VAT in case of bankruptcy before 2015

Until 2015, when selling property during bankruptcy, VAT was paid in full. At the same time, bankrupt companies formalized transactions, issued an invoice, declared the sale of property, but did not pay tax due to the lack of funds in the account. Therefore, the status of a tax agent was received by buyers who had to pay the tax and then receive a deduction, reducing the basis for calculation.

In 2015, they tried to correct the conflict: the property rights and property of the bankrupts themselves ceased to act as an object for calculating VAT. However, this change did not affect finished products and services provided. This led to double interpretation and disputes between enterprises and tax authorities.

As a rule, bankrupt property is sold at competitive bidding and auctions without VAT and issuing an invoice. If the debtor enterprise continued to conduct its main activities, then the products could be taxed or not. If the buyer received an invoice, then when trying to get a deduction, the Federal Tax Service usually refused it, explaining that the property of a bankrupt was acquired, that is, the VAT rate should be 0%. In judicial practice, the decision was usually made in favor of the tax service.

As a result, buyers transferred VAT twice (during the purchase of goods or services, and then during the subsequent sale). This violated the equality of doing business. The Constitutional Court drew attention to a similar imbalance in the calculation of VAT in bankruptcy.

As a result, it was ordered not to prevent VAT refunds to buyers in the event of bankruptcy of an enterprise, provided that they purchased products with a dedicated value added tax.

All about VAT on the sale of property of bankrupt debtors

A detailed article from a lawyer.

The article analyzes controversial issues of law enforcement of subparagraph 15 of paragraph 2 of Article 146 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation). The defects of the legal approach to the courts' interpretation of this norm of tax legislation and the reasons for the ongoing contradictions in the law enforcement practice of arbitration courts in the issue of qualifying the list of the debtor's property, the sale of which is subject to VAT, are examined.

The normative basis of the issue is that sub. 15 paragraph 2 art. 146 of the Tax Code of the Russian Federation does not recognize transactions for the sale of property and (or) property rights of debtors recognized as insolvent (bankrupt) in accordance with the legislation of the Russian Federation as an object of VAT taxation. The stated norm is valid from 01/01/2015.

As follows from the above provisions, the concepts of “sale of goods” (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation) and “sale of the debtor’s property” (subclause 15, clause 2, article 146 of the Tax Code of the Russian Federation), used in article 146 of the Tax Code of the Russian Federation , are not identical and, accordingly, have different contents.

Taking into account that Chapter 21 of the Tax Code of the Russian Federation does not contain a definition of the concept of “sale of the debtor’s property”, on the basis of clause 1 of Art. 11 of the Tax Code of the Russian Federation and taking into account the explanations given in paragraph 8 of the resolution of the Plenum of the Supreme Court of the Russian Federation and the Plenum of the Supreme Arbitration Court of the Russian Federation dated 06/11/1999 No. 41/9, to clarify the range of operations in respect of which subclause should be applied. 15 paragraph 2 art. 146 of the Tax Code of the Russian Federation, it is necessary to refer to the provisions of the Bankruptcy Law.

According to paragraph 1 of Art. 131, art. 110 of the Bankruptcy Law, the opening of bankruptcy proceedings in relation to the debtor organization means that all of its property, available on the date of opening of bankruptcy proceedings, and identified during bankruptcy proceedings, is recognized as constituting the bankruptcy estate, and must be sold through auctions.

However, by virtue of clause 6 of Art. 139 of the Bankruptcy Law, property that is a product manufactured by the debtor in the course of its business activities is not subject to sale at auction. An analysis of changes in tax legislation (2011 - 2015) regarding the procedure for paying VAT by bankrupt organizations indicates that such changes concerned only property included in the bankruptcy estate.

Thus, the sale of the debtor’s property means the sale of property included in the bankruptcy estate, with the exception of products manufactured by the debtor in the course of its current business activities, and on the basis of clause 1 of Art. 11 of the Tax Code of the Russian Federation in the same meaning, the concept of “sale of the debtor’s property” should be interpreted for the purpose of applying subparagraph. 15 paragraph 2 art. 146 of the Tax Code of the Russian Federation.

This approach to the interpretation of subclause.

15 paragraph 2 art. 146 of the Tax Code of the Russian Federation is logical, motivated and confirmed by the Determinations of the Judicial Collegium for Economic Disputes of the Supreme Court of the Russian Federation No. 304-KG18-4849 of October 26, 2018, No. 309-KG18-9573 of November 8, 2018. The stated interpretation is consistent with the purpose of introducing of this norm - to eliminate the conflict between clause 4.1 of Art. 161 of the Tax Code of the Russian Federation and Article 134 of the Bankruptcy Law, which is addressed, in particular, by the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated January 25, 2013 No. 11, and which consists in the fact that the provisions of the Tax Code imposed on the buyer the obligation to withhold VAT amounts from the amount paid the price of the property being sold to the debtor and transferring them to the budget without any priority, and the bankruptcy legislation prescribed that the claims of creditors (the authorized body) be satisfied from the proceeds from the sale of the debtor's property in compliance with a strictly established priority.

The topic raised, it would seem, has already been the subject of articles and discussions many times, and the Judicial Collegium for Economic Disputes of the Supreme Court of the Russian Federation, by Determinations No. 304-KG18-4849 of October 26, 2018, No. 309-KG18-9573 of November 8, 2018. (the cases of Tsentralnaya CHPP LLC and Eliz OJSC) have already put an end to the question of how sub-clause should be interpreted. 15 paragraph 2 art. 146 of the Tax Code of the Russian Federation, indicating that this article deals with the exemption from VAT on the sale of property of a bankrupt debtor included in the bankruptcy estate.

However, the enforcement of lower courts on this issue is currently raising more and more questions.

So, for example, the same Seventeenth Arbitration Court of Appeal, which was the first in the country to express that interpretation of sub. 15 paragraph 2 art. 146 of the Tax Code of the Russian Federation, which was subsequently supported by the SKES of the Supreme Court of the Russian Federation in Determinations No. 304-KG18-4849 of October 26, 2018, No. 309-KG18-9573 of November 8, 2018 (cases of LLC "Centralnaya CHPP" and OJSC "Eliz" ") when considering a dispute between Eliz OJSC and the tax authority for a different tax period, but under completely identical circumstances, almost the same composition of judges on 04/09/2019 issued Resolution No. 17AP-3261/2019-AK in case A50-31773/ 2018, which took the exact opposite position, indicating that sub. 15 paragraph 2 art. 146 of the Tax Code of the Russian Federation does not separate the types of property of a bankrupt debtor, as a result of which any operations on the alienation of any property of the debtor are non-taxable with reference to the Decision of the Supreme Court of the Russian Federation of March 15, 2018 in case No. AKPI17-1162, which is not relevant to the case in any circumstances , nor on the subject of the dispute.

Moreover, the Seventeenth Arbitration Court of Appeal in the framework of case A50-15272/2017, in which the SKES of the Supreme Court of the Russian Federation has already given an interpretation of sub. 15 paragraph 2 art. 146 of the Tax Code of the Russian Federation in Determination No. 309-KG18-9573 of November 8, 2018, despite the fact that the judicial panel of the Supreme Court of the Russian Federation in accordance with clause 14 of part 1 of art. 291.13 of the Arbitration Procedure Code of the Russian Federation spells out the interpretation of sub. 15 paragraph 2 art. 146 of the Tax Code of the Russian Federation, subject to application in this case, still, in the order of appeal consideration of the case, the satisfaction of the requirements of Eliz OJSC was refused with the same reasoning: sub. 15 paragraph 2 art. 146 of the Tax Code of the Russian Federation does not separate the types of property of a bankrupt debtor, as a result of which any operations involving the alienation of any property of the debtor are non-taxable.

At the same time, earlier the same Seventeenth Arbitration Court of Appeal in cases A50-25315/2018 supported Eliz OJSC in the issue of application of sub-clause. 15 paragraph 2 art. 146 of the Tax Code of the Russian Federation. This taxpayer found similar support in the Arbitration Court of the Ural District in cases A50-31673/2017, A50-31674/2017.

However, it is already obvious that from late March to early April 2019, the approach of the courts in resolving the issue of interpretation of sub-clause. 15 paragraph 2 art. 146 of the Tax Code of the Russian Federation began to change in the exact opposite direction without obvious reasons.

A similar trend was reflected not only in the cases of Eliz OJSC, but also in the disputes of Central Thermal Power Plant LLC (cases A27-6964/2019, A27-6971/2019), DAGNEFTEGAZ JSC (case A15-5058/2018), MUP "Electroseti" (case A66-8536/2018), OJSC "LDSK" (case A45-21869/2018), LLC "Agrotorg" (case A35-9685/2017).

At risk of cancellation, all other cases involving disputes between bankrupt debtors for the right to carry out current activities in bankruptcy proceedings with VAT (for example, case No. A03-6274/2018 at the request of Pavlovskaya Poultry Farm CJSC, case No. A45-14525/2018 at the request of OJSC Investment and construction, cases No. A50-31778/2018, A50-25315/2018, A50-25316/2018 at the request of Eliz OJSC, case No. A73-12971/2018 at the request of Amurmetall-Lite LLC, case No. A60- 37739/2018 at the request of PJSC “Machine-building plant M.I. Kalinin, Yekaterinburg”).

The listed cases are only a small part of the huge number of disputes about the interpretation of one fairly simple (if you know the bankruptcy legislation) norm - sub-clause. 15 paragraph 2 art. 146 of the Tax Code of the Russian Federation, around which completely unfounded disputes arose that had profound socio-economic consequences.

- Before formulating the consequences of the interpretation of the controversial norm by law enforcement officials, it is necessary to find out why taxpayers who are allowed to make sales without VAT resist this and do not want to submit to the “unique” proposal of the tax authorities, although bankrupts, it would seem, are offered a wonderful opportunity not to pay VAT and this should be a benefit for the taxpayer, and even for the one who is in bankruptcy proceedings and is looking for a way out of it, continuing economic activity.

When answering this question, you should still pay attention to the fact that K. Marx and F. Engels indicated back in the century before last that economic reasons predetermine all other socio-political processes.

In relation to cases of bankrupt debtors, this logic is also applicable - the budget needs funds, and they must arrive more quickly than what happens in the case of bankrupt debtors - in the order of priority established by Art. 134 of the Bankruptcy Law. These circumstances determined the approach that is applicable in all of the above arbitration cases. The fact is that the interpretation of sub. 15 paragraph 2 art. 146 of the Tax Code of the Russian Federation, according to which the sale of any property of a bankrupt debtor is not subject to VAT, leads to the creation of an artificial model of withdrawal of VAT to the budget, bypassing the priority established by Article 134 of the Bankruptcy Law and the budget receives funds in the form of VAT faster than if fiscal withdrawals will take place according to the established Art. 134 of the Law on Bankruptcy Queue.

This situation arises due to the peculiarities of the economic and legal nature of the value added tax. The Constitutional Court of the Russian Federation indicated that this tax, being a form of withdrawal to the budget of part of the added value created at all stages of production and defined as the difference between the cost of goods, works and services sold and the cost of material costs attributed to production and distribution costs, is indirect tax (resolution dated March 28, 2000 No. 5-P

, dated February 20, 2001

No. 3-P

and dated June 3, 2014

No. 17-P

;

definitions dated April 8, 2004 No. 169-O

, dated November 4, 2004

No. 324-O

, dated February 15, 2005

No. 93-O

, dated November 10, 2016

No. 2561-O

, etc.).

The indirect nature of value added tax leads to the following consequences of qualifying the sale of goods by a bankrupt as a non-taxable transaction:

Firstly, when a bankrupt person sells products to the buyer, VAT is not charged to the buyer; accordingly, the buyer does not have the right to deduct (refund) VAT when purchasing said products (clause 1 of Article 171 of the Tax Code of the Russian Federation);

Secondly, the buyer (VAT payer) sells products to consumers, adding his trade markup to the purchase price of the product, as well as VAT calculated on the price of the products sold (clause 1 of Article 168 of the Tax Code of the Russian Federation); the consumer transfers to the buyer the price of the product, as well as the amount of VAT charged to him;

Thirdly, fulfilling the obligation to pay tax, the buyer pays the amount of VAT transferred to him by the consumer to the budget.

This chain reflects that when interpreting sub. 15 paragraph 2 art. 146 of the Tax Code of the Russian Federation, as excluding the imposition of VAT on any property of a bankrupt debtor, the burden of paying VAT is essentially shifted from the bankrupt to its buyer, who actually becomes a “tax agent” in operations for the sale of the bankrupt’s products. Since no insolvency (bankruptcy) procedures have been initiated against the buyer, the VAT amount is transferred to the budget immediately, by sending a payment document to the bank, within the time limits established by Art. 174 Tax Code of the Russian Federation.

This picture is confirmed by the fact that after bankrupt debtors who are denied application of VAT on the sale of goods, arbitration courts receive applications from buyers of these bankrupts (for example, Energoservice-Perm LLC - the buyer of Eliz OJSC), who purchased the products in good faith bankrupt debtor and have now become hostages of an incorrect interpretation of the rule of law and risk becoming the same bankrupt debtors themselves due to the filing of tax claims for the period from 01/01/2015 (date of introduction of sub-clause 15 clause 2 of article 146 of the Tax Code of the Russian Federation) to the present time.

Accordingly, the application of an incorrect interpretation of subsection to bankrupts. 15 paragraph 2 art. 146 of the Tax Code of the Russian Federation, set out above, leads to the creation of an artificial model of VAT receipts into the budget, bypassing the order of repayment of creditors' claims for current payments established by clause 2 of Art. 134 of the Bankruptcy Law, by actually shifting the burden of paying VAT from the bankrupt to his counterparty - the buyer. With this model, VAT will go to the budget through the buyer (“tax agent”) immediately, “in the first place,” and not in the fourth place to satisfy the claims of creditors for the bankrupt’s current payments.

The application of the stated model for calculating and paying VAT violates not only the rights and legitimate interests of bankrupts, but also the rights and legitimate interests of its creditors, the repayment of whose claims precedes the payment of VAT. The number of such creditors includes, in particular, the bankrupt’s employees, the payment of wages to whom is included in the second stage of current creditor claims (clause 2 of Article 134 of the Bankruptcy Law).

In this regard, there is a direct analogy between the above procedure and the “agency” procedure for paying VAT (clause 4.1 of Article 161 of the Tax Code of the Russian Federation), which was used in practice before the publication of the Resolution of the Supreme Arbitration Court of the Russian Federation dated January 25, 2013. No. 11. Established earlier in clause 4.1 of Art. 161 of the Tax Code of the Russian Federation, the “agency” procedure for paying VAT led to preferential satisfaction of the claims of the authorized body (represented by the Federal Tax Service of Russia) over other creditors, since VAT was received by the budget through a tax agent, bypassing the priority established by Art. 134 of the Bankruptcy Law. The inadmissibility of applying such a procedure is indicated by the Supreme Arbitration Court of the Russian Federation in paragraph 1 of the Resolution of the Plenum of January 25, 2013. No. 11.

It was precisely in order to ensure a balance of interests of creditors and to prevent priority satisfaction of the requirements of the tax authorities for the payment of current VAT that clause 4.1 of Art. 161 of the Tax Code of the Russian Federation and sub-clause was put into effect. 15 paragraph 2 art. 146 of the Tax Code of the Russian Federation.

Interpretation of sub. 15 paragraph 2 art. 146 of the Tax Code of the Russian Federation, set out in the above judicial acts, essentially creates the same situation with the withdrawal of VAT to the budget in violation of the established Art. 134 of the Law on Bankruptcy priority, which took place before the adoption of sub. 15 paragraph 2 art. 146 of the Tax Code of the Russian Federation, which, in essence, makes the introduction of this rule of law into the content of the Tax Code of the Russian Federation meaningless.

At the same time, incorrect interpretation of sub. 15 paragraph 2 art. 146 of the Tax Code of the Russian Federation creates conditions for the use of this mechanism by unscrupulous bankrupts to the detriment of the budgetary interests of the state, when unscrupulous participants in civil transactions can deliberately enter into bankruptcy proceedings, continuing their actual activities for the purpose of non-payment of value added tax.

Along with these circumstances, the courts completely ignore the point that the interpretation of subsection they use. 15 paragraph 2 art. 146 of the Tax Code of the Russian Federation does not have an economic basis; it entails a violation of the principles of uniformity and equality of taxation (Article 3 of the Tax Code of the Russian Federation), since, in their opinion, in sub. 15 paragraph 2 art. 146 of the Tax Code of the Russian Federation, operations for the sale of goods by bankrupt debtors are excluded from the object of VAT taxation, but operations for the sale of works and services by these persons are not excluded, and therefore, such work (services) performed (rendered) by bankrupts are subject to VAT in the general manner .

Thus, this enforcement excludes from the objects of VAT taxation operations for the sale of goods (products manufactured in the course of the bankrupt’s current activities), but includes operations for the sale of works (services) performed (rendered) by bankrupts in the course of the current activities.

This logic goes against the content of Articles 38, 39, sub. 1 clause 1 art. 146 of the Tax Code of the Russian Federation, in which the sale of goods and the sale of work, services are equated to each other for tax purposes, is used in a single bundle “sale of goods (work, services)” as a single object of taxation.

The sale by a bankrupt in the course of his current activities of produced (provided, performed) goods (works, services) has a single economic essence and identical economic results, which consist in the creation of tangible and intangible benefits, their sale to the buyer (customer). Accordingly, there are no objective differences between the sale of goods produced in the course of the bankrupt’s current business activities and the sale of work (services) performed (rendered) under identical conditions for VAT tax purposes.

In this case, VAT calculated when the bankrupt carries out operations both on the sale of goods (products) produced in the course of current economic activity, and on the sale of work (services) performed (rendered) by the bankrupt in the current activity, is subject to inclusion in the same queue of settlements with creditors for current payments and is paid to the budget in the same manner - primarily before the claims of the debtor's creditors included in the register (Article 5, 134 of the Bankruptcy Law).

Accordingly, there are no objective differences between the sale by a bankrupt of goods produced in the course of his current economic activity and the sale of work (services) performed (rendered) by a bankrupt under identical conditions for tax purposes. The financial consequences for the budget system associated with the payment of VAT on transactions involving the sale of goods, works, services by bankrupts and the use of deductions by bankrupt counterparties who sell goods and bankrupt counterparties who sell work (services) are the same.

Therefore, if we assume that with the introduction of sub. 15 paragraph 2 art. 146 of the Tax Code of the Russian Federation, the legislator’s goal was to exclude from the objects of VAT taxation operations on the sale of not only the bankruptcy estate of the bankrupt, but also the results of his current activities not included in the bankruptcy estate, then such a measure would be carried out equally as in relation to the sale of goods (products), and in relation to the implementation of works (services).

The Constitutional Court of the Russian Federation in paragraph 2.1 of the Determination dated July 17, 2014.

No. 1579-O indicated that by virtue of Art. 19 of the Constitution of the Russian Federation in conjunction with its Article 57, taxation must be based on the constitutional principle of equality, which excludes the discriminatory nature of taxes and fees and the possibility of their different application. In taxation, equality is understood primarily as uniformity, neutrality and fairness of taxation. This means that the same economic results of taxpayers’ activities should entail the same tax burden, and that the principle of equality of the tax burden is violated in cases where a certain category of taxpayers is provided with different conditions compared to other taxpayers, although there are no significant differences between them that would justify unequal legal regulation (Resolution of the Constitutional Court of the Russian Federation dated June 22, 2009 No. 10-P).

In paragraph 5 of the Resolution of January 30, 2001. No. 2-P, the Constitutional Court of the Russian Federation formulated a legal position according to which the principle of equal tax burden, arising from Article 8 (Part 2), 19

(Part 1) and

57

of the Constitution of the Russian Federation, in the field of tax relations, means that the establishment of taxation rules of a discriminatory nature is not allowed, including depending on the nature (content) of the entrepreneurial activity of taxpayers (Resolution of the Constitutional Court of the Russian Federation of March 21, 1997).

Thus, the interpretation of the courts allows for an arbitrary division of bankrupt taxpayers who continue economic activities in bankruptcy proceedings by type of economic activity (sale of goods or works, services).

Social consequences of the approach to the interpretation of subsection.

15 paragraph 2 art. 146 of the Tax Code of the Russian Federation are obvious: Firstly, a bankrupt, with a high degree of probability, will no longer have a chance to restore his solvency, as well as repay the register of creditors’ claims in full, since the size of current claims increases by the amount of unjust enrichment (Article 1102 of the Tax Code RF), which are presented by buyers of goods in the amount of overpaid VAT.

Secondly, the buyer himself, in the event of non-receipt of the amount of unjust enrichment from the bankrupt debtor, receives serious financial losses in the form of additional VAT charges, penalties and fines under Art. 122 of the Tax Code of the Russian Federation, which can undermine its solvency, lead to criminal legal consequences for managers (Article 199 of the Criminal Code of the Russian Federation), as well as civil legal consequences in the form of subsidiary liability of persons controlling the debtor.

Thirdly, as a rule, the continuation of current financial activities is carried out at manufacturing enterprises with a large staff of employees, accordingly, the termination of the activities of a bankrupt and, possibly, the insolvency of the buyer of the bankrupt’s products, creates the preconditions for the termination of jobs, the emergence of a situation of serious social tension .

Thus, unprincipled law enforcement, which goes against the positions of the highest judicial authorities, significantly creates negative socio-economic consequences, violates the legal foundations of tax legislation and the legislation of the Russian Federation on insolvency (bankruptcy), and therefore cannot but raise doubts about the validity of the approach to application of subclause 15 paragraph 2 art. 146 of the Tax Code of the Russian Federation.

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

VAT in case of bankruptcy of an enterprise from 2022

At the beginning of the year, the order of the Constitutional Court came into full force. The assets of an enterprise in the bankruptcy stage are sold without VAT. All tax amounts are taken into account in the final cost, which now does not allow issuing an invoice with a separately specified VAT upon shipment.

As a result, when selling property or finished products of such an enterprise:

- VAT is not determined separately;

- no invoice is issued;

- VAT previously accepted for deduction must be restored.

If a bankrupt company issues an invoice indicating value added tax, then the buyer will definitely not be able to receive a deduction.

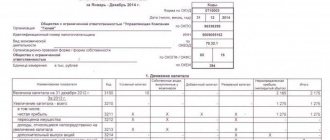

Example of VAT calculation in case of bankruptcy

Let's say the company is in bankruptcy and bankruptcy proceedings are in effect. At the same time, the main activity continues, finished products are produced and sold. In the first quarter of 2022, revenue amounted to 10,000,000 rubles. When shipping to customers, no VAT was allocated and no invoice was issued.

Moreover, the raw materials were purchased in the fourth quarter of 2022, when the company was not bankrupt. The total purchase amount was 6,000,000 rubles, of which 1,000,000 rubles were VAT. The latter amount was accepted for deduction and compensated from the budget. Now, for this amount, it is necessary to restore VAT in case of bankruptcy in the first quarter of 2022, when transactions not subject to this tax were carried out.

Direct VAT recovery occurs by registering the corresponding “incoming” invoices in the sales book:

- for goods, services and works in full;

- for fixed intangible assets and funds in an amount proportional to their balance sheet residual value without taking into account the revaluation performed.

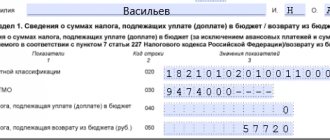

In the VAT return, these amounts will be recorded in section No. 3 on line 080. The tax is paid in equal installments over the next three months after the end of the first quarter.

Restoration of VAT on real estate

Reinstatement of VAT on real estate occurs in a special manner. It is used by companies that purchased real estate, accepted VAT on it for deduction, and then began to use this property for tax-free transactions (clause 3 of Article 171.1 of the Tax Code of the Russian Federation).

This is the order.

VAT must be restored at the end of each calendar year for 10 years. The countdown of this period begins on the first day of the month following the month in which this facility was put into operation.

For 10 years, at the end of each calendar year, it is necessary to restore 1/10 of the amount of VAT previously accepted for deduction. To do this, at the end of each year, the share of shipped goods (work, services) that are not subject to VAT in the total cost of shipped goods (work, services) for the year is determined.

The restored amount of VAT is taken into account as part of other expenses according to the rules of Article 264 of the Tax Code.

VAT on a real estate property does not need to be restored if:

- the property has been in operation by the company for at least 15 years;

- real estate is fully depreciated in tax accounting.

Read in the berator “Practical Encyclopedia of an Accountant”

How to fill out Appendix 1 to Section 3 “Amount of tax subject to recovery...” of the VAT return

When is it necessary to pay VAT in bankruptcy?

In April 2022, the Ministry of Finance described situations that deprive enterprises of the right to operate without VAT in case of bankruptcy. Thus, today the debtor and creditors can enter into settlement agreements. In this case, the bankruptcy case is stopped and the debtor returns to the general legal field. From this moment on, the company again loses the right to sell goods without allocating VAT.

If in our example such a situation occurred and bankruptcy proceedings were closed on April 1, 2021, then the company begins to operate under the same conditions. Let’s say that in April, 2,400,000 rubles worth of finished products were sold, including VAT. During the holiday, the buyers were given the entire package of documents, including an invoice, where the tax was highlighted. If a VAT deduction was not applied to the cost of raw materials, then the manufacturer has the right to apply for it.

The procedure for selling property in the event of bankruptcy of an individual

An individual can also be declared bankrupt. The sale of his property is an extreme measure that is resorted to if the earlier stage of bankruptcy - debt restructuring - is impossible for a number of reasons or was carried out with violations. The sale is carried out as follows:

- The insolvency administrator describes all of the debtor's property. This could be transport, real estate, securities, expensive furniture, equipment, etc. The manager must analyze the citizen’s transactions over the last 3 years. Agreements, especially deeds of gift, with interdependent persons (spouses, children, parents, subordinates, etc.) can be canceled, then the property ends up in the bankruptcy estate.

- They conduct an assessment of property with the involvement of independent appraisers, if necessary; they will establish the market value of things in their report.

- They publish an announcement about bidding, which is held as an open electronic auction. All associated expenses are covered by the citizen.

- An arbitration manager or a specialized independent company conducts auctions - no later than two months and in three stages. The first is a bullish auction. The auction step here is 5-10% of the starting price. The one who offers the most money wins. The second stage - if no one showed up to participate in the auction (or there is only one participant), then the organizer has the right to recognize it as invalid. The starting price compared to the market price is reduced by 10-30%. The third stage is a public offer with bearish trading. The reduction in property price can reach 90%. Unsold items of an individual are returned to him subject to the conditions of clause 5 of Art. 213.26 Federal Law No. 127. The transfer of unrealized property to a creditor in the event of a citizen’s bankruptcy is possible: by its legal nature, this option is close to compensation (Article 142.1 of Federal Law No. 127). Clause 1 of Art. allows this article to be applied to citizens. 213.1 Federal Law No. 127.

- Settle accounts with creditors (in accordance with Article 213.27 of Federal Law No. 127), pay legal costs, and pay remuneration to the manager and independent organizer.

- The manager reports on the sale of an individual's belongings to the court and creditors. All evidence of the facts of the sale and settlements with creditors must be attached to such a report. If the proceeds are not enough to pay all debts, the remaining ones are written off, the individual becomes bankrupt, and the court terminates the corresponding procedure.

Taxes in case of bankruptcy of a legal entity

Currently, many legal entities, due to the difficult economic situation in the country, are faced with difficulties in doing business. Most companies cannot repay their debts, pay their bills and therefore, over time, they are faced with claims from creditors. If there is no way out of this situation, you should think about bankruptcy proceedings. This process is regulated by the Federal Law “On Insolvency (Bankruptcy)” No. 127-FZ, which was adopted back in 2002.

A bankruptcy case is being considered in an arbitration court according to the norms and rules established by the Arbitration Procedural Code of the Russian Federation. Many managers of companies that have decided to go bankrupt are concerned about the question of what taxes they will have to pay in the event of bankruptcy of a legal entity, and how they will be collected.

Income tax

According to Article 247 of the Tax Code of the Russian Federation, the object of taxation for corporate income tax is all profit that was received by a given taxpayer during the reporting period. Profit is the difference between the income received and the costs incurred by the enterprise.

Taxpayer income includes:

- Revenue received from the sale of goods, work performed or services provided. This also includes income from the sale of property rights.

- All other income.

Income from the sale of goods (work, services) includes revenue received both from the sale of own products or services provided, and from purchased goods. These provisions are specified in Article 249 of the Tax Code of Russia.

When selling property that is depreciated at the enterprise, the taxpayer has the right to reduce the income received by the residual value of the object. These norms are specified in Article 268 of the Tax Code of the Russian Federation.

Chapter 25 of the Tax Code of the Russian Federation, which is devoted to corporate income tax, does not provide for recognition as a tax agent of an organization or an authorized person that sells property. Therefore, on the income that will be received from the sale of any property of the debtor at electronic auctions, the bankrupt himself will pay income tax.