Skip to content Kontur.Partner

PRACTICAL ACCOUNTING, TAXES, PERSONNEL

8-800-551-36-30

Free call within Russia

06/01/2021 Vladlena Vladlena Articles

- Format electronic documents and paper documents

- Request sent to the taxpayer in electronic form

Cases in which the Federal Tax Service sends a request for the submission of documents

Case one: during desk and field inspections

In case of initiation of desk and field audits, tax inspectors, guided by the provisions of Art. 93 of the Tax Code of the Russian Federation, have the right to request certain documentation from the taxpayer.

When conducting a desk audit, the tax office has the right to request the provision of only those documents that are contained in the list mentioned in the provisions of Art. 88 Tax Code of the Russian Federation:

- documentation confirming the right to receive certain benefits ( clause 6 of Article 88 of the Tax Code of the Russian Federation )

- documentation confirming the right to receive a VAT deduction ( clause 8 of Article 88 of the Tax Code of the Russian Federation )

- invoices, primary and other documentation related to the case of contradictions that arose when providing data specified in the VAT return and in the reporting documentation belonging to counterparties (clause 8.1 of Article 88 of the Tax Code of the Russian Federation )

- documentation that represents confirmation of changes to the initial data, as well as to the tax registers, which reflect the indicators corresponding to the situation “before” and “after” the changes (clause 8.3 of Article 88 of the Tax Code of the Russian Federation )

- documentation that confirms the validity of reflecting non-taxable amounts and applying reduced tariffs in the event of submitting a calculation of insurance premiums ( clause 8.6 of Article 88 of the Tax Code of the Russian Federation )

However, in exceptional cases, tax inspectors have the right to request additional documentation during a desk audit. Exceptional cases include:

- checking the declaration that was submitted by a member of a simple partnership

- presentation of excise tax deductions

- provision of any services on the territory of the Russian Federation by a company registered as a foreign counterparty

If an on-site inspection is carried out, representatives of the Federal Tax Service are not limited in their rights and can request the immediate provision of absolutely any documentation if it is related to the procedure for calculating and paying taxes for the period and on the issue of the tax being audited ( clause 12 of Article 89 of the Tax Code of the Russian Federation ).

Basic Concepts

- A tax audit is an action that is procedural in nature. This check must be carried out by the tax office. The main purpose of the inspection is to identify possible violations. During this audit, tax control data is reconciled with the data reflected in reporting declarations.

- Declaration - A legal act that formulates the basic principles, as well as the goals of the two parties.

- A counter inspection is an inspection conducted by the Federal Tax Service. The goal is to study the financial and economic activities of the organization’s counterparties.

- A document is a different kind of information carrier that has details. The document records all the basic information that reflects the activity.

- Counterparty is the party with whom the contract was concluded. The counterparty can be either an individual or a legal entity who is entrusted with fulfilling various types of obligations.

Form for receiving a request from the Federal Tax Service

Clause 4 of Article 31 of the Tax Code of the Russian Federation regulates the rules and deadlines for filing a claim by the tax authority with the taxpayer. In the case when the payer submits tax reports in electronic form, the requirement to submit documents must also be sent to him through electronic document management.

Article 23 (clause 5.1) of the Tax Code of the Russian Federation establishes the taxpayer’s obligation to provide himself with the technical ability to receive documentation from representatives of the Federal Tax Service in electronic form via telecommunications with the help of one or another electronic document management (EDF) operator. For this purpose, the tax payer undertakes to enter into an agreement with one or another EDF operator, and subsequently receive from him a qualified certificate for the electronic signature verification key. All these operations must be carried out within no more than 10 days from the moment the taxpayer assumes responsibility for submitting reports in electronic form.

Electronic document management is not mandatory for all taxpayer companies, but only for those whose average number of employees is above 100 people . We note that despite this, reporting in electronic form is mandatory for all value added tax payers without exception, as well as for those companies that are tax agents for VAT or issue invoices to counterparties. All this leads to the fact that in practice the obligation to use electronic document management is inherent in most organizations and individual entrepreneurs, and therefore they must receive requirements from the Federal Tax Service exclusively in electronic form.

The obligation to correspond with the Federal Tax Service in EDI format on behalf of the taxpayer may be assigned to an authorized representative of the organization. In this case, the Federal Tax Service Inspectorate must obtain from the taxpayer a document that confirms the rights of an authorized representative of the organization to receive an electronic request from the tax authority, as well as other documents addressed to this taxpayer (clause 5.1 of Article 23 of the Tax Code of the Russian Federation) .

In the event that a particular taxpayer has the right to submit tax reports on paper, tax authorities are obliged to send him requests for the submission of documents on paper by sending registered mail using the services of the Russian Post or expressly by courier service. It is noted that such a payer is exempt from the obligation to ensure the ability to receive electronic claims from the Federal Tax Service through the EDF operator.

Form for sending requested documents

The Tax Code does not contain an article obliging taxpayer organizations that have received requirements in electronic form to fulfill them exclusively in the EDI format, i.e. Having received a request to provide information in electronic form, the organization has the right to prepare and send a response on paper to the Federal Tax Service Inspectorate. However, as practice shows, payers who receive a request in the EDI format also provide response documents in electronic form.

Format electronic documents and paper documents

Paragraph 2 of Article 93 of the Tax Code of the Russian Federation regulates the procedure for submitting formatted electronic documents - according to the provisions of this article, through EDI, the payer has the right to provide either an electronic form of a document of the established format (in particular, an invoice), or scanned copies of paper documents.

In order to transfer scanned copies of paper documents, they must be converted into a certain electronic format, which was previously approved by the provisions of Order No. ММВ-7-6/16 of the Federal Tax Service of Russia dated January 18, 2017. The transfer of such documents is carried out via telecommunications through an EDI (electronic document management) operator. A mandatory requirement for such documents is their confirmation by an enhanced qualified electronic signature of the person being verified or his representative.

In the event that the payer prefers to exercise his right to provide documentation on paper, he personally, or through a representative, or by sending registered mail using the appropriate Russian Post service, sends certified copies of documents drawn up on paper to the Federal Tax Service.

IMPORTANT! If documentation is provided at the request of the Federal Tax Service on paper, all sheets must be bound and numbered, and notarization is generally not required (clause 2 of Article 93 of the Tax Code of the Russian Federation).

Electronic documents “non-format”

The articles of the Tax Code do not regulate the method of presenting documents requested by tax authorities, in the case where they were originally drawn up in electronic format, but not in the established format (for example, contracts). At the same time, according to the provisions of the Tax Code of the Russian Federation, if the so-called “non-format” documents, after being drawn up, were signed with an electronic signature and transferred to the counterparty through the EDI system, they are legally significant .

According to the text of the letter of the Federal Tax Service of Russia No. SA-4-7/15871 dated 09.09.2015, the document, before it is submitted to the tax authority, must be printed and certified in the usual manner, making a note that it was previously has already been signed electronically. After completing this procedure, the “unformatted” document can be provided to tax inspectors for review. Such documentation can be sent either by registered letter by Russian Post or during a personal visit to the Federal Tax Service by the taxpayer.

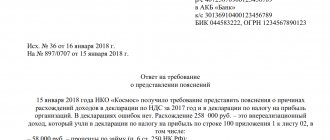

Drawing up an explanatory note for submission to the tax office

Often, the taxpayer must attach an explanatory note for the tax authorities. Let's look at how to compose it correctly.

First of all, such a note must contain all the data about the documents being submitted and subject to verification, and its content depends directly on the type of document to which it is attached.

The explanatory note must be drawn up on an A4 sheet; if it has several pages, they must be bound and framed in a transparent cover. The pages of the explanatory note are numbered starting from the title page. The note should be written using a formal business writing style.

Mandatory information that must be contained in the note includes:

- The name of the NS inspection unit to which the note is addressed.

- Legal entity identification code.

- Details of the requirement that is the reason for drawing up this note.

- Details of the document to which the note is being drawn up.

- Data on all expenses and income of the enterprise.

- The amount of all costs or losses incurred.

- Data on existing discrepancies between accounting and tax accounting. If any exist.

Deadlines for submitting documents

The Tax Code of Russia regulates the deadlines for providing documentation requested by tax authorities as part of a desk, field or counter audit.

If a desk or field audit is initiated against the payer, then all documentation requested by the tax authority must be provided within a period not exceeding 10 working days from the date of receipt of the request (clause 3 of Article 93 of the Tax Code of the Russian Federation ).

Other requirements for the timing of the provision of documentation - in the event of a counter inspection by the Federal Tax Service. Here, the period for providing documents should not exceed 5 working days from the date of receipt of the request. If tax inspectors addressed a request regarding a specific transaction, then the deadline for providing documentation, as in the case of a desk audit, cannot exceed 10 working days from the date of receipt of the request ( clause 5 of Article 93.1 of the Tax Code of the Russian Federation ).

Request sent to the taxpayer in electronic form

In the event that a tax payer has received a demand in electronic form, the date of its receipt is considered to be the day on which the file with this demand was opened, which initiates the automatic sending to the Federal Tax Service of a receipt confirming the receipt of this demand (clause 10 of the Procedure approved by the order of the Federal Tax Service of Russia dated 07/16/20 No. ED-7-2/448).

IMPORTANT! The receipt of acceptance of the request by the tax payer must be submitted to the tax authority through the EDF operator within a period not exceeding 6 working days from the moment the request was sent by the inspectorate ( clause 5.1 of Article 23 of the Tax Code of the Russian Federation ), and it should be taken into account that the very moment of sending is recorded in the document - “Confirmation of dispatch date”, generated automatically by the EDF operator.

Requirement on paper

In the event that a taxpayer accepts a request for information sent to him by a tax authority on paper, the date of receipt of the documentation is considered to be the sixth day from the date of sending the specified letter ( clause 4 of Article 31 of the Tax Code of the Russian Federation ).

What is a counter check?

The concept of a counter tax audit has long since disappeared from the pages of the Tax Code. Previously Art. 87 contained a detailed definition of oncoming traffic. However, despite the fact that the Tax Code of the Russian Federation no longer contains this type of checks, the procedure for carrying out control actions in this way still functions.

As before, this event is most often carried out during a desk or field audit in order to obtain information about transactions with the seller or buyer (hereinafter referred to as the counterparty) of the taxpayer being audited.

Read more about the subject of the counter check in this material.

Procedure in case the taxpayer does not meet the deadlines

In a situation where the taxpayer does not meet the deadlines specified in the requirement, he needs to notify the tax authority about this (Order of the Federal Tax Service of Russia dated April 24, 2019 No. ММВ-7-2/204). The deadline for filing such a notice is the day following the day the request is received. This notification is submitted either during a personal visit to the Federal Tax Service by a representative of the organization, or in electronic form via EDI. And only those persons who are not required to provide reports in electronic form have the right to send a notification via Russian Post.

After receiving this document, the tax authority must, within 2 working days, make a decision on extending the deadline for submitting the requested documents or refusing.

IMPORTANT! The Tax Code of the Russian Federation does not in any way limit tax inspectors in the matter of extending the deadline for submitting documents.

What is the procedure for conducting a counter-inspection?

Having decided to check the validity of a particular transaction reflected in the accounting records of the taxpayer being audited, tax authorities issue an order to the tax authority with which its counterparty is registered. The instruction requests the necessary explanations and documents to obtain more information about the essence of the transaction being audited or to identify inconsistencies in the data provided by the taxpayer and the counterparty.

Based on the received instruction, the Federal Tax Service Inspectorate of the counterparty issues a request to it, in which it asks to submit documents or information according to the list from the instruction. The instruction itself is also attached to the request. At the same time, the Federal Tax Service does not always issue an order: the exception is the situation when the taxpayer and his counterparty are registered with the same tax authority.

What a request from tax authorities will look like in this case can be found in the material “The inspectorate does not issue an order for a counter-inspection.”

The counterparty is given 5 days to prepare documents. At the same time, the legislation provides that the counterparty may ask the tax authorities to extend the specified period. To do this, he must send a letter to the Federal Tax Service indicating:

- reasons for the inability to collect documents in the allotted time;

- the time period within which he will be able to submit documents.

Having considered such a letter, tax authorities, in turn, may refuse to extend the deadlines or, conversely, agree with them. In this case, an appropriate decision is made and sent to the counterparty.

A way to quickly send a large amount of documentation to the Federal Tax Service

In most cases, the volume of documentation requested by tax authorities is enormous. It can be difficult to prepare and transfer such volumes, which is why most modern taxpayer companies use various services in their work that can speed up the process of submitting documents to the inspectorate many times over. One of the best services in this area is Connector Kontur.Extern, which allows you to send tens of thousands of electronic documents to the tax authority at a time.

Using "Connector" it is possible to transfer to the Federal Tax Service absolutely any electronic documents created in approved formats. In addition, the documentation transfer service "Connector" copes with sending pdf, jpg, png, tiff formats of scanned copies of documents previously created on paper. The convenience of this service is the automatic creation of an inventory of transferred documents.

If it is necessary to send enormous volumes of documentation, it is possible to install the “Kontur.Extern Connector” service on different computers and start sending documentation in parallel. This reduces the risk of missing documentation deadlines to zero.

Procedure for a taxpayer when re-requesting documentation

The Federal Tax Service has the right to re-request documentation that was previously provided by the taxpayer. In this case, the taxpayer has the right to refuse to re-submit documentation. In this case, the taxpayer or his representative is obliged to notify the Federal Tax Service that the documents requested by the tax authority have previously been provided, indicating the details of the document containing in its application all the repeatedly requested information. The deadline for filing such a notice coincides with the deadline for fulfilling the requirement .

An exception to this rule is a request for original documents that were previously returned to the taxpayer after review and documents that were lost “due to force majeure circumstances.” Such documents must be provided a second time.

Sanctions for violators of the deadlines and procedures for providing documentation in response to the requirements of the Federal Tax Service

If the payer is obliged to submit a report to the Federal Tax Service in electronic form, but has not ensured the possibility of receiving electronic documents from the tax authority, then his bank accounts may be blocked at the request of the Federal Tax Service. The same sanctions will be applied by tax authorities to the payer if they do not send them a receipt for receiving an electronic demand ( subclause 1.1 and subclause 2 of clause 3 of Article 76 of the Tax Code of the Russian Federation ).

For refusal to submit the requested documents on time, the taxpayer may be fined in accordance with paragraph 1 of Article 126 of the Tax Code of the Russian Federation . In this case, the fine will be 200 rubles for each document not submitted. In case of refusal to provide documentation by the counterparty, the fine provided for in paragraph 2 of Article 126 of the Tax Code of the Russian Federation will be 10,000 rubles . An unjustified refusal to provide information about a specific transaction will entail a fine of 5,000 rubles , according to clause 1 of Article 129.1 of the Tax Code of the Russian Federation , and a repeated refusal within 1 year will result in a fine of 20,000 rubles (clause 2 of Article 129.1 of the Tax Code of the Russian Federation) .