Expert consultation

Since 2022, new rules for accounting for fixed assets (FPE) have been applied, namely, new FAS 6/2020 “Fixed Assets” and FAS 26/2020 “Capital Investments” have been introduced. Tax accounting has not been spared the changes: from 2022, the rules for calculating depreciation during reconstruction will be clarified.

The expert “What to do Consult” talks about what modernization and reconstruction are.

Modernization is a change in the technological or service purpose of equipment, updating an object, bringing it into compliance with new requirements and standards, technical conditions, and quality indicators. The initial standard indicators of the functioning of the facility are improved (increased) (clause 2 of article 257 of the Tax Code of the Russian Federation, clause 3.2 of section III of the Official statistical methodology for determining investments in fixed capital at the federal level, clause 16 of the Letter of the State Statistics Committee of Russia dated 04/09/2001 No. MS -1-23/1480).

Reconstruction is a reorganization of a facility associated with the improvement of production (to increase production capacity, improve quality and change the product range). The initial parameters of the object itself or its parts are changed. For example, the area of buildings, the number of floors changes, load-bearing building structures are replaced or restored, etc. (clause 2 of article 257 of the Tax Code of the Russian Federation, clause 14 of article 1 of the Civil Code of the Russian Federation, clause 16 of the Letter of the State Statistics Committee of Russia dated 09.04 .2001 No. MS-1-23/1480).

Modernization and reconstruction are carried out to change the purpose of the OS or improve its characteristics (Letter of the Ministry of Finance of Russia dated March 22, 2017 No. 03-03-06/1/16312).

The new federal accounting standard (FSBU) also reveals these concepts in its own way. Modernization and reconstruction of operating systems are measures to improve them (subparagraph “g”, paragraph 5 of FSBU 26/2020).

Accounting for OS modernization and reconstruction from 2022

The actual costs of improving the operating system in accounting are recognized as capital investments (sub-clause “g” clause 5, clause 9 of FSBU 26/2020).

The list and amount of these costs are determined in the same order as when creating the operating system. Material assets necessary for modernization (reconstruction) are taken into account in the same way as material assets used to create fixed assets (subparagraph “a”, paragraph 5 of FSBU 26/2020).

For example, the actual costs of improving the OS include:

- amounts paid or payable to the contractor performing work to improve the environment, minus refundable VAT (subparagraph “a” clause 10, subparagraph “a” clause 11 of FSBU 26/2020);

- the cost of material assets used to improve the operating system, minus refundable VAT (sub-clause “a” clause 5, sub-clause “a” clause 11 of FSBU 26/2020);

- the salary of employees who perform work to improve the operating environment, and insurance premiums accrued on this salary (subparagraph “e”, paragraph 10 of FSBU 26/2020);

- depreciation of assets that are used to improve fixed assets (subclause “c” of paragraph 10 of FAS 26/2020);

- interest on loans and borrowings, if there is reason to consider improvements as an investment asset (their implementation requires a long time and significant costs). Interest must be capitalized during the period when measures were taken to improve the operating system (subparagraph “e”, paragraph 10 of FSBU 26/2020, Appendix to the Letter of the Ministry of Finance of Russia dated January 21, 2019 No. 07-04-09/2654, paragraphs. 1, Recommendation R-71/2016 “Debt costs in subsequent capital investments”).

If, during measures to improve the operating system, material assets are extracted (for example, spare parts, scrap metal) that can be sold or used in another way, then the estimated cost of these assets must be subtracted from the amounts of actual costs. The estimated price is determined independently, for example, based on the fair value of assets, net realizable value, etc. Moreover, it should not be higher than the cost of improving the operating system (clause 15 of FSBU 26/2020).

Depending on the purposes of further use, the extracted material values can be recognized:

- as capital investments, if it is planned to use them to create major repairs, improve other operating systems (subparagraph “a”, paragraph 5 of FSBU 26/2020);

- as inventories, if in the future they will be used in ordinary activities for no more than 12 months;

- as long-term assets for sale if there is an intention to sell tangible assets, but not in the ordinary course of business.

You can also increase the initial cost of the OS by the amount of completed capital investments to improve the OS (clause 18 of FSBU 26/2020, clause 24 of FSBU 6/2020).

Accounting

In accounting, modernization costs are included in the cost of fixed assets (PBU 6/01 clause 14). Investments in OS modernization flow into the account. 08, as a rule, with the opening of a corresponding sub-account. On the account 01, with whom the account subsequently corresponds. 08, a sub-account “OS Modernization” can also be opened, however, quite often the costs are taken into account directly in the cost of the modernized OS. Amounts are allocated in a subaccount, as a rule, if the number of fixed assets and the scale of modernization work are large enough.

Question: How to reflect the modernization, reconstruction, retrofitting and completion of fixed assets in accounting when applying FAS 6/2020 and FAS 26/2020? View answer

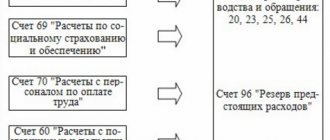

Typically, accounts correspond here like this:

- Dt 08 Kt 10, 23, 60, etc. – write-off for modernization of inventory items, services of auxiliary production, works (services) of third-party organizations.

- Dt 01 Kt 08 – the cost of the operating system has been increased for modernization costs.

The accountant needs to remember: interest on the loan, if the funds were taken for the modernization of the operating system, are included in the costs and increase the book value of the modernized object. This is the position of the Ministry of Finance.

How to take into account the modernization and reconstruction of fixed assets in tax accounting ?

If subaccounts are used, when transferring for modernization, an internal transfer is made Dt 01/subaccount “Assets for modernization” Kt 01/subaccount “Assets in operation”. Similar to account 01, account 03 may be involved in postings when it comes to upgrading an OS object provided for temporary possession or use for a fee, used to generate income. Example: a building that is intended exclusively for rental.

Modernization is documented in the following documents:

- operating schedule;

- cost estimate;

- work orders, contracts for the performance of work, services (depending on how they were performed - on their own or with the involvement of third-party companies);

- acts of work execution;

- invoices, etc.

How can a lessee take into account the costs of modernizing leased fixed assets ?

Materials are sold according to invoices, requirements, and limit cards. The increase in the cost of fixed assets as a result of modernization is reflected in the inventory card of the fixed asset.

By the way! Modernization and reconstruction are terms that are similar in meaning, but not identical. Modernization is always associated with work leading to changes in the technological and service purpose of the OS. The OS object is transformed into a more modern, more powerful one with improved qualities. Reconstruction is the reorganization of the operating system in order to increase the technical and economic indicators of product production: changing the assortment, improving quality, increasing production volume. These nuances follow from Art. 257-2 Tax Code of the Russian Federation. Repair is aimed at restoring worn-out operating systems; it is not directly related to fundamental improvements of objects.

Postings

| Contents of operation | Debit | Credit |

| The actual costs of improving the OS are included in capital investments | 08/OS improvements | 60 (70.69, etc.) |

| Material assets extracted during the process of modernization (reconstruction) of the OS were capitalized | 10 | 08/OS improvements |

| The costs of improving the OS are included in its initial cost | 01 | 08/OS improvements |

With the help of SPS ConsultantPlus, you will easily navigate the legislation and track all changes in a timely manner.

What is modernization?

The concept of modernization (for tax accounting purposes) is established by paragraph 2 of Article 257 of the Tax Code of the Russian Federation and implies work to change the functionality of equipment, while reconstruction is understood as a set of measures to increase existing capacities and improve their quality. Needless to say, modernization requires additional costs for the acquisition of new technological elements, spare parts, and payment for modification services. Let us dwell in detail on the basic components of the modernization process.

Procedure for calculating depreciation

The calculation of depreciation on fixed assets that are in the process of modernization, reconstruction, additional equipment or completion does not need to be suspended (clause 30 of FSBU 6/2020).

Before accruing depreciation on a modernized (reconstructed) fixed asset, it is necessary to check whether it is necessary to change the depreciation elements of this object and, first of all, its useful life (clause 37 of FSBU 6/2020).

The useful life of the OS after modernization (reconstruction) may not change, but may increase. If there are reasons to change the useful life or other elements of depreciation, you need to make an appropriate decision and document it.

Accrual of depreciation based on the changed book value and new depreciation elements begins from the date of completion of the modernization (reconstruction) of the asset. If depreciation is accrued from the first day of the month following the month of recognition of the fixed assets in accounting, then depreciation is accrued from the 1st day of the month following the month of completion of the modernization (reconstruction) of the fixed assets (clause 4 of PBU 21/2008 “Changes in estimated values” , Recommendation R-6/2009 KPR “Changing the useful life of fixed assets during operation”). Depreciation is calculated in the general manner.

Upgrading the OS in 1C 8.3 - step-by-step instructions

Fixed assets in the course of the activities of any organization lose their initial properties: they wear out and break. The organization has to bear the costs of ensuring the functioning of fixed assets. It is important to distinguish between concepts such as repair and modernization. During repairs, the technical indicators of the fixed asset do not change, and modernization entails an improvement in the qualities of the fixed asset. Let me give you a simple example: retrofitting a computer with a video card.

Let's consider how to modernize fixed assets in 1C 8.3 Enterprise Accounting 3.0.

As of 01/01/2019, the organization’s balance sheet includes a fixed asset “Samsung Computer” worth 120,000 rubles and a useful life of 40 months. The computer was used for a year, the amount of accumulated depreciation was 36,000 rubles.

Let’s generate a report “Asset Depreciation Statement” to view the initial data on our fixed asset.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

On January 15, an “nVidia Quadro P1000” video card worth 15,000 rubles was purchased for subsequent retrofitting of our OS. We will reflect the operation with the document “Receipt” with the type of operation “Goods (invoice)”. The document is located in the section “Purchases - Receipts (acts, invoices”).

In the document we indicate:

- the supplier and the agreement under which we purchase the video card;

- nomenclature, quantity and price;

- accounting account 10.06 “Other materials”.

When posting the document, a posting was generated on the debit of account 10.06 - capitalization of the material, and the cost of VAT was separately allocated on the debit of account 19.03.

To upgrade the OS, we transfer the video card with the document “Requirement-invoice”. The document can be entered based on the “Goods receipt” document. You can also create a document manually in the “Warehouse - Requirements-invoices” section.

On the “Materials” tab, indicate the nomenclature, quantity and write-off account 10.06.

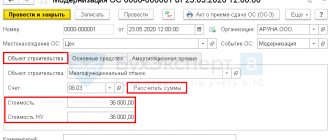

On the “Cost Account” tab:

- indicate account 08.03 “Construction of fixed assets”;

- construction site that we will modernize. To do this, you need to create a new element in the directory;

- cost item “Write-off of materials”;

- “Contract” construction method.

When posting the document, a transaction was generated to write off the material from the credit of account 10.06 to the debit of account 08.03.

In the “Account Analysis” report for account 08.03, we can see the total amount of costs that will increase the initial cost of the fixed asset.

In the section “OS and intangible assets - Accounting for fixed assets” we create the document “OS Modernization”.

On the “Construction object” tab we will indicate the modernization object, invoice 08.03. By clicking the “Calculate amounts” button, the amount of expenses for the invoice on 03/08 will be automatically determined.

On the “Fixed Assets” tab, indicate our computer and click the “Distribute” button. In this case, the amount of modernization costs will be distributed equally among all specified fixed assets. If necessary, you can change the useful life of a fixed asset. In the example under consideration, the useful life has not changed.

When posting the document, a posting was generated that reflects the increase in the initial cost of the fixed asset.

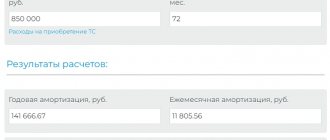

Let's check the calculation of depreciation of fixed assets after modernization.

- First we need to calculate depreciation for January 2022. To do this, we will perform the routine operation “Depreciation and depreciation of fixed assets” in the section “Operations - Closing the period - Closing the month”.

- We will generate a report “Asset Depreciation Statement” for January 2019. The cost of the computer, taking into account modernization, was 132,500 rubles, the residual value was 93,500 rubles.

- Now let’s calculate depreciation for February 2019.

The calculation occurred as follows: Residual value of the asset / Remaining useful life: 93,500 / 27 months = 3,462.96 rubles.