Income recognition under the accrual method

The specificity of the accrual method is that income must be included in the tax base for profit in the period in which they arise according to documents justifying their occurrence, regardless of the actual payment (or the transfer of property as it).

The conditions for reflecting income using the accrual method are contained in Art. 271 Tax Code of the Russian Federation. Revenues from sales can be recognized as of the date:

- acceptance and transfer certificate - for immovable objects (paragraph 2, paragraph 3, article 271 of the Tax Code of the Russian Federation);

- a report or notice drawn up by a commission agent (agent) - on intermediary transactions (paragraph 1, clause 3, article 271 of the Tax Code of the Russian Federation);

- fulfillment of the obligation to transfer securities; crediting funds from partial repayment of the par value of securities - for securities (paragraph 3, clause 3, article 271 of the Tax Code of the Russian Federation).

Let us highlight some dates for the recognition of non-operating income:

- The date of the acceptance and transfer certificate is for the gratuitous transfer of property (clause 4.1 of Article 271 of the Tax Code of the Russian Federation).

- The end date of the reporting period is for transactions reflecting the restoration of the reserve (clause 4.5 of Article 271 of the Tax Code of the Russian Federation).

- The date of settlement in accordance with the contract or the end of the reporting period - for agreements concluded within the framework of lease relations (clause 4.3 of Article 271 of the Tax Code of the Russian Federation).

- Date of payment - in relation to dividends received free of charge (clause 4.2 of Article 271 of the Tax Code of the Russian Federation)

A complete list of situations indicating the moment of recognition of non-operating income for them is given in paragraph 4 of Art. 271 Tax Code of the Russian Federation.

Note that many situations regarding income recognition are controversial. ConsultantPlus experts have compiled a selection of explanations from officials and court decisions on the most common issues:

Get trial access to the system for free and see different points of view.

Note that for income of different periods, when the connection between income and expenses has not been identified, it will be necessary to distribute the income received using the principle of uniformity. The same method should be followed when receiving income from production with a long cycle and in the absence of phased delivery of work. However, taking into account the requirements of Art. 316 of the Tax Code of the Russian Federation, the procedure for the distribution of income, according to this principle, must be recorded in the accounting policy.

See also: Long production cycles may require revenue sharing .

We form the balance using the accrual method

Let's turn to the list of accounting objects. This:

- assets, liabilities and capital (balance sheet elements);

- income and expenses (elements of the income statement).

In the article “A Simple Accounting System… Isn’t Easy!” We came to the conclusion that the facts of economic life are special objects formed from the five above. For the purpose of accounting using the double entry method, a fact combines such objects in pairs (this is the essence of the correspondence of accounts). And with simple recording, a fact arises when one of these objects changes.

Under double-entry accrual accounting, income generates assets in the form of customer receivables (DEBIT 62 CREDIT 90). We also associate expenses with the formation of assets - in particular, work in progress (DEBIT 20 CREDIT 02, 10, 69, 70, ...). However, trying to link the recognition of an asset to its payment leads to a dead end. This is not surprising since the definition of assets is not related to current cash flows, but is fundamentally based on future cash flows. Liabilities are defined through the concept of assets. Well, capital is the difference between assets and liabilities (clauses 7.2–7.4 of the Concept of Accounting in the Market Economy of Russia, approved by the Methodological Council on Accounting under the Ministry of Finance of the Russian Federation, the Presidential Council of the IPB of the Russian Federation on December 29, 1997).

As a result, the balance must be formed exclusively on the accrual basis. Only then does it characterize the financial position of the company.

The system is not only cash register, but also simple

It was not by chance that we started with mention of a simple system. It is a simple entry that will allow you to combine the recognition of payment income and accrual assets. It recognizes these objects separately. What about expenses?

Most accountants are convinced that assets are also generated in connection with expenses. But this is the biggest misconception! It is generated by the inconsistency of terminology in PBU 10/99. Let us turn to paragraph 2 of this standard. It states that expenses inevitably lead to a decrease in capital. This sign of expenses does not fit in with the properties of assets. At the same time, paragraph 6 of PBU 10/99 clearly describes the formation of an asset.

Free webinars at Kontur.School

Changes in accounting. Practical situations. Arbitrage practice. Webinar schedule

In fact, you need to differentiate between costs and costs. Expenses are elements of the income statement. Costs are the means that form assets. Confirmation is in clause 8.6.3 of the Concept. It states: “Costs are recognized as an expense when it is clear that they will not produce future economic benefits to the entity or when future economic benefits do not meet the criteria for recognition as an asset in the balance sheet.” The term “costs” is also used in the Instructions for using the Chart of Accounts (approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n).

In other words, if a company controls costs and they entail an influx of cash, then it has an asset (on its balance sheet). Otherwise, the costs will generate an expense (in the income statement). As Igor Sukharev, head of the accounting and reporting methodology department of the Ministry of Finance of the Russian Federation, explains: “An expense is recognized when the organization has incurred expenses, but the requirements for recognizing an asset have not been met.”

So, under the cash method, derecognition of assets from the balance sheet generates expenses in the income statement only if the assets are paid for. Reconciling these facts through traditional double entry is problematic. In a simple system, these facts are taken into account separately. This is exactly what we need.

Conclusion: we conduct cash accounting using a simple system.

Recognition of expenses using the accrual method

Recognition of expenses is also carried out not when their payment was actually made, but taking into account their occurrence in accordance with a specific economic situation (Article 272 of the Tax Code of the Russian Federation).

You can recognize expenses:

- On the day of transfer of raw materials by the seller or on the date of the acceptance certificate - for material costs (clause 2 of Article 272 of the Tax Code of the Russian Federation).

- Monthly on the last day - for depreciation (clause 3 of Article 272 of the Tax Code of the Russian Federation).

- Monthly – for labor costs (clause 4 of Article 272 of the Tax Code of the Russian Federation).

- On the date when the provision of services occurred - for the repair of fixed assets (clause 5 of Article 272 of the Tax Code of the Russian Federation).

- On the date of payment in accordance with the contract or evenly throughout the entire period of its validity - expenses for compulsory medical insurance and voluntary medical insurance (clause 6 of article 272 of the Tax Code of the Russian Federation).

Non-operating and other expenses can be recognized:

- As of the accrual date - for taxes, insurance premiums, reserves (clause 7.1 of Article 272 of the Tax Code of the Russian Federation).

- On the date of settlements according to the contract or the last day of the month - for commission fees, payment for work (services) under contracts, rent (clause 7.3 of Article 272 of the Tax Code of the Russian Federation).

- On the date of payment - for lifting, compensation for the use of personal transport (clause 7.4 of Article 272 of the Tax Code of the Russian Federation).

Of course, these lists are incomplete, and it is difficult to cite absolutely all the dates and situations provided for by the Tax Code of the Russian Federation in a short article. A complete list of points for recognizing expenses associated with production and sales can be found in paragraphs. 2–6 tbsp. 272 of the Tax Code of the Russian Federation, non-operating expenses - paragraphs. 7–10 tbsp. 272 of the Tax Code of the Russian Federation.

How are expenses recognized in tax accounting using the cash method?

If a company uses the cash method in its practice, then expenses should be recognized only after payment for goods, services or work. According to paragraph 3 of Art. 273 of the Tax Code of the Russian Federation, payment is considered a factor in the termination of the obligation that the buyer has to the seller.

The above definition means that prepayment or advance payment will be recognized as expenses not at the moment when they are received by the seller, but at the moment of shipment of goods, provision of services, acceptance of work or transfer of property rights.

In addition to this nuance, Article 273 of the Tax Code of the Russian Federation contains several more important features of recognizing expenses under the cash method, such as:

- Material expenses (with the exception of costs for the purchase of raw materials and materials), expenses for credit interest, labor costs and payment for services provided by third parties, named in clause 3.1 of Art. 273 of the Tax Code of the Russian Federation, it is allowed to recognize: at the time of debiting funds from the account;

- at the time of disbursement of funds from the cash register;

- at the time of repayment by any other available method.

If the organization failed to comply with the limits under which the cash method is possible, then, according to clause 4 of Art. 273 of the Tax Code of the Russian Federation, from the beginning of the year it will be necessary to switch to the accrual method. In this case, this action should be reflected in the accounting policy by issuing a separate order.

See also “Accrual Basis and Cash Basis: Key Differences.”

Features of the cash method

The cash method is characterized by the fact that income is reflected at the moment when funds are credited to current accounts (received at the cash desk) or property acting as payment has been received (Article 273 of the Tax Code of the Russian Federation).

Are advances received considered income when using the cash method? The answer to this question is in the ConsultantPlus system. Get free trial access to the system and proceed to the explanations.

Expenses must be recorded when they are actually paid.

It should be noted that not every taxpayer can exercise the right to use this method of accounting for income and expenses. So, you cannot use the cash method:

- Companies whose average revenue for the previous 4 quarters excluding VAT is more than 1 million rubles. for every quarter.

- Banks.

- Credit consumer cooperatives.

- Microfinance organizations.

- Controlling persons of controlled foreign companies.

- Organizations extracting hydrocarbons from a new offshore field, if they have the appropriate license, as well as operators of these fields.

See also the material “What is the procedure (conditions) for recognizing income and expenses using the cash method?” .

KM under the simplified tax system - income

For companies and individual entrepreneurs, income is determined as such after the fact of receiving funds from the customer. Obligations received in other ways are also counted. It is assumed that no matter how the debtor pays the company, only income acquired as a result of a bilateral transaction is taken into account.

The date of receipt under CM is determined by the day on which:

- the money supply has been deposited into the cash register or appeared in the current account;

- property or rights to it have been acquired;

- services were provided, work was performed;

- the debt is repaid in a manner other than those described above.

When the amount of compensation is less than the actual debt, it is its size that is taken into account in the receipt.

Receipts are reflected as follows:

| Debit | Credit |

| 50, 51 | 90, 91 |

Example 1. leased kitchen equipment. The monthly payment is 43 thousand rubles. In October, Vector, by mutual agreement with Alisa, decided that she would repay the debt in a month by supplying her products. The tenant fulfilled the obligation and delivered goods worth 43 thousand rubles, which the company capitalized as income.

To avoid questions from tax authorities, the parties drew up an addendum to the previous lease agreement. An act of offset regarding mutual claims was also drawn up.

On the day the documents were prepared, the company wrote off Alisa’s receivables. As of the same date, the amount of income received was recorded in accounting.

Difficulties in recognizing income and expenses

When using one method or another, the taxpayer often has a question: when should a certain income or expense be recognized? For example, there is a controversial situation regarding the issue of the emergence of non-operating income that arises in the event of the expiration of the statute of limitations on accounts payable (clause 18 of Article 250 of the Tax Code of the Russian Federation).

Tax officials explain that income arises on the last day of the reporting (tax) period in which the statute of limitations expired (letter of the Federal Tax Service of Russia dated December 8, 2014 No. GD-4-3/ [email protected] , letter of the Ministry of Finance of the Russian Federation dated September 12, 2014 No. 03 -03-РЗ/45767). But some arbitrators believe that this income must be taken into account in the period when the manager signed an order to write off such debt (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 15, 2008 No. 3596/08).

On this issue, see the material “In what period are overdue accounts payable included in income?” .

When applying the cash method, the amount of accounts payable (including VAT) is also included in non-operating income, while the period of income recognition falls on the date the debt is written off (letter of the Ministry of Finance of Russia dated August 7, 2013 No. 03-11-06/2/31883). This letter refers to a situation in which the taxpayer applies the simplified tax system, but since clause 1 of Art. 346.17 of the Tax Code of the Russian Federation stipulates that “simplers” keep records of income and expenses using the cash method, it can be assumed that this approach is used by all taxpayers who use this method. It should be noted that previously such accounts payable were not recognized as non-operating income when applying the cash method (letter of the Ministry of Finance of Russia dated August 26, 2002 No. 04-02-06/3/61).

Thus, in order to avoid controversial situations, it is better to establish the procedure for recognizing a particular income or expense in the accounting policy.

See also the material “What to change in tax accounting policies” .

Payroll accruals

In wages, the total benefit that the employer will provide to the employee is vacation or sick pay

. This means that over time, the employee accumulates additional sick leave or vacation time, and this time is placed in the bank. Once the time has been accrued, the employer or payroll provider will track the amount of time spent on sick leave or vacation.

Experience

For most employers, a leave policy is published and is followed in relation to the accrual of benefits. These policies ensure that all employees are treated fairly with respect to the allocation and use of sick time and vacation time.

Under these guidelines, the rate at which an employee will accrue vacation or sick time is often determined by length of service (the amount of time the employee has worked for employers).

Probation

no In many cases, these guidelines state that there is a probationary period (usually 30 to 90 days) where the employee is not given time off. This does not prevent an employee from calling in sick immediately after being hired, but it does mean that they will not be paid for this time. However, this does not allow the employee, for example, to plan vacation for the second week of work. After this probationary period, time may begin or may be retroactive to the date of hire.

Rollover/carryover

Some accrual policies may carry forward or carry forward some or all of the unused time that has been accrued to the next year. Unless the accrual policy provides for any rollover, any accrued time in the bank is typically lost at the end of the employer's calendar year.

Results

Chapter 25 of the Tax Code of the Russian Federation talks about 2 methods of recognizing income and expenses that can be used when calculating income tax:

- accrual method;

- cash method.

However, if any taxpayer has the right to choose the first of them, then the second is only those that meet the conditions established by the Tax Code of the Russian Federation.

Having given preference to one method or another, its choice should be reflected in the accounting policy.

Sources:

- Tax Code of the Russian Federation

- Letter from the Federal Tax Service of Russia dated December 8, 2014 N GD-4-3/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

CONSTRUCTION OF CHART OF ACCOUNTS, Chart of accounts

Our tradition uses a single generally accepted national chart of accounts.

However, under GAAP practice, each firm may develop its own chart of accounts.

, based on your needs. A small company initializes several dozen accounts, while a multinational corporation is forced to maintain thousands of information storage units (accounts).

Let's look at an example of the structure of a simple chart of accounts.

Assets (No. 100 – 199)

100 Cash 110 Accounts receivable 120 Bills received 130 Inventory 140 Insurance paid 142 Prepayment for materials

150 Land 160 Buildings 170 Equipment

Obligations (Nos. 200 – 299)

200 Accounts payable 210 Short-term bills issued 220 Accrued wages 225 Accrued interest

260 Long-term bills issued

Owner's capital (No. 300 – 399)

300 John Pumpkin, capital 310 John Pumpkin, withdrawals

Income (No. 400 – 499)

400 Revenue 410 Rental income 420 Interest received

Expenses (Nos. 500 – 599)

500 Salaries 510 Payroll taxes 520 Equipment rental costs 525 Premises rental costs 530 Utilities costs 540 Insurance costs 550 Material costs 560 Operating costs 570 Interest payments

The chart of accounts is prepared before the recording of transactions and is consolidated in the Final Book (GL).

A system of subaccounts is used

, i.e. a smaller grouping of transactions than an account. For example, to store information about the debt of each client or each supplier.

At the end of the reporting period, such subsidiary accounts are closed and the balance is transferred to the consolidated account.

, what in our example will be the accounts receivable (accounts receivable) or accounts payable (accounts payable) account.

Since a larger grouping of operations is already a balance sheet item

, then to consolidate detailed accounts into articles, in the chart of accounts, for example, the following encoding is made. (Let me remind you: a balance sheet item includes several accounts).

1000 – 00 Current assets 1100 – 00 Cash, Monetary aggregate 1110 – 00 Cash 1120 – 00 Bank, Deposits 1130 – 00 Petty cash fund

Translating the Russian chart of accounts into the chart of accounts of a companion company may not be difficult here.

For example:

5001 – 00 – 00 Cash desk (Rubles) 5002 – 00 – 00 Cash desk (US dollars) 5101 – 00 – 00 Current account 5201 – 00 – 00 Foreign currency account (US dollars) 5202 – 00 – 00 Foreign currency account (Euros)

Looking at the above chart of accounts, you, of course, noticed that it is similar to ours only up to account No. 300 “Owner’s capital” (analogous to account No. 85 “Authorized capital”).

Starting from account No. 310 “Withdrawals” onwards, accounts are listed that are not in our chart of accounts.

income and expense accounts

.

Features of accounting policies under the simplified tax system

If an entrepreneur applies a simplified taxation system, then he pays:

- Tax of 6% on income or 15% on income minus expenses.

- Pension contributions.

- Health insurance contributions.

- Contributions related to the provision of social guarantees.

If a company’s expenses make up less than 60% of its income, then of the taxable objects provided for by the simplified tax system, it is more profitable for it to switch to accounting with a simplified tax system of 6% (income) in 2020. It should be noted that this tax regime (USN 6%) has several advantages. When calculating the amount of tax to be paid, only the amount of receipts and payments that can reduce the accrued tax is required. But in this case, special attention must be paid to accounting expenses, since tax authorities check them especially meticulously.

And the transition to accounting under the simplified tax system “income” implies the payment of a single tax on your income, which replaces the profit tax, VAT and property tax, but this does not eliminate the need to pay transport tax, land tax and trade tax. Such taxes depend on the availability of vehicles and the land on which the activity is carried out. If the presence of import operations is implied, then VAT is charged.

Advantages of the Accrual Method of Accounting

The remaining 12,240 rubles. will be recognized as expenses in December.

According to the principles of the accrual method described in IFRS (in particular, IAS 19 “Employee Benefits”), the bank’s expenses for the payment of vacation pay will be recognized as the employee “earns” the right to vacation, that is, monthly, simultaneously with the accrual of the employee’s salary. Therefore, by November, when the employee goes on vacation, the expenses will already be recognized in previous periods, in the periods when economic benefits were received from them.

Similar distortions will occur when taking into account other expenses associated with supporting the activities of a credit institution.

Thus, the Draft requires taxes and fees to be reflected no later than the deadlines established for their payment. In practice, these dates fall within other reporting periods. In IFRS, taxes must be calculated on the last day of the tax period.

Travel and entertainment expenses, according to the Project, are reflected on the date of approval of the advance report. In IFRS, transactions are reflected at the time they are completed, and not documented, so these expenses will be recognized at the time of their actual implementation, regardless of the date of approval of the expense report.

With regard to the requirements for recognition of depreciation on the last day of the period and legal costs at the date of award, in the Project they correspond to the accrual method under IFRS.

Thus, it is obvious that the accrual method proposed in the Project only formally corresponds to the accrual principle in the Western sense. In practice, the use of such a “Russified” method will certainly lead to distortion of reporting indicators prepared in accordance with IFRS.

At the same time, direct copying of the IFRS accrual method is not possible today due to a number of objective reasons: the construction of Russian accounting on the basis of primary documentation (often the date of preparation of the document and the date of the transaction refer to different periods), the requirements of other branches of legislation (for example , the Labor Code of the Russian Federation, which establishes the procedure for calculating and accruing vacation pay and compensation), the lack of a concept of professional judgment of an accountant and the legal force of this judgment, etc.

At the same time, for example, there are no barriers to calculating taxes on the last day of the period, that is, as prescribed by IFRS.

International Financial Reporting Standards are a system of standards that provide a comprehensive understanding of business and a reliable reflection of a bank’s activities in financial statements. Distortion of the fundamental assumptions of IFRS will undoubtedly lead to the generation of reporting, the qualitative characteristics of which will not meet the requirements of IFRS.

In order for the principles of IFRS in the Western sense to begin to work effectively in the domestic banking system, it is extremely important to correctly identify their essence in the regulatory documents of the Bank of Russia. S.V.Manko

S.V.Manko

Financial Director

LLC "PROMOTING"

An important difference between Russian accounting standards and IFRS is the approach to reflecting income and expenses in the latter on an accrual basis. This method is basic in International Financial Reporting Standards.

Which method to use: cash or accrual

The same transactions, only the methods of recognizing revenue and expenses differ. This is what happened in the end ↓

As you can see, the method of recognizing revenue and expenses makes a significant difference. Using the accrual method, we made a net profit and ended the month in a good mood. You can even pay yourself dividends.

But on a cash basis we are at a loss. Of course, since May took on all the costs of rent and materials! At the same time, in the next months it seems that we will not be using either the new workshop or the remaining crushed stone.

In our example, the cash method distorted the result for the worse. But it may be the other way around, and this is especially dangerous. Let’s imagine that in June we will receive half a million in advance payments for future orders. Let us remember that we have already paid for the rent and gravel. And we will get some incredible profit - although in fact we are using rent, spending crushed stone, and have not yet fulfilled prepaid orders.

The cash method distorts the real picture of the business. On the other hand, it is simple. There is no real need to keep cash accounting - in most cases, it will be enough to look at May expenses in the Internet bank.

There are situations when the cash method can be used without distorting the financial result of the company:

- If the amounts of inventories and debts are zero at the beginning and end of the period.

- The month of the services you provided coincides with the month of payment. The client placed an order, and 10 minutes later you shipped it. You calculated your salary for May and paid it by May 31st.

- According to the Tax Code: can be used by organizations with average quarterly revenue not exceeding 1 million rubles for 4 consecutive quarters.

But this is all about exceptional companies. In general, we strongly recommend using the accrual method to calculate real net profit, calmly withdraw dividends to yourself without cash gaps, and evaluate the effectiveness of business areas.

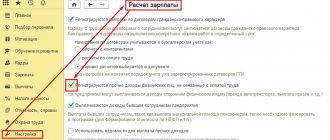

Formation of Accruals in 1C configurations

What 1C configurations allow you to reflect the results of a company’s financial activities using the accrual method?

- 1C: Accounting CORP IFRS;

- 1C: Holding management;

- 1C:ERP;

- 1C: Integrated automation.

Basic scheme for reflecting business transactions using the accrual method

| Process steps | Process step description |

| 1 | Formation of PL according to the “Plan” scenario (Fig. 1 and Fig. 2) |

| 2 | Formation and approval of the needs of the Central Federal District |

| 2.1 | Purchase Request (Fig. 3 and Fig. 4) |

| 2.2 | Accrual schedule in the agreement (Fig. 5) |

| 3 | Formation of Accruals (Fig. 6) |

| 4 | Purchase of inventory items or services (receipt of goods or services, advance report, etc.) (Fig. 7) |

| 5 | Write-off of inventory items or services (receipt of goods or services, demand invoice, etc.) |

| 6 | Reversal Accruals (Fig. |

| 7 | Formation of PL using the accrual method according to the “Actual” and “Forecast” scenarios, comparison of different scenarios |