Who needs a schedule and why?

Each department processes a large number of different documents per day.

With the spread of electronic document management, the number of papers has decreased, but this has little effect on the system of interaction between departments of the enterprise. The presence of an approved document flow schedule in any organization facilitates the task of storing and processing incoming and outgoing documents. This internal act is used by employees of the accounting department, production and sales departments, secretaries and other employees through whom a certain number of papers pass daily. A well-designed document flow plan and schedule will allow you to avoid:

- loss of documentation;

- non-reflection or untimely reflection in the accounting of facts of economic life;

- fines from regulatory authorities.

Drawing up a schedule is especially important for companies that have branches and separate divisions in their structure. If the EDI system is not used, the risks of paper loss increase significantly.

Use free instructions from ConsultantPlus experts to properly organize document flow in your organization.

What is a document flow schedule and why is it necessary?

A document flow schedule is information presented, usually in tabular form, that describes the regulations for the movement of primary documents and their processing at all stages of their “life”: from the moment of creation to transfer for storage.

A workflow schedule helps:

- streamline the process of working with documents;

- rationally distribute “documentary” responsibilities among employees;

- reduce time delays when processing documentation;

- avoid work conflicts;

- monitor employee compliance with document processing functions and identify deficiencies at each stage of work;

- generate reports in a timely manner.

IMPORTANT! From 2022, FAS 27/2020 “Documents and document flow in accounting” is mandatory.

ConsultantPlus experts explained in detail how to organize document flow for accounting purposes under the new FAS 27/2021. Get trial demo access to the K+ system and upgrade to the Ready Solution for free.

See primary accounting forms: Unified forms of primary documents (list) Unified form TORG-12 - form and sample Unified form No. OS-6 - form and sample

The amount of information reflected in the document flow schedule depends on:

- the scale of the company's activities;

- enterprise structures;

- features of building a control system;

- types of primary materials used;

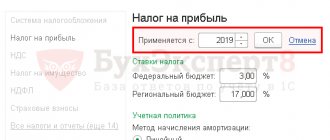

- other nuances (features of processing accounting information, software used, etc.).

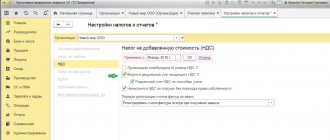

The document flow schedule is an annex to the accounting policy of the enterprise. Find out how to correctly draw up an accounting policy and appendices to it in the Typical Situation from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Who shapes it

Since most finance-related papers are processed and stored in the accounting department, and incoming and outgoing letters are under the responsibility of the secretary or office manager, sometimes the question arises who develops the document flow schedule in the organization and who approves it.

Typically, the development is carried out by the chief accountant, who is responsible for the correct and timely reflection of business transactions in accounting.

Example: a delivery note and an invoice, along with the goods, first go to the warehouse, where an employee signs for receipt of the goods and checks the quantity and integrity of the packaging. Then the documents are transferred to the purchasing department, where the operator enters data on the receipt of goods and materials into the program. After this, the papers go to the accounting department, where the correctness of prices and quantities is checked, the accountant reflects VAT in the accounting and registers the invoice in the purchase book.

For internal acts not related to finance (fire safety instructions, cleaning schedules, etc.), the manager has the right to appoint persons directly related to them as responsible for monitoring the implementation of relevant activities.

What is GDO

Any business transaction of an economic entity must be confirmed by a primary document. The procedure for compiling the primary report, its processing, and transfer to the accounting department for reflection in accounting is established in a separate manner. For this purpose, a special standard is drawn up - a schedule or regulation for the flow of accounting documents in the company - in fact, this is a documented procedure for the movement of primary and accounting documentation within an economic entity.

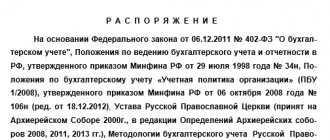

The obligation to draw up a GDO is regulated by the following standards:

- Federal Law on Accounting No. 402-FZ dated December 6, 2011.

- Regulations on documents and document flow in accounting, approved by the USSR Ministry of Finance on July 29, 1983 No. 105.

- Federal Accounting Standard for Public Sector Organizations “Accounting Policies, Estimates and Errors”, approved. by order of the Ministry of Finance of the Russian Federation dated December 30, 2017 No. 274n.

- Federal Accounting Standard for Public Sector Organizations “Conceptual Framework for Accounting and Reporting of Public Sector Organizations”, approved. by order of the Ministry of Finance of the Russian Federation dated December 31, 2016 No. 256n.

Compilation rules

The document is drawn up in the form of text, table or diagram indicating the names and positions of the responsible persons. When there are changes in the staffing table (hiring and dismissal of employees, transfers to other positions) and changes in job descriptions, changes are made to the document flow procedure: a new act or additions to it are drawn up.

The main purpose of drawing up a schedule is to ensure operational accounting of business transactions. Consequently, the period during which the document is in each department is set to a minimum.

Particular attention should be paid to the confidentiality of information contained in individual documents. The list of persons having access to them is strictly limited.

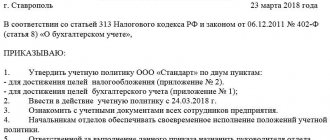

Regardless of who draws up the document flow schedule, the procedure is approved by order signed by the manager. All persons responsible for the preparation, storage and processing of paper and electronic documents sign to confirm that they are familiar with the procedure and undertake to comply with it.

How to apply

The Soviet Ministry of Finance proposes to create a kind of card for each type of primary accounting document. Then a sample document flow schedule for accounting policies looks like this:

However, the 2022 sample should reflect technical and other capabilities as much as possible. Below we provide a sample document flow schedule for accounting policies in relation to accounting. Also see “Money for reporting: how to issue and process it.”

How to approve

After the schedule is drawn up, an order is issued for its approval, in which the head of the company puts his signature under the heading “APPROVED”. Sometimes the question arises whether the document flow schedule is approved by the head of the organization if the document is drawn up for the internal document flow of a branch or separate division. In this case, the order is approved by the head of the branch or separate division. A separate order is drawn up for the exchange of documents with the head office.

How to prepare for drawing up a document flow schedule?

To draw up a document flow schedule, it is necessary to carry out preliminary preparation, during which:

- compile a complete list of documents to be processed;

- for each document, determine the number of copies necessary to meet the needs of internal and external users;

Find out how many copies an advance invoice is issued in from the material “Rules for issuing an advance invoice.”

- create a table of correspondence between the type of document and the positions of responsible employees who have a legal basis for signing them;

Find out how to assign the right to sign primary documents to an employee from the material “Order on the right to sign primary documents - sample” .

- compare each type of document with the responsible persons responsible for receiving (executing) the document in accordance with the job descriptions of the performers;

- specify the calendar nuances - indicate the time periods established by law or internal regulations for the preparation, coordination and approval of the document, as well as the transfer of the finished document to the end user;

- develop a system for monitoring the execution of the document flow schedule;

- specify other nuances of the schedule (depending on the needs of organizing internal document flow).

After collecting and clarifying all the initial data, this information is reflected in a special table (document flow schedule), the number of rows and columns of which depends on the needs of the organization.

Such freedom of choice when drawing up a document flow schedule is acceptable for any organization if the requirement for the use of a specific form of this document is not provided for by industry and (or) other regulations.

What is the graph?

A worker's working day can be standardized or irregular. It is established on the basis of the following regulations:

- Local routine.

- Collective agreement.

- Contract of employment.

Standard modes of employee activity:

- Five days with 2 days off.

- Six days with 1 day of rest.

- Flexitime.

The work schedule is discussed within the framework of the provisions of Article 103 of the Labor Code. This document is required when the duration of the production process is longer than the worker’s working day. What does this mean? Rarely do the company's working hours and the employee's working hours coincide. For example, a specialist’s working day ends at 18:00. But the institution continues to work. It can work around the clock.

The schedule is necessary to ensure continuity of the production process. It is expected that workers will replace each other. This eliminates downtime of production facilities. A shift schedule is required for irregular working hours.

Usually the schedule serves as an annex to the collective agreement. It is approved by the head of the company. However, the latter must obtain consent to approve the schedule from the representative body.

In addition, the employees themselves must be familiarized with the approved schedule upon signature. If the employee refuses to familiarize himself, a corresponding report is drawn up in the presence of 2 witnesses.

How does a schedule differ from a timesheet?

The time sheet is drawn up in accordance with Article 91 of the Labor Code. It is needed to record how much specialists worked over a certain period. The document reflects the actual time worked. The schedule, in turn, serves to plan time. It does not reflect actual data. The document serves specifically for planning.

There are certain requirements for the schedule. For example, it should be consistent with the employee representative structure. There are no such requirements for the report card. Any organization must maintain a timesheet. The schedule is not considered a mandatory document. However, it must be carried out with a large number of employees who work in shifts.

Graph functions

The working time schedule is endowed with these functions:

- Organizing working time.

- Determining the size of the salary for the fulfillment of certain obligations.

- Determination of average salary.

- Setting the amount of benefits.

- Establishing the insurance period of employees.

- Prevention of errors when establishing salary/vacation compensation.

- Determination of overtime and establishment of additional payments for them.

A working time schedule is a document that can be used to determine salary and other payments.

Document flow of a construction organization

Documents received by the organization undergo initial processing, preliminary review, registration, review by management and are sent to the performers. For LLC "KSIL" we can propose the following document flow schedule (Table 2.2) [9], [33].

Table 2.2 — Document flow schedule of KSIL LLC

| N p/p | N shape | Title of the document | Number of copies | Period of execution | Deadlines for transfer to accounting by other departments | Note | |||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | |||||||||

| On accounting of labor and its payment | |||||||||||||||

| 1 | T-1 | Order (instruction) on hiring an employee | 1 | No later than the first working day of the newly hired employee | 3 days from the date of receipt copy | The order (instruction) signed by the head of the organization or an authorized person is announced to the employee(s) against signature. Based on the order, a record of hiring is made in the work book, a personal card is filled out (Form N T-2), and an employee’s personal account is opened in the accounting department (Form N T-54a) | |||||||||

| 2 | T-2 | Employee personal card | 1 | After hiring an employee; if there are changes | Executed and stored in the HR department | ||||||||||

| 3 | T-3 | Staffing table | 1 | Every year no later than December 25 of the previous year; when making changes | Executed and stored in the HR department | The staffing table contains a list of structural units, positions, information on the number of staff units, official salaries, allowances and monthly payroll. Approved by order (instruction) of the head of the organization or a person authorized by him. Changes to the staffing table are made in accordance with the order (instruction) of the head of the organization or his authorized person | |||||||||

| 4 | T-5 | Order (instruction) to transfer an employee to another job | 1 | When transferring an employee | Executed and stored in the HR department | They are filled out by a personnel service employee, signed by the head of the organization or a person authorized by him, and announced to the employee(s) against signature. Based on the order (instruction) on transfer to another job, notes are made in the personal card (Form N T-2), personal account (Form N T-54a), and an entry is made in the work book | |||||||||

| 5 | T-6a | Order (instruction) on granting leave to employees | 1 | When granting leave to an employee, but no later than 3 days before it starts | The day after vacation pay is calculated, a copy the day after signing | They are drawn up by a personnel service employee or an authorized person, signed by the head of the organization or his authorized person, and announced to the employee against signature. Based on the order (instruction) to grant leave, marks are made in the personal card (Form N T-2), personal account (Form N T-54a) and the wages due for leave are calculated according to Form N T-60 “Note- calculation for granting leave to an employee" | |||||||||

| 6 | T-7 | Vacation schedule | 1 | Every year no later than December 25 of the previous year | — | The vacation schedule is endorsed by the head of the personnel service, heads of structural divisions, agreed with the elected trade union body (if there is one) and approved by the head of the organization or his authorized person. When the vacation period is postponed to another time, with the consent of the employee and the head of the structural unit, appropriate changes are made to the vacation schedule | |||||||||

| 7 | T-8a | Order (instruction) on termination of the employment agreement (contract) with employees | 1 | No later than the last working day of the dismissed employee | The day after signing | They are filled out by a personnel service employee, signed by the head of the organization or a person authorized by him, and announced to the employee(s) against signature. Based on the order to terminate the employment agreement (contract), an entry is made in the personal card (Form N T-2), personal account (Form N T-54a), work book, and settlement is made with the employee using Form N T-61 “Note- settlement upon termination of an employment agreement (contract) with an employee" | |||||||||

| 8 | T-9a | Order (instruction) on sending employees on a business trip | 1 | When sending an employee | — | Filled out by a personnel service employee and signed by the head of the organization or his authorized person. The order for sending on a business trip shall indicate the surname(s) and initials, structural unit, profession (position) of the traveler(s), as well as the purpose, time and place(s) of the business trip | |||||||||

| 9 | T-10 | Travel certificate | 1 | Before the employee departs on a business trip | At a/o, after 3 days from the date of return from a business trip | Issued in one copy by an employee of the personnel service on the basis of an order (instruction) on sending on a business trip (Form N T-9). After returning from a business trip to the organization, the employee (accountable person) draws up an advance report with attached documents confirming the expenses incurred | |||||||||

| 10 | T-10a | Official assignment for sending on a business trip and a report on its implementation | 1 | Same | Same | The official assignment is signed by the head of the structural unit in which the posted employee works. It is approved by the head of the organization or a person authorized by him and submitted to the personnel service for issuing an order (instruction) on sending on a business trip (form N T-9a). A person arriving from a business trip draws up a brief report on the work performed during the business trip, which is agreed upon with the head of the structural unit and submitted to the accounting department along with a travel certificate (Form N T-10) and an advance report | |||||||||

| 11 | T-11a | Order (instruction) on incentives for employees | 1 | As needed | No later than the last day of the reporting month | They are compiled based on the submission of the head of the structural unit of the organization in which the employee works. Signed by the head of the organization or a person authorized by him, announced to the employee(s) against signature. Based on the order (instruction), a corresponding entry is made in the employee’s work book. When registering all types of incentives, except for monetary rewards (bonuses), an exception is allowed from Form N T-11 “__ rub. __ kopecks.” | |||||||||

| 12 | T-13 | Time sheet | 1 | At the end of the reporting month, but no later than the 5th day of the month following the reporting month | Same | They are drawn up by an authorized person, signed by the head of a structural unit, an employee of the personnel service, and transferred to the accounting department. Notes in the report card about the reasons for absence from work or about working part-time, about working overtime and other deviations from normal working conditions must be made only on the basis of documents executed properly (certificate of incapacity for work, certificate of fulfillment of state duties and etc.) | |||||||||

| 13 | T-49 | Payroll | 1 | If necessary | Compiled by accounting employees | ||||||||||

| 14 | T-51 | Payslip | 1 | At the end of the reporting month, but no later than the 5th day of the month following the reporting month | Same | ||||||||||

| 15 | T-53 | Payment statement | 1 | After preparing the relevant payslip | -«- | ||||||||||

| 16 | T-53a | Payroll register | 1 | Based on the results of the reporting year | Maintained by an accounting employee | ||||||||||

| 17 | T-54a | Personal account (svt) | 1 | When hiring; then annually | Filled out by an accounting employee | ||||||||||

| 18 | T-60 | Calculation note on granting leave to an employee | 1 | When granting leave to an employee, but no later than 3 days before it starts | The calculation of vacation pay is submitted by the HR department to the accounting department and compiled by the accounting department. Submitted along with a copy of the leave order | ||||||||||

| 19 | T-61 | Calculation note upon termination of an employment agreement (contract) with an employee | 1 | Upon termination of the employment contract, but no later than the last day of work | The calculation of dismissal pay is submitted by the HR department to the accounting department and compiled by the accounting department. Submitted along with a copy of the dismissal order | Compiled by a human resources employee or an authorized person. Calculation of due wages and other payments is made by an accounting employee | |||||||||

| 20 | T-73 | Certificate of acceptance of work performed under an employment agreement (contract) concluded for the duration of certain work | 2 | Upon acceptance of work | Three days from the date of signing | Drawed up by the employee responsible for accepting the work performed, approved by the head of the organization or a person authorized by him and transferred to the accounting department for calculation and payment of the amount due to the contractor | |||||||||

| Accounting for work in capital construction | |||||||||||||||

| 21 | KS-2 | Certificate of acceptance of completed work | 2 | As work progresses | 3 days after signing by the parties | The act is drawn up on the basis of the data from the Logbook of work performed (Form N KS-6a) in the required number of copies. The act is signed by authorized representatives of the parties who have the right to sign (work performer and customer (general contractor)). Based on the data from the Certificate of Acceptance of Work Completed, a Certificate of Cost of Work Completed and Expenses is filled out (Form N KS-3) | |||||||||

| 22 | KS-3 | Certificate of cost of work performed and expenses | 2 | As needed | Same | ||||||||||

| 23 | KS-6a | Journal of completed work | 1 (for each object) | As work progresses daily | On demand | The work log is kept by the contractor for each construction project based on measurements of work performed and uniform standards and prices for each structural element or type of work. Costs in the line “Overhead and other expenses” are reflected on the basis of estimates of these expenses for the reporting period in amounts determined in accordance with the methodology adopted in the construction organization | |||||||||

| 24 | KS-8 | Certificate of commissioning of a temporary (non-title) structure | 3 | As needed | 3 days after signing by the parties | The act is drawn up by the contractor of construction and installation work in three copies: the first remains with the person who handed over the object for storage, the second is transferred to the person who accepted the object for safekeeping, the third is transferred to the accounting department. Materials to be returned are indicated in the table of the act. Against each type of material, the quantity and percentage of suitability of materials expected to be returned after disassembling the given object are shown. Data on the expected return of materials is used in the future to control the return of materials during the dismantling of temporary (non-title) structures | |||||||||

| 25 | KS-9 | Act on dismantling temporary (non-title) structures | 3 | Same | 3 days after signing by the parties | The act is drawn up by a commission specially appointed by order (instruction) of the head of the construction organization or an authorized person. The act is drawn up in the required number of copies, one of which is transferred to the accounting department, the other to the person who accepted the object for safekeeping. The act notes the quantity and percentage of suitability of materials actually received from the dismantling of temporary structures, as well as the expected return of materials during the construction of this structure, which is indicated on the basis of the data in columns 5, 6 of the Act on the commissioning of a temporary (non-title) structure (Form N KS-8 ). In case of discrepancies in the quantity of materials received from disassembly and the quantity of the intended return, the person responsible for the return explains the reason for the discrepancy. The materials actually received from disassembly are transferred to the financially responsible person, and his signature is affixed to the act | |||||||||

| 26 | KS-10 | Act on the assessment of buildings, structures, structures and plantings subject to demolition (relocation) | As needed | As demolition is required | 3 days from the date of BTI approval | The act is drawn up by a commission, which must include the owner (owner) of the building, structure, structure, planting to be demolished, or his representative, a representative of the customer (developer) of the newly constructed facility, a representative of the technical inventory bureau. If necessary, the commission may include representatives of other interested organizations | |||||||||

| 27 | KS-17 | Act on suspension of construction | As needed | As necessary when construction is suspended | 3 days after signing by the counterparty or with the owner. way by the directorate | The act is drawn up in the required number of copies for each construction site, indicating separately the work suspended by construction. One copy is transferred to the contractor, the second to the customer (developer), the third is presented only at the request of the investor | |||||||||

| 28 | KS-18 | Act on the suspension of design and survey work for uncompleted construction | As needed | As necessary when design and survey work is suspended | From the moment of receiving the design and survey work of the organization | The act is drawn up by the customer in the required number of copies, of which one remains in the customer’s accounting department, two are sent to the design organization, the fourth copy is provided only at the request of the investor | |||||||||

| For accounting of cash transactions | |||||||||||||||

| 29 | KO-1 | Receipt cash order | 1 | Daily when cash flows through the cash register | The next day after the transaction, along with the cashier’s report | A cash receipt order is issued by an accounting employee and signed by the chief accountant or a person authorized to do so. The receipt for the cash receipt order is signed by the chief accountant or a person authorized to do so, and the cashier, certified with the seal (stamp) of the cashier and registered in the register of receipts and expenditure cash documents (Form N KO-3) and handed over to the person who deposited the money, and the receipt the cash order remains in the cash register | |||||||||

| 30 | KO-2 | Account cash warrant | 1 | Same | Same | It is written out by an accounting employee, signed by the head of the organization and the chief accountant or a person authorized to do so, and is registered in the journal for registering incoming and outgoing cash documents (Form N KO-3). In cases where the documents (applications, invoices, etc.) attached to cash vouchers have a permit from the head of the organization, his signature on cash vouchers is not required | |||||||||

| 31 | KO-3 | Journal of registration of incoming and outgoing cash documents | 1 | -«- | -«- | Expense cash orders issued on payment (settlement and payment) statements for wages and other payments equivalent to it are registered after their issuance | |||||||||

| 32 | KO-4 | Cash book | 1 | -«- | -«- | The cash book must be numbered, laced and sealed with a seal on the last page, where the entry “There are numbered and laced sheets in this book” is made. The total number of laced sheets in the cash book is certified by the signatures of the head and chief accountant of the organization | |||||||||

| 33 | KO-5 | Book of accounting of accepted and issued funds | 1 | -«- | -«- | It is used to record money issued by a cashier from the organization's cash desk to other cashiers or an authorized person (distributor), as well as to record the return of cash and cash documents for transactions performed | |||||||||

| For accounting of settlements with accountable persons | |||||||||||||||

| 34 | AO-1 | Advance report | 1 | If necessary, but no later than 3 days after the deadline established by the order on accounting policies | On the day of filling | The verified expense report is approved by the manager or an authorized person and accepted for accounting. The balance of the unused advance is handed over by the accountable person to the organization's cash desk using a cash receipt order in the prescribed manner. Overexpenditure on the advance report is issued to the accountable person according to the cash receipt order. Based on the data of the approved advance report, the accounting department writes off accountable amounts in the prescribed manner | |||||||||

| By recording inventory results | |||||||||||||||

| 35 | INV-1 | Inventory list of fixed assets | 2 | According to the order for inventory | Established by order to conduct an inventory | The inventory list is signed by the responsible persons of the commission separately for each place of storage of valuables and by the person responsible for the safety of fixed assets. One copy is transferred to the accounting department for drawing up a matching statement, the second remains with the financially responsible person(s) | |||||||||

| 36 | INV-2 | Inventory label | 1 | Based on actual counting at storage locations | Every day after the warehouse is sealed | The label is filled out by the responsible persons of the inventory commission and stored together with the counted inventory items at their location. Data from form N INV-2 are used to fill out an inventory list of inventory items (form N INV-3) | |||||||||

| 37 | INV-3 | Inventory list of inventory items | 2 | According to the order for inventory | Established by order to conduct an inventory | The inventory list is drawn up and signed by the responsible persons of the commission on the basis of recalculation, weighing, re-measuring of inventory items separately for each location and the financially responsible person or group of persons in whose custody the assets are located. One copy is transferred to the accounting department for drawing up a matching statement, the second remains with the financially responsible person(s) | |||||||||

| 38 | INV-4 | Inventory report of shipped inventory items | 2 | Same | Same | The act is drawn up by the responsible persons of the inventory commission and signed by them. One copy is transferred to the accounting department, the second remains with the financially responsible person(s) | |||||||||

| 39 | INV-5 | Inventory list of inventory items accepted for safekeeping | 2 | -«- | -«- | The inventory is compiled by the responsible persons of the inventory commission on the basis of actual data, signed by the responsible persons of the commission and the financially responsible person(s). One copy of the inventory is transferred to the accounting department, the second remains with the financially responsible person(s) | |||||||||

| 40 | INV-6 | Act of inventory of inventory items in transit | 2 | -«- | -«- | The act is drawn up by the responsible persons of the inventory commission on the basis of documents confirming the location of inventory items in transit, and is signed by them. One copy is transferred to the accounting department, the second remains in the commission | |||||||||

| 41 | INV-11 | Act of inventory of future expenses | 2 | -«- | -«- | Compiled by responsible persons of the inventory commission based on the identification of balances of amounts listed in the corresponding account from the documents, signed, and one copy is transferred to the accounting department, the second remains in the commission | |||||||||

| 42 | INV-15 | Cash inventory report | 2 | -«- | -«- | An inventory of cash, various valuables and documents is carried out by a commission appointed by order of the head of the organization. The commission verifies the accuracy of accounting data and the actual availability of funds, various valuables and documents in the cash register through a complete recalculation. The results of the inventory are drawn up in an act, signed by all members of the commission and persons responsible for the safety of valuables, and brought to the attention of the head of the organization. One copy of the act is transferred to the organization’s accounting department, the second remains with the financially responsible person. When there is a change of financially responsible persons, the act is drawn up in triplicate. One copy is transferred to the financially responsible person who handed over the valuables, the second to the financially responsible person who accepted the valuables, and the third to the accounting department. During the inventory, operations for receiving and issuing cash, various valuables and documents are not carried out | |||||||||

Continuation of Table 2.2

| 43 | INV-16 | Inventory list of securities and strict reporting forms | 2 or 3 | -«- | -«- | The inventory is drawn up in two copies, signed by the responsible persons of the inventory commission and the financially responsible person(s). One copy of the inventory is transferred to the organization’s accounting department, the second remains with the financially responsible person(s) who accepts securities or strict reporting document forms for safekeeping. If there are strict reporting document forms numbered with one number, a set is compiled indicating the number of documents in it | ||||||||||||||||

| 44 | INV-17 | Act of inventory of settlements with buyers, suppliers and other debtors and creditors | 2 | According to the order for inventory | Established by order to conduct an inventory | The act is drawn up and signed by the responsible persons of the inventory commission based on the identification of the balances of the amounts listed in the relevant accounts from the documents. One copy of the act is transferred to the accounting department, the second remains with the commission | ||||||||||||||||

| 45 | INV-18 | Comparison statement of the results of inventory of fixed assets | 2 | Same | Same | The matching statements reflect the results of the inventory, i.e. discrepancies between accounting indicators and inventory records. For valuables that are not owned, but are listed in accounting records (those in safekeeping or rented, received for processing), separate matching statements are compiled. The matching statement is drawn up by an accountant, one copy is kept in the accounting department, the second is transferred to the financially responsible person(s) | ||||||||||||||||

| 46 | INV-19 | Comparison sheet of inventory items | 2 | -«- | -«- | The matching statement is drawn up by an accountant, one copy is kept in the accounting department, the second is transferred to the financially responsible person(s) | ||||||||||||||||

| Accounting for work in motor transport | ||||||||||||||||||||||

| 47 | N 3 | Passenger car waybill | 1 | As transport enters the line | The next day upon receipt of a new waybill | Issued by the dispatcher or an authorized person. The waybill is valid for one day or shift only. For a longer period, it is issued only in the case of a business trip when the driver performs a task for more than one day (shift). The waybill must include the serial number, date of issue, stamp and seal of the organization that owns the car | ||||||||||||||||

| On accounting of fixed assets and intangible assets | ||||||||||||||||||||||

| 48 | OS-1 | Certificate of acceptance and transfer of fixed assets | 2 | For any movement of fixed assets | 3 days from approval | |||||||||||||||||

| 49 | OS-3 | Certificate of acceptance and delivery of repaired, modernized fixed assets | 2 | Same | 3 days from the date of approval (conducted object by object) | The act, signed by an employee of a structural unit of the organization authorized to accept fixed assets, and a representative of the organization that carried out repairs, reconstruction and modernization, is submitted to the accounting department of the organization. The act is signed by the chief accountant (accountant) and approved by the head of the organization or a person authorized to do so. The technical passport of the corresponding fixed asset object must contain the necessary changes to the characteristics of the object related to major repairs, reconstruction and modernization. If repairs, reconstruction and modernization are carried out by a third-party organization, the act is drawn up in two copies. | ||||||||||||||||

| 50 | OS-4 | Act on write-off of fixed assets (except for vehicles) | 2 | -«- | 3 days from approval | The act is signed by the members of the commission and approved by the head of the organization or a person authorized to do so. The first copy of the act is transferred to the accounting department, the second remains with the person responsible for the safety of fixed assets, and is the basis for the delivery to the warehouse and sale of spare parts, materials, scrap metal, etc. remaining as a result of write-off. | ||||||||||||||||

| 51 | OS-4a | Act on write-off of motor vehicles | 2 | For any movement of vehicles | 3 days from approval | The act is drawn up and signed by members of the commission appointed by the head of the organization, approved by the head of the organization or a person authorized to do so. The first copy with a document confirming deregistration with the State Traffic Inspectorate is transferred to the accounting department, the second remains with the person responsible for the safety of vehicles, and is the basis for the delivery to the warehouse and sale of material assets and scrap metal remaining as a result of write-off | ||||||||||||||||

| 52 | OS-6 | Inventory card for recording a fixed asset item | 1 | From the moment of receipt, as you move based on primary documents until the moment of write-off | Maintained by accounting | An inventory card is maintained in the accounting department for each object or group of objects. In the case of group accounting, the card is filled out by positional records of individual fixed assets. The form is filled out on the basis of documents for the enrollment of the object, its movement, retrofitting, reconstruction, modernization, major repairs and write-off | ||||||||||||||||

| 53 | OS-14 | Certificate of acceptance (receipt) of equipment | 1 | For any movement of fixed assets | 3 days from approval | When installation work is carried out by contract, the selection committee also includes a representative of the contract installation organization. In this case, a separate act for the transfer of equipment for installation is not drawn up. Upon receipt of equipment for safekeeping, the authorized representative of the installation organization signs directly on the act, and a copy of the act is given to him. If it is impossible to carry out high-quality acceptance of equipment when it arrives at the warehouse, the Certificate of acceptance (receipt) of equipment (Form N OS-14) is preliminary, drawn up based on external inspection | ||||||||||||||||

| 54 | OS-15 | Certificate of acceptance and transfer of equipment for installation | 1 | For any movement of fixed assets | 3 days from approval | |||||||||||||||||

| 55 | OS-16 | Report on identified equipment defects | 1 | When detecting defects | Compiled for defects identified during the inspection, installation or testing of equipment | |||||||||||||||||

| 56 | NMA-1 | Intangible assets accounting card | 1 | Upon commissioning | Object by object. Filled out on the basis of a document for posting, acceptance and transfer (movement) of intangible assets and other documentation | |||||||||||||||||

| According to materials accounting | ||||||||||||||||||||||

| 57 | M-2a | Power of attorney | 1 | As you receive material assets | Compiled by the accountant of the material group, transferred to the supplier, the counterfoil is returned to the accounting department along with the receipt documents | |||||||||||||||||

| 58 | M-4 | Receipt order | 1 | As materials arrive at the warehouse | Within 3 days from receipt of material resources | |||||||||||||||||

| 59 | M-7 | Certificate of acceptance of materials | 2 | As discrepancies between the actual data and those indicated in the accompanying documents are identified when receiving materials | Within 3 days from the date of approval along with receipt documents | |||||||||||||||||

| 60 | M-8 | Limit fence card | 2 | As needed for materials | Within 3 days from the moment the limit is closed | |||||||||||||||||

| 61 | M-11 | Requirement - invoice | 2 | As needed for materials for one-time production needs | Within 3 days from the date of receipt of material assets | |||||||||||||||||

| 62 | M-15 | Invoice for issue of materials to the side | 2 | As it is sold to the side | Within 3 days from the date of release of material assets | |||||||||||||||||

| 63 | M-17 | Material accounting card | 1 | As you move based on incoming and outgoing documents | As required | |||||||||||||||||

| 64 | M-35 | Act on the recording of material assets received during the dismantling and dismantling of buildings and structures | 2 | As materials arrive at the warehouse during the liquidation of fixed assets | Within 3 days from the date of receipt of material assets at the warehouse | |||||||||||||||||

| Settlement documents | ||||||||||||||||||||||

| 65 | 401060 | Payment order | 3 | As needed | Compiled by a financial accountant | |||||||||||||||||

| 66 | 401063 | Letter of Credit | 4 | As necessary, in case of direct reference to this type of payment in the contract | Same | |||||||||||||||||

| 67 | 401061 | Payment request | 3 | Same | -«- | |||||||||||||||||

| 68 | 401071 | Collection order | 3 | As necessary, in case of direct reference to this type of payment in the contract | Compiled by a financial accountant | |||||||||||||||||

| 69 | 401066 | Payment order | 1 | As needed | Same | |||||||||||||||||

| 70 | 401065 | Register of accounts | 2 | As required in case of letter of credit settlements | -«- | |||||||||||||||||

Continuation of Table 2.2

| 71 | 401014 | Register of settlement documents submitted for collection | 2 | As necessary in case of collection payments | -«- | |

| 72 | 401004 | Statement of acceptance, refusal of acceptance | 3 | As necessary in case of acceptance type of settlements under the contract | -«- | |

| 73 | 402001 | Announcement for cash payment | 1 | As necessary when depositing proceeds to the bank | -«- | |

| Documents not listed in the Albums of standard unified forms of the State Statistics Committee of Russia | ||||||

| 74 | Prepayment invoice | 2 | As needed | As funds are received from customers | ||

| 75 | Accounting information | 2 | Same | Compiled by an accounting employee | ||

| 76 | Certificate of completion | 2 | When providing services, work | Upon signing by the customer | ||

| 77 | Sales receipt | 1 | As needed | Doesn't seem to be | ||

| 78 | Invoice order | 2 | Same | As funds are received from customers | ||

| 79 | Special invoice for conversion of units of measurement | 1 | -«- | Along with the primary invoice | ||

| 80 | Summary statement on the calculation of the unified social tax | 1 | Monthly | Compiled by a billing service accountant | ||

| 81 | Summary statement on the calculation of personal income tax | 1 | -«- | Same | ||

| Documents related to tax calculation | ||||||

| 82 | Invoice | 2 | When selling goods (performing work, providing services) subject to VAT taxation | Daily upon discharge | ||

| 83 | Form 1-NDFL | 1 | Monthly | Compiled by a billing service accountant | ||

| 84 | Form 2-NDFL | 2 | -«- | Same | ||

In the unified forms of primary accounting documentation (except for forms for recording cash transactions), approved by the State Statistics Committee of Russia, the organization, if necessary, can enter additional details. At the same time, all details of the unified forms of primary accounting documentation approved by the State Statistics Committee of Russia remain unchanged (including code, form number, document name). Removing individual details from unified forms is not allowed. The formats of the forms indicated in the albums of unified forms of primary accounting documentation are recommended and may be changed [9].

A document flow schedule is a schedule or diagram that describes the movement of primary documents in an enterprise from the moment of their creation to the moment of transfer for storage. There is no unified form of document flow schedule. Each enterprise draws up a schedule independently, based on the characteristics of its activities. The schedule should establish rational document flow at the enterprise or institution. The document flow schedule should help improve all accounting work at an enterprise, institution, strengthen the control functions of accounting, and increase the level of automation of accounting work. Correct preparation of a document flow schedule and its observance contribute to the optimal distribution of job responsibilities between employees, strengthening the control function of accounting and ensure the timeliness of reporting.