Accounting statements for 2021

→ Section updated on October 3, 2022.

Must be submitted no later than March 31, 2022

(inclusive) Attention! It is no longer necessary for organizations to submit financial statements to Rosstat authorities (with some exceptions) Attention! Only organizations belonging to small and medium-sized businesses can submit financial statements on paper. Absolutely all organizations must submit financial statements annually, regardless of the tax regime applied.

Organizations submit their financial statements to the Federal Tax Service at the location of the organization (clauses

5, 5.1 clause 1 art. 23 of the Tax Code of the Russian Federation). In addition, organizations whose annual accounting (financial) statements contain information classified as state secrets in accordance with the legislation of the Russian Federation must submit financial statements to Rosstat (Part 7, Article 18 of the Federal Law of December 6, 2011 N 402-FZ).

Accounting statements are submitted to the Federal Tax Service and to the Rosstat branch (whose responsibilities include submitting financial statements to statistical authorities) no later than three months after the end of the reporting year (clause 5, 5.1, clause 1, article 23 of the Tax Code of the Russian Federation, part 5, art.

18 of Federal Law dated December 6, 2011 N 402-FZ), i.e. no later than March 31 of the year following the reporting year. Moreover, if March 31 falls on a weekend, the deadline for submitting financial statements is postponed to the first working day following this date (clause 7, article 6.1 of the Tax Code of the Russian Federation, clause 7 of the Procedure, approved.

Order of Rosstat dated March 31, 2014 N 220). Accounting statements are submitted exclusively in electronic form via TKS through a special operator (Part 5 of Article 18 of the Federal Law of December 6, 2011 N 402-FZ).

True, small and medium-sized businesses are allowed to submit such reports for 2022 either on paper or in electronic form at their choice (Clause 4, Article 2 of Federal Law of November 28, 2018 N 444-FZ). As a general rule, the financial statements include (Part 1, Article 14 of Federal Law No. 402-FZ of December 6, 2011):

Who submits simplified financial statements?

Organizations using simplified accounting methods:

- small businesses;

- non-profit organizations (NPOs);

- organizations that have received the status of participants in the Skolkovo project.

Attention! Simplified reporting forms cannot be used:

- organizations whose accounting (financial) statements are subject to mandatory audit;

- housing and housing construction cooperatives;

- credit consumer cooperatives;

- microfinance organizations;

- organization of the budgetary sphere;

- political parties, their regional branches or other structural units;

- bar associations;

- law offices;

- lawyer consulting;

- bar associations;

- notary chambers;

- non-profit organizations included in the register of non-profit organizations performing the functions of a foreign agent.

Accounting statements must be submitted no later than three months after the end of the reporting (calendar) year, i.e. no later than March 31 of the following year.

Attention! For organizations created after September 30, the first reporting year is the period from the date of their registration to December 31 of the following year.

Small businesses are allowed to show less information in a simplified annual report compared to other organizations. Let's take a closer look at an example of filling out simplified financial statements for 2022. Thus, the asset balance sheet of a small enterprise consists of one section instead of two; it reflects only five indicators plus a total. The liability side of the balance sheet contains one section of six indicators plus a total. By virtue of Law No. 402-FZ, all lines for which aggregated indicators are indicated (“Tangible non-current assets”, “Intangible, financial and other current assets”) must be assigned a code corresponding to the largest of the indicators included in the total line amount.

In addition, when filling out the line “Tangible non-current assets”, you must include data on debit balances on accounts 01, 03, 07, 08 (except for subaccounts 08-5 and 08-8), 15 and 60, and indicate the balance on account 16 and credit balance on account 02. When filling out the line “Intangible, financial and other non-current assets”, it is necessary to include in it debit balances on accounts 04, 58, 97, and sub-accounts 08-5, 08-8, 55-3, 73-1 and credit balance on accounts 05 and 59. This is defined in paragraph 35 of PBU 4/99.

Simplified reporting differs from regular reporting in that it contains only generalized items. Lack of detail. This system has a number of features:

- You can maintain a generalized calculation plan.

- Simplified case may be used. You will need to create your own format for it.

- The cash method allows you to take into account and record all the company's income and expenses.

- No need to use double entry.

Debit and credit are not used in the statements under consideration. For this reason, it is almost impossible to obtain detailed information from the document.

, draw up a balance sheet for a small enterprise

Simplified accounting financial statements for 2022

The statements do not indicate information that is not considered material for a number of companies. Such information includes expenses for basic activities, current income taxes and other indicators. The reporting contains the following data:

- Revenue. You must first subtract VAT and excise taxes from it.

- Expenses related to the basic activities of the enterprise, including commercial expenses and management expenses.

- Interest payable on existing loans and borrowings.

- Other income. That is, income that is not related to the basic activities of the company.

- Other expenses from which interest payable is deducted.

- Income tax.

- Net profit.

This is the basic information you need to provide. If necessary, this list can be expanded.

CALL IN EKATERINBURG

How can we help you?

Simplified financial statements - balance sheet and income statement, which are located on one form and have an abbreviated form. The right to provide such reporting is granted to organizations classified as small businesses

IMPORTANT! The due date has been postponed to 05/06/2020 - taking into account the postponement due to non-working days, letter of the Ministry of Finance No. 07-04-07/27289, Federal Tax Service No. ВД-4-1/ dated 04/07/2020)

There are a number of features for preparing an annual report for small businesses. In particular, specifically for them, by order of the Ministry of Finance No. 66n, the KND form 0710096 was approved - simplified accounting statements. The timing and procedure for sending it to the bodies of Rosstat and the Federal Tax Service do not differ from those established for all other legal entities. The only privilege is a small form and no obligation to provide explanations. Let’s take a closer look at who submits simplified financial statements in this form and what exceptions exist.

The procedure for whom simplified accounting is possible is regulated by the Federal Law on Accounting. Its article 20 states that such a right is one of the principles of accounting regulation in Russia. But not all MPs have this right. Thus, paragraph 4 of Article 6 of Law No. 402-FZ contains a closed list of legal entities that are required to keep full records, which means submitting an annual report in full. These include:

- housing and housing construction cooperatives;

- microfinance organizations;

- credit consumer cooperatives;

- notary chambers;

- lawyer consulting;

- bar associations;

- law offices;

- public sector organizations;

- political parties;

- non-profit organizations that are included in the register provided for in paragraph 10 of Article 13.1 of Federal Law No. 7 of January 12, 1996 “On Non-Profit Organizations”, as foreign agents.

If an organization is a small enterprise by all criteria, but at the same time a microfinance organization, a consumer cooperative or a law office, a simplified balance sheet is not for it; all reports will have to be submitted in full.

To simplify accounting for small businesses, legislators have long promised to develop a special federal standard. But this promise has not yet been fulfilled, so small businesses are guided by a number of laws and regulations, in particular, such accounting and reporting are regulated by:

- Federal Law No. 402 of December 6, 2011 “On Accounting”;

- Accounting Regulations “Accounting Statements of an Organization” PBU 4/99, approved by Order of the Ministry of Finance of Russia No. 43n dated 07/06/1999;

- Regulations on maintaining accounting and financial statements in the Russian Federation, approved by order of the Ministry of Finance of Russia No. 34n dated July 29, 1998;

- Order of the Ministry of Finance of Russia No. 66n dated July 2, 2010 “On the forms of financial statements of organizations”;

- other current regulatory documents on accounting.

Although small enterprises do not have to submit an explanatory note along with the annual report, by virtue of paragraph 39 of PBU 4/99 they have the opportunity to provide the regulatory authorities with any additional information about themselves. This information is provided in any form, as it is not an approved attachment to the report.

The simplified form is issued in accordance with the procedure set out in the information of the Ministry of Finance No. PZ-3/2015. The document allows you to independently decide whether to include forms on changes in capital and cash flows in the annual report. In addition, the MP independently develops the reporting form, using simplified forms of the balance sheet and income statement.

As for simplified individual entrepreneurs without employees, they provide the balance in a different form, KND 1152017.

Which enterprises are small

The law establishes several criteria that companies and individual entrepreneurs must meet in order to be considered small businesses. Their values are periodically adjusted. The following criteria currently apply:

- The amount of income is no more than 800 million rubles for the previous year. It is income, not revenue, as was previously the case. This means all income that is taken into account for tax purposes.

- No more than 100 employees based on the average number of employees for the previous year.

- If the company’s share belongs to legal entities, then restrictions apply: the share of charitable and other foundations, public and religious organizations, the Russian Federation and its constituent entities, as well as municipalities can be no more than 25%;

- the share of a foreign legal entity and organization that does not belong to small and medium-sized businesses is no more than 49%.

In some cases, the rules limiting the participation of other legal entities in the capital of a small enterprise (clause 3) may not apply. For example, they are ignored for participants in the Skolkovo project and for organizations whose work is related to the implementation of the results of intellectual activity (know-how, computer programs, etc.). At the same time, other criteria must be met.

However, not every small enterprise can submit simplified reporting. For example, microfinance organizations and legal consultations are prohibited. Any organization whose reporting is subject to mandatory audit must also report in full. The list of entities that cannot submit simplified reporting is given in paragraph 5 of Article 6 of Law 402-FZ.

Accounting statements of non-profit organizations in 2022

Accounting (financial) reporting form according to KND 0710099

> > January 29, 2022 Will the financial statements of non-profit organizations be presented in full or simplified form in 2022?

Who has the opportunity to simplify accounting and, accordingly, reporting? The answer to this is given by clause 4 of Art. 6 of Law No. 402-FZ.

What reporting forms must a non-profit organization submit? What changes have the accounting reporting forms undergone in 2022? You will find answers to these and other questions in our article. The main difference between a non-profit organization and a for-profit organization is its fundamental purpose. The goal of a commercial company is to extract the maximum possible amount of profit.

Non-profit organizations do not pursue the goal of making a profit.

This is reflected in Art. 50 Civil Code of the Russian Federation. In their activities, they must first of all be guided by the Civil Code of the Russian Federation and the Law “On Non-Profit Organizations” dated January 12, 1996 No. 7-FZ. As in commercial structures, the types of activities of a non-profit organization are fixed in its constituent documentation. The activities carried out by such an organization must correspond to the purpose of its creation and operation.

Non-profit organizations are founded for the state to implement its functions in the social sphere, education, medicine, and culture. They also conduct religious, charitable and other activities.

Non-profit organizations can also be created in the form of associations of citizens and legal entities to solve common problems. Non-profit organizations can also engage in entrepreneurial activities that generate income.

For example, educational institutions may provide additional paid services.

But such activities should not contradict the main purpose of the organization. It must also be stated in the constituent documents, for example in the charter. Accounting for income received from the results of such activities is carried out separately from the main one.

Legislation may establish certain restrictions on its conduct by certain types of non-profit organizations. Financial support for non-profits

Filling Features

Accounting (financial) reporting

The principles for filling out accounting records for SMP are similar to the standard principles. Thus, the balance sheet also consists of two sections: assets and liabilities. Each section provides detail for the largest groups, which, in turn, are revealed over the dynamics of several reporting periods.

If, after submitting the balance sheet, errors are identified, even significant ones, then the submitted reports cannot be corrected. Error correction is not provided for SMP. In this case, new reports are completed using a retrospective method. That is, the error is corrected in accounting, the balance sheet indicators are recalculated.

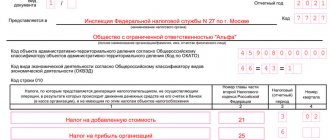

Accounting statements form KND 0710099

When the financial year ends, the accountant is required to submit an accounting report to the tax office. For this purpose, KND form 0710099 has been developed.

If you download the KND form 0710099, you will see the presence of barcodes in the upper left corner on each page of the form. Why is this needed? This nuance ensures both electronic acceptance of the document and its manual execution. With the help of a barcode, it becomes readable for computer devices.

This form was developed specifically for tax purposes. If you are preparing financial statements for your personal needs or another department, you can use the forms from Order No. 66n without coding.

Accounting financial statements of the form according to KND 0710099 are a whole set of reports. Here are its components.

OKUD code

Report title

Income statement

Statement of changes in equity

Cash flow statement

Targeted use of funds (fill in only those who received targeted money from the budget)

Attachments to reports

The composition of the form described above is a complete version. Not all subjects of economic activity in the Russian Federation rent it out. There are a number of exceptions for which a shortened version has been formed, but it has a different OKUD code. This is KND form 0710096. The simplified version can be used by:

- Small companies;

- Skolkovo participants;

- Budgetary enterprises. However, they provide only the balance with the corresponding applications and information about the intended use of funds.

Important! Individual entrepreneurs do not have to report in full or simplified form

Changes coming into force in 2022

Certain clauses of the Appendix to Order No. 61n become effective only in 2022. For the form of simplified financial statements (KND 0710096) for 2022, they are optional. But, if the company wants, it can take into account the new provisions when filling out documents for last year. They concern codes for the financial results report (Appendix No. 4 to the order):

- removed encodings 2421, 2430, 2450;

- when reflecting income tax, code 2410 is indicated in the report line, and for other income taxes the value of line 2411 is assigned;

- entered the value 2412 – “Deferred income tax”;

- a new code 2530 has been added - tax on profits from transactions not included in net profit.

Legislators also changed the wording of paragraph 9 of the note to the report on earmarked funds.

The updated coding becomes mandatory for 2020 reports.

KND 0710096 for 2022, simplified financial statements

Tax authorities are optimizing the submission of reports by taxpayers, including the filing of financial statements. For electronic submission of simplified reporting, use KND form 0710096.

Legal requirements for submitting accounting reports

Accounting statements are a set of documents of a certain content, compiled according to accounting data (clause 1, article 13 of the law “On Accounting” dated December 6, 2011 No. 402-FZ). Keeping accounting records is not mandatory for individual entrepreneurs, private practitioners and divisions of foreign companies that keep records in accordance with the rules of Tax legislation (Clause 2 of Article 6 of Law No. 402-FZ). Accordingly, accounting is not mandatory for them. But the legal entity must prepare and submit it (subclause 5, clause 1, article 23 of the Tax Code of the Russian Federation).

Today there are 2 options by which accounting records are formed (order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n):

- full;

- simplified, which can be used by legal entities that have the right to conduct accounting according to simplified rules.

Simplification of reporting implies the possibility of drawing up 3 forms of reporting in a reduced volume:

Reporting for small businesses for 2022: are there any changes?

Who has the opportunity to simplify accounting and, accordingly, reporting? The answer to this is given by clause 4 of Art. 6 of Law No. 402-FZ. The list of such entities is given in the table:

| Who can keep simplified records | Law regulating the activities of the subject |

| Small businesses | Law “On the development of small and medium-sized businesses in the Russian Federation” dated July 24, 2007 No. 209-FZ |

| NPO | Law “On Non-Profit Organizations” dated January 12, 1996 No. 7-FZ |

| Companies operating within the Skolkovo project | Law “On the Skolkovo Innovation Center” dated September 28, 2010 No. 244-FZ |

At the same time, the listed entities must meet the conditions specified in paragraph 5 of Art. 6 of Law No. 402-FZ, for example, not be subject to mandatory audit, not be a government organization, political party, not engage in microfinance, etc.

The forms of simplified reports are given in the current version of the order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n. The table below reveals which reports are required for bookkeepers, as well as the features of special forms:

| Is the report required for bookkeepers? | Is there a special simplified template? (order No. 66n, appendix 5) | Features of the simplified report | |

| Financial statements | |||

| Balance | Yes | Yes | It has enlarged articles that group several elements. If any indicator is significant, it must be highlighted separately |

| Income statement | Yes | Yes | There is no division by type of expenses for core activities, there is no current income tax and other indicators that are most likely to be insignificant for bookkeepers |

| Applications | |||

| Statement of changes in equity | No for insignificant indicators | No, the general one is used, taking into account the materiality of the indicators | |

| Cash flow statement | No for insignificant indicators | No, the general one is used, taking into account the materiality of the indicators | |

| Report on the intended use of funds | Yes - for non-profit organizations and legal entities with targeted revenues; no - for others with insignificant indicators | Yes | There is no breakdown by type of contribution, no detailed breakdown of expenses |

| Explanations for reporting | No for insignificant indicators | No, the general one is used, taking into account the materiality of the indicators |

The templates from Order No. 66n are advisory; an organization can develop its own form that corresponds to its activities, leaving and grouping the necessary articles of the general reporting forms. There are no templates for applications, since their preparation is mandatory only if the data specified there can have a significant impact on the opinion of users (subparagraph “b”, paragraph 6 of Order No. 66n).

In June 2022, adjustments were made to the full and simplified reporting forms.

Now instead of:

- million rubles use thousand rubles. The unit of measurement in millions has been abolished.

- OKVED use OKVED2.

The electronic simplified reporting format, designed for filing with tax authorities, includes a cover page and 5 reports. Of these, 3 (balance sheet, financial results report and report on the intended use of funds received) were created according to the simplified forms given in Order No. 66n, and reports on changes in capital and cash flows, which do not have simplified options, are given in the usual format.

A separate simplified reporting template is available for download on our website.

Article taken from the website Nalog-nalog.ru

Spread the love

Simplified income statement

The income statement for small firms consists of seven lines. Data must be reflected for the reporting year and the previous year. Expenses and losses are shown in brackets. Revenue, as always, must be reflected net of VAT and excise taxes, and expenses for ordinary activities include cost of sales, selling and administrative expenses.

The formation of items in a simplified form of the financial results statement is shown in the table.

| Name of simplified report lines | Name and line codes of the standard report |

| Revenue | Revenue (2110) |

| Expenses for ordinary activities | Cost of sales (2120), selling expenses (2210) and administrative expenses (2220) |

| Percentage to be paid | Interest payable (2330) |

| Other income | Other income (2340) |

| other expenses | Other expenses (2350) |

| Income taxes (income), including current income tax, deferred income tax | Code 2410 or 2460 is assigned depending on which indicator has the greatest share when forming the line: income tax or other (tax paid in connection with the application of a special tax regime) |

| Net income (loss) | Net profit (loss) (2400) |

KND 0710099 financial statements in 2022 – 2022 download

Today we will look at the topic: “KND 0710099 financial statements in 2021 - 2022 download” and we will analyze it based on examples.

A distinctive feature of these reporting forms is the presence of a special barcode and the possibility of transmission in electronic form. Let's consider the composition and features of these reporting forms. No video. Video (click to play).

The composition of financial statements is regulated by Art.

14 of the Law of December 6, 2011 No. 402-FZ.

Templates for reporting forms, including simplified ones, were approved by the Ministry of Finance in Order No. 66n dated July 2, 2010. Each form has its own OKUD code.

If reporting is generated for internal users, you can use the forms from Order No. 66n without line codes, the same forms can be used for submission to the statistics body (with completed line codes). The tax office will need the accounting financial reporting form KND 0710099.

The reporting submitted to the Federal Tax Service is designed for electronic document flow, therefore the reporting forms for KND 0710099 are developed in a machine-readable version.

But they can also be used when submitting a report on paper. Each form page contains a special barcode in the upper left corner.

Accounting statements KND 0710099 consists of the following forms: Balance sheet (OKUD 0710001); report on financial results (OKUD 0710002); report on changes in capital OKUD 0710003); report reflecting cash flow (OKUD 0710004); report on the intended use of funds (OKUD 0710006); explanations for reporting.

The form can be downloaded on the website of the Federal Tax Service or on the website of the Federal State Unitary Enterprise GNIVC. The forms on these resources are presented with a .tif extension. They can be printed and filled out by hand, but adjustments cannot be made using a computer.

Tax authorities recommend using specialized software. When

Current forms of financial statements KND 0710096, 0710099, etc. (download)

Date and deadline for approval of annual reports in 2022

Balance sheet form for 2022: form

Balance adjustment

Balance sheet asset

Cash in foreign currency account on balance sheet

At the end of each year, accounting (financial) statements - form according to KND 0710099 - are submitted by business entities to the tax office. A distinctive feature of these reporting forms is the presence of a special barcode and the possibility of transmission in electronic form. Let's consider the composition and features of these reporting forms.

The step-by-step algorithm for liquidating an organization looks like this:

Step 1. Making a decision to terminate activities (voluntary, by court or bankruptcy). Drawing up a notification to the Federal Tax Service in form 15001 to make changes to the Unified State Register of Legal Entities. In addition to the Federal Tax Service, form 15001 should be sent to all extra-budgetary funds, all founders (owners), registration state bodies and authorities.

At this point you need to remember the basic principles and methods of accounting. It is well known that accounting must reliably reflect complete information about the obligations, state of property and capital of the organization and all changes that occur in them.

Such control is carried out through a complete, continuous and documentary reflection of all business transactions in the organization on the basis of double entry. This means that each digit in the accounting data is posted to two different accounts, debit and credit.

Thanks to this, a balance is achieved when the debit part is always equal to the credit part, if no errors were made. This method naturally concerns accounting results, so all forms of annual financial statements for 2022 are comparable and must be linked with each other.

This is, first of all, checked by regulatory authorities when they receive documents from legal entities.

The main indicators of the form are:

- revenue in net valuation (the indicator should not contain VAT, amounts of excise taxes and other payments of the same nature);

- cost of goods (or services) sold.

Based on them, the value of gross profit is calculated (we subtract costs from revenue), and then, taking into account commercial and administrative expenses, the profit from sales (or loss if a negative result) is calculated. There is a separate line in the form for each of these indicators.

Individual entrepreneurs who have at least one employee working under a contract are required to submit data on the average number of employees every year. And every quarter report to the Pension Fund of the Russian Federation using forms RSV-1 and 4-FSS.

Unified financial reporting for organizations (LLC) according to KND 0710099 includes the main consolidated accounting reports: balance sheet and statement of results (profit and loss), appendices to the accounting. balance sheet - reports on the flow of capital, cash and the use of target funds (OKUD from 0710003 to 0710005).

Small businesses fill out only basic KND reporting forms without attachments.

KND 0710099 - financial statements in 2022 with this code began to be created in a new electronic format. Let's consider what it is, who can use it and how, where to download the accounting reporting form KND 0710099. It may also be required in 2022 for submitting financial reporting.

The list of reports included in the accounting records is determined by Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n.

This document divides the sets of prepared reporting forms into 2 types:

The simplified version is available to persons who are permitted by law to conduct accounting using the simplified version (small enterprises, non-profit organizations, participants in the Skolkovo project). At the same time, they must fully meet the conditions provided for in paragraph 5 of Art. 6 of Law No. 402-FZ of December 6, 2011 “On Accounting”.

Both sets include:

- Income statement.

- Explanations for accounting.

- Report on the intended use of funds.

- Balance.

The first three documents for full and simplified reporting are different, since simplification entails combining report indicators, and therefore changing the number of lines in it. The full set of reporting forms additionally includes reports:

- about cash flow.

- about changes in capital;

Each of the above forms has its own code according to OKUD (All-Russian Classifier of Management Documentation), indicated in its upper right corner.

As you can see, accounting (financial) statements 0710099 are not among them. However, accounting statements 0710099 have every right to exist.

Sample annual reporting 0710096 for 2021

> >

- for information about length of service and data on the presence of employees - in the law “On individual (personalized) accounting...” dated 04/01/1996 No. 27-FZ (clauses 2 and 2.2 of article 11);

- for environmental collection - in Decree of the Government of the Russian Federation dated October 8, 2015 No. 1073 (clause 1).

- for payments for negative impact - in the Law “On Environmental Protection” dated January 10, 2002 No. 7-FZ (clause 5 of Article 16.4);

Tax Code of the Russian Federation (clause

7 tbsp. 6.1), as well as Rosstat’s order No. 220 dated March 31, 2014 (clause 7 of the appendix) provide for the possibility of postponing the deadline indicated as the deadline for submitting reports to a later day if its last date coincided with a weekend. The other documents above do not provide for a similar possibility of shifting dates for reports.

targeted use of finances;

- applications submitted along with mandatory reporting.

Private entrepreneurs do not have to submit such reports, while for small businesses it is possible to submit reports in a simplified version, including reporting information on financial results without details, as well as indicating in the annexes only those data that will allow assessing the financial position of the company, as well as evaluate its financial performance.

If the information needed to complete the above applications is not available, you can only fill out statements on the balance sheet and financial results. KND form 0710099: A current example of filling out a declaration can be downloaded for free from the Internet today or viewed online.

Form KND 0710096 is one of the simplified accounting reporting forms recommended by the Federal Tax Service of the Russian Federation. This type of reporting includes forms of a balance sheet, a statement of financial results and the intended use of funds. In accordance with Federal Law 402, financial statements are a series of documents that include data on the financial and property indicators of organizations and enterprises, reflecting receipts, income, and data on financial results for a certain reporting period.

Submission deadlines

Enterprises are required to report for 2022 no later than March 31, 2020. From this year, forms are sent only to the Federal Tax Service; documents are no longer required to be submitted to Rosstat. For 2022, small and medium-sized companies can submit forms in paper form for the last time; for all other organizations, the obligation to submit reports electronically has been introduced starting with the 2022 reports.

For a company, the use of simplified financial statements for 2019 is optional.

The form of documents is chosen by the management of the organization and is fixed in the accounting policy. If desired, reporting can be submitted in full. When filling out documents, you need to take into account the amendments introduced by Order of the Ministry of Finance No. 61n dated April 19, 2019. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Who is required to keep financial records?

According to the Federal Law “On Accounting”, starting from January 1, 2013, any organization must maintain financial statements. In this case, neither the taxation system nor the form of ownership matters.

Federal law assumes that individual entrepreneurs with a general or simplified system or with imputed tax are exempt from accounting reporting. But at the same time, income must be reflected in accordance with tax legislation.

For those who work under the general tax regime, it is necessary to enter all their income and expenses in a specially designated book for transactions of individual entrepreneurs.

The letter of the Ministry of Finance of the Russian Federation dated July 17, 2012 states that individual entrepreneurs must keep records of how their physical indicators change.

Simplified balance: features

The simplified balance sheet form is given in Appendix No. 5 to Resolution No. 66n dated July 2, 2010. In accordance with paragraph 6 of this order, groups of balance sheet items may not be detailed.

The balance sheet is compiled on the basis of accounting data maintained by the enterprise. Small businesses can introduce accounting in a simplified version, set out by the Ministry of Finance in memo No. PZ-3/2015 dated 06/03/2015. For example, it is allowed not to apply PBU 18/2. In this case, the lines showing deferred tax assets and liabilities will not appear on the balance sheet. In addition, small businesses may not create reserves, with the exception of reserves for doubtful debts. It is also allowed to use the cash method of accounting. But retrospective recalculation of balance sheet indicators when errors are identified in previous periods may not be used. In this case, the profit or loss must be included in other income or expenses of the current period.

In conclusion, we emphasize that the use of simplified reporting is the right of a small enterprise, but not an obligation. If desired, you can draw up a full balance sheet and all other reports.

Tax return codes

The directory contains tax return codes (TDC), which are used in tax returns (calculations). Connect electronic reporting

- Changes from April 17, 2013

- Download KND in Excel (.xls)

| KND | Title of the document |

| 1110011 | Information on received permits for the extraction (catch) of aquatic biological resources, the amount of fees for the extraction (catch) of aquatic biological resources, subject to payment in the form of one-time and regular contributions |

| 1110012 | Information on the licenses (permits) received for the use of objects of the animal world, the amounts of fees for the use of objects of the animal world subject to payment, and the amounts of fees actually paid |

| 1110022 | Information on the number of objects of aquatic biological resources subject to removal from their habitat as permitted by-catch, on the basis of a permit for the extraction (catch) of aquatic biological resources and the collection amounts subject to payment in the form of a one-time contribution |

| 1151001 | Tax return for value added tax |

| 1151003 | Excise tax return |

| 1151006 | Tax return for corporate income tax |

| 1151020 | Tax return for personal income tax (form 3-NDFL) |

| 1151026 | Calculation of regular payments for subsoil use |

| 1151038 | Tax return for income tax of foreign organizations |

| 1151039 | Tax return on excise taxes on petroleum products |

| 1151040 | Tax return for excise duty on excisable mineral raw materials (natural gas) |

| 1151044 | Calculation of fees for the use of the names “Russia”, “Russian Federation” and words and phrases formed on their basis |

| 1151046 | Tax return for the unified social tax for taxpayers making payments to individuals |

| 1151050 | Calculation of advance payments for the unified social tax for taxpayers making payments to individuals |

| 1151054 | Tax return for mineral extraction tax |

| 1151056 | Tax calculation (information) on the amounts of income paid to foreign organizations and taxes withheld |

| 1151059 | Tax return for the unified agricultural tax |

| 1151063 | Tax return for the unified social tax for individual entrepreneurs, lawyers, notaries engaged in private practice |

| 1151066 | Calculation (declaration) of tax on transactions with securities |

| 1151072 | Tax return for water tax |

| 1151074 | Tax return on excise taxes on tobacco products |

| 1151081 | Data on the calculated amounts of the single social tax on the income of lawyers |

| 1151082 | Tax return for corporate income tax upon implementation of production sharing agreements |

| 1151084 | Excise tax return on excisable goods, with the exception of tobacco products |

| 1151088 | Tax declaration on indirect taxes (value added tax and excise taxes) when importing goods into the territory of the Russian Federation from the territory of member states of the customs union |

| 1152001 | Calculation of corporate property tax |

| 1152002 | Calculation of corporate property tax (for a separate division) |

| 1152004 | Tax return for transport tax |

| 1152011 | Tax return for gambling business tax |

| 1152016 | Tax return for single tax on imputed income for certain types of activities |

| 1152017 | Tax return for tax paid in connection with the application of the simplified taxation system |

| 1152019 | Calculation of forest taxes when selling timber, taking into account the area and number of trees assigned for felling |

| 1153001 | Tax return for land tax |

| 1153005 | Tax return for land tax |

| 1152026 | Tax return for corporate property tax |

| 1152028 | Tax calculation for advance payment of corporate property tax |

You can download the official “Directory of compliance of tax declaration (calculation) codes (KND) with budget classification codes (BCC)” on the Federal Tax Service website. www.nalog.ru