In this article I was going to show how to make a balance sheet from SALT. However, having figured out how I would do this, I realized that I would start using accounting rules and terms. And I’m not sure that you and I will have the same understanding of them. So, I came up with this.

I am not interested in writing a purely theoretical article. I want to engage you so that together we can go from “reviewing SALT” to filling out the balance sheet.

For this I have my own approach: when giving new knowledge, I strive to ensure that there is a repetition of the previous ones. In other words, we repeat the knowledge that serves us as a support for new ones.

I would like to note that in this series of articles about filling out a balance sheet, I will talk about general ideas, basic rules, and show how it is done. Together with me, you will go all the way to creating a balance sheet based on the OCB of a real enterprise.

So, let's go...

Here is the OCB of a working enterprise. In the previous article, we prepared her for creating a balance sheet .

Please note that I added two empty columns to the OCB: “Name” and “AP”. Why did I do this? I answer - For independent work, for warming up and remembering past knowledge.

Here's what we should do now:

- and open it

- In the “name” column, write the name of the account. No need to look at the chart of accounts. There is no need to achieve some exact match between the name of the account and what it is called in the chart of accounts. Just remember and write. It is enough that your name reflects the essence of the account. For example . I will call the 50th account “Cashier”. And in the chart of accounts it can be called “Enterprise Cash Office”.

- in the “AP” column for each account, indicate what it is, “A – active account”, “P – passive account” or “AP – active-passive account”. Hint : Active accounts are those that store information about what the company has and this is “what” helps the company operate and earn money. Usually “it” can be touched. Active accounts always have a debit balance or zero. Liability accounts are the debts/obligations of our company. This is simply information about the amounts owed. Passive accounts always have a credit balance or zero.

Of course, putting down “A, P and AP” is not an easy task. This requires knowledge and some reflection. I agree that there are invoices where you can issue them right away, and somewhere you can use a hint and enter the required characteristics. In any case, put it where you can do it. And fill in the remaining empty cells according to the chart of accounts. .

Once you solve the problem, compare it with what I did.

Answers are available only to subscribers!

If you are subscribed to blog updates by email, enter the access code from the last mailing letter. To receive an access code, subscribe to blog news.

Some General Rules and Observations

I assume, reader, that you remember that accounting accounts collect and store information about the activities of a business. All information is separated according to certain criteria. So, the code and name of the accounting account serves as a separation criterion. As a result, OSV shows all the accounting accounts involved in our enterprise. From the OSV we see what information has been collected.

However, the balance sheet collects business information in a different way.

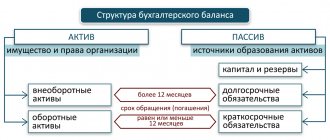

Firstly , the balance sheet divides information into ASSETS and LIABILITIES.

Secondly , within ASSET and LIABILITY, information is divided into certain groups. Each such group is an economic indicator.

Ultimately, SALT is simply regrouped on the balance sheet.

- All debit balances, and these are accounts with characteristic A, go to the “ASSET balance” section

- All credit balances, and these are accounts with characteristic P, go to the “LIABILITY” section of the balance sheet.

- Accounts with the AP characteristic are transferred to the balance sheet as follows: if there is a debit balance, it goes to an ASSET, if there is a credit balance, it goes to a LIABILITY.

The amount received in ASSET or LIABILITY is entered into the specific name of the economic indicator. The basis for including the amount in the economic indicator will be the name of the accounting account, or, when it is not clear, we will use the law on filling out the balance sheet. Well, we will start filling out the balance very soon.

How to read SALT

For an uninitiated person in the intricacies of accounting and the methodology for reflecting transactions, it is not easy to immediately read the data that the statement stores. To get started you will need:

- master the principle of drawing up postings;

- methodology for distributing transactions by turnover;

- methods for forming the final balance.

Accounting accounts are divided into active (A), passive (P), active-passive (AP).

| A | P | AP |

Material:

|

|

|

Intangible:

| ||

Financial:

|

The group of active accounts contains information about inventory:

- tangible (01, 10, 41, 45) and intangible (08);

- financial (50, 51, 52, 55).

As a result, the turnover sheet for accounts gives an idea of the amount of VAT accrued for payment, the balance of money in the cash register and in ruble or foreign currency accounts of the organization. For example, turnover on 51 accounts will show how much money was received and written off in the time period under study.

Passive accounts (02, 05, 66, 70, 80, 82, 98) contain information about the sources of financing and assets of the organization, as well as changes in capital.

The profit received or the existing loss will be shown by active-passive accounts (40, 60, 62, 73, 75, 76, 84, 90, 91, 99). The balance is formed by both debit and credit accounts. For example, the credit balance on account 62 (settlements with customers) will show the debt for goods sold or services provided.

The turnover sheet is intended to group information into synthetic and analytical accounts. The main sign that accounting is being kept correctly is equality between them.

In accounting, with the help of the balance sheet (SBS), they control settlements with counterparties and transactions related to general business activities. Based on the statement, financial statements are formed - balance sheet.

Fixed assets and intangible assets when filling out the balance sheet

Fixed assets are inextricably linked with such a concept as depreciation (accounted for in account 02). Depreciation is a gradual decrease in the initial cost of an asset associated with the operation of the asset. The depreciation process for fixed assets occurs over a certain period of time, but more than a year. As a result, everything will come to the point that the amount of depreciation will be equal to the original cost of the operating system.

Look at SALT . Account 01 records the amounts of all fixed assets at their original costs. Account 02 takes into account the depreciation amounts of these fixed assets. Now you are asking yourself, what does this have to do with the balance sheet?

It would seem that according to the rules for posting amounts from SALT to the balance sheet, we must send the amounts from the 01st account to the ASSET, and send the amounts from the 02nd account to the LIABILITY of the balance sheet. However, there is an exception for Fixed Assets.

Its essence is that before sending the amount to the balance sheet, we take the amounts from 01, subtract the amounts from 02 and send the resulting amount to where????

IN THE ASSET balance. Because depreciation can never be more than the original cost of the asset, and therefore the difference between 01-02 will always be a debit. 01 account (A) > 02 account (P). Well, in extreme cases, it will be 0.

Exactly the same situation with accounts 04 and 05. This takes into account the assets of an enterprise that do not have a physical object, like a machine or a machine. Account 04 takes into account such assets of the enterprise as licenses, the exclusive right to a patent, the exclusive right to software, etc. Their period of use is also more than 12 months and they are not intended for resale. Everything is the same as with the OS. Depreciation of Intangible Assets (IMA) is accounted for on account 05.

How to make a balance sheet from SALT

In this article I was going to show how to make a balance sheet from SALT. However, having figured out how I would do this, I realized that I would start using accounting rules and terms. And I’m not sure that you and I will have the same understanding of them. So, I came up with this.

I am not interested in writing a purely theoretical article. I want to engage you so that together we can go from “reviewing SALT” to filling out the balance sheet.

For this I have my own approach: when giving new knowledge, I strive to ensure that there is a repetition of the previous ones. In other words, we repeat the knowledge that serves us as a support for new ones.

I would like to note that in this series of articles about filling out a balance sheet, I will talk about general ideas, basic rules, and show how it is done. Together with me, you will go all the way to creating a balance sheet based on the OCB of a real enterprise.

So, let's go...

Here is the OCB of a working enterprise. In the previous article, we prepared her for creating a balance sheet .

Please note that I added two empty columns to the OCB: “Name” and “AP”. Why did I do this? I answer - For independent work, for warming up and remembering past knowledge.

Here's what we should do now:

- download the balance sheet and open it

- In the “name” column, write the name of the account. No need to look at the chart of accounts. There is no need to achieve some exact match between the name of the account and what it is called in the chart of accounts. Just remember and write. It is enough that your name reflects the essence of the account. For example . I will call the 50th account “Cashier”. And in the chart of accounts it can be called “Enterprise Cash Office”.

- in the “AP” column for each account, indicate what it is, “A – active account”, “P – passive account” or “AP – active-passive account”. Hint : Active accounts are those that store information about what the company has and this is “what” helps the company operate and earn money. Usually “it” can be touched. Active accounts always have a debit balance or zero. Liability accounts are the debts/obligations of our company. This is simply information about the amounts owed. Passive accounts always have a credit balance or zero.

Of course, putting down “A, P and AP” is not an easy task. This requires knowledge and some reflection. I agree that there are invoices where you can issue them right away, and somewhere you can use a hint and enter the required characteristics. In any case, put it where you can do it. And fill in the remaining empty cells according to the chart of accounts. Download the chart of accounts.

Once you solve the problem, compare it with what I did.

If you are subscribed to blog updates by email, enter the access code from the last mailing letter. To receive an access code, subscribe to blog news.

Some General Rules and Observations

I assume, reader, that you remember that accounting accounts collect and store information about the activities of a business. All information is separated according to certain criteria. So, the code and name of the accounting account serves as a separation criterion. As a result, OSV shows all the accounting accounts involved in our enterprise. From the OSV we see what information has been collected.

However, the balance sheet collects business information in a different way.

Firstly , the balance sheet divides information into ASSETS and LIABILITIES.

Secondly , within ASSET and LIABILITY, information is divided into certain groups. Each such group is an economic indicator.

Ultimately, SALT is simply regrouped on the balance sheet.

- All debit balances, and these are accounts with characteristic A, go to the “ASSET balance” section

- All credit balances, and these are accounts with characteristic P, go to the “LIABILITY” section of the balance sheet.

- Accounts with the AP characteristic are transferred to the balance sheet as follows: if there is a debit balance, it goes to an ASSET, if there is a credit balance, it goes to a LIABILITY.

The amount received in ASSET or LIABILITY is entered into the specific name of the economic indicator. The basis for including the amount in the economic indicator will be the name of the accounting account, or, when it is not clear, we will use the law on filling out the balance sheet. Well, we will start filling out the balance very soon.

Fixed assets and intangible assets when filling out the balance sheet

Fixed assets are inextricably linked with such a concept as depreciation (accounted for in account 02). Depreciation is a gradual decrease in the initial cost of an asset associated with the operation of the asset. The depreciation process for fixed assets occurs over a certain period of time, but more than a year. As a result, everything will come to the point that the amount of depreciation will be equal to the original cost of the operating system.

Look at SALT . Account 01 records the amounts of all fixed assets at their original costs. Account 02 takes into account the depreciation amounts of these fixed assets. Now you are asking yourself, what does this have to do with the balance sheet?

It would seem that according to the rules for posting amounts from SALT to the balance sheet, we must send the amounts from the 01st account to the ASSET, and send the amounts from the 02nd account to the LIABILITY of the balance sheet. However, there is an exception for Fixed Assets.

On the topic of the article! The balance sheet contains financial information about the enterprise

Its essence is that before sending the amount to the balance sheet, we take the amounts from 01, subtract the amounts from 02 and send the resulting amount to where????

IN THE ASSET balance. Because depreciation can never be more than the original cost of the asset, and therefore the difference between 01-02 will always be a debit. 01 account (A) > 02 account (P). Well, in extreme cases, it will be 0.

Exactly the same situation with accounts 04 and 05. This takes into account the assets of an enterprise that do not have a physical object, like a machine or a machine. Account 04 takes into account such assets of the enterprise as licenses, the exclusive right to a patent, the exclusive right to software, etc. Their period of use is also more than 12 months and they are not intended for resale. Everything is the same as with the OS. Depreciation of Intangible Assets (IMA) is accounted for on account 05.

CONCLUSION

To finish this article, I propose to do a practical task. We'll work a little with the numbers from the OS. The task is:

- divide your sheet in a notebook or notepad into two columns: “Asset” and “Passive”

- from SALT we will work with the column “Balance at the beginning of the period”

- according to all the rules studied in this article - write out the accounting accounts and amounts, what can be classified as “Asset” and what can be classified as “Liability”

- In each column, calculate the total of all amounts

- compare the total amount of “Asset” and the total amount of “Liability”

To complete the task, you already have previously downloaded OSV. If you haven't downloaded it yet, download it here.

If you are subscribed to blog updates by email, enter the access code from the last mailing letter. To receive an access code, subscribe to blog news.

Perhaps now we are ready to fill out the balance sheet. We will do this in the next article. I invite you.

PS

I can't get this article out of my head. There is some feeling of incompleteness, or something. The goal is clear - to lead you, the reader, to filling out the balance. Make sure you are as prepared as possible for this action. And, although I have to try to make the explanation understandable, there is still something missing in this article.

I understand that there will still be questions, but I want to keep them to a minimum. I think that I will answer some of these questions in advance. Before we start filling out the balance sheet form , I suggest working a little more with SALT.

This is what we need to do.

- we continue to work with the first column of SALT - “opening balance”

- write down the invoices that you believe collect information about our company's debts. You can immediately start writing out those bills that you know are in SALT. You can go the opposite way - cross out those accounts that are responsible for the company’s property, for what you can touch. The remaining bills are what you need.

- Issued invoices have amounts in “Debit” or “Credit”, or even both. Write out the invoice, each amount, and write what kind of debt it is - “Should our

- Remember what is called “Our Debt” in accounting. In parentheses for these names, write accounting terms for each amount. For tips, read this article.

Once you do it, compare it with what I got.

If you are subscribed to blog updates by email, enter the access code from the last mailing letter. To receive an access code, subscribe to blog news.

PS

I can't get this article out of my head. There is some feeling of incompleteness, or something. The goal is clear - to lead you, the reader, to filling out the balance. Make sure you are as prepared as possible for this action. And, although I have to try to make the explanation understandable, there is still something missing in this article.

I understand that there will still be questions, but I want to keep them to a minimum. I think that I will answer some of these questions in advance. Before we start filling out the balance sheet form , I suggest working a little more with SALT.

This is what we need to do.

- we continue to work with the first column of SALT - “opening balance”

- write down the invoices that you believe collect information about our company's debts. You can immediately start writing out those bills that you know are in SALT. You can go the opposite way - cross out those accounts that are responsible for the company’s property, for what you can touch. The remaining bills are what you need.

- Issued invoices have amounts in “Debit” or “Credit”, or even both. Write out the invoice, each amount, and write what kind of debt it is - “Should our

- Remember what is called “Our Debt” in accounting. In parentheses for these names, write accounting terms for each amount. For tips, read this article.

Once you do it, compare it with what I got.

How to learn to understand and analyze the balance sheet

I will devote today’s article to one of the most important accounting documents, without which analysis of the company’s economic activities would be extremely difficult. We will talk about the TURNOVER BALANCE STATEMENT (BALANCE).

1. What is OSV

2. Why is OSV needed?

Let's imagine: for a whole month we record in accounting all the business transactions that take place, be it payroll, payment to a supplier, receipt of goods and materials, issuance of funds for reporting, in other words, everything that happens in the company day after day. And now the hour “X” comes, when the month ends, and we need to check how things are going with our accounts, whether there are any errors, to whom and how much we owe, who owes us, how much money the buyers paid us, who did not account for the accountable amounts ... And this is where the balance sheet will help us.

3. How to understand SALT

Understanding SALT is not that difficult. But in order to be able to read it, you must first learn how to compose it, that is, practically feel what it consists of, then the analysis will be clear.

This is exactly what we will do now - draw up a SALT. Let's take a few of the most common operations as a basis.

So: “Over the course of a month, the accountant carried out a number of business transactions:

| the name of the operation | Dt | CT | Sum |

| Paid from the account 129,800 rubles. for the goods to the supplier. | 60 | 51 | 129 800 |

| Capitalized goods in the amount of 129,800 (including VAT 18% RUB 19,800) | 41 | 60 | 110 000 |

| VAT allocated on capitalized goods | 19 | 60 | 19 800 |

| VAT is accepted for deduction based on the invoice from the supplier | 68.2 | 19 | 19 800 |

| Received materials to the warehouse worth RUB 29,500. (including VAT 18% RUB 4,500) | 10 | 60 | 25 000 |

| VAT allocated on capitalized goods | 19 | 60 | 4 500 |

| VAT is accepted for deduction based on the invoice from the supplier | 68.2 | 19 | 4 500 |

| An advance payment of 300,000 rubles was received from the buyer. | 51 | 62 | 300 000 |

| Arranged for the shipment of goods to the buyer in the amount of 212,400 (including VAT 18% RUB 32,400) | 62 | 90.1 | 212 400 |

| VAT is charged on the sale of goods | 90.3 | 68.2 | 32 400 |

| The cost of the goods is written off as cost | 90.2 | 41 | 110 000 |

| Withdrawal from the account and entry into the cash register 50,000 rubles. | 50 | 51 | 50 000 |

| Issuing a report 50,000 rubles. | 71 | 50 | 50 000 |

| Payroll for employees RUB 250,000. | 44 | 70 | 250 000 |

| Personal income tax withheld from salary - 32,500 rubles. | 70 | 68.1 | 32 500 |

Now let’s proceed directly to filling out our accounting register. Namely: in the table that will serve us as SALT, we enter all the accounts used in our case (1)

and initial balances

(2)

.

Let's say we had a balance on DT.sch. 51, equal to 200,000 rubles, and according to Kt, the account is 62,200,000 rubles. After posting the accounts and the opening balance, we will enter all the amounts (turnovers) for Dt and Kt of the above accounts (3)

.

Finally, let's calculate account balances at the end of the period (4)

.

So, in fact, our SALT is ready!

Having generated the report with our own hands, we already clearly understand where the numbers come from and what significance they have. Thus, we can easily analyze movements and balances in any area of accounting.

So, for example, from the SALT you can clearly see how much money was received into the company’s current account during the reporting period, how much we paid and what reserve we can still use. We can check the remaining goods or materials in the warehouse. As you can see, in our case, we have materials worth 25,000 in the warehouse, but all the goods have been written off. An analysis of the “creditor” showed that at the end of the period, LLC “Sfera” had a debt to suppliers in the amount of 29,500 rubles, and an advance payment from buyers on Kt 62 invoices was also “hanging” - 87,600 rubles. In addition, wages to employees have not been paid - the organization’s debt according to the Account Code. 70 – 217,500 rub. The turnover on account 90.1 shows the company’s revenue, it amounted to 212,400 rubles, including VAT, which is reflected in the Dt account. 90.3, etc.

In order to obtain detailed information on a specific accounting area, a SALT is generated for a specific account.

As you can see, the balance sheet is simply necessary for every accountant; it accumulates information about all the company’s operations.

Thus

Subscribe to our YouTube channel!

Why do I recommend this course?

First, you will realize that accounting is easy to master.

Secondly, you will receive ready-made practical cases for almost all working situations from the company’s economic activities.

Thirdly, you will test yourself and make sure of the knowledge you have acquired.

Fourthly, you choose a convenient way of learning: face-to-face or remotely.

And fifthly, it’s really interesting!

| Author of the article: Matasova Tatyana Valerievna - expert on tax and accounting issues |