We have already discussed why it is important for any businessman to submit reports on time in the article on accounting.

A free audit can help you check the completeness and timeliness of reporting.

Check your accounting for free

For your convenience, we have created a calendar of reports and tax payments that will help you not violate the deadlines established by law.

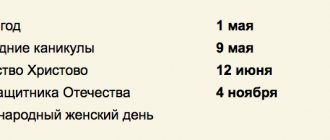

Please note that the deadlines in the calendar are indicated as in the Tax Code of the Russian Federation, however, if the deadline for submitting a report or paying a tax falls on a weekend, it is postponed to the next working day.

So that you can try outsourcing accounting without any material risks and decide whether it suits you, we, together with the 1C company, are ready to provide our users with a month of free accounting services:

Free accounting services from 1C

Tax calendar for individual entrepreneurs

Read more about individual entrepreneur taxation. The simplest tax calendar for individual entrepreneurs who do not have employees:

| Tax | 1st quarter | 2nd quarter | 3rd quarter | 4th quarter or year-end | NPA |

| simplified tax system* | Advance payment for the first quarter - no later than April 25 | Advance payment for half a year - no later than July 25 | Advance payment for nine months - no later than October 25 | Annual declaration under the simplified tax system and payment of tax no later than April 30 | Art. 346.21, 346.23 Tax Code of the Russian Federation |

| Unified agricultural tax | — | Advance payment for agricultural tax for the half-year - no later than July 25 | — | Annual declaration under Unified Agricultural Tax and payment of agricultural tax no later than March 31 | Art. 346.9, 346.10 Tax Code of the Russian Federation |

| VAT** | Submit your declaration no later than April 25 and pay tax by June 25 inclusive | Submit your declaration no later than July 25 and pay tax by September 25 inclusive | Submit the declaration no later than October 25 and pay tax until December 25 inclusive | Submit your declaration no later than January 25 and pay tax by March 25 inclusive | Art. 174 Tax Code of the Russian Federation |

| Personal income tax | Advance payment for the 1st quarter - no later than April 25 | Advance payment for half a year - no later than July 25 | Advance payment for nine months - no later than October 25 | Personal income tax at the end of the year - no later than July 15. Declaration for the year in form 3-NDFL until April 30 inclusive | Art. 227 – 229 Tax Code of the Russian Federation |

| Single simplified declaration*** | Submit no later than April 20 | Submit no later than July 20 | Submit no later than October 20 | Submit no later than January 20 | Art. 80 Tax Code of the Russian Federation |

*STS payers who have no income in the reporting period do not pay advance payments in the corresponding period.

**VAT is paid in a special order: 1/3 of the amount for the expired quarter no later than the 25th day of each of the three months following the expired quarter. For example, VAT accrued for payment for the first quarter is paid in equal installments no later than April 25, May 25 and June 25.

***A single simplified declaration is submitted for several taxes at once, provided that during the reporting period there was no movement in accounts and cash and there were no objects of taxation.

Individual entrepreneurs working for PSN do not file a declaration. The tax, in the form of the value of the patent, is paid as follows:

- A patent issued for a period of up to six months must be paid in full no later than its expiration date;

- If the patent validity period is from six months to a year, then one third of its full cost must be paid no later than 90 days after the start of validity, and two thirds - no later than the expiration date of the patent.

Entrepreneurs also have a specific payment that is not related to taxes, but is required to be paid. These are insurance contributions for your pension and health insurance.

Contributions are divided into two groups:

- mandatory in a fixed amount, which is the same for all individual entrepreneurs;

- additional, in the amount of 1% of the amount of annual income exceeding 300,000 rubles.

Insurance premiums for yourself in a fixed amount must be transferred no later than December 31 of the current year, and an additional contribution, if any, is transferred no later than July 1 of the next year. Thus, individual entrepreneur contributions in the amount of 43,211 rubles must be paid no later than December 31, 2022, and the additional contribution must be paid no later than July 1, 2023. There is no reporting on contributions for yourself.

In addition, individual entrepreneurs who have the corresponding object of taxation have responsibilities for other taxes: land, water, transport, mineral extraction tax, excise taxes. For information about these taxes, see the end of the article.

Fines

Penalty for reporting to the Pension Fund

not on time: “1)

if less than 180 days have passed,

5% of the amounts of contributions payable on the basis of this calculation (for example, the fine for an individual entrepreneur with 16159.56 will be 807.98 rubles and it does not matter whether he paid or not) for each month, but no more than 30% and no less than 100 rubles.

2) if more than 180 days have passed

, 10% of the amount, but not less than 1000 rubles” (Article 46 212-FZ).

Penalty for Declarations

to the tax office not on time: “5 percent of the unpaid amount of tax subject to payment (additional payment) on the basis of this declaration, for each full or partial month from the day established for its submission, but not more than 30 percent of the specified amount and not less than 1,000 rubles ." (27.07.2010 No. 229-FZ). Those. If you paid the simplified tax system, but did not submit the declaration, then the fine is 1000 rubles. Fines and penalties are not displayed in the declaration. Fine calculator.

If taxes or payments to the Pension Fund are not paid on time, a penalty

in the amount of 1/300 multiplied by the payment amount and multiplied by the refinancing rate per day. Penalty calculator

Tax calendar for LLC

| Tax | 1st quarter | 2nd quarter or half year | 3rd quarter or 9 months | 4th quarter or year-end | NPA |

| simplified tax system* | Advance payment for the first quarter - no later than April 25 | Advance payment for half a year - no later than July 25 | Advance payment for nine months - no later than October 25 | Annual declaration under the simplified tax system and payment of tax no later than March 31 | Art. 346.21, 346.23 Tax Code of the Russian Federation |

| Unified agricultural tax | — | Advance payment of agricultural tax for the half-year - no later than July 25 | — | Annual declaration under Unified Agricultural Tax and payment of agricultural tax no later than March 31 | Art. 346.9, 346.10 Tax Code of the Russian Federation |

| VAT** | Submit your declaration no later than April 25 and pay tax by June 25 inclusive | Submit your declaration no later than July 25 and pay tax by September 25 inclusive | Submit the declaration no later than October 25 and pay tax until December 25 inclusive | Submit your declaration no later than January 25 and pay tax by March 25 inclusive | Art. 174 Tax Code of the Russian Federation |

| Income tax for organizations whose reporting period is quarterly (with quarterly income of no more than 15 million rubles) | Advance payment and declaration in a simplified form for the first quarter - no later than April 28. | Advance payment and declaration in a simplified form for the six months - no later than July 28. | Advance payment and declaration in a simplified form for nine months - no later than October 28. | Payment of tax for the year and declaration at the end of the year - no later than March 28. | Art. 285, 286, 287, 289 Tax Code of the Russian Federation |

| Organizational property tax | No later than April 30. | No later than July 31st. | No later than October 31st. | Tax at the end of the year - no later than March 1. Annual declaration – no later than March 30. | Art. 383, 386 Tax Code of the Russian Federation |

| Annual financial statements | No later than March 31 for the previous year | — | — | — | Art. 18 Federal Law No. 402 dated December 6, 2011 |

| Single simplified declaration*** | Submit no later than April 20 | Submit no later than July 20 | Submit no later than October 20 | Submit no later than January 20 | Art. 80 Tax Code of the Russian Federation |

*STS payers who have no income in the reporting period do not pay advance payments in the corresponding period.

**VAT is paid in a special order: 1/3 of the amount for the expired quarter no later than the 25th day of each of the three months following the expired quarter. For example, VAT accrued for payment for the first quarter is paid in equal installments no later than April 25, May 25 and June 25.

***A single simplified declaration is submitted for several taxes at once, provided that during the reporting period there was no movement in accounts and cash and there were no objects of taxation.

Individual entrepreneur on the simplified tax system: payment and reporting deadlines

Entrepreneurs, like organizations, pay advance quarterly payments, pay a fee at the end of the year and submit a declaration. The procedure for calculating the tax fee for entrepreneurs is similar. But for individual entrepreneurs, slightly different deadlines are established.

Individual entrepreneurs also submit their tax return once a year. But for them the due date has been shifted by a month. The report must be submitted no later than April 30 of the year following the reporting year. Also, the tax at the end of the year must be transferred a month later than the LLC.

Payment of the simplified tax system, deadlines 2022 for individual entrepreneurs.

| Transfer date | Reporting period |

| 25.04.2019 | 1st quarter |

| 25.07.2019 | Half year |

| 25.10.2019 | 9 months |

| 30.04.2019 | Year |

Accountability of employers for employees

In addition to the specified tax reporting, all employers (individual entrepreneurs and LLCs) submit the following reporting for their employees:

| Report | 1st quarter | 2nd quarter | 3rd quarter | 4th quarter or year-end | NPA |

| Calculation of insurance premiums to the Federal Tax Service | No later than April 30 for the first quarter | No later than July 30 for the half year | No later than October 30 for nine months | No later than January 30 for the calendar year | Clause 7 of Article 431 of the Tax Code of the Russian Federation |

| SZV-M in the Pension Fund of Russia | Monthly, no later than the 15th day of the month following the reporting period | Monthly, no later than the 15th day of the month following the reporting period | Monthly, no later than the 15th day of the month following the reporting period | Monthly, no later than the 15th day of the month following the reporting period | Article 11 of Federal Law No. 27 of 04/01/96 |

| SZV-Experience | No later than March 1 for the previous year and upon the occurrence of personnel events. | When personnel events occur. | When personnel events occur. | When personnel events occur. | Article 11 of Federal Law No. 27 of 04/01/96 |

| SZV-TD | No later than the working day following the hiring or dismissal | No later than the 15th day of the month following the one in which other personnel events occurred. | — | — | Article 11 of Federal Law No. 27 of 04/01/96 |

| 4-FSS to FSS | No later than April 20 in paper form and no later than April 25 in electronic form for the 1st quarter | No later than July 20 in paper form and no later than July 25 in electronic form for the 1st half of the year | No later than October 20 in paper form and no later than October 25 in electronic form for 9 months | No later than January 20 in paper form and no later than January 25 in electronic form for the year | Article 24 Federal Law No. 125 dated July 24, 1998 |

| “Information about the insured person” in the Social Insurance Fund | When hiring or changing information about an employee. | When hiring or changing information about an employee. | When hiring or changing information about an employee. | When hiring or changing information about an employee. | Art. 13 Federal Law No. 255 dated December 29, 2006 |

| 6-NDFL in the Federal Tax Service | No later than April 30 for the 1st quarter | No later than July 31 for the 1st half of the year | No later than October 31 in 9 months | No later than March 1 for the past year | Art. 230 Tax Code of the Russian Federation |

| Certificate confirming the main type of activity in the Social Insurance Fund* | No later than April 15 at the end of the year | — | — | — | Order of the Ministry of Health and Social Development of the Russian Federation of January 31, 2006 |

*Confirmation of the main type of activity in the Social Insurance Fund is submitted by individual employers only if they have changed the type of main activity from which the greatest income was received in the past year.

The deadlines for submission to Rosstat are specific; usually reports are submitted selectively, at the request of statistical agencies. You can also independently check on the department’s website whether you need to submit a report.

Other taxes for individual entrepreneurs and LLCs

The payment of some taxes depends on the availability of the object of taxation, so not all organizations and entrepreneurs pay them.

Land tax

Taxpayers for this tax are organizations, individual entrepreneurs and ordinary individuals who have land plots on the basis of ownership, perpetual use or lifelong possession. A number of benefits apply to land tax:

- reduction of the tax base (Article 391 of the Tax Code of the Russian Federation);

- preferential tax rate (Article 394 of the Tax Code of the Russian Federation);

- exemption from payment (Article 395 of the Tax Code of the Russian Federation).

Municipalities can establish additional benefits on their territory.

Only organizations submitted a tax return for land tax, but now it has been completely cancelled. Land tax is paid at the location of the land plots; payment deadlines are established by Article 388 of the Tax Code of the Russian Federation.

Organizations transfer land tax for the reporting year no later than March 1 of the following year. Advance payments - no later than the last day of the month following the reporting quarter: April 30, July 31, October 31. Individual entrepreneurs pay land tax as individuals - no later than December 1 for the past year.

Transport tax

The vehicles specified in paragraph 2 of Article 358 of the Tax Code of the Russian Federation, for example, transport of agricultural producers, as well as passenger and cargo watercraft and aircraft that are the property of legal entities or individual entrepreneurs whose main activity is transportation, are not subject to taxation under this tax.

The tax return for transport tax was also cancelled. The deadlines for paying transport tax for organizations are the same as for land tax: March 1, April 30, July 31, October 31. Individual entrepreneurs pay transport tax once a year - no later than December 31 for the reporting year.

Water tax

Taxpayers for this tax are organizations and individuals engaged in special water use, in the form of water withdrawal from water bodies or the use of their water area. Organizations and individuals using water bodies under water use agreements or decisions on the provision of water bodies for use, concluded or adopted after the entry into force of the Water Code of the Russian Federation, are not recognized as taxpayers.

The extensive list of situations of water intake or use of water areas specified in Article 333.9 of the Tax Code of the Russian Federation, such as water intake for irrigation of agricultural land, use of water areas for fishing and hunting, for the placement and construction of hydraulic structures, etc., is not subject to taxation under the water tax. filing a tax return and paying the water tax coincide - no later than the 20th day of the month following the reporting quarter.

Excise taxes

Excise tax is an indirect tax that is included in the price of a product and is actually paid by the consumer. Excise taxes are paid by organizations and individual entrepreneurs who are producers, processors and importers of excisable goods. Excise goods are specified in Art. 181 of the Tax Code of the Russian Federation, these include:

- alcohol-containing products, with the exception of medicines, cosmetics and perfumes;

- alcoholic products, including beer;

- tobacco products;

- cars;

- motorcycles with power over 150 horsepower;

- motor and straight-run gasoline;

- diesel fuel and motor oils.

The tax period for excise taxes is a calendar month, the declaration is submitted at the end of each month, no later than the 25th day of the next month. Excise taxes must also be paid within the same period. An exception is for excise tax payers on transactions with denatured alcohol and straight-run gasoline: the deadline for submitting a declaration and paying excise taxes for them is no later than the 25th day of the third month following the reporting period.

MET - mineral extraction tax

This tax is paid by organizations and individual entrepreneurs who have licenses for the use of subsoil, extracting minerals, with the exception of commonly used ones. The tax period for mineral extraction tax is a calendar month. The tax return must be submitted no later than the last day of the month following the reporting month, and the tax must be paid no later than the 25th day of the month following the reporting month.

How are the deadlines for paying the simplified tax system calculated in 2022?

Reporting periods for the single tax on the simplified tax system are 1st quarter, half a year and nine months. Advance payments for simplified tax must be transferred no later than the 25th day of the first month following the reporting period (i.e. quarter, half-year and 9 months).

Accordingly, as a general rule, the tax must be paid to the budget no later than April 25, July 25 and October 25, 2022. Such terms follow from Art. 346.19 and paragraph 7 of Art. 346.21 Tax Code of the Russian Federation.

At the end of the year - the tax period under the single simplified tax - organizations and individual entrepreneurs use the simplified tax system to sum up the results and determine the final amount of tax.

With the object “income minus expenses” this is a single or minimum tax. Organizations transfer these payments to the budget no later than March 31 of the following year, and individual entrepreneurs - no later than April 30 of the next year.

It is possible that the tax payment deadline for the simplified tax system falls on a weekend, non-working day or holiday. In this case, a single tax or advance payment under the simplified tax system can be sent to the budget no later than on the next working day (clause 7, article 6.1 of the Tax Code of the Russian Federation).

KEEP IN MIND!

The tax according to the simplified tax system for 2022 and the payment for the 1st quarter of 2022 had to be paid to the budget before May 6, 2022 inclusive. This is due to the postponement of the payment deadline due to non-working days, quarantine and coronavirus 2022. But for organizations and individual entrepreneurs from affected industries, other deadlines apply (see below).

Please note that when closing an individual entrepreneur, there are different tax payment deadlines under the simplified tax system. Moreover, this is a controversial issue, which was analyzed and resolved in ConsultantPlus:

The Tax Code of the Russian Federation does not establish specific deadlines for paying tax according to the simplified tax system when closing an individual entrepreneur. In our opinion, you need to calculate and pay the tax before... (read in full).