Loans between related parties are common transactions, which, however, does not exempt them from tax risks. The latter are due to the fact that such loans can be made for selfish purposes and serve to launder funds. Therefore, such transactions are accompanied by enhanced control.

Question: Does the lender need to determine income based on the market interest rate for the use of funds if an interest-free loan agreement is concluded between related parties using the simplified tax system? View answer

Loan agreement between related parties

Interdependent organizations are entities that meet a number of characteristics. They are specified in paragraph 2 of Article 105.1 of the Tax Code of the Russian Federation:

- One entity participates in the capital of the second by more than 25%.

- One entity owns more than 50% of another.

- The heads of the organizations are the same persons.

- The management teams of the companies include the same individuals.

Question: Does an LLC have the right to issue an interest-free loan to an individual entrepreneur if he is one of the founders and director? Is such a loan considered a transaction with related parties? Does an individual entrepreneur have income subject to personal income tax? View answer

Establishing interdependence can be carried out on other grounds if they have a significant impact on the terms of transactions between legal entities (clause 2 of Article 105.1 of the Tax Code of the Russian Federation).

What does a taxpayer need to know about transactions between related parties ?

Loan agreements between interdependent entities are divided into these types:

- Paid. The borrower returns to the lender not only the amount of debt, but also the interest on it.

- Free. Interest is not calculated.

Loans between interdependent legal entities can be classified as controlled transactions if the signs from subparagraphs 2-3 of Article 105.14 of the Tax Code of the Russian Federation are present.

What are interest-free loans between related parties ?

Interest on loans between related parties

In a letter dated July 15, 2015 No. 03-01-18/40737, the Ministry of Finance of the Russian Federation explained that companies, including interdependent ones, are legally allowed to enter into loan agreements on terms convenient for them.

However, for income tax purposes, interest on such transactions for interdependent persons (VLPs) is taken into account in accordance with clause 1.1 of Art. 269 of the Tax Code of the Russian Federation. Learn about the features of methods for recognizing income and expenses for tax accounting purposes from our material “Accrual method and cash method: main differences.”

Transactions between related parties are considered controlled if they are characterized by the conditions of Art. 105.14 Tax Code of the Russian Federation. From January 1, 2015, tax legislation considers interest on debt obligations on controlled transactions between overhead lines as income/expense determined based on the actual rate, but within the limits of the rates fixed in clause 1.2 of Art. 269 of the Tax Code of the Russian Federation.

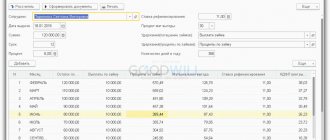

Here's what these rates look like on ruble loans:

- for the period from January 1 to December 31, 2015 - from 0 to 180% of the key rate of the Central Bank of the Russian Federation;

- after January 1, 2016 - from 75 to 125% of the key rate of the Central Bank of the Russian Federation.

For loans in foreign currency, the rates are determined based on the rates EURIBOR, SHIBOR, LIBOR on the conditions specified in sub. 2-6 clause 1.2 art. 269 of the Tax Code of the Russian Federation.

Read about the differences between the key rate and the refinancing rate here.

Find out about the tax consequences of loans between interdependent parties in the material from ConsultantPlus. If you don't have access to the system, get a free trial online.

Interest loan

Transactions are partially regulated by letter of the Ministry of Finance No. 03-01-18/40737 dated July 15, 2015. It states that when forming interest on a loan between interdependent persons, it is not necessary to apply to the Tax Code of the Russian Federation. The percentage can be any amount.

When determining the tax base, the creditor's income from interest is taken into account as part of non-operating income on the basis of paragraph 6 of Article 250 of the Tax Code of the Russian Federation. The debtor includes paid interest in non-operating expenses on the basis of paragraph 1 of Article 265 of the Tax Code of the Russian Federation. Article 269 of the Tax Code of the Russian Federation states that the procedure for recognizing interest is determined by whether the transaction is recognized as controlled:

- The transaction is not recognized as controlled. Interest is taken into account in the amount calculated from the interest rate. The latter is taken from the contract.

- The transaction was recognized as controlled. Interest is taken into account based on the contractual rate within the limits prescribed in paragraph 1.2 of Article 269 of the Tax Code of the Russian Federation.

Let's consider the limits established by Article 269 of the Tax Code of the Russian Federation:

- Debt in rubles incurred from January 1, 2015 to December 31, 2015 – 0-180% of the Central Bank rate.

- Debt in rubles arising from January 1, 2016 – 75%-125% of the Central Bank rate.

- Debt in foreign currency - the rate is set on the basis of subparagraphs 2-6 of paragraph 1.2 of Article 269 of the Tax Code of the Russian Federation.

The key rate of the Central Bank from May 2, 2022 is 9.25% per annum.

Limit on interest on a loan, or How to discourage the desire to lend

Moneylenders and old pawnbrokers.

In December 2022, clause 5 of Art. appeared in the Civil Code of the Russian Federation. 809 of the Civil Code, according to which the court can reduce the amount of interest under a loan agreement between individuals. The concept of usurious interest was introduced - this is an interest rate that is two or more times higher than the interest usually charged in such cases.

Interestingly, the order of reduction is not specified and remains at the discretion of the court “up to the amount of interest usually charged in comparable circumstances.”

This rule applies to loan agreements concluded after 06/01/2018.

A different rule applies to microfinance organizations. For them, from July 1, 2019, the contract rate cannot exceed 1 percent per day. The maximum amount of debt cannot exceed one and a half times the loan amount.

There was freedom of contract, but now it cannot be unlimited.

Before the advent of the Civil Code of the Russian Federation, clause 5 of Article 809, the courts recognized any amount of interest as acceptable and refused to reduce borrowers’ interest rates on the loan, citing freedom of contract (Appeal ruling of the Vladimir Regional Court dated September 13, 2017 in case No. 33-3336/2017).

After the adoption of the norm, the courts refused to borrowers on the basis that the agreement was concluded before 06/01/2018 (Appeal ruling of the Supreme Court of the Republic of Bashkortostan dated 03/26/2019 in case No. 33-6300/2019).

However, there is a solution in favor of the borrower. On April 24, 2019, the Moscow City Court, in its appeal ruling in case No. 33-34941/2019, concluded that:

1. The principle of freedom of contract is not unlimited;

2. The amount of interest on a loan between individuals is more than twice the interest normally charged and is excessively burdensome;

3. The interest rate should be reduced to double the refinancing rate.

Pandora's Box?

It seems that the norm is opening Pandora's box. How to understand the amount of interest usually charged in this case? Focus on consumer or mortgage lending? The parties there are not individuals, but licensed organizations. How to prove the rules of custom? Where can I get information on similar transactions between other individuals? How to deal with abuse on the part of the borrower? There are more questions than answers.

What to do?

To reduce the risk of challenging the interest rate, it is necessary to prove that the borrower knew what he was getting into, that he assessed alternative options, and that he would not abuse the right to challenge. It is advisable for the lender to formalize the terms of mutual assurances in the loan agreement or additional agreement.

The assurances must reflect:

1. The borrower is of sound mind and good memory;

2. The borrower applied to credit institutions and was refused;

3. The borrower considered alternative offers (indicate which ones with links to the conditions posted on the Internet) and they are less profitable;

4. The borrower will not dispute the amount of interest on the loan;

5. The lender invests funds profitably and is not ready to provide a loan at a lower interest rate because he is losing income.

The court may still side with the borrower, since the rule is as uncertain as possible. But the lender will have a chance to prove the borrower’s bad faith and use the rule on abuse of right.

Interest-free loan

Interest-free loans between interdependent legal entities serve for simple redistribution of funds within a group of companies. Such transactions are not prohibited by law. However, they also entail tax risks. The latter refers to the possible additional charge of income tax.

The lender's taxable income is established based on the amount of interest that could hypothetically be received in a similar transaction with an outside entity. That is, you need to turn to comparable transactions. The corresponding provision is contained in paragraph 1 of Article 105.3 of the Tax Code of the Russian Federation.

The interest-free transaction creates income for the lender, which will be subject to income tax. This means that interest will have to be paid in any case. For the debtor, receiving an interest-free loan does not generate income. The financial benefit received does not increase the tax base. The corresponding rule is contained in the letter of the Ministry of Finance No. 03-03-06/1/5149 dated February 9, 2015.

The following scheme is possible: one subject takes out a loan from a bank. Funds in the form of an interest-free loan are transferred to the dependent entity. In this case, tax representatives may recognize the resulting benefit as unjustified. However, if such a redistribution of funds does not contradict the Tax Code, it is possible to make an arbitration decision in favor of the subject. An example of this is the resolution of the AS SZO No. A56-60966/2014 dated July 1, 2015.

Loan and interest

Paragraph 1 of Article 807 of the Civil Code of the Russian Federation establishes that when concluding a loan agreement, the lender must transfer money or things to the borrower, which he must subsequently return.

Thus, from the provisions of this paragraph it follows that the legally essential conditions of the loan transaction are questions about the subject of the loan (money or things) and the need to return the property borrowed. At the same time, the need to pay compensation to the lender for the use of his property, that is, to pay interest under the loan agreement, is not discussed in paragraph 1 of Article 807 of the Civil Code of the Russian Federation. Consequently, a loan transaction, in accordance with the requirements of Article 432 of the Civil Code of the Russian Federation, will be considered concluded, even if the text of the agreement does not regulate the issue of interest by the parties.

This conclusion is directly confirmed by the provision of paragraph 1 of Article 809 of the Civil Code of the Russian Federation, which determines that there may be no indication of the need to pay interest in the text of the agreement.

However, the practice of relationships between business entities gives key importance to the issues of determining the amount of interest under a loan agreement and their payment, since the main goal of a commercial organization is to make a profit. Consequently, all the subtleties of determining the amount and procedure for paying interest must be carefully reflected in the text of the agreement between legal entities.

Controllability of transactions

Typically, loans between interdependent legal entities are interest-free or issued at a symbolic interest rate. The purpose of such transactions is to replenish the debtor's working capital. Therefore, when making transactions, the question of controllability arises.

Letters of the Ministry of Finance No. 03-01-18/6-114 dated August 28, 2012 and No. 03-1-18/5-92 dated July 5, 2012 contain these arguments:

- The characteristics of controlled transactions are contained in Article 105.14 of the Tax Code of the Russian Federation. Transactions specified in subparagraphs 2 and 3 of paragraph 1 and subparagraphs 1-5 of paragraph 2 of the same article are considered controlled when the amount of income on them in a year exceeds the corresponding amount criterion.

- Clause 9 of Article 105.14 of the Tax Code of the Russian Federation states that the amount of income from transactions for the year is formed by adding the income from such transactions with one related party. In this case, the procedure for recognizing income contained in Chapter 25 of the Tax Code of the Russian Federation is taken into account.

The letter of the Ministry of Finance No. 03-01-18/4-67 dated May 23, 2012 states that when determining the amount of income to establish the controllability of a transaction, it is necessary to take into account income in the form of interest received under the loan agreement. Loan income (principal amount) is not taken into account in the calculations.

IMPORTANT! If a transaction is recognized as controlled, both income and expenses in the form of interest will be controlled.

Tax risks

As already mentioned, loans between interdependent entities entail tax risks. They will be different for the borrower and the lender.

Risks for the borrower

Transactions between related parties are subject to administration by the Federal Tax Service. The transaction is checked for compliance with market prices (based on letter of the Ministry of Finance No. 03-01-18/9-173 dated November 19, 2012). The type of loans in question must comply with the special requirements of the Tax Code of the Russian Federation. In particular, the assessment of income in case of gratuitous transfer is carried out on the basis of market prices established on the basis of 105.3 of the Tax Code of the Russian Federation.

Risks for the lender

If, as part of a loan, property is transferred to a dependent entity for gratuitous use, the payer makes the decision to pay VAT as for the sale of services independently. However, he needs to take into account that refusal to charge VAT on the market value entails significant tax risks.

IMPORTANT! Accrued VAT is not taken into account for profit tax purposes on the basis of paragraph 19 of Article 270 of the Tax Code of the Russian Federation.

In what cases do tax risks arise?

Tax risks arise in two cases:

- The loan falls under the characteristics of controlled transactions established by subparagraph 1 of paragraph 2 of Article 105.14 of the Tax Code of the Russian Federation (availability of a certain amount and interdependence of participants).

- The loan was provided on non-market terms (no interest or a symbolic amount).

Legal entities must take into account that most transactions between interdependent entities are controlled.

Additional Information

On January 1, 2022, some changes to tax legislation came into force. In particular, interest-free loans between Russian interdependent entities are not subject to control. The relevant provisions are contained in subparagraph 7, paragraph 4 of Article 105.14 of the Tax Code of the Russian Federation, in letter of the Ministry of Finance No. 03-03-RZ/16846 dated March 23, 2017. The Federal Tax Service letter No. ED-4-13/6968 dated April 13, 2022 states that the loan is not subject to tax control if the place of registration of the legal entity is Russia. The date of conclusion of the contract is not taken into account.