In the latest issue of accounting educational program, Alexey Ivanov talks about what revenue, cost, commercial and administrative expenses, other income and expenses are. This classification helps you understand how you make money and what you spend it on. It underlies the grouping of income and expenses in one of the main forms of accounting reporting - the financial performance report. And it helps a lot in management reports.

Hi all! Alexey Ivanov is with you, the knowledge director of the online accounting “My Business” and the author of the telegram channel “Accounting Translator”. Every Friday on our blog on Klerke.ru I talk about accounting. I started with the basics, then I will move on to more complex matters. For those who are just preparing to become an accountant, this will help them get to know the profession better. Seasoned chief accountants should look at familiar categories from a different angle. Last time we figured out the concepts of income and expenses, today I’ll introduce them to their types.

Let's start with income. Income in accounting is divided into revenue and other income.

Revenue

Revenue (Sales Revenue or simply Sales) is income from the company’s normal activities. It is income, not the flow of money. Last time I talked in detail about how these categories differ.

What is considered normal activities is determined by the company itself. The main rule here is systematic income generation. If a product, product, work or service is sold regularly, its sale is a normal activity.

Here's what brings in revenue in different businesses:

- store - sales of purchased goods;

- plant - sales of its own products;

- broker - sales of securities;

- hairdresser - hairdressing services;

- leasing company - renting out property.

In this case, a company may have several normal activities. A grocery store can start producing salads that will be sold along with purchased goods. And the plant sells not only its products, but also purchased spare parts for them. Such sales will also generate revenue.

Once again, I would like to focus on the moment of revenue recognition. Revenue arises in accounting at the moment of transfer of ownership of a product or product from the seller to the buyer. For works and services, the moment of revenue recognition is the date of signing the act of their completion.

The amount of revenue is equal to the amount of the buyer's receivables arising. If the purchase is paid for at the time of purchase, the proceeds coincide with the amount of cash received. If the purchase is partially paid, the proceeds consist of the payment amount and the balance of receivables. This is the so-called “dirty” revenue or gross revenue. It may contain VAT and excise taxes, which will need to be returned to the state. The financial statements reflect net revenue from which these taxes are excluded so that the real income of the company can be understood.

Example 1. A car dealership sold a new Gelendvagen for 12 million rubles. According to the terms of the contract, the client pays half of the cost immediately, and the second half within a year from the date of purchase. Gross revenue consists of 6 million rubles. paid money and 6 million rubles. debtors. Net revenue - 10 million rubles. The remaining 2 million rubles. VAT is the income of the state, not the car dealership.

Identification of violations in the accounting of traffic and work permits

If, as a result of inspection actions, violations are identified at any stage, it is necessary to clarify their essence, determine their features and outline corrective measures (most often complex).

The most frequently detected violations are:

- the procedure for recognizing other income and expenses is not reflected in the accounting policy;

- methods for assessing PD&R are not fully established;

- in the working chart of accounts, any subaccount is forgotten to account for P&R (three are required - 91.1 “Other income”, 91.2 “Other expenses”, 91.9 “Balance of other income and expenses”);

- the procedure for reflecting PD&R in accounting documentation is not formalized;

- There are no acts on the inventory of certain types of development work.

If these and other shortcomings are discovered, this indicates that in certain aspects the accounting for other income and expenses is reflected incorrectly and/or incompletely.

Significance of the identified violations

Not all detected inconsistencies have the same meaning. When conducting an audit of development and documentation measures, an assessment of their materiality is carried out - that is, a critical level, upon reaching which accounting data ceases to be reliable and no longer provides data for forecasting and planning. To do this, they evaluate data on shortages and excess amounts and compare the indicators of previous checks and the current state. If the discrepancies are significant, conclusions are drawn:

- about errors in primary documentation, as a result of improper organization of its maintenance;

- about violations of the reflection of financial data for other types of economic activities.

Other income

Other Revenue is any company income other than revenue:

- rent (for the lessor);

- dividends;

- income from the sale of fixed assets;

- interest on deposits;

- present.

The moment of recognition and measurement of the amount of other income are determined in the same way as for revenue. The exception is gifts. There is no receivable due to a gift, so income is determined based on the market value of the gifted asset.

The division of income into revenue and other income depends on what the company does. For a store, rent is other income, and for a leasing company, it is revenue. The accrued dividends will be revenue for the qualified investor, but other income for the plant. And only gifts qualify as income except from a professional kept woman.

Cost price

Let's move on to the classification of expenses. The first type of expense is cost (Cost of Goods) . These are the costs of manufacturing and selling products, performing work, and providing services. Next I will talk about products, meaning work and services too.

It seems like a simple definition, but it is important to understand that the cost varies. Each of the calculated costs is analyzed for its own purposes. And, if the cost of production is 100 rubles, and the sales revenue is 150 rubles, the profit from sales is not necessarily 50 rubles. Such information is not enough - you need to clarify exactly what cost we are talking about.

Manufacturing cost is the cost of making a product. It needs to be counted and broken down into components in order to understand what can be tweaked in the production process. Reduce waste of materials, switch to cheaper analogues, organize work more efficiently to reduce labor costs, etc.

The monthly production cost shows how much it cost to produce. But it is useless to compare it with revenue for three reasons.

- It is not enough to produce products, they must also be sold. And before it sells, store it somewhere. And all these are additional expenses that affect the financial result.

- Products that were started to be produced this month are not always released in the same month. The costs are already there, but there are no products yet. Such costs in accounting are called work in progress. And this is your asset.

- Products produced in a month are not always sold in the same month. This applies only to products; it is not relevant for works and services. If the products remain in stock, this is your asset.

When you look at the income statement, what you see is the manufacturing cost of goods sold. If you have a trading organization, everything is simpler. Instead of manufacturing cost, there is the cost at which you purchased the resold goods. In accounting, it is called the actual cost of goods.

Cost of sales (full cost) is the cost of manufacturing and selling products. Cost of sales consists of the production cost of products sold and the costs of selling them. It is this cost that must be compared with revenue to correctly determine the financial result.

Example 2. Horns and Hooves LLC produces cakes. During the day, 3 cakes were made and sold. To prepare them, food was purchased for 500 rubles, another 1000 rubles. was the pastry chef's salary. Cakes are sold on Instagram for 1000 rubles. The advertisement cost 2,000 rubles.

Production cost: 1500 rub. (500 rub. + 1000 rub.).

Cost of sales: 3500 rub. (1500 rub. + 2000 rub.).

Sales loss: 500 rub. (3000 rub. - 3500 rub.).

If the owner, when determining the financial result, was guided by production costs, he would decide that he owns a profitable business. But that's not true.

Example 3. Same conditions, but 2 cakes sold.

Production cost of production: 1500 rubles.

Cost of sales: 3000 rub. (2 * 500 rub. + 2000 rub.)

Sales loss: 1000 rub. (2000 rub. - 3000 rub.)

Another 500 rub. — production cost of the cake remaining in the warehouse. If tomorrow they buy it without advertising, then it will bring a profit of 500 rubles.

Setting the goals and objectives of the audit of other income and expenses (OP&R)

Any financial audit is a check of how correctly and reliably business transactions and their results for a certain reporting period are reflected in the accounting documentation.

The purpose of this type of audit is an opinion on the correctness of the accounting of other income and expenses of the organization, the reflection of which, according to PBU, is account 91 “Other income and expenses”. Correctness is determined in relation to the current legislation of the Russian Federation and adopted regulations.

IMPORTANT! An audit of this type of profit and expense of a company is an essential link in controlling business activities and planning accounting policies.

What applies to other income of the organization ?

To achieve this goal, the following interrelated tasks are solved during the audit:

- the accounting policy of the organization is studied for the organization of accounting for P&R, its compliance with legislative acts;

- discipline under contractual obligations is checked;

- the procedure for maintaining documentation for this type of costs and expenses is analyzed;

- the procedure for maintaining planned accounting for account 91 is assessed;

- forming an opinion regarding the correctness, completeness, truth, and timeliness of reflecting accounting information;

- interface with the requirements of tax legislation.

How to take into account other expenses ?

Business expenses

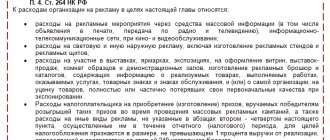

Selling Expenses are the costs of selling goods, products, works, and services. The composition of such expenses depends on what the company does.

If a company manufactures products, then selling expenses begin as soon as the products are released. Commercial expenses will include:

- storage of products (rent or depreciation of warehouses, salaries of storekeepers and loaders);

- promoting it to the buyer (marketing and advertising, services of intermediary sellers);

- shipment (packaging, delivery, export customs clearance, insurance en route).

If a company performs work or provides services, then commercial expenses will be mainly those associated with their promotion. There is simply nothing to store and ship.

If a company sells goods, then almost all costs associated with trade are commercial, except for the cost of the goods themselves:

- procurement (remuneration to intermediary suppliers, customs clearance of imports, insurance during transit);

- delivery (of purchased goods to your warehouse/store and sold goods to the buyer);

- salary (from the director to the salesperson - everyone is involved in sales);

- depreciation or rental of buildings, equipment and vehicles;

- marketing and advertising;

- entertainment expenses;

- warranty repair costs;

- any other costs for storage and shipment of goods.

As you can see, the list of commercial expenses for trading organizations is wider than for manufacturing organizations. Therefore, the share in the financial results report is higher. For example, in the financial statements of the Magnitogorsk Iron and Steel Works for 9 months of 2019, commercial expenses amount to 7% of revenue. And in the same reporting X5 Retail Group - 13%.

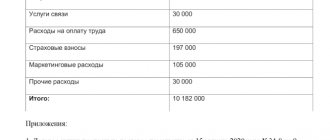

Administrative expenses

Administrative Expenses are expenses that are not related to the production, storage and marketing of products, but are necessary for the functioning of the organization. They are also called general economic ones.

This includes:

- salaries of managers and other office employees: from accountant to cleaner;

- office maintenance costs: from coffee and cookies to depreciation or rent;

- communication costs: Internet, telephony, postal correspondence;

- costs of assessment, audit and other consulting services;

- transportation costs for office plankton: from maintaining the director’s personal staff to a corporate taxi or travel tickets at the expense of the company;

- entertainment expenses, if it is not possible to correlate them with the sale of specific goods;

- any other expenses not related to the production, storage or sale of products.

The list of administrative expenses for a particular enterprise depends on the specifics of its activities. For example, for most businesses, an accountant’s salary is a general business expense, but in our online accounting “My Business” it is included in the cost of the service. For a call center, the cost of telephony is a production cost, and for a factory it is a general business expense.

As you can see, management expenses are mainly aimed at maintaining administrative and management personnel and office infrastructure. When I started my career at the plant, the shop floor people called such employees parasites. Because they do not produce products and do not sell them. And you need to feed them.

There is some truth to this. Administrative expenses, as a rule, are semi-fixed. That is, they do not depend on output volumes. This means they should be as small as possible. And one interesting fact is connected with this.

In the income statement, administrative expenses can be shown either in cost of sales or as a separate line item. And here are two examples.

- Private Norilsk Nickel.

- State RusHydro.

In the first case, administrative expenses are shown as a separate line. It is immediately clear that for 1 rub. the cost of production accounts for 14 kopecks in administrative expenses. In the second case, management costs are buried in the cost price. Why it is so big is unclear. Maybe the resources are expensive, or maybe the directors receive huge salaries.

By the way, the new FSBU “Reserves”, although it will not be released in the form in which the Ministry of Finance should have adopted it, prohibits the inclusion of management expenses in the cost of production. As Peter the Great said: “So that everyone’s stupidity can be seen.”

What does an audit of other income and expenses check?

In relation to the P&R audit, a set of verification activities is applied, which includes the following aspects:

- whether, from the point of view of accounting policy, financial resources are distributed between fixed and other;

- whether the feasibility and validity of classifying finances as other income and expenses has been observed;

- whether distributed finances are correctly reflected in the accounting of basic and other income and expenses;

- how correctly the provisions of the accounting policy regarding P&R are formulated;

- whether the choice of a particular accounting policy option is justified under Article 91 (where the law allows for variability);

- whether other costs incurred and income received are accurately posted over time relative to the reporting period;

- how can you evaluate operations related to the DPIR regarding their completeness, timeliness, and reliability of reflection;

- whether appropriate records are maintained in accordance with current requirements and rules;

- whether the internal accounting and audit systems adopted at the enterprise are effective;

- Are there any violations on the part of the P&R regarding the formation of the tax base?

Why are PD&Rs checked separately?

Other income and expenses by their nature have functional differences from other financial income and expenses, especially from those carried out in the main type of activity. P&R accounting indicators have a significant impact on the formation of the organization’s accounting policy, the correct display of financial results, and the formation of rating indicators of the economic activity of the entire organization.

Therefore, verification of PD&R accounting can be carried out by:

- as a separate unit within the general audit;

- as an audit of individual transactions - specifically for account 91.