Revaluation of foreign currency balances upon purchase

The acquisition of foreign currency by companies is necessary for business development, for example, in order to import goods. The following entries should be made in accounting:

| Debit | Credit | A comment |

| 57 | 51 | Funds were transferred to purchase foreign currency |

| 52 (1-3) | 57 | Foreign currency is credited to a special account |

| 10 | 57 | Reflection of revaluation of foreign currency balances (difference between Central Bank rates and purchases) |

| 91.2 | 57 | Bank commission accounting |

| 51 | 57 | Crediting unused amounts |

In the case when foreign currency is not purchased for import operations, the following should be recorded in accounting:

| Debit | Credit | A comment |

| 57 | 51 | Funds for the purchase of foreign currency have been transferred |

| 52 (1-3) | 57 | Money has been credited to the transit account |

| 91.2 | 51 | Remuneration paid to the bank |

The financial result of the transaction is subsequently reflected:

- When the Central Bank exchange rate is less than the purchase rate, the difference (exchange rate) is taken into account as a component of costs:

Dt 91.2 Kt 57

The amount reduces the company's profit.

- Operating income appears provided that the Central Bank quotation exceeds the purchase rate:

Dt 57 Kt 91.1

The company's profits are growing.

Example 1. Bought $4500. The purpose of purchasing currency is to pay travel allowances to employees going abroad.

265.5 thousand RUB were transferred to the bank.

The bank purchased $ at the rate of 57.3 rubles/dollar. For the operation he wrote off the commission:

(265,500/4500 – 57.3) 4500 = 7,650 rubles.

On the day when the operation was carried out, the Central Bank exchange rate was 56.8 rubles/dollar.

How is revaluation carried out for tax purposes?

There is no separate recalculation of amounts in foreign currency into rubles specifically for the purpose of calculating income tax. Income and expenses generated in accounting as a result of exchange rate differences take part in determining the tax base:

- income from revaluation increases the tax base as part of non-operating income (clause 11 of article 250 of the Tax Code of the Russian Federation);

- expenses arising from revaluation reduce the tax base as part of non-operating expenses (subclause 5, clause 1, article 265 of the Tax Code of the Russian Federation).

NOTE! The results of the revaluation of currency balances are taken into account not only for calculating the “ordinary” income tax under OSNO. When applying special regimes, where the amount of tax is related to the income actually received, the financial result from fluctuations in foreign exchange rates is also taken into account when calculating the tax.

For example, a positive difference is considered the income of a simplifier: “The exchange rate difference from the sale of currency is the income of a simplifier.”

The impact of revaluation on VAT calculations deserves a separate discussion. The revaluation provisions for accounting of advances and payments for acquired tangible assets, as well as works and services, are related to the requirements of the Tax Code of the Russian Federation in terms of determining the amounts on which VAT payable and deductible is calculated.

Conversion into rubles for the operations listed in the previous paragraph is performed once, on the date of the operation. Accordingly, the resulting ruble amount will be the basis for calculating VAT for payment or deduction. Provided that the transaction is subject to VAT according to the legislation of the Russian Federation.

Features of revaluation when selling currency

In modern conditions, organizations can sell from 0 to 25% of their foreign currency earnings to the state. This process is reflected as follows:

| Debit | Credit | A comment |

| 57 | 52.1 | sending currency for sale |

| 51 | 91.1 | crediting the proceeds from the sale to the account |

| 91 | 57 | sold foreign currency written off |

| 91.2 | 51 | sales costs taken into account |

On the last day of the reporting period, currency balances are revalued. Possible entries upon receipt:

- arrived Dt 91 Kt 99

- loss Dt 99 Kt 91.9

Important! Unrealized earnings in foreign currency are credited to the account:

Dt 52.1 Kt 52.(1, 2)

Advance payments and exchange rate differences

Amounts of advance funds issued or received are subject to accounting at the rate current on the date that corresponds to the moment of transfer of the money supply or its receipt.

When, for example, raw materials are purchased on account of an advance payment previously paid, it is paid at the rate prevailing on the day the advance money was transferred.

Problems in accounting are possible if they are insufficient to fully cover the cost of the supplied raw materials. The value of the purchased product will be formed from two components:

- The advance amount, which is calculated in accordance with the quotation on the date of its sending.

- Cost not covered in advance. It is calculated using the exchange rate in effect on the day the raw materials were accepted for accounting.

The previously transferred advance payment is not subsequently subject to revaluation.

Features of payment in foreign currency for loans and borrowings

Loans received by companies are:

- Short-term (up to 12 months).

- Long-term (more than a year).

In the first case, accounts are used to account for them. 66, 66.21, 66.22, and operations are reflected as follows:

| Debit | Credit | A comment |

| 52 | 66.21 | Money was credited to the foreign currency account as a short-term loan |

| 66.21 | 52 | Transfer of funds to cover a loan in foreign currency |

| 66.22 | 52 | Interest coverage |

In accounting for long-term loans in $, €, £, accounts are used. 67, 67.21, 67.22:

| Debit | Credit | A comment |

| 52 | 67.21 | Money is credited to a foreign currency account as a long-term loan |

| 67.21 | 52 | Funds transferred to repay the loan |

| 67.22 | 52 | Transferred interest |

Accounting for loans in foreign currency is carried out in a similar way using accounts 66.23 and 67.23.

Calculation of exchange rate differences when purchasing non-current assets

When a company purchases fixed assets, intangible assets in foreign currency under previously concluded contracts, their value is determined either at the Central Bank exchange rate or at another quotation agreed upon by the parties on the date the assets were included in accounting. After a while it is not recalculated.

Only payment arrears (if any) are subject to revaluation. Then exchange rate differences arise, positive or negative.

Example 2. The company purchased refrigeration equipment for $20 thousand. The Central Bank exchange rate on the day of purchase: 57.4361. Payment is deferred for a month.

| Description | Debit | Credit | Amount in rub. |

| Refrigeration equipment purchased | 08 | 60 | 1 148 722,00 (20 000·57,4361) |

On the last day of the month, the debt payment should be recalculated. The Central Bank quote is 57.6587, which is higher than the previous one. The company incurs costs - for a full settlement, it needs a larger amount of ruble money to pay the counterparty:

| Description | Debit | Credit | Amount, rub. |

| Reflection of exchange rate differences according to settlements with the counterparty | 91 | 60 | 4 452,00 (20 000·(57,6587-57,4361)) |

Accounts with a special revaluation procedure in 1C 8.3

It is worth saying a few words about the register of information for accounts with a special revaluation procedure. You can get to this register through the Main menu – Chart of accounts – More – Accounts with a special revaluation procedure:

Accounts in the chart of accounts that require a revaluation method different from the one described above are entered here. If the chart of accounts account is included in this list, then automatic revaluation of balances when performing transactions on the reporting date as a routine operation will not occur. Revaluation must be done manually using the document Transactions entered manually:

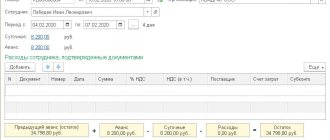

For example, 05/06/2016 the organization provided a service in the amount of 2000 USD,

thereby creating a debt on account 62.31:

If the information register of the Account with a special revaluation procedure is left blank, then at the end of the May period in the Currency Revaluation operation the account balance 62.31 will be revalued:

If account 62.31 is added to this list:

then at the Closing of the month the balance for it will not be revalued:

Thus, the accounting program of the 1C 8.3 Accounting 3.0 family can help a user who is faced with the difficult issue of accounting and revaluation of currency balances. The accountant simply needs to set everything up correctly and control the generated transactions.

Features of settlements with counterparties under contracts in foreign currency and in monetary units, accounting for exchange rate differences, at what point and how exchange rate differences are automatically calculated in 1C 8.3, transfer of currency to a foreign supplier under a foreign trade contract - all this is discussed in our course on working in 1C 8.3 Accounting in the Currency Transactions module. For more information about the course, watch our video:

Give your rating to this article: (

4 ratings, average: 5.00 out of 5)

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

Exchange differences in tax accounting

The income received from the translation of foreign currency balances does not relate to profit from the sale of products. It is logical that it is not subject to VAT taxation.

The company revaluates foreign currency balances depending on the accounting method used.

How exactly fluctuations in currency quotes are reflected in VAT accounting are shown in the table:

| Payment Features | Tax accounting and revenue accounting | VAT |

| Full payment after sending the goods | on the date of transfer of ownership of the goods | No recalculation |

| Full prepayment | the day the advance funds appear in the account | |

| Partial payment | on the date of receipt of partial payment + on the day when the goods become property |

Example No. 3. Goods worth €12,000 were shipped on November 2 (rate 74.2256), and paid for on November 26 (rate 75.1258). VAT at the rate of 18% must be paid in the following amount when using the method:

- accruals 160,327.30 (12,000 74.2256 0.18)

- cash 162,271.72 (12,000 75.1258 0.18)

Differences in exchange rates are taken into account in non-operating income (expenses) exactly as in accounting. This means that when they are positive, they are included in the amount subject to income tax.

A little theory and settings

Let us first turn to the legislative framework of the Russian Federation. In it we will see that according to PBU 3/2006, if the value of assets and liabilities is expressed in foreign currency, then for reflection in accounting this value is recalculated into rubles on the date of the transaction in foreign currency and on the reporting date, that is, the last day of the month.

How is currency accounting and currency revaluation implemented in 1C 8.3 Accounting 3.0?

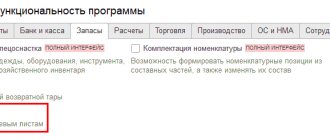

In order to be able to maintain currency accounting in the 1C 8.3 program, when starting operation, you need to configure the Functionality that allows you to conduct currency transactions. Main menu – Settings – Functionality:

Next, on the Calculations tab, first select the Keep records under contracts checkbox, then - Calculations in currency and monetary units:

It is also necessary in the Currency directory:

add the foreign currencies required to work in 1C 8.3:

and ensure timely and regular updating of exchange rate values in the information register of the same name:

Accounting for currency transactions in 1C 8.3

If an enterprise has a foreign currency bank account, data about it must be entered into the directory Bank accounts of the organization:

To conduct currency transactions in the 1C 8.3 Enterprise Accounting 3.0 program, in the chart of accounts there are special accounts that have the attribute of currency accounting:

This feature allows you to see in standard reports of the 1C 8.3 program the balances on these accounts not only in the regulated currency - rubles, but also in the required foreign currency:

Revaluation of foreign currency in 1C 8.3

Nothing stands still and exchange rates change. Accordingly, the ruble equivalent amounts of balances on foreign currency accounts must be recalculated while keeping the amount of the foreign currency balance unchanged. Depending on whether the exchange rate has risen or fallen, the organization will have other income or expenses during revaluation.

Where in 1C 8.3 is currency revaluation

As soon as currency accounts with balances on them appear in the information base of the 1C 8.3 Accounting 3.0 program, the transaction line Revaluation of currency funds will appear in the Month Closing processing. This operation is precisely intended to analyze balances on foreign currency accounts of the chart of accounts and revaluate foreign currency amounts with the recognition of other income or other expenses, generating the corresponding transactions automatically.

Read our article about what needs to be done before closing a month or year, or before drawing up any declaration in 1C 8.3.

Let’s say that in April the organization Romashka LLC opened a foreign currency current account and a payment from a client in the amount of $1,000 was credited to it (rate 68.2724). Having reflected the receipt of currency in the 1C 8.3 program, the operation Currency revaluation appeared in the Month Closing processing:

although it was not there in March:

So, now knowing all of the above, let’s return to the 1C Accounting 3.0 program and use examples to understand how currency is revalued automatically.

Example 1. If the rate has decreased

As of April 19, 2016 The dollar exchange rate was 68.2724 rubles as of the reporting date 04/30/2016. it dropped to 64.3334 rubles. Nothing has changed in the currency amount, but the ruble equivalent has decreased, and accordingly the company incurred expenses, which is reflected in the operation Currency revaluation at the end of the period in April:

Example 2. If the rate has increased

During the month of May, no transactions were made on the account; accordingly, on the next reporting date, 05/31/2016, the need for revaluation again arises. The dollar exchange rate increased as of May 31, 2016 compared to the previous revaluation. amounted to 66.0825 rubles. Thus, the organization generated other income, which is reflected in the regulatory operation Currency revaluation for May:

Example 3. Revaluation at the time of transaction

As for currency revaluation in 1C 8.3 when performing a transaction, the mechanism is similar to what was discussed above, only the currency conversion rate is taken according to the day of the transaction:

Relative to the previous revaluation date of 05/31/2016. the rate fell as of June 10, 2016. amounted to 63.7402 rubles. The organization must register the expense, which is what we see in the postings:

Foreign exchange income under the simplified tax system and OSNO

Simplified people freely open foreign currency accounts for settlements with foreign partners.

Under the simplified tax system, income and expenses in foreign currency are recalculated into RUB at the Central Bank rate used on the relevant dates.

According to the Tax Code, simplifiers are not obliged to:

- revaluate foreign currency balances due to changes in quotes;

- carry out accounting of costs and income from such recalculation.

Therefore, unlike OSNO companies, simplified companies:

- no amounts arise in the form of positive (or negative) exchange rate differences.

- income and costs are established once - on the date of occurrence of income or expenses.

The explanation for such features is the cash method, which is the basis of the simplified tax system.

Important! Foreign exchange earnings are subject to conversion into RUB at the Central Bank exchange rate valid on the day it is included in income. It will be credited to a transit (not current) currency account. Advance amounts in foreign currency are included in income in the same way.

The company's costs incurred due to foreign currency loans and credits include:

- interest that must be paid regularly;

- exchange differences resulting from the revaluation of accrued %%;

- minus differences between the quotes of the Central Bank and the domestic market, which arise when purchasing foreign currency necessary for the timely execution of loan agreements;

Additional costs associated with expenses under surety agreements, credit risk insurance, and bank guarantees are also included in this list.

Rules for revaluation of currency balances

In order to carry out the revaluation of currency as prescribed, the following rules should be followed:

- Each transaction in foreign currency carried out with the participation of financial institutions should certainly be entered into the daily balance sheet in rubles.

But for monitoring and analysis, the use of transaction registers and software in foreign currency is permitted. The bank provides its clients with bi-currency statements.

- Recalculation is required for all incoming balances on foreign currency accounts. Exceptions are amounts of advance payment for goods (issued or received), advances for services or a complex of works performed. To reflect them, you should use balance sheet accounts for mutual settlements that are carried out for transactions with partners.

- In the case when analytical accounts are prepared only in foreign currency, the balances of each matching balance sheet account are reflected in rubles at the Central Bank exchange rate simultaneously in:

- accounting registers;

- forms of analytical and synthetic accounting.

This procedure is necessary for subsequent reconciliation of accounting documents.

Revaluation of balances in foreign currency - is it necessary to recalculate at the end of the month?

As can be seen from the table above, foreign currency funds are revalued on all possible grounds listed in PBU 3/2006. This is an accounting item that can be revalued even daily (for example, this is what banks are supposed to do).

For ordinary enterprises, daily recalculation of currency balances is, as a rule, not required. Therefore, revaluations and accounting for exchange rate differences are performed when the period is closed (standardly a month). That is, the end of the month in this case plays the role of an interim “reporting date”. Accordingly, at the end of the month it is necessary to make an interim revaluation of currency items.

A ready-made solution from ConsultantPlus will help you re-evaluate balances on foreign currency accounts and correctly reflect it in accounting. Get trial access to the system for free and proceed to expert explanations.

NOTE! Most modern accounting programs (for example, 1C) perform revaluation of balances in foreign currency during the month-end closing operation automatically. The user only needs to monitor the timely updating of the currency directory so that the revaluation results are correct.