The linear method of calculating depreciation of fixed assets - the essence of the technique

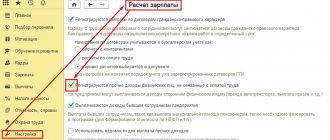

When choosing the linear method, depreciation is accrued every month for each fixed asset separately, depending on its useful life (clause 2 of Article 259 of the Tax Code of the Russian Federation).

The straight-line depreciation method implies that the following formula for calculating depreciation charges is used:

Am = OS × k

Where

Am – the amount of depreciation charges for the month;

k – monthly depreciation rate, expressed as a percentage;

OS is the initial or replacement cost of a depreciable fixed asset.

The depreciation rate for each fixed asset item is determined based on its useful life in months and is calculated using the formula:

k = (1/n) × 100%

where n is the number of months of useful use of the fixed asset.

This indicator is established on the basis of the Classification of fixed assets included in depreciation groups, approved by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1 (hereinafter referred to as the Classification of fixed assets).

ATTENTION! The amount of depreciation calculated using the linear method is the same in accounting and tax accounting. Except in cases where bonus depreciation is applied.

ConsultantPlus experts explained how to calculate depreciation in tax accounting. Get trial access and upgrade to the Ready Solution for free.

Uniform attribution to expenses of the cost of depreciable fixed assets is the main convenience of the linear method.

Determination of the norm of the indicator

To carry out a linear calculation, you must first calculate the annual rate. This indicator reflects the amount of funds that are written off by inclusion in the cost of goods produced. Simply put, this is the percentage of the initial cost of the property that is written off in 1 year.

The formula for determining the annual rate is as follows:

K = (1 : n) * 100%

- the K indicator expresses the annual depreciation rate;

- n – indicator reflecting the SPI.

By dividing the final result by the number 12, you can determine the monthly norm. This indicator reflects the percentage of the initial cost that must be depreciated over 1 month of operation of the facility.

Calculation of depreciation using the straight-line method - example

Let us explain with a specific example how the linear depreciation method is used in practice.

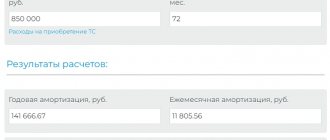

On March 18, 2020, a woodworking machine for furniture production was purchased from Gamma LLC and registered as a fixed asset at an initial cost of RUB 180,000.00. The useful life of the machine was set at 72 months, because This fixed asset belongs to the 4th depreciation group according to the Classification of fixed assets.

IMPORTANT! The value of assets classified as fixed assets in tax accounting is equal to 100 thousand rubles, and in accounting accounting - 40 thousand rubles. Read about the differences between accounting and tax accounting in the material “What applies to fixed assets of an enterprise.”

Let's calculate the amount of depreciation for one month:

Am = 180,000.00 x (1/72 × 100%) = RUB 2,500.00.

Since, with a linear month, depreciation starts from the month following the month the purchased machine was accepted onto the balance sheet, then starting from 04/01/2020, for 6 years (72 months), Gamma LLC will monthly expense a depreciation amount of 2 RUB 500.00

If you have access to ConsultantPlus, check whether you have correctly calculated and reflected depreciation in your accounting. If you don't have access, get a free trial of online legal access.

Method 2. Reducing balance method

Let's start by calculating the annual amount of depreciation, as prescribed by PBU 6/01. The annual amount of depreciation charges is equal to (paragraph 3 of clause 19 of PBU 6/01, paragraph “b” of clause 54 of the Methodological Instructions):

SAgod = OS x NA,

where SAgod is the annual amount of depreciation; OS - the residual value of the fixed asset at the beginning of the year; NA is the annual depreciation rate, which, in turn, is calculated as follows:

NA = (100% / N) x K,

where N is the number of years during which the organization plans to use this object; K is the acceleration coefficient (see paragraph 3 of clause 19 of PBU 6/01, paragraph “b” of clause 54 of the Guidelines and the note below).

The amount of depreciation to be calculated monthly is 1/12 of the annual amount. Since the residual value of a fixed asset is taken at the beginning of each reporting year, the annual depreciation amount will decrease every year. The monthly depreciation amounts will remain the same for each year.

Example 2.1 (from the Guidelines for PBU 6/01 ) . An item of fixed assets worth 100 thousand rubles was purchased. with a useful life of 5 years. Acceleration factor =2. The solution is given in the example file on the Reduced Remaining sheet. Year. amount of JSC Annual depreciation rate = (100% / 5 * 2), which will be 40 percent.

- In the first year of operation, the annual amount of depreciation charges is determined based on the initial cost formed when accepting the fixed asset item for accounting, 40 thousand rubles. (RUB 100,000 x 40% / 100%)

- In the second year of operation, depreciation is charged at the rate of 40 percent of the residual value at the beginning of the reporting year, i.e. the difference between the initial cost of the object and the amount of depreciation accrued for the first year will amount to 24 thousand rubles. (RUB 100,000 – RUB 40,000) x 40% / 100%).

- In the third year of operation, depreciation is accrued in the amount of 40 percent of the difference between the residual value of the object formed at the end of the second year of operation and the amount of depreciation accrued for the second year of operation, and will amount to 14.4 thousand rubles. ((60,000 rub. – 24,000 rub.) x 40% / 100%), etc.

This is where the solution in the Methodological Recommendations ends. But, we will try to continue it using the proposed calculation logic.

- In the 4th year of operation, depreciation is accrued in the amount of 40 percent of the residual value of the object at the beginning of the 4th year of operation (calculated as the difference between the residual value of the object at the beginning of the 3rd year and the amount of depreciation accrued for the third year of operation) and will be 8 .64 thousand rub. ((RUB 36,000 – RUB 14,400 = RUB 21,600) x 40% / 100%).

- In the 5th year of operation, depreciation is accrued in the amount of 40 percent of the residual value of the object at the beginning of the 5th year of operation (i.e. = 21,600 rubles - 8,640 rubles = 12,960 rubles) and will amount to 5,184 rubles. (RUB 12,960 x 40% / 100%).

Note : To calculate the Annual Amortization Amount using the Reducing Balance method, you can use the DDOB() and PUO() functions. But making calculations to determine monthly charges using these functions is incorrect, because according to PBU 6/01, the amounts of monthly depreciation during each year must be unchanged.

In our calculations, the residual value of the object at the end of the last year of useful use was 7,776 rubles. But, remember that according to PBU 6/01, depreciation charges are charged until the cost of this object is fully repaid or this object is written off from accounting. Why did we not pay off the cost of the object in full? This is a consequence of the applied calculation algorithm using the Diminishing Balance method: using it, the property will never be fully depreciated.

There are two ways out of this situation. The first is to write off an asset, for example, because it has become unusable or has been sold. The second method is to completely write off the remaining cost in the last month of the service life to the credit of account 02 “Depreciation of fixed assets” and to the debit of the cost accounting account. This can be done by invoking the principle of rationality. It allows you to recognize costs as expenses of the reporting period if their amount is not significant. The materiality criterion is prescribed in the accounting policy. For example, it could be 1 percent of the original cost ( ]]> https://www.glavbukh.ru/art/21188-amortizatsiya-osnovnyh-sredstv ]]> ).

Since the residual value of the fixed asset is taken at the beginning of each reporting year, the annual depreciation amount will gradually decrease. The monthly depreciation amounts for each year will remain unchanged and equal to 1/12 of the Annual Depreciation Amount (see the example file on the Declining Balance sheet)

Note : In example 2.1 it is implicitly assumed that the fixed asset item was accepted for accounting in December, i.e. accounting began in January.

Transition from non-linear to linear depreciation method

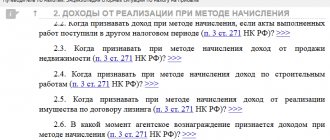

If a non-linear depreciation method was initially used, and later it was decided to use a linear one (the Tax Code allows changing depreciation methods, but not more than once every 5 years), then accountants may have a lot of questions in connection with such a transition.

- What useful life is used in the calculation? When switching to the straight-line depreciation method, deductions are calculated based on the remaining useful life of the asset. This period must be determined on the 1st day of the month of the tax period, when the use of the linear method begins (paragraph 2, paragraph 4, article 322 of the Tax Code of the Russian Federation).

- What value of the object should be taken as the basis for the new method of calculating depreciation? When switching to the linear depreciation method, you need to remember that part of the cost of the fixed asset has already been depreciated, so the calculation uses the residual value, which is also determined at the beginning of the tax period (clause 4 of Article 322 of the Tax Code of the Russian Federation). This is the position of officials (letter of the Federal Tax Service of Russia for Moscow dated December 1, 2009 No. 16-15/125942, letter of the Ministry of Finance of Russia dated January 28, 2010 No. 03-03-06/1/28).

- What should you do if, when switching to the straight-line depreciation method, the period of actual operation exceeded the useful life of the object, but the cost of the fixed asset was not completely written off as expenses? In such a situation, it is necessary to charge depreciation of the object until its value is written off (letter of the Ministry of Finance of Russia dated July 21, 2014 No. 03-03-RZ/35549). In this case, the useful life is determined by the taxpayer in accordance with the provisions of paragraph. 2 clause 7 art. 258 of the Tax Code of the Russian Federation and taking into account safety requirements and other factors affecting the wear and tear of the object.

Accrual stages

The depreciation process must be carried out in accordance with established rules and requirements. They apply to all methods, including linear.

Basic Rules:

- Depreciation charges are introduced from the month following the date of commissioning and putting the object on the balance sheet.

- Calculated monthly deductions are made regardless of profit or other financial results.

- Deductions are subject to accounting in the corresponding tax period.

- If the facility is not in use for more than 3 months or is under repair for more than 1 year, deductions are suspended.

- If property rights are lost, written off due to wear and tear, or completely removed from the balance sheet, depreciation will stop accruing from the next month.

It must be taken into account that the linear calculation is carried out for each OS object separately. At the same time, the initial (or replacement) cost of the object is a constant factor.

Therefore, having calculated the annual and monthly depreciation rates, these indicators do not change until decommissioning.

Results

The straight-line method of calculating depreciation is used in both accounting and tax accounting. The calculated amount will be the same in both cases, except in cases where bonus depreciation is applied.

Sources:

- Tax Code of the Russian Federation

- Decree of the Government of the Russian Federation dated January 1, 2002 No. 1

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Increasing and decreasing coefficients

Tax accounting provides for the possibility of introducing different coefficients that affect the overall depreciation period. However, this possibility is not provided for the linear calculation method. Depreciation rates remain the same regardless of the conditions of use of the property.

The depreciation term can be influenced in the only case - if the coefficients were taken into account when determining the service life and reflected in the formula in the calculations. In this case, the resulting standard indicator cannot change until the operational life of the object expires.

Linear depreciation is a calculation method in which the cost of an object purchased by an enterprise is written off in equal shares over a certain period of time. The amount of deductions is determined taking into account the initial cost and operational life. The indicator is calculated for each individual OS. The method can be applied to both new and used property, provided that it falls within the criteria of linear calculation objects.

Top

Write your question in the form below

When is it beneficial to use?

The linear method is often called straight-line, uniform.

Each month the cost of the fixed asset is written off in equal amounts.

When is it convenient? First of all, in cases where the OS object has a long useful life.

For example, in tax accounting, the linear calculation method is even mandatory for buildings, structures, and transfer devices from 8 to 10 depreciation groups.

Thus, the uniform method of deductions is convenient if:

- the asset has a long SPI;

- the characteristics and capabilities of the asset change slowly over time;

- the object is operated evenly throughout its entire service life;

- there is no need to quickly replace or update the fixed asset.

Also, the method is often used by those companies that want to keep the same records for accounting and tax purposes.

The calculation procedure is almost the same, so the differences will be minimal or absent.

Another reason is the organization’s reluctance to understand non-linear methods and to constantly recalculate depreciation.

This is especially true for small enterprises with a small number of fixed assets.

Accrual procedure

Deductions are made from the first day of the month following the date the asset is registered.

This process is completed only in two cases:

- after full transfer of cost to finished products;

- disposal of an object from the enterprise’s property as a result of sale, theft, breakdown and other cases.

In this case, depreciation charges cease to be accrued from the first day of the month following the date of exclusion of the asset from the organization’s property.

Accrual may be temporarily suspended if:

- the object is mothballed for a period of more than three months;

- the property has been under reconstruction or modernization for over a year.

Once the assets are returned to production, deductions should be resumed. The annual depreciation amount must be calculated taking into account the replacement cost.

Sometimes the assets of an enterprise include assets that were used in other organizations. Such objects include:

- contributions to the authorized capital;

- fixed assets acquired after reorganization;

- assets purchased are not new.

For such objects, the rules, calculation and procedure for calculating depreciation are exactly the same as for new ones. However, it is worth considering the length of their stay in another company. For current accounting, it is necessary to subtract the time of its actual operation from the useful life period. All accumulated depreciation for this object in another company is taken together with the book value of the asset.

Accounting for depreciation is carried out using contra account 02. In the course of its activities, the enterprise records with postings all cases of movement of the accumulated amount. For example:

| Operation | Debit | Credit |

| Depreciation accrued | 20 (23, 25, 26, 29, 44) | 02 |

| Write-off upon disposal of fixed assets | 02 | 01/select |

| Markdown when revising the cost of fixed assets | 02 | 84 (91.2) |

| Overestimation of depreciation | 83 (91.1) | 02 |

All these entries are entered into the transaction journal based on the depreciation calculation sheet. The cost of fixed assets is subject to transfer to finished products on a monthly basis .

The amount of depreciation, additional accruals and markdowns as a result of the revision of the value of assets should be promptly entered into the inventory card of the object.

How to correctly draw up an order to write off fixed assets - see this article. How to account for fixed assets in an enterprise - read here.

When is it used?

The uniform method is convenient to use for OS objects with a long useful life , during which the fixed asset slowly loses its operational properties.

The method is simple and straightforward, therefore it is popular for use.

The high prevalence of this accrual method is also due to the fact that a uniform write-off procedure is provided for in both accounting and tax accounting, which allows for identical accounting with minimal discrepancies.

Chart of accounts

To summarize information about depreciation accumulated during the operation of fixed assets, account 02 is used. Posting is carried out on it; if depreciation of fixed assets is accrued, accrued depreciation is reflected on the credit of this account, and the debit reflects the disposal of fixed assets (sale, write-off, transfer, etc.). This means that account 02 is passive, although it is not directly involved in the formation of the balance sheet liability. It only reduces the residual value of fixed assets that are reflected in it, and all postings for depreciation of fixed assets are carried out with its help. This is due to the fact that the balance sheet uses the so-called net valuation of fixed assets, and to correctly display their actual value, depreciation shown in account 02 is subtracted from the original amount. It corresponds with most accounts used to record expenses.

The property subject to depreciation is the company's expensive intangible assets. To account for their depreciation, a separate account 05 is used. The principle of its application does not differ from account 02; it is also passive and corresponds with the accounts on which expenses are recorded.

Analytics should be carried out in the context of all fixed assets that are on the organization’s balance sheet. This is defined in the order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, which approved the current chart of accounts. Accounting entries for accounting for the costs of restoring depreciation of fixed assets, using a standard chart of accounts, are carried out by the accountant, based on this order, other legal regulations, PBUs and the accounting policies of the organization.

Posting example

Vesna LLC owns a machine used for the production of materials. Its initial price is 550,000 rubles. The useful life is determined to be 20 years. The organization uses a linear method. Before posting, you need to determine the amount.

The depreciation rate per year is:

Or it is calculated for a year like this:

100% / 20 = 5%.

In total this is:

550,000 × 5 / 100 = 27,500 rubles.

This means that every month you need to write off 2291.67 rubles. This is the amount of accrued depreciation. As a result, the depreciation of the machine is recorded in accounting by posting:

Dt sch. 20 “Main production” Ct. 02 “Depreciation of fixed assets” - 2291.67.

When using other methods, the amount of wear will change, but the postings will remain the same.