The balance sheet is the most important document in the financial reporting of an organization. In accordance with national and international rules, such forms must reflect data on the assets, liabilities and equity capital of the company. It is not difficult to guess that both entrepreneurs themselves and, for example, government inspectors are interested in the processes of competent and comprehensive development of such certificates. With the help of the documentation in question, a specialist can easily analyze the company’s performance for the time period under study.

What is a balance sheet in accounting, and how does it characterize the enterprise as a whole?

This term is usually understood as a tabular version of the decoding of the economic indicators of a brand within certain dates. The balance sheet consists of two modules. The first part contains tabs with information about what things are at the disposal of the organization, the second section is devoted to liabilities - the sources of acquisition of certain assets.

It is not difficult to guess that the activity of accountants also involves recording property losses and acquisitions, maintaining equality between the specified parameters. Any particularly noticeable discrepancy, for example, will raise questions during the first check sent on behalf of the Federal Tax Service.

Balance sheet - what is it?

The balance sheet is a tabular version of the reflection of the financial indicators of an organization as of a certain date. In the most widespread form in the Russian Federation, the balance sheet consists of two equal parts, one of which shows what the organization has in monetary terms (balance sheet asset), and the other - from what sources it was acquired (balance sheet liability). This equality is based on the reflection of property and liabilities using a double entry method in accounting accounts.

From 2022, financial statements will be submitted exclusively in electronic form. Paper forms will no longer be accepted.

A balance sheet drawn up as of a specific date allows one to assess the current financial condition of an organization, and a comparison of balance sheet data drawn up on different dates allows one to track changes in its financial condition over time. The balance sheet is one of the main documents that serves as a source of data for conducting an economic analysis of an enterprise's activities.

Last changes

The company's balance sheet consists of two identical tables, and is a set of information about the financial condition of the corporation within certain time boundaries. The regulations for filling out such extremely important and necessary documentation, of course, change periodically. For example, in 2022, Order of the Ministry of Finance No. 61-N came into full force on the territory of the Russian Federation, introducing the following legislative variations:

- a ban on the use of the “million rubles” indicator - now reporting takes into account only thousands;

- the need to provide statements about the audit organization responsible for conducting specialized audits;

- replacing the OKVED item with OKVED-2 in the header of the form is a rather specific point that simply facilitates some aspects of the work of modern accountants.

In addition, several years ago government authorities approved and published a decree prohibiting entrepreneurs from submitting reports in paper form. Now all document flow is implemented in a digital, electronic format.

Classification of balances: static and dynamic

The accounting report of corporations in Form No. 1 is usually divided into two main categories:

- Static – reflecting static data not a specific moment;

- Dynamic – showing the dynamics of changes in individual indicators.

Static balances are formed upon the occurrence of certain events in the company and show information as of a specified date. In such reports it is impossible to carry out an accurate analysis of the dynamics of changes in individual indicators of the company’s activity, therefore such balance sheets are called static.

The most common form of this balance sheet is the annual reporting balance, to which, with rare exceptions, information from the previous period is added.

As of the last day of 2016. From the balance sheet, account data is distributed between report items. Ultimately, the total amount of assets must exactly match the amount of liabilities. Such an annual report is subject to submission to regulatory authorities.

Dynamic balances reflect changes in the results and results of a company’s activities over a specific time period. This information is used to develop solutions for managing trade or production processes, depending on the direction of the company’s work. As an example, we should note the turnover sheets and checkerboard turnover balances.

The period for reflecting information in such balances is a month. During this period, interim reporting is not generated, but management is provided with a sufficient amount of information about the movement of the company's assets. The main goal of dynamic balances is to convey reliable information to management to develop a position in solving current problems, the deadline for which is within one month.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

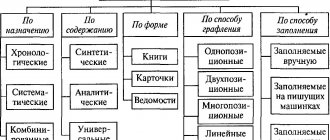

Classification of balance sheets

It is not difficult to guess what the most complex and broad concept of an accounting balance is, which includes a huge number of various calculations. The diversity of such reporting is due to various reasons. Modern specialists, accustomed to interacting with such documentation, are accustomed to the classical system of dividing it into a certain list of groups, depending on all sorts of characteristics:

- method of displaying data;

- moment of compilation;

- the amount of information included;

- direct assignment;

- properties of the source information and so on.

As mentioned earlier, the balance sheet is a table consisting of two columns. Moreover, the content of these sections can change dramatically, including due to the organizational and legal form or type of direct activity of the enterprise.

Types of balances depending on the user

The structure of the balance sheet may differ depending on which entity the document is being drawn up for:

- For commercial companies. This is the most used form of BB. Differs in versatility. Relevant for organizations with any form of ownership. An enterprise may also engage in various forms of economic activity. The specifics of the economic activity of the subject primarily influence the composition of the asset. If it is a trading company, most of its finances will be concentrated in inventory.

- For insurance organizations. The majority of the asset is receivables generated as a result of insurance operations. Most of the liabilities are insurance reserves and accounts payable.

- Banks and credit entities. There are no inventories or finished products in the assets, since institutions work with finances, not products. Instead of goods, assets include precious metals, money, loans provided to clients, and money held in other financial institutions. Liabilities reflect funds from the Central Bank, government loans, money from clients and banking institutions. The balance sheet of credit institutions reflects the peculiarities of the turnover of funds in them.

- For budgetary institutions. The balance sheet of these entities includes three areas: supply, financing and consumption. Most of the liability is financing and related payments.

Should an organization prepare a balance sheet ?

Question: How long should the balance sheet statement have? View answer

Balance sheets differ depending on the specifics of the activity. Therefore, they distinguish between types of BB depending on for which institution the document is being drawn up.

When and to whom is the balance sheet handed over?

It is not difficult to guess that the main parties interested in receiving the securities in question are representatives of the Federal Tax Service, as well as top managers, executives, current investors and future investors of the company. According to generally established standards, reporting in this format is sent to the Federal Tax Service once a year, on any day in March. This provision is enshrined in paragraph 2 of Art. 18 of Federal Law No. 402-FZ of December 6, 2011. However, if the legal entity commenced operations, for example, in the second or third quarter, its notice period will be reduced to three months. A similar exception to the general regulations is a situation in which a corporation has declared liquidation. Then the deadline for the reporting boundary will be the day the related information is entered into the Unified State Register of Legal Entities.

The composition, content and sections of the balance sheet provide valuable information for accounting. They are of interest not only to tax service specialists, but also to people who want to receive a summary of data on the results of the commercial activities of a particular company. In accordance with paragraph 4 of Article 13 of Federal Law No. 402-FZ of December 6, 2011, owners and other interested parties can receive such calculations at their own request, freely. Of course, it takes a lot of time to prepare the submitted documentation, but for some potential investors, as a rule, calculations dated from previous quarters are enough.

Types of balance sheet by nature of information

Based on the nature of the information, the balance sheet can be one of the following types.

Finished works on a similar topic

Coursework Types of balance sheet 420 ₽ Essay Types of balance sheet 240 ₽ Test work Types of balance sheet 240 ₽

Receive completed work or specialist advice on your educational project Find out the cost

- Inventory balance. Such a balance is drawn up based on the results of an inventory of the organization’s property and liabilities.

- Book balance. This balance is drawn up solely on the basis of accounting data.

- General balance. Such a balance is drawn up on the basis of accounting data, but taking into account data on future inventory.

The concept and meaning of balance sheet items

So, the balance sheet of an enterprise is an accounting of a summary of indicators that reflect the financial condition of a particular company. As mentioned earlier, it is developed in the form of a table, which simply cannot be formatted without various profile abbreviations. Each abbreviation of any reporting parameter is described, for example, in Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66-N. Only a person who has the required amount of skills, knowledge, skills and qualifications will be able to substantively understand the calculations proposed in this enforcement regulation. Even such a simple category of notification as non-current assets, by law, must include a whole list of various lines:

- intangible means;

- results of research, testing and development;

- search modules;

- material elements;

- classic types of OS;

- profitable investments;

- interactions with values;

- economic subsidies;

- deferred tax benefits.

But there are also other columns: capital, reserves, long-term liabilities, short-term loans, inventories, VAT, accounts receivable, and so on. All of them require the most substantive analysis, and any mistakes made by the master involved in paperwork will certainly lead to troubles for the entire company.

Balance sheet: essence

The balance sheet is a special way of generalized reflection and grouping of funds by composition and their placement by sources and intended purpose as of a certain date:

A balance sheet item is a separate line that contains information about funds. Homogeneous articles are combined into sections/subsections. Graphically, the table consists of 2 parts:

- the left one, that is, the asset, reflects economic funds received as a result of accomplished facts of financial and economic transactions;

- the right one, that is, liability, reflects the organization’s funds according to the sources of their forms: equity capital - investments of owners and profits accumulated over the entire period of operation of the organization; long-term and short-term liabilities - funds that were generated as a result of economic activities, as well as settlements for which can lead to an outflow of assets.

Dual classification of the same funds reflected in the balance sheet means that Asset = Liability.

The economic essence of balance can be represented in the form of a basic balance equation:

ASSETS = CAPITAL + LIABILITIES.

Composition of balance sheet items

As mentioned earlier, absolutely every entrepreneur who wants to avoid problems emanating from employees of the Federal Tax Service must understand the question of what the purpose of the balance sheet is and what its left side is called. General information can be obtained, for example, from PBU 4/99, approved. By Order of the Ministry of Finance dated July 6, 1999 No. 43-N. Within the framework of this enforcement regulation, the following mandatory rules are provided:

- complete reliability, correctness, neutrality and literacy of the source data entered into the tables;

- compliance with the principles of materiality, taking into account calculations from previous reporting periods;

- confirmation of annual notifications through results obtained during or thanks to the inventory;

- no need to roll up debit and credit balances designated within quarterly boundaries;

- indication of the parameters of fixed assets and intangible assets using standards relating to residual value.

There are many similar recommendations in government regulations, and each of them is followed literally unquestioningly. It is not difficult to guess that an experienced expert from the Federal Tax Service, who is responsible for accepting and parsing accountable papers, will easily notice any discrepancies. In the best case, the displays will be sent back, with a set of accompanying notes, and in the worst case, the brand will face a fine and additional inspection.

Composition of balance sheet items

Balance sheet items are filled out based on data on balances in accounting accounts as of the reporting date. When filling out a report for submission to the Federal Tax Service, you must be guided by a number of rules established for the preparation of such reports (PBU 4/99, approved by order of the Ministry of Finance of Russia dated July 6, 1999 No. 43n).

- The initial accounting data must be reliable, complete, neutral and formed in accordance with the rules of the current PBU. When reflecting them, it is necessary to comply with the principles of materiality and comparability with the results of previous periods.

- In the current report, data from previous periods must be consistent with the figures in the final accounts for those periods.

- For the annual balance sheet, the presence of property and liabilities must be confirmed by the results of their inventory.

- Debit and credit balances in the balance sheet are not collapsed.

- Fixed assets and intangible assets are shown at residual value.

- Assets are reflected at their book value (less created reserves and mark-ups).

And below is information about on the basis of the balances of which accounts the above balance sheet items are filled in in relation to the current version of the chart of accounts, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n.

Under the article “Intangible assets”, the residual value of intangible assets is indicated, corresponding to the difference in the balances of accounting accounts 04 and 05. At the same time, for account 04, data falling in the line “Results of research and development” is not taken into account, and for account 05 - figures related to intangible search assets.

The article “Results of research and development” is filled in if there is data on R&D costs in account 04.

Data on the items “Intangible exploration assets” and “Tangible exploration assets” are important only for those organizations that develop natural resources if they have information on account 08 to fill out lines for these items. Tangible exploration assets include tangible objects, and intangible assets include all others. Both types of assets are subject to depreciation, recorded in accounts 02 and 05, respectively.

For the item “Fixed Assets”, data on the residual value of fixed assets (the difference in the balances of accounting accounts 01 and 02, while account 02 does not take into account data related to material exploration assets and profitable investments in assets) and capital investment costs (account 08, excluding the figures included in the lines of the articles “Intangible search assets” and “Tangible search assets”).

Data for the article “Profitable investments in assets” is taken as the difference between the balances of accounts 03 and 02 in relation to the same objects.

The item “Financial investments” in non-current assets is filled in if there are amounts with a repayment period of more than 12 months in accounts 55 (deposits), 58 (financial investments), 73 (loans to employees). The balance of account 58 is reduced by the amount of the created reserve (account 59) related to long-term investments.

Under the article “Deferred tax assets”, organizations applying PBU 18/02 indicate the balance of account 09.

When the line item “Other non-current assets” is used, the balance sheet reflects assets that are either not included in the above lines, or those that the organization considers necessary to highlight.

The figure for the item “Inventories” is formed as the sum of the balances on accounts 10, 11 (minus the reserve recorded on account 14), 15, 16, 20, 21, 23, 28, 29, 41 (minus account 42, if accounting for goods carried out with a markup), 43, 44, 45, 46, 97.

The item “VAT on purchased valuables” reflects the balance of account 19.

To obtain the data indicated under the “Accounts receivable” item, debit balances on accounts 60, 62 (both accounts minus the reserves formed on account 63), 66, 67, 68, 69, 70, 71, 73 (minus data , recorded under the article “Financial investments”), 75, 76.

The article “Financial investments (except for cash equivalents)” in current assets shows data on accounts 55 (deposits), 58 (financial investments), 73 (loans to employees) with repayment periods of less than 12 months. In this case, the figures in account 58 are reduced by the amount of the created reserve (account 59) for short-term investments.

The data for the item “Cash and cash equivalents” is obtained by adding the balances of accounts 50, 51, 52, 55 (excluding deposits), 57.

The line of the article “Other current assets” includes assets that are either for some reason not reflected in the above lines, or those that the organization considers necessary to highlight. For example, this could be a bad debt from a counterparty or the value of stolen property for which investigative actions have not yet been completed. Reflection of such data on this line with a corresponding reduction in figures for those items in which they could have been reflected if there had not been a decision by the organization to allocate them, will require notes both to the article “Other current assets” and to the second article, which will be affected such an operation.

The data for the article “Authorized capital (share capital, authorized capital, contributions of partners)” is taken as the balance of account 80.

The figures in the article “Own shares purchased from shareholders” correspond to the balances of account 81.

For the article “Revaluation of non-current assets”, data on balances on account 83 related to fixed assets and intangible assets is used.

Data for the item “Additional capital (without revaluation)” is formed as balances on account 83 minus data on the revaluation of fixed assets and intangible assets.

The item “Reserve capital” shows the balance of account 82.

The value reflected under the item “Retained earnings (uncovered loss)” in the annual balance sheet is the balance of account 84. For interim reporting (before the balance sheet reformation carried out at the end of the year), this figure is the sum of two balances: for account 84 (financial the result of previous years) and 99 (financial result of the current period of the reporting year). The item “Retained earnings (uncovered loss)” is the only balance sheet item that can have a negative value.

At the same time, it is important that for an organization that has a loss, the total of the “Capital and Reserves” section (net assets) does not turn out to be less than the amount of the authorized capital. If this circumstance occurs for two financial years in a row, then the organization must either reduce its authorized capital to the appropriate figure (and this is not always possible, since the authorized capital cannot be less than the minimum value established by current legislation), or it is subject to liquidation.

With the reporting campaign for 2022, changes to PBU 18/02, 16/02, 13/2000, FSBU 5/2019 “Reserves” come into effect. And starting with reporting for 2022, the new FSBU 25/2018 “Lease Accounting”, FSBU 6/2020 “Fixed Assets”, FSBU 26/2020 “Capital Investments” should be applied. You can start applying new accounting standards earlier. This decision needs to be fixed in the accounting policy of the enterprise.

The article “Borrowed funds” in the “Long-term liabilities” section is filled in if there is debt on loans and borrowings, the repayment period of which exceeds 12 months (account balance 67). In this case, interest on long-term borrowed funds must be taken into account as part of short-term accounts payable.

Under the article “Deferred tax liabilities”, organizations applying PBU 18/02 indicate the balance of account 77.

The value under the item “Estimated liabilities” in the section “Long-term liabilities” corresponds to the balance in account 96 (reserves for future expenses) in relation to those reserves whose useful life exceeds 12 months.

The item “Other liabilities” in the section “Long-term liabilities” shows liabilities with a maturity of more than 12 months that are not included in other lines of long-term liabilities.

The article “Borrowed funds” in the “Short-term liabilities” section is filled in if there is debt on loans and borrowings, the repayment period of which is less than 12 months (account balance 66). At the same time, this includes interest on long-term borrowed funds, recorded in account 67, and debt on long-term loans and borrowings, recorded in account 67, if there are less than 12 months left until its repayment.

The data for the “Accounts payable” item is formed as the sum of credit balances for accounts 60, 62, 68, 69, 70, 71, 73, 75, 76.

For the item “Deferred income” the value is taken as the sum of balances on accounts 86 (target financing) and 98 (deferred income).

The value under the item “Estimated liabilities” in the section “Short-term liabilities” corresponds to the balance in account 96 (reserves for future expenses) in terms of those reserves whose useful life is less than 12 months.

Under the item “Other liabilities” in the section “Short-term liabilities”, liabilities with a maturity of less than 12 months are shown that are not included in other lines of short-term liabilities.

Balance sheet form

In 2022, the regulations for compiling the balance sheet have undergone significant changes. They were as follows:

- all amount parameters are now provided in the “thousand rubles” format, without the concept of “million”;

- the OKVED item, present in the header of the form, was replaced by OKVED-2, which slightly made the work of many accountants easier;

- Now companies must provide information about audits conducted, including information about the companies that carried out the research.

The main resolution concerned the reporting system. According to the new laws, paper versions of unifications are equal to their electronic counterparts. Simply put, specialists can send calculations in digital format, however, after they are certified by affixing the UKEP.

Example of building a balance sheet

The answer to the question about what sections of accounts are. The balance sheet of an enterprise is the key to successful interaction with the Federal Tax Service, as well as persons interested in the widespread and competent development of the company. These may include owners, holders, potential investors and current investors. The document itself looks quite simple. It states that as of December 31, 2022, it has the following assets and liabilities:

- intangible objects - 80 thousand;

- OS - 150 thousand;

- stocked building materials and products - 400 thousand;

- buyer's debt - 150 thousand;

- money in cash and on current accounts - 200 thousand;

- authorized capital - 500 thousand;

- retained income - 75 thousand;

- long-term loan debt - 300 thousand.

Moreover, all of the listed columns, as mentioned earlier, are entered into a single table. Registration of the submitted paper is a complex process, which specialized commodity accounting software helps to cope with at a decent level. The production of the indicated programs is carried out, including by the Russian one. The brand modules “Warehouse-15” and “Store-15” are already configured for operation, as well as widespread optimization of all kinds of routine business procedures.

balance sheet and financial reporting form

You can download a sample statement for your own use, for example, here. Similar calculations are also presented on this page, with a detailed breakdown of all operations for a particular enterprise. True, it is worth understanding that each company has its own characteristic features that also relate to maintaining such documentation. Almost all organizations and legal entities have their own items of income and expenses, reflected in a unique, specialized manner. However, the proposed templates can be easily used for trivial acquaintance and obtaining information on how to correctly interact with the types of papers in question.

Four types of balance changes.

Business transactions that take place in the course of the enterprise's activities have an impact on the balance sheet.

This occurs due to the fact that every transaction is reflected in two accounts, that is, it affects two balance sheet items, which can be in both assets and liabilities, or both at the same time - in assets and both at the same time - in liabilities.

From this point of view, all changes in the balance sheet can be divided into four types.

1) Business transactions of the first type (active changes in the balance sheet) are characterized by the fact that when they are performed, a regrouping of the enterprise’s economic assets reflected in the asset occurs, while the liability is not affected.

Mathematically, the impact on the balance of business transactions of the first type can be expressed by the following formula:

A + X – X = P,

where: X is the amount of turnover in rubles for a business transaction.

An example of business transactions of the first type is:

● withdrawal of funds from a bank account to the cash desk (D50 K51);

● receipt of cash from the organization's cash desk to a bank account (D51 K50);

● release of materials from warehouse to production (D20 K10);

● receipt of finished products to the warehouse from production (D43 K 20).

active accounts are involved in the accounting entries : some accounts increase and others decrease, that is, a regrouping of items occurs and a change in the composition of the enterprise's assets, but the total of the assets and liabilities of the balance sheet does not change.

2) Business transactions of the second type (passive changes in the balance sheet) affect only liability items of the balance sheet, as a result of which, within this part of the balance sheet, a regrouping of sources of funds , while the asset is not affected.

The impact on the balance sheet of business transactions of this type can be described by the following formula:

A = P + X – X.

An example of business transactions of the second type is:

● withholding personal income tax (NDFL) from personnel wages (D70 K 68-NDFL);

● withholding income tax from the organization’s profit (D99 K68-NP);

● formation of reserve capital from net profit (D84 K82);

When performing these operations, passive accounts are involved : some accounts increase, while others decrease, i.e. there is a regrouping of the sources of formation of the enterprise's economic resources, but the total of the liability balance sheet and the balance sheet itself does not change.

3) Business transactions of the third type (active - passive changes in the balance sheet with an increase in totals) lead to an increase in funds in the Asset of the balance sheet with a simultaneous increase in their sources in the Liability by the same amount .

When performing these operations, the balance sheet currency increases for Assets and Liabilities by the same amount.

The impact on the balance sheet of business transactions of the third type can be expressed by the following formula:

A + X = P + X

Examples of business transactions of the third type could be:

● obtaining loans from banks for foreign currency or current accounts (D52.51 K66.67);

● payroll for employees of the enterprise (D20,25,26 K70);

● calculation of contributions to state social extra-budgetary funds (D20,25,26 K69).

When these business transactions are carried out, active and passive accounts are involved in the accounting entries, and both of them increase.

of the enterprise's assets and the sources are modified with an increase in the total of the Asset and Liability balance sheet.

4) Business transactions of the fourth type (active - passive changes in the balance sheet with a decrease in totals) lead to a decrease in funds in the Asset of the balance sheet with a simultaneous decrease in their sources in its Liability .

When performing these operations, the balance sheet currency decreases for the Asset and for the Liability by the same amount.

The impact on the balance sheet of business transactions of the fourth type can be expressed by the following formula:

A – X = P – X

Examples of such operations could be:

● return of bank loans from current or foreign currency accounts (D66.67 K51.52);

● payment of wages to employees of the organization (D70 K50);

● payment of the supplier's invoice for the provided values and services (D60 K51).

When these business transactions are carried out, active and passive accounts are involved in the accounting entries, and both are reduced.

In the course of business transactions of this type, the composition of the enterprise's assets and the sources of their formation are modified, with the total of the Asset and Liability balance sheet decreasing by the same amount.

The following four types of transactions allow you to trace all options for changes in the balance sheet:

The first type is changes in asset items while the balance sheet remains unchanged.

The second type is changes in liability items while the balance sheet remains unchanged.

The third type is changes in asset and liability items towards an increase.

The fourth type is changes in asset and liability items downward.

Four types of business transactions and their impact on the balance sheet are presented in the table

| Type of business transaction | Asset (property) | Passive (sources) |

| I | + – | |

| II | + – | |

| III | + | + |

| IV | – | – |

The equality of the totals of assets and liabilities of the balance sheet is maintained after any business transaction.

The main thing in these conclusions is the proof of the duality of changes occurring in the balance sheet under the influence of any business transaction, which is of utmost importance for a reasonable procedure for reflecting business transactions in accounting.

Current accounting of property and business processes is practically impossible to carry out by drawing up new balance sheets after each business transaction. For this purpose, accounting accounts are used, which display information about transactions.

Lecture 8. Classification of balance sheets

Classification of balance sheets

Classification of balance sheets is carried out on the following main grounds:

1) By structure;

2) By the presence of regulations;

3) By the method of evaluating articles;

4) According to the intended purpose.

According to the balance sheet structure.

According to its structure, i.e. According to the order of arrangement of articles and presentation of information, balances are divided into horizontal and vertical.

Horizontal balances are characteristic of the continental school of accounting; they are compiled in Western European countries and the Russian Federation.

In horizontal balance sheets, the Asset is located on the same level as the Liability, i.e. (horizontally), as shown below:

The horizontal balance equation is as follows:

Active = Liability

Vertical balance is characteristic of the Anglo-Saxon school of accounting.

It consists of countries that were once part of Great Britain, namely the USA, Great Britain, Australia, New Zealand, India, Canada.

The vertical balance equation is as follows:

Asset – Borrowed funds = Own funds.

In a vertical balance sheet, Liability is located below Asset:

The vertical balance sheet in its final line provides users with very important information about the amount of own funds , therefore, for investors - individuals, such reporting will be more understandable.

Since in countries that use a vertical balance sheet, and, above all, in the USA and Great Britain, there are a significant number of investors on the stock market - individuals , this type of balance sheet is the most acceptable for them.

In countries that use horizontal balance, large capital is more present in the stock market .

Specialists of such organizations are well versed in accounting statements, including balance sheets, so the horizontal balance sheet is clear to them and quite satisfactory to them.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Other non-current assets - what are they in the balance sheet and accounting

According to the current legislation of the Russian Federation, these include:

- deposits accounted for in subaccounts of account 08;

- items of equipment prepared for switching and installation;

- transport and procurement expenses;

- one-time lump sum payments;

- summarized parameters of accrued advance payments;

- advance payment for any work, goods and services.

Simply put, this column includes all indicators that did not find their place in other paragraphs of the section number one.

Current liabilities: line 1500

A certain part of the balance sheet is a document that is initially difficult to analyze and understand in detail. For example, inexperienced accountants regularly get confused with processes related to reflecting the existing passive elements of an enterprise. The fact is that in the accompanying and legislative documentation such a term is reflected rather weakly, without detailed instructions. However, in reality, things are as simple as possible. The status of the required element here is given to paragraph 1500, which is the total value of columns 1510, 1520, 1540, 1550 and 1530.

Balance sheet: types

There are currently 4 forms of balance sheets in use:

1. Balance sheet of commercial organizations:

- most widely used;

- is universal and can be used by enterprises of various forms of ownership and having several different types of economic activity;

- the characteristics of the type of economic activity of the organization are reflected mainly in the content of the asset;

- in the balance sheet of a trading organization - a significant part of the funds is placed in inventory.

2. Balance sheet of insurance organizations:

- a significant share of the asset is accounts receivable from insurance operations;

- In liabilities, the share of insurance reserves and funds, as well as accounts payable for insurance operations, is significant.

3. Balance sheet of banks and non-bank financial institutions. The balance sheets of commercial banks and non-bank financial institutions, as well as insurance organizations, reflect the specifics of the circulation of funds in these organizations:

- the balance sheet assets of a commercial bank do not include industrial inventories, finished products that replace precious metals and stones, funds in the Central Bank of the Russian Federation, funds in other banks and loans issued to customers;

- in liabilities, the most important sources are funds from the Central Bank of the Russian Federation, government funds. loans, funds from other banks and clients.

4. Balance sheet of budgetary organizations. Three processes take place in the budgetary sphere:

- supplies;

- consumption;

- financing.

Therefore, in the liabilities, a larger number of items are intended to reflect financing, financing calculations, etc.

Answers to popular questions

Some of the most common dilemmas faced by those maintaining financial records of an enterprise include the following dilemmas:

- What happens if you don't submit your balance sheet? The answer is given, for example, in paragraph 1 of Art. 126 of the Tax Code of the Russian Federation and clause 1 of Art. 15.6 Code of Administrative Offenses of the Russian Federation. The mentioned law enforcement regulations talk about fines in the amount of 200 and 300-500 rubles, respectively.

- What papers are included in mandatory reporting? This list is given in PBU 4/99, and includes not only the BB documentation itself, but also notifications of economic results and various applications.

- Where and how are the company's intangible assets reflected? Line 1110 receives the status of the required section (at least according to the recommendations described in Order of the Ministry of Finance No. 66-N).

As a rule, more or less experienced accountants do not have any difficulties with the remaining points.