Unified form or custom

The payroll statement is one of the accounting documents used within the company that confirms the procedure associated with the issuance of cash from the cash register.

Considering the right of companies to independently develop primary accounting documents, the question arises: is it possible to come up with, approve and apply a payroll themselves or will you have to be content with the unified T-53 form that is familiar to everyone?

The answer to this question is contained in the information of the Ministry of Finance dated December 4, 2012 No. PZ-10/2012, from which it is clear that from 2013 it is not necessary to use unified forms of documents.

However, this does not apply to all primary filings - the forms established by the authorized bodies on the basis of federal laws remain mandatory. The payroll can be classified as such papers.

IMPORTANT! The use of payroll is regulated by Central Bank Directive No. 3210-U dated March 11, 2014 on the conduct of cash transactions.

In order not to violate the procedure for conducting cash transactions, you should use payroll 0301011 (paragraph 2, paragraph 6 of Directive No. 3210-U). Payroll index corresponding to OKUD 0301011: T-53. This form was approved as unified by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1.

You will find a step-by-step algorithm for issuing salaries from the cash register in ConsultantPlus. Get trial access to the system for free and go to the Ready-made solution.

Payroll in form T-53 can be found on our website:

Why do you need the T-53 form if you have the T-49 statement?

Indeed, with the help of another commonly used unified document - the payroll sheet in the T-49 form - you can solve absolutely all problems related to accounting for cash payment of wages. In accordance with clause 6 of Bank of Russia Directive No. 3210-U dated March 11, 2014, any form of the employer’s choice can be used: T-49 or T-53 (or only RKO - in the required quantity - instead of any of them).

At the same time, the T-53 document has a noticeably simpler structure in comparison with the T-49 form. If we consider the tabular part of the form, then in the T-53 document it is supposed to fill out 6 columns (in this case, the numerical data on salary are reflected in only one), and on the T-49 form - 23 columns (of which more than half are numerical on salary ).

The form was approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1.

Payroll form T-53

It is assumed that a preliminary calculation of those figures that are to be included in the T-53 form will first be made using other tools. In the general case, using the registers of an accounting program: then the T-53 form will be used only as a summary (reflecting the results of calculations) primary document. Which, one way or another, should be - since the payment of wages from the cash register must necessarily be reflected in one statement or another in accordance with the requirements of the Central Bank of the Russian Federation.

Thus, the T-53 document is, first of all, applicable in cases where the salary calculation registers used by the employer are difficult to reproduce in the unified T-49 form. Only the finished amount is taken from these registers and is reflected against the signature of the employee receiving the salary in a document in the T-53 form.

At the request of the employer, the corresponding register may be the form of a “clean” payroll T-51 (which is usually used for non-cash payments as a primary document). In this case, it and document T-53 form a logical link between the “payroll” and “payroll” statements.

But this bundle most likely will not have any practical advantages over the “ready-made” payroll sheet T-49: there is more work, and some sheets may even be lost. But scenarios for the justified use of the “bundle”, however, can be given: for example, if one specialist or group of specialists (HR department) is responsible for the “payment” part, and another (accounting) is responsible for the “payment” part, then it makes sense to distribute to them forms of various appointments.

If a “couple” is used, then equality must be ensured:

- amounts reflected in column 18 of form T-51;

- amounts reflected in column 4 of the T-53 statement.

As well as other information that requires synchronization in essence.

If salaries are paid in cash to only one or two employees, then it is most likely easier to draw up a cash order for each of them and not waste time working with statements. The instructions of the Central Bank of the Russian Federation directly provide for this option.

All completed T-53 statements are reflected in a special journal compiled according to the unified T-53a form. This journal is created for 1 year. Each closed journal at the end of the year must be kept in the accounting department for 5 years.

Despite the simplicity of the structure, the T-53 form is characterized by a number of remarkable nuances in terms of filling - let’s take a closer look at them.

How to replace a payroll

The use of a unified payroll in form T-53 is not the only option for processing the issuance of earned funds to an eligible person. This procedure can also be completed using other documents - they are provided for by the same Directive No. 3210-U.

For example, you can issue a salary to one person using an expense cash order (Form No. KO-2), and organize a group payment using a payroll slip (Form T-49).

The materials on our website will help you document the payment of your salary:

- “Unified form No. T-49 - form and sample”;

- “Unified form No. KO-2 - cash receipt order”.

Payment statement. Filling out Sheet No. 2

Next, you need to fill out a table in which you need to fill in the employee data indicated in the table sequentially and line by line: the employee’s personnel number, his last name and initials, the amount of salary due in figures.

Further, when issuing wages to employees, each of them, upon receipt, puts a signature next to his last name, checking the amount received with that indicated on the payroll.

If some employees have not received their salaries, for example, due to absence for three days indicated on the title page, then the money must be handed over to the bank, and in column 5 the deposit of the amount must be noted. The employee will receive it later. (click to expand)

When the entire table is filled out, the employees have received their earnings, under the table you need to write the total amount issued and, if any, the deposited amount. The amount is indicated in words and in numbers in brackets. In the column “paid” the last name, first name and patronymic of the person responsible for issuing the salary are indicated.

Next, the document on the basis of which money was issued to employees from the cash register is indicated; this is an expense cash order: its number and date. That's it, the payroll is completed, you need to submit it for verification to the accounting department and for signature by management.

Next, the payroll must be registered in the payroll register, form T-53a. You can download this journal form from the link below.

| ★ Collection and directory of all personnel documents (forms and documents in word format) > 1200 books purchased |

To organize personnel records in a company, beginner HR officers and accountants are perfectly suited to the author’s course by Olga Likina (accountant M.Video management) ⇓

| ★ Author's course “Automation of personnel records using 1C Enterprise 8” (more than 30 step-by-step video lessons for beginners with instructions) purchased > 2000 practical courses |

Mandatory sections of the payroll statement

The preparation of the salary payment slip form begins by indicating the name of the company and its structural unit.

Separately, in the T-53 form, a field is filled in to reflect the corresponding account - when issuing salaries, account 70 “Settlements with personnel for wages” is indicated.

Then the information is entered into the cells according to the timing of payment of money. Then fill in the total amount issued on the statement (in numbers and in words).

IMPORTANT! The duration of the time period during which it is permissible to issue wages from the cash register and make other payments is established by clause 6.5 of Directive No. 3210-U and is 5 working days (including the day of receipt of cash from the bank).

Following this information are the signatures of the company’s responsible persons: the manager and the chief accountant.

It is also necessary to indicate the payroll number and the date of its preparation.

Pay slips for the issuance of wages (a form for filling out which you can download on our website) contain one more additional field - to reflect the billing period. This information is important for the correct registration of the salary payment transaction in the accounting registers.

In addition to the signatures of the director and chief accountant, the payroll contains the signatures of several more responsible persons: the accountant who checked the payment processing; the specialist who carried out the operation to issue wages (cashier or other authorized person). The specified signatures with transcripts of the full name complete the registration of the payroll.

We will talk about filling out the tabular part of the payroll in the next section.

Important! Tip from ConsultantPlus You can make corrections to pay slips if you discover an error. It can be fixed... See K+ for more details by getting a free trial access.

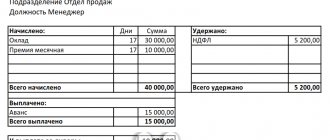

Filling out form T-49

Everything in the header is standard: name of the organization, structural unit (if any), OKPO code, document number (invoice from the beginning of the year) and the date of its preparation.

The line “To the cashier for payment on time from.” The period for which money is withdrawn from the organization’s current account is indicated. According to the rules, you cannot store cash in excess of the established limit in the cash register, with the exception of funds intended for issuing wages - they can be stored for 3 days. Therefore, it is better to indicate a 3-day period in this line (but not necessary).

The period for which the statement is prepared is indicated (usually the billing month). The head of the organization and the chief accountant put their signatures on the left.

Column 1. Serial number of the entry. Typically, employees are listed in alphabetical order.

Columns 2 and 3. Personnel number and position of the employee (can be viewed in the personal card).

Column 4. Tariff rate, salary that the employee receives.

Column 5. Number of days or hours worked (information is taken from the working time sheet).

Column 6. Number of days off or hours worked (double rate for them).

Column 7. Work on holidays (days or hours).

Column 8-12. All types of accruals for the current month are reflected. These columns in the form are initially empty. You yourself enter into them the names of the charges that were made. The sample states the following:

— Salary (column

— Prize (column 9)

— Sick leave (column 10)

Column 13. Other income in the form of social and material benefits.

Column 14. Total amount of accruals (add the amounts of lines 8-13).

Column 15. The amount of personal income tax (income tax 13%) calculated from the employee’s salary is indicated.

Columns 16, 17, 18. We enter other deductions from the employee for the billing month (for example, advance payment, alimony, outstanding loan from the organization, etc.)

Column 19. The amount of debt owed by the enterprise to the employee (if any).

Column 20. The amount of debt owed to the employee (for example, from a previous overpayment).

Column 21. The total amount that the employee will receive after all deductions in columns 15, 16, 17, 18.

Columns 22 and 23. Last name, initials and signature of the employee, if money was paid to him personally. If the employee has not received the money, the cashier makes the entry “Deposited” in column 23.

After filling out the table, the total amount of wages that must be paid to all employees is calculated. This amount is indicated in words and numbers in the header above the table, as well as after the table. Also indicated at the bottom of the form:

— Details of the cash receipt order, on the basis of which money was taken from the cash register

— Cashier who issued the salary (full name and signature)

— Full name, signature of the accountant responsible for payroll

— Deposited amount in words and figures, if not all employees received the salary

Accruals to be paid: fill out the tabular part of the statement

The basis for filling out the tabular part of the T-53 form is the payroll sheet. Accruals are made by the company's specialists on the basis of salaries, tariffs, piece rates - depending on the forms of remuneration used in the company.

Before information about earned funds is entered into the tabular part of the payroll, the necessary deductions are made from the accrued amounts (alimony, compensation for damage, etc.), and personal income tax is deducted. The result of the calculations is entered in column 4 of the payroll.

Each amount of the calculated salary is entered in a separate line of the tabular part of the payroll statement (which you can find on our website).

To personalize the accrued amounts in the statement, columns 2–3 are provided, which contain information about the personnel number and full name of the recipient.

Column 5 of the payroll table is intended to confirm the fact of disbursement of funds from the cash register or to mark the deposit of unpaid amounts. Please note that as of November 30, 2020, the requirement to put a note on the deposit of wages not received by employees on the payroll has been cancelled.

Column 6 “Note” deserves special attention. In a normal situation, when money is received personally by company employees, it is not filled out. Information appears in it, for example, when issuing salaries by proxy. In this case, in the specified line, the cashier makes an entry “by power of attorney,” and the power of attorney itself is attached to the payroll (clause 6.1 of Directive No. 3210-U).

Form T-51 - pay slip: procedure for application and completion

The document form in question is used to reflect only payroll. To reflect payments through the enterprise's cash desk, in this case, payroll T-53 is used. If the company uses the T-49 payroll sheet to reflect the accrual of employee benefits, then this excludes the use of forms T-51 and T-53.

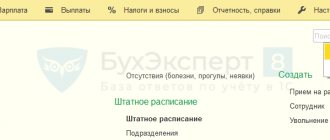

The form can be filled out by hand, or it can be filled out on computer media using appropriate software for accounting accounting transactions (for example, the 1C family). Information on accruals and deductions is provided for each employee separately.

Data on accrued wages is filled in based on the following primary documents:

- time sheets;

- employment contracts;

- bonus orders;

- documents on absence from work (paid and unpaid). For example, sick leave, vacation orders, etc.;

- orders for other payments.

After calculating the amounts to be accrued, the amounts withheld from the salary are calculated: personal income tax, alimony, professional contributions, etc. The last column of the tabular part of the document shows the amount to be paid to the employee (payroll statements can be found at the end of the article).

Results

Payroll slips include many mandatory fields: from the timing of cash payments to a detailed indication of the amounts of wages paid.

Several people sign such a statement: the head of the company, the responsible person who made the payment, the chief accountant and the accountant performing control functions.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to fill out the second sheet

The second page details payments for each employee. It contains a table of six columns:

- Sequential number (for the document).

- Employee personnel number (according to internal company records).

- FULL NAME. salary recipient.

- The amount due for his work at the end of the reporting period.

- Receipt or deposit mark.

- Notes (for example, for recipients' identification document numbers).

IMPORTANT!

When the money is issued, each employee must sign the salary payment form: the form without their signatures is invalid. The wording “Deposited” is provided in case the employee has not received the funds. Then the cashier must sign, confirming that he did not give out the money.

Next, you need to calculate the total amount due for payment and transfer it to the first sheet.

The sample payroll slip also contains information on the total amounts paid and deposited. These lines are filled in when the calculations are already completed.