There are two ways to return accountable funds:

- bring the money to the institution’s cash desk, and then the cashier will independently deposit the amount into the institution’s account;

- transfer the debt yourself.

Let's look at how to properly process the return of imprest amounts to a current account; we'll show the accounting entries in the table.

IMPORTANT!

In order for employees to independently return money directly to the current account of a government agency, secure this possibility in the accounting policy or in a separate local act. For example, in the provision on settlements with accountable persons.

Features of returning money to the cash desk by an accountable person

Organizations (IP) can issue funds on account in two ways:

- transfer to an employee’s account or corporate card (letter of the Ministry of Finance of the Russian Federation dated October 5, 2012 No. 14-03-03/728);

- issuing cash (directive of the Bank of Russia “On the procedure for conducting cash transactions...” dated March 11, 2014 No. 3210-U).

If an employee has not used all the accountable money issued to him, he must return it within the time period established for this by the employer (clause 6.3 of instruction No. 3210-U).

The amount of the refunded amount is determined based on the results of verification and approval of the advance report on the amounts spent. Such a report must be drawn up no later than the number of working days approved by the organization from the expiration date for which the money was issued (clause 6.3 of instruction No. 3210-U).

ATTENTION! From November 30, 2020, the requirement to submit a report within 3 working days has been canceled.

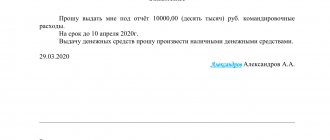

The issuance period is fixed in the application drawn up by the employee for the issuance of an advance, or in the employer’s administrative document on the issuance of money on account. From 08/19/2017 (instruction of the Bank of Russia dated 06/19/2017 No. 4416-U), the completion of an application by an employee is no longer a mandatory condition for the payment of accountable amounts. It can be carried out on the basis of an administrative document of the head of the legal entity (or individual entrepreneur).

You will find an example of such a document in ConsultantPlus. Trial access to the legal system is free.

IMPORTANT! Directive No. 3210-U applies its rules only to the rules for issuing and returning funds in cash. For non-cash payments for accountable amounts, its provisions do not apply, and an employer using this method must approve the procedure for settlements with accountables by an internal document.

What are reportable amounts?

Employers give employees money to meet the needs of the organization: purchasing office supplies, paying suppliers, purchasing gasoline for the fleet. Such payments are called accountable payments. Their use must be reported within the prescribed period, and the unspent balance must be returned.

The procedure for issuing money for reporting is regulated by Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U. They are issued in one of two ways:

- cash from the organization's cash desk;

- transfer to a corporate card or personal account of an employee (letter of the Ministry of Finance of the Russian Federation dated October 5, 2012 No. 14-03-03/728).

The question arises: if it is possible to give money to an employee by bank transfer, then is it possible to return accountable funds to the organization’s account? Let's figure it out.

Is it possible to return accountable funds to a current account?

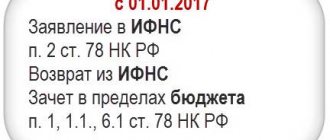

Current legislation does not prohibit employees from returning accountable amounts to the employer’s bank account. However, in order to avoid disputes with tax authorities, it is necessary to establish in an internal regulatory document the possibility of reporting persons returning unspent funds to the company’s current account or to record such a return option in an application (order) for the issuance of advance amounts.

To identify the transfer, the employee making the transfer must indicate in the payment purpose that he is returning the accountable amounts.

And yet, the optimal way to return accountable funds, eliminating any disagreements with controllers, is to the enterprise’s cash desk.

Do not give out money from prohibited sources

You can issue money on account only from cash proceeds.

The new rules for cash payments prohibit the issuance of money to accountants from other sources (Central Bank Directive No. 5348-U dated December 9, 2019). For example, due to borrowed funds received at the cash desk, and even due to returned accountable amounts. They must first be handed over to the bank. Previously, returned accountable amounts could be given to another employee for reporting purposes and even as a salary. Now the advance returned by the accountant must be handed over to the bank. If you do not do this, you will violate the rules for cash payments (see letter of the Central Bank dated July 9, 2022 No. 29-1-1-OE/10561). Violation entails a fine of 40,000 to 50,000 rubles. under Part 1 of Article 15.1 of the Administrative Code.

It is allowed to issue loans only to microfinance and some other specialized organizations, for example, consumer cooperatives (clause 1 of the Guidelines).

Issue cash on account only from revenue. If it is not there, you need to withdraw money from your bank account. You can also switch to non-cash payments with subordinates.

How is the amount of return of funds taken into account reflected in accounting?

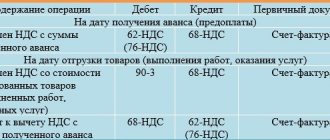

The company, having received accountable amounts from the employee, reflects the following entries in accounting:

- Dt 50 Kt 71 - return of cash to the cash desk;

- Dt 51 Kt 71 - return of accountable amounts to the ruble bank account of the enterprise;

- Dt 52 Kt 71 - return of the sub-report to the company’s foreign currency account;

- Dt 94 Kt 71 - reflection of the debt of the accountable in case of non-repayment of the amounts issued by him.

For information on what to do if an employee does not have enough accountable funds, read the article “ What to do if an accountable person has spent his money? "

What to do with the transfer fee

Some banks charge fees for transfers. If an employee had to pay extra money in the form of a commission for the return of accountable funds, then the employer can decide for himself whether it needs to be reimbursed. Provide for this in local regulations:

- if such an expense is not provided, then you are not obligated to reimburse the employee for expenses, and if you decide to reimburse, you will not be able to take them into account as expenses;

- if an expense is provided, it can be taken into account when calculating income tax, like other expenses associated with production and sales.

You can include a condition on the commission in the following wording: “With a non-cash method of returning accountable amounts, the employer reimburses the employee the amount of the commission charged for the specified transaction on the basis of certified copies of the payment order submitted by the employee and an extract from the register of payments on the employee’s bank account.”

Look at your tariff fees on the list of banks. If you're spending a lot of money on returns, you might want to open a separate account for them.

How to return funds from the account if an employee no longer works for you

If the current employee does not return the accountables, you will find recommendations for further actions in ConsultantPlus. Get trial access to the system for free and go to the Ready-made solution.

In a situation where the employee did not return the accountable money and quit, you can do the following:

- If the employee has not yet been paid, then the debt can be withheld from his salary, subject to the decision of the manager and the consent of the employee. In this case, the withholding should not exceed 20% of the salary (Article 138 of the Labor Code of the Russian Federation).

- If all settlements with the employee are terminated or he does not agree with the amount of withheld amounts, the debt can only be collected through legal proceedings.

To find out whether it is possible to delay the payment of funds due to an employee upon dismissal if he has not returned the accountable amounts, read the material “What payments are due to an employee upon dismissal”.

Certificate of return of funds at the cash desk: details of registration

Often during a work shift, cashiers develop a cash gap. This may be due to several reasons:

- The employee mistakenly entered an incorrect check (for example, the amount in the fiscal document is greater than the cost of the actual purchased goods).

- The cashier punched the receipt, but the client changed his mind about purchasing it - the situation is relevant for retail outlets, where they first pay for the purchase, and then release the products in the desired department.

- The buyer returns the goods directly on the day of purchase and is reimbursed from the operating cash register.

In all of the above cases, it is necessary to draw up an act f. KM-3. It is drawn up in a single copy when closing a shift and making a Z-report on the same day when the cash gap occurred. When conducting a tax audit, Federal Tax Service employees pay special attention to the correctness of the document and the supporting documents attached to it. Therefore, when designing, it is necessary to take into account some nuances.

The act of returning funds from the cash register is signed by a commission, which includes: the head of the company (branch manager), the head of the department, the senior cashier and the cashier. After signing, the cashier enters the total amount of the act (for all canceled fiscal documents) in gr. 15 register f. KM-4 (Cashier-operator's journal).

You must also attach incorrectly punched checks. For convenience, they can be glued to a sheet of paper. Each document must bear the signature of the manager and a stamp with Fr. The fiscal document is not always available. This may be because it was not presented by the buyer or was lost by the cashier.

In the first case, the client must write a statement indicating the reason why he was unable to present the check. The document is endorsed by the head of the outlet and attached to the act. If a cash register provides the ability to print information about a purchase, it can also be an application.

If a fiscal document is missing due to the fault of the cashier, but a decision is made not to punish him, then the employee only needs to write an explanatory note and draw up a sales report. In this case, Federal Tax Service employees can fine the entrepreneur for not posting the proceeds, but, based on judicial practice, the courts most often side with the businessman.

In the absence of supporting documents, tax authorities may equate this to illegal trafficking and bring both tax and administrative liability. However, in accordance with Part 1 of Art. 4.5 of the Administrative Code, a legal entity or individual entrepreneur cannot be held accountable after 2 months have passed from the date of the offense.

1. Ask our specialist a question at the end of the article. 2. Get detailed advice and a full description of the nuances! 3. Or find a ready-made answer in the comments of our readers.

Refund for services not provided

Masha 06/23/2018 16:04:23

Hello! I can’t get rid of the company **** the name is covered with asterisks, they refuse to disappear under various pretexts, or rather, they persistently do everything to continue stealing money, since they actually do not provide any services, but at the same time they continue to send invoices. How can we force these people to stop this outrage and return all the money they stole? It all looks like a long time, because they lie and do everything in such a way that, by coming up with various excuses and constant lies, they continue to steal the money of the client, who has long explained that he does not want to have anything to do with them. Situation: In September 2022, it turned out that they had cheated by almost 30,000 rubles over 2 years - they entered a duplicate of my number into the account number, from the first month they switched the Internet tariff to twice as expensive, and constantly included services in the bills that they did not provided They agreed to return the money only for a duplicate phone - 10,000 rubles. At the first request - nothing was returned. I demanded a refund to the same card from which they wrote off the money - they refused to make a refund, citing the need to write a statement. Or rather, they said that the money was returned to the account. To which I replied that I was not going to ever use their services again, and demanded that the money be returned to the same card from which they wrote it off. I also demanded to disable all their services except my mobile number, to which they also refused, citing the need to write a refusal application. In September or October 2017, it turned out that they were cheating and deceiving. Or rather, this was clear before, when instead of the tariff amount of 1,100 rubles, bills for 2,500-3,900 rubles began to arrive... With the operator, it turned out that they were entering two numbers into the bill instead of one, and this is not by chance, they also accessed the Internet using a SIM card and they changed the tariff, including for the same amount as mine. When I started to find out what the number was, it turned out no one was using it. This number **** was issued by the tenant themselves. I asked the question then why they take so long to withdraw money, since no one has been using it for 2 years - they answered me - well, you pay for it. As far as I know, if a phone doesn’t call for several months, the operators turn it off.. After they agreed to return the money for this charge, **** sent bills for another two months, where this number was still entered - a duplicate of my number . In December, on the 18th, I also wrote an application to transfer my mobile number to another operator. But despite this, they disconnected my number. Suddenly, on December 27-29, my mobile phone *****, which I received personally with my passport, stopped working. I called to find out what was wrong, the operators told me on the phone that since the number was connected to the home account for KST services. no one else cheats like that, so all services are disabled, the Internet also did not work. Around December 18th, I switched all services in the same way, calling a technician from another operator, so in fact there could be no traffic on my part. In March, it turns out that bills from **** continue to arrive, and they take money for the home phone and televisions. And the mobile phone was turned off again, because there was supposedly a debt on the home account. And surprisingly, someone even called once from the home number, which is actually impossible, and once again confirmed the fact that they write whatever they want on the receipts. they were unable to provide me with anything other than a blank piece of paper that simply contained the name of my tariff. There is no evidence of traffic either, and generally no documents on the basis of which they provided their services and demanded that you come and write statements from them. I wrote 2 complaints about deleting all accounts from the beginning of 2022 for the reasons that everything was turned off and for a refund of the difference for the tariff switched without my knowledge and the amounts that they also included for mobile Internet, which I did not order and which did not correspond to the tariffs at all, and wrote a claim for the return of 10,000 rubles, which they withheld all this time and did not return. A week later, some guy from this company called me and continued to talk about how their fraud was organized in many stages. After that, I wrote 2 more claims by email, and strangely enough they accepted them - they sent me claim numbers. That is, they still accept claims by email... A month passed, and I called to ask where my money was, and why they continued to withdraw money for the phone and TVs. Regarding TVs, they said that they have not received 2 more set-top boxes out of three, and if they do not have these set-top boxes, then the service is automatically considered to be provided. Although in December I also wrote and called them to come and pick up their equipment. And they said that there was an application in December only to disconnect the mobile phone from another person, who is the responsible tenant. Even when it turned out that they were stealing money, it turned out that for some reason my mobile number was not registered to me, although I came with it with a passport, but to the responsible tenant. Regarding the return of 10,000 rubles, today it turned out that they did not consider my application, because it had to be from a responsible tenant. The fact that I myself came to connect the TV Internet and mobile phone - and they took my passport from me, it turns out, does not play any role in their company. I have a reasonable question: do they even have the right to record the SIM cards of some people on the passports of others? A month passed after filing the claims, they did not return the money, and I did not receive any answers, they wrote by email that they sent me an answer by letter, I suppose in order to continue to stall for time and continue to rob. Moreover, I asked the responsible tenant whether he entered into any agreement with **** for services? He replied no. In addition, they did not give me any contracts or other documents when I connected the Internet mobile TV. And now they tell me that I can’t turn anything off and take it away, since only a 90-year-old tenant who is obliged to run to their office constantly can. The point is that when the state company MGTS, after the collapse of the union, passed into the hands of other people and began to be called differently, they continued to take money from the population, which did not enter into any agreements with them, I believe. The situation is described briefly because they stole and cheated before. It’s just that when such a deception and calculation was discovered, a complete shutdown was required. And my question is, do they have the right not to return the money both upon request and after the application is submitted? Although, when I came to write them, they didn’t tell me anything about what only the answer could do. the tenant demands something from them. Who didn’t sign anything with them at all and didn’t order anything from them. And for almost a year they continue to impose their services, which they actually do not provide, especially after they were required to completely shut down. And now they were also saying, when a month ago the guy from **** called, what kind of mobile phone they turned off back in March, I also have some kind of debt. I am registered in this apartment, I personally went to connect these services, and for half a year now I have been demanding that they get rid of them and return the money. They continue to send invoices allegedly on the grounds that the responsible KVS’s application for disconnection was not written. When I asked the question why the Internet was turned off and nothing was written off for the Internet, on which both TV and home actually work, at least for the company that I have had since the end of December, I did not receive an answer. How to force these ******* to return all the money for the calculation, and get rid of it forever. As I understand it, they don’t have any contracts at all for the activities they started, since they didn’t even give me any documents, and couldn’t even provide anything in the office, but they demand that apartment owners constantly leave them their passports data and signatures. Do they violate my rights and the rights of a responsible tenant who is being charged with services that he did not order? Do they even have the right to refuse to return and disconnect services to the person who is registered in the apartment, I am my daughter, and not to give the money for shortchange? And demand that only otv kv.s come? Thank you.