Who pays advances on profits and fills out page 290?

The procedure for paying mandatory payments with a billing period exceeding a month, as a rule, includes the need to transfer advances. This is quite logical: if funds were received into the budget once a year or quarter, then financing current expenses would be difficult.

For income tax, advances are provided, the payment of which is regulated by clause 2 of Art. 286 Tax Code of the Russian Federation.

In general, all taxpayers calculate monthly advance payments based on data for previous periods and record them on page 290 of sheet 02 of the income tax return.

An exception is made for two categories:

- Organizations that have the right to pay once a quarter (clause 3 of Article 286 of the Tax Code of the Russian Federation). These include:

- companies with average quarterly revenue for the last year of less than 15 million rubles;

- budgetary institutions and autonomous organizations (not including budgetary cultural institutions, which are in principle exempt from advances on profits under Article 286 of the Tax Code of the Russian Federation);

- foreign organizations operating through permanent representative offices in the Russian Federation;

- NGOs that do not sell goods, works, services;

- participants in partnerships, production sharing agreements and trust management agreements.

2. Companies that voluntarily, subject to notification, switched to settlements with the budget based on actual profits.

The two categories of payers indicated above have the right not to fill out page 290 of the income tax return.

How to calculate the indicators for everyone else, we will consider in the next section.

What guidelines are there in the legislation?

The basic procedure for calculating advance payments is regulated in the second paragraph of Article 286 of the Tax Code of Russia. In accordance with this document, the advance payment must be transferred by the 28th day of the month for which the report is being reported. The budget receives money at the beginning of the month following the month of filing the last declaration.

Please note that advances can be calculated quarterly or based on actual profits. In the second option, reporting is submitted every month no later than the 28th. However, representatives of the organization who wish to submit reports on actual profits are required to notify the tax office in advance. The company chooses the payment option independently. You can change the method of paying advance payments no more than once a year by submitting an application to the tax office before December 31 of the year preceding the change in the payment method.

The deadline for filing a declaration is regulated in Article 246 of the Tax Code of Russia. Failure to comply with deadlines will result in the company being charged a penalty.

Calculation of advances for page 290

The calculation of line 290 of income tax is discussed in detail in paragraph 2 of Art. 286 Tax Code of the Russian Federation. The procedure for determining the amount depends on which reporting period we are talking about:

- In the 1st quarter the amount is equal to advances for the 4th quarter. previous year.

- Payments for the 2nd quarter determined based on the actual amount for the 1st quarter. They are reflected on line 290 for the 1st quarter. and should be equal to the indicator of page 180 for the same period.

- On the 3rd quarter advances are defined as the difference between indicators for 6 and 3 months. This calculation procedure is due to the fact that the data is determined on an accrual basis from the beginning of the year. But, in essence, we are talking about the fact that in the 3rd quarter. actual payments for the 2nd quarter are “transferred”. This amount is indicated on page 290 for the 2nd quarter. and equals the difference between the indicators p. 180 for the 2nd and 1st quarters.

- Similarly in the 4th quarter. the amount is calculated from the fact for the 3rd quarter, i.e. as the difference between line 180 for 9 and 6 months. The same amount is carried over to the 1st quarter. next year. Therefore, line 290 does not need to be filled out in the annual income tax return. This is established by clause 5.11 of the Regulations, approved by order of the Federal Tax Service of the Russian Federation on October 19, 2016 No. ММВ-7-3 / [email protected] (hereinafter referred to as the Regulations).

Example

Advance payments of Alpha LLC, calculated based on the results of 6 months of 2019, amounted to 400 thousand rubles, and based on the results of 9 months - 550 thousand rubles.

Thus, the amount of advance payments for the 4th quarter. 2022 and 1st quarter 2022 will be:

AB = 550,000 – 400,000 = 150,000 rub.

How to calculate and fill out data on profitable advances: example

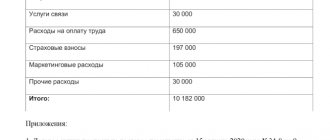

Clubtk.ru LLC received the following results in 2022:

| Index | Declaration period | ||||

| Form line number | 1st quarter | half year | 9 months | year | |

| Profit (tax base) | 060 and 100 | 500 000 | 800 000 | 1 200 000 | 2 000 000 |

| Tax | 180 | 100 000 | 160 000 | 240 000 | 400 000 |

| Advance payments for transfer in the next quarter | 290 | 100 000 | 60 000 | 80 000 | — |

Example of calculation for 9 months:

Remembering that the calculation for 9 months also affects transfers in the first quarter of next year, we will move the indicator to line 320.

Our online calculator will help you avoid making mistakes when calculating a profitable payment to the budget.

Can page 290 contain a minus value?

In the example considered, a standard situation was given when the company makes a profit every quarter. What if, for example, in the 3rd quarter there was a significant loss and the estimated amount payable for 9 months turned out to be less than for 6 months? Can an income tax return contain line 290 with a minus?

The answer to this question is also contained in paragraph 2 of Art. 286 Tax Code of the Russian Federation. The Code states that if a negative or zero calculated value is received, advance payments do not need to be made. Consequently, a negative indicator cannot be contained on page 290. In such a situation, a dash is placed in this field.

That is, the column essentially remains blank.

When else may certain categories of taxpayers not fill out page 290? In particular, this may be due to the small amount of revenue. If the average revenue for the previous four quarters exceeded the established limit (15 million rubles per quarter), then the company is obliged to switch to monthly payments. Let's consider how income tax should be reflected on page 290 in this case.

Rules for filling out Appendix 1 to Sheet 02

This section of the report includes information about the company's income structure.

At the beginning of the application, the sign on which the application of benefits depends is indicated. An ordinary organization that does not belong to special categories indicates attribute “1”.

If the company is engaged in licensed activities, then the license number is also indicated here.

Information about the attribute and license is also indicated in sheet 02 and appendices 2–5 thereto.

- Line (hereinafter referred to as page) 010 indicates revenue (Articles 248, 249 of the Tax Code of the Russian Federation).

- Page 011–014 contain a transcript of page 010.

- Page 020–022 are used only by professional stock market participants. The income from the sale of securities is indicated here.

- Pages 023 and 024 indicate income from the sale of securities for all other organizations.

- Page 027 contains a special type of income - revenue from sales for the enterprise as a whole (Article 268.1 of the Tax Code of the Russian Federation).

- Page 030 includes information about some special types of income reflected in Appendix 3 to Sheet 02.

- Line 040 indicates the total income from sales.

- Page 100 contains the amount of non-operating income (Article 250 of the Tax Code of the Russian Federation).

- On pages 101–106 the meaning of page 100 is deciphered.

Since all the revenue came from the sale of goods of own production, the accountant filled out Appendix 1 to Sheet 02 as follows:

Next, he proceeded to draw up Appendix 2 to Sheet 02.

Features for transition periods

Let's assume that the business has revenue that causes it to exceed the limit in the 3rd quarter of 2022. Therefore, it should start making monthly payments from the next quarter i.e. 4th quarter. Therefore, already when filling out a declaration for 9 months of 2019, the enterprise must enter data on line 290. The amount is determined on a general basis, that is, as the difference between line 180 for 9 and 6 months. The company has this data, since it is obliged to calculate quarterly payments in any case.

The opposite situation may also arise - when revenue has fallen and the company no longer has the obligation to pay every month. In this case, it is enough not to fill out page 290 in the reporting period preceding the transition date. There is no need to specifically notify tax authorities about a change in the payment regime (letter of the Federal Tax Service of the Russian Federation dated April 14, 2011 No. KE-4-3/5985).

A situation is possible when a company merges with another legal entity. However, to determine the order of transfer of advances, you need to take into account only the indicators of the main enterprise. The revenue of the merged company received before the reorganization is not taken into account in this case (letter of the Federal Tax Service of the Russian Federation dated October 31, 2017 No. SD-4-3 / [email protected] ).

Line 210 in the income tax return and how to fill it out

It is important to take into account that you will need to generate and submit a declaration for 2022 when using the new reporting document format. In the declaration in question there is more than one line with number 210, however, difficulties with filling out relate only to sections on sheet 02

The advance payment method applies to all types of tax payers; there are no exceptions. This indicates that all organizations will be required to enter data in this section, provided that they are operating successfully and making a profit.

An advance payment implies that this is the amount that is calculated by the entity, it is payable based on the results of the past period for reporting. The values that should have been entered are reflected, rather than those that were actually entered.

The specified line is free, it is understood that the total amount of the advance is calculated at a rate of 20%. It is not reflected in the formula for calculating other values and terms.

Then the division is made according to budget levels:

- the federal rate is 3 percent;

- the balance of 17% goes to the regional treasury.

The specified lines take part in calculating the amount that must be paid additionally or reduced. A deduction is made from the advance payment; if we talk about the annual result, then from the tax that is calculated for the period reflected in the declaration. These values are related to the content of the indicator under consideration.

Entering information in line 210 when filling out a profit declaration depends on the method of payment for the advance-type fee.

There are three types of techniques:

- every quarter;

- monthly, after which an additional payment is made at the end of the quarter;

- every month according to the actual profit.

Each technique has its own filling method. However, regardless of the choice, you will need to reflect in this line the amount that has been accrued and must be paid for the time preceding the filing of the declaration. For this reason, you will need to use previous reporting.

If a company makes tax calculations every month, then the data in the line is entered differently. To the accrued advance amount for the previous period, you need to add monthly contributions, which are indicated for the last quarter.

Thus, when preparing reports, you should take into account the provisions of tax legislation. The reflection of information depends on the frequency of provision of documentation.

Other nuances of paying advances

In a consolidated group of taxpayers, the tax is paid by the responsible participant. Advances that he must pay in the 1st quarter. the first year of the group’s existence, are made up of advances made by group members for the 3rd quarter. previous year. That is, we are talking about the sum of the indicators of the lines of 290 declarations of participants for the 2nd quarter. (Clause 8 of Article 286 of the Tax Code of the Russian Federation).

The company also has the right to voluntarily switch to paying taxes based on actual profits. This can only be done in the new year. In this case, it is necessary to notify tax authorities about the transition (clause 2 of Article 286 of the Tax Code of the Russian Federation). Page 290 in the report for 9 months must be filled out, since advances are paid in the 4th quarter on its basis. And in the annual declaration this indicator is not filled in in any case.

A reverse transition is also possible, from actual monthly advances to calculated ones. It can also only be produced from the beginning of the year. That is, the first settlement payments are due in the 1st quarter. Their amount for each month is equal to 1/3 of the difference between the calculated amount for 9 and 6 months of the previous year.