers registered in Moscow if they wish. Let's take the same conditions as a basis. And we additionally point out that from February 8 to July 15, 2016, Shirokova, on the basis of Part 1 of Article 93 of the Labor Code of the Russian Federation, worked part-time.

In our opinion, the second (Moscow) sample for filling out a certificate of average earnings in 2022 is even easier to complete than the one developed by the Ministry of Labor, since it includes a smaller number of mandatory details related to calculating the average earnings of a resigned (dismissed) employee for the last 3 months.

Also see “Average earnings for 3 months: how to calculate.”

It is important to say that each regional employment center develops its own form. Therefore, before filling out the certificate, contact the territorial office of the employment service for the form. Submission of a certificate not in the form approved by the regional employment center may be the reason for refusal to assign unemployment benefits (letter of Rostrud dated November 8, 2010 No. 3281-6-2).

Calculation period for calculating average earnings for calculating unemployment benefits

Clause 3 of Procedure No. 62 establishes that the employee’s average earnings are calculated for the last three calendar months (from the 1st to the 1st) preceding the month of dismissal.

Example 1 An employee quit on November 7, 2016. What billing period should I take to fill out the certificate?

In this case, the calculation period will be from 07/01/2016 to 10/31/2016.

Note:

If an employee quits on the last day of the month, the month of dismissal can be included in the billing period, but only if the average earnings are higher (Definition of the RF Armed Forces dated June 8, 2006 No. KAS06-151).

Example 2

The employee resigned on October 31, 2016. What billing period should be taken in this case?

In the case under consideration, the period from 07/01/2016 to 10/31/2016 can be taken as the calculation period, if the average earnings calculated for this period are greater than the average earnings for the period from 06/01/2016 to 09/30/2016. The average earnings may be higher, for example, if the employee was paid a bonus in the month of dismissal.

We draw your attention to clause 4 of Procedure No. 62, which states that days should be excluded from the billing period when:

- the employee retained his average earnings in accordance with the legislation of the Russian Federation;

- the employee received temporary disability benefits or maternity benefits;

- the employee did not work due to downtime due to the fault of the employer or for reasons beyond the control of the employer and employee;

- the employee did not participate in the strike, but due to this strike he was unable to perform his work;

- the employee was provided with additional paid days off to care for disabled children and people with disabilities since childhood;

- in other cases, the employee was released from work with full or partial retention of wages or without payment in accordance with the legislation of the Russian Federation;

- the employee was provided with days of rest (time off) in connection with work beyond the normal working hours under the rotation method of organizing work and in other cases in accordance with the legislation of the Russian Federation.

How to determine the billing period if it consists entirely of days excluded from it in accordance with clause 4 of Procedure No. 62?

In this case, the average earnings are determined based on the amount of wages actually accrued for the previous period of time equal to the calculated one (clause 5 of Procedure No. 62). Example 3 An employee quit on the last day of maternity leave – November 7, 2016. Before this, she had maternity leave. How to determine the billing period?

In connection with these vacations, the employee was absent from work from June 20, 2013 to November 7, 2016. Thus, the billing period determined according to the general rules consists entirely of days excluded from it. Therefore, it is necessary to take the period from 03/01/2013 to 05/31/2013 as the calculated period.

How to determine the payroll period if the employee did not have actual accrued wages or actually worked days during the payroll period and before it? Average earnings in this case are determined based on the amount of wages accrued for the days actually worked by the employee in the month of dismissal (clause 6 of Procedure No. 62).

Example 4

The employee resigns on November 23, 2016. He has been working at the institution since November 1, 2016. How to determine the billing period?

In this case, the calculation period will be the period of work of this employee in the institution, that is, from November 1, 2016 to November 23, 2016.

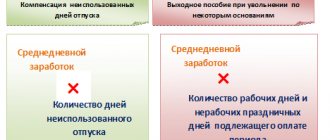

Billing period

To calculate, you need to take the three months that precede the employee’s dismissal. The following times must be excluded from the period:

- illness, child care, maternity leave;

- being on a business trip or paid leave;

- absence from work with or without maintaining income.

There are situations when an employee quits on the last day of the month. In this case, to calculate the average monthly salary, it is allowed to use three months, taking into account the month of dismissal. It is advisable to apply this procedure if the employee received a significant bonus and the average monthly salary calculated for this period exceeds the average earnings calculated according to the general rules (Definition of the Supreme Court No. KAS06-151).

Payments that are included in the calculation of average earnings

By virtue of clause 2 of Order No. 62, when calculating average earnings, all types of payments provided for by the remuneration system applied in the relevant organization are taken into account, regardless of the sources of these payments, which include:

- wages accrued to employees at tariff rates (official salaries) for time worked, at piece rates, issued in non-monetary form;

- monetary remuneration accrued for time worked to persons holding government positions;

- wages accrued to teachers of primary and secondary vocational education institutions for hours of teaching work in excess of the reduced annual teaching load (counted in the amount of 1/10 for each month of the billing period, regardless of the time of accrual);

- the difference in the official salaries of employees who transferred to a lower-paid job (position) while maintaining the amount of the official salary at the previous place of work (position);

- wages finally calculated at the end of the calendar year, determined by the remuneration system (counted in the amount of 1/12 for each month of the billing period, regardless of the time of accrual);

- allowances and additional payments to tariff rates (official salaries) for professional excellence, class, qualification category (class rank, diplomatic rank), length of service (work experience), special conditions of civil service, academic degree, academic title, knowledge of a foreign language, work with information constituting a state secret, combining professions (positions), expanding service areas, increasing the volume of work performed, performing the duties of a temporarily absent employee without exemption from the main job, leading a team;

- payments related to working conditions, including payments determined by regional regulation of wages (in the form of coefficients and percentage bonuses to wages), increased wages for hard work, work with harmful and (or) dangerous and other special working conditions, for work at night, payment for work on weekends and non-working holidays, payment for overtime work;

- bonuses and remunerations, including remuneration based on the results of work for the year and one-time remuneration for length of service;

- other types of payments in accordance with the existing remuneration systems in the organization.

Please note: As already mentioned, clause 4 of Order No. 62 establishes periods that are excluded from the calculation. Amounts paid during this time are also not taken into account when calculating average earnings.

Description of the certificate to the court about salary

A certificate for the court about wages is written in free form, but it is better if it is provided according to a conventionally accepted sample. As a rule, accounting employees have no problems with this, even taking into account some of the nuances of its preparation.

Compliance with the rules for writing such documents allows you to assign legal force to it. A salary card certificate for bailiffs must contain accurate data for a specific period of time (usually 6 months).

Important: in the header of the certificate you must indicate the name of the company, its address and contacts, as well as the date of registration.

On the portal you can download examples of documents in free format, namely:

Sample certificate

Certificate form to fill out

In order to calculate the average salary, accounting is usually guided by the following factors:

- all income issued as salary, bonus, etc. is taken into account.

- if the employee was released from work for some period, then this time is not counted;

- if the employee did not work and wages were not accrued, then this period of time is not taken into account, but the previous month is taken into account.

The organization must provide a certificate no later than three days later. But for this you need to write a corresponding application.

Nuances of the salary certificate:

- The company address should be indicated postal and in fact, because employees of a financial institution and bailiffs have the right to conduct an inspection. Therefore, to avoid stalemate situations, check the certificate before applying.

- The body of the certificate must indicate all amounts that the employee received each month. Changing the numbers is regarded as fraud by conspiracy by a group of persons, and this is already the Criminal Code of the Russian Federation.

- Signatures are also required. At the end of the certificate there must be a signature of the chief accountant and/or supervisor. In the absence of the director, his deputy has the right to sign the certificate.

- The seal is the main element of the certificate, which confirms the originality and validity of the document. You can install it either for general purpose or intended for the accounting department. As a rule, in small organizations printing is in a single format, while in large companies there may be several types.

- Information about why the certificate is needed is indicated in the following wording: “At the place of request.” In this form, the certificate can be submitted to any authority. If a specific purpose is indicated, it will be impossible to bring the document to another organization.

If the above data is missing or formatted incorrectly, the document will not be valid. Consequently, the banking institution and bailiffs will not accept it, and the salary account will not be unblocked. Of course, it will have to be redone.

Formula for calculating average earnings

Clause 7 of Order No. 62 provides that to determine average earnings, it is necessary to use the average daily earnings, which is calculated using the formula:

| Average daily earnings | = | The amount of wages actually accrued for the billing period |

| Number of days actually worked during this period |

| Average earnings | = | Average daily earnings | X | Average monthly number of working days in the billing period (depending on the length of the working week established in the organization) |

Note:

When an employee is assigned part-time work (part-time work week, part-time work), the average daily earnings are calculated by dividing the amount of actually accrued wages by the number of working days according to the calendar of a five-day (six-day) work week falling on the time worked in the billing period.

Let's give an example of calculating average earnings.

Example 5

The employee resigned on November 7, 2016. His salary for the billing period from 08/01/2016 to 10/31/2016 was:

– for August – 32,000 rubles;

– for September – 30,000 rubles;

– for October – 32,000 rubles.

The billing period has been fully worked out. The employee has a 40-hour work week (five working days). Let's calculate his average earnings to compile a certificate for the employment service.

The amount of wages actually accrued to the employee for the billing period will be 94,000 rubles. (32,000 + 30,000 + 32,000).

The number of days actually worked during the billing period is 66 working days (23 + 22 + 21), where 23, 22 and 21 are the number of working days according to the production calendar for August, September and October 2016, respectively.

The average daily earnings of an employee will be 1,424.24 rubles. (94,000 rubles / 66 working days).

The average monthly number of working days in the billing period is 22 (66 working days / 3 months).

Average earnings will be 31,333.28 rubles. (RUB 1,424.24 x 22 working days).

How is the form compiled?

Order of the Ministry of Labor No. 182n provides a recommended template with payment data for the two-year period preceding the termination of work.

The regulatory act regulates the procedure, establishes the structure of the certificate, indicating vacation days and other periods of time when the employee maintained his average salary, but social contributions were not deducted for it.

The procedure for issuing a form indicating the amount for three months is not centrally regulated by federal legislation. The company is authorized to develop a template with text and tabular information independently.

Form of income certificate for 3 months

The document contains the following points:

- name of the enterprise (organizational and legal structure), INN, OGRN, legal address, contact details;

- name of the form, with a three-month period;

- date of submission to the social security structure;

- the fact that the form was issued to an actual employee of the company (the name of the employer is indicated);

- the position of the specialist and the period of his employment;

The sample specifies the total amount of salary transferred for a specific period . The digital form is duplicated with text.

The accounting specialist also enters the amount of income tax deducted. If the applicant pays alimony or credit obligations established by a court decision, then this is also indicated.

The form provides for calculating the average monthly income of a citizen. Information for filling it out is taken from the personal account or expense order. At the end, the signature of the manager, chief accountant is placed.

Important to remember!

Printing is required. If it is not available, then documentation confirming the authority of the specialist issuing the certificate must be attached. The seal is placed on the left side and should not overlap the signature. Errors and blots are not permitted.

HR departments are authorized to develop the printed form independently. Often an accountant draws up a document in the 1C program.

Registration of a certificate of income in the 1C program

Sample filling

Its strict form is not provided:

- Information about the enterprise and contact information of the employer are indicated.

- Information about the specialist is indicated: his position, grounds for employment - type, contract number.

- It is recommended to enter the start and end date of the activity if the employee has already resigned.

The accountant refers to information from statements, personal accounts, and orders. The total amount of payments is entered. One-time charges that are not subject to insurance premiums are excluded from the list of mandatory data. Additionally, the legislator gives the authority to indicate periods with the same salary. The template requires the signature of the accountant and the head of the company.

A sample form is developed by the company in accordance with local regulations. Design is done with a blue or black ballpoint pen. If the form is developed in advance, it is printed on a PC.

Deciphering the signatures of authorized specialists is desirable. The form should indicate all accruals provided for by the enterprise’s wage system.

Formula for calculating average earnings with summarized accounting of working hours

Paragraph 8 of Procedure No. 62 states that when determining the average earnings of an employee for whom a summarized recording of working time is established, the average hourly earnings are used, determined as follows:

| Average hourly earnings | = | The amount of wages actually accrued for the billing period |

| Number of hours actually worked during this period |

| Average earnings | = | Average hourly earnings | X | Average monthly number of working hours in the billing period depending on the established length of the working week |

Let's give an example of calculating average earnings.

Example 6 An employee was fired on November 7, 2016. The billing period from 08/01/2016 to 10/31/2016 has been fully worked out. During the billing period, the employee was provided with a summarized recording of working time. The number of working hours according to the 40-hour workweek schedule in accordance with the production calendar for 2016 is as follows:

– in August – 184 hours, 176 hours worked, salary – 28,000 rubles;

– in September – 176 hours, 182 hours worked, salary – 32,000 rubles;

– in October – 168 hours, 170 hours worked, salary – 30,000 rubles.

Let's calculate the average employee's earnings to prepare a certificate for the employment service.

So, first we determine the average hourly earnings. It will be equal to 170.45 rubles. ((28,000 rub. + 32,000 rub. + 30,000 rub.) / (176 hours + 182 hours + 170 hours)).

The average employee's earnings will be RUB 29,999.20. (RUB 170.45 x ((184 hours + 176 hours + 168 hours) / 3 months)).

Calculation of average earnings if the employee had earnings only in the month of dismissal

Example 7

An employee quits on November 23, 2016. He works at the institution from November 1, 2016 to November 23, 2016. In this case, the estimated period of work of this employee in the institution will be. During the billing period, his salary amounted to 28,000 rubles. The employee has a 40-hour work week (five working days). Let's calculate his average earnings.

The amount of payments included in the calculation of average earnings accrued to him for this period is 28,000 rubles, the number of days worked is 17. The number of working days according to the production calendar for November 2016 is 21.

The average employee's earnings will be 34,588.24 rubles. (RUB 28,000/)

17 work days x 21 workers days).

Calculation of average earnings taking into account bonuses

Clause 9 of Order No. 62 establishes the procedure for calculating average earnings taking into account bonuses depending on the type of bonus: monthly, quarterly or annual.

Let's look at each award in more detail. When calculating average earnings, you must take into account:

1) monthly bonuses and rewards - no more than one payment for the same indicators for each month of the billing period.

Example 8

The employee was fired on November 7, 2016. His salary for the billing period from 08/01/2016 to 10/31/2016 was:

– for August – 32,000 rubles;

– for September – 30,000 rubles;

– for October – 32,000 rubles.

The billing period was fully worked out by him. The employee has a 40-hour work week (five working days). In addition, he was paid a monthly bonus of 6,000 rubles. Let's calculate the average salary of an employee to prepare a certificate for the employment service.

First, we determine the amount actually accrued to the employee for the billing period. It will be 112,000 rubles. (32,000 rub. + 30,000 rub. + 32,000 rub. + 6,000 rub. x 3 months). The number of days actually worked during the billing period is 66 working days.

The average daily earnings of an employee will be 1,697 rubles. (RUB 112,000 / 66 working days).

The average monthly number of working days in the billing period is 22 (66 working days / 3 months).

The average salary of an employee will be 37,334 rubles. (RUB 1,697 x 22 working days).

Note:

If an employee is awarded two bonuses for one indicator in one month, for the calculation it is necessary to take the bonus whose amount is greater.

2) bonuses and remunerations for a period of work exceeding one month - no more than one payment for the same indicators in the amount of a monthly portion for each month of the billing period.

Example 9

The employee was fired on November 7, 2016. His salary for the billing period from 08/01/2016 to 10/31/2016 is equal to:

– for August – 32,000 rubles;

– for September – 30,000 rubles;

– for October – 32,000 rubles.

The billing period has been fully worked out. The employee has a 40-hour work week (five working days). He was also paid a monthly bonus in the amount of 6,000 rubles, and was also given a quarterly bonus in the amount of 24,000 rubles. Let's calculate the average salary of an employee to prepare a certificate for the employment service.

So, when calculating average earnings, it is necessary to take into account all bonuses paid to the employee:

– monthly bonuses in the amount of 18,000 rubles. (RUB 6,000 x 3 months);

– quarterly bonus in full, that is, 24,000 rubles. (RUB 24,000 / 3 months x 3 months).

The average daily earnings will be 2,060.60 rubles. (RUB 136,000 / 66 working days).

The average monthly number of working days in the billing period is 22 (66 working days / 3 months).

The average salary of an employee will be 45,333.20 rubles. (RUB 2,060.60 x 22 working days).

3) remuneration based on the results of work for the year, a one-time remuneration for length of service (work experience), other remuneration based on the results of work for the year, accrued for the previous calendar year - in the amount of 1/12 for each month of the billing period, regardless of the time the remuneration was accrued.

Example 10

The employee was fired on November 7, 2016. His salary for the billing period from 08/01/2016 to 10/31/2016 was:

– for August – 32,000 rubles;

– for September – 30,000 rubles;

– for October – 32,000 rubles.

The billing period has been fully worked out. The employee has a 40-hour work week (five working days). In addition, in April 2016, he was paid a bonus for 2015 in the amount of 36,000 rubles. Let's calculate his average earnings to fill out a certificate for the employment service.

The annual bonus accrued for the previous calendar year must be taken into account when calculating average earnings in the amount of 1/12 for each month of the billing period, regardless of the time the remuneration was accrued. This means that the annual bonus will be taken into account in the amount of 9,000 rubles. (RUB 36,000 / 12 months x 3 months). Thus, the average employee’s earnings will be 34,333.34 rubles. (RUB 103,000 / 66 working days x 22 working days).

4) bonuses and remunerations in the event that the time falling within the billing period is not fully worked or time was excluded from it in accordance with clause 4 of Procedure No. 62 - in proportion to the time worked in the billing period (except for monthly bonuses paid together with wages for a given month).

Example 11

The employee was fired on November 7, 2016. He was given a 40-hour work week (five working days). The billing period from 08/01/2016 to 10/31/2016 was not fully worked out by him:

– from 09/12/2016 to 09/16/2016 (five calendar days) he was on sick leave;

– from 10.10.2016 to 14.10.2016 (five calendar days) the employee was on a business trip.

In addition, during the billing period he was paid bonuses:

– in August for the second quarter of 2016 – in the amount of 18,000 rubles;

– in September for August – in the amount of 6,000 rubles;

– in October for September – in the amount of 6,000 rubles, for October – in the amount of 6,000 rubles, for the third quarter of 2016 – in the amount of 18,000 rubles.

Let's calculate the total amount of bonuses when determining the average earnings for the employment service.

The number of working days according to the production calendar for 2016 for the billing period (from 08/01/2016 to 10/31/2016) was 66 working days, and the number of days worked by the employee during this period was 56 working days.

When calculating average earnings, bonuses will be taken into account in the following amounts:

– for August 2016 – 5,090.90 rubles. (RUB 6,000 / 66 work days x 56 work days);

– for September 2016 – 5,090.90 rubles. (RUB 6,000 / 66 work days x 56 work days);

– for October 2016 – 6,000 rubles, since this is a monthly bonus paid along with wages for a given month;

– for the second quarter of 2016 – 15,272.72 rubles. (RUB 18,000 / 66 work days x 56 work days);

– for the third quarter of 2016 – 15,272.72 rubles. (RUB 18,000 / 66 work days x 56 work days).

The total amount of bonuses taken into account when calculating average earnings for an employment center will be 46,727.24 rubles. (5,090.90 + 5,090.90 + 6,000 + 15,272.72 + 15,272.72).

Note:

If an employee has worked in an organization for an incomplete working period, for which bonuses and rewards are accrued, and they were accrued in proportion to the time worked, they are taken into account when determining average earnings based on the actually accrued amounts according to the rules established by clause 9 of Procedure No. 62.

Certificate of average earnings: new recommended form

Only in May of this year, the Russian Ministry of Labor published letter No. 16-5/B-5 dated January 10, 2019, in which it announced the update of the recommended form on average earnings for the last three months at the last place of work.

A certificate of average earnings to determine the amount of unemployment benefits is issued to the dismissed employee to receive unemployment benefits from the employment service at his place of residence.

Now in the new certificate form there is no need to list the periods when the employee did not receive wages (due to unpaid leave, sick leave, downtime, absenteeism, etc.).

Basically, the composition of the certificate remained unchanged. As before, it should contain the following information:

- about the company in which the citizen worked;

- about the individual to whom the certificate was issued;

- about the period of work in the company;

- about working conditions (full or part-time, indicating the number of working hours);

- about the average salary for the last three months;

- on the grounds for issuing a certificate (personal accounts, payment documents);

- about the director and chief (senior) accountant of the organization.

Please note that the new certificate form is recommended. The employer can draw up a certificate in any form.

Also, specialists from the Ministry of Labor clarify that if the employer has drawn up a certificate in any form and it contains all the information that is needed to determine the amount and timing of payment of unemployment benefits, then the employment service does not have the right to refuse to accept the certificate.

Unemployment benefits for 2022

Let us remind you that for 2022 the minimum and maximum amounts of unemployment benefits have been increased. A special maximum is established for citizens of pre-retirement age (Resolution of the Government of the Russian Federation of November 15, 2018 No. 1375).

According to Article 30 of the Federal Law of April 19, 1991 No. 1032-1 “On Employment in the Russian Federation”, the amount of benefits in the first year will be from average earnings:

- in the first three months – 75%;

- in the next four months – 60%;

- in the remaining five months - 45%.

However, whatever the result of the calculation, the amount of unemployment benefits cannot exceed the maximum amount (Article 33 of the Federal Law of April 19, 1991 No. 1032-1). This is why it is installed.

From January 1, 2022, the unemployment benefit amounts are:

- minimum – 1,500 rubles;

- maximum – 8,000 rubles.

For citizens of pre-retirement age who have less than 5 years of work left before retirement, the maximum unemployment benefit will be 11,280 rubles.

Calculation of average earnings

To calculate an employee’s remuneration based on average earnings, they are guided by the general calculation procedure (Article 139 of the Labor Code of the Russian Federation) and the specifics of calculation (approved by the Government of the Russian Federation in Resolution No. 922 dated December 24, 2007).

To calculate average earnings, you need to determine:

- billing period;

- number of working days in the billing period;

- the amount of payments that the employee received in the pay period.

Let's briefly look at each of these periods.

How to determine the billing period

The billing period is the 12 calendar months preceding the period during which the employee retains his average salary.

In this case, a calendar month is considered to be the period from the 1st to the 30th (31st) day of the corresponding month inclusive (in February - to the 28th (29th) day inclusive).

Companies can refuse the generally established billing period of 12 months and establish a different billing period (Article 139 of the Labor Code of the Russian Federation). The billing period can be six months, three months, etc. It must be taken into account that the situation of employees cannot be worsened in comparison with that established by law.

How to determine the number of days in a billing period

Once the billing period has been determined, to calculate average earnings it is necessary to calculate the number of working days in this period. The procedure for calculating the number of days in a pay period depends on whether the employee worked all the days included in the pay period or not.

If the employee has worked the pay period completely, you need to determine the number of working days in the pay period according to the calendar of a five-day work week. When determining the number of working days, holidays and weekends are not taken into account.

The pay period may not be fully worked by the employee. Thus, the calculation period does not include days on which:

- the employee received temporary disability benefits or maternity benefits;

- an employee raising a disabled child was provided with additional paid days off;

- the employee was on leave without pay;

- the employee was released from work with full or partial retention of wages;

- the employee did not work due to downtime (for example, due to the suspension of the organization or workshop);

- the employee did not participate in the strike, but due to it was not able to perform his work.

Accordingly, periods for which payments were calculated based on average earnings are excluded from the calculation period, with the exception of breaks for feeding a child.

If the billing period has not been fully worked out, then it is necessary to calculate the number of working days worked in the billing period according to the calendar of a five-day working week.

How to determine the amount of payments for the billing period

Once you have determined the pay period, you need to determine the amount of payments to the employee for this period.

The procedure for calculating average wages is established by Article 139 of the Labor Code of the Russian Federation and the Regulations on the specifics of the procedure for calculating average wages (approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922).

When calculating average earnings, you should, in particular, take into account:

- wages accrued to employees at tariff rates, official salaries, piece rates, as a percentage of revenue from sales of products (performance of work, provision of services);

- wages paid in non-monetary form;

- Commission remuneration;

- bonuses and additional payments (for class, qualification category, length of service, combination of professions, etc.);

- the final calculated salary of the previous year, regardless of the time of accrual;

- compensation payments related to working hours and working conditions (determined by regional regulation, additional payments for work in hazardous and difficult working conditions, at night, in multi-shift work, on weekends and holidays and overtime);

- bonuses and rewards (provided for by the remuneration system);

- other payments applied by the employer, etc.

It should be especially noted that funds issued to employees not as remuneration for labor (dividends on shares, interest on deposits, insurance payments, financial assistance, loans, etc.) are not taken into account when calculating average earnings.

Calculation of average earnings when increasing salaries in an organization

Clause 10 of Procedure No. 62 establishes the rules for calculating average earnings when tariff rates (official salaries, monetary remuneration) increase in an organization (branch, structural unit).

In this case, the average earnings of employees increases as follows: 1) if the increase occurred during the billing period, payments taken into account when determining the average earnings and accrued for the period of time preceding the increase are increased by coefficients that are calculated by dividing the tariff rate (official salary, monetary remuneration ), established in the month of occurrence of the event that is associated with the preservation of average earnings, at tariff rates (official salaries, monetary remuneration) of each month of the billing period.

Example 12

The employee was fired on November 7, 2016. The billing period is from 08/01/2016 to 10/31/2016. From September 1, 2016, the organization increased salaries from 28,000 to 32,000 rubles. The employee has worked out the entire pay period. Let's calculate the average salary for the employment service.

Let's determine the increase factor. It will be equal to 1.14 (32,000 rubles / 28,000 rubles).

The average daily earnings of an employee will be 1,453.34 rubles. ((28,000 rub. x 1.14 + 32,000 rub. + 32,000 rub.) / 66 working days), where 66 working days is the number of days actually worked in the billing period.

The average earnings that must be indicated in the certificate for the employment service will be equal to 31,973.48 rubles. (RUB 1,453.34 x (66 work days / 3 months)).

2) if the increase occurred after the billing period before the day of dismissal, the average earnings calculated for the billing period increase.

Example 13

The employee was fired on November 7, 2016. The billing period is from 08/01/2016 to 10/31/2016. From November 1, 2016, salaries increased from 28,000 to 32,000 rubles. The employee has worked out the entire pay period. Let's calculate the average salary for the employment service.

First, it is also necessary to determine the increase factor. It will be equal to 1.14 (32,000 rubles / 28,000 rubles).

The average daily earnings of an employee will be 1,272.72 rubles. ((28,000 rub. + 28,000 rub. + 28,000 rub.) / 66 working days), where 66 working days is the number of days actually worked in the billing period.

The average salary of an employee, which must be reflected in the certificate for the employment service, is RUB 31,919.82. (RUB 1,272.72 x (66 work days / 3 months) x 1.14).

3) if the increase occurred after the employee was dismissed, the average salary does not increase.

Indexation of payments

If there was a salary increase at the enterprise as a whole or in the department where the leaving employee worked, then the increase must be taken into account when calculating the average monthly earnings:

- if the increase occurred during the billing period, then payments before the increase are indexed;

- if after, then the average monthly salary is indexed.

The conversion factor is determined by the formula:

Let's return to our example. From November 1, salaries were increased throughout the enterprise. The salary for the driver position has been increased from RUB 30,000. up to 33,000 rub.

The conversion factor is:

We recalculate the average monthly salary, since the increase occurred after the billing period:

This is the amount that should be reflected in the certificate.